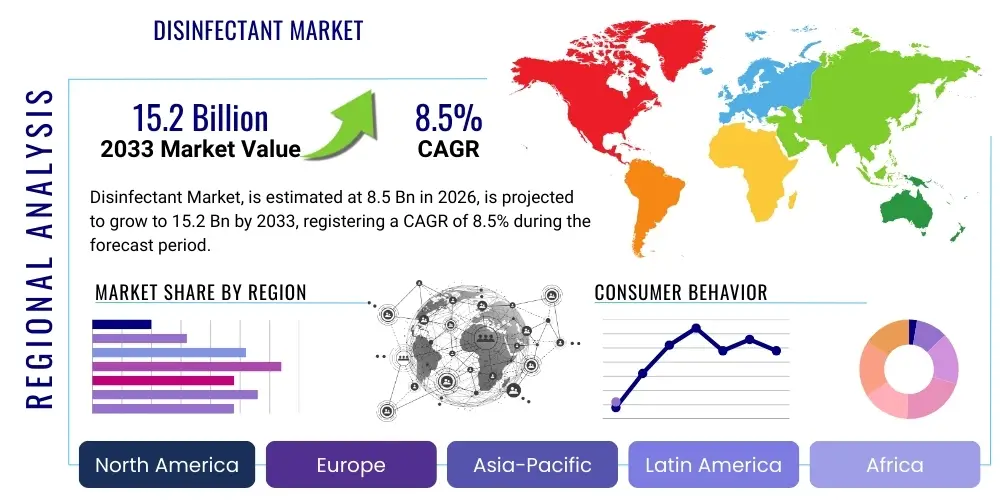

Disinfectant Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443591 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Disinfectant Market Size

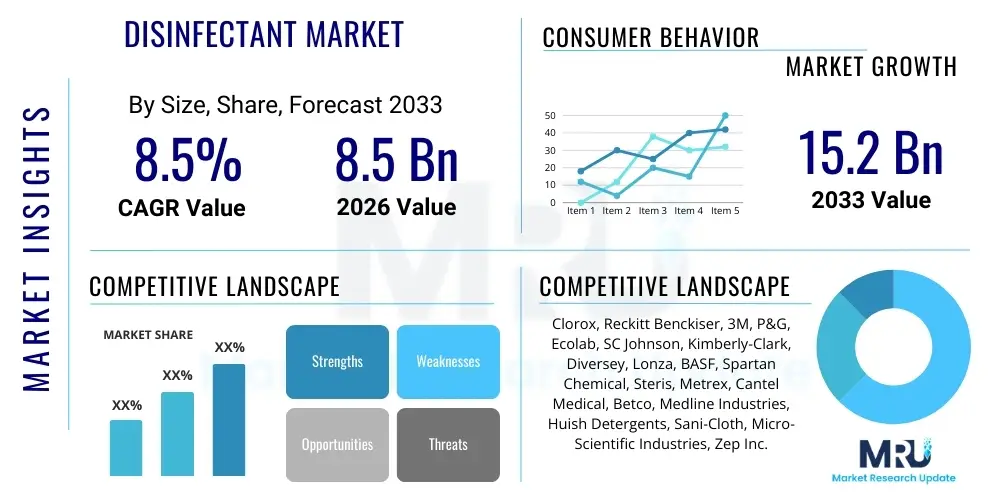

The Disinfectant Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 15.2 Billion by the end of the forecast period in 2033.

Disinfectant Market introduction

The Disinfectant Market encompasses the production, distribution, and sale of chemical agents specifically designed to eliminate or significantly reduce microbial contamination (bacteria, viruses, fungi, and protozoa) on inanimate surfaces and objects. These products are critical components of infection control strategies across institutional, commercial, and household settings. Market growth is fundamentally tied to increasing global health awareness, stringent regulatory mandates regarding hygiene standards in critical infrastructure like healthcare and food processing, and a persistent focus on preventing healthcare-associated infections (HAIs) and managing widespread infectious disease outbreaks. Modern disinfectant formulations emphasize not only high biocidal efficacy but also user safety, material compatibility, and environmental sustainability, driving continuous innovation within the product landscape.

Disinfectants are broadly applied across multiple sectors, ranging from complex hospital environments where surgical instruments and patient areas require high-level disinfection (HLD), to the household sector where routine cleaning products are utilized for general sanitization. Major applications include surface cleaning in hospitals and clinics, sanitation procedures in the food and beverage industry to prevent spoilage and pathogen transmission, water treatment for public safety, and general facility hygiene in schools, offices, and transportation hubs. The primary benefit derived from these products is the direct reduction of pathogen transmission risks, which translates into lower morbidity rates, improved public health outcomes, and minimized economic losses associated with contamination events or product recalls in sensitive industries.

Driving factors for sustained market expansion are diverse and interconnected. A crucial driver is the aging global population and the corresponding increase in surgical procedures and chronic diseases, necessitating rigorous infection control standards within healthcare facilities. Furthermore, the rapid industrialization, particularly in developing economies, leads to greater demand for industrial-grade disinfectants in manufacturing and sanitation processes. Technological advancements in formulation chemistry, specifically the development of non-toxic, eco-friendly, and broad-spectrum disinfectants (such as stabilized hypochlorites and advanced quaternary ammonium compounds), also propel market adoption by addressing former limitations related to corrosiveness and harmful residue. The sustained influence of global pandemics and localized outbreaks ensures that hygiene remains a high-priority public expenditure area globally.

Disinfectant Market Executive Summary

The Disinfectant Market is characterized by robust business trends centered on convergence toward sustainability and efficacy maximization. Post-pandemic structural shifts have solidified higher baseline expectations for hygiene standards across all sectors, leading to sustained demand growth even in traditional low-penetration markets. Key business strategies currently focus on optimizing supply chain resilience, ensuring rapid scalability in response to unforeseen public health crises, and leveraging digital technologies for compliance tracking and usage optimization, particularly within commercial and institutional segments. Furthermore, manufacturers are investing heavily in R&D to introduce novel formulations that offer long-lasting antimicrobial protection (residual disinfection) and formulations that minimize the environmental footprint, aligning with global corporate social responsibility (CSR) initiatives and evolving consumer preferences for green chemistry.

Regionally, the market exhibits differential growth trajectories. North America and Europe currently represent mature, high-value markets, driven by stringent regulatory frameworks, high awareness levels, and significant spending on healthcare infrastructure. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This accelerated growth in APAC is attributed to rapid urbanization, increasing governmental investment in public health infrastructure (especially in countries like India and China), and rising disposable incomes leading to greater adoption of household disinfectants. Regulatory harmonization efforts across trade blocs are also facilitating easier cross-border movement of compliant products, indirectly supporting multinational expansion strategies into high-growth emerging economies.

Segmentation trends indicate a strong shift towards specialized product types and convenient application formats. While traditional chemical classes like chlorine compounds and alcohols maintain dominance due to cost-effectiveness and proven efficacy, the demand for advanced, less harmful chemistries such as peracetic acid and hydrogen peroxide is rising significantly, particularly in sensitive areas like surgical settings and food processing where residue is a concern. Segment-wise, the Hospitals & Clinics application sector remains the largest revenue generator, but the Industrial & Commercial segment, including heavy manufacturing and transportation, is expected to exhibit dynamic growth due to increasing automation and regulatory scrutiny concerning workplace cleanliness and safety protocols. Form factor innovations, specifically the widespread adoption of ready-to-use disinfectant wipes and aerosol sprays, contribute substantially to convenience and standardized application across various end-user groups.

AI Impact Analysis on Disinfectant Market

User inquiries regarding AI's influence in the Disinfectant Market often revolve around predictive modeling for disease outbreaks, optimization of disinfectant usage to reduce waste, and development of intelligent monitoring systems for compliance. Users are keen to understand how AI can move disinfection protocols from reactive measures to proactive, data-driven strategies, focusing on maximizing efficiency (using the right dosage at the right time) and verifying successful decontamination in real-time. Concerns frequently emerge about the integration costs, data privacy related to monitored spaces, and the need for specialized training to manage AI-driven sanitation infrastructure. The consensus expectation is that AI will primarily enhance efficacy, reduce human error, and integrate disinfection into broader smart building management systems.

- AI-driven Predictive Analytics: Utilizing machine learning algorithms to forecast pathogen hotspots and potential outbreak locations, enabling proactive and targeted disinfection deployment rather than blanket coverage.

- Dose and Application Optimization: Employing sensor data and AI to calculate the precise disinfectant volume and frequency required based on real-time contamination risk assessment, minimizing waste and ensuring optimal biocidal efficacy.

- Robotics and Autonomous Disinfection: AI controls sophisticated robotic systems (e.g., UV-C robots, automated sprayers) used in large institutional settings (Hospitals, Airports) ensuring complete coverage and compliance without human intervention.

- Supply Chain Resilience: AI models enhance inventory management and logistics, predicting demand spikes during infectious disease waves and optimizing the distribution network for critical disinfectant supplies.

- Quality Control and Formulation Discovery: AI accelerates the screening of novel chemical compounds and optimizes existing disinfectant formulas for improved stability, reduced toxicity, and enhanced broad-spectrum antimicrobial activity.

DRO & Impact Forces Of Disinfectant Market

The Disinfectant Market dynamics are shaped by a complex interplay of influential factors. Primary drivers include the relentless global focus on infection prevention, exacerbated and institutionalized by recent pandemics, which mandates continuous investment in high-efficacy cleaning and sanitization products across public and private sectors. Restraints primarily revolve around escalating regulatory hurdles concerning chemical toxicity, residue formation, and environmental impact (e.g., microplastic content in wipes), which increase R&D costs and restrict the usability of older, less sustainable chemistries. Opportunities are abundant, specifically in the development of residual or long-acting surface protectants, non-toxic plant-derived alternatives, and the massive untapped potential in low and middle-income countries where public health infrastructure development is rapidly accelerating, creating new mass market consumption patterns.

Key drivers significantly contributing to market momentum include the high prevalence of Healthcare-Associated Infections (HAIs) globally, which places substantial pressure on healthcare providers to adopt advanced disinfection protocols and products. Furthermore, the expansion of the Food and Beverage (F&B) industry and stricter global food safety regulations (HACCP, ISO standards) necessitate continuous and high-volume usage of validated disinfectants to prevent contamination and product recalls. The rising geriatric population also contributes to increased healthcare utilization, consequently boosting demand for institutional disinfectants. These combined forces create a consistent, non-cyclical demand base for reliable disinfection solutions, ensuring stable revenue streams for market players.

Conversely, significant restraints must be managed. One critical challenge is the growing concern over microbial resistance to common chemical disinfectants, pushing the industry towards complex, expensive, and often regulated novel chemistries. Price volatility in key raw materials (e.g., ethanol, specialized amines) due to global supply chain disruptions adds cost pressure, potentially impacting profitability and market accessibility in price-sensitive regions. Moreover, stringent environmental regulations, particularly in Europe, regarding the disposal of hazardous chemical waste and the phase-out of certain biocides (e.g., formaldehyde-releasing compounds) force manufacturers into costly reformulation cycles, slowing down product development and market entry for new chemistries.

The core impact forces shaping this market include political mandates stemming from public health crises, economic shifts affecting raw material costs, social factors driving consumer preference toward "green" and perceived safe products, and technological advancements enabling high-efficiency, targeted delivery systems. These forces interact to create a market environment where innovation is non-negotiable; companies failing to adapt to sustainability pressures or unable to meet evolving biocidal efficacy benchmarks are likely to lose market share, while those leveraging novel encapsulation technologies or biodegradable formulations stand to gain significantly, particularly in premium markets.

Segmentation Analysis

The Disinfectant Market is segmented based on chemical composition (Type), end-use environment (Application), and physical form (Formulation). This layered segmentation allows for a granular analysis of demand patterns, showing that different sectors prioritize efficacy, cost, material compatibility, and regulatory compliance distinctively. The market structure reflects a trend toward specialization, with high-level disinfection products serving critical medical needs and more generalized, cost-effective options dominating household and standard commercial cleaning applications. Understanding these segments is crucial for strategic market positioning and R&D investment prioritization.

- By Type:

- Quaternary Ammonium Compounds (Quats)

- Alcohols (Ethanol, Isopropanol)

- Chlorine Compounds (Sodium Hypochlorite, Chlorine Dioxide)

- Iodophors

- Aldehydes (Glutaraldehyde, Formaldehyde - declining due to toxicity concerns)

- Phenolics

- Peracetic Acid and Hydrogen Peroxide

- Others (e.g., Biguanides, Enzyme-based formulations)

- By Application:

- Hospitals & Clinics (Healthcare)

- Household & Consumer

- Food & Beverage Processing

- Industrial & Commercial (Manufacturing, Logistics, Offices)

- Water Treatment

- Pharmaceutical & Biotechnology

- By Formulation:

- Liquid Concentrates

- Ready-to-Use (RTU) Liquids

- Disinfectant Wipes

- Aerosol Sprays and Foggers

- Powders and Granules

Value Chain Analysis For Disinfectant Market

The Disinfectant Market value chain begins with the upstream procurement of essential chemical raw materials, including solvents (e.g., ethanol), surfactants, sequestering agents, and active biocidal ingredients (e.g., Quat precursors, chlorine compounds). Manufacturers must maintain robust relationships with specialized chemical suppliers, often navigating complex global commodity markets to manage input costs and ensure quality control, as the efficacy and stability of the final product are highly dependent on the purity of these foundational components. Quality assurance at the upstream stage is paramount, especially for medical-grade disinfectants which require compliance with pharmacopoeial standards and strict regulatory approval processes (e.g., EPA registration or EU Biocidal Products Regulation compliance).

The midstream segment involves the core manufacturing process, encompassing formulation, blending, packaging, and regulatory documentation. Key activities here include optimizing chemical synthesis processes to achieve desired efficacy (kill-rate) and shelf-life, while simultaneously addressing safety profiles (reducing corrosivity or volatility). Efficiency in packaging, particularly for high-volume products like disinfectant wipes and RTU sprays, drives cost competitiveness. Following manufacturing, the distribution channel acts as the critical link to the downstream end-users. Distribution is highly segmented: direct sales are common for large institutional clients (major hospital networks, industrial facilities) where technical support and bulk delivery are required, while indirect channels leverage vast networks of specialized medical distributors, janitorial supply companies, mass retail outlets, and e-commerce platforms to reach the fragmented consumer and small commercial markets.

Downstream analysis focuses on end-user application and consumption patterns. Institutional end-users (Hospitals, F&B facilities) demand robust training, centralized procurement, and evidence-based efficacy data, often utilizing contracts and specialized closed-loop dispensing systems provided by the manufacturer or distributor. The household segment, conversely, relies heavily on brand recognition, ease of use (Formulation: wipes, sprays), and perceived value driven by retail marketing efforts. The efficiency and reliability of the supply chain, particularly for high-demand items like surface wipes, are tested frequently by public health emergencies. Furthermore, the disposal aspect, including managing chemical waste and packaging recyclability, is becoming an increasingly important downstream consideration, influencing customer purchasing decisions and regulatory scrutiny.

Disinfectant Market Potential Customers

The potential customer base for disinfectants is extensive and diverse, primarily categorized into institutional, commercial, and household end-users, each with distinct requirements concerning product efficacy, volume, and compliance. Healthcare facilities, including major hospitals, outpatient clinics, surgical centers, and long-term care facilities, constitute the highest-value and most quality-sensitive customer segment. These facilities require specialized, often high-level disinfectants (HLD) for critical equipment, intermediate disinfectants for non-critical surfaces, and are heavily regulated, prioritizing validated broad-spectrum efficacy and material compatibility to protect sensitive medical devices and patient safety.

The second major segment encompasses the Food and Beverage (F&B) processing industry and the broader Industrial & Commercial sector. F&B manufacturers require disinfectants that comply with strict food contact safety standards, focusing on non-tainting and fast-acting formulations (e.g., peracetic acid and stabilized chlorine compounds) for cleaning processing lines, storage tanks, and packaging areas to prevent microbial spoilage and human illnesses. The commercial sector includes schools, offices, transportation systems (airlines, public transit), and hospitality venues, which prioritize cost-effective, easy-to-use solutions (wipes, RTU sprays) suitable for frequent use to maintain public confidence and employee well-being, often procuring through janitorial supply contracts.

Finally, the household segment represents a vast, consumer-driven market that demands convenient, perceived-safe, and aesthetically pleasing products. Driven by immediate visibility and accessibility via retail channels and e-commerce, this segment primarily purchases multi-purpose surface disinfectants, sanitizing wipes, and specialized products for kitchen and bathroom areas. Purchasing decisions here are influenced more by brand trust, fragrance, and environmental claims (e.g., plant-derived ingredients) than by technical efficacy data, though the baseline expectation of microbial kill performance remains a key sales driver, particularly in periods of heightened public health concern.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 15.2 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Clorox, Reckitt Benckiser, 3M, P&G, Ecolab, SC Johnson, Kimberly-Clark, Diversey, Lonza, BASF, Spartan Chemical, Steris, Metrex, Cantel Medical, Betco, Medline Industries, Huish Detergents, Sani-Cloth, Micro-Scientific Industries, Zep Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Disinfectant Market Key Technology Landscape

The technological landscape of the Disinfectant Market is characterized by a push towards enhanced delivery systems and sustainable, next-generation chemistry, aiming to improve efficacy while simultaneously mitigating user and environmental harm. A significant focus is placed on stabilizing highly reactive biocides, such as hydrogen peroxide and peracetic acid, using proprietary stabilizers and encapsulation techniques to extend shelf life and maintain efficacy under various environmental conditions, making them more practical for field use. Furthermore, advancements in synergistic formulations, combining multiple active ingredients (e.g., Quats with non-ionic surfactants or alcohols) are designed to achieve broader spectrum efficacy, faster contact times, and improved cleaning performance simultaneously, addressing the industry demand for effective "cleaner-disinfectants."

Innovation in application and delivery mechanisms represents another crucial technological area. This includes the development of sophisticated dispensing systems tailored for institutional settings, ensuring accurate dilution of concentrates to maintain compliance and avoid waste, often incorporating IoT connectivity for automated usage tracking and inventory management. The rise of residual disinfection technologies, which leave an invisible, long-lasting antimicrobial layer on surfaces, is gaining traction. These formulations often utilize polymers or specialized bonding agents to maintain biocidal activity for extended periods (hours or even days), significantly reducing the required frequency of reapplication and lowering the risk of cross-contamination in high-touch areas like public transportation or hospital waiting rooms.

The future of disinfectant technology is also heavily invested in non-chemical alternatives and novel biocidal mechanisms. UV-C light disinfection systems, particularly automated mobile robots, and pulsed xenon light technologies, are being integrated into hospital terminal cleaning protocols, offering chemical-free, high-level disinfection for large areas. Additionally, research into advanced materials incorporates antimicrobial properties directly into surfaces, such as copper alloys or silver-impregnated coatings, shifting the burden from periodic application to continuous, passive protection. Regulatory compliance (e.g., BPR registration in Europe) for these novel technologies and chemical classes requires rigorous testing and documentation, acting as both a quality control mechanism and a significant barrier to entry for new market participants.

Regional Highlights

- North America (United States, Canada, Mexico): Dominates the global market in terms of revenue share, driven by a highly mature healthcare system, strict regulatory environment (EPA, FDA), and high consumer awareness regarding hygiene. The US is a hub for R&D in novel chemical formulations and advanced application technologies (e.g., robotic disinfection). High per capita expenditure on cleaning and sanitization products ensures stable, high-value demand, with significant traction in the professional cleaning and medical device reprocessing segments.

- Europe (Germany, UK, France, Italy, Spain): Characterized by stringent environmental regulations, particularly the EU Biocidal Products Regulation (BPR), which heavily influences product formulation and approval processes. Market growth is robust, focused intensely on sustainability, demanding biodegradable and non-toxic disinfectants. Germany and the UK show strong institutional demand, while rapid adoption of ready-to-use wipes is common across the consumer segment.

- Asia Pacific (APAC) (China, India, Japan, South Korea): Expected to be the fastest-growing region, fueled by massive infrastructure development in healthcare and F&B sectors, rapid urbanization, and increasing public health expenditure. China and India represent immense potential due to their large populations and rising middle-class consumer spending. Japan remains a technologically advanced market with a strong emphasis on specialized, high-quality, and hypoallergenic formulations.

- Latin America (Brazil, Argentina, Rest of LATAM): Exhibits promising growth potential, though constrained by economic volatility and varying regulatory landscapes across countries. Demand is driven by local manufacturing growth and heightened focus on water treatment and public sanitation improvements. Brazil is the largest market, seeing increasing adoption of professional-grade disinfectants in commercial sectors.

- Middle East and Africa (MEA): Growth is driven primarily by substantial investments in modern healthcare facilities (particularly in Gulf Cooperation Council countries), rapid tourism growth necessitating high hygiene standards in hospitality, and water scarcity issues mandating robust water disinfection solutions. South Africa and Saudi Arabia are key regional revenue centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Disinfectant Market.- The Clorox Company

- Reckitt Benckiser Group plc

- 3M Company

- The Procter & Gamble Company (P&G)

- Ecolab Inc.

- SC Johnson & Son, Inc.

- Kimberly-Clark Corporation

- Diversey, Inc.

- Lonza Group AG

- BASF SE

- Spartan Chemical Company, Inc.

- Steris Corporation

- Metrex Research, LLC

- Cantel Medical Corp.

- Betco Corporation

- Medline Industries, LP

- Hillyard, Inc.

- Zep Inc.

- Novozymes A/S (Enzyme-based solutions)

- Neogen Corporation

Frequently Asked Questions

Analyze common user questions about the Disinfectant market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Disinfectant Market?

The primary factor driving market growth is the globally heightened focus on infection control and prevention, particularly in response to the high prevalence of Healthcare-Associated Infections (HAIs) and the persistent threat of pandemic outbreaks. This compels constant investment in rigorous sanitation protocols across all sectors.

Which disinfectant chemical type is currently exhibiting the fastest growth rate?

The segments involving advanced, low-toxicity chemistries, specifically Peracetic Acid (PAA) and stabilized Hydrogen Peroxide formulations, are experiencing the fastest growth. These compounds are favored for their strong efficacy, rapid contact time, and environmentally favorable decomposition profiles (breaking down into oxygen and water).

How is the Disinfectant Market addressing environmental sustainability concerns?

Market players are addressing sustainability by focusing on biodegradable formulations, reducing volatile organic compounds (VOCs), eliminating harmful residues, utilizing sustainable packaging (e.g., refill systems), and developing plant-derived or enzyme-based alternatives that meet stringent regulatory standards while minimizing ecological impact.

What role does the Asia Pacific region play in the future of the Disinfectant Market?

APAC is projected to be the fastest-growing regional market due to accelerating industrialization, substantial governmental investment in public health infrastructure development, and increasing consumer awareness and disposable income, particularly in large economies like China and India.

What is the difference between a high-level disinfectant (HLD) and an intermediate-level disinfectant?

High-Level Disinfectants (HLDs) are approved for destroying all microorganisms, including bacterial spores, and are used for reprocessing critical or semi-critical medical devices. Intermediate-Level Disinfectants eliminate vegetative bacteria, most viruses, and fungi, but not necessarily bacterial spores, making them suitable for non-critical environmental surfaces.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Electrostatic Disinfectant Sprayers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Bromine Disinfectant Tablet (BCDMH) Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Bromine Disinfectant Tablet Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Nipple disinfectant spray Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- ASEAN Livestock Disinfectant Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager