Dispensing Systems and Equipment Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441026 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Dispensing Systems and Equipment Market Size

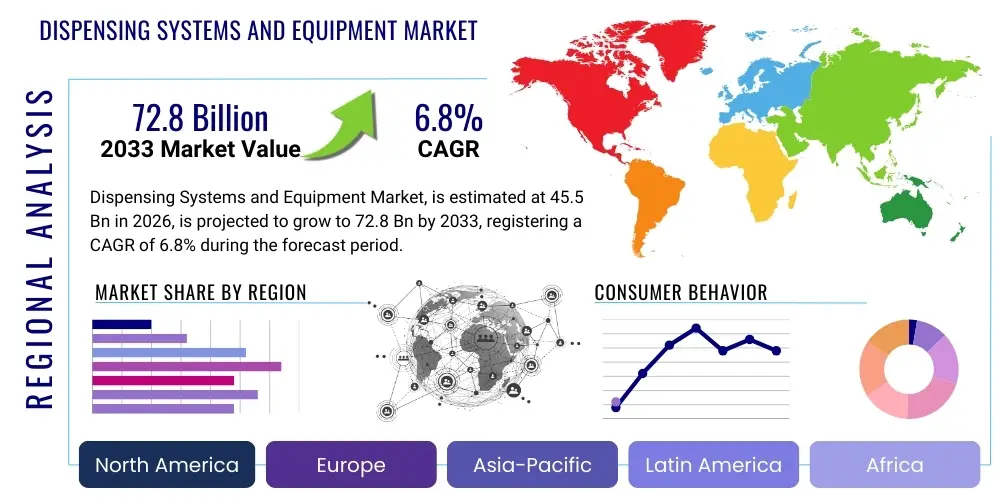

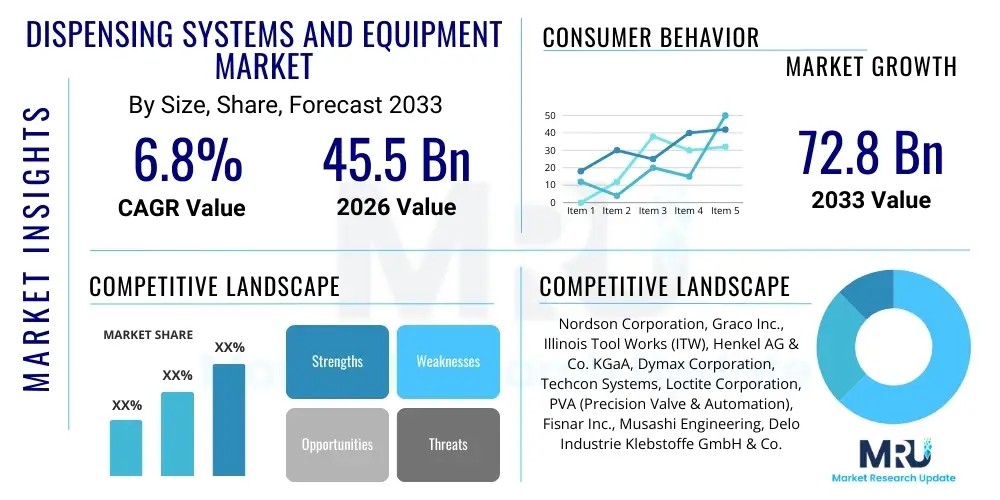

The Dispensing Systems and Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 45.5 Billion in 2026 and is projected to reach USD 72.8 Billion by the end of the forecast period in 2033.

Dispensing Systems and Equipment Market introduction

The Dispensing Systems and Equipment Market encompasses specialized machinery and apparatus designed for the precise, measured application of fluids, pastes, powders, and viscous materials in various industrial processes. These systems range from simple manual applicators to highly sophisticated, robotic, and automated volumetric dosing units crucial for manufacturing consistency and quality control. Key product categories include automated fluid dispensers, adhesive dispensers, sealant applicators, volumetric dispensing pumps, and specialized printing systems utilized for material placement. The underlying principle involves ensuring repeatability and high precision, minimizing material waste, and optimizing production speeds across diverse manufacturing landscapes.

Major applications for dispensing technology span critical sectors such as electronics manufacturing, automotive production, pharmaceuticals, food and beverage processing, and general industrial assembly. In electronics, dispensing equipment is vital for processes like underfill application, conformal coating, and thermal interface material (TIM) placement in semiconductors and PCBs. In the automotive industry, these systems are essential for structural bonding, sealing, and gasket formation, driven by the increasing demand for lightweight vehicles and advanced battery assembly. The immediate benefits derived from adopting modern dispensing solutions include enhanced production accuracy, significant reduction in manual labor costs, and adherence to stringent quality and regulatory standards, particularly in high-stakes environments like medical device manufacturing.

The market is primarily driven by the escalating demand for miniaturization in electronics, necessitating ultra-high precision fluid deposition, and the pervasive trend toward industrial automation (Industry 4.0). Furthermore, the growing adoption of advanced materials, such as two-component (2K) epoxies and specialized silicones requiring intricate mixing and precise application profiles, fuels the need for sophisticated dispensing equipment. The pharmaceutical sector's stringent requirements for sterile and accurate dosing of active ingredients further contributes to market momentum, emphasizing the need for validation-ready and highly reliable systems capable of handling complex fluid dynamics and viscosity variations across different temperature ranges and operating conditions.

Dispensing Systems and Equipment Market Executive Summary

The Dispensing Systems and Equipment Market is characterized by robust growth, propelled primarily by global manufacturing shifts toward automation, precision, and efficiency. Business trends indicate a strong focus on developing integrated solutions that combine dispensing technology with robotics and vision systems to achieve micron-level accuracy and repeatability, particularly crucial in the rapidly evolving semiconductor and electric vehicle (EV) battery manufacturing spaces. Key market participants are heavily investing in R&D to introduce smart dispensing heads equipped with IoT connectivity, enabling real-time process monitoring, predictive maintenance, and seamless data integration into factory management systems (MES). The increasing complexity of materials, including highly conductive adhesives and delicate bio-materials, mandates innovative pump and valve designs capable of handling varying viscosities and abrasive properties without compromising material integrity or flow rate stability, defining the competitive edge in the current business landscape.

Regionally, the Asia Pacific (APAC) stands out as the dominant growth engine, attributed to the massive expansion of electronics production facilities, particularly in China, Taiwan, and South Korea, coupled with significant governmental support for advanced manufacturing initiatives. North America and Europe maintain strong market shares, driven by high demand from the automotive sector transitioning to EVs and the stringent quality requirements of the established medical device and pharmaceutical industries. Trends within these mature markets lean heavily toward sophisticated, closed-loop feedback systems and highly localized technical support, emphasizing Total Cost of Ownership (TCO) over initial capital investment. The regulatory environment, particularly concerning safety and quality standards (e.g., FDA requirements), further solidifies the demand for validated, high-performance equipment across all major geographic regions, necessitating global harmonization in equipment design and validation protocols.

Segment trends reveal that the automated dispensing systems segment is capturing the largest market share, driven by labor shortages and the necessity for high-volume, continuous operation environments. Within product types, volumetric dispensing systems, which rely on positive displacement principles, are experiencing faster growth compared to time/pressure systems, owing to their inherent independence from fluid viscosity changes and ability to deliver extremely accurate, repeatable shots. Application-wise, the electronics segment remains the largest consumer, while the biomedical and life sciences applications are exhibiting the most rapid growth rate, fueled by advancements in microfluidics, wearable devices, and personalized medicine manufacturing techniques. Material trends highlight the increasing use of specialized high-viscosity materials and reactive resins, posing continuous challenges and opportunities for equipment manufacturers to innovate pumping and mixing technology.

AI Impact Analysis on Dispensing Systems and Equipment Market

User queries regarding AI's influence on dispensing systems predominantly focus on enhanced process control, predictive maintenance, and optimization of material usage. Users are specifically concerned with how AI can minimize variability in fluid properties (like viscosity changes due to temperature or batch differences) and automatically adjust dispensing parameters in real-time to maintain perfect output quality. Expectations center around achieving 'zero-defect' dispensing by leveraging machine learning algorithms to correlate sensor data (pressure, temperature, flow rate, vision system feedback) with final product quality, thereby moving beyond traditional statistical process control (SPC) towards truly adaptive manufacturing. There is also significant interest in using AI for failure prediction in critical components (e.g., pumps, valves) to maximize uptime and improve overall equipment effectiveness (OEE), significantly altering maintenance schedules.

- AI-driven real-time adaptive process control, compensating for material or environmental variables automatically.

- Predictive maintenance schedules for dispensing pumps and valves based on vibration and anomaly detection via machine learning.

- Optimization of dispensing parameters (speed, pressure, nozzle distance) for new materials using simulation and AI modeling.

- Integration of machine vision and deep learning for instant, high-resolution defect detection and quality assurance post-dispensing.

- Enhanced material utilization efficiency and waste reduction through intelligent dosing optimization algorithms.

- Automation of complex programming and path planning for robotic dispensing cells using reinforcement learning techniques.

DRO & Impact Forces Of Dispensing Systems and Equipment Market

The market dynamics for dispensing systems are heavily influenced by a critical balance between the increasing need for high-precision manufacturing (Driver) and the substantial initial investment required for advanced automated machinery (Restraint). Opportunities are largely centered on the explosive growth of niche, high-value applications such as micro-dispensing for advanced packaging (e.g., FOWLP, 3D stacking) and the development of sustainable, solvent-free adhesive and coating materials. The primary impact forces driving strategic decisions include global competition, stringent environmental regulations forcing material changes, and the rapid pace of technological obsolescence necessitating continuous investment in equipment upgrades.

Key drivers include the global push for industrial automation (Industry 4.0), leading to increased demand for robotic dispensing cells capable of 24/7 operation; the rapid expansion of the electronics sector, particularly in smartphone, EV, and advanced sensor manufacturing, where micron-level precision is non-negotiable; and the rising necessity for manufacturing traceability and verifiable process control in regulated industries such as medical devices and aerospace. These drivers emphasize system reliability, integration capabilities, and the ability to handle extremely sensitive or abrasive materials reliably over long operational cycles.

However, the market faces significant restraints, including the high cost associated with sophisticated, fully automated dispensing systems, creating barriers to entry for small and medium-sized enterprises (SMEs). Furthermore, the operational complexity and the need for highly skilled technicians to program, calibrate, and maintain these complex fluid handling systems represent a persistent challenge. A major technical restraint involves overcoming the inherent variability in material properties—such as viscosity and curing time—across different batches or environmental conditions, which can undermine dispensing accuracy if not addressed by advanced control mechanisms.

The foremost opportunities lie in the expansion into new application areas, such as 3D printing of high-viscosity materials (e.g., ceramics or specialty polymers) and the integration of dispensing heads into bioprinting and regenerative medicine workflows. Moreover, there is a clear opportunity for manufacturers to develop standardized, modular, and easily reconfigurable dispensing platforms that cater to high-mix, low-volume manufacturing environments, offering greater flexibility and faster changeover times. Finally, the development of intelligent, self-calibrating systems incorporating AI and machine learning to counteract material variability represents a significant technological and commercial opportunity that promises enhanced operational stability and reduced reliance on manual adjustments.

Segmentation Analysis

The Dispensing Systems and Equipment Market is comprehensively segmented based on the level of automation, the mechanism or product type, the material being dispensed, and the primary application industry. This segmentation provides a granular view of market dynamics, revealing varying growth rates across different technology and end-user adoption cycles. The critical distinction between automated, semi-automated, and manual systems defines the operational efficiency and scale capabilities, while the mechanism type (e.g., jetting, volumetric, time/pressure) determines the precision level achievable. Analysis of these segments helps stakeholders tailor product development and strategic marketing efforts to specific high-growth niches within industrial assembly and fluid management.

- By Type:

- Automated Dispensing Systems

- Semi-Automated Dispensing Systems

- Manual Dispensing Systems

- By Mechanism/Technology:

- Volumetric Dispensing Systems (Piston Pumps, Gear Pumps, Progressive Cavity Pumps)

- Time/Pressure Dispensing Systems

- Jetting Dispensing Systems (Non-contact)

- Spray/Coating Dispensing Systems

- By Application Material:

- Adhesives and Sealants (Epoxies, Urethanes, Silicones)

- Gaskets and Encapsulants (Form-In-Place, Potting Compounds)

- Thermal Interface Materials (TIMs)

- Solder Paste and Flux

- Lubricants and Oils

- Biological Fluids and Reagents

- By End-Use Industry:

- Electronics (Semiconductors, PCB Assembly, Mobile Devices)

- Automotive and Transportation (EV Battery Assembly, Body Assembly)

- Medical Devices and Pharmaceuticals

- Aerospace and Defense

- Food and Beverage

- General Industry and Packaging

Value Chain Analysis For Dispensing Systems and Equipment Market

The Value Chain for Dispensing Systems and Equipment initiates with the upstream supply of specialized components and raw materials, including high-precision machined parts for pumps and valves, advanced ceramics for nozzles, and sophisticated electronic control modules. Upstream activities are characterized by reliance on high-quality component suppliers specializing in microfluidics and precision engineering, ensuring the longevity and accuracy of the final equipment. Key challenges in this stage include maintaining stable supply chains for proprietary materials and managing the cost volatility of specialized metals and rare earth elements used in sensor and motor components.

The core manufacturing stage involves the assembly, integration, and testing of complex electro-mechanical systems. Manufacturers focus heavily on software integration, system calibration, and achieving necessary certifications (e.g., ISO, CE). This stage is highly capital-intensive and requires substantial expertise in industrial automation and software development to produce integrated robotic cells. Downstream, the value chain involves distribution, system integration, installation, and critical after-sales support. Given the complexity of the equipment and its direct impact on customer production lines, technical expertise and rapid response capabilities are paramount for system integrators and distributors.

Distribution channels are typically segmented into direct sales, especially for large, customized, or highly complex automated systems sold directly to global Original Equipment Manufacturers (OEMs), and indirect sales through specialized regional distributors or system integrators for standardized or smaller equipment. Direct channels allow for deeper technical consultation and tailored solutions, building strong client relationships, while indirect channels provide wider geographical reach and efficient logistics. Effective inventory management and the provision of localized maintenance and spare parts services through the distribution network are crucial determinants of customer satisfaction and overall market success in this sector.

Dispensing Systems and Equipment Market Potential Customers

Potential customers for Dispensing Systems and Equipment are highly diverse, spanning all sectors involved in precision assembly, fluid handling, and material coating, where quality, repeatability, and high throughput are essential operational requirements. The primary buyers include large-scale manufacturing Original Equipment Manufacturers (OEMs) in high-tech sectors, as well as specialized contract manufacturers (EMS providers) who require versatile, robust equipment to handle a variety of client projects. These customers prioritize equipment reliability, integration flexibility with existing production lines, and verifiable process data for quality control and regulatory compliance, making their purchasing decisions highly technical and long-term focused.

Specifically, the electronics industry remains a major end-user, with buyers in semiconductor packaging (for underfill and encapsulation), PCB assembly (for solder paste, conformal coatings), and display manufacturing (for adhesives and sealants). Automotive manufacturers, particularly those pivoting towards electric vehicle (EV) production, constitute a rapidly growing customer base, driven by the critical need for robust battery module assembly (thermal management materials dispensing) and structural body bonding. These buyers demand systems capable of high throughput and precision application of highly viscous and sometimes abrasive thermal interface materials (TIMs) and specialized structural adhesives under demanding factory conditions.

The pharmaceutical and medical device sectors represent another key customer segment, where purchasing criteria are dominated by extremely stringent regulatory requirements (e.g., FDA validation), system sterility, and unparalleled accuracy in micro-dosing drugs, reagents, or specialized medical grade adhesives for devices like catheters and syringes. These customers often seek closed-loop dispensing systems that provide complete traceability and validated performance logs. Additionally, packaging companies utilizing complex sealing agents and the growing field of additive manufacturing, requiring precision deposition of specialty pastes, represent emerging high-potential customer bases demanding cutting-edge dispensing technology capable of handling diverse rheological challenges.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.5 Billion |

| Market Forecast in 2033 | USD 72.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nordson Corporation, Graco Inc., Illinois Tool Works (ITW), Henkel AG & Co. KGaA, Dymax Corporation, Techcon Systems, Loctite Corporation, PVA (Precision Valve & Automation), Fisnar Inc., Musashi Engineering, Delo Industrie Klebstoffe GmbH & Co. KGaA, GPD Global, EFD (Nordson), Dürr Group, Eisenmann SE, Valco Melton, Mycronic AB, Dispense Works Inc., Trelleborg AB, and Scheugenpflug AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dispensing Systems and Equipment Market Key Technology Landscape

The technological landscape of the Dispensing Systems and Equipment Market is currently defined by a profound shift towards non-contact dispensing methods and the increasing sophistication of volumetric control. Non-contact jetting technology has gained significant traction, especially in semiconductor and high-density PCB manufacturing, as it allows for extremely fast and accurate material deposition without physical contact, mitigating the risk of substrate damage or contamination, and enabling dispensing over complex topography. Jetting systems are critical for maintaining high throughput while achieving feature sizes down to tens of microns, necessitating high-speed piezo actuators and advanced fluid dynamics modeling to ensure stable droplet formation and placement repeatability.

Another crucial technological advancement is the widespread adoption of positive displacement (volumetric) pumps, such as progressive cavity pumps and precision gear pumps, which provide exceptional shot-size accuracy that is independent of changes in material viscosity or supply pressure. These systems are essential when working with expensive, high-performance materials like high-viscosity thermal gap fillers or structural two-component (2K) adhesives where precise mixing ratio control is paramount for proper curing and structural integrity. The continuous refinement of these pump technologies, including the use of specialized materials for pump rotors and stators to enhance durability against abrasive fillers, is a key area of R&D investment among leading market players.

Furthermore, the integration of Industry 4.0 elements—specifically IoT sensors, machine vision systems, and closed-loop feedback mechanisms—is transforming dispensing equipment from standalone machinery into smart, interconnected production assets. Modern dispensing systems incorporate high-resolution cameras and laser sensors to verify material presence, track bead width, and measure layer thickness in real-time. This data is fed back instantly to the dispensing controller, allowing for autonomous, micro-adjustments to parameters like flow rate or robotic speed, ensuring that every dispensed pattern meets specifications, a capability vital for complex manufacturing processes like EV battery module sealing and intricate medical device assembly.

Regional Highlights

The global market for dispensing systems and equipment exhibits distinct regional growth patterns, heavily influenced by local manufacturing intensity, technological adoption rates, and regulatory frameworks. Asia Pacific (APAC) currently dominates the market both in terms of consumption volume and production capacity, driven by the sheer scale of electronics manufacturing, particularly in China, South Korea, and Taiwan. The region’s rapid expansion in electric vehicle (EV) production and supportive government policies focused on building robust supply chains for advanced materials and high-precision machinery solidify its position as the primary growth market. APAC manufacturers are rapidly adopting automated and robotic dispensing cells to achieve cost competitiveness and quality parity with global standards, making it a critical focus area for market penetration by global equipment suppliers.

North America holds a substantial market share, characterized by high technological maturity and a strong demand for advanced, customized dispensing solutions within the aerospace, defense, and high-value medical device manufacturing sectors. These industries demand systems with validated processes, high traceability, and the capability to handle highly specialized, expensive materials (e.g., aerospace-grade epoxies). The transition toward domestic semiconductor manufacturing (driven by initiatives like the CHIPS Act) and the established base of EV manufacturing are generating significant new investments in highly automated dispensing and conformal coating equipment across the US and Canada, focusing on precision and long-term reliability.

Europe represents a mature market focusing on high-quality, sustainable manufacturing, particularly within the automotive, machinery, and pharmaceutical sectors, notably in Germany, Italy, and Switzerland. European demand centers on sophisticated, energy-efficient dispensing solutions capable of handling environmentally friendly, solvent-free adhesives and sealants. The pharmaceutical industry in Europe drives substantial investment in precise micro-dosing and sterile fluid handling systems, requiring adherence to strict European Medicines Agency (EMA) and local country regulations. Market growth in this region is primarily driven by replacement cycles for upgrading existing machinery to incorporate advanced automation and digitalization features, emphasizing TCO and longevity.

- Asia Pacific (APAC): Leading market share due to unparalleled growth in consumer electronics, semiconductor back-end processes, and the establishment of large-scale EV battery gigafactories. High demand for cost-effective, high-speed automated jetting and volumetric systems.

- North America: Strong growth underpinned by the resilient aerospace, defense, and medical device sectors. Focus on highly specialized, traceable, and complex fluid dispensing solutions, coupled with significant governmental investment in localized semiconductor production.

- Europe: Mature market emphasizing high-precision, sustainable manufacturing techniques. Key application areas include automotive structural bonding, specialized industrial machinery, and pharmaceutical micro-dosing applications requiring rigorous validation and certification.

- Latin America & MEA: Emerging markets showing steady growth, primarily in packaging, general assembly, and localized automotive assembly operations. Demand tends towards semi-automated and reliable, easy-to-maintain equipment, with increasing interest in sophisticated systems aligning with industrial modernization initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dispensing Systems and Equipment Market.- Nordson Corporation

- Graco Inc.

- Illinois Tool Works (ITW)

- Henkel AG & Co. KGaA

- Dymax Corporation

- Techcon Systems

- Loctite Corporation

- PVA (Precision Valve & Automation)

- Fisnar Inc.

- Musashi Engineering

- Delo Industrie Klebstoffe GmbH & Co. KGaA

- GPD Global

- EFD (Nordson)

- Dürr Group

- Eisenmann SE

- Valco Melton

- Mycronic AB

- Dispense Works Inc.

- Trelleborg AB

- Scheugenpflug AG

Frequently Asked Questions

Analyze common user questions about the Dispensing Systems and Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between volumetric and time/pressure dispensing systems?

Volumetric dispensing systems, utilizing principles like positive displacement (e.g., piston or gear pumps), deliver a precisely measured volume of fluid independent of material viscosity changes or fluctuations in supply pressure, offering superior accuracy and repeatability. Time/pressure systems, conversely, rely on applying air pressure for a set duration, making them highly sensitive to material viscosity variations and ambient temperature, offering less control but typically lower initial cost.

How is the electric vehicle (EV) battery industry driving demand for dispensing equipment?

EV battery manufacturing requires precise application of highly viscous thermal interface materials (TIMs) and structural adhesives for cell-to-module and module-to-pack bonding. Dispensing systems must handle these abrasive, high-filler-content materials at high speeds while maintaining micron-level thickness and gap control, which necessitates advanced volumetric and mixing systems.

What is non-contact jetting dispensing and where is it predominantly used?

Non-contact jetting is a high-speed dispensing technology where tiny droplets of fluid are ejected onto the substrate without the nozzle touching the surface. This technique minimizes contamination, allows dispensing over complex topography, and is crucial for high-density electronic assembly, semiconductor packaging (underfill), and display manufacturing where speed and ultra-fine dot size are essential.

What impact does Industry 4.0 integration have on modern dispensing systems?

Industry 4.0 facilitates the integration of dispensing systems with factory networks (IoT), enabling real-time monitoring of process variables (temperature, pressure, flow rate), predictive maintenance alerts, remote diagnostics, and the use of closed-loop control systems with vision feedback to achieve self-optimizing, adaptive manufacturing processes and full production traceability.

Which end-use industry holds the largest market share for dispensing systems?

The electronics industry, encompassing semiconductor manufacturing, PCB assembly, and consumer device production, consistently accounts for the largest share of the dispensing systems market due to the critical and growing need for precision application of materials like solder paste, fluxes, underfill, and conformal coatings required for miniaturized and high-performance components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- High Resolution Dispensing Systems and Equipment Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- High Resolution Dispensing Systems And Equipment Market Size Report By Type (Semi-Automatic Dispensing Systems, Automatic Dispensing Systems), By Application (Electronics, Adhesive and Sealant Dispensers, Electrical Conductive Adhesives, Nonconductive Adhesives, Glue Dispensers, Liquid Material Dispensers, Powder Dispensers, Electronics, Automotive, Aerospace, Oil &Gas, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager