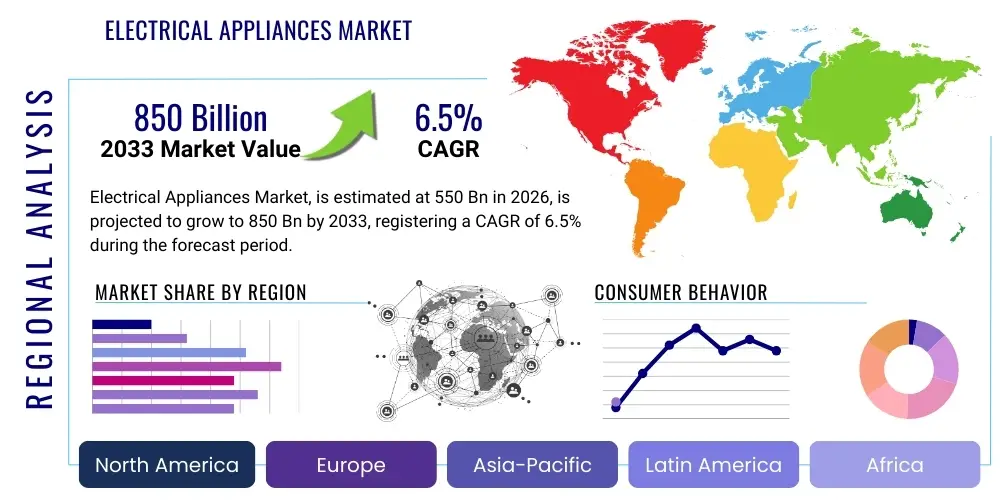

Electrical Appliances Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442572 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Electrical Appliances Market Size

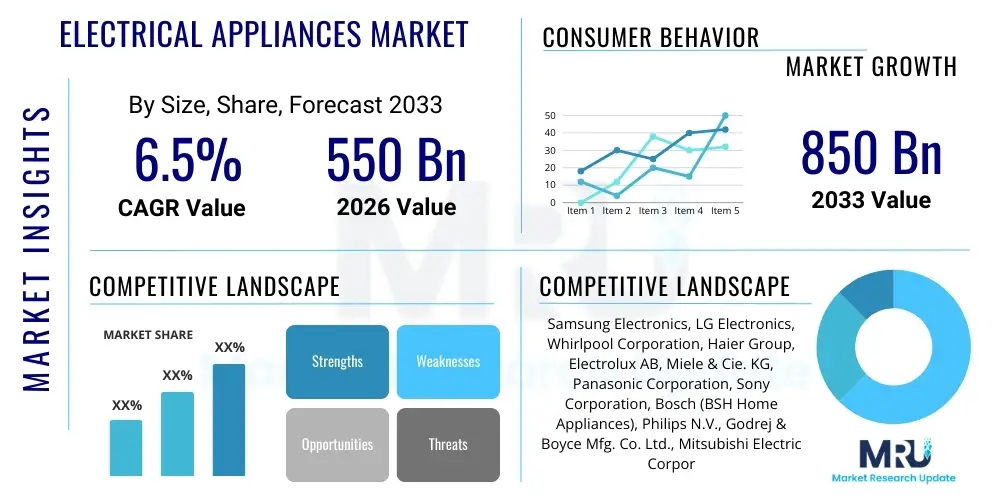

The Electrical Appliances Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 550 billion in 2026 and is projected to reach USD 850 billion by the end of the forecast period in 2033. This robust growth trajectory is underpinned by increasing global urbanization, rising disposable incomes in emerging economies, and the continuous innovation in product design focusing on energy efficiency and smart connectivity.

Electrical Appliances Market introduction

The Electrical Appliances Market encompasses a diverse range of devices designed for household or commercial use, facilitating daily tasks, enhancing comfort, and improving quality of life. This broad category spans major appliances such as refrigerators, washing machines, air conditioners, and ovens, as well as small appliances like blenders, toasters, vacuum cleaners, and personal care devices. The primary function of these products is to automate, simplify, or expedite routine activities, thereby saving time and reducing physical labor for consumers. Increasing demand for these products is driven by demographic shifts, particularly the growing number of nuclear families globally, and the consistent introduction of innovative models featuring enhanced features and aesthetic appeal.

Major applications for electrical appliances are predominantly categorized into residential and commercial sectors. In residential settings, they are crucial for kitchen management (cooking, preservation), laundry care, climate control, and entertainment. Commercially, applications extend to hospitality (hotels, restaurants), healthcare (specialized refrigeration, sterilization equipment), and corporate offices (climate control, minor kitchen equipment). The market’s continued expansion is heavily influenced by construction rates, particularly new residential housing starts, and the replacement cycle necessitated by aging infrastructure or obsolescence of existing equipment.

The fundamental benefits derived from modern electrical appliances include significant energy savings due to stringent governmental regulations and technological advancements (e.g., inverter technology in air conditioners and refrigerators). Driving factors for market growth include the rising penetration of the Internet of Things (IoT), enabling seamless integration and control of appliances through smart home ecosystems; increasing consumer awareness regarding sustainable and eco-friendly products; and competitive pricing strategies adopted by major manufacturers to capture market share in developing regions. Furthermore, supportive governmental policies promoting efficient energy consumption and infrastructure development in power distribution networks also fuel market expansion.

Electrical Appliances Market Executive Summary

The Electrical Appliances Market is undergoing a fundamental transformation driven by technological convergence and shifting consumer priorities towards efficiency and connectivity. Business trends indicate a strong focus on supply chain resilience, vertical integration, and aggressive mergers and acquisitions aimed at consolidating market presence and acquiring specialized technology. Manufacturers are increasingly prioritizing subscription-based maintenance services and integrated digital platforms to enhance customer lifetime value and gather valuable usage data. Sustainable manufacturing practices, including reduced material waste and use of recycled components, are no longer differentiators but prerequisites for leading market players, reflecting growing environmental consciousness among consumers and regulatory bodies.

Regionally, the Asia Pacific (APAC) continues its dominance, fueled by rapid urbanization, significant infrastructure investment, and burgeoning middle-class populations in countries like China and India, which are driving first-time purchases and upgrades. North America and Europe, characterized by high penetration rates, focus heavily on replacement cycles driven by smart upgrades and energy efficiency mandates (AEO consideration: consumers search for "energy-efficient appliance standards Europe"). Latin America and the Middle East & Africa (MEA) present lucrative long-term opportunities, although growth is moderated by economic volatility and slower adoption rates of high-end, smart appliances. Strategic expansion into localized production facilities in these emerging regions is a key trend for multinational corporations seeking to mitigate geopolitical risks and reduce logistics costs.

Segment trends underscore the robust growth of the Smart Appliances category, particularly those capable of diagnostics, remote control, and integration with voice assistants. Within product types, Major Appliances, specifically cooling and heating equipment (HVAC), exhibit strong volume growth due to climate change impacts leading to increased demand for temperature control solutions. Distribution trends highlight the accelerating shift towards online channels, providing consumers with greater price transparency, access to niche brands, and convenient delivery options, although specialized installation and after-sales service remain critical advantages for offline retail partners. This digital shift necessitates manufacturers investing heavily in direct-to-consumer (D2C) e-commerce capabilities and sophisticated digital marketing to maintain brand visibility and secure direct customer engagement.

AI Impact Analysis on Electrical Appliances Market

User inquiries regarding the integration of Artificial Intelligence (AI) in electrical appliances frequently revolve around core themes: "How does AI improve energy efficiency in my home?", "What privacy risks are associated with smart appliances using AI?", and "Can AI-powered appliances predict maintenance needs?" The primary concern is centered on tangible benefits, specifically cost savings through optimized performance, and security assurances regarding the vast amounts of usage data collected. Consumers expect AI to transition appliances from reactive tools to proactive, autonomous household managers capable of learning user habits, optimizing operation schedules based on utility pricing, and providing predictive maintenance alerts before failure occurs. Manufacturers are responding by focusing on edge computing within appliances to process sensitive data locally and enhancing transparency regarding data utilization policies, addressing the fundamental user need for efficiency without compromising security or autonomy.

The integration of deep learning and machine learning algorithms is revolutionizing the functionality of high-value appliances. In refrigeration, AI algorithms monitor food inventory, track expiration dates, and suggest recipes, minimizing food waste—a significant consumer value proposition. Laundry machines use sensor fusion combined with AI to determine fabric type, load size, and soil level, automatically adjusting water usage and cycle time, thereby maximizing cleaning performance while minimizing resource consumption. This automated decision-making process, often invisible to the user, translates directly into measurable savings and enhanced convenience, positioning AI as a critical differentiator in premium market segments.

Furthermore, AI facilitates highly personalized user experiences. By analyzing cumulative usage patterns, smart thermostats learn temperature preferences throughout the day and week, adjusting settings preemptively rather than reactively. Similarly, robotic vacuum cleaners utilize advanced mapping algorithms, informed by AI, to optimize cleaning routes and prioritize high-traffic areas. This shift toward self-optimizing, adaptive appliances creates a competitive landscape where continuous software updates and the integration of third-party services (e.g., grocery delivery linked to refrigerator inventory) become standard, driving recurring revenue streams and bolstering ecosystem loyalty. The market views AI not just as an added feature, but as the foundational operating system for future electrical appliances.

- Enhanced Predictive Maintenance: AI diagnoses potential malfunctions using operational data, reducing downtime.

- Optimized Energy Management: Algorithms adjust appliance usage based on grid load and peak pricing, yielding cost savings.

- Personalized User Experience: Appliances adapt settings (e.g., cooking times, temperature) based on learned user behaviors.

- Improved Resource Efficiency: AI-driven sensor fusion minimizes water, detergent, and energy use in tasks like laundry.

- Autonomous Operation: Enabling complex tasks (e.g., inventory management in refrigerators, dynamic cleaning paths in robotics) without user input.

DRO & Impact Forces Of Electrical Appliances Market

The dynamics of the Electrical Appliances Market are shaped by a complex interplay of positive and negative forces, influencing strategic decision-making and investment priorities across the industry. Key drivers, such as the accelerating adoption of smart home technology and the implementation of stringent global energy efficiency regulations (e.g., stricter minimum energy performance standards, MEPS), compel manufacturers to innovate rapidly, focusing on connectivity, miniaturization, and reduced power consumption. These forces collectively push the market toward higher-value, technology-intensive products, often leading to rapid product cycles and increased R&D expenditure to maintain competitive edge. The rising penetration of high-speed internet infrastructure globally further supports the driver of smart device integration, making sophisticated appliance functionality accessible to a broader consumer base.

Conversely, the market faces significant restraints, primarily stemming from the inherent volatility of global supply chains and the increasing cost of essential raw materials, including copper, plastics, and semiconductor components—the latter being critical for smart functionality. High initial purchase prices for advanced, energy-efficient or smart appliances often deter price-sensitive consumers in developing markets, slowing down the rate of technology adoption. Furthermore, the longevity and extended replacement cycles of durable goods, such as refrigerators and washing machines (often exceeding 8-10 years), naturally limit annual sales volumes compared to consumer electronics, requiring manufacturers to continuously explore new revenue streams like service contracts and software enhancements.

The primary opportunity lies in tapping into emerging markets in Africa, Southeast Asia, and specific regions of Latin America, where electrification rates are rising, and demographic shifts favor increased appliance penetration. Beyond geographical expansion, a major opportunity exists in the development of specialized appliances tailored for urban micro-living spaces and aging populations, requiring compact, highly automated, and accessible designs. The impact forces manifest strongly in competitive rivalry, fueled by Asian manufacturers expanding aggressively into Western markets, leading to intense price competition and continuous feature upgrades. Regulatory pressure and technological disruption act as significant external forces, constantly redefining the parameters of product design and performance standards, thereby requiring continuous adaptation and strategic foresight from all market participants.

Segmentation Analysis

Segmentation analysis provides a critical framework for understanding the diverse consumer preferences and operational characteristics shaping the Electrical Appliances Market. The market is fundamentally segmented across dimensions such as product type, distribution channel, end-user application, and technological maturity (smart vs. conventional). Analyzing these segments allows manufacturers to tailor marketing strategies, optimize product portfolios, and allocate resources efficiently toward high-growth areas. The differentiation between Major Appliances (white goods) and Small Appliances (brown goods) is crucial, as they exhibit distinct replacement cycles, price sensitivities, and consumer buying behaviors, necessitating specialized supply chain management and retail strategies for each category.

Further granularity within segmentation is achieved by differentiating between residential and commercial end-users; the commercial sector demands industrial-grade durability, higher capacity, and centralized control systems, whereas the residential segment emphasizes aesthetics, energy efficiency, and seamless smart integration. The fastest-growing segment currently revolves around technology, specifically the smart appliance ecosystem, which is characterized by higher profit margins and opportunities for recurring software-based revenue. Understanding these distinct segments is essential for strategic planning, especially when considering regional variations where specific segments, such as air cooling solutions in hot climates, disproportionately drive market growth compared to global averages.

The ongoing trend towards omni-channel retailing further complicates segmentation based on distribution, requiring hybrid strategies that leverage the immediate gratification and expertise of physical stores alongside the convenience and vast selection offered by e-commerce platforms. Manufacturers must effectively manage channel conflict while ensuring consistent brand messaging and service quality across all touchpoints. This detailed market mapping ensures that product development efforts are precisely aligned with defined consumer needs, moving beyond generic offerings to specialized solutions that address niche requirements, such as professional-grade kitchen equipment for enthusiastic home cooks or energy-efficient laundry systems for multi-family residential units.

- Product Type: Major Appliances (Refrigerators, Washing Machines, Air Conditioners, Dishwashers, Ovens), Small Appliances (Toasters, Kettles, Blenders, Vacuum Cleaners, Coffee Makers).

- Distribution Channel: Offline Retail (Supermarkets, Hypermarkets, Brand Stores, Specialty Stores), Online Retail (E-commerce Platforms, Company Websites).

- End-User: Residential (Single-Family Homes, Multi-Family Units), Commercial (Hotels, Restaurants, Offices, Hospitals).

- Technology: Conventional Appliances, Smart Appliances (IoT-enabled, AI-integrated).

Value Chain Analysis For Electrical Appliances Market

The value chain for the Electrical Appliances Market is highly complex, involving multiple stages from raw material sourcing to final consumer service, each contributing significantly to the final product cost and market efficiency. The upstream segment involves the procurement of critical components, including specialized plastics, metals (steel, aluminum, copper), electronic components (microprocessors, sensors, PCBs), and chemical inputs (refrigerants, insulation materials). Given the global nature of manufacturing, securing a stable and ethical supply of these materials, particularly semiconductor chips necessary for smart functionality, is paramount. Effective upstream management focuses on establishing long-term contracts with diverse suppliers, investing in proprietary component manufacturing, and implementing rigorous quality control and sustainable sourcing protocols to mitigate risk and ensure compliance.

The midstream phase focuses on manufacturing and assembly, which is increasingly automated and globally distributed to capitalize on regional labor efficiencies and proximity to large consumer bases. Major Original Equipment Manufacturers (OEMs) often employ a decentralized production model, utilizing advanced robotics and lean manufacturing principles to maximize scalability and minimize production lead times. Logistics and inventory management within this phase are critical, as appliances are large, heavy items requiring specialized handling and warehousing. Innovations in manufacturing technology, such as additive manufacturing for prototyping and customization, are starting to optimize the midstream process further, enabling faster iteration and specialized product variants for regional markets.

The downstream segment encompasses distribution, sales, and post-sales service, acting as the primary interface with the consumer. Distribution channels are bifurcated into direct sales, leveraging brand-owned stores and D2C e-commerce, and indirect sales, which utilize third-party retailers, specialized electronics chains, and online marketplaces. Direct channels offer greater control over branding and pricing, while indirect channels provide wider market reach. Crucially, the downstream also includes robust after-sales support, encompassing installation, warranty fulfillment, maintenance, and spare parts management. The efficiency of this service network significantly influences brand loyalty and overall customer satisfaction, making investment in highly trained technical staff and localized service centers a key competitive advantage in securing market share.

Electrical Appliances Market Potential Customers

The consumer base for the Electrical Appliances Market is exceptionally broad, spanning across demographics, income levels, and geographies, but can be systematically categorized based on purchase motivation and consumption patterns. Primary potential customers include New Homeowners and First-Time Buyers, who drive substantial initial demand for complete sets of major and small appliances needed to furnish a new residence. This segment is often highly price-sensitive but increasingly values integrated smart features and energy efficiency as long-term investments. They rely heavily on detailed online reviews, comparative pricing tools, and recommendations from builders or real estate agents before making purchase decisions.

A second crucial segment comprises Replacement Buyers, typically middle to high-income consumers residing in developed economies, whose purchasing decisions are triggered by appliance failure, technological obsolescence, or the desire for an upgrade (the "lifestyle upgrade" buyer). This group is less price-sensitive than first-time buyers but places a premium on advanced features, aesthetic design, brand reputation, and seamless integration with existing smart home ecosystems. Manufacturers often target this segment with premium, feature-rich models and trade-in programs, leveraging the replacement cycle as an opportunity to introduce innovative, higher-margin products like connected refrigerators or heat pump tumble dryers.

The third major segment is the Commercial and Institutional Sector, including hotels, large restaurants, hospitals, and corporate facilities. These buyers prioritize industrial-grade reliability, compliance with specific health and safety standards, large capacity, and centralized control and monitoring systems. Their purchasing involves complex procurement processes, long sales cycles, and often results in bulk orders requiring specialized B2B sales teams and extensive commercial service contracts. Targeting this segment requires specialized product lines designed for high-throughput environments and strict adherence to commercial energy and operational efficiency mandates, differentiating them significantly from the standard residential consumer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Billion |

| Market Forecast in 2033 | USD 850 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Samsung Electronics, LG Electronics, Whirlpool Corporation, Haier Group, Electrolux AB, Miele & Cie. KG, Panasonic Corporation, Sony Corporation, Bosch (BSH Home Appliances), Philips N.V., Godrej & Boyce Mfg. Co. Ltd., Mitsubishi Electric Corporation, Hisense Group, Arçelik A.Ş., Sharp Corporation, Daikin Industries, Gree Electric Appliances, Voltas Limited, Havells India Ltd., V-Guard Industries Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electrical Appliances Market Key Technology Landscape

The Electrical Appliances Market is heavily dependent on advancements in several key technological domains, driving both functional performance and consumer appeal. Central to the current landscape is the widespread integration of the Internet of Things (IoT), which allows appliances to connect to the internet, communicate with other smart devices, and be remotely controlled via smartphone applications or voice assistants. This connectivity is facilitated by robust Wi-Fi modules, standardized communication protocols, and cloud computing infrastructure capable of managing massive datasets generated by millions of active devices. This technological shift moves appliances beyond simple utility to becoming integrated components of a cohesive home automation system, offering unprecedented levels of convenience and centralized management capabilities.

Beyond connectivity, critical technological development is focused on enhancing core operational efficiency and sustainability. Inverter technology remains a cornerstone for energy efficiency in motor-driven appliances such as refrigerators, washing machines, and air conditioners, offering variable speed control that significantly reduces power consumption compared to traditional fixed-speed motors. Furthermore, the shift towards environmentally friendly refrigerants (low Global Warming Potential, GWP) is driving innovation in compressor and heat exchange design, ensuring appliances meet increasingly stringent environmental mandates imposed across Europe and North America. Material science also plays a vital role, with ongoing research into lightweight, durable, and highly insulating materials to improve product longevity and energy retention.

The future technology landscape is heavily influenced by Artificial Intelligence (AI) and Machine Learning (ML). These computational technologies are embedded in appliance operation to facilitate true autonomy and learning. For instance, sensors combined with ML algorithms allow ovens to precisely track the doneness of food, minimizing human intervention, or enable vacuum cleaners to distinguish between different floor surfaces and adjust suction power accordingly. Furthermore, AI is crucial for developing sophisticated diagnostic systems capable of predicting component failure, automatically ordering replacement parts, or scheduling technician visits. This convergence of connectivity, high-efficiency mechanical design, and intelligent software processing defines the cutting-edge of the modern electrical appliance industry, ensuring that technology remains the primary competitive battleground.

Regional Highlights

Regional dynamics play a crucial role in shaping the Electrical Appliances Market, reflecting disparities in economic development, technological adoption, climate patterns, and regulatory frameworks. Each major region exhibits unique consumption patterns and demands tailored product offerings from global manufacturers.

- Asia Pacific (APAC): This region is the largest and fastest-growing market, driven by massive population density, rapid industrialization, and rising middle-class income levels, particularly in China, India, and Southeast Asian nations. Demand is fueled by first-time appliance purchases, especially for major appliances like air conditioners (due to climate) and refrigerators. The competitive landscape is dominated by both global giants and strong regional players focusing on volume sales and accessible pricing, although there is a surging interest in premium, smart, and feature-rich imported models among urban consumers.

- North America: Characterized by high market maturity and penetration, growth in North America is predominantly driven by replacement cycles, smart upgrades, and increasing consumer focus on environmental performance and energy efficiency certifications (like ENERGY STAR). The market exhibits strong demand for high-capacity, large-format appliances and advanced smart home integration capabilities, with consumers showing a willingness to pay a premium for seamless connectivity and sophisticated design.

- Europe: The European market is highly regulated, placing immense emphasis on strict energy efficiency standards, sustainability, and longevity (the 'right to repair' movement). Consumers prioritize durability, low noise levels, and minimalist design aesthetics. Western Europe leads in the adoption of specialized, highly efficient technologies such as heat pump dryers and induction cooking appliances, while Central and Eastern European markets demonstrate high growth potential as disposable incomes rise.

- Latin America (LATAM): Market growth is steady but often subject to macroeconomic instability and currency fluctuations. Key drivers include urbanization and improving electrification rates. Consumers typically prioritize basic functionality, durability, and value for money. Brazil and Mexico represent the largest markets, focusing primarily on necessary major appliances like refrigerators and washing machines, with smart adoption remaining concentrated in affluent urban centers.

- Middle East and Africa (MEA): This region offers significant long-term growth opportunities, particularly the Gulf Cooperation Council (GCC) countries where high temperatures drive exceptional demand for HVAC systems and specialized cooling solutions. Investment in new residential construction and tourism infrastructure fuels demand. The African market is highly fragmented, with penetration rates increasing slowly but steadily, focusing on low-cost, robust appliances capable of handling intermittent power supplies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electrical Appliances Market.- Samsung Electronics

- LG Electronics

- Whirlpool Corporation

- Haier Group

- Electrolux AB

- Miele & Cie. KG

- Panasonic Corporation

- Sony Corporation

- Bosch (BSH Home Appliances)

- Philips N.V.

- Godrej & Boyce Mfg. Co. Ltd.

- Mitsubishi Electric Corporation

- Hisense Group

- Arçelik A.Ş.

- Sharp Corporation

- Daikin Industries

- Gree Electric Appliances

- Voltas Limited

- Havells India Ltd.

- V-Guard Industries Ltd.

Frequently Asked Questions

Analyze common user questions about the Electrical Appliances market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Smart Electrical Appliances segment?

The primary drivers are the increasing penetration of the Internet of Things (IoT), consumer demand for convenient remote control and monitoring capabilities, and the integration of Artificial Intelligence (AI) to optimize energy consumption and deliver personalized appliance performance. Regulatory pressures favoring energy efficiency also propel smart, connected device adoption.

Which geographical region holds the largest market share for electrical appliances?

The Asia Pacific (APAC) region currently dominates the global electrical appliances market share, driven by rapid urbanization, substantial growth in disposable income among the burgeoning middle class, and high demand for both major and small appliances in high-population countries like China and India.

How are environmental regulations impacting the manufacturing of major appliances?

Environmental regulations, particularly in North America and Europe, mandate continuous improvements in Minimum Energy Performance Standards (MEPS) and the phase-out of high Global Warming Potential (GWP) refrigerants. This forces manufacturers to invest heavily in inverter technology, improved insulation, and sustainable manufacturing processes to ensure product compliance and market access.

What are the key distribution channel trends observed in the market?

The market is experiencing a significant shift toward Online Retail (e-commerce platforms) due to consumer preference for price comparison, convenience, and broader selection. However, Offline Retail remains crucial for high-value major appliances, where consumers require in-person product experience, specialized installation services, and personalized consultation.

What differentiates Major Appliances from Small Appliances in terms of market dynamics?

Major Appliances (e.g., refrigerators, washing machines) exhibit long replacement cycles (8-15 years), high purchase value, and strong sensitivity to energy ratings. Small Appliances (e.g., kettles, toasters) are characterized by shorter replacement cycles, higher volume sales, lower price points, and are often driven by impulse purchases, gifting trends, and rapid technological innovation in specialized functions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Low Voltage Electrical Appliances Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Bakelite Market Size Report By Type (Alcohol-soluble, Modified, Oil-soluble), By Application (Semi-Conductors, Wire Insulations, Brake Pads, Industrial & Mechanical, Consumer Goods, Electrical Appliances And Electronics, Automotive, Aerospace, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Plastics for Electrical Appliances Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Polycarbonate (PC), Polypropylene (PP), Acrylonitrile Butadiene Styrene and Styrene-acrylonitrile (ABS & SAN), Low-density Polyethylene (LDPE/LLDPE), Polystyrene (PS), Polyvinyl Chloride (PVC), Polyamide (PA), Others), By Application (Household, Commercial), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Polyamide 66 (Pa66) Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Blow Molding Grade, Injection Molding Grade, Extrusion Grade), By Application (Auto Industry, Electronic and Electrical Appliances Industry, Equipment, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager