Fall Protection Equipment Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441230 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Fall Protection Equipment Market Size

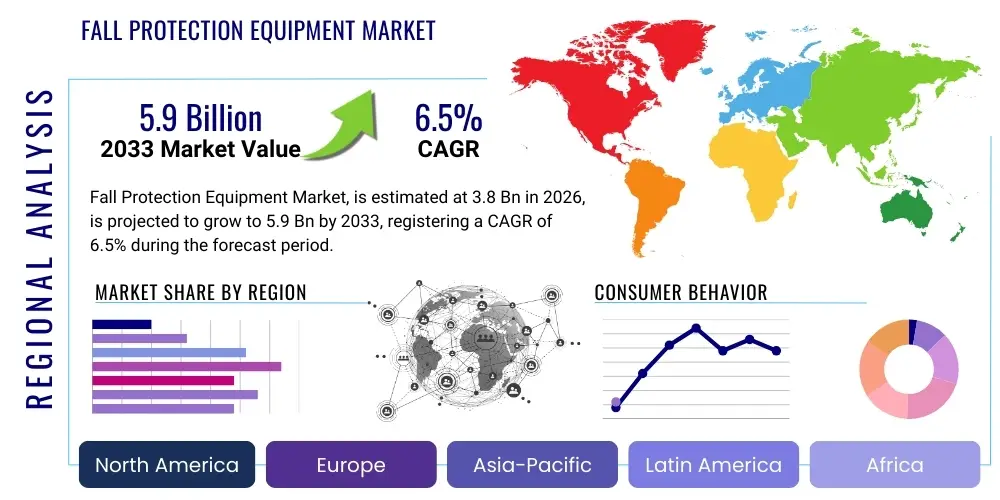

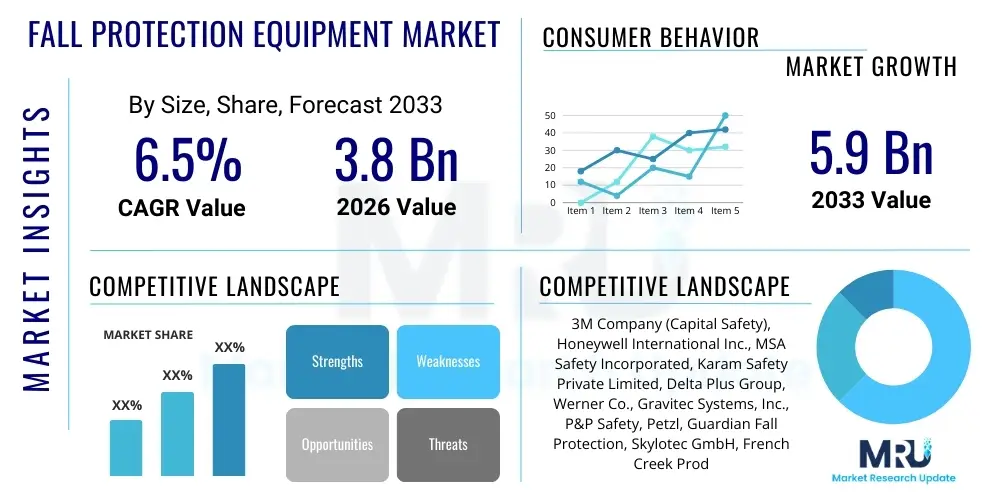

The Fall Protection Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 3.8 Billion in 2026 and is projected to reach USD 5.9 Billion by the end of the forecast period in 2033.

Fall Protection Equipment Market introduction

The Fall Protection Equipment Market encompasses the manufacturing and distribution of specialized devices and systems designed to prevent workers from falling from heights or to minimize the severity of injuries should a fall occur. This equipment is critical in high-risk industries such as construction, mining, oil and gas, utilities, and general manufacturing, where working at elevated levels is a routine requirement. Key products include safety harnesses, lanyards, lifelines, anchors, connectors, and self-retracting lifelines (SRLs). The demand for these products is fundamentally driven by stringent governmental safety regulations, notably those enforced by OSHA (Occupational Safety and Health Administration) and similar bodies globally, which mandate comprehensive fall protection programs in environments above a certain height threshold. Increasing urbanization, infrastructure development in emerging economies, and the growing awareness among employers regarding worker safety and liability reduction are major factors contributing to sustained market growth, emphasizing the adoption of advanced, ergonomically superior equipment.

Fall protection systems are generally categorized into two main types: active systems, which involve the user actively engaging with the equipment (e.g., body harnesses and lanyards), and passive systems, which include physical barriers or protective coverings that do not require active worker involvement (e.g., guardrails and safety nets). The primary application of this equipment is centered around ensuring compliance with international safety standards, reducing workplace fatalities, and limiting the significant economic burden associated with fall-related accidents, which include medical costs, lost productivity, and potential litigation. Benefits extend beyond mere compliance, enhancing overall worker confidence and efficiency when performing tasks at height. Recent technological advancements focus on integrating smart features, such as sensors in harnesses and RFID tags for better inspection and inventory management, thereby ensuring compliance and improving the lifespan and reliability of the equipment under harsh operational conditions.

Driving factors for this market are highly correlated with global construction spending and industrial maintenance activities. The necessity of maintaining aging infrastructure, combined with large-scale renewable energy projects (like wind farms), inherently requires specialized fall protection solutions. Moreover, the increasing focus on advanced training and simulation tools, complementing the use of high-quality equipment, ensures that safety protocols are strictly followed. The market is experiencing a shift toward lighter, more durable materials, such as specialized aluminum alloys and high-strength synthetic fibers, which offer superior performance without compromising comfort, thereby encouraging consistent use by workers. Global standardization efforts, despite regional variations in specific regulatory limits, also contribute to the harmonization of product quality and testing requirements, fostering international trade and market expansion.

Fall Protection Equipment Market Executive Summary

The global Fall Protection Equipment Market demonstrates robust growth, primarily propelled by rigorous regulatory enforcement across industrialized nations and rapidly increasing infrastructure investment in the Asia Pacific region. Business trends highlight a pronounced shift towards integrated safety solutions, where equipment is bundled with training, inspection services, and digital management tools to offer a holistic safety program. Leading manufacturers are intensely focused on product innovation, particularly the development of lighter, ergonomically enhanced harnesses and self-retracting lifelines (SRLs) featuring advanced energy absorption mechanisms. Mergers and acquisitions remain a vital strategy for market participants to consolidate technology, expand geographic reach, and capture niche markets such as specialized confined space rescue gear or extreme environment fall arrest systems. Sustainability is also emerging as a key trend, with companies exploring recyclable materials and manufacturing processes that reduce environmental impact while maintaining necessary safety standards.

Regional trends indicate that North America and Europe maintain dominance due to established industrial safety cultures and stringent legislative frameworks like those set by OSHA and the European Agency for Safety and Health at Work (EU-OSHA). However, the Asia Pacific region is forecast to exhibit the highest CAGR, driven by massive construction projects in countries like China, India, and Southeast Asia, coupled with improving regulatory compliance standards enforced by local governments transitioning towards global safety benchmarks. Latin America and the Middle East and Africa (MEA) are also showing promising growth, largely attributed to expanding oil and gas exploration, mining operations, and large-scale public utility developments. The regulatory environment acts as a primary market mover globally, ensuring a consistent replacement cycle for equipment due to mandatory expiration dates and inspection requirements.

Segmentation trends reveal that the full body harness segment continues to hold the largest market share due to its mandatory use across most high-risk applications, offering comprehensive support and load distribution during a fall event. Concurrently, the self-retracting lifeline (SRL) segment is experiencing rapid technological adoption and market penetration, owing to its superior mobility, reduced fall distance, and ease of use compared to traditional lanyards. By vertical, the Construction sector remains the largest end-user, but the Utilities segment (especially wind energy maintenance) and General Industrial sector are demonstrating accelerated adoption rates for specialized rescue and fall protection kits. Material innovations are impacting the market, with high-performance polymers and composite materials being adopted to enhance durability against UV exposure, chemicals, and abrasion, thereby prolonging the serviceable life of the safety gear and improving return on investment for end-users.

AI Impact Analysis on Fall Protection Equipment Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Fall Protection Equipment Market primarily revolve around how AI can enhance proactive safety measures, automate compliance checking, and improve the lifespan and reliability of safety gear. Users frequently inquire about the integration of AI with smart wearables to detect physiological signs of fatigue or stress in workers before a fall incident occurs, moving the industry from reactive fall arrest to predictive fall prevention. Concerns also focus on the cost-effectiveness and practicality of deploying complex AI systems on remote or harsh industrial sites, asking if the technology is robust enough to withstand typical operational environments. Furthermore, safety managers seek clarification on how AI can streamline mandatory equipment inspection processes, automate documentation for regulatory bodies, and analyze large datasets from job sites to identify previously unrecognized hazards or patterns of risky behavior among workers, ultimately driving down overall accident rates. The consensus expectation is that AI will transform safety management from a periodic audit function into a continuous, real-time risk mitigation system.

- AI-driven Predictive Analytics: Utilizing machine learning algorithms to analyze environmental data, worker movement patterns, and historical incident records to predict high-risk scenarios and alert supervisors proactively, shifting focus from fall arrest to fall prevention strategies.

- Smart Compliance Monitoring: Implementing AI-powered vision systems on job sites to automatically verify the correct usage of mandatory fall protection equipment (e.g., checking if harnesses are properly donned and anchored) in real-time, reducing human error in safety observation.

- Automated Equipment Inspection: Using AI and computer vision integrated with drones or fixed cameras to inspect anchors, lifelines, and structures for wear, tear, or structural integrity issues that might compromise fall protection effectiveness, thereby ensuring compliance and extending equipment life.

- Ergonomic Design Optimization: Leveraging AI to analyze biomechanical data collected from smart harnesses during various tasks, aiding manufacturers in designing lighter, more comfortable, and anatomically efficient equipment that workers are more likely to use consistently and correctly.

- Enhanced Training Simulations: Deploying AI and Virtual Reality (VR) environments to create highly realistic fall-risk simulations, offering personalized feedback and improving worker response to dangerous situations without physical exposure, leading to better preparedness and awareness.

- Digital Incident Reconstruction: Utilizing AI to meticulously analyze sensor data immediately following a fall event, providing precise details about the dynamics of the incident, impact forces, and equipment performance, which is crucial for root cause analysis and future safety improvements.

DRO & Impact Forces Of Fall Protection Equipment Market

The Fall Protection Equipment Market is shaped by powerful Drivers, inherent Restraints, substantial Opportunities, and various Impact Forces. The primary driver is the non-negotiable imperative of worker safety, underpinned by escalating regulatory standards worldwide, which mandate the use of certified protection systems. This regulatory pressure ensures continuous demand for new and replacement equipment. Opportunities reside significantly in developing smart fall protection gear (IoT integration) and expanding market presence in emerging economies where industrialization is surging but safety compliance remains nascent. Restraints primarily involve the high upfront cost associated with premium, advanced fall protection systems and the persistent challenge of ensuring consistent and correct use of equipment by workers, often stemming from poor training or perceived discomfort. Impact forces, such as technological innovation (e.g., advanced materials) and fluctuating global commodity prices (affecting manufacturing costs), exert continuous pressure on pricing structures and product performance capabilities, demanding agile supply chain management from key market players to maintain competitive advantage and meet stringent safety certifications.

Specific market drivers include rapid growth in the construction sector, particularly high-rise and complex civil engineering projects globally, alongside rigorous maintenance requirements in sectors like telecommunications (tower maintenance) and renewable energy (wind turbine inspection and upkeep). Mandatory safety refresher courses and equipment inspection laws in key markets necessitate frequent purchasing and replacement, generating stable revenue streams for manufacturers. Furthermore, increasing corporate focus on ESG (Environmental, Social, and Governance) criteria places greater emphasis on employee well-being and zero-harm policies, pushing companies to invest proactively in the highest grade of safety equipment available, often exceeding minimum regulatory requirements. This voluntary adoption of superior safety standards is a powerful organic driver, especially among large multinational corporations seeking to protect their reputation and manage liability risks effectively across diverse jurisdictions.

Conversely, the market faces significant restraints related to end-user education and the cultural acceptance of safety protocols. In certain regions, safety spending is still perceived as a cost center rather than an investment, leading to the selection of low-quality, non-certified equipment. Another key restraint is the complexity of integrating diverse fall protection components into seamless systems; incompatibilities between different manufacturers' gear can pose safety risks if not managed properly. Opportunities are abundant in the customization of equipment for specific, challenging environments, such as marine environments or highly corrosive chemical plants, requiring unique material compositions and certification. Additionally, the move toward digital platforms for safety management, encompassing training, inventory tracking, and compliance reporting, presents a major opportunity for vendors to offer value-added services beyond the physical product, creating stronger long-term customer relationships and recurring service revenues.

Segmentation Analysis

The Fall Protection Equipment Market is broadly segmented based on product type, end-use vertical, application, and distribution channel. Product segmentation is crucial as it dictates the functional utility and regulatory approval required for each item, ranging from simple lanyards to complex engineered systems. The end-use vertical analysis highlights the varying safety needs and purchasing power across industries, with construction, oil & gas, and utilities being the most dominant consumers. Application segmentation often differentiates between work positioning, fall arrest, and rescue operations, each requiring distinct sets of components and systems. This granular segmentation allows manufacturers to tailor their marketing strategies and product development efforts toward specific high-growth areas, such as the increasing demand for specialized rescue equipment tailored for confined spaces or challenging elevated maintenance scenarios, ensuring maximum market penetration and optimized resource allocation for regulatory compliance and product development.

- By Product Type:

- Full Body Harnesses

- Self-Retracting Lifelines (SRLs)

- Lanyards

- Anchorage Connectors

- Vertical Rail/Cable Systems

- Horizontal Lifeline Systems

- Rescue and Descent Devices

- Other Accessories (Ropes, Carabiners, Shock Absorbers)

- By End-Use Vertical:

- Construction (Residential, Commercial, Infrastructure)

- Oil & Gas (Upstream, Midstream, Downstream)

- General Industrial (Manufacturing, Warehousing)

- Utilities (Power Generation, Transmission, Telecom)

- Mining

- Government & Defense

- By Application:

- Fall Arrest

- Work Positioning

- Suspension

- Rescue

- By Distribution Channel:

- Direct Sales (Contractual Agreements)

- Indirect Sales (Distributors, Retailers, E-commerce)

Value Chain Analysis For Fall Protection Equipment Market

The value chain for the Fall Protection Equipment Market is complex, beginning with the sourcing of high-strength raw materials such as specialized synthetic fibers (Nylon, Polyester, Kevlar), metal alloys (Aluminum, Steel), and advanced polymers used for shock absorption and housing. The upstream segment involves the rigorous testing and certification of these materials to meet industrial standards like ANSI or EN, ensuring durability, strength, and resistance to environmental factors like UV degradation and chemical exposure. Key activities at this stage include research into lighter, stronger, and more comfortable materials to enhance user adoption. Manufacturing involves high precision fabrication, stitching, and assembly, requiring specialized machinery and highly skilled labor to ensure that every component, especially load-bearing seams and connection points, adheres to zero-defect standards required for life-critical equipment. Quality control and mandatory third-party certification checks are integral before products proceed to the downstream segments.

The downstream activities focus heavily on distribution, logistics, and crucial post-sale services. Distribution channels are typically dual: direct sales are used for large industrial clients (e.g., government contracts, major construction firms) requiring customized engineered systems and on-site technical support. Indirect channels, involving authorized safety equipment distributors, specialized resellers, and increasingly, e-commerce platforms, manage the high-volume sales of standardized products like harnesses and lanyards. The channel partners play a vital role in local inventory management, providing immediate access to replacement parts, and organizing localized safety seminars. Post-sale services, including mandatory annual inspections, repair, recertification, and comprehensive safety training programs, represent a critical profit center and a point of differentiation for major market players, ensuring continuous revenue generation long after the initial sale, solidifying customer loyalty, and guaranteeing regulatory compliance throughout the product lifecycle.

Direct sales provide manufacturers with greater control over pricing and customer feedback, enabling quick adjustments to product specifications based on real-world usage and regulatory updates. However, indirect channels offer broader geographical reach and superior scalability, leveraging the established logistics networks of global and regional distributors. The value chain is significantly impacted by regulatory bodies; compliance costs are substantial but necessary, embedding safety testing and documentation throughout the entire process. Furthermore, the final stage involves the end-user (e.g., construction workers, maintenance technicians), whose training and correct utilization of the equipment close the safety loop, ensuring the system functions as intended during an incident. Therefore, strong linkages between manufacturers, trainers, and end-users are paramount to maximizing the value delivered by the equipment.

Fall Protection Equipment Market Potential Customers

Potential customers for the Fall Protection Equipment Market span across virtually all industrial sectors where workers are routinely exposed to elevated workspaces, ranging from temporary heights on construction sites to permanent access points in manufacturing facilities and utility structures. The primary end-users are large general contractors, specialized subcontractors in roofing, facade installation, and structural steel erection, who require bulk quantities of standard and specialized personal fall arrest systems (PFAS). Beyond construction, the energy sector, encompassing oil and gas drilling platforms (both offshore and onshore), refining operations, and the maintenance teams for wind and solar farms, represents a highly lucrative customer base, demanding rugged, specialized equipment capable of resisting extreme weather and corrosive environments. These energy clients often prefer long-term supply contracts that include maintenance and inspection services.

The utility sector, including electricity transmission and distribution companies, telecommunications tower maintenance providers, and public works departments responsible for bridge and reservoir maintenance, constitutes another crucial customer segment. These entities require portable, reliable systems for accessing remote or difficult-to-reach locations. General industry, including automotive manufacturing, aerospace assembly, and large-scale warehousing operations that utilize elevated conveyor systems or rack access, also represents a constant, steady demand source, typically focusing on permanent engineered systems like rigid lifelines and guardrail installations integrated into facility infrastructure. Governments and defense organizations, particularly navies and air force bases requiring specialized harness and restraint systems for high-altitude work or vehicle maintenance, are significant, albeit highly specified, buyers, driven strictly by military and national safety standards which often exceed commercial requirements.

Furthermore, smaller, often overlooked customers include independent professional service providers such as commercial window cleaning companies, chimney repair specialists, and disaster relief/rescue organizations. The growth of specialized training and consulting firms that purchase equipment for demonstration and certification purposes also contributes to the market. The purchasing decision process for all these customer types is highly influenced by insurance requirements, liability concerns, the reputation of the equipment manufacturer for reliability and compliance, and crucially, the cost-benefit analysis concerning worker injury reduction. The most attractive customers are those with high employee turnover and continuous project cycles, requiring steady replacement and expansion of their safety equipment inventory to meet evolving project demands and workforce size fluctuations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.8 Billion |

| Market Forecast in 2033 | USD 5.9 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company (Capital Safety), Honeywell International Inc., MSA Safety Incorporated, Karam Safety Private Limited, Delta Plus Group, Werner Co., Gravitec Systems, Inc., P&P Safety, Petzl, Guardian Fall Protection, Skylotec GmbH, French Creek Production, Pure Safety Group (Gryphon Partners), TRACTEL, KASK S.p.A., Mallcom (India) Ltd., ELK River, Sellstrom Manufacturing Co., Safewaze, Eurosafe Solutions. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fall Protection Equipment Market Key Technology Landscape

The technological landscape of the Fall Protection Equipment Market is rapidly evolving beyond traditional static gear, moving towards sophisticated, integrated smart systems designed for enhanced user comfort, compliance, and real-time safety monitoring. A major development is the integration of Internet of Things (IoT) sensors and RFID technology into key components like harnesses, anchors, and lifelines. This digital integration allows safety managers to track the usage history, inspection status, and location of every piece of equipment instantly, ensuring that only certified and non-expired gear is utilized on job sites. Furthermore, advanced material science plays a crucial role; manufacturers are utilizing aerospace-grade aluminum and composite materials to significantly reduce the weight of anchors and self-retracting lifelines (SRLs) while increasing their strength and resistance to harsh environmental conditions, thereby improving worker compliance and reducing fatigue over long shifts.

A specific area of intensive innovation lies within Self-Retracting Lifelines (SRLs), which are evolving to include sophisticated features such as dual-mode operation (leading edge compliant) and high-speed braking mechanisms that minimize fall distance and impact force, particularly important in modern light-gauge steel construction where sharp edges are common. Energy absorption technology is also progressing, with new shock absorbers designed to provide softer deceleration over a longer distance, reducing the maximum force exerted on the worker’s body to well below the regulatory limit of 1,800 pounds (or 8kN in Europe). This focus on reducing the physiological trauma of a fall event is a major design priority. Furthermore, connectivity extends to emergency response; certain smart harnesses are now equipped with integrated GPS and inertial sensors capable of detecting a fall and automatically alerting emergency services or supervisors, providing precise location data crucial for rapid rescue operations, especially in remote or noisy industrial environments.

The industry is also leveraging digital platforms for training and certification. Virtual Reality (VR) and Augmented Reality (AR) tools are becoming increasingly prevalent, offering immersive, risk-free environments for workers to practice essential safety maneuvers, proper harness donning, and complex rescue procedures, significantly improving learning retention compared to traditional classroom methods. This technological evolution is driven not only by performance but also by the need for better data documentation. Digital safety management systems automatically generate audit trails necessary for regulatory reporting and insurance purposes, streamlining administrative burdens associated with safety compliance. The convergence of hardware performance, material science, and data analytics represents the core technological trajectory of the fall protection market, moving towards fully integrated, highly intelligent Personal Protective Systems (PPS) rather than disparate pieces of equipment.

Regional Highlights

- North America (U.S. and Canada): This region is characterized by exceptionally stringent regulatory mandates enforced by OSHA and ANSI standards, making it the most mature and dominant market globally in terms of value. High adoption rates are driven by a strong safety culture, particularly across the massive construction, oil and gas, and aerospace industries. Innovation is robust, with manufacturers focusing heavily on IoT integration, advanced comfort features, and specialized systems compliant with leading-edge requirements. The compulsory replacement cycle of fall protection equipment due to regulatory lifespan mandates ensures steady, high-value demand, supported by well-established distribution and training networks.

- Europe (Germany, UK, France, Italy): Europe is a key market, guided by directives from the European Agency for Safety and Health at Work (EU-OSHA) and specific EN standards. Germany and the UK are primary revenue generators, characterized by high spending on engineered fall protection systems and an emphasis on passive protection (e.g., guardrails). The region is a leader in sustainable manufacturing practices within the safety sector. Growth is supported by infrastructure repair projects and significant investment in wind energy maintenance, which requires specialized rope access and fall protection solutions.

- Asia Pacific (China, India, Japan, South Korea): The APAC region is poised for the fastest growth (highest CAGR) during the forecast period. This acceleration is fueled by massive urbanization, relentless infrastructure development (e.g., high-speed rail, mega-cities), and a gradual but firm shift towards stricter government-enforced safety legislation, particularly in China and India. While price sensitivity remains a factor, increasing foreign direct investment in manufacturing and construction is driving the demand for high-quality, certified international-standard equipment, moving away from low-cost, uncertified alternatives.

- Latin America (Brazil, Mexico): Growth in Latin America is tied closely to the volatile performance of the mining and oil and gas sectors, particularly in Brazil and Mexico. The market is developing, with rising awareness of occupational hazards leading to legislative reforms. Adoption rates are improving, though often constrained by economic stability and the prevalence of small-to-medium enterprises that may lack comprehensive safety budgets. International regulatory standards often influence local procurement decisions, especially for large multinational companies operating in the region.

- Middle East and Africa (MEA): The MEA market is heavily influenced by large-scale oil and gas investments (Saudi Arabia, UAE) and ambitious infrastructure projects (e.g., Expo sites, mega-towers). These projects often adhere to international safety standards (US or European), driving demand for premium products. The market growth is strong but concentrated around urban and resource extraction hubs. Africa presents a significant long-term opportunity as industrialization increases, requiring fundamental safety framework implementation and corresponding equipment provision.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fall Protection Equipment Market.- 3M Company (Capital Safety)

- Honeywell International Inc.

- MSA Safety Incorporated

- Karam Safety Private Limited

- Delta Plus Group

- Werner Co.

- Gravitec Systems, Inc.

- P&P Safety

- Petzl

- Guardian Fall Protection

- Skylotec GmbH

- French Creek Production

- Pure Safety Group (Gryphon Partners)

- TRACTEL

- KASK S.p.A.

- Mallcom (India) Ltd.

- ELK River

- Sellstrom Manufacturing Co.

- Safewaze

- Eurosafe Solutions

Frequently Asked Questions

Analyze common user questions about the Fall Protection Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Fall Protection Equipment Market?

Market growth is primarily driven by increasingly strict occupational safety regulations enforced globally (e.g., OSHA, EN standards), mandatory equipment inspection and replacement cycles, and massive infrastructure development projects, especially in emerging economies. Corporate focus on reducing liability and improving ESG performance also mandates high investment in worker safety gear.

Which product segment holds the largest share in the Fall Protection Equipment Market?

The Full Body Harnesses segment consistently holds the largest market share globally due to its mandatory use as the central component of any Personal Fall Arrest System (PFAS) across nearly all elevated work environments, providing comprehensive safety and load distribution during a fall event.

How is technology impacting the modern design of fall protection equipment?

Technology is moving towards 'smart' systems, integrating IoT sensors, RFID tags, and GPS into harnesses and SRLs for real-time tracking, automated inspection, and digital compliance documentation. This integration enhances proactive safety management and streamlines regulatory reporting processes.

What is the projected Compound Annual Growth Rate (CAGR) for the Fall Protection Equipment Market?

The Fall Protection Equipment Market is projected to experience a robust Compound Annual Growth Rate (CAGR) of 6.5% between the forecast years of 2026 and 2033, driven largely by regulatory expansion in high-growth regions like Asia Pacific.

Which end-use vertical is the largest consumer of fall protection equipment?

The Construction sector remains the dominant end-use vertical globally, driven by the sheer volume and complexity of high-rise commercial, residential, and infrastructure projects that inherently require continuous and rigorous deployment of fall protection systems and engineered anchors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Fall Protection Equipment and System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Industrial Fall Protection Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Construction Fall Protection Equipment Market Statistics 2025 Analysis By Application (Building Construction, Bridge Construction), By Type (Harness, Lanyard, Self Retracting Lifeline, Belt), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager