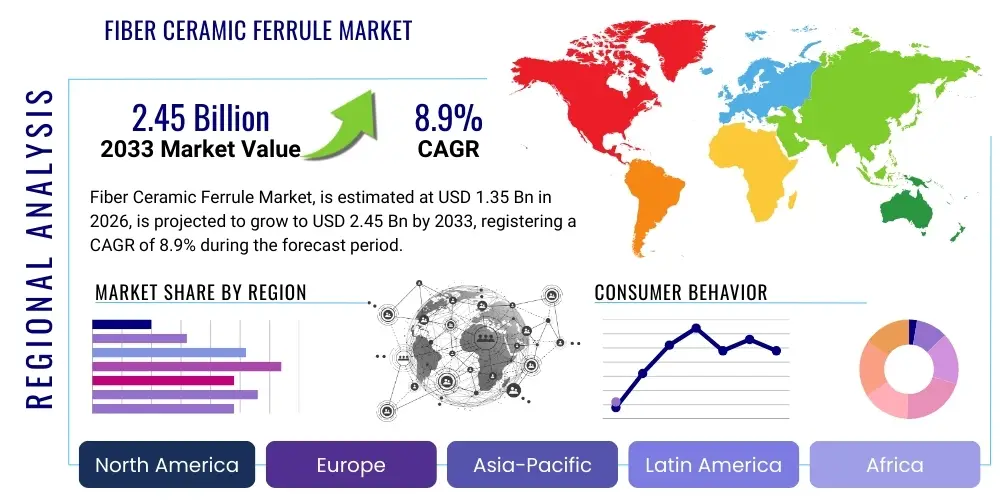

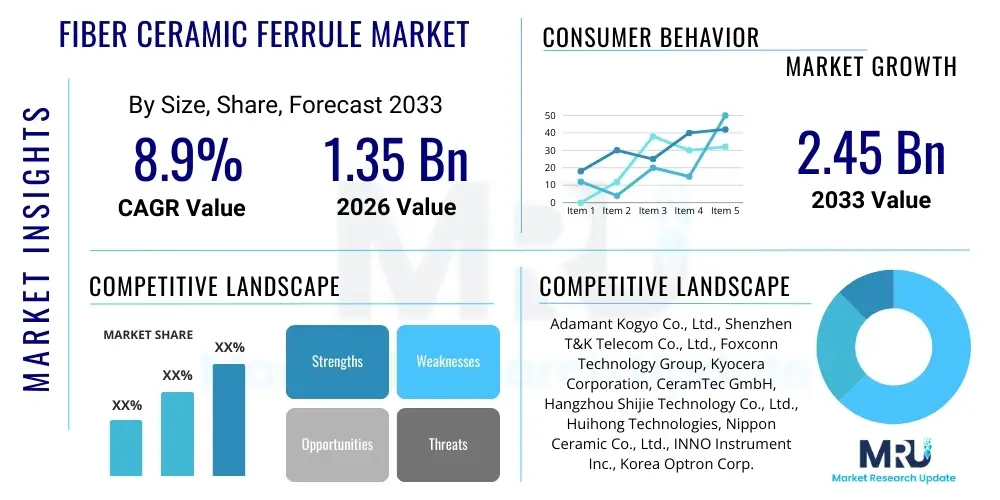

Fiber Ceramic Ferrule Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441369 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Fiber Ceramic Ferrule Market Size

The Fiber Ceramic Ferrule Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 950 Million in 2026 and is projected to reach USD 1,580 Million by the end of the forecast period in 2033.

Fiber Ceramic Ferrule Market introduction

Fiber ceramic ferrules are highly precise, cylindrical components typically manufactured from Zirconia ceramic, essential for ensuring accurate alignment and protection of optical fibers within connectors. These specialized components are fundamental to the performance of any fiber optic communication system, acting as the critical mechanical interface that guarantees minimal signal loss and high return loss. The unparalleled hardness, thermal stability, and low coefficient of thermal expansion of Zirconia make it the material of choice, differentiating ceramic ferrules from less robust alternatives and positioning them as indispensable elements in high-speed, high-reliability networking infrastructure. Their precision is measured in sub-micron tolerances, crucial for modern data transmission requirements.

The primary applications of fiber ceramic ferrules span across various high-growth sectors, particularly telecommunications, data centers, and enterprise networking. They are utilized in a wide array of products including standard connectors (SC, LC, FC, ST), high-density MPO/MTP connectors, and passive optical components such as splitters and couplers. The ongoing global expansion of communication networks, driven by bandwidth-intensive applications like 4K streaming, cloud computing, and industrial IoT, directly translates into sustained demand for high-quality, high-precision ferrules. Furthermore, emerging fields such as Fiber-to-the-X (FTTx) deployments, particularly in developing regions, solidify the market foundation for these components.

The core benefits derived from utilizing ceramic ferrules include superior durability, excellent mechanical stability, and high performance even under harsh environmental conditions, such as temperature fluctuations or high vibration. Key driving factors fueling market growth are the relentless pace of data center expansion, the worldwide deployment of 5G networks requiring robust fiber backhaul, and the persistent push towards miniaturization and higher channel counts in optical interfaces. These factors necessitate ferrules with stricter dimensional control and advanced polishing specifications, thereby driving innovation in manufacturing processes and material science within the industry.

Fiber Ceramic Ferrule Market Executive Summary

The Fiber Ceramic Ferrule Market is characterized by robust growth, primarily propelled by monumental investments in digital infrastructure globally. Business trends highlight a significant shift towards MPO/MTP connectors, demanding multi-fiber ferrules that provide high channel density and simplified installation, particularly within hyperscale data centers. Key players are increasingly focused on vertical integration and stringent quality control standards to meet the sub-micron tolerance requirements mandated by next-generation networking protocols. Strategic collaborations between ferrule manufacturers and major connector assembly companies are defining the competitive landscape, aiming to optimize the supply chain efficiency and reduce time-to-market for complex optical solutions. Furthermore, sustainability in manufacturing and the optimization of sintering processes to reduce energy consumption are emerging as important considerations influencing corporate investment strategies and market positioning.

Regionally, Asia Pacific (APAC) stands as the dominant market, driven by massive governmental and private sector investment in FTTx projects and the establishment of vast manufacturing hubs in countries like China, Japan, and South Korea. North America and Europe, while mature, exhibit strong demand fueled by the continuous upgrade of existing infrastructure to 100G, 400G, and beyond, alongside the rapid build-out of 5G core networks. Emerging regional trends include increased localized production capabilities in countries like India and Brazil to mitigate geopolitical supply chain risks and cater directly to rapidly expanding local telecom markets, thereby fragmenting the distribution channels and introducing new competition dynamics.

Segment trends reveal that Zirconia is overwhelmingly the preferred material due to its superior mechanical properties, overshadowing traditional materials like stainless steel or plastic composites. Within the application segment, Data Centers and Telecommunication providers remain the core revenue generators, though specialized applications in medical imaging (endoscopy) and military/aerospace environments are demonstrating promising growth trajectories, demanding customized, highly robust ferrule designs. Regarding physical characteristics, 1.25mm diameter ferrules (used primarily in LC connectors) currently dominate the volume, yet the market is witnessing accelerated uptake of multi-fiber ferrules crucial for high-density, multi-lane optical modules, signaling a shift in technology adoption patterns across the enterprise segment.

AI Impact Analysis on Fiber Ceramic Ferrule Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the Fiber Ceramic Ferrule Market typically center on themes of manufacturing precision, quality assurance automation, and predictive demand forecasting. Common questions address whether AI-driven visual inspection systems can replace human quality control processes, how machine learning optimizes the complex high-temperature sintering phase to minimize defects, and the application of AI in managing volatile raw material supply chains. The overarching expectation is that AI will be a transformative force, moving the industry away from traditional statistical process control toward real-time, adaptive manufacturing environments, ultimately leading to higher yields, reduced scrap rates, and even tighter dimensional tolerances, essential for 800G and 1.6T optical transceivers.

AI's primary impact is expected in enhancing production efficiency and quality control. By deploying advanced computer vision algorithms, manufacturers can automate the final inspection of ferrule end faces and geometry with accuracy surpassing human capabilities, identifying microscopic flaws or deviations in polishing geometry that severely impact connector performance. Furthermore, sophisticated machine learning models can analyze vast amounts of data generated during the complex sintering process—temperature profiles, pressure, and atmospheric composition—to predict and preemptively adjust parameters, ensuring consistent material density and minimizing dimensional shrinkage variance. This application is crucial because sintering is often the most energy-intensive and critical step determining the final product quality.

Beyond the factory floor, AI tools are revolutionizing supply chain management and demand planning for ferrules. Given that the demand for ferrules is highly correlated with cyclical telecom infrastructure upgrades and data center construction schedules, predictive analytics utilizing macroeconomic indicators, regional network penetration rates, and customer inventory levels provide much more accurate forecasts. This enables manufacturers to optimize Zirconia powder procurement and inventory management, significantly reducing lead times and mitigating the risk associated with supply shortages or excess capacity, thus stabilizing the overall cost structure of ferrule production.

- AI-Enhanced Quality Control: Automated visual inspection of ferrule end-face geometry using deep learning algorithms, ensuring sub-micron precision.

- Predictive Maintenance: ML models optimize sintering ovens and polishing machines, reducing downtime and extending equipment lifespan.

- Manufacturing Optimization: Real-time adjustment of high-temperature sintering parameters to maximize yield and uniformity of ceramic density.

- Supply Chain Forecasting: Utilizing advanced analytics to predict demand based on global data center build-outs and 5G deployment phases.

- Defect Reduction: Identifying subtle patterns leading to dimensional defects or surface imperfections during the complex injection molding stage.

- Process Automation: Implementation of robotic systems guided by AI for precise handling and sorting of high-volume ferrule production.

DRO & Impact Forces Of Fiber Ceramic Ferrule Market

The Fiber Ceramic Ferrule Market is powerfully shaped by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces dictating market trajectory. The primary Driver is the exponential growth in global data consumption, necessitating continuous upgrades in transmission speeds and density within data centers and carrier networks. This relentless demand for bandwidth, particularly spurred by cloud computing adoption and the roll-out of 5G, creates an inescapable requirement for high-precision optical interconnect components like ceramic ferrules. However, the market faces significant Restraints, most notably the high capital expenditure required for establishing highly precise manufacturing facilities and the intense price competition, especially for standard single-fiber ferrules, which pressure profit margins. Furthermore, dependency on the sourcing of high-purity Zirconia powder, subject to geopolitical supply chain disruptions, poses a continuous risk.

Opportunities within the market largely revolve around technological specialization and diversification. The move toward specialized multi-fiber ferrules (MPO/MTP) and miniaturized ferrules for Small Form-factor Pluggables (SFPs and QSFPs) offers significant growth potential, commanding higher margins due to the complexity of manufacturing. Moreover, opportunities exist in penetrating non-traditional fiber optic markets, such as automotive sensing (LiDAR systems) and specialized medical diagnostics equipment, which demand exceptionally rugged and customized ceramic components. Successfully navigating these opportunities requires continuous investment in advanced polishing and grinding techniques to meet ever-stricter industry standards for Insertion Loss (IL) and Return Loss (RL).

The collective Impact Forces suggest that the long-term growth momentum is strong and sustained by irreversible digital transformation trends. The main challenge lies in balancing the need for massive production volumes to meet core telecom demand while simultaneously developing specialized, high-margin products for niche high-performance applications. Companies that can strategically leverage automation (AI) to reduce manufacturing costs while ensuring supreme quality will gain a decisive competitive advantage, mitigating the pressure exerted by cost constraints and raw material volatility. The necessity of maintaining strict quality control in mass production remains the single most critical force impacting industry reputation and market share.

Segmentation Analysis

The Fiber Ceramic Ferrule Market is comprehensively segmented based on material type, product diameter, application, and end-user industry, providing nuanced insight into market demand patterns and technological requirements. Zirconia remains the dominant material segment, valued for its superior hardness and thermal stability, which are critical for achieving the high precision necessary for low-loss optical connections. The segmentation by diameter, particularly the split between 2.5mm (SC, FC, ST) and 1.25mm (LC), illustrates the industry's sustained transition toward miniaturization and higher port density in rack systems, driven by data center real estate constraints. Understanding these segmentation nuances is crucial for manufacturers to tailor their production capacities and strategic investments effectively.

Further analysis of the application segment highlights the market's dependence on the telecommunications and data center sectors, which together account for the overwhelming majority of ferrule consumption. However, the growing need for high-speed connectivity in specialized environments, such as aerospace, medical sensing, and industrial control systems, is fostering the growth of the specialty ferrule segment, often requiring customized polishing angles (e.g., APC vs. UPC) and unique mechanical properties. The geographical segmentation, led by the Asia Pacific region due to rapid infrastructure development, further emphasizes that localized supply chains and distribution networks are vital for maintaining competitive responsiveness in this global market.

The distinct requirements across these segments—from the high volume and standardization needed for core telecom infrastructure to the ultra-high precision and low volume required for defense applications—mandate flexible manufacturing strategies. Manufacturers must optimize their processes to handle both single-mode and multi-mode ferrules, catering to the diverse specifications required by various standards (e.g., IEC, Telcordia). This detailed segmentation framework ensures that market participants can accurately forecast demand across different product lines and allocate resources toward the most profitable and high-growth segments, such as multi-fiber MPO ferrules for cloud infrastructure build-outs.

- By Material Type:

- Zirconia Ceramic Ferrule (Dominant)

- Plastic Ferrule

- Stainless Steel Ferrule

- By Diameter/Type:

- 2.5mm Ferrule (SC, FC, ST)

- 1.25mm Ferrule (LC)

- Multi-fiber Ferrule (MPO/MTP)

- By Polishing Type:

- PC/UPC (Physical Contact/Ultra Physical Contact)

- APC (Angled Physical Contact)

- By Application:

- Telecommunication

- Data Centers & Enterprise Networks

- Cable TV (CATV)

- Industrial & Military/Aerospace

- Medical & Sensing Devices

Value Chain Analysis For Fiber Ceramic Ferrule Market

The value chain for the Fiber Ceramic Ferrule Market is characterized by highly specialized processes, starting with the complex upstream sourcing of raw materials. The chain begins with the mining and refining of Zirconia ore to produce ultra-high purity ceramic powders, which must meet stringent quality standards regarding particle size distribution and chemical homogeneity. This raw material phase is critical, as the quality of the Zirconia powder directly influences the mechanical properties and dimensional stability of the final sintered ferrule. Key upstream suppliers include specialized chemical and material science companies, often concentrated in specific geographical areas known for advanced material processing capabilities, leading to potential supply chain bottlenecks if diversification is not maintained.

The middle segment of the value chain encompasses the high-precision manufacturing processes: ceramic injection molding, debinding, and high-temperature sintering, followed by precise grinding and polishing. This manufacturing stage requires immense capital investment in highly automated machinery and cleanroom environments, coupled with deep expertise in materials engineering to achieve the required sub-micron tolerances. Distribution channels subsequently move the finished ferrules to connector assemblers (often referred to as downstream customers), who incorporate them into finished fiber optic connectors, patch cords, and optical transceivers. The distribution model includes both direct sales from ferrule manufacturers to large, tier-one connector companies and indirect sales through specialized global distributors and agents, particularly for smaller assembly houses.

Downstream analysis focuses on the end-use industries: telecommunication carriers, hyperscale data center operators, and specialized systems integrators. The final buyers are highly sensitive to ferrule quality, as failure at this component level directly impacts network reliability and performance. Direct distribution channels are favored for large, recurring orders where customization or technical support is required, facilitating seamless integration into the customer's connector assembly line. Indirect channels, relying on distributors, serve to broaden market reach, particularly in regions where manufacturers lack a physical presence, offering inventory management and localized logistics support. The integrity of the entire value chain is dependent on the stringent quality checks implemented at the manufacturing stage to minimize defects passed along to the final customer.

Fiber Ceramic Ferrule Market Potential Customers

The core potential customers and end-users of fiber ceramic ferrules are centralized within industries undergoing rapid digital transformation, primarily those requiring high-speed, reliable, and low-latency data transmission. These customers are categorized mainly as major telecommunication equipment manufacturers and network service providers responsible for deploying national and international fiber backbones, including FTTx infrastructure. Given the ferrule's role as the fundamental alignment mechanism in fiber optics, any organization involved in installing, upgrading, or maintaining high-capacity fiber networks represents a direct purchasing entity or influences the purchasing decisions of their suppliers. Specifically, network operators globally are continually investing in millions of connectors, making them the largest volume buyers.

A second major customer segment comprises hyperscale and enterprise data center operators, including major cloud service providers (CSPs) and colocation facilities. These entities require massive volumes of high-density, multi-fiber ferrules (MPO/MTP types) for interconnecting servers, storage arrays, and high-speed switching equipment within their facilities. Their demands are characterized by requirements for extreme reliability, specialized geometry (e.g., elliptical core alignment), and rapid deployment capabilities. The purchasing decisions in this segment are highly influenced by performance metrics like Insertion Loss variability and the compatibility of the ferrule with automated assembly processes used for mass production of transceiver modules.

Beyond these primary markets, important potential customers exist in niche high-reliability sectors. These include military and aerospace contractors requiring ruggedized, environmentally shielded connectors for communication and sensing in extreme conditions; industrial automation firms utilizing fiber for EMI-immune control systems; and medical device manufacturers incorporating optical fibers into diagnostic and surgical tools. These specialty customers, while lower in volume, demand extremely customized ferrules with highly specific material properties and manufacturing certifications, often leading to higher average selling prices and stronger, longer-term supplier relationships built on specialization and trust.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 950 Million |

| Market Forecast in 2033 | USD 1,580 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Chaozhou Three-Circle (Group) Co., Ltd. (CCTC), Adamant Co., Ltd., Foxconn (FIT), Nippon Ceramic Co., Ltd., Shenzhen Wofo Technology Co., Ltd., Kyocera Corporation, Shenzhen Nanbo Technology Co., Ltd., INOAC Corporation, Senko Advanced Components, Coining Manufacturing LLC, NTT Advanced Technology Corporation (NTT-AT), Korea Optron Corp., Ningbo Yuzhou Optical Fiber Component Co., Ltd., Huzhou Aipu Optical Fiber Communication Technology Co., Ltd., T&S Communications Co., Ltd., Shenzhen JPT Opto-electronics Co., Ltd., Sun-sea Industrial Co., Ltd., Diamond SA, OptiTape GmbH, Suzhou Wujiang Jin Hong Fiber Optical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fiber Ceramic Ferrule Market Key Technology Landscape

The technological landscape of the Fiber Ceramic Ferrule Market is defined by the necessity for extreme precision in mass production, focusing heavily on materials science and advanced manufacturing techniques. The foundational technology involves the use of high-ppurity Zirconia ceramic powder, often stabilized with Yttria, processed through sophisticated ceramic injection molding (CIM). CIM allows for the precise shaping of the green body (unfired ceramic) with micron-level tolerances, a crucial step before the high-temperature processing begins. Continuous refinement of CIM processes, including mold design and material flow simulation, is paramount to minimizing internal stresses and ensuring the uniform density required for subsequent successful sintering.

The subsequent key technological stage is high-temperature sintering, where the green body is fired at temperatures often exceeding 1,400°C to achieve full densification and the final ceramic structure. Advanced sintering techniques, often utilizing vacuum or controlled atmospheric conditions, are employed to control grain growth and minimize porosity, directly impacting the ferrule's mechanical strength and polishability. Recent technological developments are focusing on flash sintering methods and optimized kiln designs to reduce energy consumption and cycle times, enhancing production throughput without compromising the final product’s integrity. The precise control over the shrinkage rate during sintering is one of the most protected proprietary technologies in the industry.

Finally, the most visible technological competition occurs in the post-sintering stage, specifically in the grinding and polishing techniques used to achieve the demanding end-face geometry (PC, UPC, or APC). High-precision robotic polishing machines using diamond slurries and controlled pressure systems are standard. Innovations include the development of multi-stage polishing processes designed to achieve low insertion loss (IL) and high return loss (RL) consistently across high-volume batches. For multi-fiber ferrules (MPO/MTP), complex guide pin hole alignment and precision grinding of the ferrule body itself are critical technological differentiators, requiring advanced jigging and non-contact metrology systems for real-time quality verification.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of both demand and production, driven by massive domestic investments in FTTx and rapid expansion of 5G infrastructure, especially in China, India, and Southeast Asia. The region hosts the world’s largest ferrule manufacturing bases, leveraging economies of scale. High data consumption, coupled with governmental support for digital infrastructure, ensures this region maintains its leading market share, requiring immense volumes of both single-fiber and MPO ferrules.

- North America: Characterized by high-value demand, North America is driven primarily by the hyperscale data center segment and the continuous upgrade to higher-speed optical transmission standards (400G and 800G). The focus here is on premium, high-density MPO ferrules and specialty components used in advanced optical transceivers. Strict quality standards (e.g., Telcordia) necessitate robust sourcing strategies and advanced polishing capabilities from suppliers serving this market.

- Europe: Growth is steady, fueled by enterprise digitalization, regulatory mandates for broadband access, and industrial IoT deployment. Europe presents a strong market for high-quality single-mode ferrules and specialized components for industrial and defense applications. The region prioritizes adherence to international standards and often seeks suppliers demonstrating high levels of automation and traceable quality processes.

- Latin America (LATAM): This region represents an emerging growth opportunity, marked by increasing fiber optic penetration, particularly in Brazil and Mexico. The market growth is contingent upon expanding urbanization and governmental initiatives aimed at improving connectivity. Demand is currently volume-focused for standard LC/SC connectors used in FTTx deployments, though data center investments are beginning to drive requirements for higher-end components.

- Middle East and Africa (MEA): Growth is localized but significant, concentrated in the Gulf Cooperation Council (GCC) countries due to smart city initiatives and massive oil and gas sector investments requiring robust industrial networking. Africa’s growth is nascent but accelerating due to cross-continental fiber cable projects and expanding mobile network capacity, focusing on reliable, cost-effective standard ferrules.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fiber Ceramic Ferrule Market.- Chaozhou Three-Circle (Group) Co., Ltd. (CCTC)

- Adamant Co., Ltd.

- Foxconn (FIT)

- Nippon Ceramic Co., Ltd.

- Shenzhen Wofo Technology Co., Ltd.

- Kyocera Corporation

- Shenzhen Nanbo Technology Co., Ltd.

- INOAC Corporation

- Senko Advanced Components

- Coining Manufacturing LLC

- NTT Advanced Technology Corporation (NTT-AT)

- Korea Optron Corp.

- Ningbo Yuzhou Optical Fiber Component Co., Ltd.

- Huzhou Aipu Optical Fiber Communication Technology Co., Ltd.

- T&S Communications Co., Ltd.

- Shenzhen JPT Opto-electronics Co., Ltd.

- Sun-sea Industrial Co., Ltd.

- Diamond SA

- OptiTape GmbH

- Suzhou Wujiang Jin Hong Fiber Optical Co., Ltd.

- Optec Technology Ltd.

- Precision Optical Manufacturing Co.

- Fiberon Technologies, Inc.

- Shanghai Yilut Technology Co., Ltd.

- Hangzhou Huacheng Communication Equipment Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Fiber Ceramic Ferrule market and generate a concise list of summarized FAQs reflecting key topics and concerns.What material is primarily used to manufacture fiber ceramic ferrules and why?

The predominant material used is Zirconia ceramic, specifically stabilized with Yttria. Zirconia is preferred due to its exceptional hardness, which resists scratching during mating, its low coefficient of thermal expansion ensuring stable alignment across varying temperatures, and its superior durability required for demanding telecom and data center environments. These properties are essential for achieving and maintaining the sub-micron precision necessary for minimal signal loss.

How is the growth of 5G infrastructure influencing the demand for ceramic ferrules?

The deployment of 5G networks significantly drives ferrule demand by requiring extensive fiber optic backhaul infrastructure to connect cellular base stations to the core network. This transition necessitates large volumes of high-quality, reliable ferrules for both traditional and high-density MPO/MTP connectors, ensuring the high-speed and low-latency connectivity mandated by 5G standards, particularly in dense urban and metropolitan areas.

What is the key difference between single-fiber and multi-fiber ferrules in the market?

Single-fiber ferrules (2.5mm and 1.25mm) align one optical fiber and are used in standard connectors like SC and LC. Multi-fiber ferrules, primarily MPO/MTP types, align 4, 8, 12, or more fibers simultaneously. Multi-fiber ferrules are crucial for high-density applications within data centers, enabling parallel optics and consuming less space, making them a significant growth segment due to continuous rack density requirements.

What are the primary technological challenges faced by ferrule manufacturers?

The foremost challenge is achieving consistent sub-micron dimensional tolerances and ultra-smooth end-face polishing across high-volume production batches. This requires advanced, high-cost manufacturing technologies like high-precision ceramic injection molding (CIM) and tightly controlled high-temperature sintering processes. Maintaining quality while managing intense price competition for standardized products remains a persistent technological and economic challenge.

Which geographical region is expected to lead the Fiber Ceramic Ferrule Market and why?

Asia Pacific (APAC) is projected to lead the market, driven by unparalleled levels of investment in government-backed FTTx initiatives, the establishment of vast 5G networks, and the concentration of major global manufacturing facilities (China, Korea, Japan). This combination of immense domestic demand and dominant global production capacity solidifies APAC's position as the largest and fastest-growing regional market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Fiber Ceramic Ferrule Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Fiber Ceramic Ferrule Market Statistics 2025 Analysis By Application (Fiber Optic Connector), By Type (SC/FC Ceramic Ferrule, ST Ceramic Ferrule, LC Ceramic Ferrule), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager