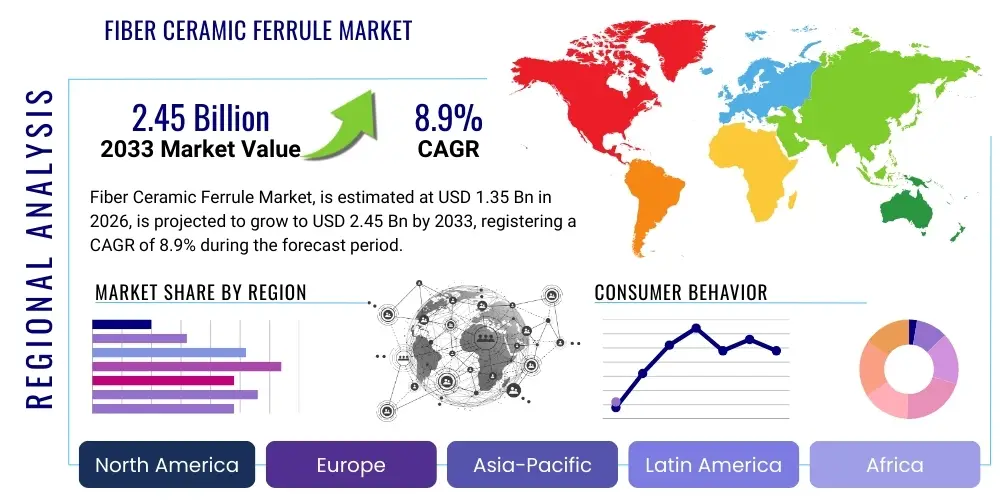

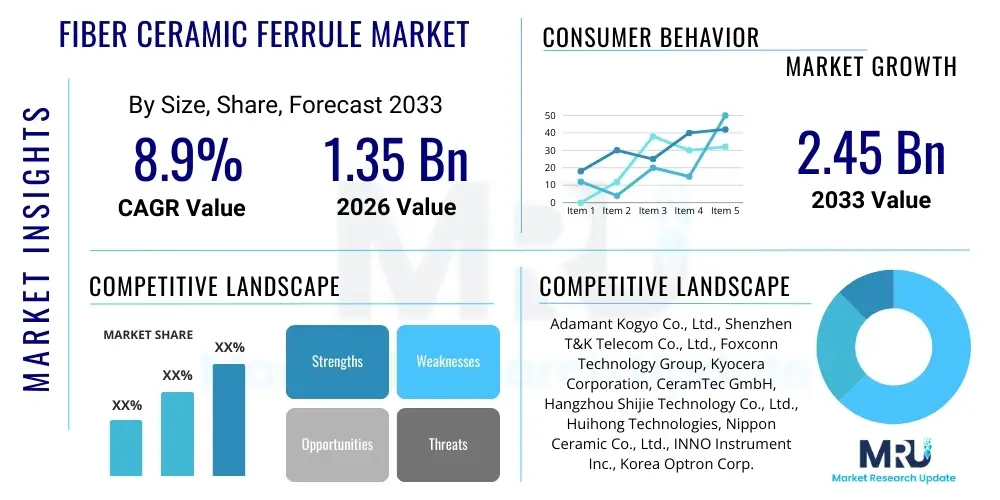

Fiber Ceramic Ferrule Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437922 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Fiber Ceramic Ferrule Market Size

The Fiber Ceramic Ferrule Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at USD 1.35 Billion in 2026 and is projected to reach USD 2.45 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the relentless expansion of global data traffic, the widespread deployment of 5G infrastructure, and the continuous necessity for high-precision, reliable passive components within sophisticated optical networks. The stability, thermal properties, and superior durability of ceramic materials, particularly high-purity Zirconia, position ferrules as indispensable elements for achieving stringent alignment requirements in fiber optic connectors, ensuring minimal signal loss and maximum transmission efficiency across diverse applications from large-scale data centers to last-mile FTTx networks.

Fiber Ceramic Ferrule Market introduction

The Fiber Ceramic Ferrule Market encompasses the manufacturing, distribution, and utilization of small, precision-engineered cylindrical components, primarily made from Zirconia (Zirconium Dioxide) ceramic, designed to house and align the stripped end of an optical fiber within a connector assembly. These ferrules are critical passive components that dictate the physical interface quality of fiber optic interconnects, ensuring accurate core-to-core alignment, which is paramount for minimizing insertion loss and maximizing return loss performance. The exceptional hardness, thermal expansion stability, and mechanical strength of Zirconia ceramic are key attributes that enable these ferrules to maintain sub-micron tolerances under varying environmental conditions, thereby guaranteeing the long-term reliability and performance of high-speed optical transmission systems globally. The fundamental role of the ferrule as the physical backbone of the connector makes it a cornerstone technology supporting the backbone of modern digital communication infrastructure.

Major applications of ceramic ferrules span the entire telecommunications and data communications ecosystem, including the construction of fiber optic patch cords, pigtails, couplers, and specialized high-density connectivity solutions used in metropolitan area networks (MANs), long-haul submarine cables, and enterprise networking environments. The escalating global demand for bandwidth, fueled by cloud computing, Internet of Things (IoT), and video streaming services, directly translates into heightened requirements for fiber optic cables and associated hardware, positioning the ferrule market for significant expansion. Furthermore, the stringent quality control necessary for high-density applications, such as those utilizing Multi-Fiber Push-on (MPO) and Multi-Fiber Termination Push-on (MTP) connectors, elevates the importance of high-quality ceramic ferrules manufactured to incredibly precise specifications, often involving advanced automated inspection and grinding techniques to ensure performance consistency across massive deployments.

The primary benefits derived from using ceramic ferrules, specifically those based on Zirconia, include superior resistance to corrosion and wear, exceptional thermal stability compared to alternative materials like plastic or metal, and the ability to achieve remarkably tight dimensional tolerances crucial for Single-Mode (SM) fiber alignment (typically requiring a bore concentricity error of less than 0.5 µm). Driving factors for market growth include the transition from 4G to 5G networks, necessitating denser backhaul and fronthaul fiber deployments; governmental investments in FTTx (Fiber-to-the-x) projects globally, especially in emerging economies; and the continuous construction and expansion of hyperscale data centers that require massive internal fiber connectivity (inter-rack and intra-rack). These large-scale deployments require components that offer both reliability and scalability, characteristics inherently provided by standardized, high-precision ceramic ferrules.

Fiber Ceramic Ferrule Market Executive Summary

The global Fiber Ceramic Ferrule Market is characterized by robust growth, propelled by sustained investment in optical infrastructure and technological advancements focused on higher density and faster data transmission speeds, particularly within the APAC region which dominates both manufacturing capacity and consumption. Business trends highlight a strong emphasis on automation in ferrule production, driven by the need to maintain sub-micron precision consistently while scaling output to meet explosive demand from hyperscale data center operators and 5G network providers. Key strategic imperatives for market participants include backward integration into high-purity Zirconia powder production to control raw material quality and cost, alongside aggressive R&D investments aimed at developing specialized ferrules for high-fiber count MPO connectors and components capable of operating reliably in harsh environments such as those encountered in industrial and military applications. Market consolidation and strategic partnerships between specialized material science firms and large component manufacturers are also defining the competitive landscape, aiming to streamline the supply chain and improve time-to-market for next-generation products required for 800G and 1.6T networking standards.

Regionally, Asia Pacific maintains its leading position, primarily due to the presence of large-scale manufacturing hubs in China, Japan, and South Korea, coupled with massive domestic fiber deployment initiatives, notably in China and India, driving substantial localized demand for standard and custom ferrules. North America and Europe, while representing mature markets, exhibit strong demand driven by the continuous upgrade cycles within data centers and the ongoing fiberization of urban areas. Segment trends reveal that Single-Mode (SM) ferrules, essential for long-haul and high-speed core networks, command the highest average selling price and exhibit steady technological advancement, focusing on improving end-face geometry and reducing concentricity errors further. The Multimode (MM) ferrule segment, though mature, remains vital for short-reach data center applications and premises wiring, supported by continued adoption of high-bandwidth short-distance optical links utilizing Vertical Cavity Surface Emitting Laser (VCSEL) technology. The emergence of specialized Zirconia components for Photonic Integrated Circuits (PICs) also represents a nascent but high-growth niche within the broader segment landscape, requiring ultra-tight tolerance standards.

Overall, the market dynamic is shifting from a focus purely on cost reduction toward a balanced approach prioritizing quality, precision, and supply chain resilience, particularly after global supply disruptions underscored the risks associated with highly centralized manufacturing. The push towards standardization, combined with the development of new manufacturing techniques such as advanced injection molding and precision diamond polishing, is enabling higher throughput while maintaining the necessary quality thresholds. Future growth is strongly linked to infrastructure spending tied to fiber network expansion, the deployment of next-generation passive optical networks (PON) like 10G-PON and 25G-PON, and the inherent requirement for robust physical connectivity that ceramic ferrules uniquely provide. The market’s resilience is underpinned by the essential nature of fiber optics in the digital economy, ensuring sustained long-term demand regardless of short-term macroeconomic fluctuations, emphasizing reliability and scalability across the global digital footprint.

AI Impact Analysis on Fiber Ceramic Ferrule Market

User inquiries regarding the impact of Artificial Intelligence on the Fiber Ceramic Ferrule Market predominantly focus on two critical areas: first, how AI-driven precision manufacturing can enhance ferrule quality and reduce defects, and second, how AI-optimized network performance influences the requirements for physical components like ferrules. Key themes emerging from these queries center on the feasibility of achieving 'zero-defect' manufacturing through machine vision and predictive maintenance systems, the potential cost savings derived from optimizing raw material utilization (high-purity Zirconia powder), and whether increased network efficiency enabled by AI traffic management might mitigate or accelerate the need for component upgrades. Users are keen to understand if AI can rapidly identify and correct microscopic polishing and concentricity flaws during production, thereby raising the industry standard above current manual or semi-automated inspection thresholds. Furthermore, there is significant interest in using AI algorithms to analyze field performance data of installed connectors, feeding back specific failure mode data to R&D teams for continuous product improvement, especially concerning thermal stress and long-term mechanical degradation under operating conditions.

The implementation of AI and machine learning (ML) is fundamentally transforming the ferrule manufacturing process, moving it towards greater autonomy and precision. AI-powered machine vision systems are now capable of inspecting ferrule end-faces and dimensional tolerances at micron and sub-micron levels far faster and more consistently than human operators, detecting anomalies such as micro-cracks, contamination, and geometry deviations that could severely impact optical performance. This shift not only accelerates quality assurance (QA) cycles but also allows manufacturers to establish tighter statistical process control (SPC), directly leading to a lower defect rate and higher yield, which is crucial given the high-volume demand for these components. The precision requirements, especially for Single-Mode ferrules used in high-bandwidth applications, necessitate this level of automated, intelligent oversight to ensure optimal return loss performance across vast installed bases. AI is effectively acting as an enabler for tighter manufacturing specifications necessary for the next generation of 400G and 800G optical modules.

Additionally, AI plays a significant role in optimizing the supply chain and internal production logistics for ferrule manufacturers. Predictive maintenance algorithms analyze data from grinding and polishing machines (vibration, temperature, power consumption) to forecast component failures or performance degradation before they impact product quality or halt production, thus ensuring higher uptime and operational efficiency. In terms of market impact, while AI doesn't change the physical requirement for a ceramic ferrule to align the fiber, it dramatically raises the quality bar for acceptable performance. As network congestion is increasingly managed by intelligent routing and resource allocation, the tolerance for physical layer impairments (like high insertion loss or poor back reflection caused by suboptimal ferrule alignment) shrinks, thus increasing the market demand specifically for the highest quality, AI-verified ceramic ferrules, indirectly accelerating the retirement of lower-quality or less precisely manufactured components. This guarantees a push towards premiumization within the bulk commodity market segment.

- Precision Manufacturing Enhancement: AI-driven machine vision and robotic quality control ensure sub-micron precision and consistency in ferrule bore size and concentricity, significantly reducing manufacturing defects and improving yield rates for high-precision components.

- Predictive Maintenance: ML models analyze production equipment data (grinders, polishers) to predict maintenance needs, minimizing unplanned downtime and ensuring continuous high-volume output of quality ferrules required for global 5G and FTTx deployments.

- Supply Chain Optimization: AI algorithms enhance inventory management of critical raw materials (Zirconia powder) and optimize production scheduling based on real-time market demand signals, improving responsiveness to sudden shifts in hyperscale data center construction timelines.

- Quality Feedback Loop: AI processes field performance data from optical network monitoring systems, providing rapid feedback to manufacturers regarding long-term ferrule degradation patterns under specific environmental stresses, informing future material and design improvements.

- Automated Inspection Standards: AI facilitates the establishment of rigorous, automated quality inspection standards that transcend human capability, positioning manufacturers who adopt this technology as leaders in producing components suitable for ultra-high-speed (400G/800G) and high-density MPO applications.

DRO & Impact Forces Of Fiber Ceramic Ferrule Market

The Fiber Ceramic Ferrule Market is powerfully shaped by its intrinsic drivers, which include the exponential growth in global data consumption demanding ubiquitous high-speed fiber connectivity, and the technological requirement for robust, highly stable physical alignment mechanisms in optical interconnects. Restraints largely center around the high capital expenditure required for establishing high-precision manufacturing facilities necessary to achieve sub-micron tolerances, combined with the inherent fragility and manufacturing complexity of high-purity Zirconia ceramics, leading to stringent quality control barriers. Opportunities arise predominantly from emerging high-growth application areas such as 5G mobile backhaul, advanced passive optical networks (PON), and specialized interconnects for harsh environments (e.g., aerospace and industrial sensing). The collective impact forces reflect a market under continuous high-pressure demand, where technological precision is non-negotiable, driving intense competition among manufacturers to perfect production techniques while simultaneously seeking cost efficiencies to capitalize on massive volume requirements from infrastructure builders and original equipment manufacturers (OEMs).

Drivers: The most significant driver is the global infrastructure build-out supporting fiber optic networks, encompassing FTTx deployments across residential and commercial sectors and the continual need for higher-density and higher-speed interconnects within data centers. The proliferation of cloud services, video conferencing, augmented reality (AR), and 4K/8K streaming places an unending demand for bandwidth, necessitating more fiber optic cable and, consequently, more ferrules. Furthermore, the global transition to 5G technology requires a massive fiber deep deployment to connect base stations and small cells, boosting the demand for robust and reliable outdoor-rated components, where ceramic ferrules outperform alternatives due to their superior thermal and mechanical stability. Lastly, the inherent advantages of Zirconia—its high mechanical strength, chemical inertness, and precise coefficient of thermal expansion (CTE) matching that of optical fiber—ensure its continued dominance over cheaper, less reliable materials in mission-critical applications.

Restraints: Key restraints challenging market growth include the capital-intensive nature of precision manufacturing, particularly the specialized grinding, sintering, and polishing equipment required to meet the stringent bore concentricity and end-face geometric specifications for Single-Mode ferrules. The high cost and reliance on specific global suppliers for high-purity Zirconia powder represent a potential supply chain vulnerability and cost burden, particularly for smaller manufacturers. Additionally, market maturity in standard ferrule sizes (e.g., 2.5mm for SC/FC/ST and 1.25mm for LC) leads to intense price competition in high-volume, standard-grade applications, squeezing profit margins. The susceptibility of ceramic materials to breakage during handling or improper connector assembly also requires careful packaging and installation training, adding operational costs throughout the supply chain and during field deployment.

Opportunities: Significant growth opportunities exist in the development of specialized ferrule designs tailored for high-density applications, such as miniature ferrules and rectangular array ferrules (used in MPO/MTP connectors) with extremely high fiber counts (e.g., 24-fiber, 48-fiber, or even 72-fiber configurations). The integration of ferrules into advanced optical sub-assemblies (OSAs) for co-packaged optics (CPO) and silicon photonics modules represents a lucrative future market requiring ultra-precise alignment solutions. Furthermore, expansion into non-telecom sectors, including medical imaging, high-power laser delivery systems, and ruggedized industrial sensing systems, offers diversification opportunities where the high reliability and precision of ceramic ferrules command premium pricing. Continuous innovation in ceramic material science, such as developing tougher, less brittle Zirconia formulations or optimizing internal processes for faster sintering, could unlock new cost and performance advantages, furthering market penetration.

Segmentation Analysis

The Fiber Ceramic Ferrule Market is primarily segmented based on Ferrule Type (Single-Mode and Multimode), Connector Type (LC, SC, FC, ST, MPO/MTP, others), Application (Telecommunication, Data Communication/Data Centers, CATV, Industrial/Military, and others), and Material Grade (Standard Zirconia and High-Purity Zirconia). Understanding these segmentations is crucial for manufacturers to align their production capabilities with specific market needs, as the technical requirements and pricing structures vary drastically between segments. For instance, the Single-Mode segment demands the highest precision in bore concentricity due to the small core size of SM fiber, commanding premium pricing, whereas Multimode applications are typically more tolerant but require higher volume due to short-reach data center demand. The rapid adoption of MPO/MTP connectors, particularly in hyper-scale data centers, is driving the growth of array ferrules, a specialized subsegment requiring complex manufacturing processes.

The differentiation between Single-Mode (SM) and Multimode (MM) ferrules represents the core technical segmentation. SM ferrules are the technological benchmark, requiring highly precise inner diameter bores (typically 125.5 µm ± 0.5 µm) and minimal eccentricity to ensure optimal light coupling for long-distance, high-speed transmission. The Multimode segment, while less demanding on concentricity, caters to the massive internal connectivity needs of data centers and local area networks (LANs), utilizing larger fiber core sizes. By application, the Telecommunication segment, covering long-haul and metropolitan networks, prioritizes reliability and low signal degradation, making high-end SM ferrules mandatory. Conversely, the Data Center segment drives volume and complexity, favoring high-density connectors using array ferrules, demonstrating the diverse requirements placed upon manufacturers across different end-use environments.

Material Grade segmentation, primarily based on the purity and formulation of Zirconia ceramic, also significantly influences performance and cost. Standard Zirconia is sufficient for many Multimode and less stringent applications, but High-Purity Zirconia, often stabilized with Yttria (Y-TZP), is required for the most demanding Single-Mode applications due to its superior mechanical strength and minimal thermal drift. Furthermore, the connector type segmentation directly correlates to market maturity and application. LC (Lucent Connector) and SC (Standard Connector) types remain dominant, but the explosive growth of MPO/MTP (Multi-Fiber Push-on/Multi-Fiber Termination Push-on) connectors in data centers indicates a strong shift towards rectangular array ferrules, which are structurally and functionally distinct from traditional cylindrical types, requiring specialized manufacturing expertise and stringent dimensional control across the entire ferrule face.

- By Ferrule Type:

- Single-Mode (SM) Ferrules

- Multimode (MM) Ferrules

- By Connector Type:

- LC (Lucent Connector) Ferrules

- SC (Standard Connector) Ferrules

- FC (Ferrule Connector) Ferrules

- ST (Straight Tip) Ferrules

- MPO/MTP (Multi-Fiber Array) Ferrules

- E2000, MU, MT-RJ, and other specialty ferrules

- By Application:

- Telecommunication Networks (Long Haul, Metro, FTTx)

- Data Communication and Data Centers (Hyperscale and Enterprise)

- Cable Television (CATV) and Broadcast

- Industrial, Military, and Aerospace (Ruggedized Applications)

- Medical and Sensor Systems

- By Material Grade:

- Standard Zirconia (Zirconium Dioxide)

- High-Purity Zirconia (Yttria Stabilized Zirconia - Y-TZP)

Value Chain Analysis For Fiber Ceramic Ferrule Market

The value chain for the Fiber Ceramic Ferrule Market is characterized by highly specialized stages, beginning with the production of ultra-fine, high-purity Zirconia powder, moving through sophisticated ceramic forming and sintering processes, and concluding with precision grinding, polishing, and final assembly into fiber optic connector products. Upstream analysis focuses on the sourcing and processing of raw materials, primarily Zirconium minerals, which must be chemically treated and calcined to produce sub-micron Zirconia powder suitable for high-tolerance ceramic fabrication. The quality of this powder directly dictates the final mechanical properties, density, and dimensional stability of the ferrule, making raw material control a critical competitive factor. Only a few specialized chemical companies globally possess the expertise to supply the necessary high-grade powder, leading to significant dependence on this upstream segment and driving some major ferrule manufacturers toward vertical integration to secure supply and maintain quality consistency, minimizing impurities that could compromise the ferrule structure.

The core manufacturing process constitutes the middle segment of the value chain, involving wet injection molding or specialized pressing techniques, followed by high-temperature sintering (firing) to achieve the final dense, hard ceramic body, and culminating in the highly critical precision machining phase. This phase involves diamond core drilling and meticulous grinding/polishing of the ferrule end-face and bore to meet sub-micron tolerance requirements for concentricity and end-face geometry (e.g., spherical radius or angle polish). The efficiency and technological maturity of these manufacturing processes determine the production cost and quality yield. Downstream analysis focuses on the immediate purchasers—primarily connector manufacturers and fiber optic component assemblers—who integrate the ferrule into complete connector assemblies (patch cords, pigtails, splitters). These downstream partners add value through cable termination, rigorous testing, and packaging before the final product reaches the end-user.

Distribution channels are multifaceted, utilizing both direct and indirect routes. Direct distribution involves ferrule manufacturers supplying large volumes directly to major multinational fiber optic connector and cable assembly companies (OEMs) under long-term supply contracts, ensuring high-volume consistency and quality control tailored to the OEM's specifications. Indirect channels involve utilizing specialized distributors and value-added resellers (VARs) who cater to smaller systems integrators, regional network operators, and the aftermarket segment, often handling lower volumes or specialized component types. Given the technical nature and high precision required, sales often involve close technical collaboration between the ferrule manufacturer and the downstream connector assembler to ensure seamless integration and optimal performance. The critical nature of this component means that quality certifications and supply chain traceability are major factors influencing procurement decisions across all distribution methodologies, favoring manufacturers with robust quality management systems.

Fiber Ceramic Ferrule Market Potential Customers

The potential customer base for the Fiber Ceramic Ferrule Market is broad, consisting primarily of large-scale infrastructure builders and specialized component integrators who require high-reliability optical connectivity solutions for data transmission. End-users and buyers of the final product predominantly fall into four major categories: Telecommunications Service Providers (TSPs) and Internet Service Providers (ISPs), Hyperscale Data Center Operators, Fiber Optic Component OEMs/ODMs, and Specialized Industrial/Defense Integrators. TSPs and ISPs are vital customers, driving massive demand through global FTTx projects and the rollout of 5G infrastructure, requiring hundreds of thousands of standard, reliable ferrules for network termination points and patch panel installations across vast geographical areas. Their procurement focus is usually balanced between volume pricing and guaranteed long-term reliability in varying environmental conditions.

Hyperscale Data Center Operators, including major cloud service providers, represent a high-growth customer segment characterized by an insatiable demand for high-density, multi-fiber interconnects. These customers require array ferrules for MPO/MTP connectors that enable 400G and 800G connectivity within their facilities, prioritizing components that minimize insertion loss and maximize rack space utilization. Their purchasing decisions are highly influenced by performance metrics (low insertion loss guarantees) and the ability of manufacturers to rapidly supply massive, consistent volumes required during swift data center build-outs. This segment drives innovation towards lower-profile, higher-tolerance ferrule designs suitable for complex internal cable management and co-packaged optics architectures.

Fiber Optic Component Original Equipment Manufacturers (OEMs) and Original Design Manufacturers (ODMs) form the largest direct customer segment, as they procure ferrules in bulk to manufacture finished goods like patch cords, pigtails, active components, and termination boxes. These companies serve as the bridge between ferrule manufacturers and the ultimate network installers. Their procurement strategy is centered on securing consistent quality, competitive pricing, and reliable lead times from top-tier ferrule suppliers. Finally, Specialized Industrial, Military, and Aerospace Integrators require ruggedized, high-specification ferrules capable of performing under extreme temperatures, vibration, and chemical exposure, often requiring customized material compositions or highly specific dimensional tolerances, commanding premium prices due to the mission-critical nature of the applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.35 Billion |

| Market Forecast in 2033 | USD 2.45 Billion |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Adamant Kogyo Co., Ltd., Shenzhen T&K Telecom Co., Ltd., Foxconn Technology Group, Kyocera Corporation, CeramTec GmbH, Hangzhou Shijie Technology Co., Ltd., Huihong Technologies, Nippon Ceramic Co., Ltd., INNO Instrument Inc., Korea Optron Corp., Ningbo Huizhong Fiber Optic Equipment Co., Ltd., Precision Ferrules, Seikoh Giken Co., Ltd., Shin-Etsu Quartz Products Co., Ltd., Shenzhen JPT Opto-electronics Co., Ltd., Sumitomo Electric Industries, Ltd., Sun Telecom, Suzhou TFC Optical Communication Co., Ltd., The Furukawa Electric Co., Ltd., UST Inforcomm Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fiber Ceramic Ferrule Market Key Technology Landscape

The technological landscape of the Fiber Ceramic Ferrule Market is defined by the quest for ultimate dimensional precision, material purity, and scalable manufacturing efficiency, primarily centered around sophisticated ceramic processing and high-precision machining. The foundational technology involves the preparation and stabilization of high-purity Zirconia powder, where specific doping elements like Yttria are used to enhance the ceramic’s mechanical toughness and thermal stability (Y-TZP technology), ensuring the resulting ferrule body is capable of withstanding extreme environmental conditions and the rigors of field installation without micro-fracturing. Advanced forming techniques, such as precision injection molding or cold isostatic pressing (CIP), are employed to create the initial cylindrical or rectangular blanks with minimal defects, which is crucial as Zirconia is highly sensitive to initial manufacturing flaws that can propagate during the high-temperature sintering process.

The most critical technological differentiator lies in the post-sintering processes: ultra-precision bore drilling, grinding, and polishing. Manufacturers utilize specialized, automated CNC grinding equipment employing diamond tools to achieve the required sub-micron tolerance on the ferrule’s inner diameter (bore) and the outer diameter, ensuring the perfect fit for the optical fiber. This step is followed by meticulous end-face polishing, often using multi-stage abrasive slurries and specialized polishing films to achieve the required convex end-face geometry (for Physical Contact - PC, Ultra Physical Contact - UPC) or angled end-face geometry (for Angled Physical Contact - APC). APC ferrules, critical for high-return loss performance required in Single-Mode long-haul networks, rely on highly specialized automated machines to control the 8-degree angle with extreme accuracy, minimizing back reflection and maximizing network efficiency. Continuous technological improvements focus on reducing cycle times for these processes while maintaining or improving geometric tolerances.

Furthermore, technology related to inspection and quality assurance is rapidly evolving, driven by the need for higher production yields. Non-contact measurement systems, often integrated with AI-powered machine vision, are used to inspect the ferrule geometry and end-face polish characteristics (including apex offset, radius of curvature, and fiber height) automatically and instantaneously, replacing slower, subjective manual inspections. Innovations in array ferrule technology (MPO/MTP) are also critical, requiring specialized processes to ensure precise pitch and parallelism between multiple fiber bores across the ferrule face, a highly complex manufacturing challenge. Advancements are also being made in developing specialized metal alloy or polymer composite materials for less demanding applications or specific environmental requirements, although Zirconia remains the gold standard due to its unmatched performance characteristics, particularly its mechanical and thermal stability properties essential for long-term reliable network operation.

Regional Highlights

The Fiber Ceramic Ferrule Market exhibits distinct regional dynamics driven by varying levels of technological maturity, manufacturing capacity, and infrastructure investment cycles across the globe. Asia Pacific (APAC) stands out as the predominant region, holding the largest market share globally. This dominance is attributed to several factors: first, the presence of major, high-volume ferrule manufacturers located in countries such as China, Japan, and South Korea, which benefit from established supply chains for high-purity Zirconia materials and advanced manufacturing expertise. Second, the massive domestic consumption driven by large-scale government-backed FTTx initiatives (particularly in China and India) and the rapid deployment of 5G networks and extensive data center construction in high-growth economies within the region fuel persistent, high-volume demand. APAC effectively serves as both the world's primary manufacturing base and its largest consumer market for these components.

North America and Europe represent mature markets characterized by sustained, high-quality demand, primarily focused on upgrades to existing fiber infrastructure and the continuous expansion of hyperscale data center capacity. North American demand is particularly strong for high-density MPO/MTP array ferrules and premium Single-Mode components necessary for 400G and 800G optical links within cloud provider infrastructure. In Europe, investments in digitalization and pan-European connectivity projects drive demand, though regulatory environments and varying national deployment speeds introduce complexity. The focus in these regions is heavily on the performance and reliability metrics of the ferrules, rather than solely on cost, ensuring a stable market for high-purity, high-precision Zirconia products. The Middle East and Africa (MEA), and Latin America, while smaller in market size, are projected to experience rapid growth, fueled by nascent FTTx rollouts and digital transformation initiatives, making them emerging opportunity regions for standard and cost-effective ferrule supply.

- Asia Pacific (APAC): Dominates the global market in both production volume and consumption value. Key drivers include state-sponsored FTTx programs (China, India), robust 5G deployment, and significant consolidation of global ferrule manufacturing expertise. This region dictates global pricing and supply trends.

- North America: High-value market segment driven by hyperscale data center expansion, rapid adoption of 400G/800G Ethernet standards, and consistent demand for high-performance, complex array ferrules (MPO/MTP) requiring the tightest tolerances.

- Europe: Characterized by stable demand fueled by ongoing national fiber infrastructure upgrades, high-speed rail connectivity projects, and regulatory pushes for faster broadband access, leading to steady procurement of reliable Single-Mode components.

- Latin America & MEA (Middle East and Africa): Emerging markets showing the highest projected growth rates as fiber infrastructure development, particularly in urban areas and national backbones, accelerates, opening opportunities for bulk commodity and reliable standard ferrules.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fiber Ceramic Ferrule Market.- Adamant Kogyo Co., Ltd.

- Shenzhen T&K Telecom Co., Ltd.

- Kyocera Corporation

- Foxconn Technology Group (FIT Hon Teng)

- CeramTec GmbH

- Hangzhou Shijie Technology Co., Ltd.

- Huihong Technologies

- Nippon Ceramic Co., Ltd.

- INNO Instrument Inc.

- Korea Optron Corp.

- Ningbo Huizhong Fiber Optic Equipment Co., Ltd.

- Precision Ferrules

- Seikoh Giken Co., Ltd.

- Shin-Etsu Quartz Products Co., Ltd.

- Shenzhen JPT Opto-electronics Co., Ltd.

- Sumitomo Electric Industries, Ltd.

- Sun Telecom

- Suzhou TFC Optical Communication Co., Ltd.

- The Furukawa Electric Co., Ltd.

- UST Inforcomm Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Fiber Ceramic Ferrule market and generate a concise list of summarized FAQs reflecting key topics and concerns.What material is primarily used for high-performance fiber optic ferrules and why is it preferred?

High-performance fiber optic ferrules are predominantly manufactured from high-purity Zirconia (Zirconium Dioxide) ceramic, often stabilized with Yttria. Zirconia is preferred due to its superior mechanical strength, high hardness, excellent thermal expansion stability (closely matching that of glass fiber), and chemical inertness, which collectively ensure long-term, highly precise alignment necessary for minimal signal loss in Single-Mode applications.

What is the critical specification that defines the quality of a Single-Mode ferrule?

The most critical specification for a Single-Mode ferrule is the bore concentricity error, which measures how accurately the inner fiber bore is centered relative to the outer diameter. For premium Single-Mode ferrules, this tolerance must be maintained at sub-micron levels (typically less than 0.5 µm) to achieve optimal light coupling, minimize insertion loss, and ensure high return loss performance in long-haul and high-speed data networks.

How is the adoption of 5G networks impacting the demand for ceramic ferrules?

The massive global rollout of 5G networks significantly increases the demand for ceramic ferrules by requiring extensive fiber deep deployments (fiber to the base station and small cells). This necessitates high-volume procurement of reliable, environmentally stable ferrules for outdoor connectivity and backhaul infrastructure, bolstering the market for standard and ruggedized Single-Mode Zirconia components across metropolitan and rural areas.

What is the key technological challenge in manufacturing MPO/MTP array ferrules?

The key technological challenge in manufacturing MPO/MTP array ferrules is achieving ultra-precise pitch, parallelism, and coplanarity across multiple fiber bores simultaneously on the rectangular ferrule face. Maintaining these geometric tolerances across 12, 24, or 48 fibers is extremely demanding and requires specialized, sophisticated precision grinding and polishing equipment, driving complexity and cost in high-density data center connectivity solutions.

Which geographical region leads the global Fiber Ceramic Ferrule Market and why?

Asia Pacific (APAC) leads the global market in both production capacity and consumption. This dominance is driven by the concentration of major global ferrule manufacturing facilities in countries like China, Japan, and South Korea, coupled with monumental domestic fiber infrastructure investment, including large-scale FTTx projects and rapid construction of data centers throughout the region, creating sustained high-volume demand.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager