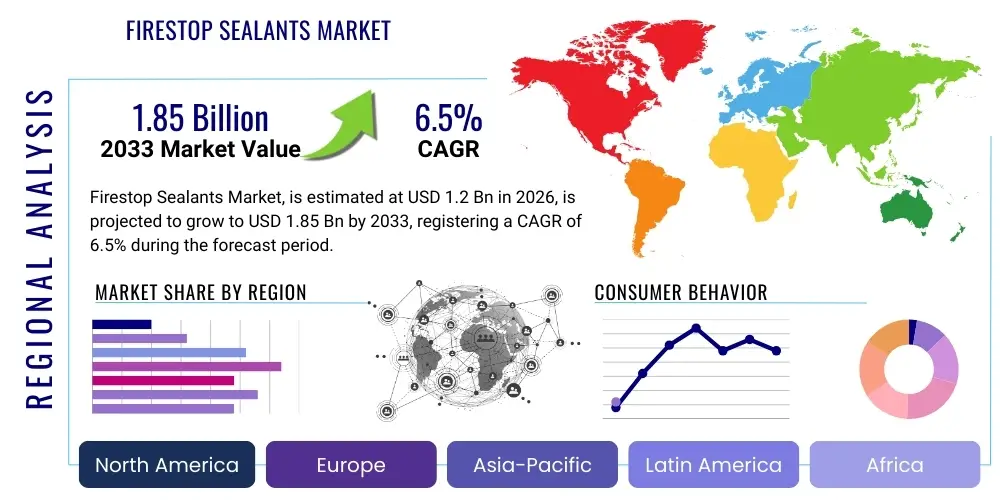

Firestop Sealants Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441414 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Firestop Sealants Market Size

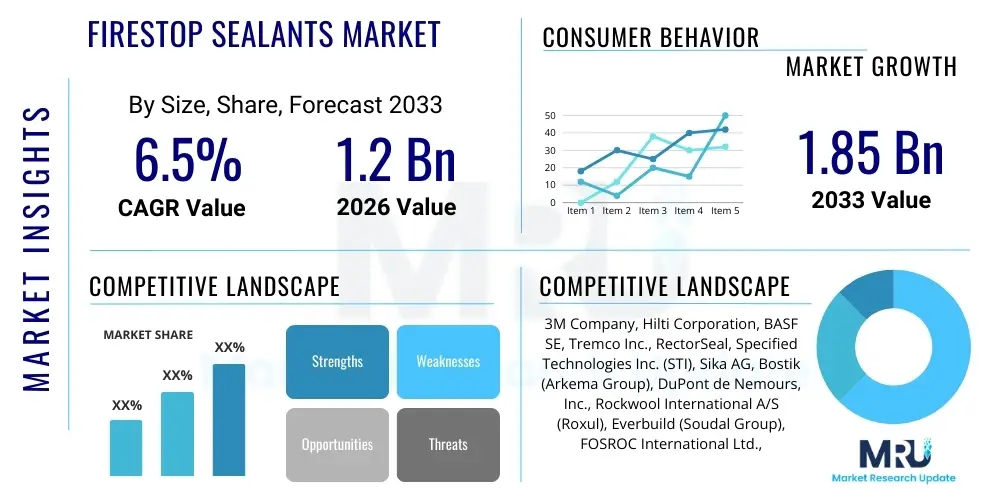

The Firestop Sealants Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 2.06 Billion by the end of the forecast period in 2033.

Firestop Sealants Market introduction

The Firestop Sealants Market encompasses specialized chemical compounds designed to seal gaps, joints, and penetrations in fire-rated assemblies, preventing the passage of fire, smoke, and toxic gases for specified periods. These sealants are critical components within passive fire protection systems, acting as physical barriers that compartmentalize a building during a fire event. The products are predominantly formulated using intumescent, elastomeric, or ablative technologies, offering varying levels of expansion or resistance when exposed to high temperatures. The fundamental product function is maintaining the integrity of fire-rated walls, floors, and ceilings where breaches occur due to mechanical, electrical, or plumbing installations.

Major applications for firestop sealants span across residential, commercial, and industrial construction sectors, including essential infrastructure like hospitals, data centers, manufacturing plants, and transportation hubs. The primary benefit derived from these products is enhanced life safety and property protection, fulfilling stringent regulatory requirements mandated by international building codes such as NFPA (National Fire Protection Association), IBC (International Building Code), and various regional standards like Eurocodes. These products are rigorously tested to standards like ASTM E814 (UL 1479) for through-penetration firestops and ASTM E1966 for fire-resistive joint systems, ensuring reliable performance under extreme conditions.

The market is primarily driven by escalating global construction activities, particularly in emerging economies undergoing rapid urbanization and infrastructure development. Furthermore, the continuous updating and tightening of fire safety regulations worldwide necessitate the mandatory use of certified firestopping materials. Increasing public and corporate awareness regarding the devastating financial and human costs associated with uncontrolled fires also contributes significantly to the demand, pushing constructors and specifiers toward high-performance, compliant firestop sealant solutions that often exceed minimum code requirements.

Firestop Sealants Market Executive Summary

The Firestop Sealants Market is experiencing robust expansion driven by global enforcement of stricter fire safety standards and a surge in high-rise and complex infrastructure projects. Business trends indicate a shift towards sustainable and low-VOC (Volatile Organic Compounds) formulations, aligning with green building initiatives and enhanced occupational safety demands. Manufacturers are focusing on developing hybrid sealants that combine intumescent properties with high movement capability, catering specifically to dynamic joints and seismic-prone regions. Strategic alliances, mergers, and acquisitions are common as large corporations seek to consolidate market share, diversify their product portfolios, and enhance global distribution networks, leading to intensified competition in key technological segments like silicone and graphite-based firestops.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, propelled by massive governmental investments in residential housing, commercial complexes, and industrial parks, particularly in China, India, and Southeast Asian nations. North America and Europe, characterized by highly mature regulatory landscapes and extensive renovation activities, maintain significant market shares, emphasizing advanced certification and compliance solutions. These mature markets prioritize retrofitting old structures to meet contemporary fire codes and are early adopters of digitally enabled fire safety solutions and installation quality assurance technologies, moving beyond basic product sales toward integrated service provision.

Segment trends reveal that the use of intumescent sealants is gaining traction due to their superior performance in expanding and closing gaps during a fire, making them indispensable for cable and pipe penetrations. The commercial sector remains the largest end-user segment due to the stringent fire safety requirements for public access buildings and large office spaces. Furthermore, the increasing complexity of modern building designs, which often utilize lightweight construction materials and modular techniques, necessitates the use of specialized, high-adhesion firestop sealants capable of bonding effectively across diverse substrates, thereby driving innovation in polymer chemistry and application methods.

AI Impact Analysis on Firestop Sealants Market

Common user questions regarding AI's impact on the Firestop Sealants Market center on the potential for AI-driven risk assessment, automation of installation and inspection processes, and optimization of material formulation. Users are keen to understand how AI can enhance the precision of fire safety design by predicting fire propagation pathways based on building structure and material composition. There is significant concern and expectation regarding AI tools that can perform automated compliance checks during the design phase, reducing human error and ensuring that penetration sealing details meet complex regulatory requirements globally. Furthermore, end-users are exploring AI's role in predictive maintenance, enabling proactive identification of compromised firestop systems in existing buildings, thereby improving the overall longevity and reliability of passive fire protection infrastructure.

- AI-enhanced modeling for fire propagation prediction, optimizing sealant placement and type selection during the design phase.

- Automation of firestop installation via robotic systems, improving application consistency and reducing labor costs in large-scale projects.

- AI-driven image recognition and machine learning for automated inspection and quality control of installed firestop barriers.

- Optimization of sealant chemical formulations using AI algorithms to discover new material combinations with superior intumescent or thermal properties.

- Predictive maintenance platforms utilizing sensor data (IoT integration) to monitor the integrity and thermal performance of installed firestop systems in real-time.

- Streamlining supply chain logistics and inventory management for firestop contractors through AI-powered demand forecasting.

DRO & Impact Forces Of Firestop Sealants Market

The Firestop Sealants Market is predominantly shaped by strict regulatory environments and continuous advancements in building safety standards, serving as the core drivers. Restraints include the prevalence of low-quality, non-compliant products entering the market and the shortage of skilled labor required for proper, certified installation, which remains a significant hurdle to market growth and integrity. Opportunities arise from the rapidly expanding green building sector, which demands sealants with low toxicity and sustainable profiles, alongside the massive potential for retrofitting older buildings in developed economies to adhere to modern fire codes. Impact forces are overwhelmingly weighted toward regulatory push and the necessity for enhanced fire compartmentalization in increasingly complex and high-density urban structures globally.

Key drivers center around mandatory building codes (such as NFPA 101, IBC, and EN 1366 series) that specifically mandate the use of certified firestopping for all building service penetrations through fire-rated separations. The global increase in severe weather events and associated risks of fire necessitates resilient construction practices, further solidifying the demand for high-performance sealants. The trend towards modular construction, which requires highly flexible and certified joint sealants, also acts as a critical growth accelerator. Furthermore, heightened scrutiny by insurance underwriters and governmental bodies following high-profile fire disasters worldwide forces immediate adoption of best-practice passive fire protection measures.

Conversely, significant restraints hinder optimal market penetration. One major limitation is the inherent complexity in ensuring correct installation; even the best sealant fails if improperly applied, leading to liability issues and performance gaps. Economic fluctuations and rising raw material costs (especially polymers like silicones and acrylates) can compress manufacturer margins and increase end-product pricing, posing a resistance point in cost-sensitive markets. The widespread issue of product commoditization, where cheap, uncertified alternatives are used to cut construction costs, undermines market quality and poses substantial safety risks. However, the immense opportunity presented by infrastructure renewal projects (e.g., refurbishment of tunnels, transportation systems, and utility plants) provides a counterbalancing growth vector, emphasizing durable and specialty firestop solutions.

Segmentation Analysis

The Firestop Sealants Market is comprehensively segmented based on product type, end-use application, and the chemistry/material composition, allowing for granular analysis of market dynamics and tailored product development. Product differentiation is essential, dictated primarily by performance characteristics such as expansion capability, movement rating, and flame spread index. Material science underpins performance, with key segments including inorganic fillers and specialized polymers optimized for thermal stability. The application segmentation highlights where the highest demand originates, distinguishing between static building joints, through-penetrations for services, and dynamic construction joints, each requiring specifically formulated sealants to maintain fire integrity under various operational stresses and structural movements.

- Product Type:

- Intumescent Sealants

- Elastomeric Sealants

- Ablative Sealants

- Cementitious Firestops

- End-Use:

- Commercial

- Residential

- Industrial

- Institutional (Healthcare & Education)

- Infrastructure (Transportation & Utilities)

- Application:

- Construction Joints (Wall-to-Wall, Floor-to-Wall)

- Through Penetrations (Cables, Pipes, Ducts)

- Perimeter Fire Barriers (Curtain Walls)

- Material/Chemistry:

- Silicone-based

- Acrylic-based

- Polyurethane-based

- Graphite-based

Value Chain Analysis For Firestop Sealants Market

The value chain for firestop sealants begins with upstream activities involving the sourcing and refinement of specialized raw materials, primarily polymers (silicones, acrylics), inorganic fillers (graphite, minerals), and proprietary chemical additives crucial for achieving intumescent or ablative properties. R&D and chemical compounding are critical value-add steps, focusing on rigorous testing and certification compliance (e.g., UL, FM Global, CE marking) before production. Manufacturers then transform these materials into finished cartridges, pails, or tubes, focusing on quality control and batch consistency, which is paramount for life-safety products. The manufacturing phase requires specialized mixing and packaging equipment to ensure shelf stability and ease of application at the construction site.

Downstream analysis focuses heavily on efficient distribution and professional application. Due to the critical nature of firestopping, the distribution channel often involves highly specialized distributors and certified contractors who possess the technical knowledge required for product selection and installation according to specified standards. Direct sales channels are frequently employed for very large infrastructure projects or by major contractors who require bulk supply and technical support directly from the manufacturer. Indirect channels, involving national and regional distributors, ensure product availability for smaller commercial and residential projects, providing logistical efficiency and localized inventory management.

The final and most crucial link in the chain is the certified installation and post-installation inspection, often carried out by trained subcontractors specializing in passive fire protection. This segment adds immense value through quality assurance, as proper application guarantees compliance and performance. Manufacturers often offer extensive training and accreditation programs to their partners to maintain high standards of installation. The value chain is heavily influenced by strict liability and compliance mandates, meaning competitive advantage is derived not just from material cost but from technical support, certification documentation, and the robustness of the entire system from formulation to final sign-off.

Firestop Sealants Market Potential Customers

The primary customers and end-users of firestop sealants are diverse entities involved in the construction, retrofitting, and maintenance of buildings and infrastructure assets where life safety is paramount. General contractors and specialized passive fire protection subcontractors constitute the largest immediate buyers, purchasing large volumes of material based on project specifications and architectural drawings. These contractors rely on manufacturers and distributors for technical data, installation guidance, and necessary product certifications required by local building authorities. Their purchasing decisions are driven equally by price competitiveness and adherence to performance specifications.

Institutional buyers, including governments, military organizations, healthcare systems (hospitals), and large educational facilities (universities), are significant end-users. These organizations often have procurement policies that demand the highest levels of safety and durability, leading them to specify premium, long-life, and heavily certified firestop systems for their extensive estates. Facility managers in commercial real estate, industrial complexes, and data centers also represent a steady stream of demand for maintenance, repair, and operational (MRO) activities, ensuring that firestop breaches caused by system upgrades or routine maintenance are promptly and correctly resealed using certified products.

Furthermore, Original Equipment Manufacturers (OEMs) in specialized fields, such as prefabricated modular construction or manufacturers of ventilation systems and fire-rated doors, serve as critical, though often smaller, volume customers who integrate specialized firestop materials directly into their products. Architects, engineers, and building envelope consultants, while not direct buyers, are crucial influencers in the purchasing process, as their specifications dictate the type, brand, and volume of firestop sealants used on any given project. Regulatory mandates and insurance company requirements further compel all these customer segments to invest consistently in high-quality firestop solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 2.06 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Hilti Corporation, BASF SE, Sika AG, Bostik (Arkema Group), tremco illbruck (Tremco CPG), Specified Technologies Inc. (STI), RectorSeal Corporation, Morgan Advanced Materials plc, Tenmat Ltd., Fire Protection Products Inc., Passive Fire Protection Partners, Fishtech Group (PFP), W. R. Meadows Inc., PPG Industries, Sherwin-Williams Company, Fosroc International Ltd., Nullifire (Cromar Building Products), GAF Materials Corporation, Soudal N.V. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Firestop Sealants Market Key Technology Landscape

The Firestop Sealants market relies heavily on advanced material science, primarily centered around three core technological platforms: intumescent, elastomeric, and ablative chemistries. Intumescent technology involves formulations, often based on graphite or hydrated sodium silicate, that expand significantly when exposed to heat, forming a highly insulating char that seals the penetration gap and prevents the spread of fire and smoke. Recent innovations focus on optimizing the expansion rate and char density, ensuring that the material withstands high-pressure fire conditions. This technology is crucial for cable trays and plastic pipes, where the sealant must aggressively expand to fill the void left by melting substrates.

Elastomeric sealants, typically utilizing high-performance silicones or polyurethanes, are designed to maintain excellent flexibility and adhesion, crucial for construction joints that experience structural movement due to thermal cycling, wind load, or seismic activity. While not always possessing intumescent capabilities, these sealants offer superior movement ratings, ensuring the fire barrier remains intact despite dynamic building stresses. The technological challenge here is balancing high elasticity with sufficient thermal resistance to maintain integrity during the initial stages of a fire before potential intumescent materials activate. The integration of low-smoke and low-toxicity characteristics into these high-movement formulations is a key area of R&D investment, driven by health and safety regulations.

Ablative technology, often involving inorganic materials like ceramic fibers or high-density mineral wool embedded within a binder, works by dissipating heat through chemical decomposition (ablation) when exposed to fire. This process consumes energy and prevents the heat from penetrating the barrier quickly. Although less common for small gaps, ablative materials are vital for specific heavy-duty industrial applications or large electrical penetration seals. The blending of these core technologies—creating hybrid sealants that are both intumescent and possess high elasticity—represents the cutting edge of the market, offering dual benefits critical for modern complex facades and critical infrastructure where movement and fire resistance are simultaneously required, driving higher performance standards across the industry.

Regional Highlights

- North America: This region is defined by highly stringent and consistently enforced building codes (e.g., IBC, NFPA), which mandate the use of third-party certified firestop products. The market is mature, emphasizing retrofit projects, commercial construction, and high-specification institutional buildings (hospitals and data centers). Technological adoption is rapid, especially concerning digital documentation and inspection tools used by specialized contractors to ensure compliance with complex jurisdictional requirements.

- Europe: Driven by the harmonized European standards (Eurocodes and the Construction Products Regulation), the European market focuses on CE marking and adherence to EN testing protocols (EN 1366 series). Germany, the UK, and France are key consumers, propelled by demanding energy efficiency standards that often intersect with passive fire protection needs (e.g., thermal insulation compatibility). Sustainability and low-VOC sealants are major purchasing criteria here.

- Asia Pacific (APAC): The fastest-growing region globally, characterized by explosive growth in infrastructure development, rapid urbanization, and high-rise construction, particularly in China, India, and Southeast Asian countries. While regulatory enforcement varies, international projects and high-value commercial construction adhere strictly to Western or global standards, creating massive demand for certified intumescent and elastomeric solutions.

- Latin America (LATAM): Growth in this region is localized, with Brazil and Mexico leading market adoption, tied closely to large-scale commercial and industrial investments. The market is sensitive to imported technology and pricing, with demand often fluctuating based on domestic economic stability and the gradual adoption of modern international building codes.

- Middle East and Africa (MEA): Large infrastructure and mega-project investments, particularly in the UAE and Saudi Arabia, fuel the demand for premium, high-performance firestop sealants, especially those designed for extreme climates and seismic conditions. Fire safety requirements, often based on US or European standards, are highly demanding in critical sectors like oil & gas and commercial skyscrapers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Firestop Sealants Market.- 3M Company

- Hilti Corporation

- BASF SE

- Sika AG

- Bostik (Arkema Group)

- tremco illbruck (Tremco CPG)

- Specified Technologies Inc. (STI)

- RectorSeal Corporation

- Morgan Advanced Materials plc

- Tenmat Ltd.

- Fire Protection Products Inc.

- Passive Fire Protection Partners

- Fishtech Group (PFP)

- W. R. Meadows Inc.

- PPG Industries

- Sherwin-Williams Company

- Fosroc International Ltd.

- Nullifire (Cromar Building Products)

- GAF Materials Corporation

- Soudal N.V.

Frequently Asked Questions

Analyze common user questions about the Firestop Sealants market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of firestop sealants in passive fire protection systems?

The primary function of firestop sealants is to restore the fire-resistance rating of fire-rated walls, floors, or ceilings after they have been breached by service penetrations (such as pipes or cables). They prevent the passage of fire, smoke, and hot gases for a specified duration, ensuring compartmentalization and allowing safe evacuation.

What is the difference between intumescent and elastomeric firestop sealants?

Intumescent sealants expand significantly when exposed to heat, forming an insulating char that seals voids, particularly effective for penetrations involving combustible materials like plastic pipes. Elastomeric sealants maintain high flexibility and movement capability, making them ideal for dynamic construction joints where structural movement must be accommodated while maintaining the fire barrier.

Which key regulations drive the demand for certified firestop sealants globally?

Demand is primarily driven by international and national building safety codes, notably the International Building Code (IBC) in the US, standards set by the National Fire Protection Association (NFPA), and the European harmonized standards (Eurocodes/EN standards), all of which mandate the use of tested and certified firestopping materials for life safety.

How does the application (End-Use) segmentation impact product choice in the market?

The End-Use segmentation significantly affects product choice due to varying performance requirements. Commercial and Institutional sectors demand highly certified, often silicone-based elastomeric sealants for critical infrastructure, while industrial sites may require specialized ablative or cementitious firestops for high-heat environments or large industrial cable trays.

What is the anticipated impact of green building trends on firestop sealant formulation?

Green building trends are increasing demand for low-VOC (Volatile Organic Compounds) and non-hazardous firestop formulations, pushing manufacturers to develop water-based acrylics and advanced hybrid polymers that comply with environmental standards like LEED while maintaining required fire resistance and durability specifications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Firestop Sealants Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Firestop Sealants Market Size Report By Type (Silicone, Acrylic), By Application (Pipe and Cable Penetrations, Curtain walls, Facades/Partition Walls, Concrete Floor, By End-Use, Residential, Commercial, Industrial), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Firestop Sealants Market Statistics 2025 Analysis By Application (Residential Building, Commercial Building, Industrial Building), By Type (Elastometric, Intumescent), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager