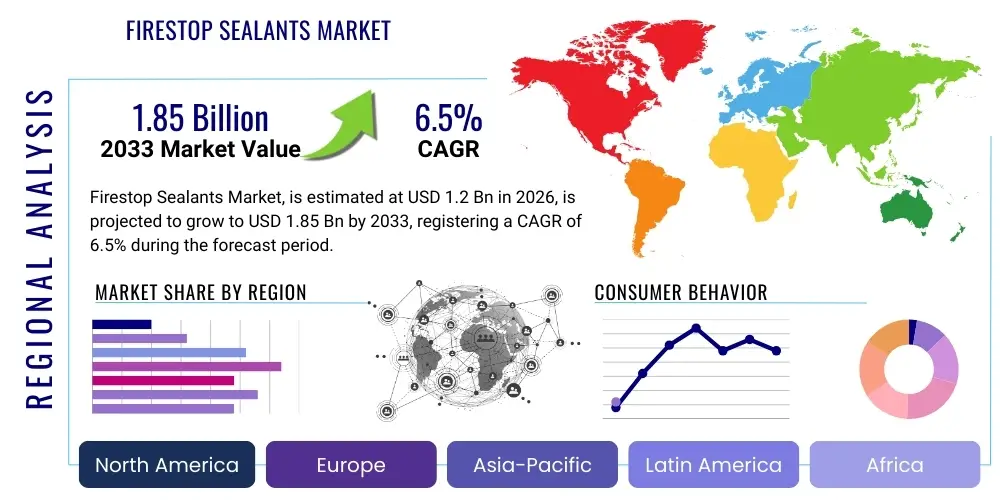

Firestop Sealants Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434437 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Firestop Sealants Market Size

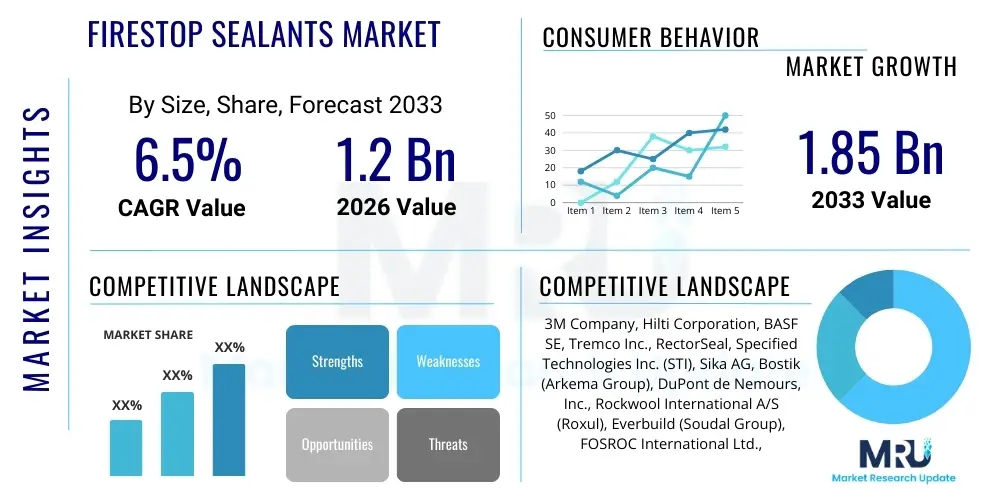

The Firestop Sealants Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.85 Billion by the end of the forecast period in 2033.

Firestop Sealants Market introduction

Firestop sealants are critical components within passive fire protection systems, specifically engineered to prevent the spread of fire and smoke through breaches in fire-rated walls, floors, and ceilings. These breaches typically arise from the penetration of services such as cables, pipes, and ventilation ducts. The primary function of firestop sealants, which include materials like silicone, acrylic, intumescent compounds, and polyurethane, is to maintain the integrity of fire compartments. When exposed to high temperatures, these materials either expand significantly (intumescent action) or form a char layer, effectively blocking the gap and limiting heat transfer, thereby preserving occupant safety and structural stability during a fire event. The demand is intrinsically linked to stringent global building codes and the mandatory requirement for certified construction practices in both new infrastructure and renovation projects.

The core applications of firestop sealants span across residential, commercial, and industrial construction sectors, where they are utilized in specific assemblies ranging from curtain wall joints and perimeter fire barriers to small cable penetrations in data centers and hospitals. The benefits of deploying high-quality firestop sealants are multifaceted, encompassing enhanced life safety, reduced property damage, and ensuring regulatory compliance (e.g., adhering to ASTM E814/UL 1479 standards). Furthermore, modern formulations are increasingly focusing on environmental sustainability, offering low VOC (Volatile Organic Compound) content, which is essential for green building certifications and improved indoor air quality, making them preferable choices for healthcare and educational facilities.

Key driving factors accelerating the adoption of firestop sealants include the robust growth in global construction activities, particularly in emerging economies focused on vertical infrastructure development. Simultaneously, the continuous tightening of international fire safety regulations, spurred by high-profile fire incidents globally, mandates the use of tested and approved firestopping materials in almost all types of public and commercial buildings. Innovation in sealant chemistry, leading to products offering superior fire ratings, better smoke resistance, and easier application, further stimulates market growth, addressing complex construction challenges posed by non-traditional building materials and modular construction techniques.

Firestop Sealants Market Executive Summary

The Firestop Sealants Market is currently experiencing dynamic growth, driven primarily by the global emphasis on mandatory compliance with fire safety standards and rapid urbanization across Asia Pacific. Business trends show a distinct shift toward advanced intumescent and hybrid sealant technologies, which offer superior performance characteristics and versatility across various substrates and movement requirements often encountered in modern structures. Manufacturers are heavily investing in product certification and digitalization efforts, streamlining the specification process for architects and engineers. Furthermore, supply chain resilience remains a central theme, as the volatility of petrochemical raw materials necessitates backward integration or strategic sourcing agreements to maintain competitive pricing and consistent product availability.

Regionally, North America and Europe maintain dominance, not solely due to high construction volumes but more significantly due to the maturity and strict enforcement of their fire safety regulatory frameworks (such as NFPA and EN standards). These regions exhibit high demand for premium, high-performance, third-party certified products, often prioritizing long-term durability and sustainability features. Conversely, the Asia Pacific region, led by China and India, presents the highest growth potential, fueled by massive government investments in infrastructure, commercial real estate development, and the gradual but persistent adoption of international building codes, transitioning away from rudimentary fire protection solutions toward specialized sealants.

Segmentation trends highlight the increasing prominence of silicone-based sealants due to their excellent flexibility, durability, and fire resistance, particularly in movement joints and exterior applications. However, acrylic sealants remain popular in cost-sensitive residential and light commercial applications where moderate fire ratings suffice. The market for firestopping specialty applications, such such as those required for high-volume data cabling in technological hubs or highly regulated pharmaceutical manufacturing plants, is witnessing accelerated growth. This demand is segment-specific, favoring products engineered to maintain critical system functionality post-fire exposure, emphasizing thermal and smoke sealing properties.

AI Impact Analysis on Firestop Sealants Market

Common user questions regarding AI's impact on the Firestop Sealants Market center on how artificial intelligence can enhance compliance documentation, optimize material formulation for specific performance criteria, and predict material failures or installation errors. Users are particularly keen on AI's ability to automate the inspection and verification process of firestop installations, which are often prone to human error and complex documentation requirements. Key themes emerging from these inquiries include the potential for AI-driven material informatics to accelerate the development of next-generation, environmentally friendly, and high-performance intumescent compounds, reducing the traditional R&D timeline. Furthermore, expectations are high regarding AI utilization in sophisticated BIM (Building Information Modeling) environments to ensure seamless integration of firestop specifications during the design phase, minimizing conflicts and enhancing overall system reliability, thus reducing liability for manufacturers and contractors.

- AI-powered material informatics accelerates the discovery and optimization of new intumescent and ablative polymer chemistries.

- Machine learning algorithms enhance quality control by predicting manufacturing defects and ensuring batch consistency in sealant production.

- AI integration in BIM software facilitates automated design clash detection, ensuring correct firestop specifications for complex penetrations.

- Computer vision and drone technology, utilizing AI, streamline on-site inspection and verification of firestop installations for compliance reporting.

- Predictive maintenance analytics use sensor data to assess the long-term performance and potential degradation of installed firestop systems in critical infrastructure.

DRO & Impact Forces Of Firestop Sealants Market

The market is fundamentally driven by continuously escalating governmental and regulatory requirements for passive fire protection (Driver). However, high raw material costs, particularly petrochemical derivatives, and the complexity of achieving global compliance certifications pose significant restraints (Restraint). The increasing focus on smart cities, green buildings, and sustainable construction offers substantial growth opportunities (Opportunity), particularly for specialized bio-based or low-VOC sealant formulations. These forces, when combined, create a powerful impact dynamic where stringent enforcement pushes market demand upwards (Impact Force), simultaneously favoring large, certified manufacturers capable of absorbing the high costs of R&D and certification, consolidating market leadership among key players who adhere strictly to international testing standards like UL, ASTM, and EN.

Segmentation Analysis

The Firestop Sealants Market is comprehensively segmented based on product type, end-use application, and chemistry, reflecting the diverse needs of the construction industry. Product classification typically includes intumescent sealants, which expand under heat, and non-intumescent sealants, which maintain their volume and provide insulation. Chemistry segmentation is crucial, differentiating performance between silicone, acrylic, polyurethane, and epoxy formulations based on factors like movement capability, adhesion to various substrates, and environmental durability. The application segment divides the market into through-penetrations (pipes, cables), construction joints (gaps between structural elements), and perimeter fire barriers, each requiring specially formulated sealant characteristics to ensure fire compartmentation effectiveness.

- By Product Type:

- Intumescent Sealants

- Non-Intumescent Sealants (Ablative, Endothermic)

- By Chemistry:

- Silicone-based Firestop Sealants

- Acrylic-based Firestop Sealants

- Polyurethane-based Firestop Sealants

- Elastomeric/Hybrid Sealants

- By Application:

- Through-Penetrations (Piping, Cabling, Ducts)

- Construction Joints (Wall-to-Wall, Floor-to-Wall)

- Perimeter Fire Barriers (Curtain Walls)

- By End-Use Sector:

- Commercial Construction (Offices, Retail, Hospitality)

- Residential Construction (Single-family, Multi-family)

- Industrial/Infrastructure (Power Plants, Manufacturing, Data Centers)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LAMEA)

- Middle East and Africa (MEA)

Value Chain Analysis For Firestop Sealants Market

The value chain for firestop sealants begins with the upstream processes focused on sourcing and synthesis of specialized raw materials, including high-performance polymers (silicones, polyurethanes, acrylics), inorganic fillers, and intumescent additives (e.g., graphite or hydrated compounds). The quality and consistency of these raw materials are paramount as they directly determine the fire rating and longevity of the final product. Manufacturers then engage in complex mixing and processing operations, which are highly regulated to ensure the consistency of rheology and curing properties. Due to the high-stakes nature of the application, R&D focused on achieving rigorous international certifications (such as UL listing or CE marking) is a significant cost center within the midstream manufacturing segment.

The downstream distribution channel is highly specialized, often involving multiple tiers to ensure products reach certified installers and specific project sites. Direct sales are common for very large industrial or infrastructural projects, where technical support and customized formulations are required. However, the majority of products flow through specialized construction distributors and suppliers who maintain inventory of fire-rated materials. A crucial element in the downstream value chain is the role of certified applicators and fire protection engineers. Unlike generic sealants, firestop products require precise installation according to tested assembly details, making training and certification programs offered by manufacturers essential for maintaining product performance and validity of the fire rating. The complexity of documentation and compliance verification also adds significant value in the latter stages of the chain.

Effective value capture across the chain is heavily influenced by intellectual property surrounding intumescent technology and access to specialized distribution networks that cater to the stringent requirements of professional builders and inspectors. The indirect channel relies heavily on architects and specifiers who mandate specific, certified brands during the design phase, highlighting the importance of manufacturer brand reputation and continuous engagement with the regulatory and design community. The overall structure emphasizes quality assurance and certification over simple cost reduction, reflecting the critical life safety function these products serve.

Firestop Sealants Market Potential Customers

Potential customers for firestop sealants primarily encompass entities involved in the design, construction, modification, and maintenance of buildings and industrial facilities where life safety is paramount. The core buyers include General Contractors (GCs) and specialized Mechanical, Electrical, and Plumbing (MEP) contractors who execute the installation of service penetrations. These professionals are responsible for procuring certified materials specified by the project architects and engineers. Regulatory bodies and third-party inspectors, while not direct buyers, exert immense influence by mandating the use of specific certified products and ensuring correct installation practices, thereby indirectly driving purchasing decisions.

A second major segment of customers includes building owners and facility managers of large commercial assets, institutional buildings (hospitals, universities), and critical infrastructure (data centers, airports). For these end-users, firestop sealants are viewed as integral components of their long-term asset protection and compliance strategy. Their purchasing cycle is often tied to refurbishment, maintenance, and upgrade projects, focusing on retrofitting older buildings to meet current fire codes. Data centers, in particular, require specialized firestop solutions that can withstand high temperatures while minimizing damage to sensitive electrical infrastructure, making them premium segment buyers.

Furthermore, Original Equipment Manufacturers (OEMs) who integrate fire protection components into manufactured building systems, such as modular construction units or HVAC assemblies, represent a niche but growing customer base. These OEMs require bulk, standardized firestop solutions that are easy to integrate and maintain necessary fire ratings. Ultimately, the purchasing decision is a multi-stakeholder process, involving specifiers focused on performance, procurement managers focused on cost and availability, and installers focused on ease of application and adherence to regulatory standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.85 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Hilti Corporation, BASF SE, Tremco Inc., RectorSeal, Specified Technologies Inc. (STI), Sika AG, Bostik (Arkema Group), DuPont de Nemours, Inc., Rockwool International A/S (Roxul), Everbuild (Soudal Group), FOSROC International Ltd., Trelleborg AB, Promat International N.V., Unifrax LLC, Saint-Gobain, Nullifire (Tremco CPG), Polyseam Ltd., HoldRite, Nelson Firestop Products. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Firestop Sealants Market Key Technology Landscape

The technology landscape for firestop sealants is dominated by advancements in chemical composition designed to enhance fire resistance, durability, and ease of application. The most critical technological domain involves Intumescent Technology, where sealants contain materials that swell dramatically (up to 50 times their original volume) when exposed to heat, forming a highly effective, insulating char barrier. Recent innovations focus on hybrid intumescent systems that combine different swelling agents to optimize performance across varying temperature profiles and gap sizes. This technological evolution aims to create multi-purpose products that reduce complexity for installers and simplify inventory management, moving beyond single-application solutions.

Another significant technological focus is the development of ultra-low VOC and sustainable formulations. With growing emphasis on green building standards (e.g., LEED, BREEAM), manufacturers are investing heavily in water-based acrylics and specialized silicones that maintain high fire ratings while minimizing the release of harmful organic compounds during and after application. This push for sustainability is coupled with technological enhancements in adhesion and elasticity, particularly crucial for construction joints exposed to continuous movement, such as those found in high-rise buildings. Specialized technologies like fire-rated spray applied sealants and self-leveling floor compounds are also gaining traction, significantly speeding up installation time in large commercial projects by leveraging advanced application methods.

Furthermore, technology is impacting application and verification. The integration of QR codes or RFID tags on sealant packaging and installation points is becoming standard practice, enabling digital documentation and traceability necessary for compliance audits. Automated dispensing systems and specialized robotic application tools are being tested in prefabrication settings and large infrastructure projects to ensure consistent bead size and depth, mitigating human error—a primary cause of firestop system failure. These technological shifts highlight the market's movement toward integrated, verifiable, and sustainable passive fire protection systems rather than viewing sealants as isolated components.

Regional Highlights

- North America: Characterized by highly stringent regulatory environments enforced by organizations like UL and NFPA. This region mandates third-party testing and certification for nearly all firestop applications, leading to a strong demand for premium, high-performance silicone and hybrid sealants. The mature commercial real estate market and significant investment in critical infrastructure (data centers, hospitals) drive consistent demand, placing emphasis on long-term durability and compliance documentation.

- Europe: Driven by the harmonized standards of the European Union (Eurocodes and CE Marking under the Construction Products Regulation). Demand is strong in Western Europe due to rigorous safety laws and a focus on renovation and retrofitting of existing buildings. Germany, the UK, and France are key markets, prioritizing sustainability and low-VOC firestop solutions in alignment with EU environmental directives.

- Asia Pacific (APAC): Represents the fastest-growing market globally, fueled by unprecedented infrastructure and residential construction booms, particularly in China, India, and Southeast Asian nations. While regulatory enforcement varies, the rapid adoption of international building codes (driven by foreign investment and high-profile projects) is increasing the demand for certified, sophisticated firestop sealants over traditional, less reliable sealing methods.

- Latin America (LAMEA): Growth is moderate, primarily concentrated in major economies like Brazil and Mexico. The market is highly price-sensitive, but urbanization and increased awareness of international safety standards, especially in high-value commercial construction, are gradually shifting demand toward certified elastomeric and silicone products.

- Middle East and Africa (MEA): Large infrastructure and commercial projects in the Gulf Cooperation Council (GCC) countries drive demand for high-end, durable firestop systems capable of withstanding extreme environmental conditions (high heat, humidity). Regulatory tightening in Saudi Arabia and UAE is accelerating the adoption of internationally approved sealants in large-scale residential and commercial towers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Firestop Sealants Market.- 3M Company

- Hilti Corporation

- BASF SE

- Tremco Inc.

- RectorSeal

- Specified Technologies Inc. (STI)

- Sika AG

- Bostik (Arkema Group)

- DuPont de Nemours, Inc.

- Rockwool International A/S (Roxul)

- Everbuild (Soudal Group)

- FOSROC International Ltd.

- Trelleborg AB

- Promat International N.V.

- Unifrax LLC

- Saint-Gobain

- Nullifire (Tremco CPG)

- Polyseam Ltd.

- HoldRite

- Nelson Firestop Products

Frequently Asked Questions

Analyze common user questions about the Firestop Sealants market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between intumescent and ablative firestop sealants?

Intumescent sealants expand significantly when exposed to heat, forming a protective, insulating char that closes the gap left by melted penetrants (like plastic pipes). Ablative sealants, conversely, do not expand but form a hard, highly insulating ceramic layer on the surface when heated, providing robust protection without volume increase.

Why are certifications like UL and ASTM crucial for firestop sealants?

Certifications from bodies like Underwriters Laboratories (UL) or compliance with ASTM standards (e.g., E814) verify that a firestop sealant has been tested in specific assemblies under controlled fire conditions. These certifications are mandatory requirements for regulatory approval and building codes, confirming the product's fire-resistance rating (F-rating and T-rating) and performance reliability, thereby mitigating liability risks.

How does the shift toward modular construction impact firestop sealant demand?

Modular construction increases demand for specialized, high-movement firestop sealants that can handle the increased relative motion between modules. It also drives demand for firestop products designed for factory application, requiring sealants that cure quickly and adhere effectively to prefabricated elements before transport and final assembly on site.

What are the primary factors determining the required fire rating for a sealant?

The primary factors include the required fire resistance duration of the structural element (e.g., 1-hour, 2-hour, or 4-hour rating), the type of penetrating items (metal pipes, plastic conduits, cables), the size of the opening (annular space), and the required temperature insulation (T-rating), which protects the unexposed side of the barrier.

Are low-VOC firestop sealants mandatory for green building projects?

While not universally mandatory, low-VOC (Volatile Organic Compound) firestop sealants are highly preferred and often necessary for achieving credits under major green building certification systems like LEED. They significantly contribute to improved indoor air quality and meet stringent health standards increasingly adopted in educational, healthcare, and residential construction.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Firestop Sealants Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Firestop Sealants Market Size Report By Type (Silicone, Acrylic), By Application (Pipe and Cable Penetrations, Curtain walls, Facades/Partition Walls, Concrete Floor, By End-Use, Residential, Commercial, Industrial), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Firestop Sealants Market Statistics 2025 Analysis By Application (Residential Building, Commercial Building, Industrial Building), By Type (Elastometric, Intumescent), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager