Flame Retardant Tape Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441863 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Flame Retardant Tape Market Size

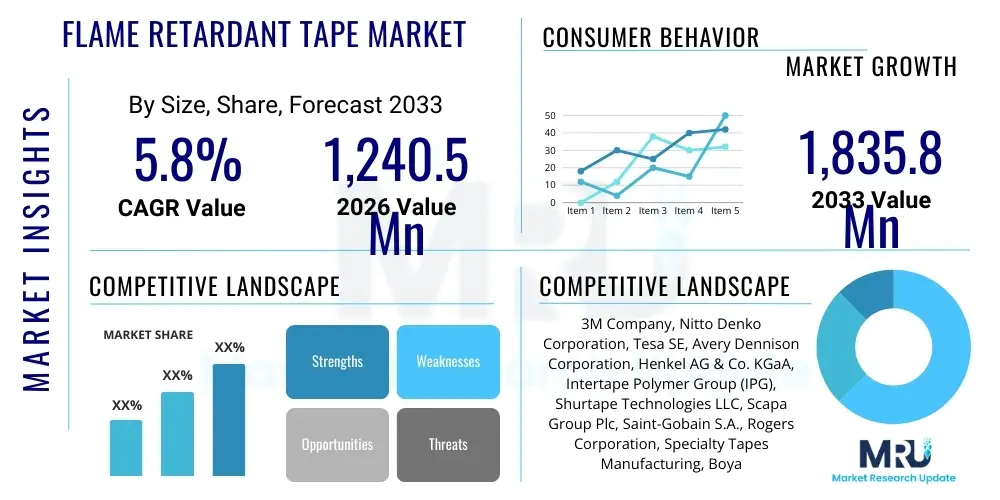

The Flame Retardant Tape Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.4 Billion by the end of the forecast period in 2033.

Flame Retardant Tape Market introduction

The Flame Retardant Tape Market encompasses specialized adhesive tapes designed to resist ignition and inhibit the spread of flames, offering critical safety enhancements in demanding industrial and commercial environments. These tapes are formulated using materials that inherently possess fire-resistant properties, such as fiberglass, PTFE, specialized polymers, or incorporating halogenated and non-halogenated flame retardant additives. The primary function of these products is electrical insulation, bundling, sealing, and thermal management in applications where high temperatures or potential short circuits pose significant fire risks. The design complexity varies, ranging from single-sided adhesive solutions for wrapping cables and pipes to double-sided tapes used in mounting electronic components within enclosures, all while meeting stringent international safety standards like UL, IEC, and ASTM.

Major applications for flame retardant tapes span across highly regulated industries, most notably aerospace, defense, automotive, and mass transit (rail). In the aerospace sector, these tapes are indispensable for wire harnessing and insulation within aircraft cabins and engine bays, where reduced smoke and toxicity are paramount. Similarly, the automotive industry utilizes these tapes for protecting critical wiring systems from engine heat and accidental fires, aligning with increasing electric vehicle production which requires robust thermal and electrical management solutions. The construction industry also represents a substantial application segment, utilizing these products for sealing ventilation systems, fire barriers, and securing electrical conduits within commercial and residential buildings, ensuring compliance with strict building codes.

The market growth is fundamentally driven by escalating global safety regulations and the mandated implementation of fire protection systems across various end-use sectors. These tapes offer superior benefits over standard insulating materials, including enhanced heat dissipation, resistance to harsh chemicals, and durability under mechanical stress. The shift towards miniaturization in electronics and the rapid expansion of complex electrical infrastructure, particularly in data centers and renewable energy installations, further necessitates high-performance flame retardant solutions to prevent catastrophic equipment failures and minimize downtime, thereby cementing the tape's role as a vital safety component.

Flame Retardant Tape Market Executive Summary

The global Flame Retardant Tape Market is exhibiting robust growth, propelled by strict safety protocols in the aerospace and construction sectors, coupled with technological advancements focusing on non-halogenated chemistries. Key business trends include strategic mergers and acquisitions aimed at consolidating specialized material expertise, and significant investment in research and development to create tapes that offer both superior fire resistance and improved handling characteristics, such as increased flexibility and stronger adhesion without compromising retardant effectiveness. Suppliers are focusing on vertically integrated operations to control the quality of base materials, particularly in the production of high-performance materials like polyimide and specialized silicone tapes crucial for high-voltage applications in electric vehicles (EVs) and industrial machinery.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, primarily due to the rapid urbanization, massive infrastructure development, and burgeoning electronics manufacturing base, particularly in China and India. North America and Europe, characterized by mature automotive and aerospace industries, maintain significant market shares due to the enforcement of exceptionally rigorous fire safety standards (e.g., FAR 25.853 in aerospace). These regions are witnessing a strong trend towards sustainable and environmentally friendly products, driving the demand for advanced, non-halogenated flame retardant tapes which mitigate the environmental concerns associated with traditional additives.

Segment trends reveal that the silicone-based tape segment is experiencing accelerated adoption due to its superior thermal stability and performance at extreme temperatures, making it ideal for engine components and high-heat environments. By application, the electrical & electronics sector maintains dominance, given the proliferation of complex wiring harnesses in consumer electronics, industrial automation, and data infrastructure. Furthermore, the market structure is moving towards customized solutions, with manufacturers collaborating closely with end-users to develop tapes precisely tailored for specific operational temperatures, mechanical loads, and required levels of flame resistance, ensuring optimal performance and compliance across diverse industrial landscapes.

AI Impact Analysis on Flame Retardant Tape Market

Common user questions regarding AI's impact on the Flame Retardant Tape Market typically center on how artificial intelligence can optimize material composition, predict product performance under stress, and automate quality control in manufacturing processes. Users are keenly interested in leveraging AI for rapid prototyping of novel non-halogenated flame retardant formulas, asking whether machine learning models can accelerate the discovery of compounds that balance superior fire safety with cost-effectiveness and improved environmental profiles. Additionally, there are inquiries about AI-driven predictive maintenance for application environments, specifically concerning how sensor data analyzed by AI can determine the optimal replacement cycle or application requirements for flame retardant tapes in complex systems like aircraft or high-speed rail, ensuring proactive safety compliance.

AI is beginning to fundamentally reshape the research and development pipeline for flame retardant tapes. Machine learning algorithms are now utilized to analyze vast datasets relating to chemical structures, thermal decomposition properties, and mechanical performance of polymers and additives. This computational approach allows manufacturers to simulate countless material combinations virtually, drastically reducing the time and cost associated with traditional trial-and-error synthesis. For instance, AI models can predict the charring efficiency and limiting oxygen index (LOI) of a new tape formula before physical production, ensuring that new tapes immediately comply with stringent fire safety regulations, thereby accelerating time-to-market for high-performance products.

In the manufacturing domain, AI and robotics enhance operational efficiency and quality assurance. Computer vision systems powered by deep learning are being implemented on production lines to detect even microscopic defects or inconsistencies in the tape's coating thickness, adhesive layer integrity, or substrate material, ensuring uniform flame retardant performance across entire batches. Furthermore, AI-driven process optimization minimizes material waste and fine-tunes curing temperatures and tension settings during production, leading to higher yields and reduced manufacturing costs, ultimately supporting the scalability of complex, multi-layered flame retardant tape structures necessary for advanced applications.

- Accelerated discovery of novel, sustainable non-halogenated flame retardant materials using generative AI.

- Optimization of manufacturing parameters (e.g., coating thickness, curing time) through predictive analytics, enhancing quality control and yield.

- Implementation of AI-powered computer vision for real-time defect detection on production lines, ensuring superior product consistency.

- Predictive modeling of thermal and fire performance of tapes in specific end-use environments (e.g., aerospace wiring) using simulation tools.

- Improved supply chain visibility and demand forecasting for specialized raw materials, reducing lead times.

DRO & Impact Forces Of Flame Retardant Tape Market

The Flame Retardant Tape Market is primarily driven by escalating safety mandates across global industries, most notably in public transportation, construction, and high-voltage electrical installations. Regulatory bodies worldwide are continuously updating fire safety codes, compelling manufacturers and builders to adopt certified flame retardant materials, which serves as a perpetual demand driver. The opportunity landscape is vast, especially in emerging economies where infrastructure development is booming, and the adoption of modern safety standards is accelerating. Furthermore, the rapid transition to electric vehicles (EVs) presents a major growth avenue, as complex battery systems require highly specialized thermal and flame-resistant insulation tapes to mitigate the risk of thermal runaway and battery fires.

However, the market faces significant restraints. A primary challenge is the high cost associated with manufacturing and purchasing high-performance, non-halogenated flame retardant tapes compared to standard insulation solutions. The specialized raw materials, rigorous testing procedures, and complex chemical formulations required to meet top-tier safety standards contribute to elevated production costs, which can hinder adoption in cost-sensitive applications. Additionally, the increasing environmental scrutiny regarding certain legacy halogenated additives (such as bromine) forces manufacturers into expensive research and reformulation efforts, creating a technological hurdle and sometimes resulting in products that may be less effective in certain fire scenarios compared to their traditional counterparts.

The impact forces influencing the market are multifaceted, combining regulatory push with technological pull. The regulatory impact is high, ensuring baseline demand, while the technological impact is constantly reshaping the product landscape, pushing innovations toward thinner, lighter, and more durable solutions. Competitive rivalry is intensifying, particularly among large chemical and adhesive manufacturers who are competing on both price and proprietary flame retardant chemistries. The threat of substitution, while present from flame retardant coatings or sleeves, is mitigated by the unique flexibility, ease of application, and sealing properties offered by tapes, solidifying their irreplaceable role in specific electrical and structural applications requiring immediate, contained fire protection.

Segmentation Analysis

The Flame Retardant Tape Market segmentation provides a granular view of product types, material compositions, end-use applications, and regional market dynamics. This detailed breakdown is critical for understanding specific demand pockets and strategic investment areas within the highly specialized industrial adhesives space. Analyzing segments such as material type (e.g., fiberglass, silicone, polyimide) allows companies to tailor their R&D efforts towards high-growth chemistries that offer superior performance parameters, such as higher temperature resistance and non-toxic combustion byproducts, which are increasingly demanded by the aerospace and defense sectors. Furthermore, the segmentation by application helps in identifying market saturation points and untapped opportunities, particularly in niche areas like renewable energy infrastructure (solar panel wiring) or specialized industrial heating processes.

Segmentation by product type typically differentiates between adhesive transfer tapes, single-sided tapes, and double-sided tapes, each designed for distinct mechanical or sealing functions, but all incorporating flame retardancy. For example, transfer tapes are crucial for bonding thin layers in electronics, while single-sided tapes dominate cable wrapping and electrical insulation tasks. The end-user industry segmentation remains the most impactful, clearly illustrating the regulatory pressure and subsequent demand emanating from automotive (especially EV manufacturing), aerospace & defense, and construction. Each industry requires adherence to unique certification regimes, making product specialization vital for market penetration.

Geographic segmentation confirms the maturity and strict regulatory environment of North America and Europe, versus the high-growth trajectory and infrastructure-led demand in Asia Pacific. Successful market strategies must address these segment-specific requirements. For instance, manufacturers targeting the European construction market must prioritize products compliant with REACH regulations and EU building codes, whereas those focusing on the APAC electronics market might prioritize volume manufacturing of cost-effective, yet compliant, polyester-based flame retardant tapes. This comprehensive segmentation provides the necessary framework for strategic market entry and competitive positioning.

- By Material Type:

- Silicone

- Polyester (PET)

- Polyimide (Kapton)

- Fiberglass

- PTFE (Polytetrafluoroethylene)

- Acrylic Foam

- By Backing Type:

- Foil (Aluminum, Copper)

- Fabric/Cloth (Fiberglass Cloth)

- Film (PET, Polyimide)

- Foam

- By Product Type:

- Single-Sided Tapes

- Double-Sided Tapes

- Adhesive Transfer Tapes

- By Mechanism:

- Halogenated Flame Retardants

- Non-Halogenated Flame Retardants

- By End-Use Industry:

- Aerospace & Defense

- Automotive (Including Electric Vehicles)

- Construction & Building Materials

- Electrical & Electronics (Consumer and Industrial)

- Mass Transit (Rail, Marine)

- Industrial Manufacturing

Value Chain Analysis For Flame Retardant Tape Market

The value chain for the Flame Retardant Tape Market commences with upstream raw material suppliers, encompassing manufacturers of base materials such as specialized polymers (silicone, polyimide), adhesive components (acrylic, rubber, silicone adhesives), and critically, the flame retardant additives (e.g., phosphorus compounds, metal hydroxides). The quality and cost of these chemical inputs directly impact the final product's performance and price. Integration at this stage is crucial; companies that secure reliable, high-purity supply of non-halogenated retardants gain a significant competitive edge due to increasing regulatory preference for these materials. Furthermore, investments in compounding technology at the base material level ensure optimal dispersion of the flame retardant chemicals, which is vital for achieving consistent fire safety ratings across the tape surface.

The manufacturing stage involves sophisticated coating and lamination processes where the adhesive is applied to the backing material and then infused or coated with flame retardant chemicals. Direct distribution channels are often preferred for highly technical or customized tapes, especially when serving large original equipment manufacturers (OEMs) in aerospace or automotive sectors. This allows manufacturers to provide direct technical support, manage compliance specifications, and ensure just-in-time delivery for complex assembly lines. Indirect distribution utilizes specialized industrial distributors and large-scale wholesalers who service smaller electrical contractors, maintenance, repair, and operations (MRO) markets, providing wider geographic reach and inventory management services for standardized products.

Downstream analysis focuses on the end-user application and integration within high-value assets. End-users, such as aircraft manufacturers or electrical system integrators, demand extensive technical documentation, performance certifications, and traceability. The effectiveness of the tape is realized only through correct application in environments like cable bundles, HVAC systems, or battery packs. The high stakes involved in fire safety mean that after-sales support, continuous product compliance monitoring, and ensuring product longevity under operational stress are key differentiators, driving strong, long-term relationships between tape manufacturers and key purchasing entities, making technical expertise a critical component of the value proposition.

Flame Retardant Tape Market Potential Customers

Potential customers for flame retardant tapes primarily exist within industries governed by stringent fire safety regulations and those dealing with high-voltage electricity or extreme heat environments. The largest and most technically demanding customer segment is the aerospace and defense industry, including major airframe manufacturers, MRO service providers, and specialized avionics suppliers. These buyers prioritize tapes certified to meet specific flammability, smoke emission, and toxicity (FST) requirements, such as those mandated by the Federal Aviation Administration (FAA) or European Union Aviation Safety Agency (EASA). Their purchasing decisions are driven by performance guarantees, material traceability, and adherence to extremely tight dimensional tolerances for lightweighting purposes.

The automotive industry, particularly the rapidly expanding electric vehicle (EV) segment, represents a high-growth customer base. EV manufacturers require advanced flame retardant tapes for insulating high-voltage battery modules, securing wiring harnesses near power electronics, and providing thermal management within the motor compartment. These customers look for tapes that offer robust dielectric strength, resistance to battery chemicals, and prolonged operational life under vibrational stress. Similarly, companies involved in mass transit, such as railway car manufacturers and subway system operators, are consistent purchasers, demanding tapes that prevent fire propagation within passenger compartments and sensitive signaling equipment, adhering to rail-specific safety standards like EN 45545.

Finally, the industrial and commercial construction sector remains a stable, high-volume customer. General contractors, electrical contractors, and specialized fireproofing companies utilize these tapes for sealing fire-rated partitions, insulating HVAC ducts to prevent flame spread through ventilation systems, and securing electrical wiring in commercial buildings, data centers, and power generation facilities. For this segment, cost-effectiveness, ease of application, and compliance with local and international building codes (NFPA, IBC) are key purchasing criteria. Data center operators, in particular, require reliable, high-performance tapes to maintain continuous operation and mitigate fire risks associated with dense server installations and high-power cabling.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Nitto Denko Corporation, Tesa SE, Avery Dennison Corporation, Shurtape Technologies LLC, Intertape Polymer Group (IPG), Saint-Gobain S.A., Rogers Corporation, Scapa Group Plc, DuPont de Nemours Inc., PPS Manufacturing Inc., DeWAL Industries Inc., Polyken (Berry Global), Vancive Medical Technologies, Techno Adhesives, Mactac LLC, Heskins LLC, Shenzhen KXT Technology Co. Ltd., Henkel AG & Co. KGaA, Sika AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flame Retardant Tape Market Key Technology Landscape

The technological evolution within the Flame Retardant Tape Market is centered around optimizing the core elements: the backing material, the adhesive formulation, and the fire-suppressing additives. A major technological focus is the transition from older, halogenated chemistries (which release toxic smoke upon combustion) to advanced non-halogenated alternatives, such as metal hydroxides (e.g., aluminum trihydrate) and phosphorus-based compounds. These new technologies require sophisticated micro-encapsulation techniques to ensure that the retardants are homogeneously dispersed throughout the polymer matrix without negatively impacting the tape’s mechanical strength, adhesion, or flexibility, which is crucial for intricate wrapping applications.

Innovation in backing materials is also vital, driven by demands for high-performance tapes that withstand extreme thermal and mechanical cycling. The utilization of advanced materials like polyimide film (known for its exceptional thermal stability, utilized under the brand name Kapton by some manufacturers) and specialized silicone elastomers enables tapes to function reliably in environments exceeding 200°C, common in automotive engine bays and military equipment. Furthermore, multi-layered tape structures incorporating reflective foil backings (aluminum or copper) are being developed. This technology not only offers electrical shielding but also enhances thermal management by reflecting radiant heat away from sensitive components, providing a dual layer of protection against overheating and subsequent fire ignition.

Adhesive technology represents another key competitive differentiator. Manufacturers are developing pressure-sensitive adhesives (PSAs) that maintain aggressive bond strength even after prolonged exposure to heat, moisture, and common industrial solvents, while also exhibiting inherent flame retardancy. UV-cured acrylic and high-performance silicone adhesives are leading this innovation wave, offering rapid processing during manufacturing and immediate tack properties necessary for fast assembly lines. The integration of advanced polymer science and material engineering is essential to produce tapes that are thinner and lighter, thus supporting industry objectives of weight reduction (especially in aerospace and electric vehicles) without compromising the critical safety function of fire containment and insulation.

Regional Highlights

The market dynamics of the Flame Retardant Tape Market exhibit significant regional variation influenced by industrial maturity, regulatory frameworks, and infrastructure investment levels. North America holds a substantial share, largely driven by its robust aerospace and defense sectors, which are subject to some of the world's most rigorous flammability standards. The region’s mature automotive market, coupled with significant R&D investments in high-temperature silicone and polyimide tapes for next-generation aircraft and electric vehicle manufacturing, ensures sustained high-value demand. Furthermore, stringent building and electrical codes in the U.S. and Canada mandate the use of certified flame retardant materials in commercial and residential construction, underpinning stable growth in this sector.

Asia Pacific (APAC) is projected to experience the fastest growth rate over the forecast period. This acceleration is fueled by massive urbanization, large-scale public transportation projects (high-speed rail networks), and the region's dominance in the global electrical and electronics manufacturing supply chain. Countries like China, South Korea, and Japan are investing heavily in advanced manufacturing and EV production, creating unprecedented demand for compliant, cost-effective flame retardant solutions. While price sensitivity remains a factor in certain segments, the increasing adoption of international safety standards, especially in high-growth industries, is pushing manufacturers towards high-quality, non-halogenated products.

Europe represents a major market segment characterized by a strong emphasis on environmental sustainability and safety regulations, such as REACH and various EU directives concerning FST performance in rail and construction. The European automotive industry, particularly in Germany and France, drives significant demand for flame retardant tapes used in wiring harnesses and interior components to meet Euro NCAP safety ratings. The region is a key hub for innovation in non-halogenated and environmentally preferred materials, often setting the global standard for product formulation and chemical safety compliance, thereby sustaining a strong market for premium, certified tapes.

- North America: Dominant market share driven by aerospace (FAA regulations), mature automotive industry, and strict commercial building codes; strong adoption of high-performance polyimide and silicone tapes.

- Europe: High demand driven by EU environmental mandates (REACH) and stringent rail safety standards (EN 45545); focus on non-halogenated and sustainable product innovation.

- Asia Pacific (APAC): Fastest growing region, propelled by infrastructure investment, rapid EV adoption, and massive expansion of the electronics manufacturing base in China and India.

- Latin America: Emerging growth market, primarily driven by investments in electrical grid modernization and basic infrastructure projects; increasing influence of international safety standards.

- Middle East & Africa (MEA): Growth centered around oil & gas facilities (requiring thermal resistance), large construction projects (e.g., smart cities), and increasing defense expenditures requiring specialized tape solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flame Retardant Tape Market.- 3M Company

- Nitto Denko Corporation

- Tesa SE

- Avery Dennison Corporation

- Shurtape Technologies LLC

- Intertape Polymer Group (IPG)

- Saint-Gobain S.A.

- Rogers Corporation

- Scapa Group Plc

- DuPont de Nemours Inc.

- PPS Manufacturing Inc.

- DeWAL Industries Inc.

- Polyken (Berry Global)

- Vancive Medical Technologies

- Techno Adhesives

- Mactac LLC

- Heskins LLC

- Shenzhen KXT Technology Co. Ltd.

- Henkel AG & Co. KGaA

- Sika AG

Frequently Asked Questions

Analyze common user questions about the Flame Retardant Tape market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between halogenated and non-halogenated flame retardant tapes?

Halogenated tapes contain chemicals like bromine or chlorine, which are highly effective at suppressing fire but release corrosive and toxic smoke when burned. Non-halogenated tapes utilize safer additives like phosphorus or metal hydroxides, prioritizing low smoke and low toxicity (LSZH) properties, which is the current preference in high-occupancy and aerospace applications.

Which end-use industry drives the highest demand for specialized high-temperature flame retardant tapes?

The Aerospace and Defense industry, followed closely by the Electric Vehicle (EV) manufacturing sector, drives the highest demand for specialized tapes, particularly those made from polyimide or silicone, which offer superior thermal stability and require strict certification against FST (Flammability, Smoke, and Toxicity) standards.

How are flame retardant tapes certified for use in critical applications like aviation?

Tapes used in aviation must pass rigorous flammability tests, most commonly FAR 25.853, which dictates specific burn rate and self-extinguishing criteria. Certification involves independent testing labs verifying the material’s ability to prevent flame spread and minimize smoke and toxic gas emission under defined combustion scenarios.

What factors are restraining the adoption of flame retardant tapes in developing regions?

The primary restraining factor is the higher cost of advanced flame retardant tapes, particularly non-halogenated variants, compared to conventional insulation tapes. Furthermore, inconsistencies in the enforcement of modern building and electrical codes can delay mass market adoption in certain developing regions.

What role does Polyimide (Kapton) play in the flame retardant tape market?

Polyimide is a critical backing material known for its exceptional dielectric strength and ability to maintain structural integrity at very high temperatures (up to 400°C). It is predominantly used in high-performance electrical insulation, circuit board manufacturing, and aerospace applications where thermal endurance is non-negotiable.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Flame Retardant Tape Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Flame Retardant Tape Market Statistics 2025 Analysis By Application (Electrical & Electronics, Automotive, Building and Construction), By Type (Single-sided Adhesive Tape, Double-sided Adhesive Tape), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager