Flame Retardant Tape Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431411 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Flame Retardant Tape Market Size

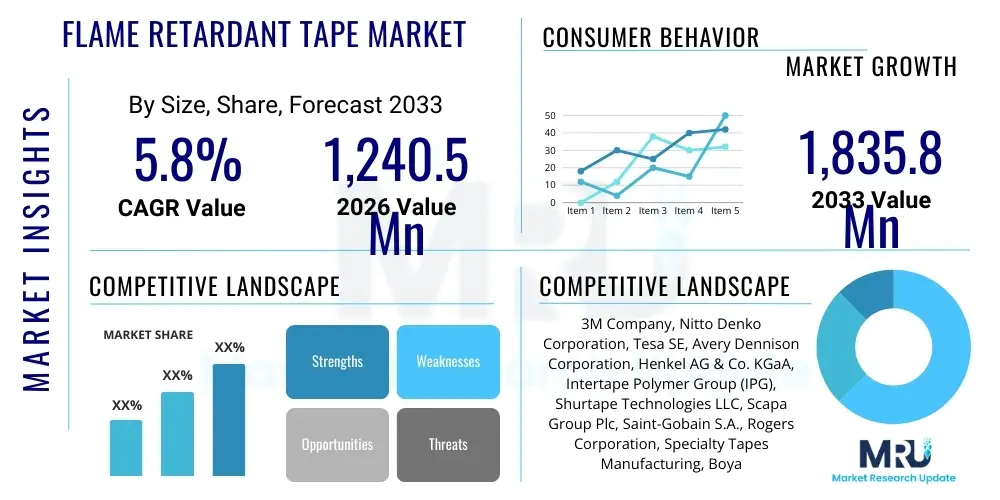

The Flame Retardant Tape Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.75% between 2026 and 2033. The market is estimated at USD 1,240.5 Million in 2026 and is projected to reach USD 1,835.8 Million by the end of the forecast period in 2033.

The consistent growth in the flame retardant tape sector is primarily fueled by stringent governmental regulations concerning fire safety across high-risk industries, notably aerospace, automotive, and electronics manufacturing. These specialized tapes are essential for insulating, bundling, and sealing components in environments where preventing the spread of fire or maintaining circuit integrity during a thermal event is critical. Increasing urbanization and rapid infrastructural development, particularly in emerging economies, are expanding the demand for high-performance building materials and electrical systems that mandate enhanced safety features, thereby bolstering market expansion.

Furthermore, the shift toward miniaturization in electronics and the rising complexity of wiring harnesses in modern vehicles necessitate tapes that offer excellent dielectric strength, heat resistance, and reliable flame-retardant properties without adding excessive weight or bulk. Technological advancements in material science, specifically the development of non-halogenated chemistries, are driving innovation and market acceptance. These new formulations address environmental concerns associated with traditional halogenated tapes, providing safer alternatives that comply with evolving global safety standards while maintaining superior performance characteristics under extreme conditions.

Flame Retardant Tape Market introduction

Flame Retardant Tape is a specialized adhesive material engineered to resist ignition and inhibit the spread of flame. These tapes are crucial safety components utilized across diverse industrial applications where thermal events pose a significant risk, including electrical systems, heating, ventilation, and air conditioning (HVAC) ducting, and transportation infrastructures. The products are typically constructed from carriers such as fiberglass cloth, polyimide, polyester, or PVC films, coated with fire-resistant or self-extinguishing adhesives, often based on silicone, acrylic, or rubber compounds, depending on the required temperature rating and environmental exposure.

Major applications of flame retardant tapes span critical sectors such as aerospace (for insulation in cabins and cargo holds), automotive (protecting wiring harnesses and battery packs in electric vehicles), construction (sealing joints and insulation in fire-rated assemblies), and electronics (insulating components in consumer devices and industrial machinery). The primary benefits derived from the use of these tapes include enhanced operational safety, compliance with mandatory industry standards (such as UL, ASTM, and FAR regulations), prevention of catastrophic failures, and maintenance of system integrity during emergency conditions. The tapes ensure that fire hazards are localized, minimizing potential damage and evacuation risks.

The market is predominantly driven by increasing regulatory scrutiny demanding fire safety certification for consumer goods and industrial equipment, particularly in regions like North America and Europe. Key driving factors include the proliferation of high-voltage systems in electric and hybrid vehicles (EVs/HEVs), which require robust thermal management and fire suppression solutions, and the ongoing modernization of aging infrastructure worldwide. The continuous innovation in material science focused on creating high-performance, environmentally friendly, non-halogenated tapes further accelerates market adoption, positioning flame retardant tapes as indispensable protective materials.

Flame Retardant Tape Market Executive Summary

The Flame Retardant Tape Market is characterized by robust growth, propelled by the convergence of stringent regulatory mandates and rapid technological shifts, particularly within the transportation and electrical infrastructure sectors. Business trends indicate a strong industry focus on product differentiation through material innovation, emphasizing non-halogenated and low-smoke formulations to meet global sustainability and environmental, social, and governance (ESG) goals. Key market participants are increasingly engaging in strategic partnerships with original equipment manufacturers (OEMs) to tailor high-temperature and high-adhesion tapes for next-generation applications, notably in EV battery thermal management systems and data center construction.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, driven by massive investments in infrastructure development, burgeoning electronics manufacturing hubs, and escalating automotive production, especially in China and India. North America and Europe maintain leading market shares, primarily due to established, high-value applications in aerospace and defense, coupled with mature regulatory frameworks that enforce mandatory fire safety standards in construction and transportation. Regional disparities in growth rates are tied directly to local safety code stringency and the rate of adoption of electric vehicle technology.

Segment trends reveal a noticeable shift towards non-halogenated materials, which are rapidly gaining traction over traditional halogenated variants due to reduced toxicity during combustion. In terms of application, the automotive segment exhibits exceptional growth potential, largely attributable to the rising global penetration of EVs, necessitating specialized tapes for robust battery insulation and wiring protection. Furthermore, PVC and cloth-based tapes continue to dominate the volume market due to their cost-effectiveness and versatility, while specialized materials like polyimide and PTFE tapes command premium prices in high-performance niches like aerospace and high-temperature industrial settings.

AI Impact Analysis on Flame Retardant Tape Market

User queries regarding AI's impact on the Flame Retardant Tape Market frequently center on themes such as accelerated material discovery, optimizing manufacturing consistency, and improving supply chain resilience. Users are keen to understand how AI-driven predictive modeling can shorten the R&D cycle for novel, non-halogenated flame-retardant chemistries, which traditionally involves extensive trial-and-error. Concerns also revolve around AI’s role in automating quality assurance (QA) processes—specifically detecting microscopic defects in tape coatings and adhesives that compromise fire performance. The consensus among potential users is that AI will primarily enhance efficiency and material performance reliability, transforming tape formulation from a reactive process based on regulatory compliance to a proactive process driven by predictive failure analysis and sustainability goals.

- AI accelerates the discovery and simulation of novel flame-retardant polymers and additives, significantly reducing R&D time for non-halogenated chemistries.

- Predictive maintenance analytics, powered by AI, optimize tape manufacturing lines, ensuring consistent coating thickness and adhesive bonding uniformity, critical for performance reliability.

- Machine learning algorithms enhance quality control by processing high-resolution imagery and sensor data to detect subtle material defects invisible to the human eye.

- AI-driven supply chain optimization improves inventory management of specialty raw materials (e.g., specific fiberglass fabrics, custom adhesive resins), mitigating risks associated with sole-source suppliers.

- Generative design tools assist in formulating tapes with optimized thermal dissipation and minimal weight, crucial for weight-sensitive applications like aerospace and electric vehicles.

DRO & Impact Forces Of Flame Retardant Tape Market

The market dynamics are significantly influenced by a powerful combination of safety regulations (Drivers), cost pressures and material availability (Restraints), and the burgeoning electric vehicle and smart infrastructure industries (Opportunities). The primary impact forces stem from the non-negotiable need for regulatory compliance across all major industrial sectors, compelling manufacturers to adopt certified flame-retardant solutions. This regulatory compliance acts as a critical demand driver, establishing a baseline requirement that supersedes price sensitivity in high-consequence applications like commercial aviation and mass transit. Simultaneously, the increasing global scrutiny on environmental safety and material toxicity mandates the rapid adoption of non-halogenated alternatives, further shaping innovation and market structure. These forces ensure continuous technological upgrading and reinforce the essential nature of specialized protective materials.

Drivers: The dominant driver is the strict enforcement of fire safety standards (such as UL 510, FAR 25.853, and various IEC/EN standards) globally, making flame retardant materials mandatory in electrical installations, aerospace components, and public transportation. Rapid expansion of the electric vehicle market acts as a secondary but increasingly vital driver, as EVs require advanced, high-temperature flame retardant solutions for battery pack insulation and thermal runaway containment. Furthermore, accelerated growth in data center construction, where equipment density elevates the risk of thermal events, mandates high-performance sealing and insulation tapes.

Restraints: The market faces significant restraints related to the higher cost of specialized raw materials, particularly non-halogenated additives and high-performance carriers like polyimide or fiberglass, which increases the final product price compared to standard industrial tapes. Supply chain volatility and the complex manufacturing processes required to ensure consistency in flame-retardant properties pose logistical challenges. Additionally, the need for extensive testing and certification procedures to comply with fragmented regional fire safety codes creates barriers to entry and slows down the market introduction of novel products.

Opportunities: Significant growth opportunities lie in the rapidly developing field of smart infrastructure and renewable energy systems, including solar panel installations and wind turbine manufacturing, all of which require specialized fire protection for wiring and components exposed to harsh environments. The continuous technological push towards lighter-weight and thinner tapes, essential for modern miniaturized electronics and weight-sensitive aircraft interiors, opens doors for high-margin, innovation-driven products. The emerging market for tapes specifically designed for lithium-ion battery insulation and fire barrier applications in the rapidly expanding EV and ESS (Energy Storage System) sectors presents the most lucrative long-term growth trajectory.

Segmentation Analysis

The Flame Retardant Tape market is broadly segmented based on material type, backing material, adhesive type, and key end-use application. Understanding these segments is crucial for manufacturers to tailor product specifications to stringent industry requirements and specific operating environments. Material segmentation (halogenated vs. non-halogenated) reflects the regulatory and sustainability trends impacting product formulation, while backing material dictates the tape's structural integrity, temperature resistance, and dielectric properties. The application segment, particularly automotive, construction, and electrical & electronics, provides insight into the highest growth potential areas, driven by infrastructure investment and EV penetration.

The core of market activity revolves around the material type, where non-halogenated tapes are steadily gaining dominance due to their superior safety profile, especially regarding low smoke and low toxicity during combustion. Geographically, segmentation highlights the maturity of markets, with North America and Europe focused on high-specification, aerospace-grade products, while APAC is heavily focused on construction and general electrical insulation applications. This detailed segmentation allows stakeholders to analyze specific competitive landscapes, assess regulatory barriers, and identify underserved niches requiring customized adhesive and carrier combinations.

- By Material Type:

- Halogenated Flame Retardant Tapes

- Non-Halogenated Flame Retardant Tapes

- By Backing Material:

- PVC (Polyvinyl Chloride)

- Cloth/Fabric (e.g., Fiberglass, Cotton)

- Polyimide (Kapton)

- Polyester (PET)

- PTFE (Polytetrafluoroethylene)

- Aluminum Foil/Laminates

- By Adhesive Type:

- Silicone

- Acrylic

- Rubber

- Pressure Sensitive Adhesives (PSA)

- By Application:

- Automotive & Transportation (Wiring Harness, Battery Insulation)

- Aerospace & Defense

- Electrical & Electronics (Cable Bundling, Component Insulation)

- Construction & Building (HVAC, Pipe Wrapping)

- Industrial Manufacturing

- Marine

Value Chain Analysis For Flame Retardant Tape Market

The value chain for the Flame Retardant Tape Market begins with upstream raw material suppliers, who provide specialized polymers, synthetic fibers (like fiberglass or aramid), flame-retardant additives (such as phosphorus compounds or metal hydroxides), and adhesive chemicals (silicone, acrylics). This upstream segment is characterized by high technical expertise and stringent quality control, as the performance of the final tape is heavily dependent on the purity and formulation of these components. Manufacturers often engage in long-term contracts with key chemical and polymer suppliers to ensure stable pricing and material quality, especially for proprietary non-halogenated compounds.

Midstream activities involve the tape manufacturers themselves, who perform complex coating, calendering, and slitting operations. The manufacturing process is critical, involving precise application of the adhesive and flame retardant coating onto the backing material, followed by curing and converting into required widths and lengths. Direct distribution channels are often preferred for large, specialized OEM clients (e.g., aerospace and major automotive companies) who require technical support and customized specifications. Indirect channels utilize specialized industrial distributors and wholesale suppliers to reach smaller businesses, maintenance, repair, and overhaul (MRO) markets, and construction sites.

Downstream analysis focuses on end-user application across industrial and consumer sectors. The performance requirements and regulatory compliance standards dictated by these end-users heavily influence the product specifications upstream. For example, the automotive industry requires tapes resistant to high temperatures and aggressive fluids, while the electronics sector prioritizes thinness and high dielectric strength. Effective management of the distribution channel, balancing direct sales for technical consultation with indirect sales for market reach, is vital for maximizing market penetration and maintaining control over product pricing and customer service.

Flame Retardant Tape Market Potential Customers

Potential customers for Flame Retardant Tape are typically Original Equipment Manufacturers (OEMs), large-scale industrial contractors, and specialized MRO providers operating in highly regulated environments where fire safety is paramount. The primary buyers are concentrated within the transportation sectors, including aerospace companies requiring tapes for cabin interior wiring and cargo fire barriers, and automotive manufacturers needing reliable insulation for complex electrical harnesses, particularly those involved in electric and hybrid vehicle battery assembly. These customers prioritize adherence to specific industry certifications (e.g., FAA, ECE) and long-term performance reliability over initial acquisition cost.

A second major customer segment includes electrical and electronics manufacturers, ranging from consumer device producers to industrial machinery makers. These buyers utilize flame retardant tapes for insulating transformers, bundling internal cables, and protecting circuit boards against thermal events. The construction industry also represents a substantial buyer base, including HVAC installers and general contractors, who use these tapes for sealing fire-rated ductwork, pipe insulation, and cable tray protection in commercial and residential buildings to meet mandatory building codes and insurance requirements. Targeting these segments necessitates product offerings optimized for durability, ease of application, and compliance verification.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1,240.5 Million |

| Market Forecast in 2033 | USD 1,835.8 Million |

| Growth Rate | 5.75% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Nitto Denko Corporation, Tesa SE, Avery Dennison Corporation, Henkel AG & Co. KGaA, Intertape Polymer Group (IPG), Shurtape Technologies LLC, Scapa Group Plc, Saint-Gobain S.A., Rogers Corporation, Specialty Tapes Manufacturing, Boya Tape (Hong Kong) Limited, Chukoh Chemical Industries, ATP Adhesive Systems GmbH, Lohmann GmbH & Co. KG, Wuhan Huateng Tape Co., Ltd., DeWAL Industries, Inc., ProTapes & Specialties, Inc., Adhesives Research, Inc., and Parafix Tapes & Conversions Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flame Retardant Tape Market Key Technology Landscape

The technological landscape of the Flame Retardant Tape Market is primarily characterized by advancements in polymer chemistry aimed at replacing traditional halogenated compounds and developing highly specialized adhesive systems capable of enduring extreme thermal and mechanical stresses. A major area of innovation is the formulation of non-halogenated flame retardants, typically involving phosphorus-based compounds, metal hydroxides (like aluminum trihydrate), or intumescent systems that expand when heated to form an insulating char layer. This shift is crucial for meeting strict environmental directives such as RoHS and REACH, ensuring that combustion byproducts are less toxic and produce lower smoke density. Manufacturers are focused on integrating these safe chemistries without compromising the mechanical performance, flexibility, or adhesive strength of the final tape product, which remains a significant material science challenge.

In addition to material science, process technology plays a vital role. Specialized coating techniques, such as transfer coating and solventless coating, are being adopted to achieve uniform application of high-viscosity, high-performance adhesives, especially for tapes intended for demanding applications like aerospace and high-voltage electrical insulation. Furthermore, the development of multi-layer and composite tape structures, combining materials like fiberglass mesh with aluminum foil or highly durable polyimide films, allows for tailored functionality. These layered constructions provide enhanced thermal barriers, superior abrasion resistance, and excellent dielectric properties, crucial for protecting sensitive electronics and wiring harnesses in next-generation transportation systems.

The convergence of material and process innovation is also driving the adoption of high-temperature adhesive systems. Silicone and specialized acrylic adhesives are being engineered to maintain strong bonding performance at continuous operating temperatures exceeding 150°C, a requirement particularly salient in EV battery manufacturing where thermal stability is paramount for preventing thermal runaway. Digitalization and automation in manufacturing lines also contribute significantly, enabling stricter quality control and rapid prototyping of new material combinations. This focus on precision manufacturing and high-performance material integration defines the competitive edge in the current market, moving away from commodity tapes towards highly technical, engineered solutions.

Regional Highlights

Regional dynamics play a crucial role in shaping the Flame Retardant Tape market, largely determined by localized industrial activity, regulatory framework maturity, and the pace of infrastructural investment. North America holds a substantial market share, driven primarily by the highly regulated aerospace and defense sectors, which demand premium, certified flame retardant materials for aircraft interiors and critical military applications. The strong presence of major automotive OEMs and the rapid growth in electric vehicle production also fuels demand for specialized high-performance tapes for battery insulation and cable protection. Stringent enforcement of NFPA and UL standards ensures continuous market uptake of compliant products.

Europe represents another mature and high-value market, characterized by strict adherence to REACH regulations, which specifically drives the demand for non-halogenated and environmentally benign flame retardant solutions. Key drivers include robust manufacturing bases in automotive and rail transport, where fire safety standards (like EN 45545 for railway applications) are exceptionally demanding. Countries like Germany, France, and the UK lead the way in adopting advanced tapes for complex electronic assemblies and stringent building codes, promoting innovation towards lower smoke emission and reduced toxicity. The European focus on sustainability necessitates continuous material substitution and development.

Asia Pacific (APAC) is projected to exhibit the highest growth rate during the forecast period. This rapid expansion is attributed to massive investments in infrastructure (roads, railways, and utilities) and the explosive growth of the electronics manufacturing industry, particularly in China, South Korea, and India. While safety regulations are often less uniformly enforced than in the West, growing awareness and the need for export compliance (as many manufactured goods are exported to North America and Europe) are pushing local manufacturers toward higher-quality, certified flame retardant tapes. The massive scaling of the electric vehicle market in China, coupled with increasing data center construction, solidifies APAC's position as the primary volume market and future growth engine.

Latin America (LATAM) and the Middle East & Africa (MEA) currently represent smaller, but emerging markets. Growth in LATAM is driven by urbanization and modernization of existing infrastructure, creating demand in the construction and public utility sectors. MEA growth is closely tied to large-scale construction projects in the Gulf Cooperation Council (GCC) countries, focusing on luxury, commercial, and energy infrastructure, which adhere to international safety codes. However, these regions often face challenges related to localized supply chains and dependency on imported specialized tape products, requiring manufacturers to establish strategic distribution partnerships to effectively tap into these developing markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flame Retardant Tape Market.- 3M Company

- Nitto Denko Corporation

- Tesa SE

- Avery Dennison Corporation

- Henkel AG & Co. KGaA

- Intertape Polymer Group (IPG)

- Shurtape Technologies LLC

- Scapa Group Plc

- Saint-Gobain S.A.

- Rogers Corporation

- Specialty Tapes Manufacturing

- Boya Tape (Hong Kong) Limited

- Chukoh Chemical Industries

- ATP Adhesive Systems GmbH

- Lohmann GmbH & Co. KG

- Wuhan Huateng Tape Co., Ltd.

- DeWAL Industries, Inc.

- ProTapes & Specialties, Inc.

- Adhesives Research, Inc.

- Parafix Tapes & Conversions Ltd.

Frequently Asked Questions

Analyze common user questions about the Flame Retardant Tape market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between halogenated and non-halogenated flame retardant tapes?

Halogenated tapes contain chemicals like chlorine or bromine, which efficiently suppress fire but release toxic, corrosive smoke upon combustion. Non-halogenated tapes utilize safer additives (e.g., phosphorus or metal hydroxides) that offer low smoke density and reduced toxicity, making them preferred for regulated environments such as aerospace and public transport.

Which application segment drives the highest growth rate for flame retardant tapes?

The Automotive & Transportation segment, particularly the Electric Vehicle (EV) sector, drives the highest growth due to the critical need for advanced thermal management and fire containment solutions for high-voltage battery packs and complex wiring harnesses.

What are the most common backing materials used in high-performance flame retardant tapes?

High-performance tapes commonly use backing materials such as Polyimide (for extreme temperature tolerance), Fiberglass Cloth (for mechanical strength and thermal stability), and specialized Aluminum Foils/Laminates (for fire barriers and reflectivity).

How do global regulations, such as REACH and RoHS, influence the Flame Retardant Tape Market?

REACH and RoHS primarily accelerate the transition away from traditional halogenated chemistries towards non-halogenated alternatives. These regulations mandate that products sold in key global markets must minimize hazardous substances, compelling manufacturers to invest heavily in sustainable and environmentally compliant formulations.

What are the key certification standards required for flame retardant tapes in the aerospace industry?

In the aerospace industry, the key certification standard is FAR 25.853, which dictates stringent flammability and smoke emission requirements for materials used within aircraft cabins and cargo areas, ensuring maximum passenger safety during fire incidents.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Flame Retardant Tape Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Flame Retardant Tape Market Statistics 2025 Analysis By Application (Electrical & Electronics, Automotive, Building and Construction), By Type (Single-sided Adhesive Tape, Double-sided Adhesive Tape), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager