Fluororubber Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441173 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Fluororubber Market Size

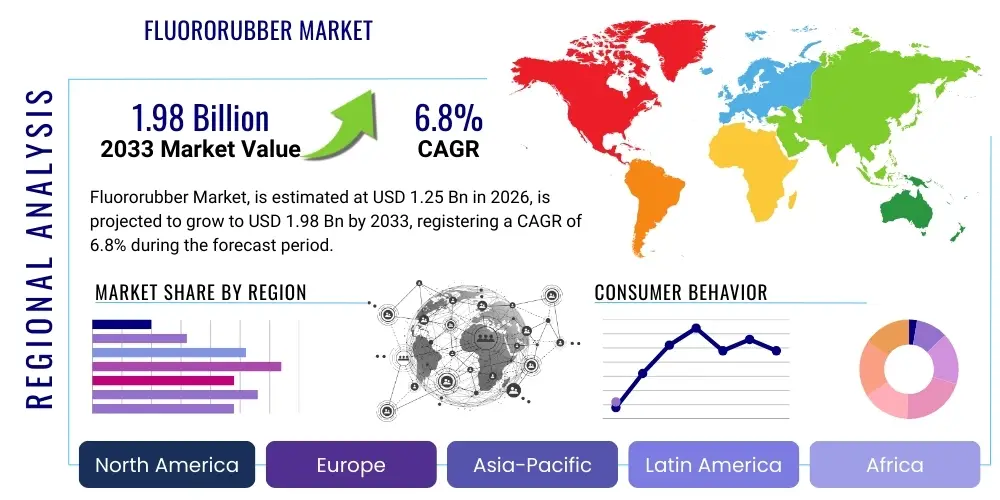

The Fluororubber Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.1% between 2026 and 2033. The market is estimated at USD 1.65 Billion in 2026 and is projected to reach USD 2.66 Billion by the end of the forecast period in 2033.

Fluororubber Market introduction

Fluororubber, often referred to by its commercial names such as FKM, FPM, or Viton, is a high-performance synthetic elastomer characterized by exceptional resistance to high temperatures, aggressive chemicals, fuels, oils, and ozone degradation. Developed initially for demanding aerospace and military applications, its superior properties compared to conventional synthetic rubbers have led to its widespread adoption across critical industrial sectors requiring sealing solutions that operate under extreme conditions. These elastomers are copolymers of vinylidene fluoride (VDF) and hexafluoropropylene (HFP), though advanced grades may incorporate tetrafluoroethylene (TFE) for enhanced chemical inertness.

The product is essential in manufacturing precision sealing components, including O-rings, gaskets, shaft seals, and specialized hoses, critical for maintaining operational integrity and safety in high-stress environments. Major applications span the automotive industry, particularly in engine systems and fuel delivery where biofuels and aggressive additives are common; aerospace, demanding extreme heat and chemical tolerance; and the oil and gas sector, used extensively in drilling and processing equipment exposed to high pressure and sour gas environments. The intrinsic benefits of fluororubber—low compression set, excellent mechanical strength, and non-flammability—justify its premium cost profile in mission-critical applications where failure is unacceptable.

Market growth is predominantly driven by stringent environmental regulations requiring more efficient, leak-proof systems, especially in the automotive sector moving towards high-performance engines and complex fuel systems. Furthermore, the expansion of chemical processing industries, particularly those handling highly corrosive media, necessitates materials like fluororubber that can withstand severe operational parameters. Continuous product innovation focused on developing specialty grades, such as perfluoroelastomers (FFKM) offering near-universal chemical resistance, further stimulates demand, positioning fluororubber as an indispensable material in the global industrial landscape.

Fluororubber Market Executive Summary

The Fluororubber Market exhibits robust growth, primarily propelled by increasing stringency in environmental and safety regulations across global industries, necessitating high-durability sealing solutions. Key business trends include aggressive capacity expansion by major polymer manufacturers, coupled with strategic focus on developing next-generation grades like high-fluorine content FKMs and specialized FFKM variants to cater to ultra-high-purity and extreme temperature applications in semiconductors and aerospace. Pricing stability remains a competitive advantage for incumbent producers, although supply chain volatility for key fluorinated monomers occasionally poses challenges. Investment in emerging markets in Asia Pacific dominates current strategy, driven by rapid industrialization and escalating domestic demand for high-performance vehicles and industrial machinery.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, characterized by accelerated expansion in manufacturing bases, particularly in China, India, and Southeast Asia's burgeoning automotive and chemical sectors. North America and Europe, while mature, maintain strong demand due to stringent regulatory frameworks in aerospace and pharmaceutical manufacturing, focusing heavily on specialized, high-margin perfluoroelastomers. The proliferation of electric and hybrid vehicles, requiring specific thermal management seals compatible with new battery chemistries and fluids, represents a crucial segment shift impacting regional consumption patterns.

Segment trends reveal that the Fluoroelastomer (FKM) type maintains market dominance due to its favorable balance of performance and cost, making it suitable for standard industrial sealing applications. However, the Perfluoroelastomer (FFKM) segment is experiencing the fastest growth rate, fueled by its unparalleled chemical resistance demanded by severe service environments in oil and gas exploration (deep-sea drilling) and semiconductor fabrication (plasma etching compatibility). Application-wise, the Automotive segment remains the largest consumer, but the Chemical Processing and Aerospace segments command higher value per unit due to the specialized nature of the fluororubber grades required, solidifying a dual market structure focused on volume for standard grades and high value for extreme performance grades.

AI Impact Analysis on Fluororubber Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Fluororubber Market typically center on how digital tools can optimize the complex polymerization and compounding processes, predict material performance under extreme stress, and enhance supply chain resilience. Users are concerned with leveraging AI for predictive maintenance in end-user applications where fluororubber seals are critical, thus minimizing catastrophic failures. Key themes revolve around the integration of Machine Learning (ML) to accelerate R&D cycles for novel fluoropolymer chemistries, improving quality control through automated inspection of molded components, and optimizing complex monomer synthesis pathways to enhance yield and reduce high energy consumption associated with fluorine chemistry production. Expectations are high that AI will transform product customization and drastically cut down the time required for new product qualification in highly regulated industries like aerospace and medical devices.

- AI optimizes monomer synthesis and polymerization reaction kinetics, increasing yield and consistency in high-performance fluororubber production.

- Machine Learning algorithms predict long-term seal degradation and compression set characteristics, enhancing reliability modeling for critical applications (e.g., aerospace engines, deep-sea pipelines).

- Predictive maintenance schedules in end-user industries (Automotive, Oil & Gas) are improved by AI analyzing sensor data related to temperature and pressure stress on fluororubber seals, reducing unplanned downtime.

- AI-driven supply chain management mitigates risks associated with volatile fluorinated monomer procurement and complex logistics, ensuring stable input availability for manufacturers.

- Generative AI assists in formulating specialized fluororubber compounds by simulating the interaction of various additives (fillers, curative agents) with the base polymer, accelerating R&D of highly customized grades.

- Automated visual inspection systems utilizing computer vision powered by AI ensure zero-defect quality control for highly precise fluororubber molded parts such as O-rings and diaphragms.

DRO & Impact Forces Of Fluororubber Market

The Fluororubber market dynamics are governed by a complex interplay of high-demand drivers stemming from regulatory needs and advanced industrial requirements, countered by significant manufacturing restraints related to cost and processing complexity. The primary driver is the pervasive need for high-reliability sealing in harsh environments, particularly in the automotive transition towards complex turbo-charged engines and new fluid types that degrade conventional elastomers. This structural demand is further reinforced by the continuous expansion of energy infrastructure, including deep drilling and chemical processing, where material inertness is non-negotiable. Opportunities lie significantly in developing specialized, non-standard grades tailored for niche high-growth sectors like electric vehicle thermal management, hydrogen fuel cell technology, and pharmaceutical processing equipment, offering manufacturers higher margin potential.

However, the market faces crucial restraints, predominantly the high cost of fluorinated raw materials (monomers) and the specialized, energy-intensive polymerization processes required. This inherent high production cost limits the substitution of fluororubber into less demanding, high-volume applications where cheaper alternatives like EPDM or NBR suffice. Furthermore, the stringent regulatory oversight and technical expertise required for processing and curing these specialty elastomers restrict the competitive landscape primarily to large, established chemical entities, creating a barrier to entry for smaller players. Supply chain risks related to the limited number of suppliers for critical fluorinated intermediates also pose an ongoing constraint on global scalability.

The impact forces driving market evolution include the accelerating pace of material innovation focused on improving low-temperature flexibility and reducing permanent compression set, key limitations of current FKM grades. The environmental impact of fluorochemicals, specifically PFOA/PFOS regulations, acts as a critical force, compelling manufacturers to invest heavily in sustainable production methods and alternative, cleaner polymerization aids, reshaping the long-term chemical landscape. The combined effect of regulatory push for durability (Driver) and the challenge of high input costs (Restraint) concentrates market growth in critical, high-value applications, where performance outweighs price sensitivity, thereby solidifying the market’s premium positioning.

Segmentation Analysis

The Fluororubber market segmentation provides a detailed view of material types and end-user applications, allowing stakeholders to identify specific growth vectors and competitive advantages. Segmentation by product type differentiates between standard grades (FKM), highly specialized grades offering extreme chemical resistance (FFKM), and unique variations like FEPM (Tetrafluoroethylene Propylene Rubber). This categorization reflects varying degrees of thermal and chemical performance capabilities, directly influencing the final product cost and suitability for extreme environments. Understanding these types is crucial as different end-use industries prioritize specific material properties—for instance, automotive typically uses FKM for cost-effectiveness, while aerospace demands the superior performance of FFKM.

Segmentation by application highlights the dominant role of the automotive sector, which consumes fluororubber primarily for fuel hoses, turbocharger seals, and dynamic sealing applications where high heat and contact with aggressive lubricating oils are constant. Following this, the chemical and petrochemical industries represent a high-value segment, driven by the need for seals in pumps and valves handling strong acids, bases, and hydrocarbons under high pressure. The increasing complexity and scale of semiconductor manufacturing also contribute significantly, demanding ultra-pure FFKM seals that prevent contamination during sensitive fabrication processes, signifying a vital shift towards high-purity elastomer demand.

Geographically, market fragmentation is evident, with established industrial economies in North America and Europe focusing on high-specification, custom-engineered solutions, contrasting with the high-volume, general-purpose fluororubber consumption characterizing the rapid manufacturing expansion across Asia Pacific. This global divergence in demand profile necessitates region-specific marketing and product development strategies. The synthesis of these segmentation views underscores that while FKM remains the volume leader, future market value growth will be increasingly concentrated in the specialized FFKM and high-purity FKM segments serving niche, technologically advanced end-users.

- By Type:

- Fluoroelastomers (FKM/FPM)

- Perfluoroelastomers (FFKM)

- Fluoro Silicone Rubber (FSR)

- Tetrafluoroethylene Propylene Rubber (FEPM)

- By Application:

- Automotive & Transportation

- Aerospace & Defense

- Oil & Gas (Energy)

- Chemical Processing

- Pharmaceutical & Medical Devices

- Semiconductor

- Industrial & Machinery

Value Chain Analysis For Fluororubber Market

The value chain for the Fluororubber market begins with the highly specialized upstream analysis involving the synthesis of fluorinated monomers, such as VDF, HFP, and TFE, which are typically sourced from a limited number of integrated chemical producers globally. This stage is capital-intensive and subject to strict environmental regulation due to the nature of fluorine chemistry. The middle tier of the chain involves the critical polymerization process, where these monomers are reacted to form the raw fluororubber polymer (gum stock). Key manufacturers often integrate vertically into this stage to ensure control over polymer quality and consistency, essential for meeting stringent end-use performance specifications. This manufacturing step determines the base properties, molecular weight, and fluorine content of the final elastomer.

The downstream analysis involves compounding and fabrication. Raw gum stock is mixed with curative agents, fillers (such as carbon black or specialized minerals), and process aids to create ready-to-mold compounds. This compounding stage is crucial as it tailors the mechanical, chemical, and physical properties of the elastomer to specific application requirements (e.g., maximizing high-temperature resistance or minimizing compression set). Fabrication then takes place, typically through compression molding, injection molding, or extrusion, transforming the compounded material into finished seals, gaskets, or specialized components. This stage often involves highly specialized processors who possess the unique equipment and expertise required to handle fluororubber’s complex curing cycles.

Distribution channels for fluororubber products are generally hybrid. Direct sales are common for high-value, highly customized parts sold to major Original Equipment Manufacturers (OEMs) in aerospace and automotive sectors, where technical consultation and material qualification are mandatory. Indirect channels, primarily specialized distributors and local fabricators, handle the sale of standard FKM compounds and replacement parts (MRO). The effectiveness of the distribution channel hinges on providing rapid access to specialized grades and offering comprehensive technical support, linking monomer producers and compounders directly to thousands of smaller end-users who require highly specific material formulations but lack the volume for direct purchasing agreements.

Fluororubber Market Potential Customers

The primary customers for the Fluororubber Market are industries requiring components that maintain integrity under extreme thermal, chemical, or mechanical stress, where failure is costly or hazardous. The largest volume consumers reside within the Automotive sector, specifically major Tier 1 and Tier 2 suppliers involved in manufacturing fuel injection seals, valve stem seals, O-rings for turbochargers, and transmission gaskets. These customers drive demand for moderately priced, high-volume FKM grades. A second crucial segment comprises Aerospace manufacturers, including commercial aircraft and defense contractors, who are potential customers for ultra-high-performance Perfluoroelastomers (FFKM) used in jet engine seals, hydraulic systems, and environmental control systems, valuing material qualification and long-term reliability over cost.

Another significant customer base includes Oil & Gas exploration and processing companies, which require fluororubber seals for downhole drilling equipment, subsea connections, and pipeline valves exposed to high pressure and corrosive media (e.g., H₂S and methane). Furthermore, the Chemical Processing Industry (CPI) represents a critical customer group, encompassing manufacturers of specialized pumps, valves, and reactors that handle highly aggressive chemicals; these end-users prioritize chemical compatibility and low swelling. The demand profile of these customers is highly technical, necessitating extensive testing and collaboration between the fluororubber manufacturer and the application engineer.

Emerging high-growth customer segments include the Semiconductor industry, which mandates ultra-pure FFKM seals for wafer processing chambers to prevent ionic contamination, and the Medical/Pharmaceutical industry, requiring biocompatible and steam-sterilizable fluororubber for fluid handling systems and seals in drug manufacturing equipment. These specialized sectors are characterized by extremely low volume but exceptionally high-value transactions, driving innovation towards specialty grades with high purity and specific regulatory compliance requirements (e.g., FDA or USP Class VI approvals).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.65 Billion |

| Market Forecast in 2033 | USD 2.66 Billion |

| Growth Rate | 7.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The Chemours Company, Daikin Industries, Ltd., 3M Company, Solvay S.A., Shin-Etsu Chemical Co., Ltd., Halopolymer, Honeywell International Inc., Asahi Glass Co. Ltd. (AGC), Kureha Corporation, Parker Hannifin Corporation, Trelleborg AB, Zhonghao Chenguang Research Institute of Chemical Industry, Shandong Huayi Chemical Co., Ltd., Dalian Richon Chem Co., Ltd., Gujarat Fluorochemicals Limited (GFL), JSR Corporation, DuPont, Mitsui Chemicals, Inc., Precision Polymer Engineering (PPE). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fluororubber Market Key Technology Landscape

The technological landscape of the Fluororubber market is characterized by continuous refinement in polymerization techniques and advancements in compounding methodologies aimed at enhancing specific material properties. Solution polymerization and emulsion polymerization are the two dominant methods used to synthesize the base polymer gum stock; ongoing research focuses on minimizing residual monomers and contaminants, especially crucial for high-purity applications in electronics. Furthermore, the development of new curative systems—moving away from traditional bisphenol-based systems towards safer, faster-curing peroxide and triazine-based systems—is a significant technological trend, improving the processing speed and thermal stability of the final elastomeric components.

A major focus of technological innovation is addressing the inherent limitation of standard fluororubber: poor performance at low temperatures. Manufacturers are investing heavily in R&D to develop low-temperature flexible FKMs (LTF-FKM) by modifying the polymer backbone or incorporating proprietary plasticizers, enabling the material's use in arctic oil exploration and high-altitude aerospace applications. Simultaneously, advancements in compounding technology, particularly the use of specialized carbon nano-fillers and functionalized silica, are being employed to optimize mechanical properties such as tensile strength and tear resistance without compromising chemical inertness, pushing the operational limits of these materials.

Furthermore, digital transformation is impacting the manufacturing technology through simulation and modeling. Advanced Finite Element Analysis (FEA) software is now routinely used to predict the long-term sealing force, creep, and stress relaxation of complex fluororubber component geometries before physical prototyping. This use of computational chemistry and engineering simulation reduces development time and cost, especially for highly customized seals used in critical infrastructure, driving a shift towards design-by-simulation and ensuring optimal performance in demanding applications like modern fuel injector seals operating under severe thermal cycling and high pressure.

Regional Highlights

- North America (USA, Canada, Mexico)

North America holds a mature yet critically important share of the global Fluororubber market, characterized by demand concentrated in high-specification, high-reliability sectors such as aerospace, defense, and high-end automotive manufacturing. The stringent regulatory environment, particularly concerning emissions and material safety, drives continuous demand for premium FKM and FFKM grades in engine seals, fuel systems, and hydraulic components. The region’s strong presence in the semiconductor and medical device industries further necessitates specialized, ultra-pure fluororubber compounds that comply with FDA and USP standards.

The market in the United States benefits significantly from substantial government and private investment in advanced manufacturing and energy infrastructure, including deepwater oil and gas activities that require elastomers capable of resisting highly corrosive sour gas environments. Technological innovation remains a key characteristic, with leading polymer producers and compounders heavily involved in collaborative research to develop materials with enhanced properties, such as improved low-temperature flexibility and increased thermal stability, directly addressing application needs in extreme climates and complex machinery.

Demand growth, while steady, is focused less on volume expansion and more on technological sophistication and material value. The transition to electric vehicles (EVs) is generating new requirements for thermal management and battery pack sealing, driving demand for specialized FEPM and FKM grades compatible with battery coolants and demanding high dielectric strength. This shift sustains high average selling prices (ASPs) for fluororubber products across the North American industrial base.

- Europe (Germany, France, UK, Italy, Spain)

Europe represents a cornerstone market for fluororubber, driven by its sophisticated automotive industry, particularly in high-performance and luxury vehicle manufacturing, and its robust chemical and pharmaceutical sectors. Strict EU regulations regarding material traceability, REACH compliance, and end-of-life disposal necessitate the use of consistently high-quality, documented fluororubber components. Germany, with its strong engineering heritage and leadership in industrial machinery and automotive production, is the largest consumer within the region, demanding durable seals for precision equipment and advanced engine designs.

The European market is marked by strong competition among major global suppliers who maintain production facilities and R&D centers within the region to cater to local OEM specifications. A key growth area is the industrial machinery sector, including pump, valve, and compressor manufacturers, who rely on fluororubber’s resistance to aggressive fluids and temperature extremes for reliable operation in demanding industrial processes. The region also exhibits significant consumption of FFKM in specialized processes, particularly in the chemical processing plants located in the Benelux countries and Germany, where highly reactive media are handled.

Sustainability and regulatory compliance are significant factors shaping procurement decisions in Europe. Manufacturers are increasingly seeking fluororubber grades that align with circular economy principles and utilize sustainable monomer synthesis pathways. This focus translates into a preference for manufacturers who can demonstrate environmental stewardship alongside high material performance, ensuring that the market continues to evolve towards higher-specification, regulatory-compliant products.

- Asia Pacific (China, Japan, India, South Korea)

Asia Pacific (APAC) is the fastest-growing and largest regional market for fluororubber, fueled by rapid industrialization, massive automotive production, and escalating investment in infrastructure and manufacturing capacity, particularly in China and India. The region serves as a global manufacturing hub, driving enormous volume demand for both standard and high-performance FKM grades across diverse applications, ranging from consumer electronics to large-scale industrial machinery. China, in particular, dominates consumption due to its scale of domestic production and export-oriented manufacturing.

Market expansion in APAC is strongly correlated with the burgeoning domestic automotive market, where improving consumer wealth translates into increased vehicle sales, thereby driving demand for engine seals, transmission components, and fuel system parts. Furthermore, the rapid growth of the region’s semiconductor manufacturing capabilities, concentrated in South Korea, Taiwan, and China, creates intense demand for ultra-high-purity FFKM and specialized FKM seals required for vacuum chambers and plasma etching equipment, which operate under conditions of extreme precision and cleanliness.

While local manufacturers are increasingly gaining market share, global players maintain a strong presence due to the technical barriers and proprietary nature of advanced fluororubber technology. Investment in local compounding and fabrication facilities by multinational corporations is common, aimed at reducing lead times and providing localized technical support. The APAC market dynamics are currently characterized by both high volume demand for general industrial use and burgeoning high-value demand for technologically advanced applications.

- Latin America (Brazil, Argentina, rest of Latin America)

The Latin American fluororubber market is characterized by moderate growth, primarily tied to the performance of its domestic automotive manufacturing and the extraction and processing of natural resources, predominantly in Brazil and Mexico. Economic volatility and varying levels of industrial maturity across the continent create a fragmented demand landscape. Brazil, possessing the largest industrial base in the region, is the key market driver, with demand focused on seals and hoses for flex-fuel vehicle engines, which necessitate materials resistant to aggressive ethanol blends.

The Oil & Gas sector, especially in countries like Brazil and Mexico with substantial offshore reserves, drives significant, albeit localized, demand for high-performance fluororubber components used in exploration and pipeline maintenance. However, compared to North America and Europe, the general industrial machinery base often favors cost-effective, standard FKM grades, and the uptake of ultra-premium FFKM grades remains limited, reserved primarily for critical infrastructure projects managed by multinational corporations operating in the region.

Market development is heavily influenced by imports, although regional distributors and smaller, specialized compounders play a vital role in customizing and supplying finished components. Future growth hinges upon economic stability, increased investment in local manufacturing infrastructure, and the adoption of stricter environmental standards that necessitate the use of high-reliability sealing materials.

- Middle East and Africa (MEA)

The Middle East and Africa (MEA) market for fluororubber is dominated almost entirely by the Oil & Gas sector, given the region’s status as a global leader in hydrocarbon exploration, extraction, and processing. The extreme operational environments—including high temperatures, high pressures, and high concentrations of H₂S (sour gas)—make fluororubber, particularly high-fluorine content FKM and FFKM, essential for ensuring the safety and efficiency of drilling equipment, wellhead seals, and refinery valves. Countries like Saudi Arabia, UAE, and Qatar are central to this demand.

Investment in chemical processing and petrochemical complexes also contributes significantly to market consumption, as these facilities require corrosion-resistant seals for handling aggressive chemicals derived from oil and gas feedstocks. Demand is typically characterized by large-scale, high-value procurement contracts, where material qualification and certification against stringent industry standards (e.g., ISO, API) are paramount, limiting entry to globally recognized suppliers.

The African component of the MEA market is highly diversified, with pockets of demand driven by mining, manufacturing, and infrastructure projects, although overall consumption volume is lower compared to the Middle Eastern oil economies. Long-term growth prospects are tied to infrastructure diversification efforts within the Gulf Cooperation Council (GCC) countries, aiming to build manufacturing bases outside of primary oil and gas activities, which will gradually broaden the application base for industrial fluororubber components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fluororubber Market.- The Chemours Company

- Daikin Industries, Ltd.

- 3M Company

- Solvay S.A.

- Shin-Etsu Chemical Co., Ltd.

- Halopolymer

- Honeywell International Inc.

- Asahi Glass Co. Ltd. (AGC)

- Kureha Corporation

- Parker Hannifin Corporation

- Trelleborg AB

- Zhonghao Chenguang Research Institute of Chemical Industry

- Shandong Huayi Chemical Co., Ltd.

- Dalian Richon Chem Co., Ltd.

- Gujarat Fluorochemicals Limited (GFL)

- JSR Corporation

- DuPont

- Mitsui Chemicals, Inc.

- Precision Polymer Engineering (PPE)

- Saint-Gobain Performance Plastics

Frequently Asked Questions

Analyze common user questions about the Fluororubber market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between FKM and FFKM elastomers?

The primary difference lies in chemical resistance and operational temperature limits. FKM (Fluoroelastomer) offers excellent resistance to heat and chemicals, suitable for general high-performance seals. FFKM (Perfluoroelastomer) offers near-universal chemical resistance, comparable to PTFE, and operates at significantly higher continuous service temperatures, making it necessary for ultra-critical applications in aerospace and semiconductor manufacturing.

Which end-user segment drives the highest volume demand for fluororubber?

The Automotive and Transportation segment consistently drives the highest volume demand for fluororubber, primarily FKM grades. This is due to the large-scale production of vehicles and the critical need for reliable seals in modern engines, transmissions, and fuel systems, where exposure to elevated temperatures and aggressive fuel additives is common.

What are the key technological challenges currently facing fluororubber manufacturers?

Key challenges include improving the low-temperature flexibility (LTF) of FKM grades, reducing the high manufacturing cost associated with fluorinated monomers, and developing eco-friendly polymerization processes that eliminate the use of regulated fluorosurfactants (like PFOA/PFOS) while maintaining high polymer quality and performance standards.

How is the growth of Electric Vehicles (EVs) impacting the demand for fluororubber?

The growth of EVs is shifting demand away from traditional fuel system seals towards specialized thermal management seals and gaskets for battery packs and cooling circuits. Fluororubber is crucial here due to its resistance to EV coolants, superior thermal stability, and low compression set required for long-life battery systems, leading to demand for specific high-performance grades.

Why is the Asia Pacific region the fastest-growing market for fluororubber?

Asia Pacific is the fastest-growing market due to rapid industrialization, massive automotive production expansion (especially in China and India), and significant investment in high-tech sectors like semiconductor manufacturing. This regional growth is driven by both high-volume industrial demand and high-value niche demand for advanced FFKM components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Fluororubber Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Perfluoroelastomer (FFKM) Market Size Report By Type (Fluororubber 246, Fluororubber 26, Fluororubber 23), By Application (Petroleum & Chemical Industry, Aerospace Industry, Electronics Industry, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Smartwatch Strap Materials Market Statistics 2025 Analysis By Application (Android System Smartwatch, iOS System Smartwatch, Windows System Smartwatch, Others), By Type (Stainless Steel Strap, Fluororubber Strap, TPU Strap, TPE Strap, TPSIV Strap, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Perfluoroelastomer (FFKM) for Semiconductor Market Statistics 2025 Analysis By Application (Petroleum and Chemical Industry, Aerospace Industry, Electronics Industry, Others), By Type (Fluororubber 246, Fluororubber 26, Fluororubber 23), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Fluororubber Market Statistics 2025 Analysis By Application (Automobile Industry, Aerospace & Military, Petroleum & Chemical), By Type (FKM, FSR, FFKM), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager