Fluororubber Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438751 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Fluororubber Market Size

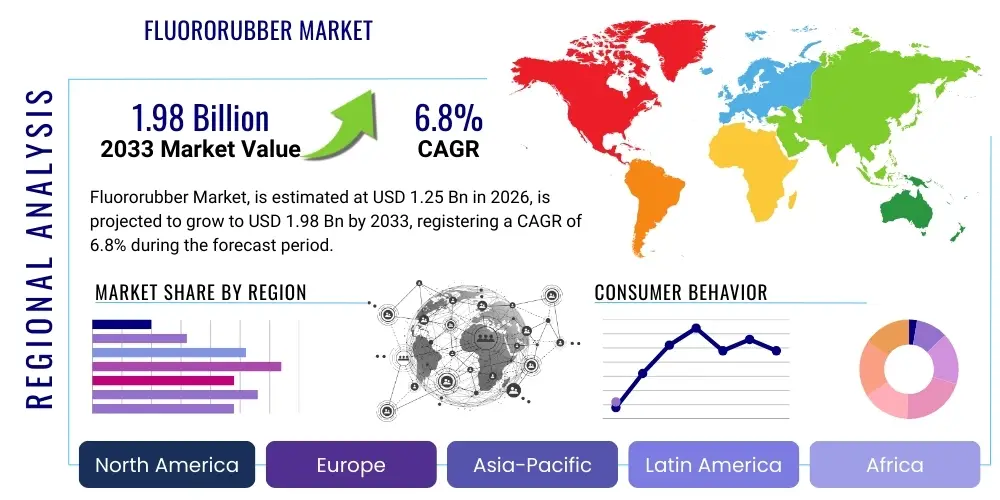

The Fluororubber Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.98 Billion by the end of the forecast period in 2033.

Fluororubber Market introduction

Fluororubber, commonly known as fluoroelastomer (FKM), is a high-performance synthetic rubber characterized by exceptional resistance to high temperatures, aggressive chemicals, fuels, and ozone. These polymers derive their superior properties from the incorporation of fluorine atoms into the polymer backbone, providing robust thermal stability and chemical inertness crucial for demanding industrial applications. The primary products include copolymers of vinylidene fluoride (VDF) and hexafluoropropylene (HFP), terpolymers incorporating tetrafluoroethylene (TFE), and highly fluorinated perfluoroelastomers (FFKM), which represent the pinnacle of chemical resistance and thermal performance in the elastomer sector. The intrinsic capability of fluororubbers to maintain integrity under extreme operating conditions—such as those encountered in oil and gas drilling, chemical processing, and aerospace propulsion systems—solidifies their status as critical material inputs across various heavy industries. Market expansion is fundamentally propelled by increasing global regulatory emphasis on efficiency and durability in transportation and industrial machinery.

The major applications of fluororubber span sealing technologies, fluid handling systems, and protective coatings where conventional elastomers rapidly degrade. In the automotive sector, FKMs are indispensable for producing high-durability O-rings, shaft seals, fuel injector components, and valve stem seals required to withstand increasingly hot engine bays and bio-fuel compatibility challenges. The aerospace industry relies heavily on these materials for hydraulic seals and gaskets in aircraft, demanding compliance with rigorous flame-retardant and low-outgassing standards. Beyond transportation, the chemical processing industry utilizes fluororubber components in pumps, valves, and pipelines handling concentrated acids, bases, and aggressive solvents. The inherent benefits of fluororubber, including extended service life, reduced maintenance downtime, and superior barrier properties against permeation, offer significant lifecycle cost savings, driving sustained demand, particularly in sectors where failure carries high safety and financial risks.

Driving factors for the fluororubber market growth include the rising complexity of modern machinery, which necessitates higher operating temperatures and pressures; the stringent environmental regulations requiring enhanced fuel efficiency and emissions control (thereby demanding better sealing solutions); and the burgeoning growth of the electric vehicle (EV) market. While EVs operate at lower temperatures, they require highly reliable seals for battery cooling systems and sensitive electronics, where fluororubbers offer excellent dielectric and thermal management properties. Furthermore, industrial digitalization and the push toward Industry 4.0 standards necessitate components capable of functioning reliably for extended periods without manual intervention, reinforcing the need for durable materials like FKM and FFKM. This convergence of technological advancement and regulatory pressure ensures fluororubber remains a vital material science component for future industrial infrastructure development.

Fluororubber Market Executive Summary

The Fluororubber Market is experiencing robust growth fueled primarily by global business trends emphasizing high-performance materials in critical infrastructure sectors, especially automotive and chemical processing. A significant business trend involves the increased adoption of higher-grade fluoroelastomers, such as FFKM, in demanding applications to maximize equipment uptime and minimize catastrophic failures. This push for quality, driven by escalating safety standards and the economic imperative to extend component lifespan, shifts the market dynamics towards premium product offerings. Furthermore, ongoing innovation in polymerization techniques and compounding processes is leading to the development of application-specific FKM grades, enhancing compatibility with new lubricants and bio-fuels, thereby sustaining market relevance despite raw material volatility. Strategic mergers and acquisitions among key manufacturers aimed at consolidating technology and expanding geographic reach are also prominent business features.

Regional trends indicate a pronounced shift in manufacturing dominance towards the Asia Pacific (APAC), particularly China and India, which are witnessing substantial expansion in their automotive production and chemical industrial bases. APAC is anticipated to command the largest market share, driven by rapid urbanization, infrastructure development, and growing demand for high-end vehicles. Conversely, North America and Europe remain crucial markets, characterized by stringent regulatory environments and a strong focus on high-specification applications, notably aerospace and advanced oil and gas exploration. These mature markets are leaders in technological adoption, often driving demand for specialty fluororubbers designed for extreme sub-zero or ultra-high-temperature environments. The Middle East and Africa (MEA) region shows accelerating growth linked to significant investments in petrochemical and energy projects, requiring durable sealing solutions resistant to crude oil and refinery byproducts.

Segment trends highlight the dominance of the automotive application segment, driven by global vehicle production increases and the necessity of high-temperature resistance in modern engines. By product type, standard FKM remains the largest volume segment, though the FFKM segment is projected to exhibit the highest CAGR due to its superior performance capabilities justifying its higher cost in mission-critical applications. The rise of electric vehicles is also establishing a new critical application segment focused on thermal management seals for lithium-ion battery packs, requiring specific low-compression set and thermal stability properties. Manufacturers are increasingly focusing R&D on developing sustainable fluororubber formulations and improving processing efficiency to meet both environmental mandates and cost reduction pressures across all key application segments.

AI Impact Analysis on Fluororubber Market

Common user inquiries regarding the influence of Artificial Intelligence (AI) on the Fluororubber market often center on three key areas: optimizing material formulation and discovery, enhancing manufacturing efficiency, and integrating predictive maintenance into end-user industries. Users are highly interested in how AI can reduce the lengthy and costly R&D cycles associated with developing new fluoropolymer grades that offer superior chemical resistance or lower compression set without sacrificing processability. There is also significant concern regarding supply chain disruptions, prompting questions about AI’s role in forecasting raw material availability (especially VDF and HFP monomers) and optimizing inventory management for these high-value materials. Furthermore, end-users in automotive and aerospace segments frequently inquire about leveraging machine learning models to analyze sensor data from seals and gaskets, transitioning from scheduled maintenance to proactive, condition-based replacement strategies, thus maximizing the lifespan and reliability of fluororubber components in critical systems.

AI's primary influence within the fluororubber manufacturing process lies in optimizing complex chemical reaction parameters, specifically polymerization and compounding. Machine learning algorithms can analyze vast datasets concerning temperature, pressure, curing agents, and filler concentrations to predict the resulting physical and chemical properties of the final elastomer, minimizing the need for extensive physical testing. This capability drastically accelerates the iteration cycle for new product development, allowing manufacturers to quickly tailor FKM and FFKM grades to highly specific, emerging application requirements, such as seals for next-generation hydrogen fuel cells or extreme-pressure oilfield equipment. By automating quality control processes using computer vision and anomaly detection, AI ensures consistent batch quality, a crucial factor given the high-performance demands placed on these elastomers.

In the downstream supply chain and usage phases, AI enables sophisticated demand forecasting, allowing producers to align expensive production schedules more closely with fluctuating requirements from sectors like aerospace, which operates on long lead times. For end-users, integrating AI-driven monitoring systems into machinery utilizing fluororubber seals allows for real-time analysis of operating stress, thermal cycling, and chemical exposure. Predictive models can estimate the remaining useful life (RUL) of critical seals, preventing unexpected failures, reducing unscheduled downtime, and offering substantial operational cost savings, thereby increasing the perceived value proposition of premium fluororubber products. This integration also generates valuable in-service performance data that manufacturers can use to further refine material specifications.

- AI optimizes polymer formulation synthesis, reducing R&D time by predicting optimal monomer ratios and curing system parameters.

- Machine learning improves manufacturing yield and reduces waste through real-time process control and automated quality inspection.

- Predictive maintenance analytics, powered by AI, extends the useful lifespan of fluororubber seals in high-value industrial assets.

- AI algorithms enhance supply chain resilience by accurately forecasting demand and managing inventory levels of costly fluorinated monomers.

- Simulation technologies driven by AI model component performance under extreme operational conditions, accelerating material validation for niche applications.

DRO & Impact Forces Of Fluororubber Market

The fluororubber market is governed by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the Impact Forces that shape its trajectory. Key drivers include the exponential growth in the automotive sector, particularly the stringent demands for high-reliability components in turbocharged engines and hybrid vehicles, alongside the critical need for chemical inertness in the expanding petrochemical and specialty chemical processing industries. The global push for improved energy efficiency and reduced emissions necessitates more durable seals that can withstand higher thermal loads and corrosive fluids, thereby underpinning the demand for high-grade FKMs and FFKMs. Conversely, the market faces significant restraints, primarily centered around the exceptionally high cost of raw materials (fluorinated monomers) and the energy-intensive polymerization processes. Furthermore, regulatory scrutiny regarding PFAS chemicals, although FKM and FFKM are generally exempted from strict bans due to their stability, poses an ongoing risk and requires continuous transparency regarding environmental impact. The highly specialized nature of processing fluororubbers also acts as a barrier to entry for smaller manufacturers.

Opportunities for market expansion are strongly concentrated in emerging technological domains. The rapid transition to electric vehicles (EVs) creates a vast new segment for thermal management seals, O-rings, and battery pack gaskets, which require specific low-temperature flexibility and flame resistance properties provided by certain FKM grades. The increasing global investment in renewable energy sources, such as solar power generation and hydrogen fuel cell technology, demands advanced sealing materials capable of operating efficiently in unique corrosive environments and under demanding thermal cycles. Developing innovative, lower-cost curing systems and improving processing aids that allow for faster molding cycles present immediate opportunities for manufacturers to improve margin profiles and make fluororubber more accessible to non-critical applications currently dominated by lower-cost elastomers. Addressing sustainability concerns through the development of bio-based or recyclable fluororubber alternatives, or optimizing manufacturing processes to minimize fluorocarbon emissions, represents a critical long-term growth avenue.

The impact forces exerted by these DRO factors ensure continuous pressure for technological evolution. The high cost of raw materials drives innovation toward high-performance, low-volume applications where the lifetime benefits justify the initial investment, prioritizing aerospace and medical devices. Regulatory tightening on chemical usage pushes manufacturers to invest heavily in compliance and potentially explore non-fluorinated alternatives for less critical uses, focusing FKM resources on where it is absolutely indispensable. The combined forces of automotive electrification and industrial expansion in Asia Pacific act as the primary engines of demand, requiring market players to strategically expand production capacity in key geographic locations and specialize in grades compatible with new generation chemistries, maintaining a competitive edge through superior material science expertise and streamlined supply chain management.

Segmentation Analysis

The Fluororubber market is comprehensively segmented based on product type, application, and end-use industry, reflecting the diverse performance requirements and commercial structures of the end-markets. Segmentation by type differentiates between standard FKM (Vinylidene Fluoride based), high-fluorine content FKM (Terpolymers), specialty FKM (e.g., those offering enhanced base resistance), and Perfluoroelastomers (FFKM), with each segment addressing varying levels of thermal stability and chemical resistance needs. The application segmentation covers the primary usage areas, such as seals, gaskets, O-rings, hoses, and molded parts, acknowledging that seals and O-rings constitute the dominant segment due to fluororubber's primary role in leak prevention and fluid management under extreme conditions. Analysis across these segments provides a clear picture of demand concentration and growth potential, highlighting the shift toward higher-value FFKM grades in critical industrial segments.

Further granularity is achieved through segmentation by end-use industry, which includes Automotive and Transportation, Chemical and Petrochemical Processing, Aerospace and Defense, Oil and Gas Exploration, Medical and Pharmaceutical, and others. The Automotive sector historically dominates due to the large volume of vehicles produced globally, requiring numerous FKM components for reliability and compliance. However, the Chemical Processing and Oil and Gas sectors drive demand for the ultra-high performance FFKM due to their harsh, corrosive operating environments. Understanding these cross-segment dynamics is vital for manufacturers focusing on specialization. For instance, players targeting the Medical segment must prioritize specific regulations regarding biocompatibility and purity, distinct from the needs of the heavy industrial sectors, necessitating tailored product portfolios and quality control systems.

The ongoing segmentation analysis reveals that while the standard FKM market is volume-driven and sensitive to raw material costs, the FFKM segment is value-driven, emphasizing performance metrics over price sensitivity. Growth in the newer segments, particularly medical devices and advanced battery technologies, demonstrates the expanding scope of fluororubber beyond traditional heavy machinery. Strategic market players utilize these segmentation insights to optimize their R&D investments, ensuring they are positioned to capitalize on high-growth, high-margin opportunities like specialized O-rings for ultra-high-pressure hydraulic systems or custom molded seals for semiconductor manufacturing equipment, both requiring extreme purity and durability.

- By Type:

- FKM (Fluoroelastomer)

- FFKM (Perfluoroelastomer)

- FEPM (Tetrafluoroethylene/Propylene Copolymer)

- Other Specialty Grades

- By Application:

- Seals and Gaskets

- O-Rings

- Hoses and Tubing

- Molded Parts

- Others (Linings, Coatings)

- By End-Use Industry:

- Automotive and Transportation

- Aerospace and Defense

- Chemical and Petrochemical Processing

- Oil and Gas

- Pharmaceutical and Medical

- Semiconductor Manufacturing

- Industrial Machinery

Value Chain Analysis For Fluororubber Market

The fluororubber value chain begins with the upstream sourcing and production of complex fluorinated monomers, primarily Vinylidene Fluoride (VDF), Hexafluoropropylene (HFP), and Tetrafluoroethylene (TFE). This initial stage is highly capital-intensive and concentrated among a limited number of specialized chemical companies due to the intricate and highly regulated processes involved in handling fluorine chemistry. Raw material purity and stability are paramount, directly influencing the quality of the final elastomer. Major fluoropolymer manufacturers often integrate upstream monomer production capabilities to secure supply and maintain strict control over quality specifications, establishing high barriers to entry in this segment of the value chain. Fluctuations in the cost and supply of these base monomers directly impact the profitability and pricing strategies downstream.

The midstream process involves polymerization, where these monomers are reacted to form the raw fluororubber gum, followed by compounding. Compounding is a critical step, involving the incorporation of curing agents, fillers (such as carbon black or silica), and processing aids to achieve the required physical properties, such as specific hardness, tensile strength, and compression set characteristics necessary for end-user applications. This stage often involves significant intellectual property regarding proprietary curing package chemistries and mixing protocols. The compounded materials are then distributed, either directly to major automotive or aerospace Original Equipment Manufacturers (OEMs) who possess their own molding capabilities, or through highly specialized fabricators and molders.

Downstream analysis focuses on the processing, distribution, and end-use of fluororubber components. Fabrication involves various molding techniques—compression molding, injection molding, and transfer molding—to produce finished seals, O-rings, and custom parts. Distribution channels are highly specialized, often relying on direct sales teams for large OEMs (direct channel) or utilizing technical distributors who provide local stock, technical support, and small-volume supply (indirect channel) to diverse industrial maintenance, repair, and overhaul (MRO) markets. The ultimate success of the fluororubber product hinges on the seamless collaboration between the polymer manufacturer, the compounder, and the molder to ensure the final component meets the demanding performance specifications required by the end-user application, emphasizing technical partnership over transactional sales.

Fluororubber Market Potential Customers

The potential customer base for the fluororubber market is diverse, spanning industries that require sealing solutions capable of operating reliably under extreme conditions of heat, pressure, and chemical exposure. The primary customer demographic consists of large-scale Original Equipment Manufacturers (OEMs) within the transportation sector. Automotive OEMs are crucial buyers, utilizing FKM in engines, transmissions, and fuel systems where high-temperature resistance and compatibility with new generation synthetic oils and biofuels are non-negotiable requirements. Specifically, manufacturers specializing in high-performance, turbocharged, or hybrid vehicles represent a high-value customer segment, alongside battery and thermal management system manufacturers within the burgeoning electric vehicle market, requiring specialized low-compression set elastomers.

In the industrial sphere, major end-users include operators and engineering procurement contractors (EPCs) within the Chemical and Petrochemical Processing industries. These buyers demand FFKMs and specialty FKMs for critical components such as mechanical seals in pumps, reactor vessel gaskets, and piping flanges handling highly corrosive media like strong acids, solvents, and steam. Similarly, the Oil and Gas exploration sector, particularly companies involved in deep-sea drilling and high-pressure/high-temperature (HPHT) environments, are significant purchasers of fluororubber components, where material failure can lead to catastrophic environmental and financial consequences. The procurement decisions in these heavy industries are often guided by stringent API (American Petroleum Institute) standards and lifecycle cost analysis rather than initial purchase price, prioritizing durability and material specifications.

Beyond these traditional heavy industries, the aerospace and defense sector represents a strategic customer segment, requiring materials that comply with strict specifications for high altitude, low outgassing, and wide temperature resilience, used in hydraulic systems, jet engine seals, and fuel line gaskets. Furthermore, the Medical and Pharmaceutical industries are growing customers, utilizing highly pure, non-leaching FFKM components in drug delivery systems, surgical devices, and processing equipment where biocompatibility and steam sterilization resistance are essential. These niche, high-value end-users seek specific certifications and require comprehensive traceability, leading to premium pricing structures and long-term supplier relationships with highly specialized fluororubber manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.98 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Chemours Company, 3M (Dyneon), Solvay S.A., Daikin Industries, Ltd., Shin-Etsu Chemical Co., Ltd., Halopolymer, Asahi Glass Co. Ltd. (AGC), Zhejiang Juhua Co., Ltd., Shanghai 3F New Materials, Zhonghao Chenguang Research Institute of Chemical Industry, Parker-Hannifin Corporation, Saint-Gobain S.A., Trelleborg AB, Precision Polymer Engineering, Greene Tweed, Momentive Performance Materials Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fluororubber Market Key Technology Landscape

The technology landscape of the fluororubber market is characterized by advancements in polymerization, compounding, and curing systems, all aimed at enhancing the material's performance envelope while optimizing production efficiency. A key technological focus is the development of next-generation FFKM grades, utilizing advanced perfluoromethyl vinyl ether (PMVE) incorporation techniques to achieve ultra-high cross-linking density. This structural enhancement provides unparalleled resistance to aggressive media like superheated steam and highly concentrated organic solvents, significantly extending service life in extreme environments typical of semiconductor fabrication and pharmaceutical cleanrooms. Furthermore, there is ongoing research into non-amine curing systems, particularly peroxide and bisphenol curing agents, which offer better process stability and reduced compression set values compared to older technologies, vital for long-term sealing performance in demanding automotive seals.

In the compounding segment, technological breakthroughs are concentrated on incorporating specialized reinforcing fillers, such as functionalized nano-carbon materials and specific grades of white carbon black, to improve mechanical properties without compromising chemical resistance or electrical insulation capabilities. Advanced mixing technology, including internal mixers equipped with sophisticated temperature control and variable rotor speed, is crucial for achieving homogenous dispersion of these high-performance fillers into the highly viscous raw rubber gum, ensuring consistent product quality across large production batches. Process modeling and simulation software are increasingly utilized to predict the viscoelastic behavior of the compounded material during molding, thereby optimizing tool design and reducing costly prototype iterations for complex seal geometries.

Furthermore, technology related to processability and sustainability is gaining prominence. Manufacturers are investing in technologies that allow for lower processing temperatures or faster cure rates, reducing overall energy consumption during molding and increasing throughput. The growing focus on environmental, social, and governance (ESG) factors is also driving innovation in minimizing the environmental footprint of fluororubber production, including optimizing monomer recovery systems and developing technologies to reduce potential emissions of fluorinated volatile organic compounds (VOCs). Future technological endeavors are expected to concentrate on creating specialty FKMs tailored for specific emerging applications, such as enhanced plasma resistance for use in semiconductor etching equipment or specific low-dielectric constant grades for advanced electronic packaging and high-frequency communication systems.

Regional Highlights

Regional dynamics are critical to understanding the distribution and growth drivers of the fluororubber market, influenced heavily by industrialization rates, environmental regulations, and local demand from key end-use sectors.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market, primarily driven by China and India. This dominance is attributed to massive industrial expansion, robust automotive manufacturing base, and increasing investment in chemical and petrochemical production facilities. The region’s rapid urbanization and infrastructure projects translate into high demand for reliable, durable sealing solutions in machinery and transportation.

- North America: Characterized by a mature industrial base and stringent quality standards, North America is a major consumer of high-specification fluororubber, especially FFKM. Key demand drivers include the large aerospace and defense sector, demanding materials for extreme operating conditions, and the sophisticated oil and gas industry requiring HPHT (High Pressure/High Temperature) elastomer components for deep-water and shale exploration.

- Europe: Europe is defined by stringent environmental and safety regulations, pushing demand towards high-quality, long-life sealing materials that minimize leakage and ensure operational efficiency. The robust automotive sector, particularly in Germany and Italy, emphasizes premium FKM usage for emissions control systems and high-efficiency engine components. The region is also a leader in specialty applications like medical devices and pharmaceutical manufacturing.

- Latin America (LATAM): Growth in LATAM is moderately paced, primarily linked to recovery in the automotive industry (Brazil and Mexico) and investment cycles in the oil and gas sector. Demand is often price-sensitive, but the need for durable materials in resource extraction and refining drives specific market niches.

- Middle East and Africa (MEA): This region is a vital market due to its concentration of upstream oil and gas and petrochemical activities. The harsh operating environments (high temperatures and corrosive chemicals) necessitate extensive use of high-performance FKM and FFKM for exploration, refining, and transportation infrastructure, ensuring steady growth particularly in the Gulf Cooperation Council (GCC) countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fluororubber Market.- Chemours Company

- 3M (Dyneon)

- Solvay S.A.

- Daikin Industries, Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Halopolymer

- Asahi Glass Co. Ltd. (AGC)

- Zhejiang Juhua Co., Ltd.

- Shanghai 3F New Materials

- Zhonghao Chenguang Research Institute of Chemical Industry

- Parker-Hannifin Corporation

- Saint-Gobain S.A.

- Trelleborg AB

- Precision Polymer Engineering

- Greene Tweed

- Momentive Performance Materials Inc.

- E.I. du Pont de Nemours and Company (Historical relevance, now Chemours)

- Lanxess AG

- Dow Chemical Company

- Sumitomo Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Fluororubber market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key differences between FKM and FFKM, and which applications demand FFKM?

FKM (Fluoroelastomer) is a highly resistant copolymer/terpolymer, offering excellent heat and chemical resistance up to approximately 200°C. FFKM (Perfluoroelastomer) contains a fully fluorinated polymer backbone, providing superior chemical inertness and exceptional thermal stability, often exceeding 300°C. FFKM is demanded in mission-critical applications like semiconductor processing, advanced aerospace sealing, and ultra-high-pressure environments in oil and gas, where component failure is unacceptable due to severe consequences.

How is the growth of the electric vehicle (EV) sector impacting the demand for Fluororubber?

The EV sector is shifting FKM demand from traditional combustion engine seals (high heat/fuel exposure) to specialized battery and thermal management system seals. FKM and specialty fluoroelastomers are crucial for ensuring the integrity and safety of lithium-ion battery packs, requiring excellent performance in dielectric properties, low compression set at moderate temperatures, and resistance to aggressive battery cooling fluids and potential chemical off-gassing.

What major restraints impede the widespread adoption and market expansion of Fluororubber?

The primary restraint is the significantly high cost of raw materials, specifically fluorinated monomers (VDF, HFP, TFE), which makes fluororubber expensive compared to standard elastomers like EPDM or NBR. Additionally, the complex and energy-intensive processing required for fluororubber compounds, along with the high regulatory scrutiny associated with fluorine chemistry and PFAS materials (even though FKM/FFKM are highly stable), limits its adoption to applications where its performance is absolutely indispensable.

Which geographical region exhibits the fastest growth potential for the Fluororubber market?

The Asia Pacific (APAC) region, led by China and India, demonstrates the fastest growth potential. This rapid expansion is fueled by massive infrastructure development, increasing domestic and export-oriented automotive production, and substantial investment in the petrochemical and manufacturing sectors, which are major end-users of high-performance sealing materials.

In the context of the Fluororubber market, how significant is the role of technology in product development?

Technology plays a vital role, particularly in optimizing curing systems (e.g., peroxide curing) and developing specialized FFKM grades that resist new, aggressive industrial chemicals and plasma environments. Technological advancements focus on improving mechanical properties (like compression set and tensile strength) and enhancing processability, allowing manufacturers to create custom-tailored materials that meet the increasingly severe operating parameters of modern machinery and advanced industrial processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Fluororubber Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Perfluoroelastomer (FFKM) Market Size Report By Type (Fluororubber 246, Fluororubber 26, Fluororubber 23), By Application (Petroleum & Chemical Industry, Aerospace Industry, Electronics Industry, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Smartwatch Strap Materials Market Statistics 2025 Analysis By Application (Android System Smartwatch, iOS System Smartwatch, Windows System Smartwatch, Others), By Type (Stainless Steel Strap, Fluororubber Strap, TPU Strap, TPE Strap, TPSIV Strap, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Perfluoroelastomer (FFKM) for Semiconductor Market Statistics 2025 Analysis By Application (Petroleum and Chemical Industry, Aerospace Industry, Electronics Industry, Others), By Type (Fluororubber 246, Fluororubber 26, Fluororubber 23), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Fluororubber Market Statistics 2025 Analysis By Application (Automobile Industry, Aerospace & Military, Petroleum & Chemical), By Type (FKM, FSR, FFKM), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager