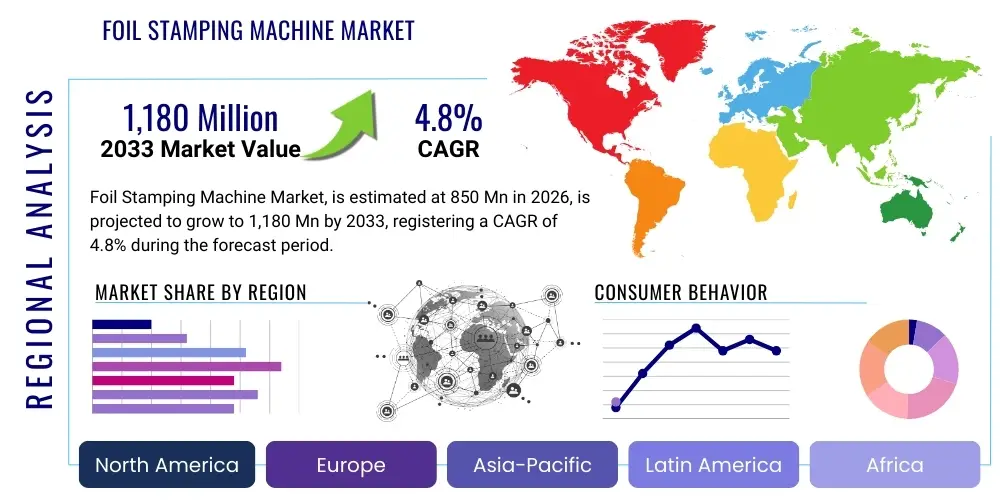

Foil Stamping Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441499 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Foil Stamping Machine Market Size

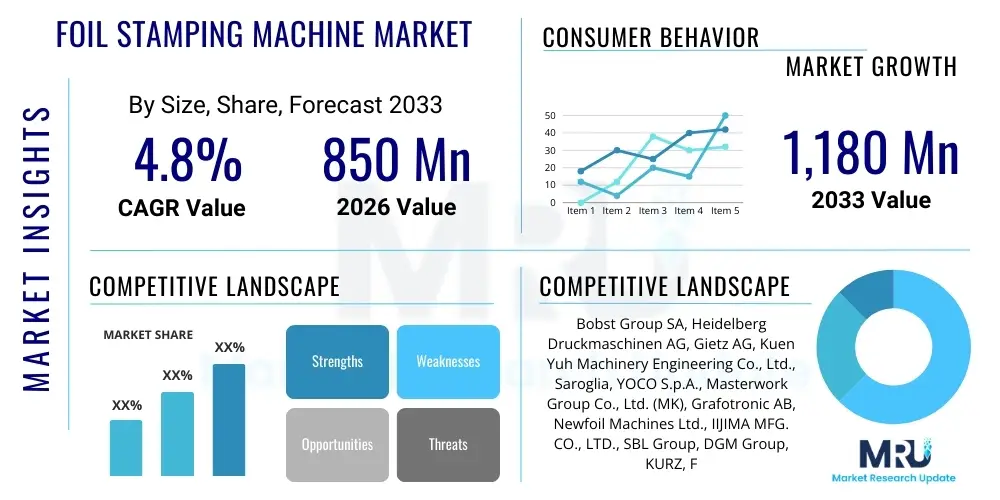

The Foil Stamping Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,180 Million by the end of the forecast period in 2033.

Foil Stamping Machine Market introduction

The Foil Stamping Machine Market encompasses equipment designed to apply metallic or pigmented foil onto substrates such as paper, plastics, textiles, and leather, creating decorative or functional effects. This process involves the use of heat and pressure (hot stamping) or adhesives (cold stamping) to transfer the foil image, thereby enhancing product aesthetics, offering brand protection, and elevating perceived value. These machines range from manual tabletop models used for bespoke jobs to highly sophisticated, automated, high-speed rotary systems integrated into large-scale printing lines, serving diverse industries from premium packaging and greeting cards to banknote security features and textile embellishment. The underlying technology relies on precise temperature control, registration accuracy, and optimized pressure profiles to ensure consistent, high-quality transfer, making them critical assets in the finishing stages of graphic arts and converting industries globally.

Product categories within the market are broadly defined by their operational mechanism: flatbed stamping machines are preferred for their versatility and suitability for thick substrates and complex dies; cylindrical (rotary) stamping machines dominate high-volume applications, particularly in flexible packaging and labels, owing to their continuous operation capability. Furthermore, digital foil stamping, a growing segment, eliminates the need for expensive dies, enabling cost-effective short runs and variable data foiling, which is particularly appealing in the current landscape of customized packaging demand. The integration of advanced servo motors and sophisticated registration systems has significantly improved the speed and accuracy of modern foil stamping processes, reducing material waste and enabling complex, intricate designs that were previously challenging to achieve consistently, thereby solidifying the market's reliance on technological innovation to drive efficiency and aesthetic quality.

The key driving factors fueling market expansion include the unwavering global demand for premium and luxury packaging, where foil stamping is an essential technique for differentiation and shelf appeal. Moreover, the increasing focus on brand security and anti-counterfeiting measures, especially in the pharmaceutical and tobacco sectors, drives the adoption of machines capable of applying holographic and security foils. The inherent benefits, such as high-gloss metallic finishes, texture, and visual depth, continue to make foil stamping an indispensable finishing technique, maintaining its competitive edge against alternative metallic printing processes. As production efficiency demands rise, investment in automatic and semi-automatic machines offering faster setup times and higher throughput remains a crucial trend underpinning market growth across mature and emerging economies.

Foil Stamping Machine Market Executive Summary

The global Foil Stamping Machine Market is characterized by a steady maturation driven primarily by the premiumization trend in consumer goods packaging and sustained technological advancements aimed at enhancing operational flexibility and integration capabilities. Business trends are heavily leaning toward automation, where manufacturers are focusing on developing hybrid machines that combine foil stamping with embossing, die-cutting, or varnishing in a single pass to maximize productivity and reduce handling costs. The push toward sustainability is also influencing business strategies, promoting the development of thinner foils and processes that minimize waste, responding to increasing regulatory pressure and corporate social responsibility goals adopted by major end-users. Consolidation among machinery manufacturers, coupled with strategic partnerships with material suppliers, aims to create integrated solutions, particularly in the highly competitive label and folding carton sectors, thus influencing pricing dynamics and service offerings.

Regionally, the Asia Pacific (APAC) market maintains its dominance, spurred by exponential growth in manufacturing and packaging industries across countries like China and India, focusing heavily on high-speed, cost-effective machinery for mass production of fast-moving consumer goods (FMCG). Conversely, North America and Europe emphasize precision, short-run capabilities, and the integration of digital finishing technologies to cater to demanding luxury segments and increasingly localized production cycles. European manufacturers, in particular, lead innovation in sustainable foil technologies and highly modular machine designs, reflecting the region's stringent environmental standards and requirement for adaptable production environments. Latin America and the Middle East & Africa (MEA) are emerging as high-potential markets, driven by industrialization, rising disposable incomes, and the subsequent demand for sophisticated local packaging solutions, encouraging strategic expansion by global equipment providers into these territories.

Segmentation trends reveal that automatic and semi-automatic machine types are commanding the largest market shares due to their efficiency gains over manual processes, directly correlating with the increasing cost of labor globally. By application, the packaging segment, including folding cartons and flexible packaging, remains the dominant end-use sector, though the label segment is exhibiting the fastest growth due to the proliferation of consumer products requiring high-impact branding. Furthermore, the rising adoption of digital foil stamping technology is shifting investment focus, particularly among commercial printers and converters serving specialized, high-mix, low-volume orders, signaling a structural change in how decorative finishes are applied, prioritizing flexibility and speed-to-market over absolute volume capacity.

AI Impact Analysis on Foil Stamping Machine Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Foil Stamping Machine Market revolve primarily around four critical themes: quality assurance, predictive maintenance, operational efficiency, and the role of design optimization. Users frequently inquire: "How can AI eliminate registration errors in high-speed foiling?", "Will AI-driven analytics reduce machine downtime and maintenance costs?", and "Can AI personalize foil designs based on consumer data?". The core concerns center on leveraging AI to overcome the inherent complexities of heat, pressure, and material variability crucial to the foiling process. Expectations are high, anticipating AI-powered vision systems to monitor minute imperfections in real-time, reducing material waste significantly, and employing sophisticated algorithms to predict component failure long before operational issues arise, thereby maximizing uptime and overall equipment effectiveness (OEE). Users also anticipate AI aiding in optimizing complex die layouts and material consumption based on job specifications, moving the stamping process toward a truly 'smart factory' environment.

The integration of machine learning models into Foil Stamping Machines promises a fundamental transformation in quality control. Traditional quality checks are often manual or rely on rudimentary sensors, leading to late detection of defects such as foil peeling, spotty coverage, or misalignment. AI-driven high-resolution camera systems, coupled with deep learning algorithms trained on vast datasets of acceptable and defective prints, can instantaneously assess the quality of every stamped piece, ensuring perfect registration and material transfer at production speeds. This real-time feedback loop allows the machine's parameters (heat, dwell time, pressure) to be dynamically adjusted during the run, minimizing defects and resulting in substantially higher yield rates, which is a significant factor in reducing the high material costs associated with premium foiling applications.

Furthermore, AI significantly enhances the lifecycle management of stamping equipment. Predictive maintenance, utilizing sensor data related to vibration, temperature fluctuations in heating elements, hydraulic pressure variations, and servo motor performance, allows machine learning models to identify subtle precursors to mechanical failure. Instead of relying on time-based or reactive maintenance schedules, operators can intervene precisely when components are nearing failure, drastically reducing unexpected downtime which is extremely costly in high-volume production environments. This shift towards prescriptive maintenance not only lowers operating expenses by optimizing maintenance resources but also extends the operational lifespan of high-value components, offering a substantial return on investment for end-users deploying AI-enabled machinery.

- AI-Powered Vision Systems: Real-time, high-speed defect detection and automatic registration correction, minimizing material waste.

- Predictive Maintenance: Analyzing sensor data (vibration, temperature, pressure) to forecast component failure and schedule proactive servicing.

- Parameter Optimization: Machine learning algorithms automatically adjust stamping pressure, temperature, and dwell time based on substrate and foil type for optimal transfer quality.

- Enhanced Customization: Utilizing AI for designing variable data foiling patterns and optimizing die creation for complex holographic effects.

- Supply Chain Optimization: AI integration assisting in forecasting foil consumption and managing inventory based on production schedules and volatility.

DRO & Impact Forces Of Foil Stamping Machine Market

The Foil Stamping Machine Market is influenced by a complex interplay of drivers, restraints, and opportunities that collectively shape its growth trajectory and competitive landscape. The principal driver is the relentless consumer appetite for aesthetically superior packaging, particularly in sectors such as cosmetics, spirits, confectionery, and tobacco, where foil stamping serves as a critical differentiator and a hallmark of luxury. This demand is further amplified by the increasing global emphasis on brand protection, driving the adoption of machines capable of handling micro-embossed and sophisticated holographic security features to combat counterfeiting. Technological advancements, notably the integration of digital foiling capabilities and highly automated feeding and registration systems, substantially boost productivity and open up new revenue streams for converters, acting as a crucial secondary driver. These combined factors exert a strong positive impact, dictating higher investment in advanced equipment and favoring manufacturers that prioritize efficiency and security features.

Despite robust demand, the market faces significant restraints, primarily centered around the high initial capital expenditure required for purchasing advanced, high-speed automatic foil stamping machinery, which creates a substantial barrier to entry for smaller or emerging printing houses. Furthermore, the operational complexity associated with achieving perfect foil registration, coupled with the need for specialized technical expertise in die preparation and material handling, limits immediate widespread adoption. Concerns regarding the environmental impact of traditional metallic foils and the subsequent challenge of recycling foiled substrates also impose a structural restraint, compelling manufacturers and end-users to seek out more sustainable, biodegradable, or recyclable foil alternatives, which can sometimes be costlier or possess inferior stamping properties, slowing the adoption cycle in highly regulated markets.

Opportunities for market expansion are considerable, particularly through the proliferation of short-run personalized packaging facilitated by digital printing integration. The capacity for digital foil stamping to execute variable data printing and on-demand customization offers a high-margin growth avenue distinct from traditional long-run commercial printing. Moreover, untapped geographical regions, especially in Southeast Asia, Africa, and Latin America, present significant potential as their domestic manufacturing and consumer goods sectors mature and seek higher quality finishing solutions. The continuous innovation in material science, leading to thinner, more efficient foils and specialized film substrates, further optimizes the process, reducing material costs and expanding the application scope into new areas such as specialized electronics components and high-performance textiles, ensuring long-term market vitality and addressing core environmental concerns.

Segmentation Analysis

The Foil Stamping Machine Market is extensively segmented based on Machine Type, Application, and Operation Mode, providing a detailed view of current market demands and future investment priorities. Understanding these segments is crucial for manufacturers to tailor their product development strategies and for end-users to select equipment optimized for their specific production volumes and quality requirements. The market structure clearly illustrates a bifurcation between high-volume, continuous production needs served by automatic rotary systems and the flexible, high-precision requirements met by flatbed and semi-automatic machines. The predominant end-use application remains packaging, demonstrating the essential role of foil stamping in consumer brand identity and shelf impact, while the burgeoning digital segment highlights the industry's pivot toward speed, flexibility, and reduced setup times to meet modern supply chain demands.

- By Machine Type:

- Flatbed Stamping Machines

- Cylindrical/Rotary Stamping Machines (Used extensively in web-fed label and flexible packaging printing)

- Clamshell Stamping Machines (Often smaller, used for niche or specific sheet sizes)

- By Operation Mode:

- Manual Machines (Low volume, high precision craft work)

- Semi-Automatic Machines (Moderate volume, operator required for feeding/unloading)

- Automatic Machines (High speed, integrated feeding and stacking systems)

- By Technology:

- Hot Foil Stamping Machines (Dominant traditional technology, uses heat and pressure)

- Cold Foil Stamping Machines (Uses adhesive, often integrated inline with printing presses)

- Digital Foil Stamping Machines (Toner-based or UV inkjet methods, requires no die)

- By Application (End-Use Industry):

- Packaging (Folding Cartons, Flexible Packaging, Corrugated Boxes)

- Labels (Wine, Spirits, Cosmetics, FMCG)

- Commercial Printing (Greeting Cards, Invitations, Brochures)

- Security and Banknotes (Holographic and security features)

- Textiles and Leather Goods

Value Chain Analysis For Foil Stamping Machine Market

The value chain for the Foil Stamping Machine Market begins upstream with raw material procurement, encompassing specialized metal alloys and high-grade steel necessary for machine fabrication, along with electronic components such as sensors, servo motors, and advanced control systems, often sourced from highly specialized global component providers. A crucial upstream element is the specialized suppliers of stamping foils, dies (magnesium, brass, or copper), and related consumable materials like adhesives and release coatings, whose quality directly impacts the final output of the machine. Machinery manufacturers then engage in complex design, engineering, and assembly, integrating sophisticated heating and pressure systems, which represent the primary value-addition stage in the chain, requiring substantial intellectual property and manufacturing precision to ensure the machine’s registration accuracy and longevity.

The midstream involves the distribution and sales network. Due to the high value and technical complexity of these machines, direct sales channels, often supported by specialized application engineers, are common for major manufacturers, ensuring customized installations, training, and robust after-sales support. Simultaneously, regional agents and third-party distributors play a vital role in reaching smaller printing houses and emerging markets, providing localized support and facilitating trade credit. This distribution network is critical not just for initial sales but also for the subsequent recurring revenue generated through the sale of spare parts, consumables, maintenance contracts, and periodic software upgrades, sustaining the manufacturer's long-term relationship with the end-user.

Downstream, the finished machines are deployed by converters, commercial printers, and specialized packaging companies (end-users), who utilize the equipment to add value to their clients' products. These end-users, serving sectors like luxury goods, tobacco, and high-end pharmaceuticals, represent the final consumer of the capital equipment. The efficiency and capability of the stamping machine directly influence the downstream market’s ability to meet stringent quality demands and delivery timelines. The value chain concludes with the final consumer purchasing the foiled product, completing the cycle where the enhanced aesthetic value generated by the machine translates into premium pricing and greater brand differentiation, reinforcing the demand for high-quality finishing machinery.

Foil Stamping Machine Market Potential Customers

Potential customers for Foil Stamping Machines are predominantly manufacturing and service entities engaged in the final stages of product packaging, labeling, and graphic production, where aesthetic enhancement and security features are paramount. The largest segment comprises commercial packaging converters, particularly those specializing in folding cartons and rigid boxes for the luxury sector (e.g., high-end spirits, cosmetics, electronics, and fine chocolates), who require high-speed, automatic flatbed and rotary systems capable of integrating seamlessly with their die-cutting and folding processes. These customers seek machines that offer flawless registration and reliability to handle high-volume, intricate foiling jobs that differentiate their clients' products on the shelf, often demanding sophisticated servo-driven control systems and quick job changeover capabilities to maximize operational efficiency and cater to variable production runs.

Another significant customer base includes label printers and converters, who utilize hot and cold foil stamping machines, often integrated inline with flexographic or offset presses, for producing premium labels for beverages (wine and craft beer), personal care products, and serialized pharmaceutical packaging. For this segment, the adoption of cold foiling is particularly appealing due to its speed and ability to be applied on heat-sensitive film substrates, driving investments in state-of-the-art rotary equipment. Furthermore, specialized security printing houses, responsible for producing government documents, tax stamps, and currency features, represent a high-value niche, requiring ultra-precise machines capable of applying micro-embossed and holographic foils for anti-counterfeiting measures, prioritizing security features and traceability over mere aesthetic output.

Additionally, the market extends to bespoke commercial printers and print finishers who serve shorter-run, high-margin niche markets such as customized wedding invitations, corporate stationery, and high-end book covers. These customers often opt for smaller, semi-automatic, or entry-level digital foil stamping machines that minimize tooling costs and offer flexibility for variable data and personalized designs without the overhead of traditional die creation. The textile and leather goods industry also constitutes a niche customer group, employing specialized machines for embossing and applying foil finishes to garments, shoes, and luxury accessories, seeking equipment capable of handling diverse non-paper substrates while maintaining consistent quality and durability of the applied foil.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,180 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bobst Group SA, Heidelberg Druckmaschinen AG, Gietz AG, Kuen Yuh Machinery Engineering Co., Ltd., Saroglia, YOCO S.p.A., Masterwork Group Co., Ltd. (MK), Grafotronic AB, Newfoil Machines Ltd., IIJIMA MFG. CO., LTD., SBL Group, DGM Group, KURZ, Foil & Specialty Effects (FSEA), CERM. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Foil Stamping Machine Market Key Technology Landscape

The technological landscape of the Foil Stamping Machine Market is rapidly evolving, moving away from purely mechanical systems toward sophisticated electro-mechanical and digital integration to improve precision, speed, and versatility. A cornerstone of modern equipment is the reliance on advanced servo drive technology, which offers highly accurate registration control, especially crucial in high-speed rotary and automatic sheet-fed machines where even minute misalignments can lead to substantial material waste. Servo motors allow for precise control over foil feeding, pressure distribution, and dwell time, optimizing the transfer quality across various substrates and minimizing the 'bounce' effect often seen in older hydraulic systems. Furthermore, thermal management technology has been significantly refined, ensuring uniform heat distribution across the stamping plate, essential for achieving consistent metallic sheen and preventing premature foil degradation during long production runs, thereby directly impacting the output quality and machine reliability.

The most transformative recent development is the maturing of digital foiling technology, which eliminates the need for expensive physical dies, thus drastically reducing setup time and costs associated with small-to-medium volume jobs. Digital foiling utilizes either a toner-reactive or UV inkjet application process, allowing for variable data foiling and immediate personalization capabilities that are impossible with traditional methods. This technology addresses the growing market demand for customized packaging and short runs, offering converters a competitive edge in high-mix environments. While digital foiling still faces limitations in achieving the absolute depth and robustness of traditional hot stamping, the continuous improvement in digital toners and adhesives is rapidly closing this quality gap, positioning it as a major disruptor to conventional die-based processes.

Beyond digital integration, there is a substantial focus on modular machine design and intelligent automation. Modern machines are increasingly designed to be modular, allowing customers to integrate stamping units with other finishing processes such as complex die-cutting, stripping, and blanking operations, creating highly efficient inline production systems. Automated setup and makeready features, often supported by integrated vision systems and job memory storage, reduce operator intervention and significantly shorten changeover times between jobs, a critical metric for profitability. Moreover, the capacity to handle complex decorative effects, such as micro-embossing, lenticular effects, and tactile spot finishes using specialty dies and high-precision stamping techniques, is constantly expanding, pushing the boundaries of aesthetic packaging design and providing essential functionalities for brand authenticity and anti-counterfeiting applications.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand and technological adoption within the Foil Stamping Machine Market, influenced by local economic growth, prevailing packaging standards, and regulatory landscapes concerning sustainability and security.

- Asia Pacific (APAC): APAC is the dominant market region and is projected to exhibit the highest growth rate throughout the forecast period. This dominance is attributed to the rapid expansion of the manufacturing sector, particularly in FMCG, cosmetics, and electronics, across major economies like China, India, and Southeast Asian nations. The region’s primary focus is on high-volume, cost-efficient production, driving significant demand for high-speed, fully automatic rotary and flatbed machines, often prioritizing throughput capacity to serve a massive and rapidly growing consumer base. Investment is also substantial in enhancing local manufacturing capabilities for stamping equipment, although imports of advanced German and Swiss machinery remain critical for high-precision, specialized applications.

- North America: This region is characterized by a strong demand for high-quality, short-to-medium run applications, driven by a mature market focused on luxury goods packaging and niche commercial printing. North American consumers place a premium on visual aesthetics and brand identity, fueling the need for advanced digital foiling technologies that enable rapid prototyping and personalization. Market participants here prioritize machines that offer maximum flexibility, minimal waste, and seamless integration with existing digital printing workflows, driving adoption of machines incorporating sophisticated sensor technology and AI-driven quality control systems.

- Europe: Europe represents a technologically mature market with a strong emphasis on automation, precision, and sustainability. Key drivers include the stringent environmental regulations, which encourage the adoption of cold foiling and specialized machines optimized for using recyclable or bio-degradable foil substrates. Countries like Germany, Switzerland, and Italy are global leaders in manufacturing high-precision stamping equipment, setting the global benchmark for registration accuracy and machine reliability. The demand in Europe is centered on modular systems that offer versatility and high efficiency for premium folding cartons and wine/spirits labels, reflecting the region's concentration of luxury brands.

- Latin America (LATAM): LATAM is an emerging market characterized by increasing industrialization and rising disposable incomes, leading to a growing demand for locally produced, well-packaged consumer goods. Countries like Brazil and Mexico are witnessing increased investment in semi-automatic and automatic stamping machinery to upgrade outdated finishing lines. Growth is currently concentrated in the packaging and label sectors, as local converters strive to meet the quality standards necessary to compete with imported goods, creating significant opportunities for mid-range machinery manufacturers focusing on value and service accessibility.

- Middle East & Africa (MEA): The MEA region is developing, propelled by investments in infrastructure and the luxury consumer goods sector, particularly in the UAE and Saudi Arabia. The market primarily demands machines for high-end packaging (cosmetics, tobacco) and security applications (government documents, tax stamps). While still smaller than APAC or Europe, this region offers high potential for manufacturers capable of providing robust, reliable equipment suitable for challenging operational environments and focused on delivering machines with strong anti-counterfeiting capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Foil Stamping Machine Market.- Bobst Group SA

- Heidelberg Druckmaschinen AG

- Gietz AG

- Kuen Yuh Machinery Engineering Co., Ltd.

- Masterwork Group Co., Ltd. (MK)

- Saroglia

- YOCO S.p.A.

- Newfoil Machines Ltd.

- IIJIMA MFG. CO., LTD.

- SBL Group

- DGM Group

- Grafotronic AB

- Konrad Kurz Stiftung & Co. KG (KURZ)

- Cermex (A part of Gebo Cermex)

- Hologram Industries

- Highcon Systems Ltd.

- Landa Digital Printing (indirectly influencing digital finishing)

- Saito Iron Works Co., Ltd.

- Tianjin Baoxiang Printing Machine Co., Ltd.

- Wenzhou Lixin Machinery Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Foil Stamping Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between hot foil stamping and cold foil stamping?

Hot foil stamping uses heat and pressure, driven by a metal die, to transfer foil onto a substrate, ideal for deep textures and durable finishes on various materials. Cold foil stamping uses an adhesive, often applied inline during the printing process, cured by UV light; this method is faster, more cost-effective for high volumes, and suitable for heat-sensitive substrates and flexible packaging.

How is the Foil Stamping Machine Market addressing environmental sustainability concerns?

The market is shifting towards developing sustainable solutions, including using eco-friendly foils that are easier to de-ink or recycle without contaminating the paper pulp stream. Furthermore, cold foiling technology often uses less material waste than traditional hot foiling, and digital foiling eliminates the need for physical dies, reducing material and energy consumption associated with tooling.

Which geographical region dominates the demand for automatic foil stamping machines?

The Asia Pacific (APAC) region dominates the demand for high-speed, automatic foil stamping machines, primarily driven by the massive scale of FMCG and electronics manufacturing in countries like China and India, where maximum throughput and cost efficiency are paramount for high-volume packaging applications.

What is the role of digital technology in the future growth of the foil stamping market?

Digital technology is critical for market growth as it enables high-mix, low-volume production runs and personalization, eliminating the costly and time-consuming process of physical die creation. Digital foiling supports variable data printing and rapid prototyping, meeting the increasing industry demand for customized and on-demand packaging solutions with minimal setup time.

What are the key technological advancements enhancing registration accuracy in modern machines?

Modern machines achieve superior registration accuracy through the integration of high-precision servo drive systems for precise foil movement and pressure control, coupled with advanced optical sensor and AI-powered vision systems. These technologies continuously monitor the foil position relative to the substrate, enabling instantaneous, micro-adjustments during high-speed operation to prevent misalignment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager