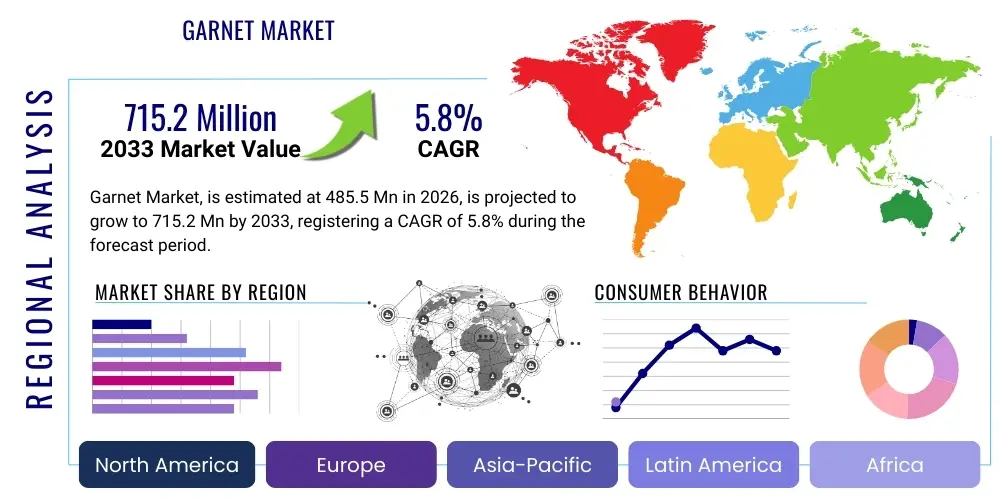

Garnet Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441777 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Garnet Market Size

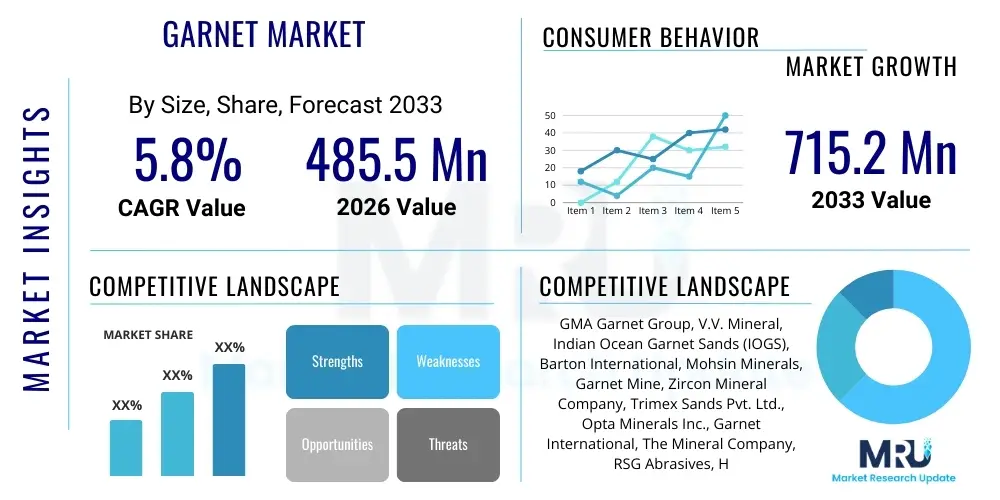

The Garnet Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. This robust expansion is fueled primarily by the escalating demand for high-performance, environmentally friendly abrasive materials, particularly in the critical sectors of waterjet cutting and protective coatings. The shift towards non-silica-based blasting media due to stringent occupational health regulations is a major catalyst driving garnet adoption globally.

The market is estimated at $750 Million in 2026 and is projected to reach $1,115 Million by the end of the forecast period in 2033. This growth trajectory reflects increased industrial activity across developing economies, coupled with significant infrastructure investments requiring superior surface preparation techniques. Furthermore, the unique physical and chemical properties of garnet, including its high hardness, low dust generation, and recyclability, position it favorably against conventional abrasives, securing its dominant role in precision applications.

Market valuation reflects the continued reliance on high-quality alluvial and hard rock garnet sources. The sustained investment in efficient mining and processing technologies, aimed at producing ultra-pure grades suitable for filtration systems and specialized electronic component manufacturing, further contributes to the overall market expansion and elevated valuation projection over the next decade.

Garnet Market introduction

The Garnet Market encompasses the global trade and utilization of naturally occurring silicate minerals known for their high hardness, density, and sharp, angular fracture characteristics. Predominantly utilized are the almandine and pyrope varieties, which are critical industrial minerals. Almandine, the iron-aluminum garnet, is the most common industrial grade, prized for its toughness and specific gravity, making it ideal for abrasive applications.

Major applications for garnet include waterjet cutting, where its uniform particle size and superior cutting efficiency are leveraged; abrasive blasting media for surface preparation in industries such as shipbuilding, petrochemicals, and infrastructure maintenance; and specialized filtration media due to its inertness and high density which aids in the removal of contaminants from water and industrial fluids. Additional benefits include low consumption rates, reduced health hazards associated with silicosis, and high recyclability, significantly lowering operational costs and environmental impact for end-users.

The market is primarily driven by global infrastructure development projects, strict regulatory standards demanding safer blasting media (pushing out silica sand), and technological advancements in waterjet machinery that necessitate high-precision abrasives. The robust growth in the maintenance, repair, and overhaul (MRO) sector, particularly in maritime and energy industries, further sustains consistent demand for high-quality garnet media.

Garnet Market Executive Summary

The Garnet Market is poised for substantial growth, characterized by strong demand from the industrial abrasive and water treatment sectors. Current business trends indicate a critical shift towards sustainability, compelling key market players to invest heavily in advanced processing techniques that enhance the purity and maximize the recyclability of garnet particles. This focus on circularity not only meets regulatory requirements but also provides a distinct competitive advantage through optimized cost structures for end-users who can reuse the media multiple times. Furthermore, market consolidation is observed, with larger integrated producers acquiring smaller mining operations to secure long-term, high-quality raw material supply, stabilizing pricing and supply chain volatility across global markets.

Regionally, Asia Pacific (APAC) stands as the dominant market, driven by massive infrastructure expansion, particularly in China and India, coupled with rapid growth in shipbuilding and manufacturing industries that rely heavily on abrasive blasting for surface preparation. North America and Europe, while mature markets, exhibit steady growth primarily due to stringent occupational safety regulations that mandate the use of non-toxic blasting materials like garnet, supplementing demand. The Middle East and Africa (MEA) are emerging as high-growth regions, spurred by significant investments in oil and gas infrastructure, where protective coatings require immaculate surface preparation, positioning garnet as the material of choice for large-scale energy projects.

Segment trends highlight the waterjet cutting application segment as the fastest-growing area, benefiting from increasing adoption of automated and precision manufacturing processes in the aerospace and automotive industries. In terms of product type, Almandine Garnet retains the largest market share due to its abundance and optimal hardness profile suitable for general-purpose blasting and water cutting. The filtration segment is also gaining traction, particularly the high-purity garnet grades, driven by the global imperative for enhanced municipal and industrial wastewater treatment capabilities. These combined business, regional, and segment dynamics underscore a positive outlook for the market throughout the forecast period.

AI Impact Analysis on Garnet Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Garnet Market predominantly center on operational efficiency, resource allocation, and quality control during mining and processing. Key concerns revolve around whether AI can optimize the complex mineral separation process, which is currently highly reliant on physical parameters, and how predictive maintenance capabilities driven by machine learning can reduce downtime in capital-intensive processing plants. Users are keen on understanding AI's potential role in optimizing logistics and supply chain management, specifically concerning the timely delivery of correctly graded garnet across continents, and ensuring consistency in abrasive quality to meet high-precision manufacturing standards.

AI technologies are anticipated to revolutionize the upstream segment of the Garnet Market by integrating sophisticated sensor data and advanced analytical models into geological exploration and resource mapping. This allows mining companies to more accurately identify commercially viable deposits and optimize extraction patterns, thereby minimizing waste and reducing overall operational costs. Furthermore, in the sorting and grading phases, computer vision and machine learning algorithms can be deployed to ensure particle size distribution and purity levels meet stringent industrial specifications, moving beyond traditional methods that sometimes yield inconsistencies. The application of AI here promises a significant enhancement in product quality and yield, directly impacting profitability.

In the downstream applications, particularly waterjet cutting and automated blasting, AI-driven process control systems are emerging. These systems monitor variables such as cutting speed, pressure, and abrasive flow rate in real-time, adjusting parameters dynamically to ensure optimal performance and minimize garnet consumption. For large-scale users, this translates into substantial material savings and improved operational precision. Predictive maintenance systems, analyzing vibration and temperature data from crushers and pumps, will also enhance the longevity of expensive processing equipment, reducing unplanned outages and securing reliable supply flows, thus reinforcing the overall stability and efficiency of the garnet supply chain.

- AI optimizes geological exploration, identifying high-yield garnet deposits more efficiently.

- Machine learning enhances particle sorting and grading, ensuring consistent purity for high-end applications.

- Predictive maintenance systems reduce downtime in mining and processing facilities, stabilizing production volumes.

- AI-driven supply chain analytics improve inventory management and global logistics for graded material.

- Real-time monitoring in waterjet cutting uses AI to optimize abrasive flow and cutting parameters, improving efficiency and reducing consumption.

DRO & Impact Forces Of Garnet Market

The Garnet Market is influenced by a dynamic interplay of factors encapsulated by Drivers, Restraints, and Opportunities (DRO), which collectively shape the impact forces on its growth trajectory. Key drivers include the overwhelming global demand for safer, environmentally compliant abrasive blasting media, especially the replacement of hazardous crystalline silica. Coupled with this is the continuous expansion of infrastructure and marine industries, requiring high-quality surface preparation for corrosion protection. Restraints primarily involve the high initial capital investment required for establishing efficient mining and processing infrastructure, and the cyclical nature of commodity pricing, which can impact profitability. Opportunities arise from technological advancements in abrasive recycling and the growing penetration of garnet in specialized high-purity filtration systems for demanding industrial processes, presenting new revenue streams.

The primary driver accelerating market expansion is the superior performance characteristics of garnet, specifically its hardness (Mohs 6.5–7.5) and low friability, which allow for faster cleaning rates and reduced consumption compared to alternatives. The environmental and health advantages—non-toxic, non-silica, and extremely low dusting—act as a major impact force, compelling regulatory adoption worldwide, particularly in mature economies like the EU and North America. Conversely, the market faces restraint from potential supply chain disruptions, as primary high-quality sources are geographically concentrated (e.g., India, Australia), leading to reliance on complex international logistics that are vulnerable to geopolitical and trade instability. The availability of low-cost, albeit less efficient, substitute materials like copper slag and synthetic abrasives in certain high-volume applications also limits garnet's market share penetration in less precision-dependent sectors.

Impact forces are predominantly driven by macroeconomic trends and regulatory mandates. The accelerating global focus on water scarcity and quality pushes the demand for high-performance filtration media, offering a significant opportunity beyond the traditional abrasive market. Furthermore, research into advanced recycling techniques that minimize material loss during processing and reuse cycles is crucial. Successful implementation of closed-loop recycling systems will significantly enhance garnet’s cost-competitiveness against non-reusable materials. The balance between regulatory pressure (driving adoption) and supply chain resilience (determining price stability) will define the overall growth rate and profitability of the market over the forecast period.

Segmentation Analysis

The Garnet Market segmentation provides a granular view of market dynamics based on Type, Application, and Function, reflecting the diverse industrial requirements met by this mineral. The differentiation by type—primarily Almandine and Pyrope—is critical as it dictates the physical properties and suitability for end-use. Almandine, being the harder and denser iron aluminum silicate, dominates the abrasive and waterjet cutting segments, commanding the largest volume share due to its widespread availability and optimal performance profile. Pyrope, though less common industrially, finds niche applications where specific chemical inertness or slightly different density characteristics are required.

Segmentation by application reveals the high dependency of the market on surface preparation industries. The waterjet cutting segment is rapidly expanding due to its precision and cold cutting capabilities required in sophisticated manufacturing sectors like aerospace and automotive, often using fine-grade garnet. Conversely, the abrasive blasting segment, which consumes the largest volume, utilizes coarser grades for heavy-duty cleaning and rust removal, especially in maritime, infrastructure, and oil and gas maintenance. The third significant segment, filtration, demands extremely high-purity, uniform garnet to maximize effectiveness in multi-media filtering systems for both municipal and industrial wastewater treatment, representing a growing high-value niche.

Functional segmentation further divides the market based on the required mesh size and quality (e.g., standard blasting grade vs. high-purity filtration grade). This granularity is essential for market players to tailor processing capabilities. Geographical segmentation highlights regional industrial activity and regulatory frameworks, positioning Asia Pacific as the volume leader due to massive industrial output, while North America and Europe lead in regulatory-driven adoption and demand for recycled and certified high-quality materials. Understanding these segments is vital for strategic investment, pricing, and supply chain planning within the competitive global market landscape.

- By Type:

- Almandine Garnet

- Pyrope Garnet

- Other Types (Grossular, Andradite, etc.)

- By Application:

- Waterjet Cutting

- Abrasive Blasting Media (Surface Preparation)

- Water Filtration Media

- Other Applications (Polishing, Lapping)

- By End-Use Industry:

- Construction and Infrastructure

- Shipbuilding and Marine

- Oil and Gas

- Automotive and Aerospace

- Water Treatment Facilities

Value Chain Analysis For Garnet Market

The Garnet Market value chain begins with the complex upstream analysis, focusing on geological exploration, mining, and preliminary processing. Garnet resources are sourced either from hard rock deposits or, more commonly and economically, from alluvial (beach) sand deposits. This upstream phase requires substantial capital investment in dredging, excavation equipment, and primary crushing and screening. Key geographical regions such as India, Australia, and the USA dominate the raw material supply. The efficiency and environmental compliance of these initial extraction activities significantly influence the overall cost structure of the final product. Reliable access to high-grade deposits is the foundation upon which downstream activities are built, making resource security a paramount strategic consideration for integrated market players.

The midstream segment involves rigorous processing to transform raw mineral concentrates into marketable industrial grades. This includes gravity separation techniques (like spirals and jigs), magnetic separation to remove contaminants (especially ilmenite and magnetite), drying, and precise screening to achieve specific mesh sizes (e.g., 30/60 mesh for blasting, 80/120 mesh for waterjet cutting, and specific finer grades for filtration). Quality control at this stage is critical, as purity and consistency are non-negotiable for high-precision applications. Specialized processors may also apply surface coatings or chemical treatments to enhance performance in specific end-uses, adding considerable value and differentiation before distribution.

The downstream analysis focuses on distribution channels, market reach, and end-user engagement. Distribution is typically handled through a mix of direct sales to large industrial consumers (such as major shipyards, foundries, and large filtration plants) and indirect sales through a network of specialized industrial distributors, agents, and resellers who service smaller abrasive users and regional markets. Direct sales enable better margin control and customization, while indirect channels provide wider geographical coverage and logistical efficiency for bulk commodity sales. Logistical expertise, particularly in intercontinental shipping, is crucial due to the product's high density and the distance between primary production sites and major consuming markets in Europe and North America.

Garnet Market Potential Customers

Potential customers for the Garnet Market are primarily large-scale industrial entities whose operational longevity and asset integrity depend on superior surface preparation, precise cutting, or effective fluid purification. The largest segment of end-users are found within the marine and shipbuilding sectors, where garnet is indispensable for cleaning and preparing steel surfaces on new vessels and during maintenance, repair, and overhaul (MRO) activities. These industries require vast quantities of blasting media that must adhere to strict international standards regarding surface cleanliness and environmental safety, positioning garnet as the preferred medium over traditional metallic or silica abrasives.

Another major customer base resides within the oil and gas infrastructure, specifically pipeline construction, refinery maintenance, and offshore platform preservation. Protective coatings applied to these critical assets must bond flawlessly, necessitating surface preparation achieved through garnet blasting, which removes corrosion and mill scale efficiently without embedding harmful contaminants. Furthermore, the automotive and aerospace manufacturing sectors utilize high-grade, fine mesh garnet in precision waterjet cutting applications for intricate component shaping, valuing the material for its accuracy, minimal heat-affected zones, and efficiency in cutting complex materials like titanium, carbon fiber composites, and specialty alloys.

Finally, a rapidly expanding customer segment is municipal and industrial water treatment facilities. These buyers rely on the inertness, high specific gravity, and durability of filtration-grade garnet for multi-media filter beds. Companies managing urban water supply, as well as industrial plants dealing with wastewater containing heavy particulate loads, represent substantial, stable demand for high-purity garnet. These diverse customer groups emphasize different purchase criteria—cost and availability for high-volume blasting users, precision and quality consistency for waterjet users, and purity and long-term durability for filtration buyers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $750 Million |

| Market Forecast in 2033 | $1,115 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | V.V. Mineral, GMA Garnet, Indian Garnet Sand Company (IGSC), Barton International, Zircon Industrial Minerals, Opta Minerals Inc., Mohs Mineral, Wuxi Rongsheng Machinery Manufacturing Co., Ltd., Star Sand, Garnet Milling Company, Tianjin Daming Co., Ltd., Blastrite, AGSCO Corp, Metarock Mining, Garnet Mine Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Garnet Market Key Technology Landscape

The technology landscape in the Garnet Market is primarily focused on enhancing the efficiency of mineral separation, achieving higher purity levels, and optimizing the application processes. In the mining and processing stages, advancements in gravity separation techniques, particularly sophisticated spiraling and jigging systems, are crucial for separating the high-density garnet from associated minerals like quartz and ilmenite. Modern processing plants utilize multi-stage separation circuits combined with powerful magnetic separators to reduce heavy metal contaminants, ensuring the garnet meets the stringent ISO standards required for blasting and the exceptional purity demanded by filtration markets. These technological upgrades are essential for maximizing recovery rates from lower-grade feed material and maintaining a competitive edge in pricing.

Furthermore, significant technological development is occurring in particle sizing and grading precision. The effectiveness of garnet in waterjet cutting depends directly on the tight distribution of particle sizes (mesh). Laser diffractometry and automated screening systems are replacing older mechanical methods to ensure extremely consistent particle sizing, which minimizes nozzle blockages and maximizes cutting efficiency and edge quality. This consistency is a critical technological requirement, particularly for high-speed, multi-axis waterjet machinery used in advanced manufacturing. Investment in these precision sizing technologies allows suppliers to command premium pricing for specialized ultra-fine and highly uniform grades.

In application technology, the integration of smart blasting and automated waterjet systems is driving demand for specific technological properties in garnet. For example, advancements in abrasive recycling systems deployed on-site—including vacuum recovery, classification, and re-screening equipment—extend the usable life of garnet media, enhancing its sustainability profile and reducing overall material consumption. Suppliers who can provide certified, easily recyclable garnet grades compatible with these closed-loop systems are better positioned. The ability of manufacturers to offer specialized, low-dusting garnet formulations through proprietary surface treatments also represents a technological advancement aimed at improving occupational health compliance and performance in complex environments like confined space blasting.

Regional Highlights

- Asia Pacific (APAC): APAC represents the dominant and fastest-growing region in the global Garnet Market, primarily due to the intense pace of industrialization and urban development across countries like China, India, and Southeast Asia. The robust expansion of the marine sector, including shipbuilding and dry dock maintenance, consumes massive quantities of garnet abrasive media. Furthermore, significant government investment in infrastructure projects, such as bridges, ports, and energy facilities, necessitates extensive surface preparation processes. The region also benefits from having major production hubs, particularly in India and Australia, ensuring a relatively steady supply chain, although domestic consumption often competes heavily with export markets. The adoption of stringent environmental regulations, following the trend set by developed economies, is accelerating the transition from silica sand to garnet, cementing APAC's market leadership.

- North America: The North American market is characterized by high demand for premium-grade, highly processed garnet, driven by rigorous environmental and occupational safety regulations (e.g., OSHA standards). The market growth is stable, focusing less on volume and more on specialized applications like precision waterjet cutting in the aerospace and defense industries, and high-efficiency filtration in the region's vast water treatment infrastructure. While domestic production exists (e.g., Barton International in the US), a substantial portion of the market relies on imported, high-quality alluvial garnet. The prevalence of advanced abrasive recycling technologies in this region further supports the long-term, cost-effective use of garnet.

- Europe: Europe is a mature market distinguished by its early and strict adoption of environmental directives concerning abrasive materials, making garnet the preferred choice over hazardous alternatives. Key drivers include the maintenance of aging infrastructure, significant activity in the offshore wind energy sector, and a strong presence of sophisticated manufacturing (automotive and precision engineering). The European market exhibits a high awareness of product quality and sustainability, leading to strong demand for certified, ethically sourced, and high-purity garnet grades suitable for demanding applications, including specialized surface treatments and protective coating preparation across industrial facilities.

- Middle East & Africa (MEA): The MEA region is experiencing rapid market expansion fueled by large-scale capital projects in the oil and gas sector (upstream and downstream facilities), petrochemical industries, and rapid infrastructure build-out (e.g., massive construction projects in the GCC states). The requirement for robust, long-lasting protective coatings against severe corrosion environments necessitates high-quality surface preparation using garnet blasting media. Market growth is high, though supply chain logistics can be challenging, often relying heavily on imports from Asia and Australia. Regional economic diversification efforts are further boosting industrial activity, sustaining strong medium-term demand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Garnet Market.- V.V. Mineral

- GMA Garnet

- Indian Garnet Sand Company (IGSC)

- Barton International

- Zircon Industrial Minerals

- Opta Minerals Inc.

- Mohs Mineral

- Wuxi Rongsheng Machinery Manufacturing Co., Ltd.

- Star Sand

- Garnet Milling Company

- Tianjin Daming Co., Ltd.

- Blastrite

- AGSCO Corp

- Metarock Mining

- Garnet Mine Company

- Combe International

- Abrasives Incorporated

- Rizhao Garnet Ltd.

- Guangzhou Oriental Garnet Abrasive Co., Ltd.

- Mineral Technologies Inc.

Frequently Asked Questions

Analyze common user questions about the Garnet market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Garnet Market?

The primary driver is the increasing global implementation of stringent occupational health and environmental regulations that mandate the replacement of traditional silica sand abrasives with safer, non-toxic alternatives like garnet, particularly in surface preparation and blasting operations worldwide.

Which application segment holds the largest share in the Garnet Market?

The Abrasive Blasting Media segment holds the largest market share by volume. Garnet's superior performance, low dust generation, and high recyclability make it the preferred choice for heavy-duty surface preparation in marine, infrastructure, and oil and gas maintenance.

How does AI impact the Garnet supply chain efficiency?

AI impacts efficiency through predictive maintenance in processing plants, reducing unplanned shutdowns, and optimizing geological surveying for higher yield. Furthermore, AI-driven logistics systems enhance global supply chain planning and inventory management for various garnet grades, ensuring timely delivery.

What is the key difference between Almandine and Pyrope garnet in industrial use?

Almandine garnet is the most common industrial type, prized for its high hardness and density, making it optimal for abrasive blasting and waterjet cutting. Pyrope garnet is generally slightly softer and less common but is utilized in niche applications requiring specific chemical properties.

What are the main geographical constraints affecting Garnet supply?

The main constraint is the concentration of high-quality, commercially viable garnet deposits in specific regions, primarily India, Australia, and parts of the US. This geographical concentration makes the global supply chain susceptible to disruptions related to political instability, trade barriers, and long-distance logistics costs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Garnet Earrings Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Almandine Garnet Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Garnet Market Size Report By Type (Almandine, Pyrope, Others), By Application (Water Jet Cutting, Abrasive Blasting, Water Filtration, Abrasive Powders, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Garnet Market Statistics 2025 Analysis By Application (Water Jet Cutting, Abrasive Blasting, Water Filtration, Abrasive Powders, Others), By Type (Almandine, Pyrope, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Almandine Garnet Market Statistics 2025 Analysis By Application (Water Jet Cutting, Abrasive Blasting, Water Filtration, Abrasive Powders, Others), By Type (Water Jet Grade, Blasting Grade, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager