Generic Oncology Sterile Injectable Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441774 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Generic Oncology Sterile Injectable Market Size

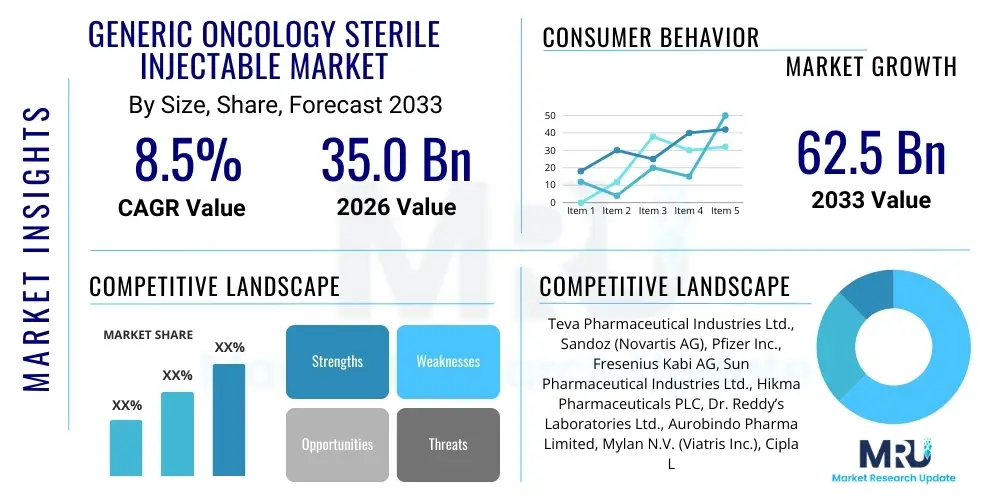

The Generic Oncology Sterile Injectable Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 29.8 Billion by the end of the forecast period in 2033.

Generic Oncology Sterile Injectable Market introduction

The Generic Oncology Sterile Injectable Market encompasses essential cytotoxic and supportive care drugs utilized in chemotherapy and targeted cancer treatment that have lost patent protection and are produced in sterile, ready-to-administer formulations, primarily via intravenous or subcutaneous routes. These products, which include established chemotherapy agents like carboplatin, paclitaxel, and doxorubicin, are critical components of global cancer care infrastructure, providing high-quality, therapeutically equivalent alternatives to branded reference products at significantly reduced costs. The sterile injectable format is mandatory for oncology drugs due to the necessity of immediate bioavailability, precise dosing, and protection against contamination, which is paramount given the immunocompromised status of many cancer patients. The increasing incidence of various cancers worldwide, coupled with intensified pressure on healthcare systems to manage costs without compromising access to treatment, are foundational drivers accelerating the adoption of generic injectable oncologics.

These generic products ensure continuity of treatment for a broad spectrum of oncological indications, including breast cancer, lung cancer, colorectal cancer, and hematological malignancies. They play a pivotal role in public health initiatives, especially in developing nations, where affordability dictates treatment protocols. The manufacturing process for these products is highly complex, requiring advanced aseptic techniques, stringent quality control measures, and often specialized containment facilities, particularly for highly potent cytotoxic compounds. Product stability, shelf life, and ease of administration are key features influencing uptake by hospitals and oncology centers. The market dynamics are heavily influenced by the staggered expiry of patents for biologics and small-molecule sterile injectables, paving the way for the entry of complex generics and biosimilars, which are increasingly driving market expansion and competition among major pharmaceutical players globally.

Major applications of generic oncology sterile injectables span curative treatments, palliative care, and combination therapies, often forming the backbone of standard-of-care regimens established by clinical guidelines. The primary benefit of these generics lies in their economic leverage, enabling national health systems and private insurers to allocate resources more efficiently, thereby expanding the patient population that can afford comprehensive cancer care. Key driving factors include the substantial volume of small-molecule oncology drugs coming off patent in the late 2020s, the rising global prevalence of chronic diseases necessitating long-term drug administration, and technological advancements in aseptic filling and drug delivery systems, such as prefilled syringes and complex drug-device combination products, which enhance patient safety and compliance while reducing preparation errors in clinical settings. This sustained demand for high-volume, low-cost critical medicines solidifies the market's robust trajectory.

Generic Oncology Sterile Injectable Market Executive Summary

The Generic Oncology Sterile Injectable Market is characterized by intense price competition and a strategic focus on expanding manufacturing capacity and regulatory expertise, particularly concerning complex small-molecule generics and emerging biosimilar versions of targeted therapies. Business trends highlight strategic alliances, including co-development and supply agreements between major generic manufacturers and Contract Manufacturing Organizations (CMOs), aimed at navigating the stringent and complex regulatory pathways required by agencies like the FDA and EMA for sterile products. Companies are also consolidating to gain control over crucial Active Pharmaceutical Ingredient (API) supply chains, mitigating risks associated with geopolitical instability and quality concerns, while optimizing logistics for cold chain management essential for many injectable oncology products. The transition towards ready-to-use formulations (e.g., pre-mixed bags or syringes) is a critical business investment designed to enhance convenience, minimize preparation errors in busy hospital pharmacies, and provide a competitive edge in tender processes, reflecting a broader industry trend toward value-added generic offerings.

Regionally, the market demonstrates significant divergence in growth velocity and maturity. North America and Europe currently represent the largest market shares due to high healthcare expenditure, well-established regulatory frameworks, and robust adoption of generic penetration strategies. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) through 2033, driven by rapidly increasing cancer rates, improving healthcare infrastructure, and favorable governmental policies promoting generic drug use and local manufacturing investment, especially in countries like China, India, and Japan. Latin America and the Middle East & Africa (MEA) are also emerging as vital markets, characterized by government-led tenders for bulk drug procurement and an increasing shift from self-pay models to mandatory health insurance, creating a predictable, high-volume environment for generic manufacturers. These regional dynamics necessitate tailored market entry strategies focusing on specific regulatory compliance and distribution network development within each major economic block.

Segment trends underscore the burgeoning impact of biosimilars targeting blockbuster monoclonal antibodies, which are revolutionizing the high-cost segment of the oncology injectable market, offering unprecedented savings. While traditional cytotoxic generics remain volume drivers, the fastest growth is observed in complex non-biological complex drugs (NBCDs) and advanced targeted therapies where manufacturing complexity provides a significant barrier to entry, thus protecting early entrants from immediate hyper-competition. Furthermore, the segmentation by formulation type shows a distinct migration away from traditional vials towards unit-dose formats such as cartridges and prefilled syringes, aligning with global initiatives for minimizing medication wastage and enhancing infection control. Overall, the market's executive summary points to a robust, growth-oriented segment that is undergoing structural shifts driven by technological innovation, rigorous quality requirements, and aggressive cost containment strategies mandated by global payors.

AI Impact Analysis on Generic Oncology Sterile Injectable Market

User queries regarding the impact of Artificial Intelligence (AI) on the Generic Oncology Sterile Injectable Market primarily revolve around three critical areas: enhancing manufacturing quality and efficiency, accelerating R&D for complex generic formulations, and optimizing supply chain resilience and integrity. Common concerns focus on how AI can reduce the variability inherent in aseptic processing, which is crucial for sterile products, and whether machine learning (ML) models can predict potential contamination risks or stability issues before they manifest in batch failures. There is also significant interest in AI's role in facilitating the development of biosimilars by speeding up target identification, characterizing complex protein structures, and simulating clinical trial outcomes, reducing the time and cost associated with demonstrating bioequivalence, a major bottleneck for generic market entry. Finally, users frequently ask how AI-driven predictive analytics can optimize cold chain logistics, ensuring product efficacy across long and complex distribution pathways, thereby minimizing expensive inventory losses due to temperature excursions.

In manufacturing, AI and ML algorithms are being deployed to monitor vast datasets generated by process analytical technology (PAT) in real-time. This application allows for continuous quality verification in sterile filling lines, moving beyond traditional batch-release testing to a proactive control strategy. AI can detect subtle deviations in environmental parameters, flow rates, and particulate matter far more efficiently than human operators, leading to fewer batch rejections and improved yield, which is vital in a price-sensitive generic market. This sophisticated quality control enhances compliance with global Good Manufacturing Practices (GMP) and supports the concept of 'Quality by Design' (QbD), making the production of highly sensitive oncology injectables more reliable and scalable. The ability of AI to model complex kinetic degradation pathways also assists in setting optimal storage conditions and extending the shelf life of temperature-sensitive drugs, contributing directly to operational savings and market supply stability.

From a commercial and strategic standpoint, AI is proving invaluable in market access and pricing strategy. By analyzing large volumes of tender data, competitive pricing models, and regional reimbursement policies, AI tools can help generic manufacturers determine optimal launch timing and pricing points to maximize market penetration while maintaining profitability. Furthermore, in clinical settings, AI applications are beginning to assist in complex drug interaction modeling and personalized dosing recommendations, especially for potent cytotoxic agents, potentially increasing therapeutic effectiveness and reducing adverse events. While direct application in generic drug discovery is limited, its impact on operational efficiencies, regulatory adherence (e.g., automated documentation review), and maximizing successful batch throughput is fundamentally changing the economics and reliability of the sterile oncology injectable supply chain, making AI integration a competitive necessity rather than a technological novelty.

- AI optimizes aseptic manufacturing processes through real-time PAT monitoring, reducing contamination risk and improving batch consistency.

- Machine learning accelerates biosimilar development by aiding structural characterization and predicting bioequivalence outcomes.

- Predictive analytics enhances supply chain integrity by proactively managing cold chain logistics and forecasting demand fluctuations.

- AI-driven data analysis supports competitive pricing strategies and optimizes participation in high-volume public health tenders.

- Automation via AI minimizes human intervention in sterile environments, significantly lowering the potential for human-induced errors.

- AI facilitates automated regulatory documentation and compliance checks, speeding up time-to-market for complex generic approvals.

DRO & Impact Forces Of Generic Oncology Sterile Injectable Market

The market growth is primarily driven by the escalating global prevalence of cancer coupled with the demographic shift towards an aging population, significantly increasing the patient pool requiring long-term pharmacological intervention. A major driver is the substantial patent cliff phenomenon, particularly the ongoing expiration of patents for high-value biological and complex small-molecule oncology drugs, which opens vast opportunities for generic and biosimilar market entry, immediately offering lower-cost alternatives that appeal strongly to cost-conscious payors and governments globally. Conversely, the market faces significant restraints stemming from the inherent technical difficulty and capital intensity required for sterile manufacturing, demanding specialized expertise in aseptic filling, lyophilization, and containment technologies, posing a major barrier to entry for smaller firms. Furthermore, regulatory scrutiny over generic sterile products is intensifying, particularly concerning demonstration of strict bioequivalence and ensuring the quality consistency throughout the product lifecycle, which can lead to lengthy approval times and high development costs that temper market expansion velocity.

Opportunities for sustained growth are substantial, particularly in emerging economies where expanding healthcare coverage and infrastructural improvements are rapidly increasing access to cancer treatments. Generic manufacturers have a strong opportunity to collaborate with local partners to establish regional manufacturing hubs, reducing reliance on long, complex global supply chains and navigating specific regional regulatory requirements more efficiently. Moreover, the development and regulatory pathway for complex generic products, such as liposomal formulations, nanosuspensions, and advanced drug-device combination products, offer a high-value niche. These products require sophisticated formulation science and command better pricing and less competition than standard generics. Furthermore, the shift towards personalized medicine creates an opportunity for generic manufacturers to invest in flexible, smaller-scale batch production capabilities to service niche populations or specific compounding needs within hospital systems, moving beyond purely large-scale, mass-market production.

The overall impact forces are dominated by the push-pull dynamic between the urgent need for cost savings in global healthcare systems (a strong driving force) and the non-negotiable requirement for pristine product quality and regulatory compliance (a restraining force). The intensifying competition among major generic players and the rise of sophisticated biosimilars are compelling incumbent companies to continuously innovate in formulation science and supply chain efficiency. Policy mandates, such as those encouraging the substitution of generics, act as powerful accelerators. The market success is fundamentally determined by a manufacturer's ability to successfully navigate the highly capital-intensive development of stable, therapeutically equivalent sterile products while managing escalating operational expenditures related to increasingly strict global GMP standards, ultimately positioning affordability and accessibility as the primary competitive battlegrounds.

Segmentation Analysis

The Generic Oncology Sterile Injectable market is comprehensively segmented based on product type, application, end-user, and distribution channel, reflecting the varied landscape of cancer treatment modalities and procurement strategies globally. Segmentation by product type is crucial, differentiating between traditional small-molecule cytotoxic agents (which form the volume base), complex generics like liposomal or micellar formulations (which require advanced technology), and biosimilars (which represent the fastest growing, high-value segment targeting targeted therapies). Analyzing these segments allows stakeholders to pinpoint areas of high growth potential, particularly the therapeutic areas where major reference products are losing patent protection, necessitating focused R&D investment and targeted marketing efforts within the complex generic space to capture significant market share before hyper-competition sets in.

Segmentation by application highlights the prevalence and treatment standards for the most common cancer types, such as breast cancer, lung cancer, and colorectal cancer, enabling manufacturers to align their portfolio with the highest disease burdens globally. End-user segmentation focuses predominantly on institutional buyers—hospitals, specialized oncology clinics, and governmental agencies—as these entities account for the vast majority of sterile injectable usage and procurement through structured tender processes and Group Purchasing Organizations (GPOs). Understanding the specific procurement needs, inventory management challenges, and formulary inclusion criteria for these end-users is essential for maximizing market penetration and establishing long-term supply agreements. Finally, distribution channels, whether direct sales to large hospital chains or indirect sales via specialized wholesalers and distributors equipped for cold chain logistics, dictate the efficiency and reach of the generic supply chain in diverse geographical regions, providing critical insight into operational bottlenecks and opportunities for logistical optimization.

- By Product Type:

- Small Molecule Cytotoxic Generics (e.g., Paclitaxel, Doxorubicin)

- Complex Generics (e.g., Liposomal formulations, Pegylated products)

- Biosimilars (Targeting Monoclonal Antibodies and Therapeutic Proteins)

- By Application:

- Breast Cancer

- Lung Cancer

- Colorectal Cancer

- Prostate Cancer

- Hematological Malignancies (Leukemia, Lymphoma)

- Others (Ovarian, Head and Neck Cancer)

- By End-User:

- Hospitals and Clinics

- Cancer Research Centers

- Ambulatory Surgical Centers

- By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Direct Sales and Government Tenders

- By Formulation:

- Vials

- Ampoules

- Prefilled Syringes (PFS)

- Cartridges and Pens

Value Chain Analysis For Generic Oncology Sterile Injectable Market

The value chain for generic oncology sterile injectables is intricate and heavily regulated, commencing with the Upstream Analysis focusing on the sourcing and synthesis of Active Pharmaceutical Ingredients (APIs). Manufacturing APIs, particularly highly potent cytotoxic compounds, requires specialized containment and expertise, often relying on outsourced production from established suppliers in regions such as India and China due to cost efficiencies. Ensuring the quality, impurity profile, and stability of the API is the foundation of product success, as any variance directly impacts the sterile formulation process and subsequent regulatory approval. Therefore, robust supplier qualification, auditing, and maintaining a secure, dual-sourced supply chain are critical risk mitigation strategies in this highly specialized upstream segment. The transition from API sourcing to sterile formulation—the core manufacturing step—involves complex processes like lyophilization, sterilization-in-place (SIP), and high-speed aseptic filling, demanding massive capital investment in sophisticated cleanroom facilities and advanced robotics to meet stringent global GMP requirements and minimize contamination risks, which constitutes the highest value-add activity.

The Downstream Analysis involves complex logistics, distribution, and engagement with end-users. Unlike standard oral generics, sterile injectables, especially biologics and certain complex small molecules, often necessitate cold chain management, adding complexity and cost to storage and transportation. The distribution channel is typically bifurcated: Direct sales involve large generic corporations negotiating bulk purchasing contracts with major hospital networks, GPOs, and government health ministries via sophisticated tendering processes, ensuring high-volume, guaranteed sales. The indirect channel relies on specialized pharmaceutical wholesalers and distributors who are certified and equipped to handle the specialized warehousing and temperature-controlled delivery required for these high-value, sensitive products. This layer of complexity means distribution capability is often a significant competitive differentiator, particularly in geographically diverse markets.

The entire value chain is characterized by severe pressure on cost and an absolute requirement for quality assurance at every stage. Successful generic manufacturers vertically integrate or establish strategic, long-term partnerships to control critical nodes, particularly API sourcing and final sterile finishing (fill-finish). The involvement of Contract Development and Manufacturing Organizations (CDMOs) has grown substantially, offering specialized expertise and scalable capacity to navigate the technical hurdles of sterile manufacturing, mitigating the need for every generic firm to build massive, proprietary facilities. Ultimately, the ability to maintain supply chain redundancy, demonstrate unwavering product quality to regulatory bodies, and successfully win competitive public tenders via efficient distribution determines the profitability and sustainability of operations within the generic oncology sterile injectable market.

Generic Oncology Sterile Injectable Market Potential Customers

The primary customers for the Generic Oncology Sterile Injectable Market are large institutional buyers who prioritize cost-effectiveness, reliability of supply, and clinical equivalence for high-volume treatments. Hospitals, particularly large-scale academic medical centers and integrated delivery networks (IDNs), represent the largest segment of potential customers. These institutions have extensive formularies and sophisticated procurement departments, often relying on Group Purchasing Organizations (GPOs) to aggregate demand and negotiate advantageous, long-term contracts for generic supplies. For hospitals, the guaranteed stability of the supply chain is paramount, as stock-outs of critical oncology drugs can severely disrupt patient care protocols. Their buying decisions are heavily influenced by factors such as the convenience of the formulation (e.g., ready-to-use solutions reducing preparation time and error) and the manufacturer's regulatory track record and reliability.

Specialized oncology clinics and ambulatory care centers also constitute a vital customer base, particularly for outpatient administration of chemotherapy and targeted therapies. These smaller facilities often purchase through regional distributors but increasingly rely on specialty pharmacies connected to major generic manufacturers for just-in-time inventory management. For these centers, minimizing medication waste and ensuring patient safety via user-friendly packaging (like prefilled syringes) are key considerations when selecting suppliers. Furthermore, in many national health systems, governmental health agencies and tender authorities act as the single largest buyer. Countries with universal healthcare systems (e.g., those in Europe and developing nations) conduct mandatory, competitive tendering processes where the lowest compliant price often wins high-volume supply contracts, making these agencies crucial gatekeepers for market entry and sustained revenue generation.

A smaller but growing customer segment includes specialized compounding pharmacies and research institutions. Compounding pharmacies require bulk sterile APIs or concentrated solutions to prepare customized doses or mixtures for patients with unique needs, adhering to strict sterility guidelines. Research centers and clinical trial organizations utilize generic injectables for control arms in new drug studies, requiring high-quality, non-branded products validated for consistency. Overall, the buying behavior across all customer segments is characterized by a high degree of centralization, a profound emphasis on regulatory compliance (e.g., FDA/EMA approval status), and a non-negotiable requirement for therapeutic parity with the reference brand, making quality assurance and stability data highly leveraged components in sales negotiations, moving beyond simple price competition.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 29.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Teva Pharmaceutical Industries Ltd., Sandoz (Novartis AG), Pfizer Inc. (Hospira/ICU Medical), Sun Pharmaceutical Industries Ltd., Dr. Reddy’s Laboratories, Hikma Pharmaceuticals PLC, Fresenius Kabi AG, Amgen Inc. (Biosimilars Division), Mylan (Viatris Inc.), Cipla Limited, Aurobindo Pharma, Accord Healthcare (Intas Pharmaceuticals), Endo International plc, Baxter International Inc., STADA Arzneimittel AG, LG Chem, Samsung Bioepis, Apotex Inc., Zydus Cadila, B. Braun Melsungen AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Generic Oncology Sterile Injectable Market Key Technology Landscape

The technology landscape for Generic Oncology Sterile Injectables is dominated by advanced aseptic manufacturing techniques crucial for maintaining product sterility and integrity, given the sensitivity and administration route of these drugs. Key technologies include Blow-Fill-Seal (BFS) technology, which offers an integrated, automated process for forming, filling, and sealing containers (typically ampoules or small bottles) in a continuous cycle, significantly reducing the risk of microbial contamination compared to conventional open-vial filling processes. Isolator technology and Restricted Access Barrier Systems (RABS) are foundational, providing highly controlled, grade-A environments necessary for handling potent cytotoxic compounds and preventing cross-contamination, ensuring both product purity and operator safety. Furthermore, lyophilization (freeze-drying) remains a critical technology, especially for oncology products that exhibit poor shelf stability in liquid form, allowing manufacturers to extend product viability and facilitate easier storage, despite adding considerable complexity and cost to the manufacturing cycle.

Beyond core aseptic techniques, innovation in drug delivery systems is rapidly shaping the generic market. There is a marked shift toward utilizing prefilled syringes (PFS) and auto-injectors, which require specialized filling and assembly lines. PFS technology enhances patient convenience, improves dosing accuracy, and minimizes drug wastage, making them highly favored by healthcare providers and patients alike. This requires integration of specialized inspection systems, often incorporating vision systems and robotics, to ensure the integrity of the syringe components, plunger, and needle assembly before release. Another technological area gaining traction is the use of nanotechnology and liposomal encapsulation for complex generics, such as Doxorubicin or Paclitaxel formulations. These technologies enhance drug solubility, improve targeted delivery, and alter pharmacokinetic profiles, offering bioequivalent products that meet or exceed the performance of the reference brands, albeit requiring sophisticated, highly controlled manufacturing environments and complex quality control analytical methods.

The underlying infrastructure supporting these manufacturing technologies includes sophisticated Process Analytical Technology (PAT) and Quality by Design (QbD) principles. PAT utilizes in-line and at-line sensors to monitor critical quality attributes (CQAs) during manufacturing, allowing for real-time adjustments and continuous process verification, which is essential for maximizing yield in high-volume, high-cost sterile injectable production. Advanced analytical tools, such as High-Performance Liquid Chromatography (HPLC) coupled with Mass Spectrometry (MS), are indispensable for the precise characterization of generic products, especially complex protein structures in biosimilars, ensuring interchangeability and clinical equivalence. The continued investment in these advanced manufacturing and analytical technologies is crucial for generic firms aiming to successfully launch and sustain market share in the technically demanding and highly competitive oncology sterile injectable sector, where regulatory expectations for quality and purity are continuously escalating.

Regional Highlights

- North America: This region holds the largest market share, driven by high healthcare spending, advanced medical infrastructure, and a substantial number of cancer cases. The U.S. market is characterized by a strong presence of Group Purchasing Organizations (GPOs) and intense scrutiny from the FDA regarding manufacturing quality and supply chain stability, particularly for essential generic oncology drugs. The market dynamics are dominated by significant cost containment pressures from payors, strongly encouraging the substitution of branded drugs with lower-cost generics and biosimilars, which fuels substantial volume growth, although the competitive environment leads to rapid price erosion following generic entry.

- Europe: Europe represents a mature market with robust generic adoption, largely governed by national regulatory bodies (under the coordination of the EMA). The primary growth mechanism is the tendering process managed by national health services (e.g., NHS in the UK, centralized purchasing in Germany and France), which ensures generics rapidly penetrate the market following patent expiry. Western Europe focuses heavily on high-quality standards and complex biosimilar uptake, while Eastern European countries offer significant potential due to rapidly improving healthcare accessibility and an accelerated need for affordable oncology solutions, making the region a key focus for generic manufacturers seeking volume expansion.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rising disposable incomes, improving healthcare infrastructure, and massive patient pools in countries like China and India. Government initiatives in major APAC economies are actively supporting local generic manufacturing (e.g., 'Make in India' campaigns) and promoting the use of cost-effective medicines to address widespread cancer incidence. Regulatory harmonization is gradually improving, making market entry more predictable. This region is critical for both consumption and production, providing essential API sourcing and manufacturing capacity for the global supply chain, driven by high unmet medical needs and the increasing affordability of complex generic treatment regimens.

- Latin America (LATAM): This region offers considerable opportunities, primarily through large-scale government tenders that dominate the procurement landscape. Market access can be fragmented, requiring navigating diverse local regulations and economic volatility. However, the increasing focus on expanding universal healthcare coverage and controlling drug expenditure ensures a steady demand for affordable oncology generics, particularly in Brazil, Mexico, and Argentina. Success hinges on robust regulatory affairs capabilities and efficient logistics to manage distribution across challenging geographical terrains.

- Middle East & Africa (MEA): Growth in the MEA region is driven by significant governmental investment in healthcare infrastructure, particularly in the Gulf Cooperation Council (GCC) countries, and the rising burden of chronic diseases, including cancer. The market is primarily import-dependent for complex generics, although local manufacturing efforts are increasing. Procurement is often centralized, involving substantial tenders. Price sensitivity is high outside the affluent GCC nations, making generic and biosimilar affordability a critical factor for market penetration and establishing a strong foothold in the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Generic Oncology Sterile Injectable Market.- Teva Pharmaceutical Industries Ltd.

- Sandoz (Novartis AG)

- Pfizer Inc. (Hospira/ICU Medical)

- Sun Pharmaceutical Industries Ltd.

- Dr. Reddy’s Laboratories

- Hikma Pharmaceuticals PLC

- Fresenius Kabi AG

- Amgen Inc. (Biosimilars Division)

- Mylan (Viatris Inc.)

- Cipla Limited

- Aurobindo Pharma

- Accord Healthcare (Intas Pharmaceuticals)

- Endo International plc

- Baxter International Inc.

- STADA Arzneimittel AG

- LG Chem

- Samsung Bioepis

- Apotex Inc.

- Zydus Cadila

- B. Braun Melsungen AG

Frequently Asked Questions

Analyze common user questions about the Generic Oncology Sterile Injectable market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Generic Oncology Sterile Injectable Market?

The market is primarily driven by the mass expiration of patents for high-value branded oncology drugs, the escalating global incidence of various cancers, and persistent governmental and payor pressure worldwide to reduce healthcare costs through the adoption of therapeutically equivalent, lower-priced generic and biosimilar injectable treatments.

What is the significance of complex generic formulations in the oncology injectable sector?

Complex generic formulations, such as liposomes or nanocrystals, are significant because they target sophisticated drug delivery systems, often offering improved patient outcomes or convenience over standard formulations. They also present higher barriers to entry due to specialized manufacturing and analytical requirements, resulting in less intense price competition and greater profitability for successful entrants.

How do biosimilars impact the overall Generic Oncology Sterile Injectable market dynamics?

Biosimilars exert a massive influence by challenging the high-cost segment dominated by original monoclonal antibodies and targeted biologics. Their introduction drastically increases competition, lowering the cost of treatment for complex cancers, and expanding market access, particularly in regions where the reference biologics were previously unaffordable for the general population or public health systems.

What major regulatory challenges do generic manufacturers face in producing sterile oncology injectables?

Manufacturers face rigorous regulatory hurdles, particularly in demonstrating strict bioequivalence and ensuring impeccable manufacturing quality and sterility consistency (cGMP compliance). Regulatory bodies impose intense scrutiny on aseptic processing techniques, containment procedures for potent drugs, and comprehensive stability data to validate product integrity throughout the shelf life.

Which geographical region is expected to demonstrate the highest growth rate and why?

The Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid improvements in healthcare infrastructure, substantial increases in chronic disease prevalence, governmental policies favoring local generic production, and expanding insurance coverage making complex oncology treatments accessible to a larger patient demographic.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager