Generic Oncology Sterile Injectable Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436146 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Generic Oncology Sterile Injectable Market Size

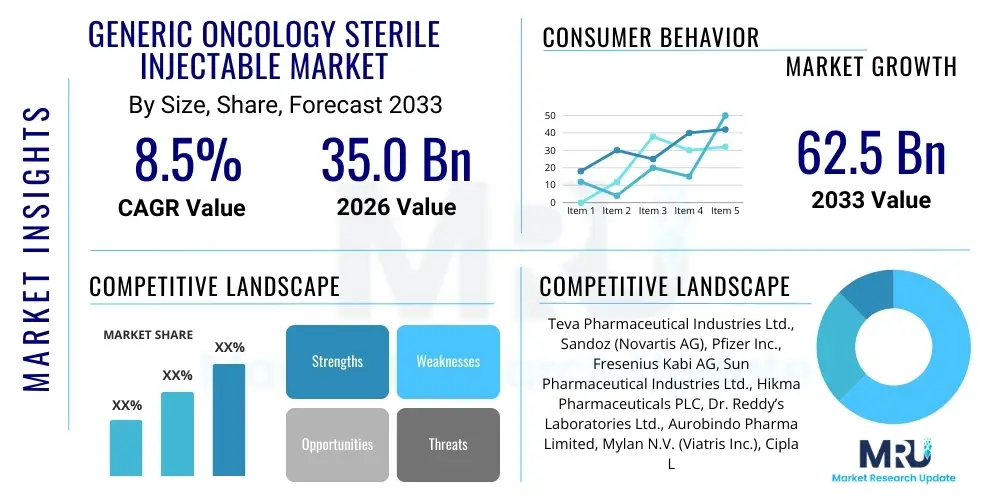

The Generic Oncology Sterile Injectable Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 35.0 Billion in 2026 and is projected to reach USD 62.5 Billion by the end of the forecast period in 2033.

Generic Oncology Sterile Injectable Market introduction

The Generic Oncology Sterile Injectable Market encompasses a critical segment of the pharmaceutical industry dedicated to producing and distributing cost-effective, high-quality versions of branded chemotherapy drugs and supportive care biologics delivered via injection or infusion. These products are crucial for treating various cancers, including breast, lung, colorectal, and prostate cancer, by offering therapeutic alternatives once original patents expire. The stringent requirement for sterility and stability, given the parenteral route of administration, places significant emphasis on advanced manufacturing techniques, including aseptic processing and terminal sterilization, ensuring patient safety and drug efficacy across diverse global healthcare settings. The increasing global cancer burden and the persistent pressure on healthcare systems to reduce expenditure drive the demand for these essential generic alternatives.

Product descriptions within this market generally involve cytotoxic agents, monoclonal antibodies, and targeted therapies presented in vials, pre-filled syringes, or cartridges. These sterile injectables are primarily used in hospital oncology departments, specialized cancer treatment centers, and increasingly, in ambulatory surgical centers, serving as the cornerstone of systemic cancer treatment protocols. The major applications include first-line chemotherapy, neoadjuvant and adjuvant therapy, and palliative care, spanning the entire spectrum of cancer management. Furthermore, the market includes generic supportive care products, such as granulocyte colony-stimulating factors (G-CSFs) and erythropoiesis-stimulating agents (ESAs), which manage treatment side effects.

Key benefits driving market adoption include substantial cost savings compared to originator biologics and patented small molecule injectables, thus improving access to life-saving treatments in emerging economies and lowering the overall financial burden on developed healthcare systems. Driving factors are manifold: the large volume of complex biologic and small molecule drugs losing patent exclusivity in the coming years, favorable regulatory pathways for generic and biosimilar approvals (like the abbreviated new drug application (ANDA) process in the US), and the increasing maturity of generic manufacturers in handling complex, sterile injectable formulations. Moreover, improvements in cold chain logistics and drug stability enhancements facilitate broader geographical distribution, further accelerating market expansion.

Generic Oncology Sterile Injectable Market Executive Summary

The Generic Oncology Sterile Injectable Market is characterized by robust growth, primarily fueled by the impending patent expiration of several blockbuster oncology drugs and the global imperative to contain healthcare costs. Business trends indicate a shift towards strategic partnerships, particularly between generic manufacturers based in Asia Pacific, which possess high-volume sterile manufacturing capacity, and established distribution networks in North America and Europe. Companies are heavily investing in developing complex generics and biosimilars, such as pegylated proteins and liposomal formulations, requiring advanced analytical and manufacturing capabilities to demonstrate interchangeability and bioequivalence. Supply chain resilience, ensuring robust cold chain management and mitigating geopolitical manufacturing risks, remains a paramount strategic focus for market leaders.

Regional trends demonstrate North America and Europe retaining the largest market shares due to high cancer incidence, well-established healthcare infrastructure, and mature regulatory frameworks supporting generic uptake. However, the Asia Pacific region, led by China and India, is registering the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by expanding healthcare access, increasing governmental focus on affordable medicines, and the presence of a strong base of sophisticated generic pharmaceutical manufacturers. Latin America and the Middle East and Africa (MEA) are also emerging as significant consumers, stimulated by tenders from national health systems seeking high-volume, low-cost oncology drugs.

Segmentation trends highlight the dominance of cytotoxic agents, though targeted therapies and biosimilars for supportive care are rapidly gaining traction due to superior efficacy profiles and regulatory alignment. By route of administration, intravenous (IV) formulations dominate, consistent with hospital-based care settings. However, there is a burgeoning trend toward subcutaneous (SC) formulations and self-administration options, driven by convenience and the desire to reduce hospital stay times. The competitive landscape is intensely focused on achieving first-to-file status for new generic opportunities, translating directly into significant market share capture during the exclusivity period following patent expiry.

AI Impact Analysis on Generic Oncology Sterile Injectable Market

User queries regarding the impact of Artificial Intelligence (AI) on the Generic Oncology Sterile Injectable Market primarily revolve around three central themes: efficiency in drug development, optimization of manufacturing processes, and improvements in pharmacovigilance and supply chain security. Users are keen to understand how AI can shorten the lengthy bioequivalence studies required for complex injectables, specifically seeking faster identification of critical quality attributes (CQAs) and excipient selection. Furthermore, concerns are raised regarding the integration of machine learning (ML) models into advanced aseptic filling lines to minimize human error and ensure higher quality assurance standards for sterile products, a traditionally high-risk area. Expectations focus on AI-driven forecasting and logistics to manage the cold chain and prevent stockouts of critical, temperature-sensitive oncology drugs globally, especially in complex generic supply chains involving multiple sourcing locations.

AI is poised to revolutionize the Generic Oncology Sterile Injectable sector by significantly enhancing R&D efficiency. Machine learning algorithms can analyze vast datasets of existing drug formulations, stability data, and processing parameters to rapidly predict optimal generic formulations that achieve bioequivalence with the reference product, thereby accelerating the often-protracted development timeline. This predictive capability is particularly valuable for complex formulations like liposomes or nanosuspensions, where subtle changes in particle size or dispersion can dramatically affect therapeutic performance. By automating data interpretation and simulation, AI reduces the necessity for exhaustive bench-top testing, lowering upfront costs and time-to-market, which is highly advantageous in a competitive generic landscape where speed is critical.

In manufacturing, AI and advanced analytics are instrumental in achieving real-time release testing and predictive maintenance within sterile injectable facilities. Computer vision systems integrated with robotic filling lines use AI to detect microscopic defects in vials or stoppers and monitor environmental parameters in cleanrooms with unparalleled accuracy, surpassing human inspection capabilities. This implementation directly addresses the industry's critical need to maintain impeccable sterility and minimize batch rejections. For supply chain logistics, AI models analyze demand fluctuations, regional cancer incidence data, and geopolitical risks to optimize inventory placement and cold chain routing, ensuring reliable and secure delivery of temperature-sensitive generic oncology treatments to hospitals worldwide, thereby significantly enhancing overall operational reliability.

- Accelerated formulation development and bioequivalence prediction using ML models.

- Enhanced quality control via AI-powered visual inspection systems in aseptic manufacturing.

- Optimized supply chain and cold chain logistics through predictive demand forecasting.

- Improved pharmacovigilance by analyzing real-world evidence and adverse event reports.

- Virtual screening of potential drug impurities and degradation pathways, ensuring product stability.

- Automation of regulatory document generation and compliance checks for global market submissions.

DRO & Impact Forces Of Generic Oncology Sterile Injectable Market

The Generic Oncology Sterile Injectable Market growth is principally driven by the widespread expiry of patents for major originator chemotherapy agents and targeted therapies, creating immediate market opportunities for generic entry. Simultaneously, fierce global pressure from governmental and private payers to control rising healthcare expenditure strongly favors the adoption of lower-cost generic alternatives over expensive branded drugs. Restraints predominantly involve the significant regulatory hurdles associated with demonstrating bioequivalence and interchangeability, particularly for complex injectables and biosimilars, necessitating substantial investment in sophisticated analytical capabilities and robust clinical data. The inherent complexity and high cost of maintaining compliant sterile manufacturing facilities, which demand impeccable quality control and specialized training, also act as a market barrier to entry. Opportunities lie in developing generic versions of next-generation complex injectables and expanding market penetration into high-growth, underserved emerging economies where affordable oncology treatment access is critical. The primary impact force is the aggressive patent cliff schedule combined with escalating global cancer incidence rates, which collectively ensure a continuously expanding demand base for affordable treatment options.

Segmentation Analysis

The Generic Oncology Sterile Injectable Market is comprehensively segmented based on various critical parameters, including drug class, formulation type, route of administration, and end-user distribution channel. The segmentation by drug class provides crucial insights into the therapeutic areas poised for the highest growth potential, dominated currently by cytotoxic agents but transitioning toward targeted therapies and biosimilars. Formulation type segmentation addresses the technological complexity involved, differentiating between simple solutions and complex dosage forms like liposomal or protein-based products. Analyzing the market through these segments helps stakeholders—from manufacturers to investors—pinpoint specific niches where technological superiority or cost advantage can yield the highest returns, especially as development cycles for biosimilar injectables become faster and more standardized globally.

Segmentation by route of administration is vital as it reflects evolving patient care settings; while IV administration remains standard for hospital oncology, the increasing prevalence of self-administration and home healthcare drives demand for user-friendly subcutaneous (SC) and intramuscular (IM) pre-filled syringes. End-user segmentation (Hospitals, Clinics, Retail Pharmacies) details the primary consumption points, illustrating the ongoing shift of outpatient oncology care from centralized hospitals to specialized oncology clinics and ambulatory infusion centers. Furthermore, understanding the regional distribution of these segments is crucial, as regulatory timelines and reimbursement structures vary significantly, influencing the commercial viability of generic products across geographical markets like North America, Europe, and Asia Pacific.

- By Drug Class

- Cytotoxic Agents (e.g., Docetaxel, Paclitaxel, Carboplatin)

- Targeted Therapy Agents (e.g., Generic monoclonal antibodies, small molecule kinase inhibitors)

- Hormonal Agents

- Supportive Care Biologics (Generic G-CSFs, ESAs)

- By Formulation Type

- Solutions/Simple Injectables

- Complex Generics (Liposomes, Nanoparticles, Sustained-Release Depot Formulations)

- Lyophilized Powders for Reconstitution

- By Route of Administration

- Intravenous (IV)

- Subcutaneous (SC)

- Intramuscular (IM)

- By End User

- Hospitals

- Specialized Oncology Clinics and Cancer Centers

- Ambulatory Infusion Centers

- Retail and Specialty Pharmacies

Value Chain Analysis For Generic Oncology Sterile Injectable Market

The value chain for the Generic Oncology Sterile Injectable Market is intricate and highly regulated, starting with the upstream sourcing and synthesis of Active Pharmaceutical Ingredients (APIs) and excipients. Upstream analysis highlights the critical importance of secure and consistent sourcing of high-quality, non-infringing APIs, often originating from specialized manufacturers in India or China, given the complexity and toxicity of many oncology compounds. The immediate next stage involves advanced sterile formulation and fill-finish manufacturing, which represents the highest value-add and risk point in the chain, requiring adherence to Current Good Manufacturing Practices (cGMP) and often involving complex aseptic techniques. Reliability in the cold chain packaging and labeling processes is non-negotiable for these temperature-sensitive products, determining product integrity prior to distribution.

Downstream analysis focuses on the distribution, sales, and end-user consumption phases. The distribution channel is often bifurcated into direct and indirect routes. Direct distribution involves large-scale contracts with national health systems, governmental tenders, and major hospital networks, especially prevalent in Europe and highly centralized systems. Indirect distribution relies heavily on wholesalers, distributors, and specialty pharmacy networks, particularly in fragmented markets like the United States, which manage the complex logistics of cold chain delivery and inventory management to end-users. Specialty pharmacies play an increasingly crucial role in managing patient support programs and ensuring proper handling and administration instructions are provided for certain self-administered generic injectables.

The primary distribution channel challenge is maintaining end-to-end cold chain integrity, critical for biosimilars and protein-based generic supportive care products. Direct channels offer greater control over product handling but require significant capital investment in internal logistics infrastructure. Indirect channels leverage existing, expansive networks but introduce additional risk points. Given the life-saving nature of oncology drugs, regulatory scrutiny throughout the entire value chain is intense, requiring robust track-and-trace systems to prevent counterfeiting and ensure rapid recall capabilities. The high cost of compliance and the need for specialized storage mean that only highly capitalized, vertically integrated or strategically partnered companies can effectively dominate the market.

Generic Oncology Sterile Injectable Market Potential Customers

The potential customers for Generic Oncology Sterile Injectables are diverse yet fundamentally centered around organized healthcare purchasing entities that manage large patient populations and seek cost efficiencies without compromising treatment quality. The primary buyers are institutional purchasers, including large public and private hospital groups, which operate specialized oncology wards and require high volumes of cytotoxic and targeted injectable generics for routine chemotherapy protocols. Group Purchasing Organizations (GPOs) in markets like North America act as major aggregators, negotiating contracts on behalf of multiple hospitals and clinics to secure favorable pricing and reliable supply for essential generic oncology drugs.

Another significant customer segment includes government healthcare bodies, such as national health services (NHS) in the UK, centralized procurement agencies in Brazil or India, and health insurance providers who heavily influence formulary decisions based on cost-effectiveness. These public sector buyers often utilize large-scale tender processes to procure generic sterile injectables, focusing heavily on proven quality, stability data, and competitive pricing. Furthermore, specialty oncology clinics and ambulatory infusion centers represent a rapidly growing customer base, as cancer treatment increasingly shifts to outpatient settings, requiring dependable, ready-to-use injectable formulations suitable for efficient administration outside the traditional hospital environment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.0 Billion |

| Market Forecast in 2033 | USD 62.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Teva Pharmaceutical Industries Ltd., Sandoz (Novartis AG), Pfizer Inc., Fresenius Kabi AG, Sun Pharmaceutical Industries Ltd., Hikma Pharmaceuticals PLC, Dr. Reddy’s Laboratories Ltd., Aurobindo Pharma Limited, Mylan N.V. (Viatris Inc.), Cipla Ltd., Baxter International Inc., Accord Healthcare (Intas Pharmaceuticals), Lupin Limited, Zydus Lifesciences Ltd., Hospira (a Pfizer Company), STADA Arzneimittel AG, B Braun Melsungen AG, Jiangsu Hengrui Medicine Co. Ltd., Hetero Drugs Limited, Alvogen. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Generic Oncology Sterile Injectable Market Key Technology Landscape

The technological landscape for Generic Oncology Sterile Injectables is defined by innovations aimed at ensuring sterility, enhancing drug stability, and replicating the complex characteristics of originator products. Aseptic fill-finish technology remains paramount; however, traditional isolator technology is increasingly being supplemented or replaced by advanced Restricted Access Barrier Systems (RABS) and fully automated robotic filling lines. These systems minimize human intervention, drastically reducing the risk of microbial contamination, which is the single most critical quality parameter for sterile injectables. Furthermore, Blow-Fill-Seal (BFS) technology, while more common in large-volume parenterals, is being adapted for certain small-volume oncology injectables, offering rapid, highly controlled, and cost-effective packaging solutions for specific drug classes.

Beyond manufacturing sterility, formulation science is crucial, particularly for developing complex generics like liposomal or nanoparticle-based injectables (e.g., generic Doxorubicin or Paclitaxel formulations). Technologies such as high-pressure homogenization, microfluidization, and controlled crystallization techniques are necessary to achieve precise particle size distribution and morphology required to match the pharmacokinetic profile of the reference drug. Demonstrating bioequivalence for these complex systems requires advanced analytical technologies, including sophisticated chromatographic methods (HPLC, UPLC), mass spectrometry, and advanced imaging techniques (cryo-electron microscopy) to confirm structural and compositional similarity to the branded product, necessitating significant R&D investment by generic manufacturers.

The industry is also prioritizing patient safety and user convenience through advancements in primary packaging materials and delivery systems. This includes the widespread adoption of cyclic olefin copolymer (COC) and cyclic olefin polymer (COP) materials for primary containers, offering improved chemical inertness and reduced risk of breakage compared to traditional glass vials, especially important for sensitive oncology drugs. The trend towards pre-filled syringes (PFS) equipped with safety features, such as integrated passive safety devices to prevent needle stick injuries, is critical in both hospital and outpatient settings, ensuring ease of use and compliance while safeguarding healthcare personnel. The combination of robotic manufacturing, advanced particle engineering, and enhanced primary packaging drives the core technological evolution in this competitive market segment.

Regional Highlights

The global Generic Oncology Sterile Injectable Market exhibits distinct characteristics across major geographical regions, influenced by varying regulatory frameworks, healthcare spending, and patent expiration timelines. North America, specifically the United States, commands a significant market share due to the high incidence of cancer, robust market access mechanisms for generics, and the presence of numerous large generic pharmaceutical companies and sophisticated specialty pharmacy networks. The high cost of branded oncology drugs creates immense pressure for quick generic substitution upon patent expiry, making this region highly attractive for product launch despite the complex regulatory requirements administered by the FDA. Demand here is exceptionally high for both cytotoxic agents and complex biosimilars used in supportive care.

Europe represents another key region, driven by centralized purchasing and aggressive price negotiation tactics employed by national health authorities. Countries like Germany, France, and the UK actively promote generic and biosimilar uptake to manage strained health budgets. The regulatory pathway facilitated by the European Medicines Agency (EMA) is well-defined, encouraging competitive entry, although pricing pressures are arguably more intense than in the US. The market dynamics in Europe are characterized by intense tendering processes and a focus on long-term supply contracts, emphasizing consistency and reliability from generic manufacturers.

Asia Pacific (APAC) is projected to be the fastest-growing market, primarily due to the vast patient population, increasing accessibility to modern healthcare, and the rapid expansion of domestic manufacturing capabilities, particularly in India and China, which serve as global manufacturing hubs for generic APIs and finished formulations. While pricing remains extremely competitive, increasing governmental investment in cancer care infrastructure and improving regulatory harmonisation create massive untapped potential. Latin America and the Middle East and Africa (MEA) are characterized by strong growth fueled by rising healthcare expenditure and reliance on international aid or government tenders for procuring essential generic oncology drugs, making affordability the paramount driver in these developing regions.

- North America: Dominant market share due to high cancer prevalence and efficient generic adoption mechanisms; strong focus on complex generics and biosimilars; intense competition for first-to-file advantages.

- Europe: Driven by cost-containment measures and established biosimilar markets; high uptake through centralized tenders; stringent quality standards enforced by EMA.

- Asia Pacific (APAC): Highest growth potential fueled by large domestic manufacturing base (India, China); expanding patient access and improving healthcare infrastructure; increasing adoption of international quality standards.

- Latin America: Growth driven by government purchasing power and increasing public health expenditure aimed at affordable cancer treatment; demand focused on essential cytotoxic drugs.

- Middle East and Africa (MEA): Emerging market heavily reliant on tenders and international pharmaceutical sourcing; market growth linked to urbanization and rising non-communicable disease burden, including cancer.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Generic Oncology Sterile Injectable Market.- Teva Pharmaceutical Industries Ltd.

- Sandoz (Novartis AG)

- Pfizer Inc.

- Fresenius Kabi AG

- Sun Pharmaceutical Industries Ltd.

- Hikma Pharmaceuticals PLC

- Dr. Reddy’s Laboratories Ltd.

- Aurobindo Pharma Limited

- Mylan N.V. (Viatris Inc.)

- Cipla Ltd.

- Baxter International Inc.

- Accord Healthcare (Intas Pharmaceuticals)

- Lupin Limited

- Zydus Lifesciences Ltd.

- Hospira (a Pfizer Company)

- STADA Arzneimittel AG

- B Braun Melsungen AG

- Jiangsu Hengrui Medicine Co. Ltd.

- Hetero Drugs Limited

- Alvogen.

Frequently Asked Questions

Analyze common user questions about the Generic Oncology Sterile Injectable market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary factors are driving the growth of the Generic Oncology Sterile Injectable Market?

Market growth is primarily driven by the scheduled patent expiration of major branded chemotherapy agents and targeted therapies, coupled with increasing global pressure from healthcare payers to adopt lower-cost generic alternatives to manage rising cancer care expenditures.

What is the most significant technological challenge in manufacturing generic sterile injectables?

The most significant challenge is ensuring absolute sterility and product stability through complex aseptic fill-finish processes while consistently demonstrating bioequivalence, especially for complex formulations like liposomes or protein-based biosimilars, which require advanced analytical characterization.

Which geographical region is expected to show the highest growth rate?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by expanding domestic generic manufacturing capacity, increasing accessibility to healthcare, and the large patient base in countries like China and India.

How do biosimilars fit into the Generic Oncology Sterile Injectable Market?

Biosimilars, which are complex biologic generics, represent a rapidly expanding and high-value segment within the sterile injectable market, addressing large-molecule originator drugs (e.g., monoclonal antibodies and supportive care factors) nearing patent expiration.

What role does the supply chain play in the competitive advantage of generic oncology drugs?

A reliable and efficient supply chain, particularly robust cold chain management, is critical for competitive advantage, ensuring the integrity and timely delivery of temperature-sensitive generic oncology treatments to global healthcare providers and specialty pharmacies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager