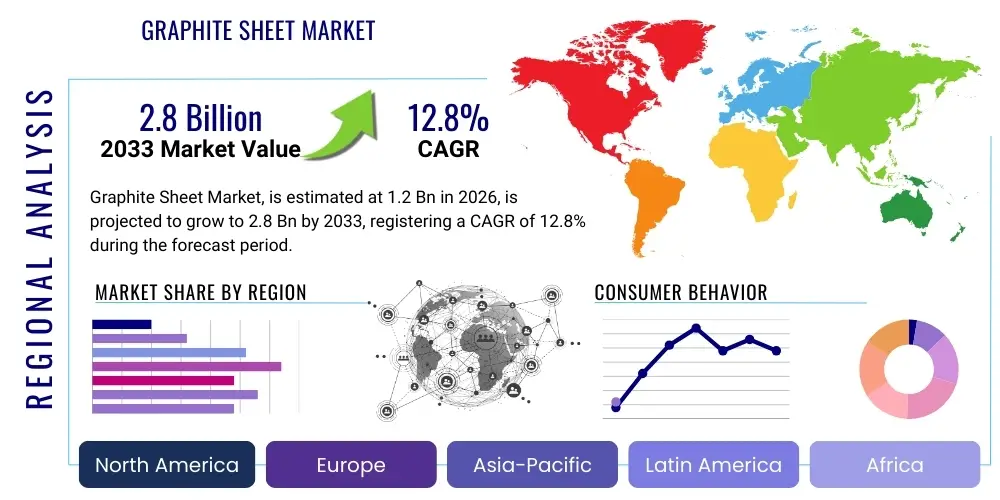

Graphite Sheet Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442517 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Graphite Sheet Market Size

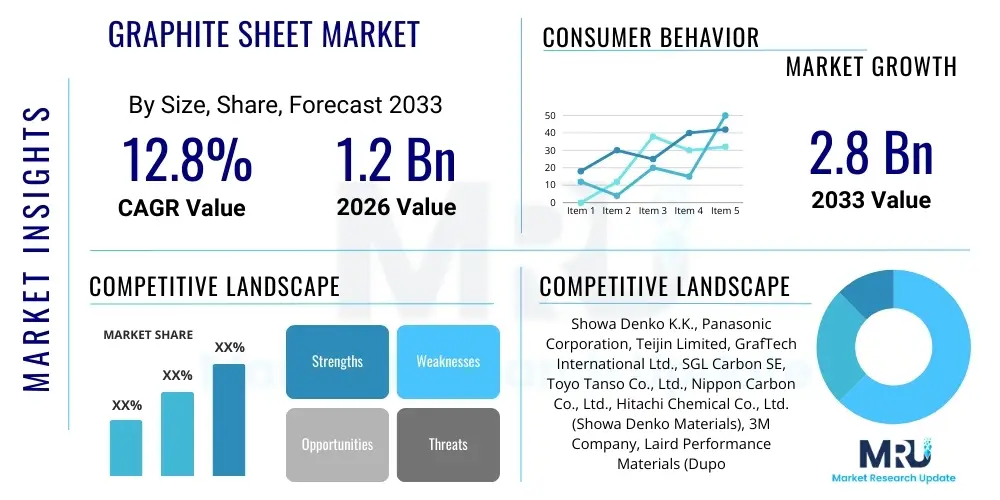

The Graphite Sheet Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.8 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating demand for advanced thermal management solutions across critical high-growth industries, particularly consumer electronics and electric vehicles (EVs). The lightweight nature and exceptional thermal conductivity of graphite sheets position them as indispensable components for efficient heat dissipation, maintaining optimal performance and extending the lifespan of sophisticated electronic devices and battery systems.

Graphite Sheet Market introduction

The Graphite Sheet Market encompasses the production, distribution, and utilization of thin, flexible sheets primarily composed of graphite. These sheets are engineered to possess superior thermal conductivity, chemical inertness, and electromagnetic shielding capabilities. Derived from either natural graphite flakes or synthetic precursors, the manufacturing process involves expansion and subsequent compression to form highly anisotropic structures, resulting in exceptional heat transfer efficiency predominantly along the basal plane. Key products include highly oriented pyrolytic graphite (HOPG) sheets and flexible graphite foils, tailored for specific application requirements ranging from heat sinks to EMI shielding components.

Major applications of graphite sheets span a broad spectrum of high-technology sectors. In consumer electronics, they are crucial for thermal management in smartphones, laptops, and tablets, preventing overheating in increasingly compact designs. The automotive industry, especially the burgeoning electric vehicle sector, utilizes graphite sheets for battery thermal management systems (BTMS) and electronic control units (ECUs). Furthermore, aerospace, industrial furnaces, and LED lighting systems rely on the material’s high-temperature stability and superior heat dissipation properties. The primary benefits include exceptional thermal performance (up to 1,500 W/mK), ultra-thin form factors, flexibility, chemical resistance, and long service life.

The market is predominantly driven by continuous miniaturization and increased power density in electronic devices, necessitating highly efficient passive cooling methods. Regulatory pressures to enhance energy efficiency in industrial applications and the rapid global transition toward electric mobility further accelerate demand. Technological advancements in synthetic graphite production, enabling customization of thermal properties and improved cost-effectiveness, also act as significant catalysts for market expansion. The synergy between material science innovation and pervasive technological adoption reinforces the growth trajectory of the graphite sheet sector.

Graphite Sheet Market Executive Summary

The Graphite Sheet Market is characterized by robust growth, primarily fueled by the accelerating proliferation of 5G infrastructure, the booming electric vehicle market, and the trend toward miniaturized, high-performance consumer electronics. Business trends indicate a strong emphasis on vertical integration among key players, focusing on controlling the supply chain from raw material procurement (natural or synthetic precursors) to specialized sheet fabrication processes, ensuring consistent quality and cost efficiency. Furthermore, strategic partnerships between graphite sheet manufacturers and original equipment manufacturers (OEMs) in the automotive and electronics sectors are becoming commonplace, aimed at co-developing customized thermal solutions that meet next-generation performance requirements. This competitive landscape is driving continuous investment in R&D to improve the thermal anisotropy and mechanical properties of the sheets.

Regionally, the Asia Pacific (APAC) region dominates the market, largely due to its status as the global manufacturing hub for electronics, including smartphones, laptops, and advanced battery cells. Countries like China, South Korea, and Japan are pivotal, housing major electronic manufacturers and battery producers, thereby exhibiting the highest consumption rates. North America and Europe are showing significant growth, particularly spurred by substantial investments in EV manufacturing capacity and stringent regulations promoting energy-efficient cooling solutions in data centers and telecommunications equipment. These Western markets prioritize high-specification synthetic graphite sheets for demanding automotive and aerospace applications.

Segment trends reveal that the synthetic graphite sheet segment is expected to experience faster growth due to its superior purity, customized thermal performance, and predictability in mass production compared to sheets derived from natural graphite. By application, the consumer electronics segment currently holds the largest market share, but the automotive segment is poised for the highest CAGR throughout the forecast period, driven solely by the massive scaling of EV production and the critical need for reliable battery thermal management systems (BTMS) to ensure vehicle safety and operational longevity. Thermal management remains the primary function, although electromagnetic interference (EMI) shielding applications are gaining rapid traction, especially with the complexity of modern communication systems.

AI Impact Analysis on Graphite Sheet Market

User queries regarding AI's influence on the Graphite Sheet Market frequently center on whether artificial intelligence can optimize manufacturing processes, predict material performance under complex operational conditions, and drive demand through enhanced electronic complexity. Key themes highlighted include the adoption of machine learning (ML) for real-time quality control in graphite sheet fabrication, the use of predictive analytics to manage supply chain volatility for raw materials, and the increased energy density and heat generation in AI-specific hardware (such as GPUs and specialized AI chips). Users expect AI to fundamentally accelerate the design cycle for thermal interfaces, optimizing the specific geometry and composition of graphite sheets for maximum efficiency in highly compact and thermally stressed environments like advanced data centers and autonomous driving systems.

- AI-driven optimization of manufacturing parameters, leading to reduced waste and improved anisotropy control in large-scale production.

- Predictive maintenance schedules for graphite sheet production machinery, ensuring continuous operational efficiency and minimizing downtime.

- Enhanced thermal modeling and simulation using deep learning algorithms, significantly reducing the time required for R&D and product validation in new electronic device designs.

- Increased demand for high-performance graphite sheets due to the rapid proliferation of high-power AI accelerators (GPUs, TPUs) requiring advanced thermal dissipation solutions in edge devices and cloud computing infrastructure.

- Supply chain optimization using AI, predicting fluctuating demand patterns across different end-use industries (e.g., matching EV battery production ramp-ups with graphite material supply).

- Development of smart thermal management systems where AI dynamically adjusts power output based on real-time temperature data, utilizing the passive cooling capabilities of graphite sheets most effectively.

DRO & Impact Forces Of Graphite Sheet Market

The Graphite Sheet Market is significantly propelled by the increasing demand for high-performance, thin-profile thermal management materials, particularly in the consumer electronics and electric vehicle sectors, constituting the primary drivers. However, the market faces headwinds from the high initial capital investment required for advanced synthetic graphite manufacturing facilities and the volatility in the prices of raw materials, particularly natural graphite flakes, which present major restraints. Opportunities are abundant in the emerging fields of flexible electronics, advanced telecommunications infrastructure (5G/6G), and specialized medical devices, which require unique, customized thermal solutions. These forces collectively shape the competitive landscape, pushing manufacturers toward innovative, scalable production methods and higher-purity products to maintain competitive edge and profitability.

Impact forces stemming from technological advancement include the development of composite graphite sheets and integration techniques, allowing for seamless incorporation into complex device architectures. Economic fluctuations, particularly disruptions in global supply chains (as witnessed post-2020), impact the availability and cost of raw graphite and precursor materials, affecting pricing strategies and market accessibility. Furthermore, stringent environmental regulations regarding mining practices for natural graphite and energy consumption in synthetic graphite production influence operational costs and push the industry toward sustainable sourcing and green manufacturing techniques. These forces demand proactive risk management and adaptation within the value chain.

A critical impact force is the competitive threat from substitute materials, such as metallic heat sinks, thermal pastes, and carbon fiber composites, which, while often lacking the supreme thermal anisotropy of graphite sheets, offer alternative solutions in specific cost-sensitive or less thermally demanding applications. Manufacturers must continually demonstrate the superior performance-to-weight ratio and thinness advantage of graphite sheets to maintain market share. The increasing complexity of electronics, however, reinforces graphite's essential role, as it is uniquely suited for dissipating concentrated heat loads in extremely confined spaces where traditional bulk cooling methods are impractical. This intrinsic technical advantage serves as a powerful long-term driving force.

Segmentation Analysis

The Graphite Sheet Market is comprehensively segmented based on material type, application, and geographic region, allowing for targeted analysis of growth dynamics and market opportunities. The type segmentation differentiates between sheets manufactured from high-purity natural graphite and those synthesized under high temperature and pressure, each serving distinct market needs concerning purity, cost, and thermal properties. Application segmentation highlights the diverse end-use sectors, with consumer electronics currently dominating the volume, while the automotive sector drives the most significant value growth. Understanding these segments is crucial for stakeholders to align their product development and market penetration strategies with the fastest-growing and highest-value segments globally.

- By Type:

- Natural Graphite Sheet

- Synthetic Graphite Sheet

- By Application:

- Consumer Electronics (Smartphones, Tablets, Laptops, Wearables)

- Automotive (Electric Vehicle Battery Thermal Management Systems, ECUs)

- Aerospace & Defense (Thermal Insulation, High-Temperature Components)

- Industrial Heat Management (LED Lighting, Power Supplies, Industrial Furnaces)

- Medical Devices

- By End-Use Function:

- Thermal Management/Heat Dissipation

- Electromagnetic Interference (EMI) Shielding

- Gaskets, Seals, and Liners

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Graphite Sheet Market

The value chain for the Graphite Sheet Market begins with the sourcing of raw materials, which constitutes the crucial upstream segment. For natural graphite sheets, this involves mining and purification of high-purity flake graphite. For synthetic graphite sheets, the upstream stage involves the procurement of carbonaceous precursors such as polyimide films, pitch, or petroleum coke, followed by graphitization processes carried out at extremely high temperatures (up to 3,000°C). Key challenges in the upstream sector include ensuring a stable supply of high-quality, ethically sourced raw materials and managing the energy-intensive nature of the graphitization process, which heavily influences the final production cost and environmental footprint of the end product.

The midstream phase involves the core manufacturing process, where raw materials are expanded, compressed, and sometimes subjected to specialized rolling or chemical vapor deposition (CVD) techniques to produce the final thin, flexible graphite sheets with desired thermal anisotropy. This phase includes precision cutting, lamination, and the integration of adhesive layers or protective coatings tailored for specific customer requirements (e.g., incorporating pressure-sensitive adhesives for electronics assembly). Efficiency and technological sophistication in this manufacturing segment are critical differentiators, as companies capable of producing ultra-thin sheets (below 50 microns) with high thermal conductivity gain significant competitive advantages.

The downstream sector focuses on distribution and integration into end-user products. Distribution channels are typically a combination of direct sales to large Original Equipment Manufacturers (OEMs) in the automotive and electronics sectors and indirect sales through specialized technical distributors and value-added resellers (VARs) who provide localized inventory, cutting services, and technical support. Direct channels are preferred for high-volume, highly customized projects (like major smartphone contracts or EV battery programs), ensuring stringent quality control and supply chain visibility. Indirect channels serve smaller industrial users and regional markets requiring faster turnaround times and smaller order quantities. The effectiveness of the downstream value chain relies heavily on establishing robust technical support and application engineering expertise to assist customers in integrating these high-performance thermal materials successfully into complex designs.

Graphite Sheet Market Potential Customers

Potential customers for the Graphite Sheet Market are predominantly concentrated in sectors experiencing high heat flux density, rapid miniaturization, and a critical need for passive thermal management and electromagnetic compliance. The largest category of buyers comprises manufacturers of sophisticated consumer electronic devices, including multinational corporations producing flagship smartphones, high-end gaming laptops, and wearable technology where device thickness is a critical design constraint. These customers prioritize materials with ultra-high in-plane thermal conductivity and thinness to maximize performance while meeting aesthetic demands. This group represents a highly volume-sensitive segment, demanding competitive pricing and high-volume consistency.

A rapidly expanding segment of potential customers is the automotive industry, specifically manufacturers of Electric Vehicles (EVs) and hybrid vehicles. These buyers utilize graphite sheets extensively in Battery Thermal Management Systems (BTMS) to ensure uniform temperature distribution across battery cells, a requirement essential for maximizing battery lifespan and guaranteeing safety during high-power operation. Additionally, advanced driver-assistance systems (ADAS) and sophisticated in-car infotainment systems require graphite sheets for thermal and EMI shielding of sensitive electronic control units (ECUs). These customers require materials certified for harsh automotive environments, prioritizing durability, chemical stability, and adherence to automotive quality standards (e.g., AEC-Q standards).

Other significant end-users include manufacturers in the telecommunications sector, particularly those developing 5G base stations and data center infrastructure, where relentless heat dissipation from high-density server racks and power amplifiers is paramount. The industrial sector, including producers of high-power LED lighting, power electronics, and induction heating equipment, also constitutes a strong customer base, valuing graphite sheets for their long-term reliability and resistance to corrosive environments. The medical device industry uses specialized, high-purity graphite sheets in diagnostic equipment and therapeutic devices where thermal stability and biocompatibility are crucial requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Growth Rate | CAGR 12.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Showa Denko K.K., Panasonic Corporation, Teijin Limited, GrafTech International Ltd., SGL Carbon SE, Toyo Tanso Co., Ltd., Nippon Carbon Co., Ltd., Hitachi Chemical Co., Ltd. (Showa Denko Materials), 3M Company, Laird Performance Materials (Dupont), TDK Corporation, Fujikura Ltd., Zhaojun Carbon Co., Ltd., Beihai Graphene Technology Co., Ltd., Nanjing Hotai Material Technology Co., Ltd., Shenzhen Caben Technology Co., Ltd., Dexin Science and Technology, Chengdu Huarui Graphite Equipment Co., Ltd., T-Global Technology Co., Ltd., Morgan Advanced Materials plc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Graphite Sheet Market Key Technology Landscape

The technology landscape for the Graphite Sheet Market is highly dynamic, driven by continuous innovation aimed at optimizing thermal performance, reducing thickness, and improving mechanical robustness. A core technological focus involves enhancing the graphitization process, particularly for synthetic sheets, where chemical vapor deposition (CVD) and high-temperature sintering techniques are constantly refined. Advancements in polymer precursor selection and treatment, such as utilizing specialized polyimide films, enable manufacturers to achieve higher levels of crystal orientation, resulting in unprecedented in-plane thermal conductivity (often exceeding 1,500 W/mK) while maintaining extreme thinness, crucial for highly compact devices like foldable smartphones and advanced wearables.

Another critical area of technological development lies in composite graphite sheet construction. Manufacturers are increasingly integrating graphite sheets with other materials, such as thin metallic foils (e.g., copper or aluminum) or specialized insulating polymer layers, to create hybrid thermal interface materials (TIMs). These composite structures are designed to provide both exceptional lateral heat spreading (via graphite) and vertical heat transfer or improved structural support, offering multifunctional capabilities like thermal management combined with electromagnetic shielding (EMI/RFI). The precise control over the lamination and bonding of these layers is a key technological differentiator, ensuring the mechanical integrity of the composite under continuous thermal cycling and mechanical stress.

Furthermore, automation and process control technologies are crucial for mass production efficiency. High-precision laser cutting and automated assembly systems are employed to handle the delicate, ultra-thin sheets and integrate them accurately into complex device assemblies. The utilization of advanced metrology and non-contact inspection methods (often leveraging AI-driven computer vision) ensures the uniformity and defect-free nature of the material surface, which is paramount for achieving optimal thermal contact resistance in demanding applications. Future technological breakthroughs are anticipated in roll-to-roll processing techniques for scalable, low-cost production of flexible graphite films and the development of tailored graphite structures for anisotropic acoustic damping and improved mechanical shock absorption in next-generation electronics.

The push for improved environmental performance is also driving technology. Efforts are being made to develop bio-based or recycled precursors for synthetic graphite, aiming to reduce the reliance on fossil fuel derivatives and decrease the overall carbon footprint of the manufacturing process. Novel technologies for enhancing the purity of natural graphite flakes without using harsh chemicals are also under intense investigation. These innovations address both market demand for superior thermal properties and growing regulatory and consumer pressure for sustainable materials sourcing and production methods across the electronics and automotive supply chains.

In the specialized field of battery thermal management, technological advances focus on incorporating intumescent or fire-retardant additives directly into the graphite sheet matrix. This creates passive thermal runaway protection systems within the EV battery pack, enhancing safety without significantly increasing the weight or volume. This hybridization of thermal management and safety features represents a significant technological leap. The ability to bond these modified graphite sheets directly to the battery cell surface while maintaining flexibility and thermal contact efficiency is a complex engineering challenge, requiring highly advanced surface treatment and adhesive formulation technologies.

Digital twin technology is also beginning to penetrate the R&D cycle. Manufacturers are creating comprehensive digital models of the graphite sheet production line and the final product's thermal behavior under various simulated load conditions. This allows for rapid iteration of material properties, testing complex thermal interactions before physical prototypes are created, drastically cutting development costs and time-to-market. This integration of advanced computational science reflects the increasing sophistication required to maintain competitiveness in the high-performance thermal materials sector, emphasizing precision engineering and predictive performance modeling.

Regional Highlights

- Asia Pacific (APAC): APAC is the unequivocally dominant market for graphite sheets, driven by the massive manufacturing capacity for consumer electronics (smartphones, computing devices), particularly in China, South Korea, Taiwan, and Japan. The region's leadership is further solidified by being the epicenter of global battery production for electric vehicles, necessitating high volumes of high-performance graphite for Battery Thermal Management Systems (BTMS). The aggressive rollout of 5G and 6G infrastructure across key Asian economies also generates substantial demand for thermal and EMI shielding applications in network equipment and user devices.

- North America: North America represents a mature yet rapidly expanding market, primarily fueled by the accelerating adoption of Electric Vehicles (EVs) by manufacturers like Tesla and traditional automakers shifting production focus. Significant growth is also observed in the high-performance computing (HPC) sector, including large data centers and specialized AI computing hardware that require premium, synthetic graphite sheets for intense heat dissipation. The region emphasizes high-specification products and advanced thermal composites due to stringent performance requirements in defense and aerospace applications.

- Europe: Europe is a key growth region, highly focused on sustainable mobility and advanced industrial applications. Demand is primarily generated by European EV manufacturing giants and their supply chains, driven by ambitious regional targets for vehicle electrification. Furthermore, industrial automation, renewable energy systems (e.g., inverters), and specialized medical equipment production utilize graphite sheets for efficient heat management, valuing high-quality, durable materials that comply with strict EU environmental regulations. Germany, France, and the UK are primary consumers.

- Latin America (LATAM): The LATAM market is emerging, characterized by increasing industrialization and gradual expansion of the consumer electronics assembly sector. While smaller than APAC or North America, the demand for graphite sheets is growing steadily, particularly in infrastructure projects, telecommunications upgrades, and the nascent local EV market development. Brazil and Mexico are the primary centers of consumption, driven by local manufacturing and assembly plants.

- Middle East and Africa (MEA): The MEA market holds significant long-term potential, primarily linked to large-scale investments in smart city development, sophisticated telecommunications infrastructure, and oil & gas automation systems which require robust electronic components and thermal management solutions. Investments in data center construction, particularly in the UAE and Saudi Arabia, are driving demand for high-end thermal materials, although the market remains niche compared to global averages.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Graphite Sheet Market.- Showa Denko K.K.

- Panasonic Corporation

- Teijin Limited

- GrafTech International Ltd.

- SGL Carbon SE

- Toyo Tanso Co., Ltd.

- Nippon Carbon Co., Ltd.

- Hitachi Chemical Co., Ltd. (Showa Denko Materials)

- 3M Company

- Laird Performance Materials (DuPont)

- TDK Corporation

- Fujikura Ltd.

- Zhaojun Carbon Co., Ltd.

- Beihai Graphene Technology Co., Ltd.

- Nanjing Hotai Material Technology Co., Ltd.

- Shenzhen Caben Technology Co., Ltd.

- Dexin Science and Technology

- Chengdu Huarui Graphite Equipment Co., Ltd.

- T-Global Technology Co., Ltd.

- Morgan Advanced Materials plc.

Frequently Asked Questions

Analyze common user questions about the Graphite Sheet market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of graphite sheets in modern electronics?

The primary function of graphite sheets is passive thermal management and heat dissipation. Their exceptionally high in-plane thermal conductivity (ability to spread heat laterally) allows them to efficiently draw localized heat away from sensitive components like CPUs and batteries, protecting the device from overheating and improving performance longevity.

How do synthetic graphite sheets differ from natural graphite sheets in performance?

Synthetic graphite sheets typically offer higher purity and more consistent, controllable thermal properties, often achieving superior in-plane thermal conductivity. Natural graphite sheets are generally more cost-effective but may exhibit greater variability in purity and structure, making synthetic sheets preferred for high-end, performance-critical applications like advanced ECUs and high-density computing.

Which application segment is driving the highest growth rate in the market?

The automotive application segment, specifically Electric Vehicle (EV) Battery Thermal Management Systems (BTMS), is projected to exhibit the highest Compound Annual Growth Rate (CAGR). The global shift toward electric mobility requires vast quantities of reliable, lightweight thermal materials to manage the intense heat generated by large lithium-ion battery packs.

What challenges exist regarding the manufacturing of ultra-thin graphite sheets?

Key manufacturing challenges include maintaining structural integrity and desired thermal anisotropy (directional heat flow) during the high-temperature graphitization and subsequent rolling/compression processes. Achieving ultra-thin profiles (under 50 microns) without introducing defects or significant thickness variation is technically demanding and requires specialized, high-precision processing equipment.

Is the integration of graphite sheets in 5G devices primarily for thermal or EMI shielding?

In 5G devices, graphite sheets are crucial for both thermal management and Electromagnetic Interference (EMI) shielding. The high power density and increased frequency use in 5G components generate more heat, necessitating excellent thermal spreading. Simultaneously, the material’s structure helps attenuate electromagnetic noise, ensuring signal integrity in complex, tightly packed 5G architecture.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Flexible Graphite Sheet Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Flexible Graphite Sheet Market Size Report By Type (Natural, Synthetic), By Application (Laptop, LED Lighting, Flat Panel Displays, Digital Cameras, Phone, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Graphite Sheet Market Size Report By Type (Natural Graphite Sheet, Synthetic Graphite Sheet, Nanocomposite Graphite Sheet), By Application (Laptop, LED Lighting, Flat Panel Displays, Digital Cameras, Phone, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- High Thermal Conductive Graphite Sheet Market Statistics 2025 Analysis By Application (Laptop, LED Lighting, Flat Panel Displays, Digital Cameras, Phone, Others), By Type (Natural Graphite Sheet, Synthetic Graphite Sheet, Nanocomposite Graphite Sheet), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager