Heavy Brick Type Tile Adhesive Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442780 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Heavy Brick Type Tile Adhesive Market Size

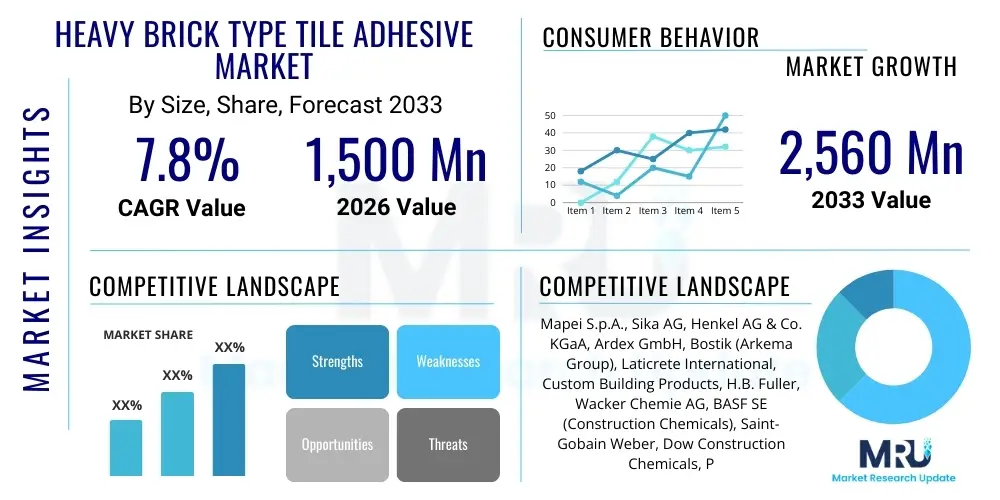

The Heavy Brick Type Tile Adhesive Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 3.3 Billion by the end of the forecast period in 2033. This robust expansion is primarily fueled by the accelerating rate of infrastructure development globally, particularly in emerging economies, coupled with stringent regulatory requirements demanding high-performance, durable construction materials for exterior cladding and large-format tile installations. The increasing popularity of heavy natural stone, engineered brick veneer, and large-format porcelain slabs necessitates specialized adhesive formulations capable of bearing significant dead loads and resisting extreme environmental stresses, driving premium segment growth.

Heavy Brick Type Tile Adhesive Market introduction

The Heavy Brick Type Tile Adhesive Market encompasses specialized chemical formulations designed for bonding high-density, low-porosity, and large-format construction elements, such as heavy clay bricks, thin brick veneers, natural stone slabs, and oversized ceramic or porcelain tiles, to various substrates. These advanced adhesives, primarily based on modified cementitious materials (e.g., polymer-modified mortars, or PM/C2-grade specifications) or reactive chemistries (e.g., epoxy and polyurethane systems), offer superior bond strength, flexibility, weather resistance, and slump resistance compared to traditional mortars. Key applications span high-rise commercial buildings, external thermal insulation composite systems (ETICS), heavy-duty flooring in industrial environments, and complex architectural facade installations where structural integrity and longevity are paramount.

Product differentiation in this market centers on specific technical attributes, including open time, adjustability, shear strength, and the ability to accommodate thermal movement differentials between the heavy brick or tile and the substrate. Major applications include facade cladding for residential and commercial complexes, swimming pool construction, demanding wet areas, and rapid repair solutions for aging infrastructure. The inherent benefits of these modern adhesives include reduced installation time, lower material consumption compared to thick-bed mortar applications, enhanced safety due to superior load-bearing capacity, and significantly improved aesthetic outcomes by minimizing efflorescence and staining.

The market is predominantly driven by increasing urbanization, which necessitates durable, aesthetically pleasing building exteriors capable of withstanding harsh weather cycles. Furthermore, the rising demand for eco-friendly and low-VOC (Volatile Organic Compounds) adhesive solutions, especially in developed markets, is shaping product innovation. Regulatory standards related to fire safety and structural integrity in building codes further mandate the use of certified heavy-duty adhesives, providing sustained momentum for market growth across all geographical regions.

Heavy Brick Type Tile Adhesive Market Executive Summary

The Heavy Brick Type Tile Adhesive Market is experiencing strong global momentum, underpinned by favorable macro-economic trends in construction and sustained innovation in polymer chemistry. Business trends indicate a clear shift towards specialized, single-component, rapid-setting adhesive systems that reduce on-site mixing complexity and accelerate project timelines. Manufacturers are strategically focusing on vertical integration and acquiring niche technology providers to secure robust supply chains for critical raw materials such as specialized polymers (Redispersible Polymer Powders - RDPs) and high-performance cement additives. Sustainability remains a core theme, with companies increasingly offering low-dust, recycled content, and low-embodied carbon adhesive solutions to meet green building standards and attract environmentally conscious developers, enhancing overall brand positioning and market accessibility.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, driven by massive infrastructure projects in China, India, and Southeast Asian nations, coupled with rapid residential expansion and luxury construction segments favoring high-end natural stone and large tiles. North America and Europe, while mature, exhibit high demand for premium, highly flexible adhesives required for demanding renovation projects and compliance with stringent energy efficiency regulations, particularly those involving exterior insulation systems. Segment trends reveal that the Polymer Modified Cementitious (PMC) category dominates the volume share due to cost-effectiveness and versatility, but the Reactive Resin (Epoxy/Polyurethane) segment is projected to register the fastest growth rate, fueled by its unparalleled performance in severe environmental conditions and applications requiring chemical resistance, such as industrial flooring and heavy cladding.

Overall, the market structure is moderately consolidated, with major global chemical and building material conglomerates holding significant market share, yet niche regional players focusing on specific application areas (e.g., facade bonding or submerged applications) continue to thrive by offering customized solutions. Key challenges include volatile raw material prices, particularly for petrochemical derivatives used in polymer modification, and the need for continuous installer training to ensure optimal application techniques for sophisticated adhesive systems. Strategic investment in R&D focusing on nanotechnology integration for enhanced strength and durability remains a crucial determinant for competitive success over the forecast horizon.

AI Impact Analysis on Heavy Brick Type Tile Adhesive Market

Analysis of common user questions regarding AI's influence on the Heavy Brick Type Tile Adhesive market reveals core themes centered on operational efficiency, quality control, and predictive material performance. Users frequently inquire about how AI can optimize adhesive formulation by analyzing massive datasets related to raw material variability, climate conditions, and application requirements, thereby minimizing product failure rates and maximizing bond strength reliability. There is significant interest in using machine learning models for predictive maintenance in manufacturing plants, optimizing batch consistency, and managing energy consumption during the complex polymerization and mixing processes. Furthermore, users expect AI integration in smart construction planning, utilizing algorithms to recommend the most suitable adhesive type based on project-specific parameters (substrate type, tile size/weight, environmental exposure) and optimizing inventory management at distribution centers, reducing waste and ensuring timely supply chain logistics. The consensus points towards AI primarily enhancing manufacturing precision, improving product specification accuracy, and streamlining construction site efficiency.

- AI-driven Predictive Formulation: Utilizing machine learning to optimize chemical composition based on desired performance metrics (e.g., slump resistance, open time, shear strength), reducing R&D cycles.

- Manufacturing Process Optimization: Employing AI in production lines for real-time monitoring of consistency, humidity, and temperature, ensuring batch uniformity and minimizing quality deviations.

- Supply Chain and Inventory Management: Predictive analytics for forecasting regional demand fluctuations, optimizing stock levels for critical raw materials, and improving logistical routing for final product delivery.

- Automated Quality Control (QC): Using computer vision and AI algorithms to inspect finished adhesive batches for particle size distribution or uniformity defects before packaging.

- Smart Application Guidance: Developing AI-powered applications that recommend the ideal adhesive system and application technique (trowel size, curing time) based on specific project inputs (climate data, substrate type, brick dimensions).

- Construction Site Robotics Integration: Enabling robotic systems for large-scale facade installation to precisely dispense and apply adhesives, monitored and calibrated by AI to maintain optimal thickness and coverage.

DRO & Impact Forces Of Heavy Brick Type Tile Adhesive Market

The market dynamics for heavy brick type tile adhesives are governed by a complex interplay of global construction mandates, material science advancements, economic volatility, and sustainability pressures. Key drivers include the global preference for robust, large-format building facades that demand superior load-bearing adhesives, coupled with increasingly stringent building codes related to fire safety and structural longevity in high-rise structures. Restraints primarily involve the high cost and volatility of key petrochemical derivatives used in polymer modification, which directly impacts manufacturing costs and final product pricing, alongside a persistent need for highly skilled labor capable of properly applying these technically demanding adhesive systems. Opportunities lie in developing advanced hybrid adhesive technologies, utilizing nanotechnology to enhance material properties, and penetrating fast-growing markets focused on sustainable retrofitting and infrastructure renewal.

The primary driving force is the global construction boom, particularly in high-density urban areas, which favors cladding materials like heavy tiles and engineered bricks for aesthetic and maintenance reasons. Furthermore, the requirement for External Thermal Insulation Composite Systems (ETICS) in Europe and North America to meet carbon reduction goals mandates the use of highly flexible, durable adhesives capable of withstanding extreme thermal cycling without degradation. The restraints are significantly compounded by supply chain disruptions impacting raw materials, especially RDPs and specialized polymers, leading to extended lead times and margin compression for manufacturers. Additionally, market penetration in rural or low-income regions remains challenging due to the higher cost profile of specialized heavy-duty adhesives compared to traditional sand-cement mortars.

Impact forces stemming from technological advancements are driving product innovation towards faster-curing, single-component, and environmentally superior formulations (e.g., low-dust, low-VOC). Regulatory impact forces, particularly those relating to health and safety standards (e.g., REACH regulations in Europe), compel manufacturers to continually reformulate products, phasing out certain toxic additives and ensuring superior performance documentation. Economic impact forces, such as fluctuating interest rates and GDP growth trajectories, heavily influence large-scale construction spending, which, in turn, dictates the demand cycles for heavy-duty adhesives. These combined forces necessitate a strategic approach focused on maintaining premium quality while exploring cost-effective raw material sourcing and maximizing application efficiency to deliver superior value to end-users.

Segmentation Analysis

The Heavy Brick Type Tile Adhesive Market is comprehensively segmented based on its chemical composition, application technology, end-user industry, and geographical distribution, providing a granular view of market dynamics and opportunity areas. Chemical composition is the fundamental segmentation, differentiating adhesives based on their primary binder system, which determines performance characteristics such as flexibility, water resistance, and set time. Application technology segmentation focuses on product delivery method—thin-set versus thick-set applications and paste versus powder formats—which directly impacts installation ease and scope. End-user categorization separates demand generated by residential, commercial, and industrial construction sectors, each having distinct technical requirements regarding load capacity and chemical resistance, driving specialized product requirements.

- By Chemical Composition:

- Polymer Modified Cementitious (PMC)

- Epoxy Adhesives (Reactive Resin)

- Polyurethane Adhesives (Reactive Resin)

- Acrylic Adhesives (Dispersion)

- By Application Technology:

- Thin-Set Mortar Application

- Thick-Bed Mortar Application

- Trowel/Spreading Application

- By End-User Industry:

- Residential Construction

- Commercial & Institutional Construction (Hospitals, Malls, Offices)

- Industrial Construction (Heavy-duty flooring, Chemical facilities)

- Infrastructure (Bridges, Tunnels, Public spaces)

- By Form:

- Powder (Dry Mix)

- Paste (Ready-to-Use)

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, India, Japan, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa (UAE, Saudi Arabia, South Africa, Rest of MEA)

Value Chain Analysis For Heavy Brick Type Tile Adhesive Market

The value chain for heavy brick type tile adhesives begins with the upstream procurement of essential raw materials, including specialized cements (high-aluminous, portland), various aggregates (silica sand, fillers), critical polymer additives (RDPs, cellulose ethers), and chemical modifiers (defoamers, rheology agents). This stage is characterized by intense price sensitivity and dependence on petrochemical suppliers for polymer derivatives, making supply chain resilience critical. Following material procurement, the manufacturing stage involves complex, quality-controlled blending and packaging processes, often requiring specialized mixing equipment to ensure homogenous distribution of polymers and additives in dry mix or wet paste formats. Leading manufacturers invest heavily in R&D here to optimize product consistency and performance metrics essential for heavy-load applications, which represents a major value-add activity.

The downstream distribution channel involves a multi-tiered approach, leveraging specialized distributors, large-scale construction material retailers (e.g., DIY chains, builders’ merchants), and direct sales to major construction contractors and large project specification teams. Direct sales are crucial for highly technical or custom formulated adhesives, where technical support and on-site training are mandatory. Distributors play a vital role in inventory management, localized logistics, and providing technical support to smaller contractors and tradespeople. The final stage involves the professional application by skilled tilers and facade installers who interact directly with the end-users (property owners/developers). Adherence to proper application techniques, often requiring specific tools and curing conditions, is essential for realizing the full value and ensuring the performance guarantee of the heavy-duty adhesive.

Direct channel interactions, typically involving specification sales and large volume contracts for major infrastructure or commercial projects, ensure better margin control and allow manufacturers to capture detailed end-user feedback for product refinement. Indirect channels, encompassing retailers and general distributors, maximize market reach and cater to the fragmented residential and small commercial segment. Optimizing the flow of information regarding product specifications and compliance standards throughout both direct and indirect channels is paramount, especially since the failure of heavy brick or tile facades due to incorrect adhesive selection or application can lead to significant liability and reputational damage for all parties involved.

Heavy Brick Type Tile Adhesive Market Potential Customers

The primary customers for Heavy Brick Type Tile Adhesives are entities requiring robust, long-lasting bonding solutions for large-format, high-density materials in structurally demanding or environmentally exposed applications. Major consumers include large-scale commercial real estate developers specializing in high-rise office towers, luxury residential complexes, and mixed-use developments that utilize natural stone or intricate brick veneers for architectural prominence. These customers prioritize high shear strength, long-term durability, and compliance with stringent facade safety regulations, often specifying premium C2 TE S2 (cementitious, improved, slip-resistant, extended open time, high deformability) adhesive types to mitigate risk associated with heavy cladding failures and thermal expansion.

Another crucial customer segment encompasses specialized construction contractors focused on infrastructure projects, such as tunneling, bridge construction, and public amenities requiring heavy-duty, chemically resistant flooring and wall linings (e.g., subway stations, wastewater treatment plants). These customers demand adhesives with specific resistance characteristics, rapid curing times to minimize disruption, and exceptional moisture barrier properties. Furthermore, industrial facility operators, particularly in manufacturing, logistics, and food processing sectors, constitute a key end-user group, requiring epoxy-based heavy tile adhesives for flooring that must withstand constant heavy traffic, chemical spills, and intensive cleaning cycles, thereby extending the lifespan of the installed surface material.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.3 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sika AG, H.B. Fuller, Ardex GmbH, Mapei S.p.A., Saint-Gobain (Weber), Laticrete International, Wacker Chemie AG, Dow Inc., Bostik (Arkema Group), Fosroc International, BASF SE, Pidilite Industries Ltd., Henkel AG & Co. KGaA, AkzoNobel N.V., Custom Building Products, Quikrete Holdings, Inc., Duralex (ParexGroup), Franklin International, Chemfix Products Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Heavy Brick Type Tile Adhesive Market Key Technology Landscape

The technology landscape of the Heavy Brick Type Tile Adhesive market is defined by continuous innovation aimed at enhancing mechanical strength, flexibility, and application ease. Polymer Modified Cementitious (PMC) adhesives remain the technological backbone, with advancements focusing on optimizing the ratio and type of Redispersible Polymer Powders (RDPs) to achieve superior adhesion to challenging, low-porosity surfaces common with heavy porcelain or engineered brick. Key technological development involves utilizing high-performance specialty polymers that impart enhanced water repellency and freeze-thaw stability, making the resulting adhesive suitable for exterior applications in extreme climatic zones. Furthermore, technologies focusing on rapid hydration cements and set accelerators are pivotal, allowing for significantly reduced curing times without compromising final bond strength, which addresses the construction industry's demand for faster project completion.

A significant technological frontier is the integration of nanotechnology, specifically incorporating nano-silica or carbon nanotubes into the adhesive matrix. This technique demonstrably improves the internal structure of the cured adhesive, boosting crack bridging capability, increasing flexural strength, and enhancing overall resistance to dynamic loading and vibration. Such high-tech formulations are increasingly specified for crucial load-bearing applications like tall building facades and high-vibration industrial environments. Additionally, the development of specialized reactive resin systems (Epoxies and Polyurethanes) tailored for specific, extremely heavy materials or chemically aggressive environments continues to evolve, focusing on low-viscosity formulations that ensure complete wetting of the bonding surface and superior barrier properties against moisture ingress or corrosive substances.

Furthermore, technology is heavily influencing sustainability, leading to the proliferation of low-VOC and low-dust adhesive formulations. Manufacturers are deploying advanced mixing technology to encapsulate fine cement particles, drastically reducing dust emissions during on-site mixing, improving worker safety and compliance with environmental health regulations. Innovations in packaging technology, such as moisture-resistant bags and self-sealing containers, are also critical for maintaining the stability and shelf life of specialized polymer-modified powders, ensuring product performance consistency from factory to final installation point, a critical factor given the high demands placed on heavy-duty adhesives.

Regional Highlights

- North America (U.S., Canada, Mexico): North America is characterized by high adoption rates of premium, highly flexible adhesives, primarily driven by stringent construction standards related to seismic activity, freeze-thaw cycles, and energy efficiency mandates (ETICS systems). The U.S. market exhibits significant demand for specialized adhesives for exterior brick veneer applications on commercial and institutional buildings. Innovation in this region is focused on sustainable formulations (low-VOC, recycled content) and the rapid growth of large-format tile installations in luxury residential and commercial segments. The renovation and remodeling sector, especially for infrastructure renewal, heavily contributes to the consistent demand for high-performance, heavy-duty tile mortars capable of long-term structural integrity. Canada’s market is particularly sensitive to severe weather conditions, thus emphasizing S2 classification adhesives with superior elasticity and temperature cycling resistance.

- Europe (Germany, UK, France, Italy, Spain): Europe is a highly mature market, driven significantly by adherence to rigorous EU standards, particularly EN 12004 classifications (C2, S1, S2), which dictate the performance requirements for tile adhesives. Germany and the UK show strong uptake due to their focus on exterior insulation systems (ETICS) for energy conservation, requiring highly flexible, cementitious polymer-modified adhesives capable of supporting heavy external cladding materials. Southern European nations like Italy and Spain, major producers and consumers of ceramic tiles, drive demand for specialized thin-set mortars for large format porcelain. The overall regional trend favors environmentally friendly adhesives that align with the EU Green Deal objectives, pushing manufacturers toward solvent-free and extremely low-emission products, positioning performance alongside ecological responsibility as key purchasing criteria.

- Asia Pacific (APAC) (China, India, Japan, South Korea): APAC represents the fastest-growing region globally, primarily fueled by rapid urbanization, massive investments in public infrastructure, and a burgeoning middle class demanding higher quality construction standards. China and India are the dominant markets, characterized by rapid high-rise residential construction and commercial development where heavy stone and brick cladding are widely used for durability and aesthetics. While pricing sensitivity remains a factor, the increasing awareness of material failure risks in high-rise buildings is pushing regulatory authorities and developers to adopt higher-grade polymer-modified cementitious adhesives, moving away from conventional site-mixed mortars. Japan and South Korea, being technologically advanced markets, display high demand for rapid-curing, high-tech adhesives tailored for pre-fabricated building components and seismic resistance.

- Latin America (Brazil, Argentina, Rest of Latin America): The Latin American market for heavy brick type tile adhesives is experiencing moderate yet steady growth, primarily driven by investments in large-scale residential housing projects and essential infrastructure development. Brazil, the largest market in the region, sees significant adoption of performance-based adhesives due to the need to withstand high heat and humidity levels, which can challenge traditional bonding materials. Market maturity is varied, with larger economies gradually transitioning towards polymer-modified systems, emphasizing water resistance and improved initial grab for vertical installations. Price remains a crucial determinant in purchasing decisions, but product durability is increasingly valued due to the high costs associated with repair and replacement of exterior finishes.

- Middle East & Africa (MEA) (UAE, Saudi Arabia, South Africa): The MEA region is characterized by high-volume, capital-intensive construction projects, particularly in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia), focusing on massive commercial developments, luxury resorts, and high-rise structures. Extreme heat and intense UV exposure necessitate specialized adhesives that can maintain flexibility and bond strength under high-temperature stress and rapid thermal cycling. The demand is heavily skewed towards premium, high-performance epoxy and highly modified cementitious adhesives (C2 TE S2) suitable for exterior facades and rooftop installations. South Africa and parts of North Africa show consistent, lower-volume demand driven by general commercial construction and increasing requirements for heavy-duty industrial flooring.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Heavy Brick Type Tile Adhesive Market.- Sika AG

- H.B. Fuller

- Ardex GmbH

- Mapei S.p.A.

- Saint-Gobain (Weber)

- Laticrete International

- Wacker Chemie AG

- Dow Inc.

- Bostik (Arkema Group)

- Fosroc International

- BASF SE

- Pidilite Industries Ltd.

- Henkel AG & Co. KGaA

- AkzoNobel N.V.

- Custom Building Products

- Quikrete Holdings, Inc.

- Duralex (ParexGroup)

- Franklin International

- Chemfix Products Ltd.

- Cemix Group

Frequently Asked Questions

Analyze common user questions about the Heavy Brick Type Tile Adhesive market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between standard tile adhesive and heavy brick type tile adhesive?

The primary difference lies in load-bearing capacity and flexibility. Heavy brick type adhesives (typically C2 or higher rated) contain higher concentrations of polymer modifiers (RDPs) to provide superior shear strength, slump resistance, and elasticity (S1 or S2 classification) necessary to securely bond non-porous, large-format, and heavy materials like natural stone or thin brick veneers against gravity and thermal movement over the long term, whereas standard adhesives are suited only for lighter ceramic tiles.

Which chemical composition segment is projected to experience the fastest growth rate?

The Reactive Resin segment, primarily comprising Epoxy and Polyurethane adhesives, is projected to register the fastest growth rate. This accelerated expansion is attributed to their unparalleled performance characteristics, including extreme chemical resistance, superior waterproofing, and exceptionally high bond strength, making them mandatory for industrial environments, submerged applications (swimming pools), and critical facade installations where conventional cementitious products may fail.

How do stringent building codes influence the demand for these specialized adhesives?

Stringent building codes, particularly those related to facade safety, seismic resilience, and fire resistance, mandate the use of independently certified, high-performance adhesives. These regulations effectively prevent the use of cheaper, traditional mortars for heavy cladding, thereby significantly increasing the demand for certified, heavy brick type tile adhesives (e.g., meeting EN 12004 standards) that provide verifiable long-term structural stability and compliance.

What role does Polymer Modified Cementitious (PMC) technology play in this market?

PMC technology remains the dominant market segment by volume due to its cost-effectiveness, ease of use (in powder form), and versatility. Ongoing innovation in PMC involves incorporating advanced RDPs and specialized additives to continually push performance limits, allowing these systems to handle increasingly heavy and large tiles, maintaining high shear strength and deformability (up to S2 grade) while retaining the application characteristics familiar to professional installers.

Which geographical region holds the largest market share and why?

The Asia Pacific (APAC) region currently holds the largest market share, driven primarily by the colossal scale of its construction industry, fueled by rapid urbanization and massive infrastructure investment in countries like China and India. The sheer volume of new residential, commercial, and high-rise building projects utilizing heavy exterior cladding materials creates the highest aggregated demand for specialized, high-performance adhesive solutions globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager