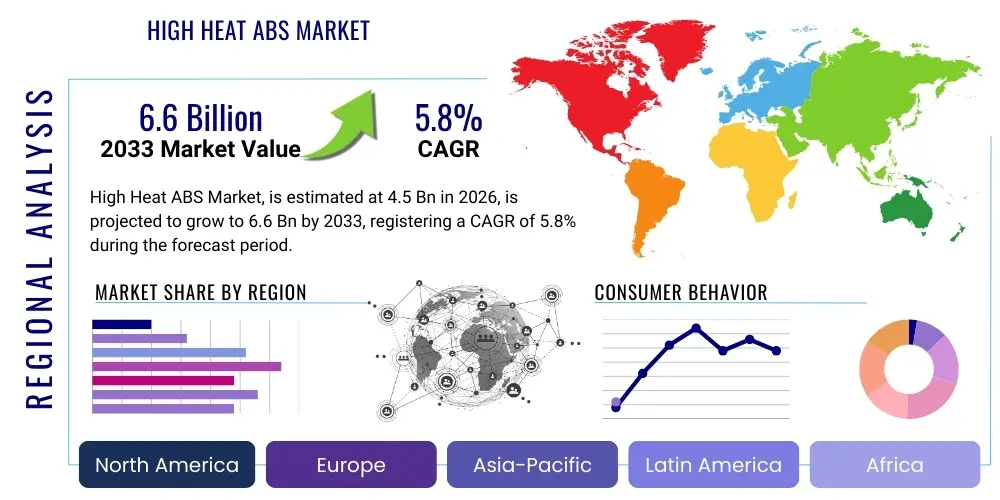

High Heat ABS Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442198 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

High Heat ABS Market Size

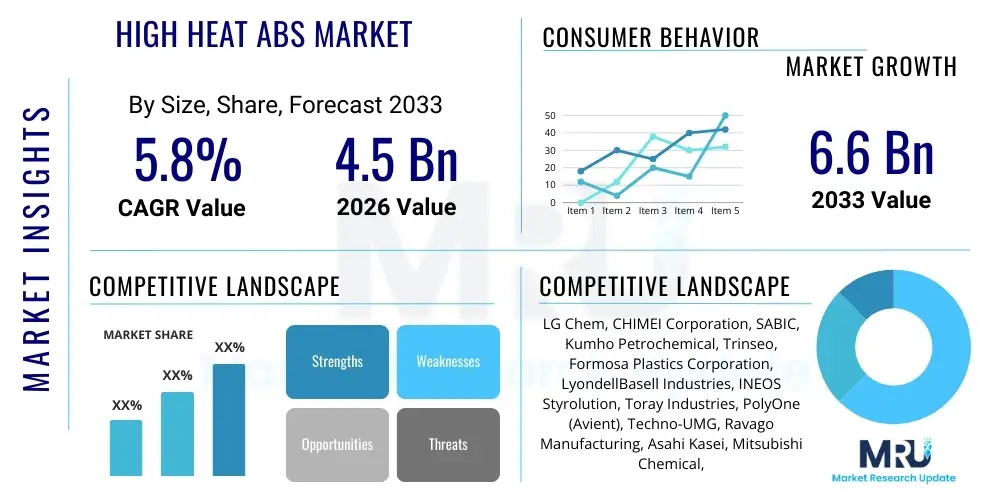

The High Heat ABS Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.6 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating demand from the automotive sector, particularly the requirements for lightweighting and thermal resistance in internal combustion engine (ICE) vehicles and emerging electric vehicle (EV) applications, alongside continuous miniaturization trends in the electronics industry.

High Heat ABS Market introduction

High Heat Acrylonitrile Butadiene Styrene (HH ABS) is a specialized engineering thermoplastic characterized by superior thermal stability and higher deflection temperatures under load compared to conventional ABS. This enhanced performance makes it indispensable in applications exposed to elevated temperatures, preventing deformation, maintaining structural integrity, and ensuring long-term reliability. The robust mechanical properties, coupled with excellent processability and dimensional stability, position HH ABS as a preferred material over traditional alternatives like standard ABS, polycarbonate (PC), or even specific grades of polyamides (PA) in certain high-demand environments.

Major applications of High Heat ABS span critical sectors, most notably automotive interior and exterior components, particularly those near engines or requiring resistance to solar loading, as well as high-wattage appliance casings, and various components within the electrical and electronics sector, such as printer housings and projector parts. The primary benefits derived from using HH ABS include increased component lifespan, improved safety due to better fire resistance properties in certain grades, and the ability to achieve complex geometries through standard injection molding processes while handling temperatures often exceeding 100°C, which is beyond the capability of standard ABS formulations.

Driving factors for the market expansion include global regulatory pressures enforcing stricter fuel efficiency standards, which necessitates the use of lightweight materials to replace metals, especially in transportation. Furthermore, the rapid growth of the consumer electronics market, demanding aesthetically pleasing yet durable and thermally resistant materials for devices, significantly bolsters demand. The continued diversification of HH ABS grades, including those offering improved chemical resistance and enhanced color stability, further broadens its applicability across specialized industrial machinery and medical device components.

High Heat ABS Market Executive Summary

The High Heat ABS market is experiencing robust commercial growth, fundamentally supported by the dynamic shifts in the automotive industry, particularly the transition towards electric and hybrid vehicles. Business trends indicate a strong emphasis on strategic collaborations between raw material suppliers and Tier 1 automotive component manufacturers to develop tailor-made compounds that meet rigorous performance and regulatory standards, such as those related to volatile organic compounds (VOCs). Key players are heavily investing in capacity expansion in the Asia Pacific region to capitalize on the accelerating production capacity in countries like China and India, which are rapidly becoming global manufacturing hubs for both automotive and electronics products. Sustainability mandates are also reshaping business models, pushing manufacturers to explore and certify bio-based or recycled content in their HH ABS formulations.

Regionally, the Asia Pacific dominates both production and consumption, driven by massive industrial growth and high domestic demand for consumer electronics and transportation infrastructure development. North America and Europe maintain a mature market structure characterized by high technological innovation and strict material specifications, leading to premium pricing for advanced HH ABS grades, particularly those required for complex thermal management systems in luxury vehicles and high-end industrial equipment. While APAC focuses on volume and general application segments, the Western markets drive innovation in specialized, flame-retardant, and highly engineered grades required for safety-critical applications.

Segment trends confirm that the Automotive application segment remains the largest consumer, valuing the material’s thermal performance and lightweight characteristics for both interior trim and structural components. The Electrical & Electronics segment is the fastest-growing segment, propelled by the relentless pace of innovation in IT hardware, communication devices, and smart home appliances, all of which generate significant internal heat requiring reliable thermal resistance from housing materials. The market for Flame Retardant High Heat ABS grades is also seeing disproportionate growth, mandated by increasingly stringent fire safety regulations globally, particularly for electrical installations and public transportation interiors.

AI Impact Analysis on High Heat ABS Market

Common user questions regarding AI's influence often center on its role in accelerating material innovation, optimizing complex polymerization processes, and ensuring predictive quality control in compounding and manufacturing. Users are keen to understand how AI-driven predictive modeling can reduce R&D cycles for new HH ABS grades with specific thermal or mechanical properties. The key themes revolve around achieving material consistency, reducing waste, and automating supply chain logistics. Expectations are high that AI will transform raw material sourcing (styrene, butadiene, acrylonitrile) by predicting price fluctuations and optimizing procurement strategies, thereby stabilizing profit margins despite volatile commodity markets, and enhancing overall operational efficiency across the entire High Heat ABS value chain.

- AI-driven optimization of polymerization reactor conditions to maximize yield and control molecular weight distribution, directly improving the high-heat performance consistency of the final polymer.

- Predictive maintenance analytics applied to compounding equipment, minimizing unplanned downtime and ensuring the continuous, high-quality production of HH ABS pellets.

- Machine learning algorithms used for virtual material screening, accelerating the discovery and formulation of novel high-performance additives that enhance thermal resistance or flame retardancy.

- Enhanced quality control systems utilizing computer vision and AI for real-time defect detection during injection molding or extrusion processes of HH ABS components.

- Optimization of complex global supply chains, forecasting demand accurately, and dynamic routing of materials to mitigate risks associated with geopolitical instabilities and transportation delays.

DRO & Impact Forces Of High Heat ABS Market

The market for High Heat ABS is fundamentally shaped by a combination of strong market drivers, persistent restraints, and significant opportunities, which collectively form the impact forces determining its future trajectory. A primary driver is the pervasive trend of lightweighting in the transportation sector, driven by stringent CO2 emission targets and the necessity for improved energy efficiency. HH ABS offers a compelling balance of high-temperature resistance and low density, enabling the replacement of heavier, more costly materials like metals or specialized engineering plastics in demanding applications such as automotive under-hood components, interior parts subject to extreme solar load, and structural elements of battery enclosures in EVs.

However, the market faces considerable restraints, primarily the inherent volatility of raw material prices. Styrene, acrylonitrile, and butadiene are petrochemical derivatives, making the production costs highly susceptible to fluctuations in crude oil prices and the global supply-demand dynamics of these chemical intermediates. This cost instability complicates long-term planning for manufacturers and can erode profit margins, especially when competing against lower-cost standard polymers. Furthermore, the processing of certain high-heat grades can be more challenging and require specialized equipment, leading to higher initial capital expenditure for fabricators compared to conventional plastics.

Opportunities for growth are plentiful, centering particularly on the burgeoning market for electric vehicles (EVs) where HH ABS can be utilized for thermal management system components and internal battery module housings, requiring robust thermal resistance and dielectric properties. Another critical opportunity lies in the development of sustainable, bio-based or chemically recycled High Heat ABS variants, catering to corporate sustainability goals and circular economy initiatives increasingly mandated by global brand owners. The development of specialized, low-VOC (Volatile Organic Compound) grades for automotive interiors, meeting increasingly strict air quality standards, also presents a lucrative niche for innovation and market expansion. The combined impact forces suggest a net positive growth environment, heavily weighted towards technological evolution and application diversification, outweighing the challenges posed by cost volatility and processing complexity.

Segmentation Analysis

The High Heat ABS market is comprehensively segmented based on its grade characteristics, primary application areas, and the specific end-use industries it serves, reflecting the diverse performance requirements across various manufacturing sectors. Segmentation is crucial for understanding specific growth pockets, as the material requirements for an automotive headlight bezel differ significantly from those required for a high-wattage hair dryer casing. The inherent ability of manufacturers to tailor HH ABS formulations—varying heat deflection temperature, impact strength, and flow characteristics—allows for precise market targeting and optimization of product offerings to meet highly specialized demands.

The segmentation by application clearly indicates the market dominance of sectors where thermal stability is paramount for safety and function. The Automotive segment necessitates materials that withstand high engine temperatures, while the Electrical & Electronics sector requires materials that manage heat generated by internal components, preventing overheating and device failure. Furthermore, segmentation by grade (e.g., standard versus flame retardant) allows key players to address regulatory compliance requirements, particularly in construction, public transportation, and power tools, where fire safety standards are non-negotiable and mandate the use of V-0 or 5VA rated materials.

The ongoing trend of segment diversification is evident in the push towards specialized grades tailored for additive manufacturing (3D printing). While traditional injection molding still accounts for the vast majority of volume, the increasing adoption of HH ABS filaments and powders for prototyping and small-batch production of thermally demanding components represents a future growth area. Analyzing these segments provides strategic insights into investment areas, such as focusing R&D efforts on materials that offer high flow rates for thin-wall applications or enhanced UV resistance for outdoor use.

- By Application:

- Automotive Components (Interior, Exterior, Under-the-Hood)

- Electrical & Electronics (Consumer Electronics Housing, IT Hardware Components)

- Home Appliances (High-Wattage Appliances, White Goods)

- Industrial & Construction (Piping, Machinery Parts, Safety Equipment)

- Others (Medical Devices, Toys)

- By Grade:

- Standard High Heat ABS

- Flame Retardant High Heat ABS

- Reinforced/Filled High Heat ABS (e.g., Glass Fiber Reinforced)

- Specialty Grades (e.g., High Flow, High Gloss)

- By End-Use Industry:

- Automotive Manufacturing

- Appliance Manufacturing

- IT and Telecommunications

- Industrial Machinery

Value Chain Analysis For High Heat ABS Market

The value chain for the High Heat ABS market begins intensely in the upstream sector with the production and procurement of core monomers: Styrene Monomer (SM), Acrylonitrile Monomer (AN), and Butadiene Monomer (BD). These raw materials, derived predominantly from petrochemical refining, dictate the initial cost structure and supply stability of the final polymer. Manufacturers of HH ABS, such as major chemical conglomerates, invest heavily in integrated production facilities or long-term supply agreements to mitigate the inherent volatility and complexity of the commodity chemical market. The sophistication of the upstream synthesis and polymerization processes is critical, as achieving the necessary glass transition temperature (Tg) for high-heat performance requires precise control over polymer morphology and additive incorporation during the compounding stage.

Midstream activities involve the actual polymerization (typically emulsion or mass polymerization techniques) followed by compounding, where specialized heat stabilizers, impact modifiers, and flame retardants are blended into the base resin to achieve the specific performance profile required by the market segment. This compounding stage is where the distinction between standard ABS and High Heat ABS is fundamentally created, relying on proprietary formulation expertise. The resulting HH ABS pellets are then channeled through various distribution channels. Direct distribution is common for large-volume customers, such as major Automotive OEMs or Tier 1 suppliers, facilitating technical support and ensuring stringent quality control measures are met across the supply chain.

Downstream activities are dominated by processors and end-use manufacturers. Injection molders and extruders convert the raw pellets into finished components like car dashboards, electrical connectors, or high-end appliance casings. The indirect distribution channel involves regional distributors and specialized compounders who cater to smaller fabricators and niche markets, providing custom colors and smaller batch sizes. The ultimate consumers are the automotive, electronics, and appliance industries, which drive the demand for specific grades and specifications. Success in the downstream market relies heavily on the ability of the material to meet demanding certifications, aesthetic requirements, and performance longevity under sustained thermal stress.

High Heat ABS Market Potential Customers

Potential customers for High Heat ABS are concentrated within manufacturing sectors that require engineering plastics capable of sustaining high operating temperatures or resisting heat exposure generated either internally (electronics) or externally (environmental factors, engine heat). The primary end-users are large-scale global automotive manufacturers (OEMs) and their extensive network of Tier 1 and Tier 2 suppliers. These customers purchase HH ABS for critical interior components like instrument panels, HVAC outlets, pillar trims, and especially for exterior components that must resist solar radiation deformation, or under-the-hood applications requiring resistance to engine heat and various automotive fluids. The shift toward electric vehicles is broadening the customer base to include battery manufacturers and EV component specialists who require flame-retardant and thermally stable materials for battery modules and charging port components.

Another major segment of potential customers encompasses manufacturers in the Electrical and Electronics (E&E) industry. This includes producers of large home appliances, such as ovens and washing machine controls, and smaller, high-wattage appliances like hair dryers, coffee makers, and industrial lighting fixtures where sustained heat generation is a constant challenge. Within the IT sector, customers include manufacturers of server casings, printer components (especially fusing assemblies), and specialized network equipment that operates in constrained, high-temperature environments. These customers prioritize materials offering excellent surface finish, color consistency, and compliance with strict flammability standards (e.g., UL listings).

Furthermore, niche potential customers exist in specialized industrial and medical device manufacturing. Industrial machinery manufacturers use HH ABS for durable casings and covers exposed to operational heat or requiring low coefficient of thermal expansion (CTE) for dimensional stability. In the medical field, high-heat stability is essential for components that must withstand repeated sterilization cycles (e.g., autoclaving), such as certain device housings and specialized trays. Ultimately, any fabricator seeking to replace higher-cost polycarbonates or structurally demanding metals while improving thermal resistance over standard ABS represents a key target customer for High Heat ABS suppliers globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LG Chem, CHIMEI Corporation, SABIC, Kumho Petrochemical, Trinseo, Formosa Plastics Corporation, LyondellBasell Industries, INEOS Styrolution, Toray Industries, PolyOne (Avient), Techno-UMG, Ravago Manufacturing, Asahi Kasei, Mitsubishi Chemical, Chi Mei Materials Technology, LOTTE Advanced Materials, Versalis (Eni), BASF, Samsung SDI Chemical, Kaneka Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Heat ABS Market Key Technology Landscape

The core technology underpinning the High Heat ABS market revolves around sophisticated polymerization techniques and proprietary compounding strategies aimed at enhancing the glass transition temperature (Tg) of the polymer backbone. Traditional ABS production utilizes mass or emulsion polymerization; however, achieving high heat resistance often involves modifying the ratio of Acrylonitrile (AN) content, which is primarily responsible for the thermal stability, and optimizing the structure of the polybutadiene rubber phase to maintain necessary impact resistance despite the higher thermal profile. Advances in continuous mass polymerization, coupled with precise control over reaction kinetics, are yielding HH ABS grades with superior homogeneity and lower residual monomer content, which is crucial for low-VOC applications in automotive interiors.

Compounding technology represents another pivotal area of innovation. Manufacturers are employing advanced twin-screw extruders and reactive extrusion techniques to introduce specialized high-performance additives. These additives include thermal stabilizers, antioxidants, and anti-hydrolysis agents that preserve the polymer’s integrity under sustained thermal stress. The development of halogen-free flame retardant systems, often utilizing phosphorus-based or inorganic compounds, is a critical technological focus, driven by environmental and regulatory demands, providing effective fire safety without compromising the high-heat deflection temperature (HDT) or mechanical properties of the base resin. Furthermore, micro-filler technology, such as the incorporation of specialized mineral fillers or glass fibers, is used to increase stiffness and dimensional stability, expanding HH ABS use into semi-structural applications.

Looking forward, the technology landscape is increasingly incorporating digitalization and simulation tools. Computational Fluid Dynamics (CFD) and Finite Element Analysis (FEA) are being used extensively to simulate component performance under thermal load, reducing the reliance on lengthy and costly physical prototyping cycles. Furthermore, the integration of High Heat ABS into additive manufacturing (3D printing) requires specialized compounding techniques to produce filaments or powders with consistent thermal properties, low warpage, and excellent layer adhesion. Innovations in blending high-heat ABS with other advanced polymers, such as high-performance polycarbonates or specific polyamides, are also emerging to create polymer alloys that offer synergistic performance benefits, tailored specifically for extreme environments like specialized industrial housings or advanced thermal shields.

Regional Highlights

- Asia Pacific (APAC): This region dominates the High Heat ABS market, accounting for the largest share in terms of both consumption and manufacturing capacity. Growth is overwhelmingly driven by the massive automotive production base, especially in China, Japan, South Korea, and India, coupled with the region's position as the global hub for consumer electronics manufacturing. APAC benefits from lower operational costs and increasing domestic demand for durable, thermally resistant consumer goods and advanced transportation solutions. Furthermore, aggressive infrastructure spending and rising middle-class disposable incomes contribute significantly to sustained growth in the construction and appliance segments, necessitating high volumes of HH ABS.

- North America: The market in North America is characterized by high technological sophistication and a focus on premium, specialized grades of High Heat ABS. Demand is largely dictated by the stringent quality and performance requirements of the region's advanced automotive industry, particularly in the development of lightweight components for performance vehicles and complex electronic control units (ECUs). North American manufacturers lead in developing low-VOC and highly aesthetic HH ABS formulations to meet strict interior air quality standards. The robust aerospace and defense sectors also contribute niche demand for materials with exceptional thermal stability and durability.

- Europe: Europe is a mature but highly innovation-driven market, distinguished by strict regulatory frameworks concerning environmental protection, material safety, and fire retardancy (e.g., REACH, RoHS, specific railway standards). This drives high demand for specialized, halogen-free, flame-retardant HH ABS grades used extensively in building & construction, public transportation (rail, bus interiors), and high-end white goods. German automotive manufacturers, known for their rigorous material specifications, are major consumers, pushing suppliers toward continuous process improvement and sustainable material sourcing, often demanding certified bio-attributed content.

- Latin America (LATAM): The LATAM market represents a growing opportunity, particularly in Brazil and Mexico, driven by increasing foreign investment in automotive assembly and electronics manufacturing. While the market size is smaller than APAC or Europe, steady urbanization and industrialization are increasing the demand for reliable, durable polymers for infrastructure projects and domestic appliance production. Growth is somewhat constrained by economic volatility but shows potential for rapid expansion as regional manufacturing hubs mature and regulatory standards align with global norms, increasing the need for quality engineering plastics like HH ABS.

- Middle East and Africa (MEA): This region is characterized by a reliance on imports for most finished HH ABS products, though local manufacturing capacity is developing, particularly in Saudi Arabia and the UAE, leveraging regional petrochemical feedstock advantages. Demand is primarily generated by infrastructure development, construction projects requiring durable fittings, and the nascent automotive assembly sector. The region's challenging climate, involving high ambient temperatures and intense UV exposure, creates specialized demand for HH ABS grades with enhanced thermal aging and UV resistance properties, driving niche innovation for climate-specific applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Heat ABS Market.- LG Chem

- CHIMEI Corporation

- SABIC

- Kumho Petrochemical

- Trinseo

- Formosa Plastics Corporation

- LyondellBasell Industries

- INEOS Styrolution

- Toray Industries

- PolyOne (Avient)

- Techno-UMG

- Ravago Manufacturing

- Asahi Kasei

- Mitsubishi Chemical

- Chi Mei Materials Technology

- LOTTE Advanced Materials

- Versalis (Eni)

- BASF

- Samsung SDI Chemical

- Kaneka Corporation

- DuPont de Nemours, Inc.

- Dongfang Electric Corporation

- TSRC Corporation

- JSR Corporation

- PetroChina Company Limited

Frequently Asked Questions

Analyze common user questions about the High Heat ABS market and generate a concise list of summarized FAQs reflecting key topics and concerns.What defines High Heat ABS and how does it differ from standard ABS?

High Heat ABS is an engineering thermoplastic with a significantly higher Heat Deflection Temperature (HDT), typically exceeding 100°C, compared to standard ABS (usually below 90°C). This superior thermal performance is achieved by modifying the polymerization process, often increasing the Acrylonitrile content, making it suitable for applications exposed to elevated temperatures, such as automotive under-hood components and high-wattage electronics housing.

Which application segment holds the largest share in the High Heat ABS market?

The Automotive components segment holds the largest market share. High Heat ABS is crucial for lightweighting vehicles and ensuring the durability of interior and exterior components, particularly those near the engine or subjected to high solar load, where standard plastics would deform or degrade rapidly.

What is the primary factor restraining the growth of the High Heat ABS market?

The primary restraint is the extreme price volatility of key raw materials—Styrene, Acrylonitrile, and Butadiene—which are petrochemical derivatives. Fluctuations in crude oil markets and complex chemical supply chains directly impact the production cost and profit margins for HH ABS manufacturers globally.

How is the Electric Vehicle (EV) industry impacting the demand for High Heat ABS?

The EV industry is positively impacting demand by creating new requirements for thermally stable and flame-retardant materials used in battery module housings, charging inlets, and power electronics components. HH ABS offers the necessary thermal management capabilities and mechanical strength vital for EV safety and performance.

Which region is the primary consumption and production center for High Heat ABS?

Asia Pacific (APAC) is the primary center for both consumption and production of High Heat ABS. This dominance is driven by the massive automotive and electronics manufacturing sectors in countries like China, South Korea, and India, coupled with high domestic demand for durable consumer goods.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager