High Purity Silica Powder Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441095 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

High Purity Silica Powder Market Size

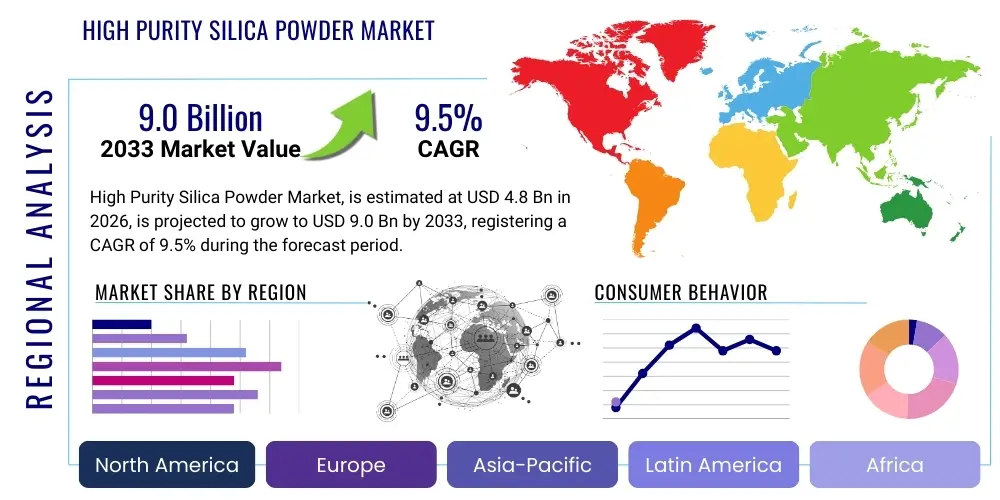

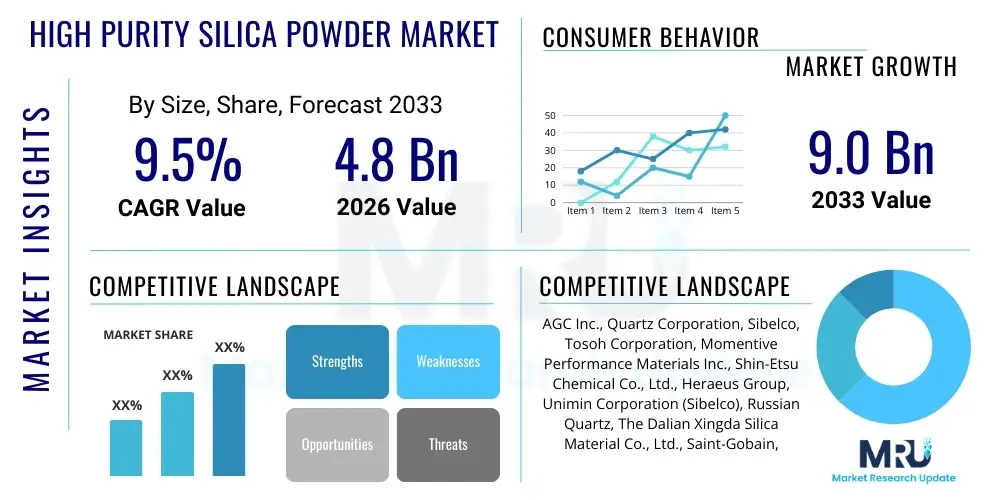

The High Purity Silica Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 9.1 Billion by the end of the forecast period in 2033.

High Purity Silica Powder Market introduction

The High Purity Silica Powder Market encompasses materials characterized by extremely low contamination levels, often quantified in parts per million (ppm) or even parts per billion (ppb). These materials, predominantly Silicon Dioxide (SiO2), are critical enabling components across several high-technology sectors where material integrity directly affects device performance, efficiency, and longevity. High purity is essential because even trace impurities like alkali metals, aluminum, or iron can severely degrade the optical, electrical, and thermal properties required in sensitive applications, particularly in the semiconductor and photovoltaic industries. The market’s growth is inextricably linked to the rapid advancements in miniaturization and the increasing complexity of electronic devices, demanding ever-higher grades of material purity.

High Purity Silica Powder (HPSP) is manufactured through specialized processes, including the crushing and refinement of high-grade natural quartz, as well as synthetic routes such as chemical vapor deposition (CVD) or sol-gel methods, which yield ultra-high purity grades (4N, 5N, 6N+). The applications for HPSP are diverse yet demanding. In semiconductors, it is vital for encapsulating materials, filler materials in molding compounds, and components in integrated circuits. In the solar industry, it forms the crucible material used for melting silicon ingots during photovoltaic cell production. Furthermore, its excellent thermal resistance and low coefficient of thermal expansion make it indispensable in advanced optics, telecommunications, and high-intensity lighting systems.

The principal driving factors accelerating market expansion include the exponential growth of consumer electronics, the global push towards renewable energy necessitating higher efficiency solar panels, and continuous investments in advanced fabrication techniques (e.g., EUV lithography) which require superior-grade raw materials. The inherent benefits of HPSP, such as superior electrical insulation, exceptional mechanical strength at high temperatures, and chemical inertness, solidify its foundational role in modern industrial manufacturing. As production costs for synthetic methods decrease and demand for ultra-high-definition displays and 5G infrastructure accelerates, the HPSP market is poised for sustained, robust expansion throughout the forecast period.

High Purity Silica Powder Market Executive Summary

The High Purity Silica Powder market demonstrates robust momentum, primarily fueled by synergistic growth across the semiconductor and renewable energy sectors. Business trends show a distinct shift toward synthetic and artificially purified silica, particularly the 5N and 6N grades, as manufacturers seek to meet stringent quality requirements for next-generation microelectronics. Strategic alliances focusing on vertical integration—from raw quartz mining to advanced powder processing—are becoming common among key players to secure supply chains and maintain quality control. Furthermore, significant capital expenditure is being directed towards expanding manufacturing capabilities in APAC, reflecting the region's dominance in end-use manufacturing, particularly in Taiwan, South Korea, and mainland China.

Regional trends clearly position the Asia Pacific (APAC) as the undisputed leader in consumption and manufacturing capacity. This dominance is attributed to the presence of major semiconductor foundries and the world's largest solar panel production hubs located within the region. North America and Europe, while smaller in consumption volume, remain crucial centers for R&D and specialized, high-margin applications, such as advanced optics and aerospace components. The structural shift towards localized supply chains, particularly post-2020 disruptions, also suggests increased investment in regional production facilities outside of traditional APAC centers to enhance resilience and shorten lead times for critical materials.

Segmentation trends highlight the increasing premium placed on higher purity grades (5N and above), which are experiencing faster growth rates than standard 4N material, driven by semiconductor innovation that demands zero-defect materials. By application, the semiconductor industry remains the largest revenue generator, although the photovoltaic sector is demonstrating the highest volume growth due to governmental renewable energy mandates globally. Manufacturing process innovation, specifically optimizing plasma torch methods for cost-effective mass production of ultra-pure spherical powders, is a key technological focus enabling this segmentation shift towards advanced geometry powders tailored for specific thermal management applications within electronics.

AI Impact Analysis on High Purity Silica Powder Market

User inquiries regarding AI's influence on the High Purity Silica Powder market frequently center on three main themes: optimization of complex synthesis processes, predictive maintenance for high-cost manufacturing equipment (e.g., fusion furnaces), and the demand acceleration stemming from AI hardware. Users are concerned with how AI tools can enhance material traceability and quality control, especially in identifying and filtering out nano-scale impurities in 6N+ powders. There is also significant curiosity about whether AI-driven design of next-generation chips will mandate new, specialized forms of silica filler, potentially accelerating the transition away from traditional, less uniform crystalline powders towards engineered spherical particles. Overall, the expectation is that AI will primarily serve as a powerful tool for enhancing operational efficiency, reducing waste, and driving material science innovation necessary for AI-specific chip fabrication.

- AI algorithms optimize parameters in Chemical Vapor Deposition (CVD) to achieve consistent purity levels (e.g., minimizing impurity spikes).

- Predictive maintenance models utilizing AI reduce downtime in high-temperature processing equipment, ensuring continuous production of sensitive materials.

- AI-driven simulation tools accelerate the development of novel silica structures required for advanced packaging (3D ICs) and thermal management in data centers.

- Increased global investment in AI server infrastructure and GPUs significantly boosts the demand for ultra-high purity silica used in associated semiconductor encapsulants and substrates.

- Automated quality inspection systems powered by machine vision improve defect detection and material grading, increasing manufacturing yields for 5N and 6N silica powder.

DRO & Impact Forces Of High Purity Silica Powder Market

The High Purity Silica Powder market is shaped by robust drivers stemming primarily from technological advancement in consumer electronics and clean energy, countered by significant restraints related to capital intensity and geopolitical supply chain risks. Opportunities are abundant, rooted in the exponential demands of nascent technologies like quantum computing and advanced medical devices. The primary impact forces are regulatory standards favoring sustainable, traceable materials and the relentless pressure from end-users (semiconductor manufacturers) for zero-defect materials, forcing continuous technological upgrading by HPSP producers. These dynamics ensure that only companies capable of massive investment in R&D and quality control can effectively compete in the high-end segments of this market.

Drivers: Key drivers include the pervasive proliferation of 5G and 6G technologies, demanding high-frequency, high-performance materials for antennas and base stations, many of which use specialized silica composites. The global energy transition mandates rapid expansion of photovoltaic (PV) capacity, which in turn elevates demand for high-quality quartz crucibles and associated silica powders. Furthermore, the continual miniaturization trend in semiconductor fabrication, necessitating extremely low dielectric constant (low-k) materials and advanced molding compounds, directly translates into increased need for ultra-high purity grades (6N). The shift towards Electric Vehicles (EVs) also indirectly drives demand, as advanced power electronics require superior thermal stability provided by specific HPSP types.

Restraints: Significant restraints include the extremely high capital expenditure required for establishing and maintaining ultra-clean manufacturing environments and specialized processing equipment (e.g., plasma purification). The cost and scarcity of high-quality natural quartz reserves suitable for conversion pose a persistent bottleneck. Additionally, the complex, multi-step purification processes are energy-intensive, raising operational costs and generating regulatory scrutiny regarding environmental sustainability. Price volatility and the intense technological rivalry among a limited number of specialized global suppliers also create supply chain risks for end-users, leading some to explore non-silica alternatives where feasible.

Opportunities: Major opportunities lie in the development of specialized, engineered silica powders, such as highly spherical or nano-sized particles, tailored for specific advanced packaging (e.g., Fan-Out Wafer Level Packaging, FOWLP) applications. The emerging market for quantum computing hardware, which requires materials stable at cryogenic temperatures, opens a new, high-value niche for ultra-pure materials. Geographic expansion into developing industrial regions, particularly Southeast Asia and Eastern Europe, which are becoming new hubs for electronics assembly, provides substantial growth potential. Finally, advancements in recycling technologies for quartz components could alleviate raw material supply constraints, offering a circular economy opportunity.

- Drivers: 5G/6G technology expansion, rapid growth of the photovoltaic sector, semiconductor miniaturization, adoption of advanced packaging technologies.

- Restraints: High capital investment requirements, stringent quality control standards, reliance on limited high-grade quartz reserves, energy-intensive purification processes.

- Opportunities: Development of spherical and nano-silica powders, growth in quantum computing applications, expansion into new electronics manufacturing geographies, advancements in quartz recycling.

- Impact Forces: End-user demand for zero-defect material quality, geopolitical stability concerning key raw material sourcing countries, environmental sustainability regulations targeting energy usage.

Segmentation Analysis

The High Purity Silica Powder market is comprehensively segmented based on its purity level, which is the primary determinant of application suitability, the specific manufacturing process employed to achieve that purity, and the diverse end-use industries it serves. Understanding these segments is crucial as the market value varies significantly; ultra-high purity synthetic silica (6N+) commands substantially higher prices and higher growth rates than standard 4N fused quartz powder, reflecting the specialized R&D and processing costs involved. The application segmentation demonstrates the foundational importance of HPSP in sectors driving global technological advancement, ranging from consumer electronics to large-scale utility infrastructure.

- By Purity Level:

- 99.9% (3N)

- 99.99% (4N)

- 99.999% (5N)

- 99.9999% (6N+)

- By Manufacturing Process:

- Fused Quartz/Natural Refinement

- Synthetic/Chemical Vapor Deposition (CVD)

- Plasma Torch Method

- Sol-Gel Process

- By Application:

- Semiconductors and Electronics (Molding Compounds, IC Encapsulation)

- Photovoltaics (Solar Grade Crucibles and Components)

- Optics and Lighting (Optical Fibers, Specialty Lenses)

- Refractories and Ceramics

- Others (Aerospace, Medical)

- By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For High Purity Silica Powder Market

The value chain for High Purity Silica Powder is highly concentrated and vertically integrated, starting with the extraction of natural quartz, which is a key bottleneck due to the limited geographic availability of ultra-high-quality deposits (e.g., Spruce Pine in the US, certain deposits in Norway and Brazil). The upstream segment involves the mining, initial crushing, and beneficiation of raw quartz material to remove gross impurities. Since the purity of the final product is dependent on the purity of the raw material, control over these source mines provides a significant competitive advantage. Technological innovation at this stage focuses on advanced flotation and acid washing techniques.

The midstream processing phase is the core value-addition segment, involving complex thermal and chemical treatments such as fusing the quartz, plasma treatment, or synthesizing silica via CVD or sol-gel methods. This segment requires massive capital investment in high-temperature furnaces, cleanroom facilities, and proprietary chemical processes to achieve 5N and 6N purity levels. Manufacturers here must also focus on particle size and shape engineering (e.g., creating highly spherical silica for flowability in molding compounds). Quality control, including trace element analysis using ICP-MS, is paramount to ensure compliance with strict semiconductor specifications. Only a few global players possess the necessary technology and scale to operate profitably in this sophisticated processing environment.

The downstream segment involves distribution, which is bifurcated into direct and indirect channels. Direct sales are predominant for major semiconductor and photovoltaic manufacturers, where long-term supply contracts and highly customized material specifications necessitate direct engagement between the HPSP producer and the end-user. Indirect sales, involving specialized chemical distributors or agents, typically handle smaller volume orders or sales to less sensitive industries like specialized ceramics or lighting. End-use industries, particularly electronics and solar, dictate the market demand, applying consistent pressure on upstream suppliers regarding cost reduction, consistency, and adherence to evolving purity standards driven by Moore's Law and the need for higher cell efficiency.

High Purity Silica Powder Market Potential Customers

The primary customers for High Purity Silica Powder are sophisticated manufacturing enterprises operating in high-technology, capital-intensive sectors where material contamination results in catastrophic device failure or reduced performance metrics. Semiconductor fabrication plants (Fabs) are the largest and most demanding customer segment, utilizing HPSP as a critical filler in epoxy molding compounds (EMC) for integrated circuit encapsulation, ensuring protection against mechanical damage and providing essential electrical insulation. These Fabs, including major IDMs (Integrated Device Manufacturers) and foundries (e.g., TSMC, Samsung, Intel), purchase based on purity certifications (often demanding 5N or 6N), spherical morphology, and consistent particle size distribution, sometimes requiring nano-scale powders.

Another major customer segment consists of ingot and wafer manufacturers within the photovoltaic industry. These companies rely heavily on high purity fused silica for manufacturing crucibles—large containers used to melt polycrystalline or monocrystalline silicon for the Czochralski process. The purity of the silica crucible is crucial as any leaching of impurities into the molten silicon directly reduces the efficiency and lifespan of the resulting solar cell. Demand from this sector is characterized by high volume procurement of large-format, robust fused quartz components, contrasting with the small-volume, high-value purchases made by the semiconductor sector.

Additional customer bases include specialized optical component manufacturers (producing high-performance lenses, prisms, and UV-resistant glass), telecommunication companies (for optical fiber preforms requiring exceptional transmission clarity), and high-intensity discharge (HID) lamp producers. Furthermore, companies specializing in advanced refractories and high-performance ceramic coatings for aerospace and defense applications represent niche, high-value end-users who value HPSP for its thermal stability and dimensional integrity under extreme conditions. Procurement strategies across these diverse customers range from long-term strategic contracts, typical in solar and semiconductors, to spot market purchases for smaller, specialized requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 9.1 Billion |

| Growth Rate | 9.5% ( Include CAGR Word with % Value ) |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shin-Etsu Chemical Co. Ltd., Momentive Performance Materials Inc., Heraeus Holding, The Quartz Corp, Tokuyama Corporation, Unimin Corporation (Sibelco), Saint-Gobain S.A., Lianyungang High-Q Quartz Co. Ltd., Jiangsu Pacific Quartz Co. Ltd., Quarzwerke GmbH, Donghai County Deklar Co. Ltd., Xuzhou Zhongcheng Quartz Products Co. Ltd., HPQ Silicon Resources Inc., Denka Company Limited, ESK-SIC GmbH, Russian Quartz, Coorstek Inc., Guartel Technologies, Wacker Chemie AG, Zhejiang Donghai Quartz Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Purity Silica Powder Market Key Technology Landscape

The technological landscape of the High Purity Silica Powder market is dominated by purification methods designed to minimize metallic, hydroxyl, and gaseous impurities, often pushing detection limits to parts per trillion (ppt). One established technology is Fused Quartz processing, which involves melting high-quality natural quartz (typically 99.9% pure) in an electric or gas furnace followed by rapid cooling and grinding. While cost-effective for 4N grade material used primarily in crucible manufacturing, this method often struggles to reach the 5N and 6N benchmarks required by advanced microelectronics due to inherent impurities in the source material. However, advancements in acid-leaching and vacuum purification have improved the quality output of fused quartz processes.

The leading edge of technological innovation resides in synthetic manufacturing processes, primarily Chemical Vapor Deposition (CVD) and the Plasma Torch Method. CVD involves reacting silicon precursors (like silanes or silicon halides) in a high-temperature environment to produce extremely fine, high-purity amorphous silica soot, which is subsequently consolidated into powder. This technique offers unparalleled control over purity (easily achieving 6N+) and particle morphology. The Plasma Torch Method, another highly effective approach, uses extreme heat generated by an electrical plasma torch to melt and atomize silica feedstocks, allowing for highly spherical particle formation and rapid evaporation of volatile impurities, which is crucial for producing spherical silica fillers prized in advanced packaging materials due to their superior flow characteristics and isotropic properties.

Beyond synthesis and purification, significant technological focus is placed on particle engineering. The shift from irregular, crushed powders to highly uniform, spherical silica powder is critical for reducing the coefficient of thermal expansion (CTE) mismatch and increasing the filler loading density in epoxy molding compounds, thereby improving device reliability. Advanced grinding, classification, and surface treatment technologies, including proprietary coating applications, are continuously being refined to ensure ultra-low moisture content, consistent size distribution (often ranging from sub-micron to 20 microns), and optimal surface reactivity, catering precisely to the evolving demands of advanced semiconductor packaging processes such as chip-on-film (COF) and high-density interconnection (HDI) substrates.

Regional Highlights

The global distribution and consumption of High Purity Silica Powder are heavily skewed toward regions with robust electronics and solar manufacturing bases. Asia Pacific (APAC) stands as the principal engine of growth and consumption, largely due to the concentration of major semiconductor manufacturing powerhouses in Taiwan (TSMC), South Korea (Samsung, SK Hynix), Japan, and the massive solar component manufacturing ecosystem in China. This region benefits from established supply chains and governmental support for high-tech manufacturing, driving relentless demand for all purity grades, particularly 5N and 6N for advanced logic and memory production. The high density of photovoltaic manufacturers in China makes it the largest regional consumer for fused quartz crucibles.

North America and Europe maintain critical roles, not primarily as high-volume consumers, but as key centers for technological innovation and specialized end-markets. North American companies dominate the upstream segment (high-grade quartz mining) and are leading developers of synthetic CVD and plasma torch technologies, focusing on ultra-high-margin, niche applications like aerospace sensors, specialized optics, and advanced R&D related to quantum technologies. European demand is driven by specialized optics, lighting, and the automotive sector (power electronics), with Germany and France hosting significant manufacturing operations that require precision HPSP materials. These regions prioritize material traceability and compliance with strict environmental standards.

Latin America (LATAM) and the Middle East and Africa (MEA) currently represent emerging markets with lower consumption volumes, though their strategic importance is increasing. LATAM demand is mainly linked to local assembly operations and basic electronic components, while the MEA region shows nascent growth, primarily driven by infrastructure projects, utility-scale solar installations (especially in the Gulf Cooperation Council countries), and regional diversification strategies aiming to establish local manufacturing capacities for electronics and solar components. Growth in these regions is heavily reliant on foreign direct investment and the establishment of local downstream manufacturing clusters, potentially creating significant long-term demand for HPSP suppliers seeking new market penetration.

- Asia Pacific (APAC): Dominates global consumption and production; hub for semiconductor foundries, vast photovoltaic manufacturing (China, Taiwan, South Korea), fastest growth in 5N and 6N purity grades.

- North America: Leader in upstream raw material supply (natural quartz) and high-margin technological development (CVD/Plasma methods); strong demand from aerospace and R&D optics sectors.

- Europe: Focused on high-precision applications, including specialized automotive power electronics, high-intensity lighting, and advanced optics; strict emphasis on sustainability and material quality standards.

- Latin America (LATAM) & Middle East and Africa (MEA): Emerging markets; consumption driven by infrastructure development and nascent solar energy projects; long-term growth potential tied to industrialization and localization efforts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Purity Silica Powder Market.- Shin-Etsu Chemical Co. Ltd.

- Momentive Performance Materials Inc.

- Heraeus Holding

- The Quartz Corp

- Tokuyama Corporation

- Unimin Corporation (Sibelco)

- Saint-Gobain S.A.

- Lianyungang High-Q Quartz Co. Ltd.

- Jiangsu Pacific Quartz Co. Ltd.

- Quarzwerke GmbH

- Donghai County Deklar Co. Ltd.

- Xuzhou Zhongcheng Quartz Products Co. Ltd.

- HPQ Silicon Resources Inc.

- Denka Company Limited

- ESK-SIC GmbH

- Russian Quartz

- Coorstek Inc.

- Guartel Technologies

- Wacker Chemie AG

- Zhejiang Donghai Quartz Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the High Purity Silica Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between 4N and 6N High Purity Silica Powder?

The primary difference lies in the impurity level; 4N (99.99%) silica powder contains total metallic impurities measured in parts per million (ppm), while 6N (99.9999%) silica powder reduces these impurities to parts per billion (ppb) or even parts per trillion (ppt). 6N grade is typically synthetic and essential for advanced semiconductor fabrication to prevent device failure.

Which application segment drives the highest volume demand for HPSP?

The Photovoltaics (Solar) sector drives the highest volume demand for High Purity Silica Powder, primarily utilizing 4N grade fused quartz for the manufacture of large silicon melting crucibles required in the production of solar ingots and wafers.

How does the shift to spherical silica powder affect semiconductor packaging?

The shift to highly spherical High Purity Silica Powder (HPSP) improves the flowability and increases the filler loading density within epoxy molding compounds (EMCs). This results in lower material viscosity, better thermal management, and reduced internal stress on sensitive integrated circuits (ICs), thereby enhancing overall device reliability and yield.

What are the key technological barriers to entering the High Purity Silica Powder market?

The key technological barriers include the extremely high capital investment required for ultra-clean manufacturing facilities, proprietary purification processes (like CVD or plasma torch synthesis), and the necessity of mastering particle size and morphology control for specific high-end applications.

Which geographical region holds the competitive advantage in HPSP production and consumption?

The Asia Pacific (APAC) region holds the competitive advantage, leading in both consumption volume (driven by major electronics manufacturing hubs) and specialized production capacity for ultra-high purity grades required by the world's leading semiconductor foundries.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- High Purity Silica Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- High Purity Silica Powder Market Statistics 2025 Analysis By Application (Solar, Semiconductor, Fiber Optic Communication, Lighting Industry, Optical), By Type (Purity 99.9%, Purity 99.99%, Purity 99.999%, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager