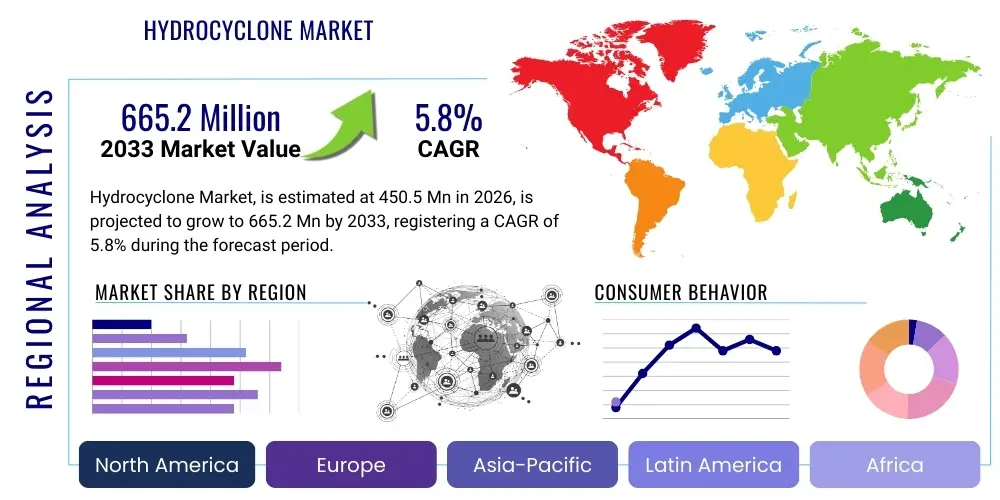

Hydrocyclone Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442514 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Hydrocyclone Market Size

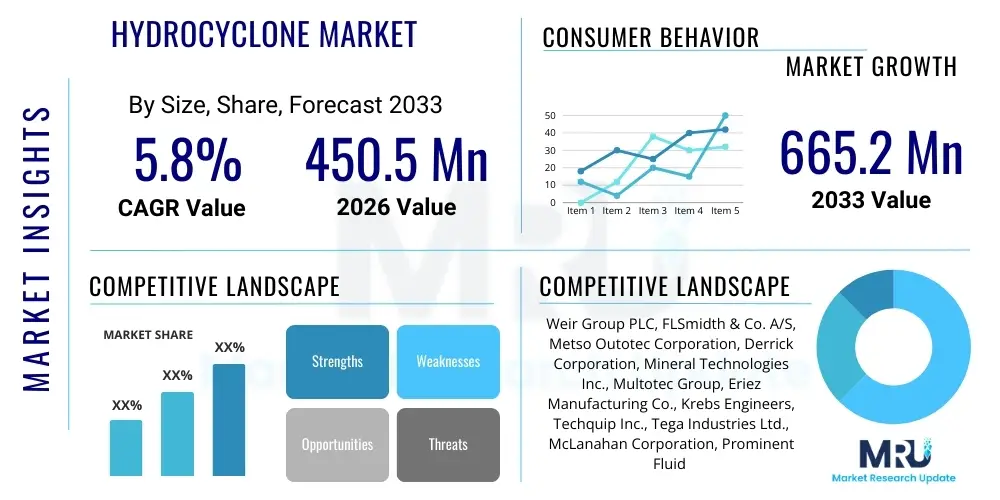

The Hydrocyclone Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 665.2 Million by the end of the forecast period in 2033.

Hydrocyclone Market introduction

Hydrocyclones are essential static devices utilized extensively across heavy industries for separating particles based on differences in fluid density and centrifugal force. They operate by introducing a slurry tangentially into a cylindrical-conical vessel, which creates a high-velocity swirling flow pattern. This rotational movement generates intense centrifugal forces that drive denser or coarser particles towards the wall, allowing them to exit through the apex (underflow), while lighter or finer particles migrate toward the central axis and exit through the vortex finder (overflow). The primary applications span crucial sectors such as mineral processing, where they are vital for classification, thickening, and dewatering of slurries; chemical processing, for solid-liquid separation; and increasingly, in industrial wastewater treatment facilities for efficient separation of suspended solids, contributing significantly to environmental compliance and resource recovery.

The inherent benefits of hydrocyclones—including their simplicity in design, low maintenance requirements, high capacity throughput relative to footprint, and absence of moving parts—make them highly cost-effective and reliable separation solutions. Their robust performance across various demanding operational environments, particularly those involving abrasive and corrosive slurries, ensures longevity and consistent separation efficiency. Furthermore, the modular nature of hydrocyclone installations allows for flexible scalability, enabling operators to adjust capacity by changing individual units or battery configurations, meeting diverse processing demands without requiring significant structural modifications. These advantages position hydrocyclones as indispensable components in modern processing plants striving for optimized operational efficiency and maximum yield.

Market growth is predominantly driven by the robust expansion of the global mining industry, particularly in emerging economies focused on increasing output of base metals and industrial minerals. Hydrocyclones are fundamental to the comminution circuit, ensuring precise classification critical for grinding efficiency and downstream recovery processes. Additionally, the tightening environmental regulations concerning industrial discharge worldwide are spurring demand for advanced separation technologies in municipal and industrial wastewater management. Technological advancements, particularly in materials science leading to longer-lasting wear components and better-optimized geometric designs achieved through advanced simulation tools, are further enhancing the efficiency and adoption of hydrocyclone technology across existing and new industrial applications.

Hydrocyclone Market Executive Summary

The global Hydrocyclone Market is characterized by stable growth driven primarily by industrialization in the Asia Pacific region and sustained capital investment in the global mining and oil and gas sectors. Current business trends emphasize enhanced system integration, focusing on incorporating hydrocyclones into complete processing circuits optimized for energy consumption and separation accuracy. Key companies are concentrating on developing hydrocyclones with advanced abrasion-resistant linings, often leveraging ceramics or specialized polymers, to minimize downtime and extend operational life in extremely demanding applications like iron ore and heavy mineral sands processing. Furthermore, there is a distinct trend towards modular and compact designs that facilitate easier installation and maintenance, catering to both greenfield projects and brownfield upgrades seeking rapid implementation and minimal operational disruption.

Regional trends indicate that the Asia Pacific (APAC) region remains the largest and fastest-growing market, largely due to extensive mining operations in countries like China, Australia, and India, coupled with rapid infrastructure development and industrial expansion driving wastewater treatment infrastructure needs. North America and Europe maintain stable demand, primarily driven by technological upgrades in established oil and gas infrastructure, stricter environmental standards mandating efficient industrial water treatment, and ongoing investments in complex mineral extraction projects. Latin America, particularly countries rich in copper and gold deposits such as Chile and Peru, also represents a significant growth corridor, necessitating robust classification and thickening solutions to handle high throughput volumes of low-grade ores.

In terms of segment performance, the mining and mineral processing application segment holds the dominant market share, reflecting the critical role hydrocyclones play in achieving optimal particle size distribution before flotation or leaching. However, the wastewater treatment segment is anticipated to register the highest growth CAGR, fueled by stringent regulatory environments pushing industries to reuse and recycle process water, thereby increasing the demand for high-efficiency solid removal systems. By type, the Classifiers segment, designed to achieve highly precise separation of fine particles, is expected to see significant technological investment and adoption, particularly as ore grades decline and the industry requires finer grinding and more accurate separation to maximize recovery yields.

AI Impact Analysis on Hydrocyclone Market

Common user questions regarding AI’s impact on the Hydrocyclone Market typically revolve around whether AI can autonomously optimize separation efficiency, predict component failure rates, and reduce energy consumption associated with slurry pumping and processing. Users are keen to understand if AI-driven sensors and algorithms can provide real-time adjustments to operating parameters, such as feed pressure and density, to maintain consistent underflow and overflow qualities despite fluctuating feed conditions. The consensus indicates a strong expectation that AI will transition hydrocyclone operation from static, manual configuration to dynamic, predictive management, ensuring peak performance while minimizing wear and tear. This shift focuses on utilizing machine learning to analyze massive datasets related to flow rates, particle size distribution, and equipment vibrations to preemptively identify maintenance needs and operational drifts, thereby maximizing overall plant throughput and availability.

- AI-driven Predictive Maintenance: Utilizing sensor data (vibration, temperature, pressure) and machine learning algorithms to predict the remaining useful life of wear components (linings, apexes, vortex finders), significantly reducing unplanned downtime and optimizing maintenance schedules.

- Real-time Process Optimization: Implementation of AI models that analyze real-time slurry properties (density, viscosity, particle size distribution) to instantaneously adjust feed pump speeds and control valve settings, ensuring the hydrocyclone operates at its optimal efficiency point (classification cut size).

- Energy Consumption Reduction: Employing deep learning algorithms to model the relationship between throughput, separation quality, and pumping energy, allowing systems to dynamically find the most energy-efficient operating point while meeting quality targets.

- Automated Anomaly Detection: Machine learning systems monitor standard operating profiles and instantly flag deviations indicative of blockages, severe wear, or process instability, enabling rapid human intervention and minimizing process upset duration.

- Enhanced Process Modeling and Simulation: AI complements Computational Fluid Dynamics (CFD) by rapidly analyzing simulation results and correlating them with empirical plant data, accelerating the design cycle for customized hydrocyclone geometries suitable for specific ore bodies or slurries.

DRO & Impact Forces Of Hydrocyclone Market

The Hydrocyclone Market is strongly influenced by cyclical investments in the resource sector, particularly mining and oil and gas. Drivers include the growing demand for base metals and critical minerals necessary for the energy transition (e.g., copper, lithium, cobalt), which necessitates increased extraction and processing efficiency. Additionally, the global push towards better water management and recycling in industrial processes provides a sustained growth impetus for separation technologies. However, the market faces significant Restraints, primarily high initial capital costs associated with setting up large processing plants and the inherent abrasive nature of slurries, which necessitates frequent replacement of expensive wear parts, leading to high operational expenditure. Economic volatility affecting commodity prices can also trigger delays or cancellations of major capital projects, impacting equipment procurement.

Opportunities are emerging through technological advancements focusing on non-metallic, high-performance wear materials (like advanced ceramics and specialized rubbers) that dramatically extend component life, thereby addressing a primary restraint. Furthermore, the burgeoning application of hydrocyclones in niche areas such as fine particle recovery, aggregate washing, and specialized chemical separation processes presents new revenue streams. The rising global focus on circular economy models encourages the adoption of efficient separation tools for waste material recovery and processing secondary resources. The ability of manufacturers to offer integrated, smart separation solutions incorporating digital technologies for monitoring and control further opens opportunities for value addition and market differentiation.

The Impact Forces shaping the market trajectory are multifaceted. Economic impact forces are tied directly to global commodity cycles; when metal prices are high, capital expenditure in mining increases, boosting hydrocyclone demand. Technologically, the push for finer particle classification, driven by lower ore grades requiring intensive grinding, compels manufacturers to innovate continuously on separation efficiency. Environmentally, increasingly strict discharge regulations globally mandate superior solid removal and water quality, making high-efficiency hydrocyclones non-negotiable for compliance. These combined forces dictate investment priorities, technological development pathways, and regional market competitiveness, ensuring that performance, durability, and operational intelligence remain central to product development strategies.

Segmentation Analysis

The Hydrocyclone Market segmentation provides a granular view of diverse product capabilities and application sectors, highlighting areas of high growth and technological maturity. Segmentation is primarily based on the hydrocyclone type, which reflects the fundamental purpose of the unit—either concentration or classification—and the various end-use application segments where these devices are critically deployed, ranging from heavy resource extraction to industrial waste management. Understanding these segments is key to tailoring manufacturing strategies, focusing R&D investment, and executing effective market entry strategies, especially in regions experiencing rapid industrial growth or resource exploration booms.

- By Type:

- Separators (Thickeners/Dewaterers)

- Classifiers

- By Material:

- Metal Hydrocyclones

- Ceramic-lined Hydrocyclones

- Rubber-lined Hydrocyclones

- Polyurethane Hydrocyclones

- By Diameter Size:

- Small Diameter (< 150 mm)

- Medium Diameter (150 mm – 500 mm)

- Large Diameter (> 500 mm)

- By Application:

- Mining and Mineral Processing

- Oil and Gas (Desanding/Desilting)

- Wastewater Treatment

- Chemical Processing

- Pulp and Paper Industry

- Others (Food processing, pharmaceuticals)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Hydrocyclone Market

The value chain for the Hydrocyclone Market begins with upstream analysis, encompassing the sourcing and processing of core raw materials such as steel and iron for the main housing structures, specialized rubber and polyurethane for internal linings, and advanced technical ceramics (like silicon carbide or alumina) for highly abrasive parts such as the apex and vortex finder. Suppliers in this segment focus on material quality, consistency, and cost-effectiveness, as these factors directly determine the hydrocyclone’s durability and separation efficiency. Key upstream activities involve precision casting, welding, and advanced wear material production, where material science innovation is critical for differentiation and performance enhancement in increasingly harsh operating environments.

The midstream involves manufacturing, assembly, system integration, and quality testing of individual hydrocyclone units and complete battery systems. Distribution channels are complex, often involving a mix of direct sales, particularly for large-scale mining projects, and specialized engineering, procurement, and construction (EPC) firms that act as intermediaries, integrating the hydrocyclones into complete processing plants. Direct distribution channels are preferred for custom-designed, high-value systems, allowing manufacturers to maintain tight control over specifications and technical support. Indirect distribution through authorized distributors and EPC contractors provides broader market reach, especially into smaller industrial applications and international markets where local expertise is essential for logistics and installation support.

Downstream analysis focuses on the installation, operation, and extensive after-sales service required by end-users. After-market support, including the supply of replacement wear parts and technical consultancy for performance optimization, constitutes a significant portion of the value chain revenue. Key participants downstream include processing plant owners (mining, chemical), operation managers, and maintenance personnel who rely on the supplier for rapid replacement parts and diagnostic services. The effectiveness of the service network and the availability of durable, high-quality replacement components are crucial for maintaining long-term customer relationships and ensuring the sustained operational efficiency of the hydrocyclone systems in the field.

Hydrocyclone Market Potential Customers

The primary customer base for hydrocyclone technology comprises heavy industries that require highly efficient, large-volume separation of solids from liquid slurries. The most significant segment of End-Users/Buyers is the global mineral processing industry, including companies involved in extracting and refining commodities such as iron ore, copper, gold, coal, and phosphates. These mining operations utilize hydrocyclones for pre-concentration, classification within grinding circuits, and final dewatering stages, making their investment decisions highly sensitive to commodity prices and regulatory requirements regarding tailings management and water reuse.

Secondary yet rapidly growing customer groups include companies in the environmental and municipal sectors, specifically wastewater treatment utilities and industrial facilities managing process effluent. These buyers seek hydrocyclones for efficient removal of suspended solids and grit, crucial for protecting downstream equipment and meeting strict discharge regulations. Furthermore, the oil and gas sector remains a consistent consumer, utilizing hydrocyclones (often in specialized configurations like desanders and desilters) to protect pipelines and surface equipment from abrasive particles introduced during drilling and production activities. Manufacturers must therefore tailor their sales and marketing efforts to address the distinct technical specifications, scalability needs, and operational environments of these diverse, yet technically demanding, customer segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 665.2 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Weir Group PLC, FLSmidth & Co. A/S, Metso Outotec Corporation, Derrick Corporation, Mineral Technologies Inc., Multotec Group, Eriez Manufacturing Co., Krebs Engineers, Techquip Inc., Tega Industries Ltd., McLanahan Corporation, Prominent Fluid Controls, Sepratech Corporation, Roxia Oy, MATEC Srl, Phoenix Process Equipment Inc., Warman International, Hydro Process, Linatex, AKW Apparate + Verfahren GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hydrocyclone Market Key Technology Landscape

The technological landscape of the Hydrocyclone Market is evolving rapidly, driven by the need for increased efficiency, extended operational lifespan, and better integration into smart processing plants. A core area of technological focus is the use of advanced Computational Fluid Dynamics (CFD) modeling. CFD simulations allow engineers to precisely model the complex turbulent flow patterns and particle trajectories within the hydrocyclone. This capability enables iterative design optimization of critical internal geometries—such as the inlet head, cone angle, and vortex finder dimensions—to achieve highly specific separation efficiencies (cut points) for challenging fine particle applications, significantly reducing the reliance on costly physical prototypes and lengthy empirical testing cycles in actual plant environments. This virtual optimization ensures new products are highly efficient from the outset.

Materials science innovation represents another fundamental shift in the technology landscape. The highly abrasive nature of most hydrocyclone applications, especially in mining, demands materials capable of withstanding extreme wear and corrosion. The market is increasingly adopting highly specialized, abrasion-resistant materials, moving beyond traditional rubber linings. Technical ceramics, such as high-purity alumina and silicon carbide, are being utilized for apex and vortex finder inserts, offering significantly longer operational periods between maintenance shutdowns—sometimes five to ten times longer than rubber components. This shift to advanced composites and ceramics reduces total cost of ownership (TCO) for end-users and enhances system availability, which is a major performance metric in high-throughput operations. Polyurethane remains essential for certain non-metallic applications where moderate abrasion resistance and chemical compatibility are key requirements, often utilized in lighter industrial slurries.

Furthermore, the integration of digital technologies and Industry 4.0 principles is fundamentally transforming hydrocyclone operation. Modern hydrocyclone batteries are increasingly equipped with sophisticated sensor arrays monitoring key operational parameters including feed pressure, slurry density, underflow rope detection, and vibration analysis. This data feeds into real-time monitoring and control systems, often leveraging proprietary optimization algorithms or machine learning models (as detailed in the AI analysis). These smart systems can autonomously adjust pump speeds or valve settings to maintain the desired separation cut point, compensating for process variability. This shift towards smart, digitally managed hydrocyclone systems ensures optimal metallurgical performance, minimal water consumption, and preventative maintenance capabilities, cementing connectivity and data integration as standard expectations for high-end market solutions.

Innovations in modular and compact hydrocyclone cluster design are also prominent, particularly catering to smaller-scale operations or mobile processing units. These advancements focus on minimizing the physical footprint while maximizing separation capacity, achieved through sophisticated manifold designs that manage feed and discharge distribution efficiently. These modular systems provide operational flexibility, allowing operators to easily add or remove hydrocyclone units in response to changing ore characteristics or production targets. Coupled with advancements in 3D printing, especially for prototyping and producing complex internal components, the technological focus is firmly on delivering highly customized, highly efficient, and maintainable separation solutions tailored to the unique physical properties of the materials being processed.

The development of specialized hydrocyclones designed for specific niche applications—such as liquid-liquid separation or gas-liquid separation—demonstrates the versatility of this technology beyond traditional solid-liquid classification. These niche hydrocyclones require specialized internal configurations and materials to manage interfacial dynamics rather than just centrifugal particle settling. For instance, in the oil and gas sector, hydrocyclones are optimized for removing trace amounts of oil from produced water (de-oiling hydrocyclones), demanding precise flow hydrodynamics and specialized internal coatings. This expansion into advanced separation duties necessitates ongoing R&D investment, often collaborating directly with end-users to fine-tune designs against specific process challenges and pushing the boundaries of what static separation devices can achieve in complex fluid mixtures.

Finally, the growing environmental imperative is driving technology focused on maximizing water recovery and minimizing the volume and toxicity of tailings. Hydrocyclone technology is crucial here, particularly in thickening applications before final disposal, reducing water content to facilitate dry stacking of tailings. Manufacturers are developing larger diameter hydrocyclones that can handle immense volumes while maintaining sufficient separation efficiency, often coupled with advanced flocculation chemistry integration points. The interplay between hydrocyclone design, chemical reagents, and sensor technology is paramount in optimizing water use efficiency, aligning market demands with global sustainability goals and ensuring that processing plants operate with minimal environmental footprint while adhering to increasingly stringent water usage permits and discharge quality standards.

Regional Highlights

- Asia Pacific (APAC): Dominates the market share due to extensive resource extraction activities, including coal, iron ore, and non-ferrous metals, particularly in China, Australia, and India. Rapid industrialization, infrastructure development, and increasing governmental focus on water pollution control contribute significantly to high demand for hydrocyclone systems in new installations and plant expansions.

- North America: Characterized by stable demand, driven primarily by the oil and gas industry (desanding/desilting applications) and the replacement of aging infrastructure in traditional mining operations. The region focuses heavily on automation and smart technology integration, leading to high adoption rates of premium, sensor-equipped hydrocyclone systems for optimized process control.

- Europe: The market is mature, driven mainly by stringent environmental regulations necessitating advanced wastewater treatment technologies and modernization of existing chemical and industrial processing plants. Demand is focused on specialized, high-efficiency, and compact units, particularly those featuring advanced material liners for reduced maintenance in critical chemical separation applications.

- Latin America (LATAM): Exhibits strong growth potential, primarily centered on large-scale copper, gold, and iron ore mining projects, particularly in Chile, Peru, and Brazil. Investment cycles are highly sensitive to global commodity prices, but the need for water conservation in arid mining regions ensures sustained demand for high-capacity thickening hydrocyclones.

- Middle East and Africa (MEA): Emerging market growth is linked to new mining projects in Africa (e.g., gold, platinum) and oil and gas recovery projects in the Middle East. Infrastructure development and a need for reliable, robust equipment capable of handling challenging operating conditions characterize the procurement strategy in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hydrocyclone Market.- Weir Group PLC

- FLSmidth & Co. A/S

- Metso Outotec Corporation

- Derrick Corporation

- Mineral Technologies Inc.

- Multotec Group

- Eriez Manufacturing Co.

- Krebs Engineers

- Techquip Inc.

- Tega Industries Ltd.

- McLanahan Corporation

- Prominent Fluid Controls

- Sepratech Corporation

- Roxia Oy

- MATEC Srl

- Phoenix Process Equipment Inc.

- Warman International

- Hydro Process

- Linatex (A brand of Weir Group PLC)

- AKW Apparate + Verfahren GmbH

Frequently Asked Questions

Analyze common user questions about the Hydrocyclone market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a hydrocyclone in mineral processing?

The primary function is particle classification, which involves separating particles based on size and density. This is crucial in the grinding circuit to ensure oversized particles are returned for further grinding while finer particles proceed to downstream recovery processes like flotation, optimizing mill efficiency and overall yield.

How do advanced materials impact the total cost of ownership (TCO) of hydrocyclones?

Advanced wear-resistant materials, such as technical ceramics or high-performance polymers, significantly reduce TCO by extending the operational lifespan of key components (apex, vortex finder, liners). This minimizes maintenance frequency, reduces downtime for replacement parts, and improves system availability, offsetting the higher initial material cost.

Which application segment is driving the highest growth in the hydrocyclone market?

While mining remains the largest volume consumer, the wastewater treatment segment is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This growth is fueled by stricter global environmental regulations demanding high-efficiency solid removal and water recycling solutions across diverse industrial sectors.

What are the typical limitations or restraints associated with hydrocyclone usage?

Key limitations include high energy consumption due to the required high feed pressure for achieving separation, susceptibility to wear and tear when handling highly abrasive slurries, and the inability to process slurries with extremely low solids concentration effectively. Efficiency is also highly sensitive to feed variations (pressure, density, flow rate).

How is digital technology enhancing the performance of modern hydrocyclone systems?

Digital technology enables real-time performance monitoring using integrated sensors for pressure and density data. This data is leveraged by control systems and AI to make instantaneous adjustments to operational parameters (e.g., pump speed) to maintain a stable, optimal separation cut point, resulting in increased efficiency and automated preventative maintenance scheduling.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Hydrocyclone Sand Separators Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Hydrocyclone Market Size Report By Type (Solid-liquid Type, Liquid-liquid Type, Dense Media Type), By Application (Mining, Oil & Gas, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Hydrocyclone Separators Market Statistics 2025 Analysis By Application (Mineral Applications, Agricultural Applications, Oil & Gas), By Type (Vertical, Horizontal), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Hydrocyclone Sand Separators Market Statistics 2025 Analysis By Application (Mining, Agricultural, Oil & Gas), By Type (Vertical, Horizontal), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Hydrocyclone Market Statistics 2025 Analysis By Application (Mining, Oil & Gas), By Type (Solid-liquid Type, Liquid-liquid Type, Dense Media Type), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager