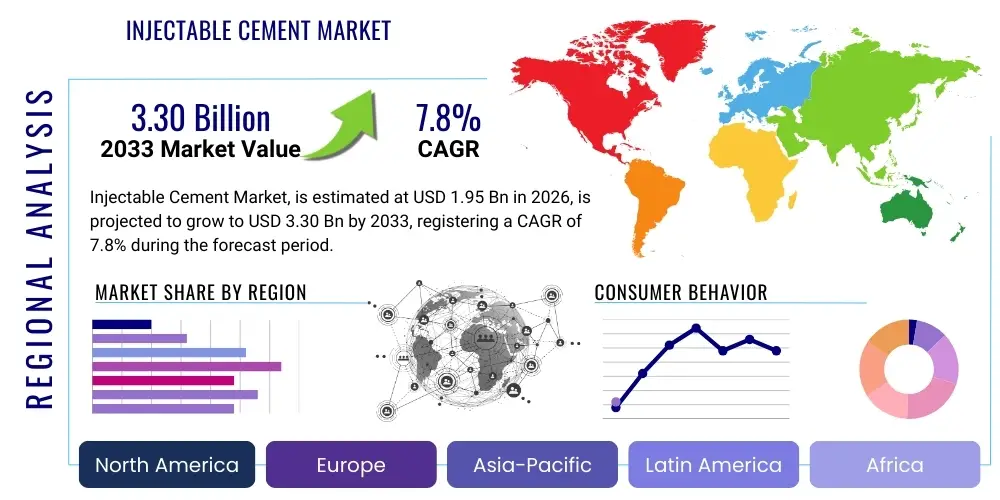

Injectable Cement Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441570 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Injectable Cement Market Size

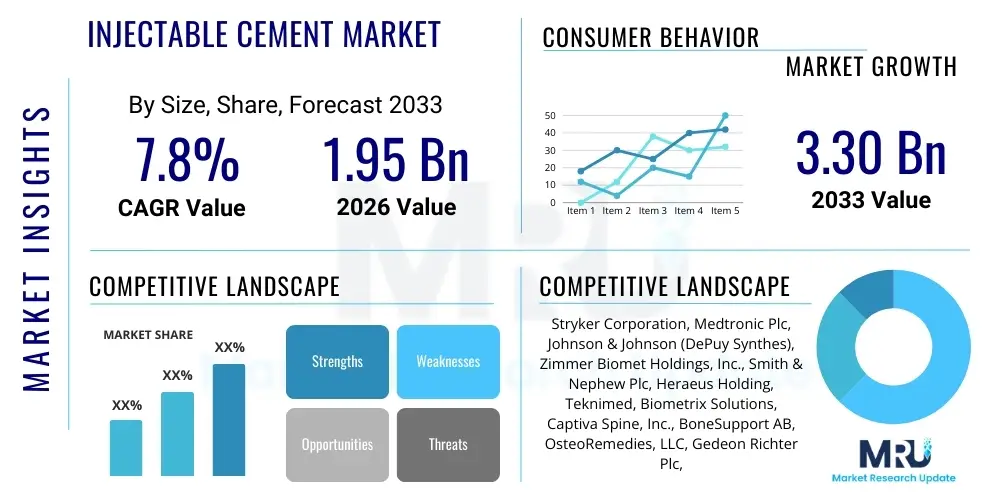

The Injectable Cement Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $3.45 Billion USD in 2026 and is projected to reach $5.84 Billion USD by the end of the forecast period in 2033.

Injectable Cement Market introduction

The Injectable Cement Market encompasses specialized biomaterials primarily used in minimally invasive surgical procedures, particularly in orthopedics and traumatology, to fill skeletal defects, augment bone density, and stabilize fractured vertebrae. These cements, typically based on polymethylmethacrylate (PMMA), calcium phosphate (CPC), or glass polyalkenoate (GIC), are designed for percutaneous delivery, offering significant advantages over traditional open surgical methods, including reduced patient morbidity, faster recovery times, and lower infection risks. The inherent ability of these materials to cure rapidly in vivo while maintaining necessary biomechanical strength makes them indispensable in procedures like vertebroplasty, kyphoplasty, and cranial defect repair.

Product descriptions vary significantly based on material composition. PMMA cements offer high mechanical strength and radiopacity, making them a standard for stabilizing osteoporotic fractures, although their exothermic curing process remains a concern that next-generation formulations are addressing. Conversely, CPC cements are favored for their biocompatibility and osteoconductive properties, promoting true bone regeneration, making them highly suitable for non-load-bearing applications or scenarios where biological integration is paramount. The increasing prevalence of age-related bone disorders, such as osteoporosis and associated vertebral compression fractures (VCFs), is the primary demographic factor driving the substantial growth in demand for these injectable solutions globally.

Major applications of injectable cements are predominantly situated within spinal care (vertebroplasty and kyphoplasty) and trauma surgery (fixation of unstable fractures). The key benefits include enhanced pain relief for VCF patients, immediate stabilization of skeletal structures, and minimizing the duration of hospital stays. Driving factors propelling this market include advancements in minimally invasive delivery tools, the shift toward outpatient surgical centers, regulatory approvals for bioresorbable cement alternatives, and significant investment in research focusing on developing composite materials that combine the strength of synthetic polymers with the regenerative capacity of bioactive ceramics.

Injectable Cement Market Executive Summary

The Injectable Cement Market is characterized by robust growth, fueled predominantly by the aging global population and the resultant surge in musculoskeletal disorders requiring intervention. Current business trends indicate a strong move toward developing customized, hybrid injectable cements that address specific clinical needs, such as antibiotic-loaded formulations to combat surgical site infections and biodegradable materials that gradually transfer load back to native bone tissue. Strategic collaborations between material science firms and medical device manufacturers are accelerating the pace of innovation, focusing on optimizing viscosity profiles for improved handling and reduced leakage risk during procedures. Furthermore, emerging economies in the Asia Pacific region are presenting vast opportunities, driven by improved healthcare infrastructure and greater access to advanced surgical technologies.

Regional trends reveal North America maintaining market dominance, underpinned by high healthcare expenditure, established reimbursement policies for spinal procedures, and the early adoption of advanced orthopedic technologies. However, the Asia Pacific market is poised for the highest growth rate, supported by a rapidly expanding patient pool suffering from bone trauma and degenerative diseases, alongside government initiatives aimed at modernizing healthcare delivery. Europe shows mature, steady growth, with strict regulatory environments prioritizing clinical efficacy and long-term safety data for novel biomaterials.

Segment trends highlight the PMMA cement type as the historical revenue leader due to its established efficacy and cost-effectiveness in load-bearing applications. Nevertheless, the calcium phosphate cement segment is witnessing accelerated growth, driven by clinical preference for materials offering genuine osteointegration and lower thermal risks during polymerization. Application-wise, spinal surgery remains the critical segment, but the use of injectable cements in trauma and extremity fixation is gaining momentum due to improvements in material properties suitable for diverse biomechanical environments. The shift towards outpatient settings is influencing product design, requiring faster setting times and minimal post-operative complications.

AI Impact Analysis on Injectable Cement Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Injectable Cement Market center around two main themes: optimizing surgical delivery and enhancing material science innovation. Users frequently ask how AI can improve the precision of cement injection, particularly in complex spinal geometries, and whether machine learning algorithms can accelerate the discovery and formulation of next-generation biomaterials with tailored properties (e.g., controlled degradation rate, tailored mechanical stiffness). Concerns also relate to the integration costs and regulatory hurdles associated with using AI-driven surgical navigation systems for cement procedures. The overarching expectation is that AI will minimize human error, improve patient-specific dosing, and lead to smarter, safer, and more predictable orthopedic outcomes by leveraging vast datasets of patient anatomies and material performance characteristics.

AI's primary influence is expected in pre-operative planning and intra-operative guidance. Machine learning models, trained on thousands of computed tomography (CT) and magnetic resonance imaging (MRI) scans, can accurately predict the optimal volume, viscosity, and trajectory for cement delivery in vertebroplasty, thereby reducing the risk of cement extravasation into surrounding neural structures or vascular spaces. This capability moves the field toward true personalized medicine, where the material handling characteristics are dynamically adjusted based on real-time anatomical feedback and bone quality assessments. Furthermore, AI can assist in robotic-assisted cement delivery systems, ensuring micro-level precision that is challenging to achieve manually, particularly in highly calcified or fragmented bone structures.

Beyond surgical application, AI is transforming research and development (R&D). Data-driven materials discovery utilizes AI to screen vast libraries of potential compounds, predicting their curing kinetics, biocompatibility, and biomechanical performance before costly physical synthesis is undertaken. This expedites the development cycle for bioactive and resorbable cements, moving away from traditional trial-and-error methods. Integrating AI-powered predictive maintenance and quality control systems in the manufacturing process will also ensure batch-to-batch consistency and regulatory compliance, further cementing its role as a key disruptive technology in the market.

- AI optimizes surgical trajectory planning, minimizing cement leakage risks.

- Machine learning accelerates the discovery of novel bioactive cement formulations.

- AI-driven navigation systems enhance precision in minimally invasive cement delivery.

- Predictive analytics aid in assessing patient-specific bone quality for optimal cement selection.

- AI improves manufacturing quality control and consistency for regulatory compliance.

DRO & Impact Forces Of Injectable Cement Market

The Injectable Cement Market is propelled by strong demographic drivers (aging populations, rising incidence of osteoporosis) and technological innovation (biomaterial science advancements), but its growth is moderated by regulatory complexities and inherent risks associated with cement leakage. Opportunities exist primarily in the development of targeted, drug-eluting cements and expansion into emerging markets, while the market remains subject to the powerful impact forces of technological shifts and intense competitive dynamics driven by intellectual property protection. These forces collectively shape the investment landscape and clinical adoption rates globally.

Drivers: The escalating global prevalence of osteoporosis, particularly among post-menopausal women and the elderly, directly drives the demand for minimally invasive treatments like vertebroplasty, which rely heavily on injectable cements for spinal stabilization and pain management. Technological advancements, including the introduction of highly viscous cements and specialized mixing/delivery systems designed to reduce extravasation, enhance the safety profile of these procedures, boosting physician confidence and patient acceptance. Furthermore, the push towards reduced hospital stays and the cost-efficiency of percutaneous procedures compared to open surgery incentivize healthcare providers to prioritize injectable solutions.

Restraints: Significant restraints include the potential complications arising from cement leakage, which can lead to pulmonary embolism, neurological deficits, or thermal necrosis of surrounding tissues, particularly with PMMA formulations. Stringent regulatory approval processes, especially in North America and Europe, require extensive clinical data demonstrating both short-term safety and long-term efficacy, increasing the cost and time required for product commercialization. Additionally, price sensitivity in emerging markets and limited reimbursement coverage for newer, high-cost bioresorbable cements pose adoption challenges.

Opportunity: The market presents substantial opportunities in developing sophisticated, functionalized cements. This includes antibiotic-loaded bone cements (ALBCs) to manage and prevent bone infections (osteomyelitis) and bioactive cements engineered to promote rapid vascularization and biological fusion. Geographical expansion into high-growth regions like APAC and Latin America, where orthopedic care is rapidly improving, offers untapped commercial potential. Furthermore, the development of synthetic cements that fully degrade and are replaced by native bone over time represents the 'holy grail' of regenerative orthopedic treatment.

Impact Forces: The market is influenced by the competitive landscape, where patent protection for proprietary formulations and delivery systems is crucial. The impact of regulatory policy changes, such as revised guidelines for biomaterial safety, directly affects market entry and product modification strategies. Socio-economic factors, including the increasing accessibility of advanced healthcare technologies through medical tourism and rising health insurance penetration, amplify market demand. Finally, the inherent clinical risks act as a persistent limiting force, compelling manufacturers to invest heavily in safety features and advanced delivery mechanisms to mitigate complications.

Segmentation Analysis

The Injectable Cement Market is comprehensively segmented based on product type, application, and end-user, reflecting the diverse clinical needs and material science advancements within the orthopedic field. Product segmentation differentiates between established synthetic materials like PMMA and more biologically active options such as calcium phosphate, which dictates their suitability for various load-bearing and regenerative applications. Understanding these material characteristics is crucial, as the performance profile directly influences clinical adoption rates and market share distribution across different geographical regions.

Application segmentation, with spinal procedures (vertebroplasty and kyphoplasty) dominating the revenue landscape, highlights the critical role injectable cements play in managing age-related musculoskeletal conditions. However, the rapidly expanding trauma care segment, including the fixation of complex extremity fractures, signifies a shift toward broader usage scenarios enabled by superior mechanical properties and customizable handling characteristics. End-user categorization distinguishes between hospitals, which handle acute trauma and complex spinal surgeries, and ambulatory surgical centers (ASCs), which increasingly adopt these procedures due to their minimally invasive nature and efficiency, impacting distribution strategies.

The transition toward next-generation materials, including specialized bioactive glass cements and bioresorbable polymers, is reshaping the competitive dynamics within product segments. While PMMA remains dominant due to its established clinical history and robust performance, growth is significantly higher in segments offering osteoconductive or drug-delivery capabilities. This indicates a market maturation driven by clinical demand for solutions that not only stabilize but also actively promote long-term bone healing and reduce post-operative complications, mandating continuous R&D investment across all major segments.

- By Product Type:

- Polymethylmethacrylate (PMMA) Cement

- Calcium Phosphate Cement (CPC)

- Glass Polyalkenoate Cement (GIC)

- Other Cements (e.g., Composite, Bioactive Glass, Bioresorbable Polymers)

- By Application:

- Spinal Procedures (Vertebroplasty, Kyphoplasty, Sacroplasty)

- Trauma and Fracture Fixation

- Joint Reconstruction (Cementing Prostheses)

- Craniofacial and Dental Applications

- By End User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Orthopedic Clinics

Value Chain Analysis For Injectable Cement Market

The value chain for the Injectable Cement Market begins with the upstream procurement and processing of highly specialized raw materials, primarily medical-grade monomers (like methyl methacrylate), specialized polymers, and high-purity calcium salt precursors. Suppliers must adhere to rigorous quality standards, as the final performance and biocompatibility of the cement are directly dependent on the purity and consistency of these components. Research and Development activities at this stage are crucial, focusing on novel composite materials and modifying existing formulations to achieve optimized viscosity, radiopacity, and setting kinetics, providing significant intellectual property value that forms the foundation of product differentiation.

The midstream involves manufacturing and final product assembly, where raw materials are compounded, sterilized, and packaged, often alongside proprietary mixing and delivery systems (cannulas, injectors). Efficiency in manufacturing, rigorous quality control checks for batch consistency, and adherence to ISO and regional medical device regulations are paramount. Distribution channels then move the final product downstream, encompassing direct sales forces targeting major hospital networks, partnerships with regional distributors specializing in orthopedic supplies, and utilizing Group Purchasing Organizations (GPOs) to negotiate favorable contracts with large healthcare systems, ensuring broad market access.

Downstream activities center on the end-users (hospitals and ASCs) and involve training surgeons and clinical staff on the proper mixing and application techniques, which is critical due to the time-sensitive nature of cement application. Direct sales are highly beneficial for specialized products, allowing manufacturers to provide intensive clinical support and gather immediate post-market feedback. Indirect distribution leverages established supply chains, often providing cost-effective coverage for commodity cement types, while digital platforms and e-commerce are gradually being integrated to streamline ordering and logistics, particularly for standard inventory items.

Injectable Cement Market Potential Customers

The primary customers and end-users of injectable cement products are specialized medical facilities and healthcare professionals who perform orthopedic, trauma, and spinal stabilization procedures. Hospitals, particularly those with comprehensive orthopedic and neurosurgical departments, represent the largest customer base, driven by the high volume of complex trauma cases, elective joint replacement surgeries (where bone cement is often used for fixation), and spinal procedures requiring vertebroplasty or kyphoplasty. The demand from hospitals is stable, focused on materials offering clinical versatility, consistent supply, and favorable group purchasing contracts.

Ambulatory Surgical Centers (ASCs) constitute a rapidly growing segment of potential customers. As healthcare systems increasingly push eligible procedures to outpatient settings to reduce costs, minimally invasive cement procedures like vertebroplasty become prime candidates for ASCs. These centers prioritize products that facilitate rapid patient turnover, require minimal preparation time, and demonstrate predictable clinical outcomes, favoring pre-packaged kits and fast-setting cement systems. The demand here is highly sensitive to product efficiency and ease of use.

Orthopedic clinics and specialized spinal intervention centers also serve as significant customers. These smaller, specialized practices often focus on specific patient groups, such as elderly patients suffering from debilitating pain due to vertebral compression fractures. Their procurement decisions are often influenced by the clinical efficacy documented in peer-reviewed literature, brand reputation among specialists, and the ability of the product to integrate seamlessly with specialized imaging equipment used during interventional radiology procedures.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $3.45 Billion USD |

| Market Forecast in 2033 | $5.84 Billion USD |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stryker Corporation, Medtronic Plc, Zimmer Biomet Holdings, Inc., Johnson & Johnson (DePuy Synthes), DJO Global (Colfax Corporation), OsteoMed, Teknimed, Smith & Nephew Plc, Heraeus Medical GmbH, Biometrix, Graftys, Gunze Limited, Kinamed, Inc., Ossur, Curasan AG, Exactech, Inc., Meril Life Sciences Pvt. Ltd., Tecres SpA, Arthrex, Inc., Globus Medical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Injectable Cement Market Key Technology Landscape

The technological landscape of the Injectable Cement Market is defined by continuous advancements focused on improving material bioactivity, enhancing mechanical performance, and perfecting delivery systems to ensure surgical precision. A major area of innovation involves developing new material compositions, moving beyond traditional PMMA to include triphasic calcium phosphate ceramics, strontium-doped CPCs, and magnesium-based cements. These next-generation materials are engineered to offer controlled resorbability and superior osteoconductivity, allowing the implant to be gradually replaced by healthy host bone, minimizing the long-term concerns associated with permanent synthetic implants and reducing the stress shielding effect common with stiff PMMA.

Furthermore, significant research efforts are dedicated to mitigating the exothermic reaction associated with PMMA polymerization. Novel formulations incorporate heat sinks or specific activators to control the curing temperature, thereby reducing the risk of thermal necrosis to adjacent tissues, which is a critical complication, especially in proximity to the spinal cord or critical nerves. Another vital technological pathway involves the integration of therapeutic agents. The development of antibiotic-loaded bone cements (ALBCs) is crucial in preventing and managing periprosthetic joint infections (PJIs). Researchers are now focusing on controlling the elution kinetics of these antibiotics to provide effective local drug concentrations over an extended period without compromising the mechanical integrity of the cement structure.

Delivery technology is equally pivotal. Advancements include high-viscosity cement systems that minimize the potential for leakage through the fractured bone structure, offering better containment during vertebroplasty. The evolution of specialized mixing devices and closed-system delivery cartridges ensures consistent material homogeneity, reduces monomer exposure risks for surgical staff, and provides precise volumetric control during injection. Integrating these delivery systems with advanced intra-operative imaging techniques, such as bi-plane fluoroscopy and cone-beam CT, further enhances the accuracy and safety of minimally invasive procedures, driving overall clinical confidence and adoption of advanced injectable solutions.

Regional Highlights

North America: North America, comprising the United States and Canada, holds the largest share of the Injectable Cement Market, primarily due to advanced healthcare infrastructure, high awareness regarding minimally invasive orthopedic procedures, and favorable reimbursement policies for spinal and trauma interventions. The region benefits from a high incidence of spinal pathologies related to the large geriatric population base and aggressive research and development activities spearheaded by major medical device companies. The U.S. market is highly competitive and technologically driven, leading to rapid adoption of premium, high-viscosity, and bioactive cements. Significant investment in clinical trials and regulatory pathways for novel biomaterials ensures that the region remains at the forefront of market innovation, continuously driving the standard of care upwards. The demand is further amplified by the increasing shift of elective procedures to Ambulatory Surgical Centers (ASCs), necessitating efficient, fast-setting materials.

Europe: Europe represents a mature and stable market, characterized by strict regulatory oversight (CE Mark requirements) which ensures high product quality and clinical safety. Western European nations, particularly Germany, France, and the UK, are key contributors, driven by government focus on improving spinal care access and managing the increasing burden of osteoporotic fractures. The European market shows a strong preference for calcium phosphate cements and bioresorbable materials, reflecting a clinical inclination toward long-term biological integration over purely mechanical stabilization. However, variations in healthcare spending and reimbursement across Eastern and Western Europe create segmented growth patterns, with leading technology adoption concentrated in the wealthier western countries. The region also exhibits significant market activity related to antibiotic-loaded cements, largely driven by rigorous infection control protocols.

Asia Pacific (APAC): The Asia Pacific region is forecast to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period. This explosive growth is attributable to massive demographic factors, including rapidly aging populations in countries like Japan and China, coupled with improving healthcare access and modernization across India, South Korea, and Southeast Asia. As disposable incomes rise and awareness of advanced treatment options increases, there is a growing demand for premium orthopedic interventions. While price sensitivity remains a factor, particularly in developing economies, increasing government investment in public health infrastructure and the rise of medical tourism are attracting advanced surgical technologies. Local manufacturing and collaborations are accelerating the adoption of international quality standards, transforming APAC into a major hub for both consumption and production of injectable cement technologies.

Latin America and Middle East & Africa (MEA): These regions currently hold smaller market shares but offer significant future potential. In Latin America, economic growth and expanding health insurance coverage in countries such as Brazil and Mexico are opening doors for specialized orthopedic products. The MEA market growth is primarily concentrated in the Gulf Cooperation Council (GCC) countries, driven by high healthcare spending, specialized medical infrastructure, and a dependency on imported advanced medical devices. Challenges in these regions include variable regulatory landscapes, fragmented distribution channels, and socioeconomic disparities affecting patient access to high-cost treatments. However, the foundational need for trauma and spinal care ensures sustained, moderate growth, especially as regional clinical expertise improves and product training becomes more standardized.

- North America: Market leader due to high healthcare spending and early technology adoption in spinal care.

- Europe: Stable growth, favoring high-quality, bioresorbable cements under strict regulatory guidance.

- Asia Pacific (APAC): Fastest-growing region, driven by aging populations and rapid modernization of healthcare infrastructure.

- Latin America & MEA: Emerging markets with increasing healthcare investment, providing long-term growth opportunities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Injectable Cement Market.- Stryker Corporation

- Medtronic Plc

- Zimmer Biomet Holdings, Inc.

- Johnson & Johnson (DePuy Synthes)

- DJO Global (Colfax Corporation)

- Smith & Nephew Plc

- Heraeus Medical GmbH

- Graftys

- Teknimed

- Gunze Limited

- OsteoMed

- Curasan AG

- Exactech, Inc.

- Meril Life Sciences Pvt. Ltd.

- Tecres SpA

- Biometrix

- Arthrex, Inc.

- Globus Medical

- Kinamed, Inc.

- Ossur

Frequently Asked Questions

Analyze common user questions about the Injectable Cement market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between PMMA and Calcium Phosphate (CPC) cements?

PMMA cement offers superior mechanical strength and is primarily used for immediate structural stabilization (load-bearing), but it is non-resorbable. CPC cement is osteoconductive, meaning it promotes new bone growth and can be gradually resorbed and replaced by natural bone, making it preferred for non-load-bearing or regenerative applications.

What are the main risks associated with injectable bone cement procedures?

The primary risk involves cement extravasation (leakage) outside the target bone cavity, which can lead to complications such as pulmonary embolism, neurological damage if near the spinal cord, or thermal injury to surrounding soft tissues due to the exothermic curing reaction of PMMA.

Which application segment drives the highest demand in the market?

Spinal procedures, specifically vertebroplasty and kyphoplasty performed to treat painful vertebral compression fractures (VCFs) often caused by osteoporosis, represent the largest and most critical application segment driving market demand for injectable cements globally.

How is technology addressing the safety concerns of injectable cements?

Technological advancements focus on developing high-viscosity cements to reduce leakage, optimizing mixing systems for consistency, and formulating materials with controlled, lower exothermic curing temperatures to minimize the risk of thermal necrosis during implantation.

Is the Injectable Cement Market shifting towards bioresorbable materials?

Yes, there is a distinct clinical and market trend favoring bioresorbable and bioactive materials (such as certain CPC and bioactive glass formulations) over permanent implants, as these materials facilitate the natural regeneration and load transfer back to the native skeletal structure over time.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager