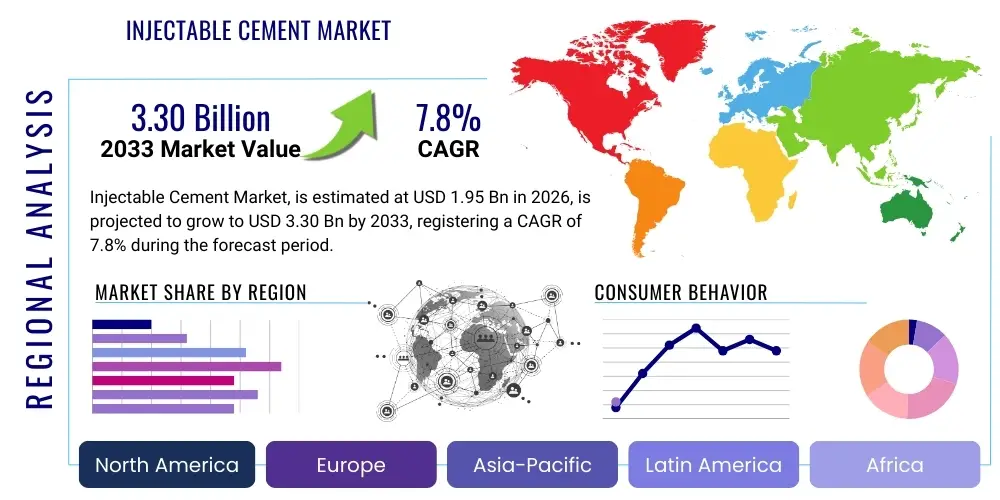

Injectable Cement Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438076 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Injectable Cement Market Size

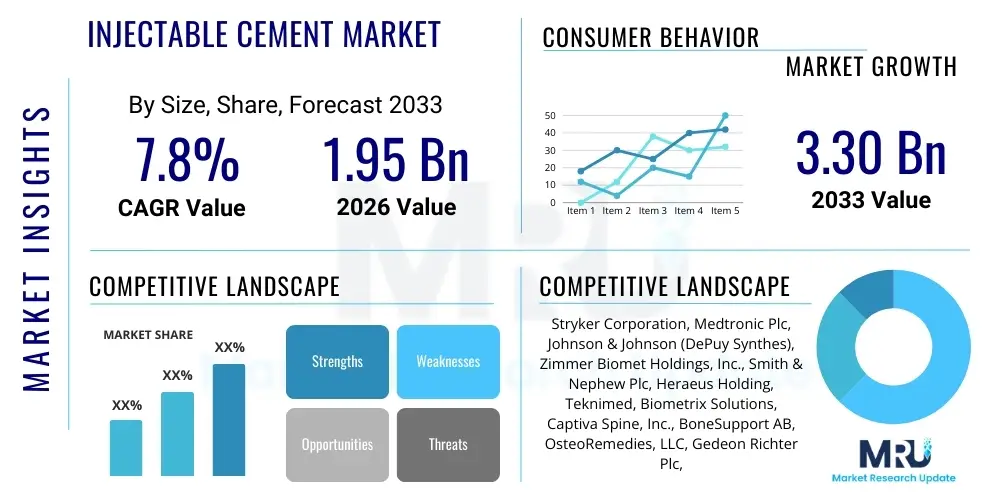

The Injectable Cement Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $1.95 Billion in 2026 and is projected to reach $3.30 Billion by the end of the forecast period in 2033.

Injectable Cement Market introduction

The Injectable Cement Market encompasses a specialized segment of orthopedic and medical materials used primarily for minimally invasive procedures such as vertebroplasty, kyphoplasty, and arthroplasty revisions. These cement formulations, typically based on polymethylmethacrylate (PMMA) or calcium phosphate (CaP), are designed to be delivered via a syringe or catheter into compromised skeletal structures, offering stabilization, pain relief, and immediate mechanical support without the need for extensive open surgery. This focus on minimally invasive techniques aligns with modern healthcare trends favoring faster recovery times and reduced patient morbidity, making injectable cements a critical component in managing age-related and trauma-induced bone defects.

The primary applications of injectable cements are widespread across various orthopedic, dental, and trauma specialties. In orthopedics, their utility is paramount in treating vertebral compression fractures (VCFs), a common consequence of osteoporosis, where the cement restores structural integrity and prevents further collapse. Beyond VCFs, these materials are increasingly utilized in augmenting screw fixation in osteoporotic bone and filling voids created by benign tumor resections. Product innovation focuses on improving handling characteristics, radiopacity, and biocompatibility, particularly the development of bioactive cements that promote bone integration, thereby moving beyond simple mechanical fixation toward true regeneration.

Key benefits driving the adoption of injectable cements include significantly reduced procedural risk compared to traditional open surgery, shorter hospital stays, and rapid mobilization of the patient. The driving factors for market growth include the globally expanding geriatric population highly susceptible to osteoporosis and degenerative bone diseases, coupled with increasing adoption of advanced imaging technologies that allow precise cement delivery. Furthermore, rising awareness regarding the efficacy of minimally invasive spinal procedures and favorable reimbursement policies in developed economies further catalyze market expansion.

Injectable Cement Market Executive Summary

The Injectable Cement Market is characterized by robust growth, propelled by the demographic shift toward an aging global population and corresponding increase in fragility fractures and degenerative orthopedic conditions. Business trends indicate a strong move toward innovation focused on incorporating bioactive components, such as hydroxyapatite and growth factors, into standard PMMA and calcium phosphate formulations to improve long-term osseointegration and reduce revision rates. Consolidation among major players is observed, driven by the need to acquire specialized technology for resorbable and drug-eluting cements, thereby enhancing product portfolios that address both mechanical stabilization and infection prevention in bone surgery. Furthermore, regulatory scrutiny, particularly in the European Union and North America, is pushing manufacturers to demonstrate superior clinical efficacy and safety profiles for new product introductions.

Regionally, North America maintains the leading position due to high procedural volumes, established healthcare infrastructure, and favorable reimbursement structures for spinal procedures like kyphoplasty. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This accelerated growth in APAC is attributable to rapidly improving healthcare access, increasing disposable incomes enabling the adoption of advanced medical treatments, and the enormous unmet need for orthopedic care, particularly in densely populated nations like China and India. European growth remains stable, fueled by consistent adoption of high-quality synthetic cements and early uptake of sophisticated delivery systems across major Western European economies.

Segment trends reveal that the Polymethylmethacrylate (PMMA) cement category currently holds the largest market share due to its proven track record of mechanical strength and long-term stability, making it the gold standard for high-load-bearing applications like vertebral body augmentation. Conversely, the Calcium Phosphate Cement (CPC) segment is anticipated to witness faster growth, driven by its inherent bioresorbability and osteoconductive properties, making it highly preferred for craniofacial, dental, and non-load-bearing applications where eventual bone replacement is desired. Application-wise, Vertebroplasty and Kyphoplasty procedures continue to dominate the market, reflecting the high incidence of osteoporotic vertebral compression fractures globally.

AI Impact Analysis on Injectable Cement Market

User inquiries regarding the integration of Artificial Intelligence (AI) into the Injectable Cement market frequently center on three core themes: precision delivery, material design optimization, and surgical planning. Users are concerned about how AI algorithms can reduce human error in minimally invasive procedures by guiding the surgeon or robotic systems in real-time, especially in complex spinal anatomy where cement extravasation poses significant risk. Expectations are high that AI can be used to analyze patient-specific bone density and structural stress data (derived from CT or MRI scans) to recommend the optimal cement viscosity and volume needed, moving away from generalized approaches toward highly personalized orthopedic intervention. The desire is to use predictive analytics to improve procedural outcomes and minimize complications associated with cement leakage.

Furthermore, there is keen interest in how AI and machine learning (ML) can accelerate the R&D process for novel cement formulations. Current research involves extensive laboratory testing to evaluate material properties such as curing time, mechanical strength, and degradation rates. AI algorithms, particularly those specialized in material informatics, can rapidly simulate thousands of molecular combinations and predict the performance characteristics of new bio-compatible polymers or bioactive glass compounds, drastically shortening the time needed to develop next-generation injectable cements that offer superior biological integration and mechanical longevity. This shift will allow manufacturers to bring specialized products addressing specific clinical needs, such as high-strength cements for trauma cases or highly resorbable variants for pediatric use, to market much quicker.

The operational impact extends to inventory management and supply chain optimization, where AI systems can forecast demand based on regional epidemiology (e.g., predicted increases in VCFs during winter months or localized demographic shifts), ensuring timely availability of specialized cement kits and delivery tools. While AI does not directly interact with the physical cement material, its influence on pre-operative decision-making, intra-operative guidance systems, and post-operative analysis (predicting long-term success or failure rates) establishes it as a foundational technology enhancing the safety and effectiveness of injectable cement procedures, transforming them into data-driven interventions.

- AI-driven image analysis improves targeting precision during vertebroplasty, minimizing cement leakage risk.

- Machine learning algorithms optimize cement material composition for enhanced strength, handling, and bioactivity.

- Predictive modeling uses patient bone density data to calculate optimal cement volume and injection pressure.

- AI-enabled robotic assistance systems facilitate highly accurate, reproducible cement delivery in minimally invasive spine surgery.

- Demand forecasting using AI ensures efficient supply chain management for specialized cement kits based on regional clinical needs.

DRO & Impact Forces Of Injectable Cement Market

The dynamics of the Injectable Cement market are primarily shaped by the significant prevalence of osteoporosis and related fragility fractures globally, acting as a powerful driver. The rapidly expanding elderly demographic is directly correlated with an increased incidence of vertebral compression fractures (VCFs) and other bone pathologies that are ideally treated using injectable cements through minimally invasive techniques. This demographic driver is strongly supported by technological advancements, specifically the development of improved cement formulations offering superior mechanical characteristics, reduced heat generation during polymerization, and enhanced radiopacity for precise visualization during the procedure. Furthermore, the growing preference for short-stay surgical procedures and reduced recovery times heavily favors the adoption of these minimally invasive methods over traditional open surgeries, sustaining high market demand.

However, the market faces constraints, notably the potential complications associated with cement leakage (extravasation), which can lead to serious adverse events such as pulmonary embolism or nerve root compression, demanding highly skilled surgeons and stringent quality controls. Another restraint is the relatively high cost of advanced, bioactive or resorbable cement formulations compared to traditional PMMA, particularly in cost-sensitive emerging markets, which can limit their widespread accessibility. Additionally, the stringent regulatory approval process required for novel biomaterials, particularly those intended for permanent implantation or bone substitution, can delay market entry and increase R&D expenses, slowing innovation uptake.

Opportunities abound in developing next-generation bioactive cements that actively promote bone healing and reduce the risk of non-union or subsequent fractures adjacent to the treated area. The emerging field of drug-eluting cements, capable of releasing antibiotics or anti-inflammatory agents locally to prevent infection following trauma or joint replacement revisions, presents a substantial revenue stream. Moreover, penetration into untapped markets in Latin America and Southeast Asia, coupled with educational initiatives to train orthopedic surgeons in specialized minimally invasive techniques, offers clear pathways for robust long-term growth. The primary impact forces driving this market include demographic pressures (elderly population), economic forces (healthcare expenditure containment favoring minimally invasive procedures), and technological innovation (enhanced material science). These forces collectively ensure sustained market expansion despite pricing and regulatory hurdles.

- Drivers: High global incidence of osteoporosis and VCFs; shift toward minimally invasive surgical procedures; technological improvements in cement materials (bioactive, low-exothermic).

- Restraints: Potential risk of cement leakage and associated adverse events; high cost of advanced cement formulations; stringent regulatory requirements for novel biomaterials.

- Opportunities: Development of drug-eluting cements for infection prophylaxis; expansion into emerging economies; application extension into dental, craniofacial, and trauma reconstruction.

- Impact Forces: Increasing life expectancy and aging demographics; advancements in delivery systems (cannulas, needles); competitive intensity among key manufacturers focusing on proprietary polymer blends.

Segmentation Analysis

The Injectable Cement Market is comprehensively segmented based on its material composition, the specific application area in which it is used, and the type of delivery procedure employed. Understanding these segments is crucial for manufacturers to tailor their R&D and marketing strategies to meet distinct clinical needs, ranging from mechanical stabilization in the spine to biological integration in peripheral skeleton repairs. The primary segments reflect the dichotomy between fast-curing, high-strength synthetic polymers (like PMMA) favored for immediate load bearing, and biologically active or resorbable materials (like CPC) preferred for situations where native bone regeneration is the ultimate goal.

The Application segment is particularly influential, with spinal procedures (vertebroplasty and kyphoplasty) constituting the largest revenue share, reflecting the high procedural volume related to osteoporotic fractures. However, orthopedic trauma and joint arthroplasty revisions represent fast-growing subsegments, demanding materials with specific characteristics such as controlled viscosity and anti-microbial properties to manage complex revision surgeries. Geographically, the segmentation highlights the varying degrees of procedural adoption and pricing sensitivity across developed markets like North America and Europe versus rapidly developing regions in Asia Pacific.

Procedure segmentation further delineates the market into traditional open surgical applications and the rapidly dominant minimally invasive techniques. The latter, which relies heavily on specialized injection systems and controlled cement viscosity, is the major driver for material development. Successful market players focus on creating material-device combinations that offer optimal clinical performance, predictability, and ease of use in confined surgical spaces.

- By Material Type:

- Polymethylmethacrylate (PMMA) Cement

- Calcium Phosphate Cement (CPC)

- Calcium Sulphate Cement

- Glass Polyalkenoate Cement (GPC)

- Other Bioactive Cements

- By Application:

- Vertebroplasty & Kyphoplasty

- Arthroplasty Revision (Joint Fixation)

- Trauma & Fracture Fixation

- Craniofacial & Dental Applications

- Tumor & Void Filling

- By End-User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialized Orthopedic Clinics

- By Procedure Type:

- Minimally Invasive Procedures

- Open Surgical Procedures

Value Chain Analysis For Injectable Cement Market

The value chain for injectable cement is complex, starting with the procurement and refinement of highly specialized raw chemical materials, primarily monomers (methyl methacrylate for PMMA) and calcium compounds. The upstream segment involves chemical synthesis and rigorous quality control to ensure pharmaceutical-grade purity, as minor impurities can significantly affect the cement’s polymerization exothermic reaction, mechanical strength, and biocompatibility. Key suppliers in this stage are specialized chemical manufacturers who must comply with stringent medical device raw material standards (ISO 13485). Efficient management of raw material costs and consistent quality supply chains are crucial for maintaining competitive pricing and product consistency downstream.

The core manufacturing process involves formulating the cement (liquid and powder components), packaging them into sterile, pre-measured kits, and developing the proprietary delivery systems (mixing bowls, high-pressure injection cannulas). This middle segment is highly intellectual property-intensive, focusing on optimizing factors like viscosity, setting time, and minimizing leaching of potentially toxic components. Direct sales forces and highly specialized distributors manage the primary distribution channel. Because injectable cements are high-value, specialized medical consumables, they typically bypass broad retail channels and move directly from manufacturers/major distributors to healthcare facilities, necessitating specialized logistics for sterile, temperature-controlled transport, particularly for kits containing liquid activators.

The downstream segment includes hospitals, ASCs, and specialized clinics—the end-users who purchase and utilize the products. Sales are driven heavily by clinical evidence, surgeon preference, and specialized training provided by the manufacturers' clinical support teams. Direct distribution ensures better technical support and immediate feedback on product performance. Indirect distribution, utilized often in emerging markets, relies on exclusive country distributors who manage local inventory, regulatory clearance, and relationship management with local orthopedic and neuro-spine specialists. Success in this final stage depends on securing formulary approvals, conducting consistent physician training programs, and ensuring excellent clinical outcomes.

Injectable Cement Market Potential Customers

The primary end-users of injectable cements are healthcare facilities specializing in orthopedic, spinal, and trauma surgery. Hospitals, particularly those with comprehensive orthopedic departments and spine centers, represent the largest segment of potential customers due to the high volume of complex trauma cases, geriatric admissions requiring VCF treatment, and joint revision surgeries performed within these institutions. These facilities demand a broad portfolio of cement types, reliable supply, and comprehensive technical support, favoring manufacturers capable of being an integrated provider for multiple procedural requirements.

Ambulatory Surgical Centers (ASCs) are rapidly emerging as a critical customer segment, driven by the shift towards outpatient and minimally invasive procedures, including many VCF treatments. ASCs prioritize efficiency, quick turnover, and cost-effectiveness. Consequently, they often seek pre-packaged, single-use cement kits that streamline the process and reduce overhead. Manufacturers targeting ASCs must emphasize ease of preparation, reliable performance, and proven clinical outcomes that support the faster patient discharge models characteristic of these facilities.

Specialized orthopedic and pain management clinics also constitute vital customers, particularly those focusing on geriatric care, chronic spinal conditions, and pain intervention therapies. These clinics often utilize injectable cements for targeted pain relief procedures, demanding high-quality materials optimized for precision and minimal invasion. Furthermore, dental and maxillofacial surgeons represent a niche, growing customer base, especially for bioresorbable calcium phosphate cements used in bone grafting and reconstructive procedures where predictable bone integration is paramount. Penetration into this diverse customer base requires tailored sales strategies and specialized clinical training for each unique application area.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.95 Billion |

| Market Forecast in 2033 | $3.30 Billion |

| Growth Rate | CAGR 7.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stryker Corporation, Medtronic Plc, Johnson & Johnson (DePuy Synthes), Zimmer Biomet Holdings, Inc., Smith & Nephew Plc, Heraeus Holding, Teknimed, Biometrix Solutions, Captiva Spine, Inc., BoneSupport AB, OsteoRemedies, LLC, Gedeon Richter Plc, Alphatec Holdings (A-TEC), REX Medical, Globus Medical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Injectable Cement Market Key Technology Landscape

The technological landscape of the Injectable Cement market is undergoing rapid evolution, moving beyond simple PMMA formulations toward sophisticated biomaterials designed for both mechanical stability and biological interaction. A critical area of advancement involves the development of low-exothermic reaction cements. Traditional PMMA polymerization releases substantial heat, which can cause thermal necrosis (tissue damage) to surrounding neural and bone tissue. New formulations incorporate specialized inhibitors and material blends that control the polymerization kinetics, ensuring the material cures quickly enough for surgical efficiency but maintains a lower peak temperature, significantly enhancing patient safety, particularly in close proximity to nerve roots.

Another pivotal technological focus is the creation of bioactive and resorbable cements, primarily utilizing calcium phosphate (CaP) and calcium sulfate compounds. These materials are engineered to slowly dissolve over time, being replaced by native bone tissue. This shift requires precise control over the degradation rate to match the pace of new bone growth. Furthermore, manufacturers are investing heavily in advanced mixing and delivery systems. These systems include closed-loop mixing cartridges that minimize monomer vapor exposure to the operating room staff and high-pressure, specialized cannulas that allow for precise, controlled injection, crucial for maximizing fill volume while preventing cement extravasation during minimally invasive spinal procedures.

The integration of drug delivery capabilities within injectable cements represents a cutting-edge technological front. Cements loaded with antibiotics or antifungals are increasingly used in complex orthopedic trauma and revision arthroplasty to manage and prevent peri-prosthetic joint infection (PJI), a devastating complication. The challenge lies in optimizing the elution profile of the drug—ensuring a therapeutic concentration is maintained locally for an extended period without compromising the cement's structural integrity. Ongoing research also explores magnetic resonance imaging (MRI)-compatible radiopacifiers to improve post-operative evaluation, replacing traditional barium sulfate with specialized iodine compounds or ceramics that maintain visibility without causing significant artifacts on advanced imaging modalities.

Regional Highlights

North America, led by the United States and Canada, remains the largest revenue contributor to the Injectable Cement Market. This dominance is attributed to high procedural volumes resulting from a large aging population, sophisticated healthcare infrastructure, rapid adoption of advanced spinal and orthopedic treatments (kyphoplasty/vertebroplasty), and favorable reimbursement scenarios that support the use of premium, advanced cement kits. Innovation, particularly in drug-eluting cements and advanced delivery systems, often originates and is first commercialized in this region.

Europe holds a substantial market share, driven by consistent quality demands and high standards set by regulatory bodies like the European Medicines Agency (EMA). Western European countries (Germany, France, UK) show high adoption rates, focusing on PMMA and high-quality bioactive cements for joint revisions and trauma. However, economic pressures in some peripheral European nations necessitate a balance between cost and clinical efficacy, leading to diverse material preferences across the continent.

Asia Pacific (APAC) is projected to be the fastest-growing region. This acceleration is fueled by increasing investments in healthcare infrastructure, rising awareness about minimally invasive procedures, and a vast patient pool, particularly in India and China, grappling with rising incidence of osteoporosis and trauma. Local manufacturers are emerging, often competing on price, but major global players are intensifying their presence through strategic partnerships and localized R&D efforts to meet the specific anatomical and economic needs of the regional market.

Latin America and the Middle East & Africa (MEA) currently account for smaller market shares but offer significant future growth potential. Growth in these regions is contingent upon improved economic stability, the expansion of private healthcare facilities, and increased training of surgeons in specialized orthopedic techniques. Regulatory fragmentation and lower per capita healthcare spending pose challenges, necessitating a focus on essential, cost-effective injectable cement solutions.

- North America: Market leader; driven by high procedural volume, advanced technology adoption, and favorable reimbursement for VCF treatments. Focus on innovation in delivery systems and bioactive materials.

- Europe: Stable growth; emphasizes quality, adherence to strict regulations, and strong utilization in arthroplasty revision and trauma. Germany and the UK are key markets.

- Asia Pacific (APAC): Fastest growing region; propelled by expanding healthcare access, large geriatric population base, and increasing investments in spine care infrastructure in China and India.

- Latin America & MEA: Emerging markets; growth dependent on economic development, infrastructure improvement, and increasing penetration of specialized orthopedic surgical training.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Injectable Cement Market.- Stryker Corporation

- Medtronic Plc

- Johnson & Johnson (DePuy Synthes)

- Zimmer Biomet Holdings, Inc.

- Smith & Nephew Plc

- Heraeus Holding

- Teknimed

- Biometrix Solutions

- Captiva Spine, Inc.

- BoneSupport AB

- OsteoRemedies, LLC

- Gedeon Richter Plc

- Alphatec Holdings (A-TEC)

- REX Medical

- Globus Medical

- Osseus Fusion Technologies

- Merit Medical Systems, Inc.

- I-MED Pharma Inc.

- Curex Group

- Kuros Biosciences AG

Frequently Asked Questions

Analyze common user questions about the Injectable Cement market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary types of injectable cement materials utilized in orthopedics?

The market is dominated by Polymethylmethacrylate (PMMA) cements, which offer high mechanical strength for immediate load bearing, and Calcium Phosphate Cements (CPC), which are favored for their bioresorbability and ability to be replaced eventually by native bone.

What application drives the highest demand for injectable cements?

Vertebroplasty and Kyphoplasty procedures, used primarily to stabilize vertebral compression fractures (VCFs) caused by osteoporosis, constitute the largest application segment globally, driving the majority of market revenue.

What is the main concern or risk associated with injectable cements during surgery?

The primary surgical risk is cement extravasation (leakage) outside the intended bone cavity, which can lead to severe complications such as vascular blockage (pulmonary embolism) or nerve compression, necessitating highly precise injection techniques.

Which geographical region is expected to show the fastest growth rate?

The Asia Pacific (APAC) region is projected to exhibit the highest CAGR, fueled by rapidly improving healthcare infrastructure, substantial increases in surgical volumes, and a vast, aging population requiring specialized orthopedic interventions.

How is technological advancement influencing the future of injectable cements?

Future growth is driven by the development of drug-eluting cements for infection prevention and bioactive/bioresorbable formulations that enhance bone regeneration, moving materials beyond simple mechanical fillers toward therapeutic agents.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager