Insulin Injection Pen Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441160 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Insulin Injection Pen Market Size

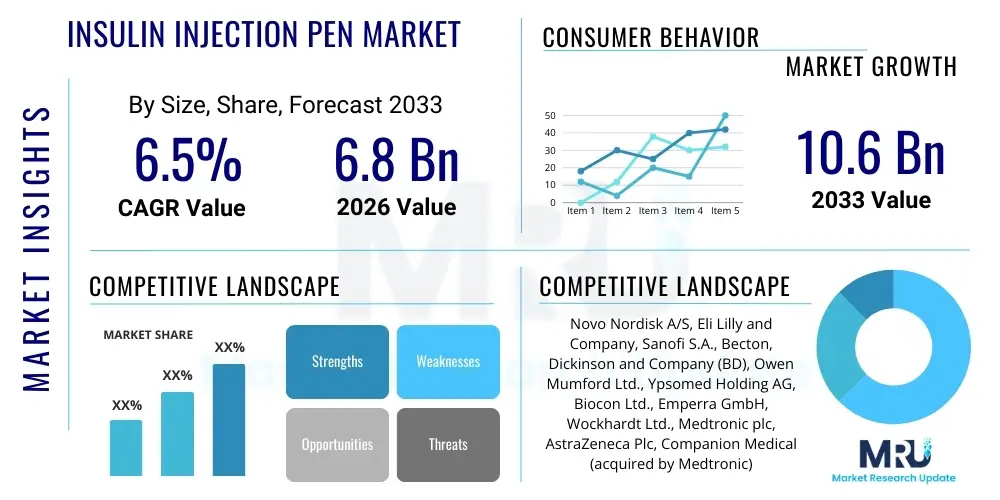

The Insulin Injection Pen Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 6.2 Billion in 2026 and is projected to reach USD 11.1 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by the accelerating global prevalence of diabetes mellitus, particularly Type 1 and Type 2 diabetes, which necessitates precise and frequent insulin delivery. Furthermore, technological advancements leading to the development of smart insulin pens with enhanced connectivity and dose tracking capabilities are significantly boosting market adoption rates across developed and emerging economies.

Insulin Injection Pen Market introduction

The Insulin Injection Pen Market encompasses devices designed for the self-administration of insulin by diabetic patients. These devices offer a superior alternative to traditional vial and syringe methods, enhancing convenience, accuracy, and patient adherence to treatment protocols. Insulin pens, categorized broadly into reusable and prefilled/disposable pens, integrate insulin cartridges and a dial mechanism for precise dose selection. The core product description involves ergonomic design, high dosage accuracy, and features promoting ease of use, making them essential tools in chronic disease management.

Major applications of these pens are centered entirely on the management of diabetes mellitus, serving both Type 1 and Type 2 diabetic populations requiring basal, bolus, or mixed insulin therapy. The widespread adoption of these pens is driven by significant benefits, including improved quality of life for patients, reduced risk of injection errors, better portability, and discreet administration in various settings. These advantages contribute directly to improved glycemic control outcomes, which is a paramount goal in diabetes care.

Key driving factors propelling market expansion include favorable reimbursement policies in developed nations, increasing geriatric populations susceptible to diabetes, intensive public health campaigns raising awareness about diabetes management, and continuous innovation focused on developing connected insulin pens. The transition from traditional needles and syringes to modern pen systems is a foundational trend supporting the projected market growth throughout the forecast period. The integration of digital health solutions further solidifies the market's positive outlook.

Insulin Injection Pen Market Executive Summary

The Insulin Injection Pen Market is characterized by intense technological competition and a definitive shift toward digital integration. Business trends indicate a strong focus on strategic collaborations between device manufacturers and pharmaceutical companies to ensure compatible insulin formulations and delivery systems. Furthermore, manufacturers are heavily investing in research and development to introduce smart pens that connect to mobile applications, facilitating automated dose logging and sharing data with healthcare providers. This move towards connected healthcare systems represents the primary axis of innovation and market differentiation, driving premium segment growth and improving patient engagement.

Regionally, North America and Europe maintain dominance, attributed to high diabetes awareness, established healthcare infrastructure, and favorable reimbursement structures supporting the adoption of advanced delivery devices. However, the Asia Pacific (APAC) region is poised for the fastest growth, driven by its massive and rapidly expanding diabetic population, increasing disposable incomes, and improving access to modern medical devices. Emerging markets in Latin America and MEA are also showing steady adoption, supported by governmental initiatives aiming to modernize diabetes care practices.

Segment trends highlight the sustained dominance of disposable insulin pens due to their convenience and reduced risk of cross-contamination, particularly in high-volume settings. Simultaneously, the reusable pen segment is gaining traction in cost-sensitive markets and among environmentally conscious users. Critically, the smart insulin pen sub-segment is expected to exhibit the highest CAGR, reflecting the industry's commitment to precision medicine and digital health integration, ensuring that dosage information is accurately tracked and analyzed, thus optimizing patient outcomes.

AI Impact Analysis on Insulin Injection Pen Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the Insulin Injection Pen Market frequently center on how AI can enhance dosage accuracy, improve personalized treatment plans, and automate data management for better patient-physician communication. Key themes revolve around the integration of predictive analytics into smart pen systems to anticipate required insulin amounts based on lifestyle, diet, and continuous glucose monitoring (CGM) data. Users express high expectations for AI to minimize human error in dosage calculation and optimize timing, thereby preventing hypo- or hyperglycemia events. Concerns often touch upon data privacy, regulatory compliance of AI algorithms in medical devices, and the accessibility of these advanced, potentially higher-cost, smart pen systems across diverse socioeconomic groups. The consensus anticipates AI transforming current reactive treatment models into highly proactive, individualized therapeutic strategies.

- AI-driven predictive dosing algorithms enhance the safety and effectiveness of insulin delivery.

- Integration with CGM data allows AI to optimize basal and bolus insulin recommendations in real-time.

- Machine learning models personalize insulin sensitivity factors and carbohydrate ratios for improved glycemic control.

- AI facilitates automated logbook generation and compliance monitoring through smart pen connectivity.

- Improved data analysis supports healthcare professionals in rapid treatment adjustment and identification of problematic trends.

- Development of next-generation closed-loop systems leveraging AI for fully automated insulin delivery (Artificial Pancreas Systems).

DRO & Impact Forces Of Insulin Injection Pen Market

The Insulin Injection Pen Market dynamics are fundamentally shaped by the interplay of growth catalysts, inhibiting factors, and emerging opportunities, collectively defining the impact forces. The primary drivers include the escalating global prevalence of diabetes, the inherent ease-of-use and superior accuracy offered by pens compared to conventional syringes, and strong regulatory support for user-friendly medical devices. Restraints largely center on the relatively higher cost associated with advanced smart pens, particularly in developing economies, and the inherent risk of needle phobia persisting in a subset of the population. Opportunities are abundant, primarily focused on the expansion into emerging markets, the development of integrated smart pens with sophisticated AI features, and creating educational programs to boost patient awareness and adherence.

Impact forces illustrate how these elements interact. The high convenience factor (Driver) directly mitigates patient reluctance (Restraint) associated with frequent injections. Simultaneously, technological advancements (Opportunity) are rapidly reducing the market share of less accurate, traditional delivery methods. However, the complexity of developing fully interconnected digital ecosystems poses a significant hurdle (Restraint) that requires substantial investment. The ultimate impact force dictates that the market will continue its robust expansion, driven primarily by innovation in smart technology and the sheer growth of the diabetic patient base, outpacing the cost concerns that might temper adoption in certain regions. Manufacturers must navigate patent expiration challenges while maintaining competitive pricing strategies to maximize penetration.

The long-term success of market players hinges on balancing precision engineering with affordability. As generic versions of insulin formulations become more prevalent, the value proposition shifts entirely to the delivery device itself, emphasizing features like dosage memory, ergonomic design, and integrated data capabilities. Thus, investment in digital health infrastructure and compliance optimization features is critical for sustaining competitive advantage and securing market leadership.

Segmentation Analysis

The Insulin Injection Pen Market is segmented based on product type, end user, and distribution channel, providing granular insights into demand patterns and competitive strategies. Product segmentation differentiates between disposable and reusable pens, reflecting varying patient needs regarding convenience, cost, and environmental impact. End-user analysis focuses primarily on hospitals, clinics, and home care settings, with home care dominating due to the necessity for self-administration of insulin. The distribution channel segment, encompassing hospital pharmacies, retail pharmacies, and online channels, is seeing a significant evolution driven by e-commerce expansion and increasing demand for direct-to-patient services.

The continuous innovation within the product type segment, particularly the introduction of advanced smart pens, is crucial for market differentiation. Smart pens are a distinct subcategory that marries the physical delivery mechanism with digital capabilities, offering unmatched data logging and integration features. This technological stratification allows companies to target different price points and patient demographics, ranging from highly compliant, technology-savvy users to those requiring basic, reliable, and cost-effective devices for daily management. The segmentation reflects a mature market adapting rapidly to the demands of precision medicine and digital health integration.

Understanding these segments is vital for market players defining their go-to-market strategies. For instance, reusable pens often appeal to healthcare systems focused on sustainability and reducing long-term costs, while disposable pens satisfy the demand for maximum convenience and sterility in varied environments. The shift towards home care settings as the primary end-user segment necessitates robust design features, high durability, and simple operational procedures suitable for patients of all ages and technological proficiencies.

- By Product Type:

- Disposable Insulin Pens (Prefilled)

- Reusable Insulin Pens (Cartridge-Based)

- Smart Insulin Pens (Connected Devices)

- By End User:

- Hospitals and Clinics

- Home Care Settings

- Ambulatory Surgical Centers

- By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies and E-commerce

- By Insulin Type:

- Basal Insulin

- Bolus/Prandial Insulin

- Pre-mixed Insulin

Value Chain Analysis For Insulin Injection Pen Market

The value chain for the Insulin Injection Pen Market initiates with upstream activities involving the sourcing of specialized raw materials, including medical-grade plastics, precision metal components for the dose mechanism, and microelectronic sensors for smart pens. This stage is characterized by stringent quality control and reliance on specialized suppliers capable of meeting high regulatory standards (e.g., ISO 13485). Key upstream considerations include ensuring biocompatibility, material durability, and cost-effectiveness. Manufacturers focus heavily on optimizing injection molding and assembly processes to maintain the required precision and scale of production efficiently.

Midstream activities encompass the core manufacturing and assembly of the pen devices, often requiring cleanroom environments and automated assembly lines. This stage includes sophisticated calibration of the dose delivery mechanism and, for smart pens, the integration of electronic components and software. Crucially, the pharmaceutical partners then fill the insulin cartridges (in the case of disposable pens) or supply the cartridges for reusable pens. This high degree of technical manufacturing complexity serves as a significant barrier to entry for new players, requiring extensive capital investment and expertise in both mechanical and electronic engineering.

Downstream analysis focuses on distribution and patient access. The distribution channel is predominantly governed by regulatory requirements and established healthcare networks. Direct channels involve manufacturers selling high volumes directly to large hospital systems or national pharmaceutical distributors. Indirect channels leverage retail pharmacies, specialized diabetes care centers, and increasingly, online pharmacies for last-mile delivery to the end user. The effectiveness of the downstream segment is tied closely to market penetration, managed care contracts, and patient education initiatives, ensuring proper usage and adherence to the prescribed therapy.

Insulin Injection Pen Market Potential Customers

The primary and largest segment of potential customers for Insulin Injection Pens comprises individuals diagnosed with diabetes mellitus—both Type 1 and Type 2—who require daily exogenous insulin therapy for glycemic control. This vast end-user base is categorized by frequency of use, age demographics (pediatric, adult, geriatric), and socioeconomic status, influencing the preference for disposable versus reusable or smart pens. As the global diabetic population continues to rise, especially in rapidly urbanizing regions, the demand from individual patients managing their chronic condition at home remains the foundational driver of market consumption.

Beyond individual patients, key organizational buyers include hospital systems, specialty clinics, and managed healthcare providers. Hospitals purchase pens for patient training and initial treatment protocols, while large integrated healthcare networks often negotiate bulk contracts directly with manufacturers to equip their entire patient cohort with standardized devices. Government health agencies and non-profit organizations focused on diabetes care also act as significant buyers, particularly in lower-income settings, where bulk purchasing of cost-effective reusable pens facilitates widespread access to modern insulin delivery technology.

Furthermore, an emerging customer segment includes professional healthcare workers, such as endocrinologists and diabetes educators. While not direct end-users of the product, they are crucial decision-makers and influencers who recommend specific pen models based on features, accuracy, ease of instruction, and patient compliance statistics. Therefore, manufacturers must target educational campaigns and clinical evidence dissemination toward these professional groups to secure product endorsement and drive prescription rates among the core patient population.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.2 Billion |

| Market Forecast in 2033 | USD 11.1 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Novo Nordisk A/S, Eli Lilly and Company, Sanofi, Becton, Dickinson and Company (BD), Owen Mumford Ltd., Ypsomed Holding AG, Biocon Ltd., Gerresheimer AG, Medtronic plc, Jiangsu Delfu Medical Devices Co., Ltd., Berlin-Chemie AG, E3D, Wockhardt Ltd., Injex, Roche Diagnostics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Insulin Injection Pen Market Key Technology Landscape

The technological landscape of the Insulin Injection Pen Market is rapidly evolving, moving beyond simple mechanical dose delivery to sophisticated electronic and digital integration. A pivotal technological trend is the development and commercialization of Smart Insulin Pens, which incorporate Bluetooth connectivity, micro-sensors, and memory functions. These pens automatically record injection time, date, and dosage, transferring this critical compliance data wirelessly to smartphone applications and cloud platforms. This connectivity enhances patient engagement and allows healthcare providers to remotely monitor adherence and treatment effectiveness, significantly bridging the data gap often present in traditional diabetes management.

Another crucial area of innovation focuses on improving the mechanics of injection to reduce patient discomfort and anxiety. This includes the development of Ultra-Fine and Shorter Needle Technology, minimizing pain and improving penetration ease. Furthermore, advancements in Dose Memory and Correction Mechanisms within the pens ensure that patients are aware of their last injection details and prevent accidental under- or overdosing, which is a major safety concern. The ongoing drive for miniaturization and enhanced ergonomics also characterizes the R&D efforts, making the pens more discreet and easier for elderly or dexterity-challenged patients to handle.

Finally, technology is driving convergence between insulin pens and Continuous Glucose Monitoring (CGM) systems. The market is increasingly seeing pens designed specifically to interface with real-time CGM data via algorithms (often AI-powered) to provide personalized dosing recommendations immediately prior to injection. This integration is crucial for the eventual realization of hybrid closed-loop or "artificial pancreas" systems, where the insulin pen acts as the automated delivery effector, responding directly to the body's glucose levels monitored by the CGM device. This seamless data exchange is defining the future standard of care in the segment.

Regional Highlights

- North America: North America, particularly the United States, commands the largest market share owing to the high prevalence of diabetes, advanced healthcare infrastructure, and the high adoption rate of premium smart insulin pens. Favorable reimbursement policies, strong awareness regarding chronic disease management, and the presence of major industry players are key growth drivers. The region is a primary innovator and early adopter of connected health solutions.

- Europe: Europe represents a mature market characterized by stringent regulatory environments and high disposable income supporting the adoption of both reusable and disposable pens. Western European countries, notably Germany, France, and the UK, exhibit strong market penetration. Focus is placed on sustainability, driving a significant preference for high-quality reusable pen systems and advanced dosing accuracy features.

- Asia Pacific (APAC): APAC is anticipated to register the fastest CAGR during the forecast period due to the massive and burgeoning diabetic population, particularly in countries like China and India. Improving economic conditions, increasing urbanization, and expanding healthcare access are fueling the demand for convenient insulin delivery systems, although cost sensitivity remains a major factor influencing the choice between reusable and disposable options.

- Latin America (LATAM): The LATAM market is growing steadily, driven by increasing government investments in healthcare infrastructure and rising awareness campaigns targeting diabetes management. Brazil and Mexico are key contributors, focusing on expanding access to affordable, reliable insulin pen devices, often supported by public health initiatives aimed at improving chronic care outcomes.

- Middle East and Africa (MEA): The MEA region shows promising growth, particularly in the GCC countries (Saudi Arabia, UAE) due to high diabetes incidence linked to lifestyle factors. These nations are adopting advanced healthcare technologies, including smart pens, supported by high per capita healthcare spending. However, large parts of Africa remain underserved, presenting significant unmet needs and long-term growth opportunities for entry-level devices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Insulin Injection Pen Market.- Novo Nordisk A/S

- Eli Lilly and Company

- Sanofi

- Becton, Dickinson and Company (BD)

- Owen Mumford Ltd.

- Ypsomed Holding AG

- Biocon Ltd.

- Gerresheimer AG

- Medtronic plc

- Jiangsu Delfu Medical Devices Co., Ltd.

- Berlin-Chemie AG

- E3D

- Wockhardt Ltd.

- Injex

- Roche Diagnostics

- DarioHealth Corp.

- VeraSmart Technologies

- AptarGroup, Inc.

- F. Hoffmann-La Roche AG

- Haselmeier AG

Frequently Asked Questions

Analyze common user questions about the Insulin Injection Pen market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between disposable and reusable insulin pens?

Disposable insulin pens come pre-filled with a fixed insulin cartridge and are discarded after the insulin is fully used. Reusable insulin pens allow the user to replace the insulin cartridge once empty, making them more environmentally friendly and potentially more cost-effective over the long term, depending on local pricing and insurance coverage.

How do smart insulin pens improve diabetes management compared to traditional pens?

Smart insulin pens, also known as connected pens, automatically log the date, time, and dosage of each injection, which they wirelessly transmit to a connected application. This feature significantly improves adherence tracking, helps prevent dose stacking, and provides physicians with crucial data for timely and personalized treatment adjustments, leading to better glycemic outcomes.

Which geographical region exhibits the highest growth potential for insulin injection pens?

The Asia Pacific (APAC) region is projected to demonstrate the highest Compound Annual Growth Rate (CAGR). This acceleration is attributed to the substantial and increasing patient pool diagnosed with diabetes, expanding access to advanced healthcare facilities, and rising consumer awareness regarding the convenience and accuracy benefits of pen delivery systems over traditional syringe methods.

What are the key technological advancements driving innovation in the market?

Key innovations include enhanced precision in mechanical dosing mechanisms, the integration of Bluetooth technology for data connectivity in smart pens, development of finer and shorter needles to minimize injection pain, and the incorporation of AI-driven predictive algorithms that recommend personalized, real-time dosing based on glucose monitoring data.

What primary restraints hinder the widespread adoption of advanced insulin pens?

The primary restraints include the relatively high acquisition cost of sophisticated smart insulin pens, which can limit accessibility in cost-sensitive markets, and challenges related to regulatory complexity and intellectual property rights, which can slow down the introduction of generic or biosimilar pens globally.

Is there a noticeable shift in end-user preference between hospital use and home care settings?

Yes, there is a pronounced and continuous shift toward home care settings dominating the consumption of insulin pens. Since diabetes requires chronic, daily self-administration, the convenience, portability, and ease-of-use offered by injection pens make them perfectly suited for independent patient management outside clinical environments, reinforcing the home care segment growth.

How does the increasing trend of obesity influence the Insulin Injection Pen Market?

The increasing global rates of obesity are directly correlated with the escalating prevalence of Type 2 diabetes. As obesity is a major risk factor for insulin resistance and subsequent diabetes diagnosis, the rising trend fuels a corresponding increase in the target patient population requiring insulin therapy, thereby strongly driving the overall demand for injection pen devices globally.

What is the role of pharmaceutical companies in the Insulin Injection Pen value chain?

Pharmaceutical companies play a critical role by manufacturing and supplying the specific insulin formulations that are loaded into the pens. For disposable pens, pharmaceutical companies often partner directly with device manufacturers to pre-fill the devices, ensuring compatibility and seamless integration between the drug and the delivery system.

Do stringent regulations pose a significant challenge to market entrants?

Yes, regulatory stringency, particularly concerning medical device safety, dosage accuracy, and electronic data security (e.g., GDPR, HIPAA compliance for smart pens), presents a substantial hurdle. New entrants must navigate complex and often expensive approval processes by bodies like the FDA and EMA, requiring robust clinical validation and adherence to ISO standards.

How are environmental concerns impacting the disposable vs. reusable pen segmentation?

Environmental concerns are gradually driving interest in the reusable insulin pen segment, especially in regions with strong sustainability mandates like Western Europe. Reusable pens generate less plastic waste over the treatment period compared to continuously discarding pre-filled disposable models, appealing to both environmentally conscious consumers and healthcare providers seeking green alternatives.

What market opportunities are associated with improving insulin absorption techniques?

Opportunities exist in developing pen technology that minimizes injection depth variability and ensures consistent subcutaneous delivery, optimizing insulin absorption kinetics. R&D focused on user-feedback mechanisms and advanced needle geometries can further enhance patient compliance and therapeutic efficacy, creating premium product opportunities.

What defines the market growth trajectory in developing economies?

Market growth in developing economies is primarily defined by rapid economic development, improved public health infrastructure, and governmental subsidies aimed at making essential diabetes care accessible. The focus is typically on higher volume sales of reliable, cost-effective reusable pens, followed by gradual adoption of disposable and smart pens as healthcare spending increases.

In the context of the supply chain, what are the upstream material requirements for smart pens?

Upstream requirements for smart pens involve sourcing high-precision components, including specialized medical-grade polymers, miniature electronic circuitry, Bluetooth modules, memory chips, and high-quality batteries. The integration of these microelectronics requires highly specialized suppliers capable of maintaining strict regulatory compliance and device reliability.

How does the competition intensity affect pricing strategies in the insulin pen market?

Competition intensity is high, particularly among major pharmaceutical manufacturers who also produce the insulin. This competition results in tiered pricing strategies: premium pricing for new generation smart pens with unique digital features, and highly competitive pricing for standard disposable pens, often leading to strategic contracts with payers to secure formulary placement.

What role does patient dexterity and age play in insulin pen design?

Patient dexterity and age are critical design considerations. Pens are engineered with features such as large, easy-to-read dose windows, minimal force required for injection, non-slip grips, and simple dose setting mechanisms, ensuring that elderly patients or those with reduced manual strength can administer their medication accurately and safely.

How significant is the impact of telemedicine on insulin pen market dynamics?

Telemedicine significantly amplifies the value of smart insulin pens. By enabling remote data transmission and consultation, smart pens become indispensable tools for virtual care models. This integration drives market demand for connected devices, as they facilitate effective management and timely intervention without requiring constant physical clinic visits.

What considerations are paramount for ensuring the security of data transmitted by connected pens?

Data security is paramount, necessitating robust encryption protocols, compliance with global health privacy standards (HIPAA, GDPR), and secure cloud storage solutions. Manufacturers must prioritize authentication measures and regular software updates to protect sensitive patient information regarding dosing history and health status from unauthorized access or breaches.

What is the importance of dose memory in insulin pens?

Dose memory is crucial for preventing dangerous medication errors, specifically accidental dose stacking (taking a second dose too soon) or forgetting to take a dose. In traditional pens, patients rely on manual logging, but in smart pens, the automated memory function serves as a critical safety feature, significantly enhancing medication adherence and safety.

What is the current trend regarding patent expirations in the market?

Patent expirations, particularly for key insulin formulations, are leading to an influx of biosimilar insulins. This trend is increasing price pressure on the drug component, subsequently shifting the competitive focus onto the proprietary features and technology embedded within the injection pen delivery device itself as the primary differentiator for market leaders.

Why is the integration of continuous glucose monitoring (CGM) critical for the future of insulin pens?

CGM integration is critical because it enables a closed-loop or 'hybrid' delivery system. By combining real-time glucose readings from the CGM with the dosing precision of the pen, future systems can offer highly automated, proactive insulin management, moving the patient closer to achieving the ideal artificial pancreas function.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager