Insulin Injection Pen Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431951 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Insulin Injection Pen Market Size

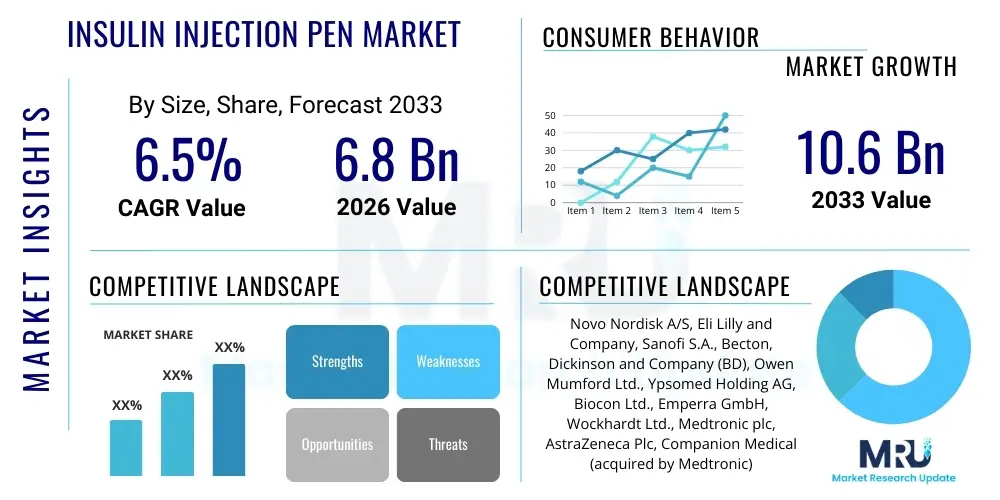

The Insulin Injection Pen Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 6.8 Billion in 2026 and is projected to reach USD 10.6 Billion by the end of the forecast period in 2033.

Insulin Injection Pen Market introduction

The Insulin Injection Pen Market encompasses devices designed for the self-administration of insulin by diabetic patients. These pens offer a highly convenient, precise, and user-friendly alternative to traditional vial and syringe methods. The product typically consists of an insulin cartridge, a dial to select the dose, and a disposable needle, significantly simplifying the complex daily routine of diabetes management. Modern insulin pens, particularly smart pens, integrate sophisticated technology to record dosage history and provide data feedback, thereby enhancing adherence and improving glycemic control. These advancements are crucial in managing the global epidemic of Type 1 and Type 2 diabetes, serving as an indispensable tool in routine clinical care.

The primary applications of insulin injection pens are centered around the treatment of both insulin-dependent and non-insulin-dependent diabetes mellitus. In Type 1 diabetes, where insulin production is negligible, patients rely entirely on external insulin administration, making pens essential for frequent daily injections. For Type 2 diabetes patients, especially those requiring intensive insulin therapy or basal insulin, the convenience and ease of use of injection pens support better compliance compared to multi-dose regimens involving syringes. The inherent benefits, such as reduced pain, discreet usage, portability, and minimized risk of dosing errors due to pre-set increments, strongly drive their adoption across all age groups globally.

Key driving factors accelerating market growth include the continuously increasing prevalence of diabetes worldwide, coupled with shifting demographics towards aging populations who prioritize ease-of-use medical devices. Furthermore, significant investment in research and development by pharmaceutical and medical device manufacturers has led to the introduction of advanced smart pens with Bluetooth connectivity, which directly links injection data to patient apps or cloud platforms. Favorable reimbursement policies in developed economies and educational initiatives promoting self-management techniques further solidify the preference for insulin pens over older injection methods, positioning them as the standard of care in modern diabetology.

Insulin Injection Pen Market Executive Summary

The Insulin Injection Pen Market is characterized by robust commercial activity driven by rapid technological integration and intensifying competition among established pharmaceutical and device manufacturers. Key business trends include strategic collaborations focusing on digital health platforms, where insulin pen data is combined with continuous glucose monitoring (CGM) systems to create closed-loop or hybrid-closed-loop diabetes management ecosystems. There is a discernible shift in product innovation towards reusable pens and smart pens, which offer enhanced value proposition through connectivity and data-logging capabilities. Merger and acquisition activities remain focused on strengthening core product portfolios and gaining access to niche technology, particularly in software and AI-driven personalized dosing algorithms.

Regionally, the market exhibits dynamic growth patterns, with North America and Europe retaining dominant market shares due to high diabetes awareness, established healthcare infrastructures, and comprehensive reimbursement coverage for advanced diabetes care devices. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This accelerated growth in APAC is attributed to the enormous population base suffering from diabetes, improving access to advanced medical treatment, increasing healthcare expenditure, and concerted efforts by governments to improve diabetes management standards in populous countries like China and India. Market penetration in Latin America and MEA remains challenging but offers substantial long-term opportunity as economic development facilitates better access to premium healthcare products.

Segmentation trends highlight the increasing demand for reusable insulin pens over disposable ones, primarily driven by sustainability concerns and potentially lower long-term cost of ownership in certain markets, though disposable pens still maintain a strong hold due to convenience. The smart insulin pen segment is the fastest-growing category, reflecting the broader trend of digital transformation in healthcare. Among end-users, the homecare setting maintains the largest market share, emphasizing the success of patient education programs focused on self-administration. Distribution channels are increasingly diversifying, with online pharmacies and e-commerce platforms gaining prominence alongside traditional hospital pharmacies and retail drugstore networks, ensuring wider accessibility for patients seeking convenience in refills and device acquisition.

AI Impact Analysis on Insulin Injection Pen Market

User queries regarding AI in the Insulin Injection Pen Market primarily revolve around the accuracy of predictive dosing, data privacy and security of integrated smart pens, the potential for autonomous insulin delivery (transitioning from smart pens to automated systems), and how AI integration will personalize treatment recommendations. Users are keenly interested in whether AI can reliably calculate optimal insulin doses based on real-time factors like diet, activity, and CGM data, thereby reducing the burden of manual calculation and minimizing hypo/hyperglycemic events. Concerns often center on the regulatory approval process for AI-driven algorithms and the ethical implications of relying on machine learning for critical medical decisions, particularly in vulnerable populations. The overarching expectation is that AI will transform the current generation of smart pens into sophisticated, proactive assistants for diabetes management.

The integration of Artificial Intelligence fundamentally redefines the utility of insulin injection pens, moving them beyond simple mechanical delivery tools into intelligent health management systems. AI algorithms analyze vast datasets—including blood glucose trends, meal consumption logs, physical activity, and historical injection patterns—collected by connected smart pens and associated sensors. This analysis provides highly personalized, real-time feedback and predictive insights, allowing the pen software to recommend precise insulin dosages and timings before injection. This level of personalization significantly enhances the efficacy of intensive insulin therapy, bridging the gap between current smart pens and fully closed-loop artificial pancreas systems. Furthermore, AI contributes to minimizing human error and variability in self-management.

Beyond direct patient care, AI also optimizes the operational aspects of the insulin pen market. In manufacturing, AI and machine learning are employed for predictive maintenance of production lines, quality control assessments, and optimization of supply chain logistics, ensuring the consistent availability and reliability of devices. In the commercial sphere, AI supports targeted marketing efforts and demand forecasting, allowing manufacturers to better anticipate regional requirements and manage inventory efficiently. This dual impact—enhancing patient outcomes through personalized therapy and streamlining industrial processes—positions AI as a critical catalyst for future market growth and innovation, compelling manufacturers to invest heavily in robust data platforms and security infrastructure to handle sensitive health data generated by smart pens.

- AI enables highly accurate predictive dosage recommendations based on real-time physiological data and behavioral patterns.

- Machine learning algorithms enhance pattern recognition for early detection of potential hypo/hyperglycemic trends in diabetic patients.

- AI optimizes the manufacturing process through predictive quality control and automated fault detection in pen assembly.

- Smart pen apps utilize AI to provide personalized coaching and behavioral insights, improving patient adherence to treatment protocols.

- Data analytics powered by AI supports clinical research by identifying optimal treatment regimes and patient subgroups responding best to specific insulin types.

DRO & Impact Forces Of Insulin Injection Pen Market

The Insulin Injection Pen Market is significantly shaped by a powerful confluence of demographic trends, technological advancements, and economic factors, summarized as Drivers, Restraints, and Opportunities (DRO). The primary drivers include the escalating global prevalence of both Type 1 and Type 2 diabetes, demanding more effective and convenient self-care tools, coupled with high demand for user-friendly drug delivery systems, particularly among the geriatric population. Restraints largely center around the higher initial cost of smart pens compared to traditional syringes, stringent regulatory approval processes that delay product launches, and challenges related to data privacy and cybersecurity associated with connected devices. Opportunities lie in the rapid proliferation of smart pen technology, penetration into untapped emerging markets, and the potential integration with fully automated diabetes management systems, leveraging AI for truly personalized care.

Impact forces acting on this market demonstrate a high degree of technological influence. The threat of substitutes, while present in the form of insulin pumps and alternative delivery methods (such as inhaled insulin), is mitigated by the unmatched convenience and portability offered by modern pens. Regulatory forces exert a strong influence, requiring manufacturers to meet rigorous standards for device accuracy, safety, and digital data handling (e.g., GDPR, HIPAA), which often increases R&D costs but ensures market credibility. Furthermore, the bargaining power of patients is increasing, fueled by better access to health information and a preference for devices that enhance quality of life, compelling manufacturers to focus heavily on ergonomic design and intuitive user interfaces. The competitive rivalry is intense, driven by major global pharmaceutical players who continuously innovate in pen design and integrated software solutions.

The overall market trajectory is positively reinforced by the overwhelming necessity for effective insulin delivery. The transition toward smart pens represents a critical evolution, addressing the historically high rates of patient non-adherence by providing actionable data and reminders. While cost remains a barrier, especially in low- and middle-income countries, the long-term healthcare cost savings associated with improved glycemic control and reduced complications (like retinopathy or neuropathy) often outweigh the initial device expense, supporting favorable governmental and insurer adoption policies in key markets. Exploiting the shift toward telehealth and remote monitoring presents a major pathway for opportunities, solidifying the pen’s role as a vital component of integrated diabetes care.

Segmentation Analysis

The Insulin Injection Pen Market is highly segmented based on product type, dosage mechanism, distribution channel, and end-user, reflecting the diverse needs of the global diabetic population and varying levels of healthcare infrastructure maturity. The segmentation provides a clear framework for understanding market dynamics, allowing stakeholders to identify high-growth areas. Segmentation by product type—disposable versus reusable pens—is fundamental, with reusable pens gaining traction due to sustainability and economical factors, while disposable pens dominate convenience-focused settings. Segmentation by end-user, particularly separating home-use from hospital settings, highlights the importance of self-management as the core market driver. Dosage mechanism further splits the market into standard pens and increasingly popular smart/connected pens, marking the digital transformation of this therapeutic area.

- Product Type

- Disposable Insulin Pens

- Reusable Insulin Pens (Manual and Smart/Connected)

- Dosage Mechanism

- Standard Insulin Pens

- Smart/Connected Insulin Pens

- Distribution Channel

- Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies/E-commerce

- End-User

- Hospitals and Clinics

- Homecare Settings

Value Chain Analysis For Insulin Injection Pen Market

The Value Chain of the Insulin Injection Pen Market is complex, beginning with the highly specialized procurement of raw materials, particularly high-grade plastics for the pen body, metal components for internal mechanisms, and precision needles. Upstream analysis involves rigorous quality control in sourcing materials to ensure device integrity and patient safety. Manufacturing and assembly represent the core value-add stage, demanding sophisticated automated production lines to maintain high precision in dosage mechanisms. This stage often includes cleanroom environments to meet strict medical device standards. Downstream analysis focuses heavily on efficient distribution and sales. The distribution channel is crucial, involving complex logistical networks to ensure temperature-sensitive insulin cartridges (often sold separately but used with the pens) and the pen devices reach end-users efficiently through direct sales forces, wholesalers, and specialized distributors.

The distribution network is segmented into direct and indirect channels. Direct channels involve manufacturers selling directly to large hospital systems, key clinics, or government health programs, ensuring maximum control over pricing and inventory. Indirect channels, which dominate the market, utilize traditional retail and hospital pharmacies, and increasingly, specialized online pharmacies and e-commerce platforms. The strong growth of indirect channels, particularly online, provides greater accessibility and convenience for patients needing regular pen and needle refills. Post-sale activities, including technical support, patient education on pen usage, and software updates for smart pens, are also critical components of the value chain, enhancing customer retention and brand loyalty. Effective collaboration between device manufacturers, insulin producers (often the same companies), and logistics providers is paramount for maintaining supply chain resilience.

Furthermore, the integration of digital services has added a significant layer of value. Smart pen manufacturers now derive substantial value from the software and data services provided alongside the physical device. This downstream digital value proposition includes cloud storage of injection data, integration with Electronic Health Records (EHRs), and AI-driven insights shared with healthcare providers. Successful management of the value chain requires adherence to global regulatory standards (ISO, FDA, EMA), cost optimization in manufacturing scale-up, and continuous investment in distribution infrastructure to support global demand growth, especially in emerging markets where infrastructure is less developed. The ability to manage logistics effectively for both the physical device and its associated consumables (needles and insulin) is a competitive differentiator.

Insulin Injection Pen Market Potential Customers

The core customer base for the Insulin Injection Pen Market consists of patients diagnosed with diabetes mellitus who require regular subcutaneous insulin administration. This encompasses both Type 1 diabetes patients, who rely entirely on external insulin, and a large proportion of Type 2 diabetes patients who require basal or bolus insulin therapy, particularly as their disease progresses. Healthcare facilities, including hospitals, specialized diabetes clinics, and primary care centers, act as major institutional buyers and decision-makers, influencing product recommendations and procurement policies. However, the ultimate end-user is the individual patient who purchases the device or receives it through insurance coverage for use in the highly dominant homecare setting, emphasizing the need for ergonomic, easy-to-use, and highly reliable devices tailored for self-administration.

Specific sub-segments of potential customers include the geriatric population, who benefit significantly from the reduced manual dexterity requirements and simplicity of dose setting offered by modern pens compared to syringes. Additionally, children and adolescents with Type 1 diabetes, or their caregivers, represent another crucial segment, where ease of use and features like dose memory (found in smart pens) are essential for consistent adherence and accurate dosing. As disposable incomes rise in emerging economies, the accessibility and affordability of insulin pens expand the customer base rapidly. Pharmaceutical companies and diabetes device manufacturers strategically target these diverse end-user profiles by offering a range of products, from basic disposable pens for cost-sensitive markets to premium smart pens for digitally-savvy consumers seeking integrated health solutions and superior disease management tools.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.8 Billion |

| Market Forecast in 2033 | USD 10.6 Billion |

| Growth Rate | Insert CAGR 6.5% ( Include CAGR Word with % Value ) |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Novo Nordisk A/S, Eli Lilly and Company, Sanofi S.A., Becton, Dickinson and Company (BD), Owen Mumford Ltd., Ypsomed Holding AG, Biocon Ltd., Emperra GmbH, Wockhardt Ltd., Medtronic plc, AstraZeneca Plc, Companion Medical (acquired by Medtronic), Jiangsu Delfu Medical Device Co., Ltd., Berlin-Chemie AG, Tandem Diabetes Care, Inc., Haselmeier GmbH, Roche Diabetes Care. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Insulin Injection Pen Market Key Technology Landscape

The technological landscape of the Insulin Injection Pen Market is rapidly evolving, driven primarily by the shift from purely mechanical devices to sophisticated, connected smart systems. The core technology centers on precise dose delivery mechanisms, which utilize highly engineered springs and ratchet systems to ensure accurate and repeatable injection volumes, minimizing the risk of dosing errors inherent in manual syringe use. Innovations in needle technology, focusing on finer gauges and advanced coatings, are instrumental in reducing injection pain and improving patient experience, directly correlating with better adherence. Furthermore, the miniaturization and integration of sensors and electronic components are critical enablers for the next generation of insulin pens.

The most transformative technology currently deployed is connectivity, establishing the category of "Smart Insulin Pens." These pens incorporate Bluetooth or Near-Field Communication (NFC) technology to automatically log the time, date, and amount of insulin injected. This data is instantly transmitted to companion mobile applications, allowing patients and healthcare providers to monitor adherence and track patterns without manual logging. This feature not only improves compliance but also generates valuable data for therapeutic adjustments. This connectivity is foundational to AEO (Automated Engine Optimization) in healthcare, allowing data engines to process real-world usage patterns to refine treatment protocols, shifting the focus from simple delivery to comprehensive data management.

Future technological advancements are heavily focused on incorporating Artificial Intelligence (AI) and machine learning capabilities directly into the software ecosystem of smart pens. This involves developing algorithms that use the collected injection data, combined with input from Continuous Glucose Monitors (CGMs), to offer proactive, highly personalized dosing advice. Other key areas include development of pens capable of delivering ultra-long-acting insulin analogues and pens with enhanced biometric security features. The focus remains on creating devices that are not just simple mechanical injectors but essential, integrated components of a comprehensive digital diabetes management system, offering intuitive feedback, predictive alerts, and seamless integration with telehealth platforms.

Regional Highlights

- North America (NA): North America, particularly the United States, holds a dominant position in the global Insulin Injection Pen Market share, characterized by high adoption rates of advanced medical devices and extensive insurance coverage for diabetes management tools. The region benefits from a high prevalence of both Type 1 and Type 2 diabetes, a sophisticated healthcare infrastructure, and high consumer spending capacity. The rapid uptake of smart insulin pens and continuous glucose monitoring systems creates a robust environment for innovation. Major market players are highly concentrated here, driving continuous R&D investment focused on connectivity and integrated digital solutions.

- Europe: Europe represents a mature and highly regulated market, where Western European countries exhibit high penetration rates for insulin pens due to favorable reimbursement policies and strong public awareness programs promoting effective diabetes self-management. The transition towards reusable and smart pen technologies is noticeable, driven partly by sustainability goals and a strong regulatory focus on patient safety and data protection (GDPR compliance). Germany, France, and the UK are key contributors, demonstrating significant expenditure on advanced diabetes technology and maintaining strong competitive intensity among device manufacturers.

- Asia Pacific (APAC): The APAC region is anticipated to be the fastest-growing market during the forecast period. This acceleration is fueled by the massive and growing diabetic population base, particularly in highly populous nations like China and India, where improved economic conditions are expanding access to modern healthcare solutions. While cost sensitivity remains a factor, increasing government initiatives to address the diabetes epidemic and growing medical tourism contribute to the rapid adoption of insulin pens over traditional methods. Manufacturers are focusing on localized manufacturing and distribution partnerships to navigate diverse regulatory landscapes and optimize pricing strategies for market entry.

- Latin America (LATAM): The market in Latin America is characterized by varying levels of healthcare access and purchasing power. Growth is steady, driven by increasing urbanization and the rising prevalence of lifestyle-related diseases, including Type 2 diabetes. Brazil and Mexico are the largest regional markets, showing increasing demand for user-friendly injection systems. Market penetration challenges often relate to infrastructure limitations and the need for greater patient education and specialized training on insulin therapy management.

- Middle East and Africa (MEA): MEA presents significant untapped potential, particularly in the Gulf Cooperation Council (GCC) countries which have exceptionally high diabetes rates and substantial healthcare spending capabilities, facilitating the adoption of premium devices, including smart pens. The African segment, however, faces challenges related to affordability and distribution logistics, making basic, cost-effective disposable pens the predominant choice. Regulatory harmonization and public health campaigns are critical for accelerating market growth across this diverse region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Insulin Injection Pen Market.- Novo Nordisk A/S

- Eli Lilly and Company

- Sanofi S.A.

- Becton, Dickinson and Company (BD)

- Owen Mumford Ltd.

- Ypsomed Holding AG

- Biocon Ltd.

- Emperra GmbH

- Wockhardt Ltd.

- Medtronic plc

- AstraZeneca Plc

- Companion Medical (acquired by Medtronic)

- Jiangsu Delfu Medical Device Co., Ltd.

- Berlin-Chemie AG

- Tandem Diabetes Care, Inc.

- Haselmeier GmbH

- Roche Diabetes Care

- DarioHealth Corp.

- Terumo Corporation

- Conmed Corporation

Frequently Asked Questions

Analyze common user questions about the Insulin Injection Pen market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between disposable and reusable insulin pens, and which segment is driving growth?

Disposable insulin pens are prefilled with insulin and are discarded after the insulin cartridge is depleted, offering maximum convenience. Reusable pens require the user to insert a new insulin cartridge or vial upon depletion, being more cost-effective and environmentally conscious over time. The reusable pen segment, particularly the smart/connected subsegment, is currently driving significant market value growth due to integration with digital health platforms and data-logging capabilities.

How do Smart Insulin Pens improve diabetes management compared to traditional pens?

Smart insulin pens enhance management by automatically recording the dose, time, and type of insulin injected, eliminating manual logging errors. They connect via Bluetooth to smartphone apps, providing crucial data for pattern analysis, dose reminders, and integration with Continuous Glucose Monitor (CGM) readings. This data integration allows for optimized, personalized dosing recommendations and facilitates better communication between patients and healthcare providers.

What are the main regulatory challenges facing manufacturers in the Insulin Injection Pen Market?

Manufacturers face stringent regulatory hurdles, particularly concerning the approval of connected devices (Smart Pens) which fall under both medical device and software regulations. Key challenges include demonstrating the reliability and accuracy of digital dosing algorithms, ensuring robust data security and privacy (e.g., meeting GDPR and HIPAA standards), and navigating the complex, often lengthy, approval processes required by bodies like the FDA and EMA for novel features and materials.

Which geographical region holds the largest market share, and why is the Asia Pacific region growing fastest?

North America currently holds the largest market share due to high healthcare expenditure, established reimbursement systems, and a high prevalence of diabetes driving demand for premium devices. The Asia Pacific (APAC) region is projected to grow the fastest, fueled by its immense diabetic population, increasing per capita income improving access to treatment, and dedicated government initiatives focused on modernizing diabetes care infrastructure in countries like China and India.

What impact does the integration of Artificial Intelligence (AI) have on the future design of insulin injection pens?

AI integration is moving the design focus from mechanical precision to predictive intelligence. Future pens will leverage AI algorithms to analyze real-time glucose and lifestyle data, offering proactive and highly individualized dosage recommendations to minimize hypo/hyperglycemia. This predictive capability transforms the pen into an active therapeutic partner, aiming for near-autonomous decision support and seamless integration within hybrid closed-loop systems, enhancing overall therapeutic outcomes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager