Interior Glass Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441469 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Interior Glass Market Size

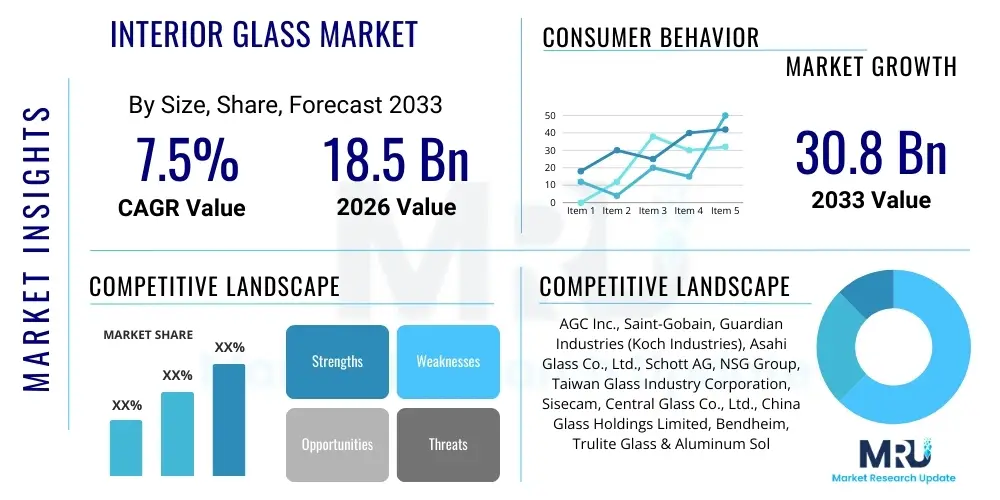

The Interior Glass Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 19.5 Billion in 2026 and is projected to reach USD 30.1 Billion by the end of the forecast period in 2033. This growth trajectory is fueled by the accelerating trend of open-plan architectural designs, particularly in commercial real estate and high-end residential projects, which prioritize natural light penetration and aesthetic fluidity. The increasing demand for sustainable and energy-efficient building materials further solidifies glass as a preferred internal partition and cladding solution, driving substantial market expansion across key global regions.

The valuation reflects robust investment in modern construction practices globally, coupled with technological advancements in glass processing that enhance safety, acoustics, and functionality. Tempered, laminated, and specialty glasses, including switchable and digitally printed variants, are gaining traction, allowing architects to create dynamic, adaptable interior spaces. Furthermore, stringent building codes mandating fire resistance and enhanced structural integrity are pushing manufacturers to innovate, thereby sustaining premium pricing and contributing positively to overall market value progression.

Interior Glass Market introduction

The Interior Glass Market encompasses the manufacturing, fabrication, and installation of various glass products used within the confines of buildings, serving both functional and aesthetic purposes. These products range from internal partitions, sliding doors, shower enclosures, balustrades, wall claddings, and flooring components. Modern interior glass products are characterized by their ability to maximize natural light transmission, improve spatial perception, and offer superior acoustic separation without sacrificing design transparency. Key product types include float glass, tempered glass for safety, laminated glass for security and sound dampening, and specialty glass like patterned or colored variants, catering to diverse architectural requirements.

Major applications span commercial sectors, including corporate offices, hospitality establishments (hotels and restaurants), retail spaces, and healthcare facilities, where glass contributes significantly to modern, hygienic, and accessible design. In the residential sector, interior glass is increasingly used in open-plan living areas, sophisticated bathroom designs, and stair railings, reflecting consumer demand for contemporary, light-filled interiors. The inherent benefits of interior glass—such as ease of cleaning, durability, non-porosity, and its contribution to achieving LEED certification through light harvesting—are critical driving factors. Furthermore, innovations such as smart glass technology, which allows for instantaneous privacy control, are transforming how internal spaces are utilized and managed.

Interior Glass Market Executive Summary

The Interior Glass Market is experiencing strong growth, underpinned by favorable macroeconomic trends such as rapid urbanization and increased global construction expenditure, particularly for high-value commercial and infrastructural projects. Business trends emphasize customization and functional integration, with a pronounced shift towards incorporating smart functionalities, such as electrochromic and polymer-dispersed liquid crystal (PDLC) technologies, which offer dynamic privacy solutions and improved energy management within buildings. Manufacturers are focusing on reducing the environmental footprint of glass production and offering recycled content, aligning with global corporate sustainability goals and influencing procurement decisions in the high-growth commercial sector.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, driven by massive infrastructure investments in China, India, and Southeast Asian nations, coupled with increasing adoption of international design standards in rapidly expanding metropolitan centers. North America and Europe, characterized by high disposable income and stringent energy efficiency regulations, exhibit high demand for premium, high-performance interior glass products, particularly those offering advanced thermal and acoustic insulation properties. Segment trends highlight the dominance of tempered glass due to safety requirements, while the application segment sees strong momentum in office partitioning as businesses seek flexible, modular workspace designs that promote collaboration and wellness.

AI Impact Analysis on Interior Glass Market

Users frequently inquire about how Artificial Intelligence (AI) can optimize glass fabrication and supply chain processes, specifically focusing on quality control, minimizing waste, and automating complex cutting patterns required for intricate interior designs. There is significant interest in AI’s role in architectural Generative Design, where algorithms assist designers in creating optimal interior layouts incorporating complex glass structures while ensuring structural integrity and maximizing daylighting performance. Key concerns revolve around the initial capital investment required to integrate AI-driven manufacturing systems and the subsequent reskilling of the workforce to manage these highly automated environments. The overarching expectation is that AI will lead to significantly faster prototyping, lower defect rates, and highly personalized glass products tailored to specific interior specifications.

In the manufacturing domain, AI algorithms are crucial for predictive maintenance of highly specialized glass tempering and coating machinery, drastically reducing downtime and improving production consistency. Furthermore, AI is revolutionizing inventory and logistics management for bespoke glass panels, which are often fragile, heavy, and produced on a just-in-time basis. By accurately forecasting demand based on real-time project schedules and optimizing delivery routes, AI minimizes breakage risks and improves project turnaround times. This technological integration is transforming the industry from a traditional materials supplier to a high-tech fabrication and solutions provider, enhancing both speed and precision in complex architectural installations.

- AI-driven optimization of glass cutting and fabrication processes, minimizing material waste.

- Predictive maintenance analytics for manufacturing equipment, reducing operational downtime and costs.

- Integration of AI in Building Information Modeling (BIM) for generative interior design, optimizing daylighting and structural performance of glass partitions.

- Enhanced quality control using machine vision systems to detect microscopic flaws in coated or laminated interior glass panels.

- Streamlined supply chain and logistics management for fragile, custom-sized interior glass products.

- Personalized glass design recommendations based on architectural constraints and end-user preferences.

DRO & Impact Forces Of Interior Glass Market

The Interior Glass Market is powerfully driven by the global shift towards sustainable building practices and the increasing appreciation for aesthetics and natural illumination in both commercial and residential architecture. The restraint forces, primarily centered around high initial procurement and installation costs, especially for highly customized or smart glass solutions, often limit adoption in budget-sensitive projects. Opportunities abound through continuous technological advancement, particularly the development of multi-functional glass that integrates lighting, heating, or electronic displays, paving the way for high-value product lines. Impact forces include stringent safety regulations concerning fire protection and impact resistance, which necessitate the mandatory use of laminated or tempered glass in public spaces, significantly shaping material choice and market dynamics.

A key driver is the trend toward constructing modern, flexible workspaces where glass partitions allow for reconfigurable layouts, fostering collaboration while ensuring necessary acoustic separation. Urban density further amplifies the need for light-maximizing materials, as interior glass helps brighten deeply set interior spaces in tall buildings. Conversely, one major restraint involves the complexity and fragility of handling large-format glass panels, leading to elevated transportation, storage, and installation expenses and requiring specialized labor. The major opportunity lies in expanding the market for intelligent glass coatings that can modulate solar heat gain, effectively positioning interior glass as an essential component in energy-efficient passive building design and offsetting some of the initial cost concerns through long-term operational savings.

Segmentation Analysis

The Interior Glass Market is highly segmented based on product type, application, and technology, reflecting the diverse functional and aesthetic demands of modern construction. Product segmentation differentiates between basic annealed glass and high-performance varieties such as tempered, laminated, insulated, and float glass, with safety and energy efficiency being key determinants of product choice. Application segmentation highlights the critical roles glass plays in commercial settings (office partitions, retail displays) versus residential environments (shower doors, mirrors, and interior railings). Understanding these segmentations is vital for manufacturers tailoring their production capabilities and marketing strategies to targeted high-growth sectors, particularly the burgeoning smart glass sub-segment.

The rise of customized and specialty glass products, including fire-rated glass and etched or sandblasted designs, signifies a move toward high-value, bespoke interior solutions. Technology segmentation underscores the rapid innovation in materials science, particularly the growth of dynamic glass (switchable privacy glass) and specialized coatings (low-E, self-cleaning), which enhance the utility of interior glass beyond simple division. The commercial segment consistently dominates the market share due to the sheer volume of glass used in large-scale office towers and hospitality venues, although the residential sector, driven by renovation and luxury housing trends, shows the fastest rate of new technology adoption.

- By Product Type:

- Float Glass

- Tempered Glass

- Laminated Glass

- Insulated Glass (IGU)

- Specialty Glass (Patterned, Wired)

- By Application:

- Partitions and Walls

- Doors and Windows

- Shower Enclosures

- Railings and Balustrades

- Flooring and Stairs

- Cladding and Decoration

- By End-User:

- Commercial (Offices, Retail, Hospitality, Healthcare)

- Residential

- Industrial

- By Technology:

- Basic Monolithic Glass

- Coated Glass (Low-E, Reflective)

- Smart Glass (Switchable, Electrochromic)

Value Chain Analysis For Interior Glass Market

The Interior Glass Market value chain initiates with the upstream analysis, focusing on the procurement and processing of fundamental raw materials, primarily high-purity silica sand, soda ash, and limestone. These materials are melted and formed into basic float glass sheets, an energy-intensive process dominated by a few large global players. Midstream activities involve advanced processing and fabrication, where float glass is converted into specific interior products through tempering (heat treating for safety), lamination (bonding with interlayers like PVB or EVA for security and soundproofing), coating (applying low-emissivity films), or digital printing for aesthetic customization. This fabrication stage is highly capital-intensive and requires specialized machinery to meet precision architectural specifications.

The downstream analysis centers on distribution and installation. Products move through complex channels, involving direct sales to large construction companies, specialized glass contractors, or indirect channels such as distributors and retailers serving smaller construction projects and renovation markets. Direct distribution is favored for large, complex commercial projects requiring bespoke solutions and technical support, ensuring quality control from factory to installation site. Conversely, standard products, like shower doors or smaller window units, frequently pass through extensive retail and wholesale networks. Installation services, often performed by specialized glazing subcontractors, represent a significant value addition stage, impacting the final quality and longevity of the interior glass application.

The efficiency of the value chain is increasingly reliant on optimized logistics, especially given the fragility and large dimensions of many interior glass products. Effective collaboration between fabricators and glazing contractors is essential to minimize waste and ensure timely delivery aligned with construction schedules. Furthermore, the incorporation of smart glass requires collaboration with electronics suppliers and specialized integration technicians, adding new layers of complexity to the traditional construction material supply chain. Profitability across the chain is often concentrated in the fabrication and installation phases, where value addition through customization and technical expertise commands higher margins.

Interior Glass Market Potential Customers

The primary consumers and buyers of interior glass products are broadly segmented into commercial, residential, and institutional end-users, each with distinct requirements and procurement drivers. Commercial developers and large-scale construction firms constitute the largest customer base, demanding high volumes of performance-grade glass for office towers, shopping malls, and hospitality complexes. These customers prioritize safety features (tempered, laminated glass), acoustic performance, and the ability to achieve modern, open-plan aesthetics, often requiring custom, large-format glass panels and sophisticated installation capabilities. Procurement decisions in this segment are heavily influenced by regulatory compliance and overall project budget.

The residential sector, comprising custom home builders, renovation contractors, and direct homeowners, represents a rapidly growing segment, particularly focusing on aesthetic upgrades, natural light maximization, and premium features like frameless shower enclosures, glass kitchen backsplashes, and elegant interior railings. These customers often seek specialty glass finishes, such as low-iron glass for maximum clarity or decorative etched glass, prioritizing design flexibility and long-term durability. The institutional sector, encompassing healthcare facilities and educational buildings, drives demand for hygienic, durable, and highly functional glass solutions, including fire-rated glass and highly impact-resistant partitions suitable for high-traffic environments where safety and maintenance are paramount concerns.

Architects and interior designers also act as critical influencers, often dictating material specifications and driving the adoption of innovative products like switchable smart glass or digitally printed decorative glass. Suppliers must therefore engage strategically with design firms early in the project lifecycle. Furthermore, specialized glazing contractors, who purchase and install the final product, are crucial indirect customers, requiring reliable supply chains, technical support, and comprehensive product training from glass manufacturers. The future growth of potential customers hinges on the continued global trend toward energy-efficient, visually appealing, and modular interior spaces.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 19.5 Billion |

| Market Forecast in 2033 | USD 30.1 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Asahi Glass Co. Ltd. (AGC), Saint-Gobain S.A., Guardian Industries, Pilkington Group Limited, Schott AG, Vitro Architectural Glass, Corning Incorporated, China Glass Holdings Limited, Taiwan Glass Industry Corporation, Sisecam, Central Glass Co., Ltd., Fuyao Glass Industry Group Co., Ltd., Nippon Sheet Glass Co., Ltd., Trosifol (Kuraray), Techno Glass Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Interior Glass Market Key Technology Landscape

The Interior Glass Market is continually shaped by innovations focused on enhancing functional performance, safety, and aesthetic appeal. A cornerstone technology is the fabrication of high-performance laminated glass, utilizing advanced interlayers such as specialized Polyvinyl Butyral (PVB) or SentryGlas (SGP) films. These interlayers dramatically improve acoustic dampening, essential for maintaining privacy in open-plan offices, and enhance structural integrity, making the glass safer upon breakage. Furthermore, low-emissivity (Low-E) coatings, traditionally applied to exterior windows, are increasingly being adapted for interior use, particularly in complex building designs to manage radiant heat transfer between zones or to protect sensitive interior finishes from ultraviolet light exposure, improving overall interior climate control and energy efficiency.

The emergence of smart glass technology represents the most disruptive technological advancement. Polymer-Dispersed Liquid Crystal (PDLC) film is integrated between two glass panes, allowing the user to switch the glass from opaque to clear instantaneously, providing dynamic privacy on demand in conference rooms or healthcare environments. Similarly, electrochromic technology allows glass to dynamically alter its light transmittance and solar heat gain properties via a low electrical voltage, optimizing ambient light and reducing reliance on artificial lighting or motorized blinds. These technologies move interior glass beyond mere separation into active, interactive architectural components, commanding premium pricing and expanding the application scope considerably.

In terms of decoration and branding, digital printing on glass using ceramic frit inks has revolutionized aesthetic customization. This allows architects and designers to embed complex, high-resolution imagery, textures, or branding elements directly onto the glass surface during the tempering process, ensuring durability and scratch resistance. This technology is vital for retail environments and corporate headquarters seeking unique, branded interior aesthetics. Additionally, advancements in ultrathin glass and chemically strengthened glass are opening avenues for lightweight, highly durable interior applications, such as interactive display surfaces and integrated flooring elements, driving the adoption of glass in previously untapped structural uses.

Regional Highlights

The Interior Glass Market exhibits diverse growth characteristics across key geographies, heavily influenced by local construction standards, economic development rates, and architectural trends. Asia Pacific (APAC) currently dominates the market share and is projected to maintain the fastest growth rate throughout the forecast period. This robust expansion is primarily attributed to unprecedented urbanization, massive government investment in commercial and residential infrastructure, especially in emerging economies like China, India, and Indonesia, and the swift adoption of modern, glass-intensive international architectural designs. The rapid development of corporate campuses and luxury hospitality sectors in APAC drives demand for both standard safety glass and high-end smart glass solutions.

North America holds a significant market share, characterized by a mature construction industry and high adoption rates of advanced, energy-efficient building materials. The market here focuses heavily on renovation and retrofit projects, especially integrating smart and functional interior glass to improve energy scores and occupant well-being in existing corporate real estate. Strict safety regulations and a strong emphasis on acoustic performance further stimulate demand for sophisticated laminated and acoustic insulating glass products. Europe follows a similar trajectory, prioritizing sustainability and premium quality, with countries like Germany, France, and the UK leading the demand for specialized, high-specification interior glass products that comply with stringent European Union thermal and structural directives.

- Asia Pacific (APAC): Highest growth region driven by urbanization, large-scale construction projects, and increasing adoption of Western architectural styles in commercial and high-end residential segments. Key markets include China, India, and Southeast Asia.

- North America: Mature market focused on high-value, performance-driven products such as smart glass partitions and high-acoustic laminates, spurred by corporate emphasis on employee wellness and office modernization.

- Europe: Demand concentrated on sustainable and energy-efficient interior glass solutions, adherence to strict building codes (e.g., thermal performance), and renovation projects utilizing sophisticated double and triple glazing for internal separation.

- Latin America (LATAM): Emerging market growth tied to residential development and modernization of central business districts in Brazil and Mexico, focusing on cost-effective aesthetic solutions.

- Middle East & Africa (MEA): Growth fueled by mega-projects in the UAE and Saudi Arabia, demanding luxury, large-format decorative glass for hospitality and high-rise commercial interior cladding.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Interior Glass Market.- Asahi Glass Co. Ltd. (AGC)

- Saint-Gobain S.A.

- Guardian Industries

- Pilkington Group Limited

- Schott AG

- Vitro Architectural Glass

- Corning Incorporated

- China Glass Holdings Limited

- Taiwan Glass Industry Corporation

- Sisecam

- Central Glass Co., Ltd.

- Fuyao Glass Industry Group Co., Ltd.

- Nippon Sheet Glass Co., Ltd.

- Trosifol (Kuraray)

- Techno Glass Co. Ltd.

- Creative Glass and Aluminum Ltd.

- Bavaria Yachtbau Gmbh

- Hansen Glass

- Sedak GmbH & Co. KG

- A&E Glass

Frequently Asked Questions

Analyze common user questions about the Interior Glass market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary safety standards governing interior glass installations?

Interior glass installations, particularly in commercial or public spaces, must adhere to stringent safety standards requiring the use of tempered or laminated glass. These standards, such as ANSI Z97.1 and CPSC 16 CFR 1201 in the US or similar European directives, ensure that the glass resists breakage or, if broken, minimizes the risk of injury, typically mandating safety glass for partitions, doors, and railings.

How does smart glass function and what are its main applications in interior design?

Smart glass, often utilizing Polymer-Dispersed Liquid Crystal (PDLC) or electrochromic technology, changes its transparency or light transmission characteristics when an electrical current is applied. Its main interior applications include on-demand privacy screens for conference rooms, dynamic dividers in healthcare environments, and specialized residential windows that control daylight and solar heat gain instantly.

What is driving the demand for acoustic performance in interior glass partitions?

The increasing prevalence of open-plan office layouts is the main driver. To maintain productivity and privacy, businesses require glass partitions that effectively block sound transmission (high Sound Transmission Class or STC ratings), achieved through specialized acoustic laminated glass featuring thicker PVB interlayers designed specifically to dampen sound waves without sacrificing visual transparency.

Which geographic region presents the highest growth opportunities for interior glass manufacturers?

The Asia Pacific (APAC) region, led by rapidly developing economies like China and India, presents the highest growth opportunities. This is due to massive infrastructure investments, accelerated urbanization, and a growing middle class driving demand for modern, glass-intensive commercial buildings and high-quality residential interiors.

How is the Interior Glass Market addressing sustainability and environmental concerns?

The market addresses sustainability by focusing on producing low-E coated glass to enhance energy efficiency within buildings, thereby reducing HVAC load. Manufacturers also increasingly incorporate recycled content (cullet) into the glass melting process and optimize fabrication to reduce material waste, aligning the product lifecycle with green building certifications like LEED.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Interior Glass Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Interior Glass Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Movable Partition, Sliding Doors, Demountable, Acoustical glass), By Application (Commercial Buildings, Institutional Buildings, Industrial Buildings, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager