Laundry Detergent by Brand Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440908 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Laundry Detergent by Brand Market Size

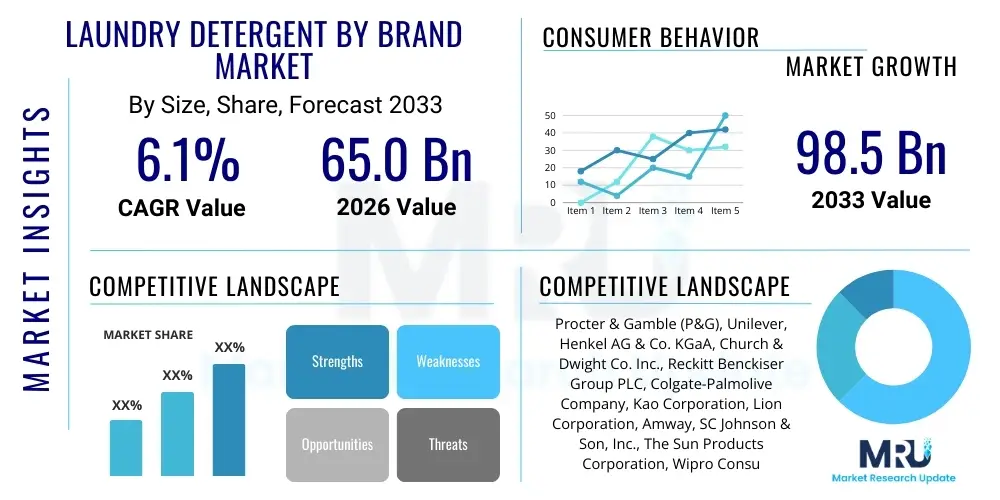

The Laundry Detergent by Brand Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 65.5 Billion in 2026 and is projected to reach USD 88.9 Billion by the end of the forecast period in 2033.

Laundry Detergent by Brand Market introduction

The global Laundry Detergent by Brand Market encompasses the competitive landscape where manufacturers differentiate their products through branding, specialized formulations, and targeted marketing campaigns aimed at specific consumer needs, such as sensitivity, high-efficiency (HE) machine compatibility, or ecological footprint. These products are formulated chemical agents designed to assist in the cleaning of laundry, primarily categorized into powder, liquid, and single-dose unit formats (pods or packs). The versatility of these formats allows brands to cater to varied global washing habits and economic segments. Major applications span both household use, which constitutes the largest volume share, and commercial applications, including laundromats, hospitality, healthcare, and industrial cleaning services, where bulk purchasing and high-performance requirements dominate decision-making.

The fundamental benefit offered by modern laundry detergents is effective stain removal and fabric care, coupled with features such as color protection, anti-redeposition agents, and long-lasting fragrances delivered via advanced encapsulation technology. Brands are increasingly focusing on delivering enhanced performance in cold water cycles, which addresses both energy efficiency concerns and the preservation of delicate fabrics. This drive towards innovation, particularly in enzyme biotechnology and surfactant chemistry, remains a central theme in product development across leading market players. Furthermore, the strategic positioning of brands often involves associating the product with specific lifestyle choices, such as natural ingredients or hypoallergenic properties, thereby establishing deeper consumer loyalty and willingness to pay premium prices.

Key driving factors accelerating market expansion include rapid global urbanization, leading to smaller living spaces and a corresponding rise in demand for concentrated and efficient detergent forms like pods. Simultaneously, heightened public awareness regarding hygiene and cleanliness, particularly in the wake of global health crises, has substantially increased the frequency of laundry cycles across all demographics. Moreover, continuous innovation in washing machine technology, specifically the shift towards High-Efficiency (HE) machines that require low-sudsing formulations, compels brands to constantly update their product lines, thus fueling market growth through continuous product cycling and consumer education on specialized use cases. Brand recognition and perceived quality play a critical role, as consumers often rely on established names for dependable cleaning outcomes.

Laundry Detergent by Brand Market Executive Summary

The Laundry Detergent by Brand Market is characterized by intense competition driven primarily by differentiation in sustainable practices, targeted formulations, and expansive digital marketing strategies. Current business trends indicate a significant shift towards environmentally conscious products, with brands heavily investing in biodegradable ingredients, plant-based surfactants, and plastic-free or highly recyclable packaging. This sustainability mandate is transforming global supply chains and influencing sourcing decisions from raw material procurement to final consumer delivery. E-commerce penetration is dramatically reshaping distribution, allowing challenger brands to gain visibility and reducing dependency on traditional retail shelf space, while established leaders leverage their logistical strength to dominate online fulfillment channels. Furthermore, consolidation remains a consistent theme, with major global corporations acquiring niche, high-growth sustainable brands to quickly integrate environmentally friendly technologies and diversify their portfolio offerings, thereby maintaining market relevance against agile direct-to-consumer competitors.

Regional trends reveal disparate growth trajectories and consumption patterns. The Asia Pacific (APAC) region is poised for the most rapid expansion, driven by massive population growth, increasing disposable incomes, and the modernization of household appliances, which introduces sophisticated detergent formats to markets previously dominated by powder variants. Conversely, North America and Europe, representing mature markets, exhibit slower volume growth but demonstrate higher value growth, attributable to a strong consumer preference for premium, highly concentrated, and single-unit dose products. European markets are particularly responsive to stringent regulatory standards regarding chemical safety and environmental claims, mandating brands to demonstrate verifiable sustainability metrics. The Middle East and Africa (MEA) region presents significant untapped potential, though market development is often hampered by infrastructural challenges and price sensitivity, necessitating the introduction of value-oriented brand offerings.

Segment trends highlight the persistent migration of consumers from traditional powder detergents to liquid and, more prominently, to unit dose formats. The convenience and pre-measured efficiency of pods are proving highly attractive to time-constrained consumers in developed economies, despite their generally higher cost per load. Simultaneously, the emphasis on specialized formulations is creating micro-segments; for instance, detergents specifically formulated for athletic wear, dark colors, or sensitive skin are capturing consumer attention and commanding premium prices. Within the distribution realm, mass merchandise retail still holds the dominant share, but the accelerated growth of online subscription services and branded direct-to-consumer platforms underscores a critical segment evolution. This shift demands sophisticated brand management focused on personalized consumer engagement and efficient inventory management across omnichannel touchpoints.

AI Impact Analysis on Laundry Detergent by Brand Market

User queries regarding AI's influence on the Laundry Detergent by Brand Market frequently revolve around optimizing complex supply chains, predicting hyper-localized demand fluctuations, and customizing product formulations based on real-time consumer data. Key concerns center on how AI can enhance the efficacy of cleaning agents while minimizing environmental waste through precision dosing recommendations and sustainable material sourcing. Consumers and industry analysts alike are keen to understand if AI can democratize the premium market by lowering production costs associated with complex enzyme and additive combinations, making high-performance cleaning accessible to broader economic segments. A recurring theme is the application of machine learning for advanced pattern recognition in consumer behavior, allowing brands to preemptively launch products tailored to emerging preferences, such as specific scent profiles or hypoallergenic requirements, significantly reducing time-to-market for innovative products and improving advertising relevance. This predictive modeling is crucial for inventory planning, especially given the fluctuating costs and availability of petrochemical and naturally derived raw materials.

AI's integration provides substantial competitive advantages, primarily by moving beyond generic formulations to personalized solutions. Through machine learning algorithms analyzing variables like local water hardness, appliance type, and typical soil level derived from smart appliance data or consumer input, brands can offer hyper-personalized product recommendations or even potentially manufacture customized batches. Furthermore, AI tools are fundamentally changing quality control and research and development (R&D). Computer vision and advanced analytics accelerate the screening of new enzyme variants or surfactant combinations for improved performance and reduced environmental toxicity, allowing brands to rapidly iterate on formulations before costly physical trials. The optimization extends to predictive maintenance within manufacturing plants, minimizing downtime and improving overall production efficiency, which directly impacts the brand's profitability and ability to sustain competitive pricing strategies in a high-volume market.

- AI-driven Predictive Demand Forecasting: Enhancing inventory precision across fragmented global distribution networks, thereby minimizing obsolescence and stock-outs.

- Formulation Optimization using Machine Learning: Accelerating R&D by simulating the performance of novel chemical and biological ingredients, specifically enhancing cold-water efficacy and sustainability metrics.

- Personalized Consumer Engagement: Utilizing algorithms to recommend optimal dosing amounts via smart devices or tailor marketing communications based on individual usage data and purchasing history (GEO optimization).

- Automated Supply Chain Transparency: Implementing AI and blockchain for tracking sustainable sourcing of raw materials, strengthening brand trust regarding ecological claims.

- Smart Manufacturing and Quality Control: Employing computer vision and sensor data analysis to ensure product consistency and identify manufacturing defects instantly, improving overall brand reliability.

DRO & Impact Forces Of Laundry Detergent by Brand Market

The market dynamics are governed by a complex interplay of forces. Key drivers include rising global consciousness regarding personal and household hygiene, necessitating frequent and effective cleaning solutions, especially in populous and developing regions where health standards are rapidly improving. Complementing this is continuous product innovation, particularly the development of high-performance, compact, and environmentally friendly formulations that address modern consumer values and technology compatibility, such as HE washers. Conversely, significant restraints include the increasing volatility in the price of key petrochemical-derived raw materials, which pressures profit margins and necessitates continuous cost-management strategies. Regulatory scrutiny regarding chemical composition, microplastics, and environmental discharge poses a constant challenge, forcing brands into expensive reformulation cycles. Opportunities are heavily concentrated in the sphere of sustainability, specifically the successful commercialization of highly effective bio-based detergents and refillable packaging systems, alongside expansion into fast-growing e-commerce channels and subscription models that offer brands greater consumer lock-in. These forces collectively shape the market's trajectory, mandating that successful brands maintain agility in innovation while navigating cost pressures and evolving environmental standards.

The most significant impact force shaping the market is the escalating pressure from non-governmental organizations (NGOs) and informed consumers demanding verifiable sustainability commitments. This transcends basic regulatory compliance and influences brand reputation and market share; brands failing to demonstrate clear paths to biodegradability or plastic reduction face consumer backlash and potential boycotts. This pressure accelerates the competitive intensity, as market leaders invest heavily in sustainable R&D to secure a first-mover advantage in green chemistry. Another strong impact force is the power of major retailers and e-commerce giants, who often dictate shelf placement, pricing, and promotional activities, thereby influencing consumer exposure to specific brands and formats. For smaller brands, securing favorable placement, either physical or digital, is a major barrier to entry, reinforcing the dominance of established players with extensive distribution leverage. Furthermore, rapid technological evolution in washing appliances dictates detergent formulation, punishing brands that fail to adapt their products for low-water, low-temperature, or specialized cycles, making brand compatibility a critical consumer selection criterion.

Segmentation Analysis

The global Laundry Detergent by Brand Market is comprehensively segmented based on product type, application, and distribution channel, providing a granular view of consumer preferences and market penetration across various sectors. Product type segmentation is crucial as it reflects the trade-off between convenience, cost-effectiveness, and regional washing habits. Liquid detergents often dominate developed markets due to their ease of use and superior blending in cold water, while powder detergents maintain a strong foothold in price-sensitive developing economies due to lower manufacturing and logistics costs. Unit dose products (pods) represent the fastest-growing segment, favored by affluent consumers for their precise dosing and mess-free convenience. Application segmentation highlights the difference in purchasing volumes and performance requirements between the stable, high-volume household sector and the performance-critical, bulk-purchasing commercial sector, which requires specialized, institutional-grade formulations. Analysis by distribution channel illustrates the ongoing channel shift, where the dominance of traditional offline retail is slowly being eroded by the accelerated growth and strategic importance of online retail platforms, particularly for niche and premium brands.

- By Product Type:

- Liquid Detergents (Includes highly concentrated and standard formulations)

- Powder Detergents (Cost-effective bulk options)

- Unit Dose Detergents (Pods/Packs, focused on convenience and precision)

- Specialty Detergents (Wool, silk, dark colors, sports attire)

- By Application:

- Household (Daily consumer use)

- Commercial/Industrial (Hospitality, healthcare, laundromats, and institutional cleaning)

- By Distribution Channel:

- Offline Retail (Supermarkets, Hypermarkets, Convenience Stores)

- Online Retail (E-commerce Platforms, Direct-to-Consumer Websites, Subscription Services)

- By Formulations:

- Traditional/Chemical Based

- Bio-Based/Natural/Eco-Friendly

Value Chain Analysis For Laundry Detergent by Brand Market

The value chain for the Laundry Detergent by Brand Market initiates with upstream activities centered on the procurement and processing of key raw materials, primarily surfactants (both petrochemical and bio-derived), enzymes (lipase, protease, amylase), builders, bleaches, and fragrances. Upstream analysis focuses intensely on supplier relationships, price negotiation, and securing stable sourcing, particularly for enzymes and bio-based surfactants, which are often derived from highly specialized biotechnology companies. Fluctuations in the price of crude oil directly impact the cost structure of petrochemical surfactants, leading brands to invest in backward integration or long-term supply agreements to mitigate risk. A crucial trend in this stage is the push for sustainable sourcing, prompting brands to audit their supply chain for ethical and environmental compliance, transforming procurement into a strategic competitive differentiator.

Manufacturing and logistics represent the midstream segment, encompassing formulation, blending, packaging, and large-scale distribution. Brands invest heavily in advanced manufacturing technologies to handle diverse product formats—from high-density liquids to precise unit-dose encapsulation—while ensuring consistent quality control. Distribution channel management is complex, relying on both direct and indirect routes. Direct distribution involves delivering products straight to large commercial clients or via branded e-commerce fulfillment centers. Indirect distribution, which accounts for the vast majority of volume, involves leveraging mass retailers, wholesalers, and third-party logistics (3PL) providers. Efficiency in this midstream segment, particularly optimizing warehousing and transportation to manage product shelf life and global reach, is paramount for maintaining competitive pricing and freshness, especially for highly volatile enzyme-based formulations.

Downstream activities focus on reaching the end consumer and post-sales engagement. This stage includes intensive marketing, advertising, brand building, and establishing relationships with key retailers who control point-of-sale visibility. Brand success is heavily reliant on effective in-store promotion, category management partnerships with retailers, and robust digital marketing campaigns that leverage social media and search engine optimization (SEO/AEO) to capture consumer attention at the moment of need. Post-purchase analysis, feedback loops, and loyalty programs are essential components of the downstream strategy, ensuring consumer retention and providing data necessary for continuous product improvement. Brands that successfully manage their indirect distribution channels by cooperating closely with hypermarkets and online marketplaces often achieve superior market penetration and volume stability.

Laundry Detergent by Brand Market Potential Customers

The primary customer base for the Laundry Detergent by Brand Market is highly diversified, spanning from individual households to large industrial institutions, each exhibiting distinct purchasing behaviors and product requirements. Within the household segment, the consumer profile is further segmented by demographics, including large families who prioritize bulk value and stain removal efficacy, urban professionals who seek convenience and unit-dose formats, and eco-conscious consumers focused exclusively on natural, hypoallergenic, or zero-waste products. Purchasing decisions among these groups are often influenced by brand reputation, perceived performance, promotional activity, and established family loyalty, making brand-specific marketing crucial for capturing share within the domestic sector.

The commercial segment constitutes another crucial set of potential customers, characterized by high volume consumption and stringent performance demands. This includes professional laundries, hospitals, hotels, and large-scale food service operations. These institutional buyers prioritize robust cleaning power, compliance with sanitation standards, cost-per-use efficiency, and reliability of supply, often selecting bulk or highly concentrated formulas. Their purchasing cycle is typically contractual and procurement-driven, relying less on retail branding and more on technical specifications, certification, and favorable business-to-business terms. Successful brands targeting this segment must invest in specialized sales teams and technical support to demonstrate the superior cost-effectiveness and performance of their institutional-grade product offerings compared to retail counterparts.

A rapidly growing customer segment comprises users of advanced High-Efficiency (HE) washing machines, who represent a technologically savvy group demanding HE-specific, low-sudsing, and highly concentrated detergents. Failure to address this specialized requirement can damage appliances, leading to brand switching and negative reviews. Furthermore, customers participating in the circular economy, increasingly embracing refillable stations or subscription boxes, are prime targets for brands offering sustainable packaging solutions. These consumers value the ethical stance of the brand as much as the product efficacy, creating a niche where purpose-driven branding and robust sustainability credentials translate directly into market loyalty and premium pricing power, demonstrating the critical importance of aligning brand values with evolving consumer ethics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 65.5 Billion |

| Market Forecast in 2033 | USD 88.9 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Procter & Gamble (P&G), Unilever, Henkel AG & Co. KGaA, Church & Dwight Co., Inc., Reckitt Benckiser Group PLC, Colgate-Palmolive Company, SC Johnson & Son, Inc., Kao Corporation, Lion Corporation, Amway, ECOVER (Ecover Group), Seventh Generation (Unilever Subsidiary), Method Products (SC Johnson Subsidiary), McBride plc, Dropps, Persil (Henkel/Unilever), OMO (Unilever), Ariel (P&G), Tide (P&G), Gain (P&G) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laundry Detergent by Brand Market Key Technology Landscape

The technological landscape of the Laundry Detergent by Brand Market is undergoing continuous revolution, driven primarily by the pursuit of superior cleaning performance coupled with a reduced environmental footprint. One of the most critical technologies is advanced enzyme engineering, which allows brands to incorporate highly specific biological catalysts (such as protease for protein stains, lipase for fat/oil stains, and amylase for carbohydrate stains) that function effectively at lower washing temperatures. This cold-water efficacy is a major selling point, reducing household energy consumption and appealing directly to eco-conscious consumers. Further advancements include the development of highly effective, mild, and readily biodegradable surfactants derived from renewable sources, such as vegetable oils, replacing traditional petroleum-based alternatives. These bio-based technologies are crucial for brands aiming to meet stringent European regulatory standards and consumer demands for natural formulations, influencing market preference through verifiable green claims.

Another major technological area is microencapsulation, utilized primarily for fragrance delivery. This technology involves embedding scent molecules in tiny polymeric shells that adhere to fabric during the wash cycle and only release the fragrance when mechanically ruptured (e.g., during wear or rubbing), providing a long-lasting scent experience. This differentiates premium brands and contributes significantly to brand loyalty. Furthermore, the design of packaging technology is rapidly evolving. Innovations include highly concentrated formulas that allow for smaller packaging sizes, reducing shipping weight and plastic use, and the introduction of water-soluble films for unit-dose detergents (pods), which are designed to dissolve completely without leaving residue. The development of automated and precise dosing systems integrated into smart washing machines and corresponding detergent brands represents the cutting edge of consumer technology integration, enhancing convenience and preventing over-use, which also contributes to sustainability objectives and cost management for the consumer.

The industry is also leveraging process technology improvements. Advanced mixing and blending equipment ensures the stability and homogeneity of complex multi-component formulas, particularly crucial for liquid and gel detergents that must prevent phase separation over shelf life. For powder detergents, granulation technology ensures optimal solubility and prevents caking in humid environments, which remains a challenge in many developing markets. The integration of data analytics and computational chemistry (as discussed in the AI section) plays a supporting role, allowing R&D teams to model and predict the performance and stability of new formulations digitally, dramatically shortening the product development cycle. These core technological advancements, encompassing formulation science, enzyme biotechnology, material science for packaging, and smart consumer integration, define the competitive battleground for leading laundry detergent brands globally.

Regional Highlights

- North America (USA and Canada) is a highly mature market characterized by high consumer spending power and a strong preference for premium, convenient formats, specifically unit-dose (pods) and concentrated liquid detergents. The region is a hotbed for innovation in sustainability and transparency; brands must prominently feature verifiable claims regarding biodegradability, cruelty-free testing, and ingredient sourcing to maintain competitive relevance. The dominance of High-Efficiency (HE) washing machines mandates strict adherence to low-sudsing formulas. Promotional activities and brand loyalty programs are critical here, given the saturation of options and intense competition among key players like P&G and Unilever.

- Europe maintains a strong focus on ecological responsibility and stringent regulatory oversight (e.g., REACH regulations). Western Europe exhibits high adoption rates for liquid and specialty detergents (wool care, sports gear), while sustainability is not just a trend but a mandated operational requirement. Brands like Henkel and Ecover thrive here by emphasizing minimal packaging, natural ingredients, and low-temperature washing performance. Eastern Europe represents a strong growth area, transitioning rapidly from traditional powder formats to modern liquid and concentrated solutions as incomes rise and appliance penetration increases.

- Asia Pacific (APAC) represents the largest volume market and the fastest-growing region globally, primarily driven by China, India, and Southeast Asian nations. Growth is fueled by increasing middle-class populations, rapid urbanization, and a shift from traditional washing methods to automated machines. Powder detergent still holds significant volume share, but demand for affordable liquid detergents is skyrocketing. Brands must navigate immense cultural diversity and fragmented distribution systems, often requiring localized branding and specific formulation adjustments to address regional water quality and unique fabric types.

- Latin America (LATAM) is characterized by a strong mix of powder and liquid formats, often influenced by economic volatility and price sensitivity. Strong regional brands often compete effectively against global giants by offering localized scents and efficient, value-oriented large-format products. Brazil and Mexico are key growth engines, showing increasing adoption of concentrated liquids and a rising, albeit nascent, interest in sustainable formulations among middle to high-income consumers.

- Middle East and Africa (MEA) is an emerging market with significant growth potential, albeit from a smaller base. Market penetration of washing machines is increasing, driving demand for branded detergents. The market is highly sensitive to pricing, making value propositions critical. Hot climates often necessitate specialized formulations for powerful stain removal in warm water, though there is a growing trend for premium brands catering to high-net-worth households in the Gulf Cooperation Council (GCC) countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laundry Detergent by Brand Market.- Procter & Gamble (P&G)

- Unilever

- Henkel AG & Co. KGaA

- Church & Dwight Co., Inc.

- Reckitt Benckiser Group PLC

- Colgate-Palmolive Company

- SC Johnson & Son, Inc.

- Kao Corporation

- Lion Corporation

- Amway

- ECOVER (Ecover Group)

- Seventh Generation (Unilever Subsidiary)

- Method Products (SC Johnson Subsidiary)

- McBride plc

- Dropps

- Earth Friendly Products (Ecos)

- The Honest Company

- PZ Cussons

- Natura &Co

- Tesco PLC (Own Brand)

Frequently Asked Questions

Analyze common user questions about the Laundry Detergent by Brand market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the shift from powder to liquid and unit dose detergents?

The shift is primarily driven by enhanced consumer convenience, precise pre-measured dosing (reducing waste), better solubility in cold water, and superior performance integration with modern High-Efficiency (HE) washing machines. Unit dose products offer mess-free handling, appealing strongly to time-constrained urban consumers willing to pay a premium for simplicity and effectiveness.

How is sustainability affecting brand innovation and consumer choice in this market?

Sustainability is a core differentiator, influencing R&D toward bio-based, plant-derived ingredients and concentrated, water-saving formulas. Consumers, particularly in North America and Europe, actively seek brands offering verifiable claims regarding biodegradability, minimal plastic use (refill systems), and transparent supply chains, often resulting in strong loyalty to eco-focused brands.

Which geographical region exhibits the highest growth potential for laundry detergent brands?

The Asia Pacific (APAC) region, specifically emerging economies like China and India, holds the highest growth potential. This is attributed to rapidly increasing household income, widespread adoption of automated washing machines, and urbanization, which collectively drives a massive increase in volume consumption and a shift towards premium, branded product formats.

What role does biotechnology play in modern laundry detergent formulations?

Biotechnology is vital, enabling the incorporation of advanced enzymes (proteases, lipases) that break down specific stains efficiently at lower temperatures, improving performance while reducing the need for harsh chemicals. This technology is critical for developing high-efficacy, environmentally preferable, and energy-saving cold-water detergents, which are now standard expectations in developed markets.

How are e-commerce and digital channels transforming the competitive landscape for major brands?

E-commerce transforms competition by providing accessible distribution for niche, sustainable, and specialized challenger brands (e.g., Dropps). For established market leaders, digital channels optimize direct-to-consumer relationships, facilitate subscription services, and enable hyper-targeted marketing campaigns, utilizing data analytics to improve personalized offerings and maintain brand relevance against agile online competitors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager