Laundry Detergent by Brand Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433246 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Laundry Detergent by Brand Market Size

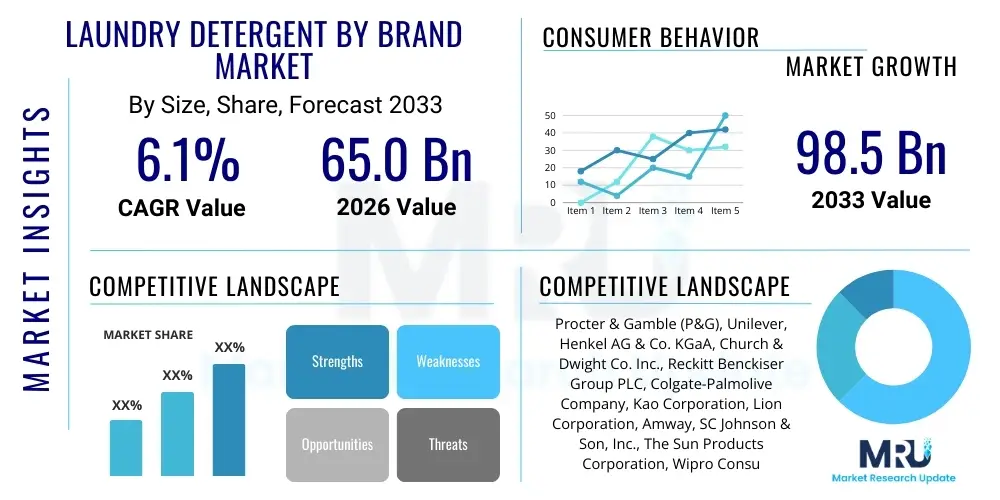

The Laundry Detergent by Brand Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.1% between 2026 and 2033. The market is estimated at USD 65.0 Billion in 2026 and is projected to reach USD 98.5 Billion by the end of the forecast period in 2033.

Laundry Detergent by Brand Market introduction

The Laundry Detergent by Brand Market encompasses the global commercial landscape for cleaning agents specifically formulated for laundry purposes, segmented and analyzed based on the proprietary identity and established reputation of the manufacturer. This market is highly competitive, characterized by intense differentiation strategies focused on cleaning performance, scent profiles, environmental sustainability, and specialized formulations (e.g., color care, sensitive skin). Product development is continuously evolving, driven by consumer demand for convenience, evident in the rising adoption of highly concentrated liquids, single-dose pods, and specialized natural/organic options. The performance of individual brands is intrinsically linked to marketing efficacy, supply chain robustness, and perceived value proposition, making brand equity a critical determinant of market share across diverse geographic regions.

Major applications of branded laundry detergents span across residential households, commercial laundering operations such as hotels and hospitals, and industrial settings requiring specialized cleaning agents. The residential sector remains the largest consumer base, utilizing detergents for routine fabric care, stain removal, and maintaining textile longevity. Commercial applications demand high-volume, cost-effective solutions that deliver consistent results under stringent hygiene standards. Key benefits derived from branded products include assurance of quality, specific technological features (like cold-water efficacy or enzyme enhancement), and reliable availability across various distribution channels. Brands often invest heavily in patented formulations that target specific consumer needs, such as hypoallergenic ingredients or high-efficiency (HE) machine compatibility, thereby reinforcing consumer loyalty and justifying premium pricing structures.

The market is primarily driven by global population growth, urbanization, and rising disposable incomes in emerging economies, leading to increased frequency of clothes washing and greater demand for quality fabric care. Furthermore, technological advancements in washing machine designs, particularly the proliferation of HE machines, necessitates the development of specialized, low-sudsing detergents, driving innovation within brand portfolios. Socio-cultural shifts favoring cleanliness and personal hygiene, coupled with aggressive advertising and promotional activities by market leaders, continually expand the consumer base and encourage brand switching based on performance claims and sustainability initiatives. The increasing consumer awareness regarding the environmental impact of chemical ingredients also acts as a significant driver, compelling brands to invest in bio-based and biodegradable formulations to capture the growing segment of environmentally conscious consumers.

Laundry Detergent by Brand Market Executive Summary

The Laundry Detergent by Brand Market is characterized by robust growth underpinned by strong consumer brand preference and significant product innovation focused on convenience and sustainability. Key business trends indicate a substantial shift towards highly concentrated formats, particularly liquid detergents and unit dose packets, driven by consumer appreciation for ease of use, reduced packaging waste, and minimized logistical footprint. Mergers and acquisitions remain a strategic tool for major players to rapidly expand geographic reach, acquire niche sustainable brands, or integrate specialized formulation technologies. Pricing strategy is highly differentiated; while mass-market brands compete fiercely on cost and volume, premium brands leverage superior efficacy, unique scents, and eco-friendly certifications to maintain higher margins. Brand owners are increasingly utilizing direct-to-consumer (D2C) channels and subscription models to foster deeper relationships with consumers and gather crucial purchasing data for personalized marketing efforts.

Regionally, the Asia Pacific (APAC) region is poised to exhibit the fastest growth, primarily due to expanding urbanization, improving sanitation standards, and the rapid adoption of automated washing appliances, particularly in large markets like China and India. North America and Europe, representing mature markets, maintain high market saturation but are pivotal in driving trends related to premiumization, ingredient transparency, and sustainable packaging solutions. In these developed regions, growth is often volume-constrained, leading brands to focus on value-added services, superior performance, and health-related claims (e.g., anti-allergen). The Middle East and Africa (MEA) and Latin America are seeing increasing penetration of global brands, challenging local manufacturers and driving modernization in distribution networks, often favoring modern trade channels such as hypermarkets and supermarkets.

Segment trends demonstrate a clear movement away from traditional powder detergents towards liquid and unit dose formats, reflecting consumer demand for less mess and precise dosing. Within the application segment, the residential market continues its dominance, yet the commercial sector shows specialized growth driven by heightened hygiene protocols in hospitality and healthcare following global health events. The ingredient segmentation reveals a strong upward trajectory for bio-based and enzymatic detergents, which are perceived as offering powerful stain removal coupled with reduced environmental toxicity compared to traditional chemical surfactants. Brands that successfully align their product portfolio with these convenience, sustainability, and performance segment requirements are best positioned for sustained market dominance throughout the forecast period.

AI Impact Analysis on Laundry Detergent by Brand Market

User queries regarding the impact of Artificial Intelligence (AI) on the Laundry Detergent by Brand Market frequently center on its role in personalized marketing, supply chain optimization, and the accelerated development of novel formulations. Consumers and industry stakeholders are keen to understand how AI tools can enhance the efficacy of cleaning agents by simulating chemical interactions or predicting consumer scent preferences based on large datasets. Key themes revolve around the expectation that AI will dramatically improve demand forecasting, reducing inventory holding costs and minimizing product obsolescence. There is also significant interest in the application of AI-powered recommendation systems through e-commerce platforms, ensuring consumers receive targeted promotions and customized product suggestions based on their specific washing habits, water hardness levels, and fabric types. Furthermore, users frequently express concerns about how AI will influence the competitive landscape, potentially allowing smaller, digitally native brands to challenge established market giants through highly efficient, data-driven operations and rapid product iteration cycles.

- AI optimizes supply chain logistics by predicting fluctuating demand across various regions, minimizing stockouts and reducing transportation costs, thus increasing brand profitability.

- Predictive analytics driven by AI models enable precise consumer segmentation and personalization of marketing campaigns, improving the return on investment (ROI) of advertising spend.

- AI accelerates Research and Development (R&D) through virtual screening of chemical compounds, identifying optimal enzyme blends and surfactant combinations for enhanced cleaning efficacy and reduced environmental impact.

- Advanced image recognition and machine learning algorithms are utilized in quality control to detect manufacturing defects in packaging and product consistency in real-time.

- Chatbots and AI-powered customer service systems provide instant support for complex dosing questions, stain removal advice, and product ingredient inquiries, enhancing the overall brand experience.

- AI facilitates dynamic pricing strategies based on competitor analysis, inventory levels, and real-time local demand fluctuations, maximizing revenue generation per unit sold.

- Brands leverage AI for trend spotting, analyzing social media chatter and search queries to quickly identify emerging consumer preferences (e.g., demand for specific scents or sustainable ingredients), driving timely product launches.

- Enhanced transparency features utilize AI to trace ingredient sourcing and supply chain steps, providing consumers with verifiable information about sustainability claims, crucial for brand trust.

DRO & Impact Forces Of Laundry Detergent by Brand Market

The dynamic nature of the Laundry Detergent by Brand Market is shaped by a confluence of driving forces, inherent restraints, and lucrative opportunities, collectively forming the market's impact forces. Principal drivers include the increasing global adoption of automatic washing machines, particularly in rapidly industrializing nations, which mandates the use of specialized detergents (like HE formulations). Significant growth is also fueled by heightened consumer focus on hygiene and wellness, accelerating the adoption of premium, anti-bacterial, and fabric-preserving formulations. These drivers are complemented by extensive marketing efforts and product differentiation strategies employed by multinational corporations seeking to capture varied demographic segments. However, the market faces significant restraints, including intense price competition, especially in commodity segments, and the volatile cost structure of key raw materials derived from petrochemicals, which impacts profit margins. Regulatory scrutiny concerning chemical residues and environmental toxicity further restricts the formulation freedom of brands, requiring substantial investment in compliant, sustainable alternatives.

Opportunities abound primarily in the sustainability sector, where a massive market potential exists for brands specializing in zero-waste packaging, concentrated refill systems, and certified organic ingredients, appealing to the eco-conscious consumer base in developed economies. Further opportunity lies in expanding penetration into untapped rural and semi-urban markets in APAC and Africa, where shifting consumer habits towards branded products are accelerating. Technological advancements provide additional avenues for growth, specifically through the integration of smart dispensing systems compatible with IoT-enabled washing machines and the development of personalized detergent solutions tailored to individual fabric loads or water conditions. Successful navigation of these opportunities requires robust R&D capabilities and flexible manufacturing processes.

The collective impact forces demonstrate a strong market momentum toward premiumization and sustainability, suggesting that brands failing to adapt their portfolio to include effective, eco-friendly options risk significant market erosion. The competitive pressure exerted by private labels and regional players necessitates continuous innovation in packaging and performance to maintain brand loyalty. The long-term success in this market will depend critically on achieving a balance between cost efficiency (to manage volatile input costs) and strategic investments in environmental compliance and digital engagement, ensuring the brand remains relevant to modern consumer priorities that increasingly value both product performance and corporate responsibility. The influence of digital platforms and direct-to-consumer models further intensifies the need for seamless integration between marketing, supply chain, and consumer feedback loops.

Segmentation Analysis

The Laundry Detergent by Brand Market is structurally segmented based on product type, application, distribution channel, and ingredient composition, allowing for granular analysis of consumer preferences and market dynamics. This detailed segmentation aids stakeholders in identifying high-growth niches, customizing product offerings, and tailoring marketing strategies to specific end-user groups. The shift in market dominance from one format to another (e.g., powder to liquid or pods) underscores the importance of the Type segmentation, reflecting consumers' perpetual search for convenience and enhanced performance. Analysis of Distribution Channels highlights the increasing penetration of organized retail and the accelerating role of e-commerce in facilitating brand discovery and purchase, especially for specialized or premium products. Understanding the nuances within each segment is crucial for competitive positioning and effective resource allocation.

- Type:

- Liquid Detergent (High growth segment due to convenience, ease of pre-treating stains, and superior performance in cold water)

- Powder Detergent (Traditional, cost-effective format; dominant in emerging markets and institutional laundering)

- Pods/Packs (Unit Dose) (Fastest-growing segment driven by extreme convenience, precise dosing, and mess-free handling)

- Gels/Paste (Niche segment, offering concentrated formula often favored in specific regional markets)

- Application:

- Residential (The largest segment, driven by household consumption and frequent usage)

- Commercial/Industrial (Includes laundromats, hospitals, hotels, and industrial textile cleaning; demands high-volume, specialized formulations)

- Distribution Channel:

- Supermarkets/Hypermarkets (Primary channel, offering wide product displays and promotional visibility)

- Convenience Stores (Important for immediate or smaller purchases)

- Online Retail/E-commerce (Rapidly growing channel, essential for subscription services and niche, specialty brands)

- Others (Includes direct sales, department stores, and specialized industrial suppliers)

- Ingredient:

- Enzymatic Detergents (Contains specialized enzymes for effective breakdown of complex stains like protein and starches; premium offering)

- Non-Enzymatic Detergents (Traditional formulations, often utilizing higher concentrations of surfactants)

- Bio-based/Natural Detergents (Formulations leveraging plant-derived ingredients and minimal synthetic chemicals, catering to eco-conscious consumers)

Value Chain Analysis For Laundry Detergent by Brand Market

The value chain of the Laundry Detergent by Brand Market begins with upstream activities involving the sourcing and processing of raw materials, primarily surfactants (often petrochemical-derived or bio-based), builders, enzymes, bleaches, optical brighteners, and fragrances. Manufacturers must secure stable, high-quality supplies, often navigating global commodity markets, which requires rigorous procurement strategies and risk management against price volatility. The midstream manufacturing phase involves sophisticated chemical formulation, blending, and filling processes, where intellectual property related to proprietary enzyme technology and scent encapsulation is highly valuable. Efficiency in this stage, leveraging automated mixing and high-speed packaging lines, is critical for competitive pricing and maintaining product consistency across massive production volumes. Branding, quality assurance, and compliance with varying international regulatory standards (especially regarding biodegradability and chemical safety) are central to value creation before the product reaches the consumer.

Downstream activities center on distribution and sales. The market utilizes a multi-channel distribution strategy that includes both direct and indirect routes. Indirect distribution dominates, relying heavily on third-party logistics (3PL) providers to transport finished goods to large retailers such as supermarkets, hypermarkets, and wholesale clubs. This stage requires efficient inventory management and precise execution of promotional agreements with retailers to secure optimal shelf placement. Direct channels, increasingly vital, involve brand-owned e-commerce platforms and subscription services, enabling deeper consumer data collection and higher margin potential. The final stage involves the consumer purchase, influenced heavily by brand loyalty, perceived performance based on marketing claims, and in-store visibility or online reviews. Effective post-sales support and handling of product inquiries further solidify brand equity and repeat purchasing behavior.

The efficiency of the value chain is a key differentiator in this highly competitive market. Leading brands invest heavily in vertically integrated operations or strategic long-term supplier partnerships to stabilize input costs and ensure the reliability of raw material quality, particularly for specialized ingredients like patented enzymes or sustainable packaging materials. The choice of distribution channel significantly impacts the final price point and market reach; while mass distribution provides widespread access, online channels facilitate the launch and scaling of niche, premium products that bypass traditional retail gatekeepers. Therefore, optimizing the flow from raw material acquisition (upstream analysis) through efficient logistics (downstream analysis) to final consumer engagement is paramount for maintaining profitability and market leadership.

Laundry Detergent by Brand Market Potential Customers

The potential customer base for the Laundry Detergent by Brand Market is highly diversified, spanning various socioeconomic and institutional sectors, yet fundamentally driven by the need for effective fabric cleaning and care. The primary end-users are residential households globally, where purchasing decisions are often made by individuals responsible for routine domestic upkeep. These consumers exhibit segmentation based on factors such as income level (influencing premium vs. economy brand choice), machine type (HE vs. standard), and lifestyle needs (e.g., sensitive skin requirements, environmental consciousness). Potential customers include first-time buyers adopting automatic washing machines in emerging markets and established, loyal users in mature markets seeking improved product attributes such as enhanced scent profiles, better stain removal technology, or reduced environmental impact.

Beyond the domestic sphere, the commercial and industrial sectors represent substantial potential customer segments that necessitate large-volume, specialized detergent formulations. Commercial customers include the hospitality industry (hotels, motels), which requires specialized formulations that maintain linen whiteness and fabric softness despite frequent washing cycles, and healthcare facilities (hospitals, clinics) demanding high-efficacy disinfectants and anti-microbial laundry solutions to meet stringent sanitation standards. Industrial users, such as manufacturing plants or military facilities, often require heavy-duty products designed to remove oil, grease, and industrial grime from workwear and specialized textiles. These institutional buyers prioritize consistent performance, bulk pricing, and specialized technical support from the brand provider.

The strategic targeting of potential customers involves recognizing the varying purchase motivators: residential users are swayed by convenience, brand reputation, and scent; commercial clients prioritize cost-in-use, consistency, and compliance; and the growing segment of eco-conscious consumers seeks transparency, sustainability certifications, and non-toxic ingredients. Brands must develop comprehensive product portfolios that address these distinct needs, ensuring robust distribution networks are in place to serve both the high-frequency, smaller purchases of the residential segment and the large, scheduled deliveries required by the industrial and commercial end-users, thereby maximizing market penetration.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 65.0 Billion |

| Market Forecast in 2033 | USD 98.5 Billion |

| Growth Rate | 6.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Procter & Gamble (P&G), Unilever, Henkel AG & Co. KGaA, Church & Dwight Co. Inc., Reckitt Benckiser Group PLC, Colgate-Palmolive Company, Kao Corporation, Lion Corporation, Amway, SC Johnson & Son, Inc., The Sun Products Corporation, Wipro Consumer Care and Lighting, LG Household & Health Care, McBride plc, Premier Brands Inc., Seventh Generation, Inc., Guangzhou Liby Enterprise Group Co., Ltd., Eco-Max, Ecover. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laundry Detergent by Brand Market Key Technology Landscape

The technological landscape of the Laundry Detergent by Brand Market is fundamentally focused on enhancing cleaning efficiency, improving sustainability profiles, and optimizing delivery systems. A primary area of innovation involves enzyme technology, where brands utilize targeted enzymatic blends (proteases, amylases, lipases) that are highly stable and effective across a wide range of water temperatures, particularly cold washes, which saves energy for the consumer. Furthermore, encapsulation technology, specifically for fragrances and active ingredients, is paramount. Microencapsulation ensures that scent bursts are released upon agitation or drying, providing a prolonged sensory experience, a key differentiator for premium brands. Advancements in surfactant chemistry focus on developing non-ionic and mild anionic surfactants derived from renewable sources, maximizing cleaning power while minimizing irritation and environmental impact. The shift towards highly concentrated liquids and unit dose technology necessitates specialized polymer science to ensure the water-soluble film (often PVA) dissolves completely without leaving residue, even in short wash cycles.

Manufacturing process technology is also evolving, driven by the requirement for flexible production lines capable of handling diverse formats (liquids, powders, pods) and supporting rapid product customization for regional markets. Sophisticated blending systems maintain ingredient integrity, especially for delicate enzymes and essential oils, ensuring quality control at mass scale. In the packaging domain, advancements are concentrated on sustainable solutions, including lightweighting of plastic containers, adoption of Post-Consumer Recycled (PCR) content, and the development of truly biodegradable or compostable packaging alternatives, reducing the brand's ecological footprint and aligning with consumer mandates. The integration of QR codes and smart packaging technologies allows for enhanced consumer engagement, offering information on ingredients, sustainability metrics, and personalized usage instructions, leveraging the digitalization trend.

The future of the technology landscape is increasingly intertwined with smart home ecosystems. Brands are exploring IoT-enabled dispensing systems that automatically measure and dispense the precise amount of detergent based on load size, fabric type, and soiling level, potentially communicated through the washing machine's onboard sensors. This level of precision optimizes performance and minimizes product wastage, offering significant value to the consumer. Furthermore, AI and machine learning are being utilized to rapidly iterate on formulation testing, predicting the stability and performance of new chemical combinations far faster than traditional laboratory testing, thereby dramatically reducing the time-to-market for novel, high-performance branded detergents.

Regional Highlights

- Asia Pacific (APAC) Market Dominance and Growth Trajectory: APAC represents the largest and fastest-growing regional market, driven by rapid economic development, escalating household penetration of automatic washing machines, and significant population density. Countries such as China, India, and Indonesia are experiencing a rapid transition from traditional laundry methods and commodity soaps to modern, branded, format-specific detergents (especially liquids and pods). Increasing consumer awareness regarding hygiene and the adoption of Western lifestyle standards are accelerating premiumization, though the powder segment remains highly relevant due to its cost-effectiveness in developing sub-regions. Market growth is sustained by local manufacturing expansion and aggressive advertising by multinational corporations targeting the rising middle-class segment.

- North American Market Maturity and Innovation Focus: North America is characterized by market maturity and high per capita consumption, making innovation the primary growth driver. The region shows an exceptionally high adoption rate of unit dose (pods/packs) detergents, valued for their convenience and dosing accuracy. Consumer focus is intensely directed towards sustainability, ingredient transparency (e.g., "free and clear" labels), and specialized features like anti-allergen claims. Competition is extremely high, prompting brands to invest heavily in brand loyalty programs, subscription models, and sophisticated digital marketing to maintain market share against strong private label competition.

- European Market Emphasis on Sustainability and Regulation: Europe is defined by stringent environmental regulations and a highly discerning consumer base that strongly favors eco-friendly and bio-based products. The market growth is concentrated in highly concentrated liquids and refillable systems designed to minimize plastic waste. Regulatory bodies, particularly within the EU, impose strict limits on certain ingredients, forcing brands to invest heavily in sustainable chemistry and transparent labeling. Germany, the UK, and France are key markets driving premiumization, where consumers are willing to pay a premium for certified ethical and environmental credentials, making brand narratives centered on corporate responsibility crucial.

- Latin America Market Dynamics and Economic Influence: Latin America presents varied market dynamics, often influenced by economic volatility and local cultural preferences regarding scent and foaming characteristics. Brazil and Mexico are leading markets, showing a strong preference for high-quality liquids and traditional powders. Brand loyalty is significant, but purchasing power can fluctuate, leading to a dual market structure where economy brands and mass-market products coexist with aspirational global premium brands. Distribution complexity, especially in remote areas, means reliance on diverse retail formats, from large hypermarkets to small, local corner stores.

- Middle East and Africa (MEA) Market Penetration and Urbanization: The MEA region is characterized by substantial potential, driven by rapid urbanization and the expansion of modern retail infrastructure. Penetration of global brands is increasing, especially in the Gulf Cooperation Council (GCC) countries, where high disposable incomes support the consumption of premium imported products. In parts of Africa, the market remains largely fragmented, with traditional powder detergents dominating. However, increasing awareness of sanitation and the proliferation of affordable automatic washing machines are creating nascent opportunities for liquid and unit dose formats in urban centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laundry Detergent by Brand Market.- Procter & Gamble (P&G)

- Unilever

- Henkel AG & Co. KGaA

- Church & Dwight Co. Inc.

- Reckitt Benckiser Group PLC

- Colgate-Palmolive Company

- Kao Corporation

- Lion Corporation

- Amway

- SC Johnson & Son, Inc.

- The Sun Products Corporation

- Wipro Consumer Care and Lighting

- LG Household & Health Care

- McBride plc

- Premier Brands Inc.

- Seventh Generation, Inc.

- Guangzhou Liby Enterprise Group Co., Ltd.

- Eco-Max

- Ecover

- The Clorox Company

Frequently Asked Questions

Analyze common user questions about the Laundry Detergent by Brand market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of unit dose (pod) laundry detergents globally?

The growth of unit dose detergents is primarily driven by consumer demand for convenience, mess-free usage, and guaranteed accurate dosing. These formats eliminate spillage and ensure optimal cleaning performance, appealing strongly to consumers in mature markets like North America and Europe who prioritize efficiency and ease of use.

How significant is the shift towards sustainable and bio-based laundry detergent brands?

The shift towards sustainable and bio-based detergents is critically significant, especially in developed markets. Consumers are increasingly scrutinizing ingredient lists and packaging sustainability, leading brands to invest heavily in plant-derived surfactants, biodegradable formulations, and zero-waste packaging to meet consumer expectations and adhere to evolving environmental regulations.

Which regional market holds the highest growth potential for laundry detergent brands?

The Asia Pacific (APAC) region holds the highest growth potential. This accelerated growth is attributed to increasing urbanization, rising disposable incomes that enable the adoption of automatic washing machines, and the growing penetration of organized retail, driving demand for modern, branded liquid and unit dose formats.

What major technological innovations are influencing laundry detergent brand performance?

Key technological innovations include advanced enzyme stability (allowing enzymes to work effectively in cold water), microencapsulation for prolonged fragrance release, and the development of specialized low-sudsing formulations optimized for High-Efficiency (HE) washing machines, ensuring superior cleaning results with less water and energy.

How does e-commerce impact the distribution strategy of major laundry detergent brands?

E-commerce profoundly impacts distribution by offering a robust platform for niche brands, facilitating subscription services, and enabling direct-to-consumer (D2C) sales. This channel provides brands with granular customer data, improves logistical efficiency for highly concentrated products, and is essential for maintaining visibility in competitive digital marketplaces.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager