LCD Glass Substrate Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441372 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

LCD Glass Substrate Market Size

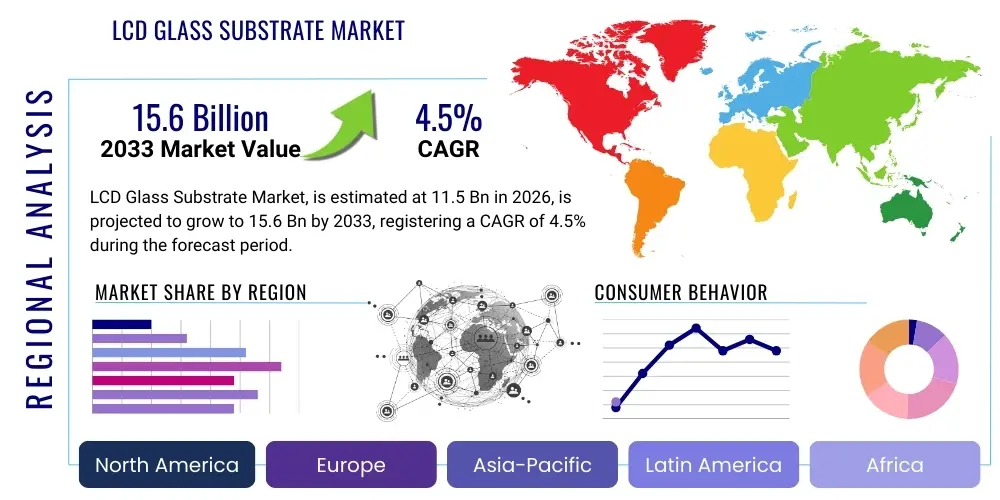

The LCD Glass Substrate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 11.5 Billion in 2026 and is projected to reach USD 15.6 Billion by the end of the forecast period in 2033. This consistent expansion is primarily fueled by the sustained demand for high-resolution large-screen displays across consumer electronics, particularly 4K and 8K televisions, coupled with the critical role glass substrates play in advanced display technologies such as Oxide TFT (Thin-Film Transistor) and LTPS (Low-Temperature Polycrystalline Silicon) panels, which require superior thermal stability and dimensional accuracy.

Despite the competitive pressure from emerging Organic Light-Emitting Diode (OLED) and MicroLED technologies, LCDs, supported by glass substrates, maintain a dominant position in high-volume, cost-sensitive applications like large-format signage and mainstream IT monitors. Manufacturers are continuously investing in larger generation glass substrates, such as Gen 10 and Gen 10.5, to improve production efficiency and lower the cost per panel. The shift towards larger substrate sizes demands exceptional glass purity and uniform thickness, driving innovation in fusion draw and float processes utilized by key industry players.

LCD Glass Substrate Market introduction

The LCD Glass Substrate Market comprises high-purity, ultra-thin glass sheets essential for the manufacture of Liquid Crystal Displays (LCDs). These substrates form the structural foundation upon which the complex Thin-Film Transistor (TFT) circuits and color filters are deposited, dictating the panel’s resolution, size, and electrical performance. The glass must possess exceptional characteristics, including low thermal expansion, high chemical resistance, and an extremely smooth surface finish to accommodate microscopic circuit patterns, making its manufacturing process one of the most technologically demanding in the display supply chain. Products range in thickness from below 0.5 mm for mobile applications up to 0.7 mm for larger TV panels, varying significantly based on the end-use device and manufacturing generation.

Major applications for LCD glass substrates span across consumer electronics, including desktop monitors, laptop screens, tablets, and most prominently, large-screen televisions. Furthermore, specialized applications in the automotive sector, such as navigation displays and digital dashboards, and in industrial settings, including medical imaging and public information displays, require highly durable and optically precise glass substrates. The primary benefits derived from using specialized LCD glass include superior optical transparency, essential for vibrant display clarity; dimensional stability, which prevents panel warping during high-temperature processing; and inherent rigidity, contributing to the longevity and structural integrity of the final display module.

Key driving factors for market growth include the global trend toward larger display sizes in the consumer segment, which intrinsically increases the area demand for glass substrates per unit sold. Furthermore, rapid industrialization and urbanization in emerging economies are boosting the demand for consumer electronics. Technological advancements, such as the implementation of advanced backlighting technologies and continuous improvements in TFT array fabrication processes, ensure that LCD technology remains a viable and highly efficient display option, sustaining the robust demand for high-quality glass substrates, which are indispensable components in this ecosystem.

LCD Glass Substrate Market Executive Summary

The LCD Glass Substrate Market is experiencing moderate growth driven primarily by structural investments in high-generation fabrication facilities (Fabs), particularly in the Asia Pacific region, led by China and South Korea. Business trends highlight a strong oligopoly among substrate manufacturers, where supply volume and quality control dictate market share. Key manufacturers are focusing their R&D efforts on producing thinner, lighter, and more environmentally friendly substrates (free of heavy metals like arsenic), simultaneously attempting to reduce manufacturing cycle times to cope with volatile end-market demand. Mergers, acquisitions, and strategic partnerships between glass suppliers and panel makers are critical strategies employed to secure long-term supply agreements and stabilize the notoriously fluctuating display supply chain, ensuring capacity utilization remains high despite periodic oversupply cycles.

Regional trends indicate that Asia Pacific remains the powerhouse for both production and consumption, housing the vast majority of Gen 8, Gen 10, and Gen 10.5 facilities necessary for large-screen panel production. China, specifically, has aggressively expanded its display manufacturing capacity, turning it into the largest consumer of LCD glass substrates globally. North America and Europe, while having limited manufacturing presence, represent high-value markets for premium, high-specification displays, often utilizing specialized substrates for niche industrial and automotive applications. The regulatory landscape in developed regions is increasingly focusing on sustainability, pushing manufacturers towards low-energy and less chemically intensive production methods, marginally impacting regional operational costs.

Segmentation trends reveal that ultra-large display applications (50 inches and above) are the fastest-growing segment by area consumed, benefiting from the cost efficiencies of Gen 10.5 substrates. In terms of technology, amorphous silicon (a-Si) glass substrates still dominate due to their low cost and mature manufacturing process, although demand for Oxide TFT glass, offering higher electron mobility suitable for high-resolution displays, is rising significantly. The segment dedicated to mobile devices, while facing erosion from flexible OLED panels, still utilizes thin glass substrates for low-to-mid range smartphones and tablets, although this area is predicted to experience slower growth compared to the TV and signage segments.

AI Impact Analysis on LCD Glass Substrate Market

User queries regarding the impact of Artificial Intelligence (AI) on the LCD Glass Substrate Market center around three key themes: optimization of manufacturing processes, predictive maintenance for large-scale production equipment (like fusion furnaces and coating lines), and the influence of AI-driven end-product advancements (e.g., higher computational requirements for AI-enabled devices) on substrate specifications. Users frequently ask how AI can improve the yield rates, which are critically important in high-cost glass manufacturing, and whether AI applications in display quality control will necessitate even stricter substrate tolerances. The consensus expectation is that AI will primarily act as an enabling technology for operational efficiency and quality assurance rather than fundamentally altering the glass composition, although the increasing complexity of AI-focused end devices (requiring better integrated touch and sensor functionality) may drive demand for specialized thin and chemically strengthened substrates.

The implementation of AI algorithms, specifically machine learning models, allows manufacturers to analyze massive datasets generated by the fusion draw process—monitoring parameters such as temperature gradients, flow rates, and material composition in real-time. This sophisticated analysis enables proactive adjustments to equipment, significantly reducing the occurrence of defects like striations or bubbles, which previously resulted in high scrap rates. By optimizing these complex variables, AI minimizes material waste and energy consumption, directly translating to enhanced profitability and better environmental stewardship for substrate providers operating high-capital facilities.

Furthermore, AI-powered quality inspection systems, utilizing computer vision, are replacing traditional manual or semi-automated inspection methods. These systems can identify microscopic defects on the substrate surface with unparalleled speed and accuracy, ensuring that only flawless glass proceeds to the costly deposition and etching stages. This enhanced level of quality control is paramount as display resolutions continue to increase, demanding tighter geometric tolerances and near-perfect surface flatness for the subsequent photolithography steps, thereby solidifying the glass substrate's foundational role in high-fidelity display manufacturing.

- AI optimizes fusion draw process parameters, leading to increased manufacturing yield rates (up to 5% improvement potential).

- Predictive maintenance using AI minimizes downtime of high-cost machinery (e.g., Gen 10.5 furnaces), ensuring continuous capacity utilization.

- AI-driven computer vision systems enhance defect detection, improving quality control and reducing scrap in pre-processing stages.

- Advanced AI models assist in supply chain optimization, forecasting raw material (silica sand, stabilizers) requirements accurately.

- AI-enabled end devices (e.g., smart home displays, automotive interfaces) drive demand for specialized, high-performance glass with integrated sensor capabilities.

DRO & Impact Forces Of LCD Glass Substrate Market

The LCD Glass Substrate Market is shaped by a robust set of driving forces centered on increasing screen sizes and technological refinement, tempered by significant restraints related to capital intensity and market competition from alternative display technologies. The opportunity landscape is broad, focusing on diversification into niche markets like automotive and industrial high-reliability displays, which require specialized glass properties. The interplay of these factors creates dynamic impact forces, primarily manifested through significant R&D spending aimed at reducing thickness while maintaining rigidity and exploring sustainable manufacturing practices to meet global regulatory pressures, all while navigating the cyclical nature of the global display industry supply and demand.

Drivers include the continuous scaling up of production capacities, particularly Gen 10.5 lines, which drastically lower the manufacturing cost per unit area for large-sized panels, thereby stimulating demand for 65-inch and 75-inch TVs. Restraints predominantly involve the extremely high capital expenditure and lengthy lead times required to construct and commission a single high-generation glass substrate facility, effectively creating high barriers to entry and limiting competition. Another significant restraint is the increasing market penetration of OLED technology in high-end mobile and premium TV segments, potentially capping the growth rate of high-value LCD segments over the long term, pushing LCDs towards the cost-competitive mainstream market.

Opportunities lie in developing ultra-thin and chemically strengthened glass for portable and rugged applications, catering to the growing need for highly durable displays in challenging environments. Furthermore, the integration of advanced functionalities, such as embedded touch sensors (in-cell or on-cell), requires customized substrates, offering premiumization opportunities for specialized manufacturers. The primary impact force remains the necessity for technological superiority; companies that can consistently produce larger, thinner, and more defect-free substrates with novel compositions (e.g., zero heavy metals) gain significant competitive advantage and preferential supplier status with leading panel manufacturers globally.

Segmentation Analysis

The LCD Glass Substrate Market is primarily segmented based on the type of technology used (e.g., a-Si, LTPS, Oxide TFT), the thickness of the glass (ultra-thin vs. standard), the generation size of the substrate (Gen 6, Gen 8, Gen 10.5), and the application (TVs, Monitors, Mobile Devices). This intricate segmentation reflects the diverse and exacting requirements of the downstream display industry. The dominance of a-Si technology is slowly being challenged by Oxide TFT, especially in premium mid-to-large size displays where energy efficiency and high resolution are paramount, demanding a substrate capable of higher temperature processing and improved electrical performance. Segmentation by generation size is critical, as it directly correlates with manufacturing efficiency and the optimal panel sizes produced, profoundly influencing regional investment strategies.

The market analysis indicates that the segment based on substrate size, specifically Gen 10.5 and above, is poised for the most rapid growth due to the immense global demand for 65-inch and larger television sets. While consumer electronics remain the largest application segment, the automotive display market is emerging as a high-growth, high-margin segment, requiring specialized substrates that meet stringent durability, temperature resistance, and vibration standards. Understanding these varied segments allows manufacturers to align their R&D and capital expenditure decisions with specific market needs, optimizing capacity allocation between high-volume, standard products and specialized, high-performance offerings.

- By Technology:

- Amorphous Silicon (a-Si) Glass Substrate

- Low-Temperature Polycrystalline Silicon (LTPS) Glass Substrate

- Oxide TFT Glass Substrate (IGZO)

- By Generation Size:

- Generation 6 (Gen 6)

- Generation 8 (Gen 8)

- Generation 10 and 10.5 (Gen 10/10.5)

- By Thickness:

- Below 0.5 mm (Ultra-Thin)

- 0.5 mm to 0.7 mm (Standard)

- By Application:

- Televisions (TVs)

- Monitors and Laptops (IT Displays)

- Mobile Phones and Tablets

- Automotive Displays

- Public Display/Signage

Value Chain Analysis For LCD Glass Substrate Market

The LCD Glass Substrate value chain is characterized by its high vertical integration at the upstream stage, dominated by a few global technology leaders. Upstream activities involve the sourcing of high-purity raw materials, chiefly silica sand and various stabilizing oxides, followed by the highly complex fusion draw or float processes used to manufacture the pristine glass sheet. This stage requires immense proprietary technological know-how, precise temperature control, and substantial capital investment, creating significant power leverage for the primary glass substrate manufacturers. Distribution channels are generally direct, involving long-term supply contracts between the glass manufacturers and the large-scale panel fabricators (Fabs) to ensure continuous and timely delivery of the heavy, fragile substrates.

Midstream processing involves panel fabricators (TFT/CF makers) who receive the raw glass substrates and perform the critical photolithography, deposition, and etching steps to create the TFT array and color filter layers. The quality of the upstream glass directly impacts the yield rates in this midstream stage; thus, reliability is prioritized over marginal cost savings. Downstream activities involve display module assemblers and Original Equipment Manufacturers (OEMs), who incorporate the final LCD panels into consumer products, automotive systems, or industrial equipment. The indirect distribution network then moves these finished goods through retail and specialized B2B channels to the end-user.

The structure of the value chain demonstrates that the highest technological and financial entry barriers exist in the upstream segment. Direct distribution dominates the substrate transaction stage due to the specialized logistics and large volume required by Gen 8 and Gen 10.5 facilities. Conversely, the final products are often sold via indirect channels—global retailers, e-commerce platforms, and specialized industrial distributors—highlighting the complex interplay between concentrated B2B suppliers upstream and highly fragmented consumer distribution downstream.

LCD Glass Substrate Market Potential Customers

The primary potential customers and end-users of LCD glass substrates are global display panel manufacturers, often referred to as flat panel display (FPD) makers, who utilize the substrates as the foundational component for LCD production. These include major electronics conglomerates operating large-scale fabrication facilities (Fabs) globally. Their purchasing decisions are critically dependent on the glass manufacturer's ability to consistently supply high-quality, large-generation substrates (Gen 8.5, Gen 10.5) with minimal defects, as flaws at the substrate level lead to catastrophic losses during subsequent manufacturing processes. Procurement teams prioritize supplier reliability, dimensional accuracy, thermal performance, and long-term contract pricing.

Secondary, but rapidly growing, customer segments include specialized manufacturers focused on high-reliability applications, such as automotive Tier 1 suppliers and industrial display integrators. These customers require substrates with enhanced physical properties, including superior chemical strengthening for impact resistance and specialized low-alkali compositions for high-temperature and harsh environmental operation. Their purchasing focus is less on sheer volume and more on tailored specifications, demanding closer collaboration with substrate R&D teams to meet precise regulatory and performance requirements mandated by industries like aviation and medical imaging.

Ultimately, the health of the substrate market is tethered to the consumer electronics market. While FPD makers are the direct buyers, the underlying demand is generated by consumers purchasing TVs, monitors, and mobile devices. Consequently, substrate manufacturers track macroeconomic indicators, seasonal demand shifts in electronics retail, and the product roadmaps of major electronics OEMs (Samsung, LG, Sony, etc.) to accurately forecast capacity requirements and technological shifts, ensuring their potential customer base remains adequately supplied with the necessary foundation for modern displays.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 15.6 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Corning Inc., Asahi Glass Co., Ltd. (AGC), NEG (Nippon Electric Glass), Tunghsu Group, AvanStrate Inc., SCHOTT AG, LG Chem, Saint-Gobain, Plan Optik AG, Beijing Oriental Electronics (BOE), Samsung Display, CSG Holding Co., Ltd., Taiwan Glass Industry Corp., Ohara Inc., K-Lite Industries, Visionox Technology Inc., Shenzhen China Star Optoelectronics Technology (CSOT), Innolux Corporation, AU Optronics (AUO). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

LCD Glass Substrate Market Key Technology Landscape

The core technology driving the LCD Glass Substrate market remains the fusion draw process, pioneered by Corning, which offers exceptional surface quality and dimensional consistency critical for large-generation substrates (Gen 8.5 and Gen 10.5). This process involves melting raw glass materials in a specialized tank, allowing the molten glass to flow over a trough (or weir) and draw down vertically under gravity, forming a continuous ribbon of pristine, untouched glass surface. Technological advancements are focused on refining the purity of the raw materials and optimizing the furnace temperature profiles to reduce internal stresses, thereby enabling the production of even thinner substrates (down to 0.4 mm) without compromising rigidity or yield rates during handling and subsequent processing.

Beyond the physical manufacturing process, the material composition itself represents a significant technological landscape. Manufacturers are increasingly shifting towards high-performance glass compositions, notably those optimized for Oxide TFT (e.g., IGZO) backplanes, which require glass capable of withstanding higher processing temperatures (up to 400°C–600°C) without suffering thermal shrinkage or deformation. These advanced compositions minimize the presence of mobile ions that can interfere with transistor performance. Furthermore, there is a push for environmentally conscious manufacturing, emphasizing arsenic-free and antimony-free glass compositions to comply with global hazardous substance restrictions, driving complex substitution R&D efforts.

The integration of advanced inspection and measurement systems, often leveraging laser scanning and sophisticated vision systems, is vital to maintaining the quality benchmark required for current high-resolution displays. Key players are also investing in technologies related to chemically strengthened glass, where ion-exchange processes create a compressive layer on the surface, increasing resistance to scratches and impact. This technology is crucial for interactive touch displays, automotive applications, and specialized signage, ensuring the substrate can meet demanding operational environments while maintaining perfect optical clarity.

Regional Highlights

The global LCD Glass Substrate market is overwhelmingly dominated by the Asia Pacific (APAC) region, which serves as the global manufacturing hub for flat panel displays.

- Asia Pacific (APAC): APAC commands the largest market share, driven by massive governmental and private investment in Gen 8, Gen 10, and Gen 10.5 fabrication facilities, primarily concentrated in Mainland China, South Korea, and Taiwan. China has become the world’s largest producer and consumer of LCD panels, necessitating robust local substrate supply chains. Countries like South Korea (home to major FPD innovators) maintain technological leadership in high-end LTPS and Oxide TFT panel production, sustaining demand for specialized, high-performance glass substrates. This region dictates global pricing and technological advancement in substrate manufacturing.

- North America: North America represents a crucial end-market for high-value displays, particularly in consumer electronics, professional IT displays, and the burgeoning automotive display sector. While minimal substrate manufacturing occurs here, the region drives demand for innovative applications and advanced specifications, often serving as a key center for R&D in display material science and specialized glass coatings. Procurement is highly concentrated toward high-margin, specialized substrates for military, medical, and high-fidelity computing applications.

- Europe: Similar to North America, Europe is primarily an end-user market focusing on premium consumer goods, advanced industrial automation, and sophisticated automotive integration. European demand for glass substrates is characterized by stringent adherence to environmental and safety regulations (such as RoHS and REACH), pushing global suppliers to accelerate the transition to arsenic-free and energy-efficient manufacturing processes. The automotive segment, driven by leading European car manufacturers, requires extremely durable and optically precise substrates for digital cockpits and HUDs.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions constitute smaller, but rapidly expanding, markets for LCD glass substrates, driven by increasing consumption of affordable televisions and monitors resulting from rising disposable incomes and expanding retail infrastructure. Demand here is predominantly focused on standard, high-volume substrates (a-Si) for Gen 6 and Gen 8 facilities that cater to mainstream consumer price points. Infrastructure development in MEA, particularly large-scale public displays and commercial signage, is contributing incrementally to substrate consumption area.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the LCD Glass Substrate Market.- Corning Inc.

- Asahi Glass Co., Ltd. (AGC)

- NEG (Nippon Electric Glass)

- Tunghsu Group

- AvanStrate Inc.

- SCHOTT AG

- LG Chem

- Saint-Gobain

- Plan Optik AG

- Beijing Oriental Electronics (BOE)

- Samsung Display

- CSG Holding Co., Ltd.

- Taiwan Glass Industry Corp.

- Ohara Inc.

- K-Lite Industries

- Visionox Technology Inc.

- Shenzhen China Star Optoelectronics Technology (CSOT)

- Innolux Corporation

- AU Optronics (AUO)

- Sichuan EM Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the LCD Glass Substrate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary manufacturing method for high-quality LCD glass substrates?

The predominant method is the fusion draw process, which is highly preferred for producing large-generation glass substrates (Gen 8, Gen 10.5). This technique ensures exceptional surface flatness and purity, crucial for the precise photolithography steps required in TFT manufacturing, by avoiding direct contact with mold materials.

How do OLED and MicroLED technologies impact the future demand for LCD glass substrates?

OLED and MicroLED technologies primarily challenge the LCD market in high-end, premium display segments (mobile and high-end TVs). While they may reduce demand growth in these specific areas, LCDs, relying on glass substrates, are expected to maintain dominance in high-volume, cost-effective segments like IT monitors, automotive displays, and large-format signage throughout the forecast period due to superior cost-performance ratios.

Why is the Asia Pacific region central to the LCD Glass Substrate market?

Asia Pacific is the critical center because the vast majority of global flat panel display (FPD) fabrication facilities, particularly high-generation lines (Gen 10.5), are located in countries like China, South Korea, and Taiwan. These Fabs are the direct consumers of glass substrates, making APAC both the largest production base and the highest consumption region globally.

What is the significance of different glass substrate generation sizes (e.g., Gen 8 vs. Gen 10.5)?

Generation size refers to the physical dimensions of the glass sheet, directly impacting manufacturing efficiency. Larger substrates (like Gen 10.5) allow display manufacturers to cut significantly more large-screen panels (e.g., 65-inch and 75-inch) from a single sheet, drastically lowering the cost per panel and supporting the market trend towards ultra-large displays.

What are the key differences between a-Si and Oxide TFT glass substrates?

a-Si (Amorphous Silicon) substrates are widely used, low-cost, and suitable for standard definition displays. Oxide TFT (e.g., IGZO) substrates, however, are designed to withstand higher processing temperatures and offer superior electron mobility, making them essential for high-resolution, energy-efficient displays used in premium monitors and high-refresh-rate applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager