Lead Nitrate Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441341 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Lead Nitrate Market Size

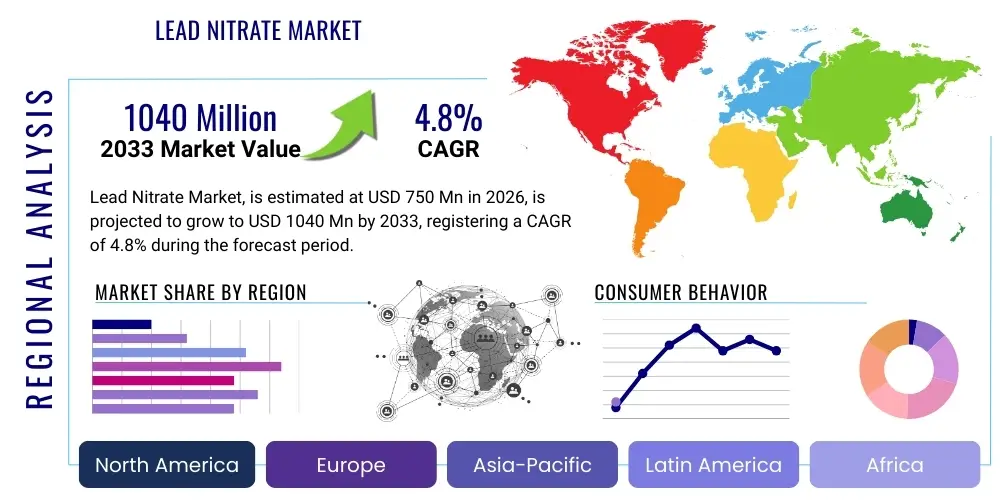

The Lead Nitrate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 580.5 Million in 2026 and is projected to reach USD 800.2 Million by the end of the forecast period in 2033.

Lead Nitrate Market introduction

Lead nitrate (Pb(NO₃)₂) is a colorless crystalline compound that is highly soluble in water, making it a pivotal chemical precursor in various industrial applications. Chemically, it is derived from the reaction of lead metal or lead oxide with nitric acid. Its market trajectory is intrinsically linked to its versatility, primarily serving the mining industry as a critical component in the gold and silver extraction process through hydrometallurgy, where it enhances the efficiency of cyanidation circuits. Furthermore, its application extends deeply into the manufacturing of highly specialized explosives, particularly lead azide, which is integral to detonators in the defense and mining sectors. The intrinsic chemical stability of lead nitrate, coupled with its ability to act as a potent oxidizing agent, secures its indispensable role across diverse high-precision chemical syntheses.

The product's demand is broadly categorized by grade, ranging from technical grade used in large-scale industrial operations like mineral processing and match production, to highly purified analytical and electronic grades required for high-precision manufacturing, such as specialized glass and certain ceramic glazes. Despite facing stringent regulatory hurdles due to its classification as a hazardous substance, particularly in developed regions like North America and Europe, the essential nature of its functional properties ensures sustained demand. Manufacturers are increasingly investing in process optimization to minimize waste and ensure compliance, focusing on closed-loop systems and developing safer handling protocols to manage regulatory risks effectively and maintain continuous supply to end-users.

Key driving factors supporting the market expansion include the sustained global demand for gold, necessitating advanced and efficient leaching processes where lead nitrate acts as a vital catalyst and oxidant. Additionally, the steady growth in the electronics industry, particularly the need for lead-based ceramics and specialty chemicals for battery precursors and plating processes, contributes substantially to consumption. However, market growth is often constrained by volatile raw material pricing—specifically lead and nitric acid—and the overarching global shift toward lead-free alternatives in consumer applications, pushing producers to focus intensely on specialized industrial and niche applications where substitution is chemically or functionally impractical.

Lead Nitrate Market Executive Summary

The Lead Nitrate market is characterized by a moderate yet stable growth trajectory, underpinned significantly by robust demand from the Asia Pacific mining and chemical processing sectors. Business trends indicate a strategic pivot among major producers toward operational excellence and geographical diversification, mitigating risks associated with highly concentrated regulatory environments in the West. Key manufacturers are focusing on securing reliable upstream supply chains for both lead concentrate and nitric acid, often entering into long-term contracts to stabilize input costs and ensure competitive pricing structures. Furthermore, there is an increasing trend in merging purification technology with sustainable chemical practices to meet the rising global standard for minimizing environmental impact, which, while increasing initial operational costs, provides a significant competitive advantage in tender processes, especially within government-regulated defense and mining operations. This emphasis on compliance and process purity is shaping the competitive landscape.

Regionally, the Asia Pacific (APAC) region dominates the consumption landscape, primarily fueled by massive gold and base metal mining activities in countries such as China, Australia, and Indonesia, where lead nitrate is indispensable for optimizing leaching efficiencies. This dominance is further amplified by the rapid expansion of the chemical manufacturing base and specialty glass production facilities across Southeast Asia. Conversely, established markets in North America and Europe are witnessing slower growth, driven mainly by replacement demand and highly specialized uses in defense and high-technology applications, where the stringent environmental regulations mandate the highest possible purity and minimal effluent discharge. The Middle East and Africa (MEA) are emerging as high-potential growth pockets, attributed to underdeveloped but resource-rich mining sectors receiving substantial foreign investment, creating new avenues for lead nitrate consumption.

Segment-wise, the Technical Grade segment maintains the largest market share by volume, predominantly serving the hydrometallurgy and fireworks manufacturing industries due to its cost-effectiveness in large-scale applications. However, the Pure Grade segment, utilized in specialized electroplating baths, pharmaceutical intermediates, and high-quality electronic components, is anticipated to exhibit the fastest Compound Annual Growth Rate (CAGR) over the forecast period. This accelerated growth is attributed to the increasing complexity and miniaturization in the electronics sector, demanding ultra-high purity chemicals to prevent component contamination and ensure longevity. Manufacturers are responding by expanding capabilities in advanced crystallization and filtration techniques to cater specifically to this high-value, high-growth niche, shifting the revenue focus from bulk sales to specialized, low-volume, high-margin products.

AI Impact Analysis on Lead Nitrate Market

User queries regarding AI's influence on the Lead Nitrate market largely revolve around enhancing supply chain resilience, optimizing complex chemical synthesis processes, and crucial environmental compliance monitoring. Stakeholders are keen to understand how AI can predict fluctuations in lead ore availability and nitric acid pricing, thereby stabilizing manufacturing costs. A major concern, given lead nitrate's toxicity, is leveraging AI-driven sensor data and machine learning algorithms to achieve highly precise process control, ensuring optimal yields while minimizing hazardous waste generation. Users expect AI tools to provide real-time analytical chemistry feedback, automating quality assurance checks for purity grades and significantly reducing human exposure risk during high-volume production cycles. Furthermore, predictive maintenance powered by AI is sought after to maximize equipment uptime in high-corrosion environments characteristic of lead chemical processing.

- AI-driven Supply Chain Optimization: Utilizing machine learning models to forecast global lead commodity price volatility and predict logistical bottlenecks, enabling proactive sourcing strategies and inventory management for raw materials (lead oxide and nitric acid).

- Enhanced Process Control and Yield: Implementing AI-integrated Distributed Control Systems (DCS) for real-time monitoring of crystallization kinetics, temperature, and pH levels, ensuring consistent batch quality, especially for highly demanding Analytical and Pure grades.

- Predictive Environmental Compliance: Employing AI algorithms to analyze effluent stream data, predict potential regulatory breaches before they occur, and optimize wastewater treatment chemical dosages to maintain strict environmental standards regarding lead discharge.

- Automated Quality Assurance: Using computer vision and machine learning for rapid spectroscopic analysis of finished lead nitrate batches, automating impurity detection and certification processes, thereby reducing testing lead times.

- Risk Mitigation and Safety: Developing AI-powered simulations for operator training and emergency response planning, specifically focusing on scenarios involving nitric acid handling and lead dust exposure, enhancing workplace safety protocols.

DRO & Impact Forces Of Lead Nitrate Market

The dynamics of the Lead Nitrate market are heavily influenced by a potent combination of growth drivers originating primarily from the mining and chemical synthesis sectors, tempered significantly by severe regulatory and environmental restraints related to lead toxicity, leading to persistent pressure on manufacturers to innovate. The primary driver remains the expansion of global gold mining operations, where lead nitrate functions as an essential leaching accelerator, boosting the economic viability of low-grade ore processing. Opportunities reside prominently in the development of specialized, controlled-release formulations and high-purity applications required for next-generation energy storage devices and advanced material science research. These positive forces are counteracted by the fundamental restraint posed by increasingly strict governmental oversight, suchifically EPA, REACH, and similar international bodies, which demand exhaustive documentation, complex disposal procedures, and mandate the search for less hazardous substitutes wherever feasible. These forces collectively shape the competitive landscape, compelling sustained investment in cleaner production technology to ensure market viability and regulatory adherence.

Segmentation Analysis

The Lead Nitrate market segmentation is critical for understanding consumption patterns, pricing dynamics, and target end-use industries. Segmentation by grade reveals a clear divergence between the high-volume industrial sector reliant on technical grades and the specialized, high-margin sectors requiring pure or analytical grades. Technical grade lead nitrate, although holding the volumetric majority, commands a lower price point and is deeply entrenched in the less sensitive, large-scale applications such as flotation reagents in mining and certain intermediate chemical production processes. Conversely, the segmentation by application highlights the dominant role of hydrometallurgy, particularly gold extraction, as the single largest consumption sector globally. The growing need for precision manufacturing in electronics and specialized chemicals is fueling the fastest expansion in niche applications like electroplating and high-specification chemical syntheses, necessitating stringent quality control across all production batches. This structural dichotomy influences capital expenditure, directing investments toward either capacity expansion for technical grade or technological enhancement for ultra-pure grade production facilities.

- By Grade

- Technical Grade: Used primarily in explosives, mining (flotation and leaching), dyeing, and general industrial chemical processes.

- Pure Grade: Employed in specific electroplating baths, high-quality ceramic glazes, and as a precursor for specialized lead salts in controlled environments.

- Analytical Grade: Reserved for laboratory reagents, high-precision calibration standards, and advanced research and development activities where ultra-high purity is mandatory.

- By Application

- Lead Azide Manufacturing (Explosives): Integral component in primary explosives and detonators for defense and commercial blasting operations.

- Dyeing and Printing: Used as a mordant or fixing agent in textile processing, particularly historically, although its use is declining due to health concerns.

- Electroplating: Utilized in specific bath formulations for depositing lead layers, offering improved corrosion resistance and specialized properties.

- Hydrometallurgy (Gold Extraction): Functions as an oxidant and activator in the cyanidation process, significantly boosting gold recovery rates from sulfidic and refractory ores.

- Other Chemicals Synthesis: Employed as a precursor in the production of various lead oxides, lead salts, and specialty inorganic chemicals.

- Pharmaceuticals: Historically used in specific preparations, now limited mainly to research applications or highly controlled medical devices precursors.

- Research & Development: Used extensively in academic and industrial labs for synthesis, catalyst testing, and materials science experiments.

- By Region

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain, Rest of Europe)

- Asia Pacific (APAC) (China, India, Japan, South Korea, Australia, Rest of APAC)

- Latin America (LATAM) (Brazil, Argentina, Rest of LATAM)

- Middle East and Africa (MEA) (South Africa, Saudi Arabia, UAE, Rest of MEA)

Value Chain Analysis For Lead Nitrate Market

The Lead Nitrate value chain commences with the upstream extraction and refining of raw materials, predominantly lead concentrate (which is subsequently converted to lead oxide or sponge lead) and the bulk industrial production of nitric acid. Lead mining and subsequent metal refining represent a high-cost, capital-intensive segment highly susceptible to global commodity price fluctuations and increasingly stringent environmental regulations regarding lead dust and slag management. The midstream manufacturing process involves the precise reaction of lead material with nitric acid, followed by sophisticated crystallization, filtration, and drying steps to achieve the desired technical or high-purity grades. Purity control is the primary value-adding activity in this segment, requiring specialized equipment and experienced chemical engineering expertise to minimize heavy metal contamination and ensure product consistency necessary for applications like electroplating or explosives manufacturing. Efficient process design focusing on low energy consumption and maximal acid recovery is key to competitive positioning.

Downstream activities involve specialized packaging, logistics, and distribution, which are critical due to lead nitrate's hazardous material classification (oxidizer and toxic substance). Distribution channels are highly regulated and often necessitate specialized carriers, certified warehouses, and compliance with global transport codes (e.g., IMO, DOT). Direct sales channels are frequently employed for large volume consumers, such as major international mining corporations and defense contractors, facilitating customized purity specifications and just-in-time delivery schedules. Conversely, indirect channels, utilizing regional chemical distributors and specialty reagent suppliers, serve smaller end-users in academia, electroplating job shops, and diverse chemical synthesis operations. The final consumption is concentrated heavily in the industrial sector, led by the application in hydrometallurgy, followed by the explosives and specialty chemical synthesis markets, emphasizing the B2B nature of this commodity.

A crucial element in the chain is regulatory compliance, which acts as an overarching cost multiplier and risk factor. Manufacturers must invest significantly in comprehensive safety data sheets (SDS), detailed material tracking, and sophisticated effluent treatment plants to neutralize residual acidity and precipitate soluble lead before discharge, ensuring adherence to zero-liquid discharge targets in many jurisdictions. This regulatory burden differentiates compliant, established manufacturers from smaller, less regulated entities, often providing an economic moats for major global suppliers who can absorb the high compliance costs and offer supply assurance to risk-averse end-users in regulated industries like defense and large-scale infrastructure projects.

Lead Nitrate Market Potential Customers

The primary customer base for lead nitrate spans several heavily industrialized sectors that rely on its unique chemical properties for highly specific functions. Mining companies, particularly those focused on extracting gold, are the single largest buyers, utilizing lead nitrate as a crucial process enhancer in cyanidation circuits to improve recovery rates from complex sulfidic ores; this segment demands large volumes of technical-grade material and prioritizes cost-efficiency and consistent supply. Defense and aerospace contractors, through their specialized chemical subsidiaries, constitute another critical segment, as they require high-purity lead nitrate for the synthesis of lead azide—a vital initiating explosive component in detonators and military ordnance. This customer group places paramount importance on rigorous quality control, traceability, and secure supply chains.

Further down the customer spectrum are specialized chemical manufacturers that use lead nitrate as an intermediate or precursor in the production of other lead-based compounds, such as certain glass batch ingredients, protective coatings, and electronic components, including piezoelectric materials and high-density radiation shielding. The electroplating industry represents a recurring customer base, employing lead nitrate in specific bath formulations used for high-performance plating applications where a durable, corrosion-resistant lead finish is required, particularly in components for automotive batteries and heavy machinery. Finally, academic and commercial research institutions purchase smaller volumes of analytical or pure grade lead nitrate for highly controlled laboratory experiments, focusing on novel material development and advanced analytical chemistry techniques.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 580.5 Million |

| Market Forecast in 2033 | USD 800.2 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Doe Run Company, Hebei Xingwang Chemical, Nanning Huali Chemical, Retro Chemical, Avantor Performance Materials, Sigma-Aldrich (Merck KGaA), Noah Technologies, American Elements, Shepherd Chemical, Hammond Group, Reagent Chemical & Research, VWR International, BASF SE, Solvay SA, Univar Solutions, Penoles, Angang Steel Company, Seidler Chemical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lead Nitrate Market Key Technology Landscape

The technological landscape in the Lead Nitrate market is centered around achieving high purity levels, enhancing process safety, and minimizing hazardous waste streams to comply with stringent global regulations. The core production technology involves optimized chemical reaction and crystallization processes. Modern facilities increasingly employ continuous crystallization techniques, such as fractional crystallization under vacuum, which are crucial for separating the lead nitrate crystals from mother liquor and achieving the ultra-high purity required for analytical and electronic-grade products. These advanced crystallization methods allow for precise control over crystal size and morphology, improving filtration efficiency and reducing the incorporation of soluble impurities, which is essential for specialized end-uses like high-quality piezoelectric materials and glass components. Furthermore, the use of automated, corrosion-resistant reactors and materials (e.g., titanium-lined equipment) is vital to ensure long-term operational integrity and prevent contamination of the product with trace metals from the manufacturing infrastructure itself.

A significant technological focus is dedicated to the reduction and treatment of liquid and gaseous effluents, addressing the toxic and corrosive nature of the raw materials (nitric acid) and the final product (lead). Advanced pollution control systems are being integrated, including sophisticated solvent extraction techniques and ion-exchange columns to recover or effectively neutralize lead traces from wastewater streams, often aiming for near-zero discharge thresholds mandated in Western markets. The implementation of closed-loop water recirculation systems and improved nitric acid recovery units minimizes waste generation and lowers operational input costs, providing a competitive edge through environmental stewardship. Additionally, remote monitoring and digitized sensor technologies are becoming standard, providing real-time data on reaction parameters, ensuring stable quality control and significantly enhancing worker safety by limiting exposure to corrosive chemicals and lead dust during handling and packaging operations, contributing to overall AEO optimization by addressing safety concerns.

Beyond synthesis, technological advancements in packaging and logistics are equally important. Manufacturers are adopting specialized, inert packaging materials and moisture-barrier liners designed to maintain the product’s integrity, especially given its oxidizing properties and sensitivity to humidity. The use of Radio-Frequency Identification (RFID) tags and advanced tracking systems for logistics ensures compliance with global hazardous materials transport regulations (like ADR and IMDG codes) and provides full traceability from the raw material source to the final consumer. This focus on logistics technology is particularly valued by high-security customers, such as defense contractors, who require stringent chain-of-custody documentation, thus integrating compliance technology directly into the product delivery service offering. These technological investments are crucial for sustaining long-term contracts in regulated industries.

Regional Highlights

The global consumption and production of lead nitrate demonstrate significant regional disparities driven by differential regulatory environments, industrial base maturity, and concentration of resource extraction activities. Asia Pacific (APAC) holds the largest market share and is projected to exhibit the fastest growth over the forecast period. This dominance is attributable to the region’s massive infrastructure development projects, the presence of major gold mining operations (e.g., in China, Australia, and Indonesia), and a rapidly expanding chemical and electronics manufacturing ecosystem. China, in particular, serves as both a major producer and consumer, utilizing lead nitrate heavily in its domestic mining sector and for specialized industrial chemical synthesis, often benefiting from less stringent enforcement of environmental regulations compared to Western counterparts, which translates to lower operational costs and competitive pricing for global exports.

North America and Europe represent mature markets characterized by slow volume growth but high demand for specialized, high-purity grades, mainly driven by niche applications in defense, high-end electronics, and R&D. These regions are defined by exceptionally stringent environmental regulations, such as the European Union’s REACH legislation and various EPA mandates in the United States, which have substantially raised the barrier to entry and increased the compliance costs for domestic producers. Consequently, manufacturers in these regions often focus on producing low-volume, high-margin analytical and pure grades, while technical-grade demand is frequently met through imports from APAC, subject to rigorous import checks. The ongoing shift toward electric vehicle battery technology and renewable energy infrastructure offers limited, highly regulated opportunities for specialized lead compounds, potentially boosting demand for specific high-ppurity precursors.

Latin America and the Middle East & Africa (MEA) are emerging markets whose consumption patterns are overwhelmingly dominated by the regional mining sector, particularly copper, gold, and silver extraction. Countries like Peru, Chile, and South Africa possess vast mineral reserves, making them high-potential consumers of technical-grade lead nitrate used in leaching and flotation processes. Growth in these regions is highly dependent on foreign direct investment into mining infrastructure and global commodity price trends. Political stability and the development of local chemical processing capabilities are key determinants of market maturation. While local production is limited, reliance on imports is high, creating lucrative distribution and supply opportunities for global manufacturers capable of navigating complex regional import regulations and logistical challenges across geographically dispersed mining sites.

- Asia Pacific (APAC): Dominates the market share due to extensive gold mining operations (requiring lead nitrate in hydrometallurgy), large-scale chemical manufacturing, and robust electronics industry expansion. China and Australia are key consumption hubs.

- North America: Mature market focused on high-purity grades for niche applications (defense, research), defined by strict environmental regulation (EPA), driving innovation in waste reduction.

- Europe: Characterized by flat volume growth and extremely rigorous compliance standards (REACH). Demand primarily stems from specialized industrial uses and the need for high-specification products.

- Latin America (LATAM): Growth tied directly to the health of the regional mining industry (gold, copper, silver). Significant importer of technical-grade material due to limited domestic production capacity.

- Middle East and Africa (MEA): High growth potential fueled by new mining investments, particularly in South Africa and West Africa, driving demand for leaching agents and explosives precursors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lead Nitrate Market.- Doe Run Company

- Hebei Xingwang Chemical

- Nanning Huali Chemical

- Retro Chemical

- Avantor Performance Materials

- Sigma-Aldrich (Merck KGaA)

- Noah Technologies

- American Elements

- Shepherd Chemical

- Hammond Group

- Reagent Chemical & Research

- VWR International

- BASF SE

- Solvay SA

- Univar Solutions

- Penoles

- Angang Steel Company

- Seidler Chemical

- Global Chemical Co., Ltd.

- Chuzhou Jingxin Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Lead Nitrate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary application driving the demand for Technical Grade Lead Nitrate?

The primary application driving demand for technical grade lead nitrate is its use as a crucial oxidant and activator in hydrometallurgy, specifically in the cyanidation process for the extraction of gold and silver from sulfidic and refractory ores globally. It significantly improves the kinetics and overall recovery yield of precious metals.

How do global regulations, such as REACH, affect the Lead Nitrate Market?

Global regulations like REACH in Europe significantly impact the market by imposing strict controls on the manufacture, use, and disposal of lead compounds, classifying them as Substances of Very High Concern (SVHC). This increases compliance costs, drives technological investment in waste reduction, and accelerates the search for lead-free substitutes in non-critical applications.

Which geographical region exhibits the highest growth potential for Lead Nitrate consumption?

The Asia Pacific (APAC) region exhibits the highest growth potential, largely due to sustained expansion in its domestic gold mining operations, robust growth in the electronics and specialty chemical sectors, and favorable industrial infrastructure development across countries like China and Australia.

What are the main alternatives or substitutes for Lead Nitrate in industrial applications?

While direct functional substitution is challenging in high-performance roles like lead azide manufacturing, alternatives in hydrometallurgy may include sodium nitrate or hydrogen peroxide as weaker oxidants, or entirely different non-cyanide leaching chemistries. However, substitution is often limited by functional efficiency and cost-effectiveness in large-scale operations.

How does the purity grade influence the pricing and application of Lead Nitrate?

Purity grade heavily influences pricing, with Analytical and Pure grades commanding a significant premium over Technical Grade. High-purity material is essential for high-specification uses like electroplating, pharmaceutical research, and sensitive electronic component manufacturing, where trace impurities cannot be tolerated, justifying the higher production and certification costs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Lead Nitrate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Lead Nitrate Market Statistics 2025 Analysis By Application (Mining, PVC Stabilizers, Pigment), By Type (Pharmaceutical Grade Lead Nitrate, Industrial Grade Lead Nitrate), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager