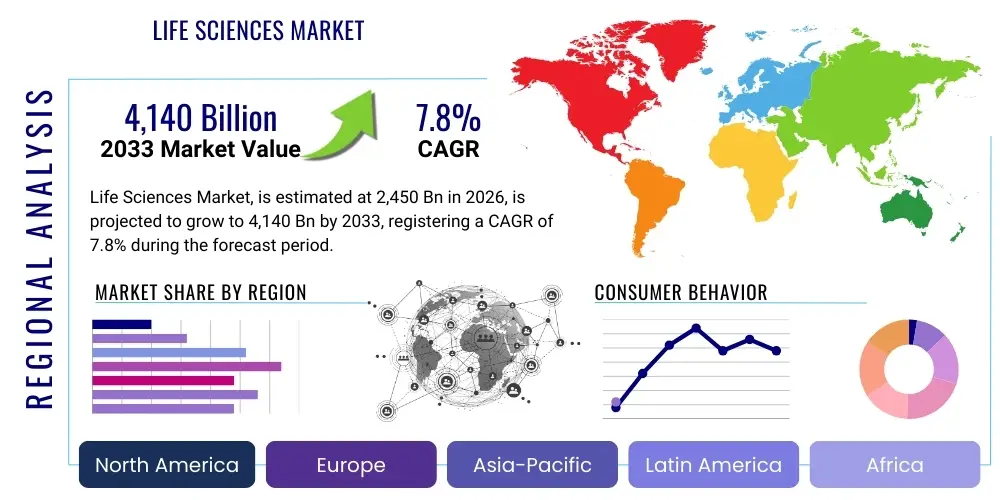

Life Sciences Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443392 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Life Sciences Market Size

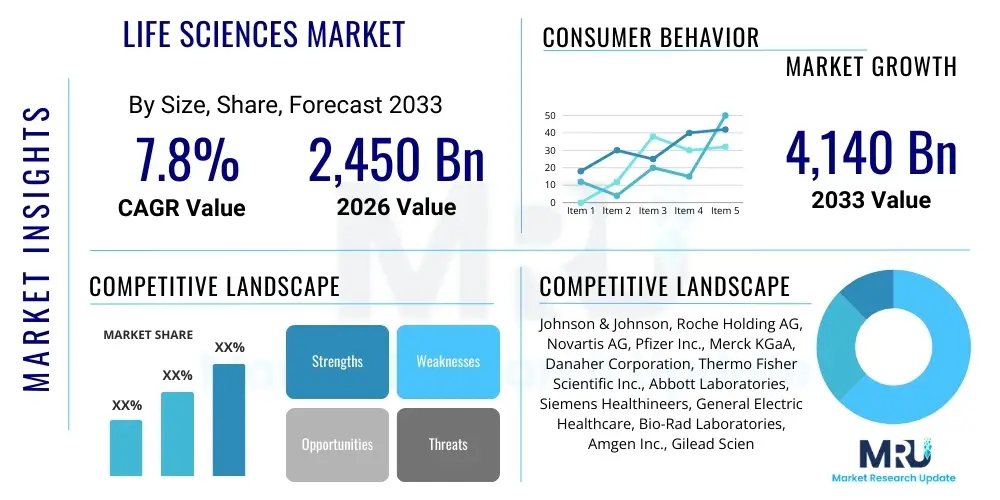

The Life Sciences Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 2,450 Billion in 2026 and is projected to reach USD 4,140 Billion by the end of the forecast period in 2033.

Life Sciences Market introduction

The Life Sciences Market encompasses a broad spectrum of industries dedicated to the study of living organisms, including pharmaceuticals, biotechnology, medical devices, diagnostics, and research tools. This sector is fundamentally driven by the imperative to improve human health, enhance agricultural output, and promote environmental sustainability. Key market activities include extensive research and development (R&D) focused on discovering novel therapeutics, developing advanced diagnostic technologies for early disease detection, and creating personalized medicine approaches tailored to individual patient genetic profiles. The complexity of biological systems requires sophisticated tools, leading to rapid innovation in areas such as genomics, proteomics, and advanced cell culture techniques. Major applications span chronic disease management, infectious disease control, oncology, and regenerative medicine, making it a critical global economic sector.

Product descriptions within the Life Sciences domain range from complex biologics, such as monoclonal antibodies and gene therapies, to high-precision surgical robots and in-vitro diagnostic kits. The market is characterized by stringent regulatory environments, long development cycles, and high capital investment, particularly in the pharmaceutical and biotechnology segments. The recent focus has shifted towards precision health, leveraging big data and molecular insights to deliver targeted treatments, thereby maximizing efficacy and minimizing adverse effects. Furthermore, the convergence of traditional biology with digital technologies, including AI and machine learning, is redefining R&D pipelines, accelerating drug discovery timelines, and improving clinical trial efficiency, thus enhancing overall market dynamism.

The primary driving factors fueling this significant market expansion include the rapidly aging global population, which necessitates increased healthcare spending and demand for chronic disease treatments; technological advancements in genetic sequencing and bioinformatics; and the growing incidence of lifestyle-related disorders. Furthermore, heightened public awareness regarding health and wellness, coupled with increased accessibility to advanced healthcare services in emerging economies, are substantial contributors to market growth. The ongoing need for pandemic preparedness and the continuous investment by governmental and private entities into basic scientific research further solidify the growth trajectory of the global Life Sciences Market, positioning it as a cornerstone of global innovation and public welfare.

Life Sciences Market Executive Summary

The global Life Sciences Market is experiencing robust growth, primarily propelled by transformative technological advancements, significant private and public investment in biopharma R&D, and evolving regulatory frameworks designed to fast-track innovative therapies. Key business trends include a pronounced shift towards mergers and acquisitions (M&A) aimed at consolidating specialized technology platforms, particularly in cell and gene therapy, and the increasing utilization of outsourcing models (CROs and CDMOs) to manage rising operational costs and development complexity. Strategic partnerships between academic institutions, technology providers, and large pharmaceutical companies are essential for bridging the gap between basic research and commercial application, particularly in areas like synthetic biology and digital health integration. The market's resilience is further demonstrated by sustained demand across all major segments, driven by demographic changes and the persistent burden of non-communicable diseases globally.

Regionally, North America remains the dominant revenue generator, characterized by substantial R&D expenditure, a mature regulatory environment (FDA), and the presence of leading biopharmaceutical companies and advanced research infrastructure. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by expanding healthcare access, increasing governmental focus on domestic pharmaceutical manufacturing capabilities (especially in China and India), and a large patient pool offering diverse opportunities for clinical trials. European markets maintain strength through sophisticated public healthcare systems and strong regulatory harmonization efforts, while Latin America and MEA show nascent growth potential driven by improving economic conditions and increased foreign direct investment in healthcare infrastructure and technology adoption.

Segment trends reveal that the Biotechnology sector, particularly therapeutics derived from biological sources, is expanding at an accelerated rate, overshadowing traditional small molecule pharmaceuticals in terms of pipeline innovation. The Medical Devices segment is heavily focused on connectivity and minimally invasive procedures, leveraging Internet of Medical Things (IoMT) capabilities for enhanced patient monitoring and surgical precision. Within the Research Tools and Reagents segment, genomics technologies, including next-generation sequencing (NGS) and CRISPR gene editing tools, are foundational, enabling rapid progress in both basic research and clinical diagnostics. Furthermore, the diagnostics segment is being revolutionized by point-of-care testing and liquid biopsy technologies, allowing for earlier and less invasive disease detection across various therapeutic areas, particularly oncology.

AI Impact Analysis on Life Sciences Market

Common user questions regarding AI in the Life Sciences market revolve around its ability to accelerate drug discovery timelines, reduce the staggering costs associated with R&D, and enhance the predictability of clinical trial outcomes. Users frequently inquire about the feasibility of AI-driven personalized medicine, asking how machine learning models can process complex genomic data to suggest optimal treatment paths, and the ethical implications surrounding data privacy and algorithmic bias in clinical decision-making. Key themes consistently emerging include the effectiveness of AI in identifying novel drug targets, optimizing synthesis pathways, and revolutionizing clinical operations through automated data management and predictive patient enrollment modeling. The overarching expectation is that AI will move from a supplementary tool to an indispensable core technology, significantly improving efficiency and innovation speed across the entire life sciences value chain.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally reshaping the Life Sciences landscape, moving the industry toward data-driven precision. In drug discovery, AI algorithms analyze vast datasets—including genomic, proteomic, and historical clinical trial data—to identify potential drug candidates and predict toxicity or efficacy profiles with unprecedented accuracy. This capability substantially reduces the time and resources traditionally required for hit identification and lead optimization. Furthermore, AI is critical in optimizing clinical trial design by selecting ideal patient cohorts, monitoring patient adherence, and providing real-time data analysis, which dramatically streamlines the development process and increases the probability of regulatory success.

Beyond R&D, AI is enhancing operational efficiencies in manufacturing and supply chain management by predicting equipment failures, optimizing batch production, and ensuring compliance through automated quality control. The application of sophisticated predictive analytics helps manufacturers maintain high standards while navigating complex regulatory requirements. This pervasive digital transformation ensures that AI is not merely an incremental improvement but a radical shift, allowing life sciences organizations to manage complexity, improve therapeutic efficacy, and ultimately deliver innovations to market faster, addressing the urgent needs of the global population for better health outcomes. Investment in specialized AI talent and robust computational infrastructure is now a top priority for market leaders seeking a competitive edge.

- AI accelerates target identification and validation, reducing drug discovery time by up to 40%.

- Predictive analytics optimize clinical trial enrollment, reducing dropout rates and costs.

- Machine learning enhances personalized medicine by interpreting complex patient molecular data for targeted therapy selection.

- AI streamlines biomanufacturing processes through predictive maintenance and quality assurance checks.

- Natural Language Processing (NLP) is used extensively for analyzing regulatory documents and scientific literature.

DRO & Impact Forces Of Life Sciences Market

The Life Sciences Market is significantly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO). Major drivers include the increasing global burden of chronic diseases such as cancer and diabetes, coupled with demographic shifts toward an older population requiring sustained medical intervention. Furthermore, substantial technological breakthroughs in genomics, proteomics, and bioinformatics are fueling innovation, enabling the creation of novel therapeutic modalities like cell and gene therapies. Restraints primarily encompass the escalating cost of pharmaceutical R&D, stringent and complex global regulatory pathways that delay market entry, and persistent concerns regarding intellectual property protection and pricing pressures exerted by governmental and third-party payers. These financial and regulatory hurdles necessitate market players to adopt highly efficient operational models and focus on breakthrough innovations that justify premium pricing.

Key opportunities for market expansion arise from the untapped potential of emerging markets, particularly in Asia Pacific and Latin America, where improving economic conditions are leading to increased access to advanced healthcare. The paradigm shift toward personalized medicine, enabled by companion diagnostics and precision therapeutics, opens lucrative niche markets. Moreover, the accelerating convergence of life sciences with digital technologies—AI, blockchain for supply chain integrity, and IoMT for remote patient monitoring—represents a massive opportunity for efficiency gains and service delivery innovation. Companies focusing on digitally enabled diagnostics and decentralized clinical trials are particularly well-positioned to capitalize on these trends, optimizing resource deployment and reducing operational bottlenecks.

The impact forces influencing the market are multifaceted, combining economic, technological, and socio-political elements. Economically, global healthcare expenditure growth directly propels market expansion, though volatility in reimbursement policies acts as a mitigating force. Technologically, rapid advancements necessitate continuous investment in cutting-edge infrastructure and talent, forcing smaller entities to seek partnerships or M&A. Socio-politically, public trust, ethical considerations (especially in gene editing), and government-led initiatives for healthcare access and pandemic readiness dictate market priorities and investment focus. These external forces necessitate proactive strategic planning, regulatory compliance excellence, and a commitment to transparent data management to maintain operational sustainability and secure public acceptance of new therapies and devices.

Segmentation Analysis

The Life Sciences Market is comprehensively segmented based on three primary categories: Product, Application, and End-User. The Product segmentation distinguishes between core sectors such as Biopharmaceuticals, Medical Devices, and Research Tools, reflecting the nature of the goods and services offered. Application segmentation highlights the therapeutic or diagnostic area of focus, including Oncology, Cardiology, Neurology, and Infectious Diseases, illustrating where innovation is most intensely directed. The End-User analysis focuses on the primary consumers of these products, ranging from Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, to Hospitals & Clinical Laboratories. This granular segmentation allows for precise market sizing and forecasting, identifying high-growth sub-segments driven by specific scientific breakthroughs or demographic needs.

- By Product:

- Biopharmaceuticals (Small Molecules, Biologics, Vaccines)

- Medical Devices (In-Vitro Diagnostics (IVD), Imaging, Surgical Tools)

- Research Tools (Reagents & Kits, Instruments & Consumables, Bioinformatics Software)

- By Application:

- Therapeutics (Oncology, Cardiovascular, Immunology, Neurology, Rare Diseases)

- Diagnostics (Genomic Testing, Proteomic Analysis, Clinical Chemistry)

- Research & Development (Academic Research, Contract Research Organizations (CROs))

- By End-User:

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Hospitals & Clinical Laboratories

- Forensic Laboratories and Governmental Agencies

Value Chain Analysis For Life Sciences Market

The Life Sciences value chain is characterized by several highly specialized and interconnected stages, beginning with upstream activities focused heavily on basic research and initial drug/device development. Upstream analysis involves raw material sourcing, including chemical synthesis materials, biological buffers, and high-quality reagents, which are primarily supplied by specialized chemical and laboratory material providers. This stage also includes initial target validation and preclinical testing, relying heavily on academic partnerships and contract research organizations (CROs) for specialized services. Effective supply chain management at this stage is crucial for ensuring the quality and traceability of inputs, which directly impacts the integrity of final products. Technological advancements in synthetic biology and high-throughput screening optimize these early-stage processes.

Moving downstream, the value chain encompasses clinical trials, regulatory approval processes, manufacturing (often handled by Contract Development and Manufacturing Organizations (CDMOs)), and commercialization. Manufacturing operations require strict adherence to Good Manufacturing Practices (GMP) and specialized infrastructure for producing biologics, cell therapies, and complex medical devices. The distribution channel is bifurcated into direct and indirect routes. Direct distribution is common for high-value specialty drugs, advanced surgical equipment, and complex research instruments, often requiring specialized logistics (cold chain management). Indirect distribution relies on established networks of wholesalers, distributors, and pharmacy chains, ensuring broad market reach for high-volume products, such as generic drugs and commodity diagnostics.

The complexity of distribution channels is amplified by varying regional regulations and reimbursement structures. Direct sales forces and specialized medical science liaisons (MSLs) are employed to communicate the scientific value of complex therapies directly to hospitals and specialists. The digital transformation is profoundly impacting the downstream segment, with e-commerce platforms increasingly used for research consumables and software licensing, while blockchain technology is being explored to enhance the security and transparency of the pharmaceutical supply chain, combatting counterfeiting and ensuring product authenticity from manufacturer to patient.

Life Sciences Market Potential Customers

Potential customers within the Life Sciences Market are diverse, reflecting the broad application spectrum of the industry’s products and services. Pharmaceutical and Biotechnology companies represent the largest group of buyers for research tools, clinical trial services (CROs), and API/biologic manufacturing services (CDMOs). These entities are constantly seeking innovative solutions to accelerate their R&D pipelines, optimize manufacturing yields, and navigate complex regulatory submissions. Their purchasing decisions are primarily driven by technological differentiation, scalability, and adherence to stringent quality and compliance standards, reflecting their pivotal role in drug development.

Hospitals, clinics, and clinical laboratories form the primary end-users for diagnostic products, medical devices, and marketed therapeutic drugs. Hospitals are increasingly investing in high-end imaging systems, robotic surgical platforms, and sophisticated laboratory automation to improve patient care efficiency and diagnostic accuracy. Clinical laboratories, including reference labs and hospital labs, are high-volume purchasers of reagents, kits, and analyzers for routine and specialized testing, driven by the need for rapid turnaround times and reliability. Their purchasing is heavily influenced by reimbursement policies, established vendor relationships, and ease of system integration within existing healthcare information technology (HIT) infrastructure.

Academic and governmental research institutions, including universities and national research laboratories, are significant customers for research consumables, high-precision instruments (e.g., mass spectrometers, NGS systems), and bioinformatics software. These institutions drive basic scientific discovery and rely on cutting-edge technology to maintain competitiveness in grant funding and scientific publication. Their procurement cycles are often dependent on grant funding availability, emphasizing the need for cost-effective and highly specialized equipment that supports fundamental scientific exploration across genomics, cell biology, and translational medicine.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2,450 Billion |

| Market Forecast in 2033 | USD 4,140 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Johnson & Johnson, Roche Holding AG, Novartis AG, Pfizer Inc., Merck KGaA, Danaher Corporation, Thermo Fisher Scientific Inc., Abbott Laboratories, Siemens Healthineers, General Electric Healthcare, Bio-Rad Laboratories, Amgen Inc., Gilead Sciences, Bristol-Myers Squibb, Sanofi S.A., Illumina Inc., Lonza Group, WuXi AppTec, Charles River Laboratories, AstraZeneca PLC |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Life Sciences Market Key Technology Landscape

The technology landscape of the Life Sciences Market is rapidly evolving, driven by the imperative for higher precision, efficiency, and scalability in research and manufacturing. A primary technological pillar is Next-Generation Sequencing (NGS) and advanced genomics platforms, which have dramatically reduced the cost and time associated with genetic analysis, enabling population-scale genomic studies and foundational personalized medicine initiatives. Alongside NGS, CRISPR-Cas systems have revolutionized gene editing, offering unprecedented precision in modifying biological systems for therapeutic development and disease modeling. These foundational molecular technologies are intrinsically linked to advancements in high-throughput screening (HTS) and automation, allowing researchers to rapidly test thousands of compounds or genetic variations, accelerating the identification of viable drug candidates.

Digital transformation technologies, notably Artificial Intelligence (AI) and Machine Learning (ML), are paramount in processing the immense volume of biological data generated by these advanced instruments. AI algorithms are deployed for tasks such as biomarker discovery, prediction of protein folding structures, and optimization of chemical synthesis routes. Furthermore, the development of sophisticated bioinformatics software and cloud-based data management platforms is essential for collaborative research and secure data sharing across geographically dispersed teams. The increasing adoption of the Internet of Medical Things (IoMT) for patient monitoring and decentralized clinical trials is also a critical technological trend, enabling real-time data collection and improving patient adherence and safety protocols during therapeutic development.

In biomanufacturing and medical devices, the transition towards continuous manufacturing processes is a key technological shift, offering improved quality control, reduced footprint, and greater flexibility compared to traditional batch processing. Advanced materials science is also crucial, particularly in developing biocompatible materials for implants, drug delivery systems, and microfluidic devices used in diagnostics and organ-on-a-chip models. Coupled with robotic process automation (RPA) in laboratories and cleanroom environments, these technological advancements ensure enhanced reproducibility, scalability, and compliance, ultimately lowering the total cost of ownership for life sciences organizations while meeting the growing global demand for advanced medical interventions.

Regional Highlights

- North America: Dominates the global market due to massive investments in biopharmaceutical R&D, a robust venture capital environment, and a concentrated presence of major pharmaceutical, biotech, and research instrument companies. The U.S. remains the core driver, supported by advanced healthcare infrastructure and favorable regulatory support (FDA) for innovative therapies, especially in areas like gene therapy and complex biologics. High healthcare expenditure per capita ensures a sustained demand for high-value therapeutics and cutting-edge medical devices.

- Europe: Represents a significant market share, driven by strong governmental support for life sciences research, particularly within the EU's Horizon Europe framework. Countries like Germany, Switzerland, and the UK are hubs for precision medicine, diagnostics, and medical technology manufacturing. The European Medicines Agency (EMA) provides a harmonized regulatory pathway, although market fragmentation regarding pricing and reimbursement across member states remains a challenge.

- Asia Pacific (APAC): Projected as the fastest-growing region, owing to rapid modernization of healthcare infrastructure, increasing accessibility to basic medical services, and significant investment by nations like China and India into domestic pharmaceutical manufacturing (e.g., generic drugs and biosimilars). The region is becoming a pivotal location for large-scale clinical trials due to its diverse and large population base, attracting substantial foreign investment.

- Latin America: Characterized by moderate growth, primarily driven by expanding middle-class populations and growing access to insurance coverage. Key markets like Brazil and Mexico are improving regulatory frameworks and domestic production capabilities, focusing on infectious disease control and expanding primary care services, thereby increasing demand for essential drugs and standard medical devices.

- Middle East and Africa (MEA): Emerging market with increasing strategic importance, especially the GCC countries which are investing heavily in establishing world-class healthcare cities and specialized medical research centers (e.g., Saudi Arabia’s Vision 2030). These investments are boosting the demand for advanced hospital equipment and specialty pharmaceuticals, reducing reliance on medical tourism.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Life Sciences Market.- Johnson & Johnson

- Roche Holding AG

- Novartis AG

- Pfizer Inc.

- Merck KGaA

- Danaher Corporation

- Thermo Fisher Scientific Inc.

- Abbott Laboratories

- Siemens Healthineers

- General Electric Healthcare

- Bio-Rad Laboratories

- Amgen Inc.

- Gilead Sciences

- Bristol-Myers Squibb

- Sanofi S.A.

- Illumina Inc.

- Lonza Group

- WuXi AppTec

- Charles River Laboratories

- AstraZeneca PLC

Frequently Asked Questions

Analyze common user questions about the Life Sciences market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Life Sciences Market?

Market growth is primarily driven by the increasing global prevalence of chronic diseases, significant demographic shifts toward an aging population, relentless technological innovation in genomics and personalized medicine, and robust investment in biopharma research and development.

How is Artificial Intelligence transforming drug discovery in the Life Sciences sector?

AI is transforming drug discovery by leveraging machine learning to rapidly analyze complex biological and chemical data, enabling accelerated identification of novel drug targets, prediction of compound efficacy and toxicity, and optimization of molecular structures, drastically reducing R&D cycle times and costs.

Which geographical region holds the largest market share in the Life Sciences Market?

North America currently holds the largest share of the Life Sciences Market, attributed to high R&D expenditure, advanced healthcare infrastructure, the presence of major industry players, and a supportive regulatory and intellectual property protection environment.

What are the primary restraints affecting the Life Sciences Market?

The primary restraints include the exceptionally high costs associated with pharmaceutical research and development, protracted and complex regulatory approval processes, growing pressure from payers regarding drug pricing and reimbursement, and challenges related to maintaining data integrity and compliance in global supply chains.

What key segments are projected to experience the fastest growth?

The Biotechnology segment, specifically cell and gene therapies, and the Research Tools segment, driven by demand for Next-Generation Sequencing (NGS) and CRISPR technologies, are projected to be the fastest-growing areas due to their potential to deliver curative treatments and advance fundamental scientific understanding.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Life Sciences and Laboratory Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- UV-Vis Spectrometer Market Size Report By Type (Single-Beam, Double-Beam), By Application (Environmental, Life Sciences R&D, Academic Research Institutes, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Atomic Absorption Spectroscopy Instrument Market Size Report By Type (Flame, Graphite Furnace, Other), By Application (Food & Agriculture, Life Sciences & Pharmacy, Chemical, Metals & Mining, Environmental, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- AFM Probe Market Size Report By Type (Silicon AFM Probes, Silicon Nitride AFM Probes, Diamond AFM Probes), By Application (Life Sciences and Biology, Materials, Semiconductors and Electronics, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Laser Service Market Statistics 2025 Analysis By Application (Materials Processing & Industrial, Microelectronics, Life Sciences & Medical, Graphic Arts & Display, Defense & Military, Others), By Type (Welding Service, Cutting Service, Marking Service), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager