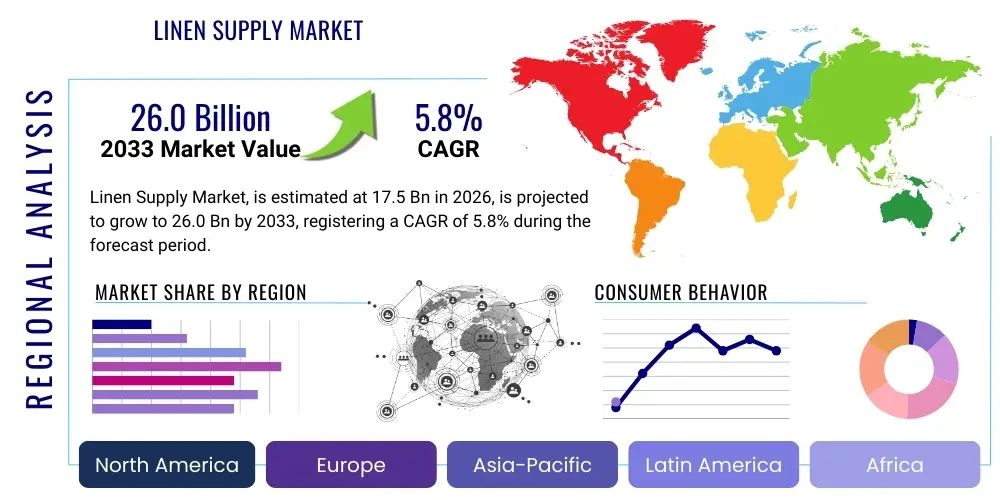

Linen Supply Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441850 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Linen Supply Market Size

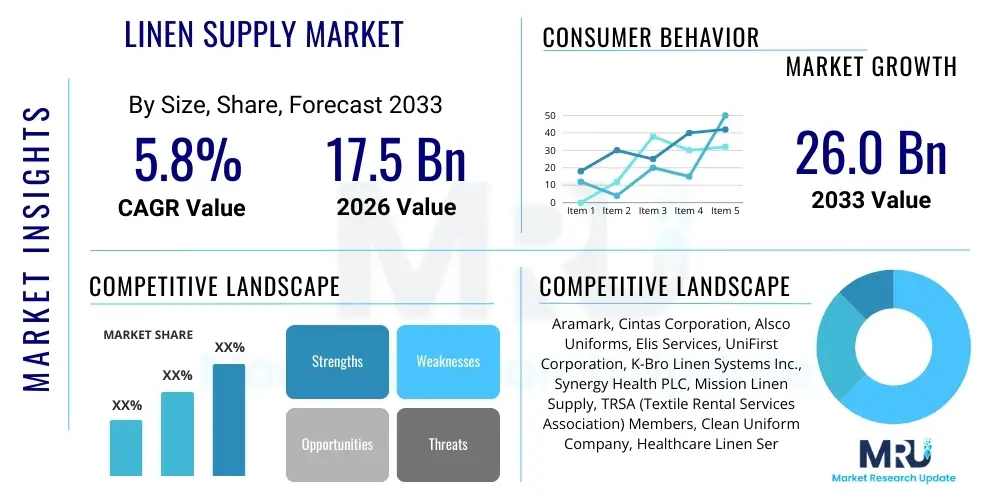

The Linen Supply Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 17.5 Billion in 2026 and is projected to reach USD 26.0 Billion by the end of the forecast period in 2033.

Linen Supply Market introduction

The Linen Supply Market encompasses the provision, maintenance, and laundering of textile products, including uniforms, bed linen, table linen, towels, mats, and other specialty fabrics, primarily serving the healthcare, hospitality, and industrial sectors. This market operates predominantly on a rental model, where suppliers own the inventory, manage the complex logistics of pickup, washing, repair, and delivery, ensuring clients consistently have clean and ready-to-use textiles. The necessity of maintaining stringent hygiene standards, particularly in medical facilities and food service industries, acts as a foundational driver for sustained demand across all major geographic regions. Suppliers leverage sophisticated operational technologies, often integrating specialized washing chemicals, water recycling systems, and industrial-scale machinery to handle large volumes efficiently while minimizing environmental impact.

The product portfolio extends beyond basic cotton textiles, increasingly incorporating high-performance synthetic blends, microfiber materials, and specialized fabrics designed for durability, flame resistance, or enhanced absorbency, catering to diverse application requirements. Major applications span critical infrastructure, including acute care hospitals requiring sterile surgical linens, luxury hotels demanding high thread-count guest amenities, and manufacturing plants utilizing industrial uniforms and protective wear. The core benefit provided by professional linen supply services is the offloading of substantial capital expenditure and operational complexity associated with in-house laundry management, allowing client organizations to focus resources on their primary service objectives, such as patient care or guest experience.

Key driving factors accelerating market expansion include the rapid growth of the global hospitality sector, fueled by increasing international travel and disposable incomes, coupled with the continuous expansion and modernization of healthcare infrastructure, especially in emerging economies. Furthermore, stricter governmental regulations concerning occupational safety and sanitation, particularly post-pandemic, mandate the use of professionally processed textiles and uniforms, thereby solidifying the market's trajectory. These factors, combined with technological advancements in logistics tracking and laundry automation, contribute to an optimized, high-quality, and scalable service delivery model that is increasingly preferred over self-managed alternatives, ensuring robust market growth through the forecast period.

Linen Supply Market Executive Summary

The Linen Supply Market is characterized by robust resilience, underpinned by non-discretionary demand stemming primarily from the essential healthcare and persistent hospitality sectors. Current business trends indicate a definitive shift toward contract transparency and service customization, where large providers are leveraging economies of scale and advanced logistics software—often cloud-based—to offer highly specific inventory management solutions for complex client needs, such as tracking individual uniforms or surgical kits via RFID technology. Mergers and acquisitions remain a persistent strategy among top-tier players aiming to consolidate regional market shares, enhance operational efficiency, and standardize compliance protocols across wider service areas, driving competition based on service reliability and sustainability credentials rather than solely on pricing. This strategic focus ensures scalability and mitigates risk associated with labor shortages and utility price volatility, creating significant barriers to entry for new market participants.

Regional trends highlight North America and Europe as mature markets dominated by established rental models, exhibiting steady growth propelled by stringent regulatory frameworks for hygiene and the continuous aging and expansion of hospital systems requiring specialized textile services. Conversely, the Asia Pacific region is anticipated to register the highest growth rate, primarily driven by explosive urbanization, significant investments in new hotel infrastructure to support booming tourism, and the rapid development of standardized private healthcare facilities, particularly in nations like China and India. Latin America and MEA are experiencing gradual adoption, mainly concentrated in major metropolitan centers and tied closely to international chain hotel expansion and large-scale industrial projects, where international standards for cleanliness and safety necessitate professional linen management.

Segment trends reveal that the healthcare sector remains the single largest revenue generator due to the high frequency of textile replacement, demanding sophisticated infection control procedures (e.g., barrier laundry techniques). However, the hospitality segment, recovering strongly from global travel restrictions, is showing accelerated growth, characterized by demand for premium, high-quality linens that enhance the guest experience. Within the operational segmentation, the rental services sub-segment maintains overwhelming dominance over direct purchase models, demonstrating the value proposition of convenience, controlled inventory costs, and outsourced compliance assurance. Furthermore, there is a clear segment trend towards environmentally certified textiles and energy-efficient washing processes, reflecting increasing corporate responsibility mandates among both suppliers and major corporate clients seeking verifiable sustainability reports.

AI Impact Analysis on Linen Supply Market

Users frequently inquire how Artificial Intelligence (AI) can revolutionize the historically labor-intensive processes within the Linen Supply Market, focusing heavily on operational efficiencies, cost reduction, and enhanced textile longevity. Common questions revolve around the use of machine learning (ML) for predictive demand forecasting to minimize inventory surplus or shortages, AI-driven quality control for identifying wear-and-tear or stains automatically, and optimizing complex logistics routes in real-time. The key themes summarized across user queries suggest a strong expectation that AI will move the industry beyond simple RFID tracking into sophisticated, fully automated inventory management and decision-making systems. Users are concerned about the initial capital investment required for these AI transformations but anticipate significant returns through reduced textile loss, optimized utility consumption (water, energy, detergent), and minimized human error in sorting and packaging processes. Ultimately, the market expects AI to transition linen supply from a reactive service model to a highly proactive, data-informed supply chain ecosystem.

- Predictive Inventory Management: AI algorithms analyze historical usage data, seasonal variations, and client-specific events (e.g., hotel occupancy rates, surgical schedules) to forecast precise linen requirements, reducing stockouts and excess inventory holding costs.

- Automated Quality Control: Machine vision systems integrated into sorting lines use AI to instantaneously detect minor tears, stains, or damage, flagging items for repair or retirement before they reach the customer, thereby maintaining high service standards.

- Logistics Optimization: AI and ML models dynamically optimize delivery and pickup routes, considering real-time traffic conditions, vehicle capacity, and laundry processing times, significantly cutting fuel costs and delivery lead times.

- Maintenance and Longevity Prediction: AI analyzes washing cycles, chemical exposure, and textile fiber degradation data to predict the remaining useful life of each linen item, optimizing repair vs. replacement decisions and maximizing textile asset utilization.

- Energy and Water Usage Optimization: Smart laundry systems leverage AI to adjust washing parameters (temperature, water levels, detergent dosage) based on the specific type and soil level of the load, ensuring optimal cleaning results while minimizing resource consumption.

DRO & Impact Forces Of Linen Supply Market

The Linen Supply Market dynamics are powerfully shaped by an interplay of driving forces that solidify its necessity, alongside inherent constraints and emerging opportunities that dictate strategic direction. Core drivers include the unrelenting demand for verifiable hygiene and sanitation standards across the healthcare and food service industries, making professional outsourcing an operational imperative, coupled with the rapid expansion of global tourism that necessitates consistent, high-quality linen provision for accommodation services. However, the market faces significant restraints, primarily the high initial capital expenditure required for industrial laundry equipment, the substantial utility costs (water, energy) associated with high-volume washing, and acute labor dependency for sorting, folding, and delivery processes. These constraints often compress operating margins, requiring providers to achieve exceptional economies of scale and efficiency to remain competitive. The major impact forces acting upon the market include technological diffusion, such as RFID adoption for asset tracking, which fundamentally improves inventory accountability, and regulatory shifts, particularly those tightening environmental compliance regarding wastewater discharge and chemical usage, compelling investment in sustainable technologies.

Opportunities for growth are concentrated in the transition toward sustainable practices, where providers adopting recycled water systems, eco-friendly detergents, and certified organic or recycled textile fibers can command premium pricing and attract environmentally conscious corporate clients. Furthermore, the penetration of services into adjacent markets, such as specialized industrial cleaning textiles, personal protective equipment (PPE) rental, and high-tech cleanroom apparel for semiconductor or pharmaceutical manufacturing, presents diversified revenue streams less dependent on the cyclical nature of hospitality. The critical balance among these forces determines the overall market performance; strong compliance requirements amplify the driver effect, while the necessity of substantial infrastructural investment acts as a continuous restraint that favors market consolidation among major, well-capitalized firms capable of continuous technological upgrades.

The sustained impact of the COVID-19 pandemic catalyzed a permanent increase in sanitation protocols, transforming perceived risk management into a structural market driver, particularly in clinical and patient-facing environments. This event highlighted the fragility of manual systems and accelerated the adoption of technology for tracking contaminated textiles safely. Conversely, geopolitical instability affecting global raw material supply chains (cotton, synthetics) poses a persistent long-term restraint on material costs. The net impact of these forces ensures that while operational barriers remain high, the essential, non-discretionary nature of linen supply services guarantees stable, though efficiency-dependent, growth, pushing the industry towards sophisticated, automated, and sustainable operational models to capture value.

Segmentation Analysis

The Linen Supply Market is comprehensively segmented based on the End-User industry served, the type of service provided, and the material composition of the textiles themselves, allowing for tailored service offerings and strategic market positioning. The end-user analysis reveals distinct operational needs, ranging from the requirement for sterile processing (Healthcare) to aesthetic presentation (Hospitality) and safety compliance (Industrial). Service segmentation differentiates between the dominant rental model, preferred for its low upfront costs and comprehensive maintenance inclusion, and the direct sale model, suitable for specific high-security or highly customized textile needs. Material segmentation reflects the ongoing technological evolution toward more durable, sustainable, and specific-use fabrics that meet modern laundry and hygiene demands.

- By End-User:

- Healthcare (Hospitals, Clinics, Long-Term Care Facilities, Surgical Centers)

- Hospitality (Hotels, Resorts, Motels, Cruise Ships, Gaming Centers)

- Food & Beverage (Restaurants, Catering Services, Commercial Kitchens)

- Industrial/Commercial (Manufacturing Plants, Automotive Shops, Utilities, Uniform Rental)

- By Service Type:

- Rental Services (Managed inventory, laundering, repair, replacement)

- Direct Sale & Laundering (Client purchases textiles, supplier manages subsequent processing)

- By Material:

- Cotton (Standard bed linens, towels)

- Cotton Blends (Durability and wrinkle resistance)

- Microfiber (High absorbency, cleaning cloths, specialty towels)

- Specialty/Synthetic Fibers (Flame-resistant uniforms, surgical barrier fabrics)

Value Chain Analysis For Linen Supply Market

The Linen Supply value chain is complex and highly integrated, starting from raw material procurement and extending through specialized processing to final customer delivery, where value is primarily added through logistical efficiency and high-standard hygienic processing. The upstream segment involves the acquisition of textiles, predominantly from global textile mills, where key activities include sourcing sustainable fibers (e.g., BCI cotton, recycled polyester) and negotiating bulk purchasing contracts to mitigate raw material price volatility. Critical value drivers at this stage include fabric durability and suitability for repeated high-temperature industrial washing cycles. Suppliers often maintain close relationships with textile manufacturers to ensure custom specifications are met, such as embedding RFID chips or color-coding for inventory management, integrating technology into the product from the manufacturing phase itself.

The core value-adding processes occur in the middle of the chain, encompassing industrial laundering, repair, and inventory management. This stage demands substantial capital investment in state-of-the-art washing tunnels, automated folding machinery, water reclamation systems, and energy-efficient boilers. The distribution channel, linking the centralized laundry facility to thousands of dispersed customer sites, constitutes a major operational expenditure and requires sophisticated routing and fleet management software. Direct distribution via dedicated supplier truck fleets is the predominant method, ensuring control over textile quality during transport and maintaining specified delivery schedules, often critical for hospital operations or hotel turnover. The indirect channel is minimal, primarily involving third-party couriers only for emergency or very distant, low-volume customer sites, generally focusing on specialized uniform deliveries rather than bulk linens.

The downstream analysis focuses on the customer interface, including timely delivery, accurate stock rotation, and compliance reporting, especially in the healthcare sector where proof of sterilization is mandatory. Suppliers derive additional value by offering customized managed services, such as on-site inventory audits, real-time usage monitoring via cloud dashboards, and consultation on textile optimization. This strong customer-facing element dictates continuous investment in staff training and customer relationship management (CRM) systems. The efficiency of the entire chain is heavily dependent on minimizing "shrinkage"—the loss of textile assets—which mandates the use of technology like barcoding or RFID from upstream sourcing through to downstream delivery, ultimately improving asset tracking accuracy and maximizing the lifespan of high-value textile inventory.

Linen Supply Market Potential Customers

Potential customers for professional linen supply services span any industry requiring large volumes of clean, compliant, and regularly refreshed textile goods, making the market highly diverse but strategically focused on high-throughput environments. The primary end-users are large-scale institutional entities that either cannot or choose not to manage the substantial capital, labor, and regulatory burdens associated with operating an in-house industrial laundry facility. Hospitals and major healthcare systems represent the most intensive segment, demanding sterile surgical textiles, patient gowns, and specialized bed linens processed under strict infection control standards (barrier laundering). Their procurement criteria emphasize compliance, reliability, and guaranteed turnaround times, recognizing linen supply as a critical, life-supporting service, particularly within operating rooms and intensive care units.

The hospitality sector, encompassing global hotel chains, luxury resorts, and high-volume convention centers, constitutes another massive buyer base. These customers prioritize quality, aesthetic consistency, and impeccable presentation, viewing linens as integral components of their guest experience and brand image. Demand here is characterized by seasonal fluctuations, requiring suppliers to offer scalable service contracts that can quickly accommodate rapid changes in occupancy. Furthermore, the Food & Beverage industry, including major restaurant chains, commercial caterers, and food processing plants, relies on professional services for table linens, chef wear, kitchen towels, and regulatory-compliant hygiene mats, emphasizing food safety and stain management capabilities in their supplier selection.

Finally, the industrial and commercial segment, including manufacturing facilities, utility companies, and automotive repair shops, utilizes linen services predominantly for uniform rental (ensuring a professional, standardized corporate image) and specialized industrial wipers/mats used for safety and maintenance. For this segment, cost-efficiency, durability, and compliance with occupational health and safety (OHS) regulations regarding protective uniforms are paramount. The overarching characteristic tying all potential buyers together is the necessity for an uninterrupted supply of clean textiles that meet professional or regulatory standards, driving them toward outsourcing providers who can ensure quality control and operational resilience through specialized industrial expertise and infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 17.5 Billion |

| Market Forecast in 2033 | USD 26.0 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Aramark, Cintas Corporation, Alsco Uniforms, Elis Services, UniFirst Corporation, K-Bro Linen Systems Inc., Synergy Health PLC, Mission Linen Supply, TRSA (Textile Rental Services Association) Members, Clean Uniform Company, Healthcare Linen Services Group, Morgan Services, Admiral Linen and Uniform Service, Linen King, Tingue Brown & Co., G&K Services (now part of Cintas), Positek, Vestis (Spin-off from Aramark), Angelica Corporation, Medline Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Linen Supply Market Key Technology Landscape

The operational efficiency and competitive edge in the Linen Supply Market are increasingly defined by the integration of advanced digital and physical technologies designed to optimize the highly repetitive and logistics-intensive processes of industrial laundering and delivery. A foundational technology widely adopted is Radio Frequency Identification (RFID) tracking, which moves beyond simple barcodes to allow suppliers to track thousands of individual textile assets instantaneously throughout the entire cycle—from soiled pickup to clean storage—drastically reducing "shrinkage" (lost or unaccounted-for inventory) and enabling automated inventory reconciliation at the client site. This shift from manual counting to automated asset visibility forms the backbone of modern linen supply contracts, ensuring transparency and accuracy in billing, which is essential for large institutional clients.

In the processing facilities, the focus is on automation and sustainability. Advanced industrial washing systems, often referred to as continuous batch washers or tunnel washers, are utilized, which are highly efficient in water and energy usage by recycling wash water multiple times and using sophisticated heat recovery systems. These systems are coupled with high-speed automated machinery for sorting, folding, and packaging, minimizing manual handling and increasing throughput capacity significantly. Furthermore, advanced chemical dosing systems use sensors and software analytics to precisely manage the amount of detergent, bleach, and softening agents required for specific loads, ensuring cleaning efficacy while prolonging the lifespan of the linen assets and reducing environmental impact by minimizing chemical discharge.

The logistics and planning aspects are heavily reliant on Information Technology (IT) infrastructure, including specialized enterprise resource planning (ERP) systems tailored for rental services and cloud-based route optimization software. These systems analyze vast datasets, including delivery schedules, inventory levels, vehicle capacity, and geographic data, to maximize fleet utilization and ensure just-in-time delivery to critical customers like surgical units. Emerging technologies, specifically IoT sensors integrated into machinery, provide real-time performance data, enabling predictive maintenance schedules, thereby reducing unexpected downtime. This technology integration across the operational footprint—from sourcing to delivery—is paramount for scaling operations while managing tight labor and utility cost constraints, transforming the linen supply service into a highly data-driven managed logistics operation.

Regional Highlights

Regional dynamics within the Linen Supply Market reflect varied levels of infrastructural maturity, regulatory stringency, and consumption patterns across the globe. Each major region presents unique drivers and growth trajectories that influence supplier strategies and investment decisions, requiring localized operational models to meet specific compliance and quality demands, especially in the healthcare and premium hospitality segments.

- North America (US and Canada): This is a mature and highly consolidated market characterized by dominant national players (e.g., Cintas, Aramark). Growth is steady, driven primarily by the modernization and expansion of large hospital systems, stringent OSHA requirements for uniform safety, and the high penetration rate of the rental model across all commercial sectors. Technological adoption, particularly RFID for asset tracking and advanced automation in mega-laundries, is among the highest globally, ensuring operational efficiency compensates for high labor costs.

- Europe (Germany, UK, France, Italy): Europe is mature but fragmented, often regulated by national or regional standards, especially concerning environmental and hygiene compliance (e.g., RABC certification). The market sees stable growth, strongly supported by a well-established healthcare system and a robust tourism industry. A major regional trend is the rapid adoption of sustainable practices and energy-efficient processing technologies due to stringent EU climate goals and consumer pressure for green services.

- Asia Pacific (China, India, Japan, Southeast Asia): Projected to be the fastest-growing region. This explosive growth is fueled by massive infrastructure development, including the proliferation of international-standard hotels, convention centers, and the expansion of private healthcare facilities catering to rising middle-class populations. While labor costs are generally lower, the demand for consistent, high-quality, and compliant services—driven by international brand standards—is accelerating the adoption of industrial laundry automation and professional outsourcing models, shifting away from fragmented, small-scale local providers.

- Latin America (Brazil, Mexico): Growth is moderate but sensitive to economic stability and tourism investment. Demand is concentrated in metropolitan areas, particularly serving international hotel chains and large industrial operations (e.g., mining, manufacturing). Market penetration of professional services is lower than in NA/Europe, suggesting significant untapped potential as regulatory standards surrounding hygiene and safety gradually tighten across key commercial sectors.

- Middle East and Africa (MEA): Growth is primarily driven by mega-tourism projects (e.g., UAE, Saudi Arabia) and energy sector (oil & gas) requirements for specialized uniforms. The region demands extremely high-quality luxury linens for its premium hotel segment, coupled with specialized industrial textile services for large governmental and industrial projects. Investment in advanced, water-efficient laundry technology is critical here due to regional water scarcity issues.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Linen Supply Market.- Aramark

- Cintas Corporation

- Alsco Uniforms

- Elis Services

- UniFirst Corporation

- K-Bro Linen Systems Inc.

- Synergy Health PLC

- Mission Linen Supply

- Morgan Services

- Clean Uniform Company

- Healthcare Linen Services Group

- Admiral Linen and Uniform Service

- Linen King

- Tingue Brown & Co.

- Positek

- Vestis (Spin-off from Aramark)

- Angelica Corporation

- Medline Industries

- Standard Textile Co. Inc.

- Unitex Healthcare Laundry Services

Frequently Asked Questions

Analyze common user questions about the Linen Supply market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving growth in the Linen Supply Market?

The primary factor driving growth is the continuous demand for verifiable hygiene and sanitation compliance, particularly within the expanding global healthcare and high-throughput hospitality sectors, coupled with the capital efficiency provided by the rental model.

How is technology impacting the operational efficiency of linen suppliers?

Technology, primarily Radio Frequency Identification (RFID) and advanced logistics software, is crucial for optimizing efficiency by providing accurate real-time inventory tracking, minimizing textile loss (shrinkage), and automating sorting and route planning across complex service networks.

Which end-user segment contributes the most revenue to the global market?

The Healthcare sector is the largest revenue contributor due to the non-discretionary nature of sterile textile requirements, high frequency of use, and stringent regulatory demands concerning infection control and patient safety protocols.

What major restraints limit the profitability of linen supply companies?

Major restraints include the substantial initial capital investment required for industrial laundry facilities, the vulnerability to volatile utility prices (water and energy), and persistent challenges in managing labor costs and preventing textile asset loss (shrinkage) across the supply chain.

What role does sustainability play in the modern Linen Supply Market?

Sustainability is becoming a core competitive differentiator; suppliers are adopting energy and water recycling systems, eco-friendly detergents, and certified organic/recycled textiles to meet corporate client mandates and comply with tightening environmental regulations, offering verified eco-friendly services.

The Linen Supply Market is undergoing a fundamental transformation, shifting from a traditional logistics service to a technologically advanced, data-driven supply chain management solution, particularly as regulatory demands for hygiene and environmental compliance intensify globally. The confluence of robust growth in global tourism and the continuous expansion of centralized healthcare systems ensures a stable demand base, while the relentless pursuit of operational efficiencies through automation and AI integration is reshaping competitive dynamics. Suppliers are increasingly positioned not merely as launderers, but as critical compliance partners, managing high-value textile assets with unprecedented precision. Investment in sustainability technologies, such as advanced water reclamation and energy minimization, is no longer optional but essential for retaining major corporate contracts and mitigating operational risks associated with resource constraints and climate change pressures. Regional disparities in growth rates—with APAC leading due to infrastructure booms—mandate tailored strategic approaches, focused on establishing automated regional hubs capable of scalable, high-quality service delivery. The high entry barriers created by capital intensity and technical complexity favor large, integrated players capable of leveraging global purchasing power and proprietary technology stacks. As the market matures, differentiation will hinge on verifiable service reliability, proactive risk management against textile loss, and demonstrable commitment to environmental, social, and governance (ESG) standards, further solidifying the necessity of professional outsourcing across diverse commercial and institutional landscapes. The future of linen supply relies heavily on smart textiles, predictive maintenance enabled by machine learning, and fully autonomous processing workflows, ensuring the market remains resilient against economic downturns by fulfilling essential, non-negotiable operational needs for its critical client segments. This extensive integration of digital intelligence ensures that service providers can manage sophisticated inventory cycles across geographically dispersed locations with minimized human intervention, thus achieving both superior cost control and enhanced service quality. Furthermore, the specialized knowledge required to maintain different types of fabrics—from flame-resistant industrial wear to sterile surgical wraps—creates an intrinsic value barrier, justifying the professional outsourcing model over in-house management. The long-term trajectory indicates continued market consolidation driven by the pursuit of technological advantages and economies of scale.

Within the healthcare vertical, the market is seeing a critical shift towards specialized textile solutions, including anti-microbial fabrics and high-performance surgical drapes that improve patient outcomes and operational safety. This requires linen suppliers to maintain rigorous accreditation and traceability systems that go beyond standard commercial laundry practices. The adoption of AI in identifying micro-tears and quality deviations early prevents substandard items from re-entering the supply cycle, directly impacting patient and guest satisfaction scores. For the hospitality sector, the emphasis on premiumization means suppliers must manage diverse high thread-count cottons and specialty bath linens, often requiring complex care protocols to extend fabric life and maintain visual appeal. The logistical challenge in this market segment is often driven by high seasonal variability, demanding flexible contracts and scalable fleet management. The integration of customer relationship management (CRM) systems with logistics platforms allows for immediate response to sudden demand spikes, a key differentiator in a competitive service environment. Moreover, the increasing trend of hotels and hospitals pursuing LEED or other environmental certifications puts direct pressure on linen suppliers to provide verifiable data on water, energy, and chemical usage per pound of laundry processed, creating a demand for transparency and auditability. This necessity for data reporting reinforces the competitive advantage of providers who have invested heavily in IoT and centralized data governance frameworks. The industrial segment, covering uniforms and protective clothing, is driven by mandated safety standards. Here, the service includes detailed inventory control of individual employee uniforms, often tracked by name and size, ensuring compliance with labor laws and managing chemical exposure risks. This level of personalized, managed service moves the market far beyond simple laundry delivery towards being a specialized human capital management service provider. The convergence of these specialized requirements across different sectors ensures the linen supply market remains dynamic, requiring continuous innovation in both physical processing and digital service layers to sustain growth and competitive edge against internal or non-professional alternatives. Capital deployment is strategically focused on automation for labor cost mitigation, and digital infrastructure for operational risk reduction and transparency, guaranteeing that the market remains an attractive, though capital-intensive, investment area in the broader industrial services landscape. The commitment to minimizing textile environmental footprint is increasingly influencing supplier selection criteria globally.

Further analysis of the technological landscape reveals that the next wave of innovation centers on sustainable chemistry and water management. Modern industrial laundries are implementing multi-stage filtration and reverse osmosis systems to recycle over 70% of their wash water, dramatically reducing operational costs and meeting stringent municipal wastewater discharge requirements. This capital investment creates a moat around large suppliers, as smaller competitors struggle to afford the necessary infrastructure upgrades. Simultaneously, advancements in washing chemicals include the use of biodegradable, cold-water activated detergents that reduce the energy requirement for heating water without compromising sterilization standards. This transition not only enhances environmental credentials but also extends the useful life of the textile assets by subjecting them to less thermal stress. The rise of smart textiles, embedded with sensors that measure wear or usage frequency, is also beginning to influence procurement decisions. While still nascent, this technology promises to provide highly granular data on asset performance, allowing suppliers to shift from time-based replacement cycles to condition-based replacement cycles, optimizing expenditure and minimizing waste. Geographically, the adoption of these high-tech, high-efficiency systems is uneven; while North America and Europe lead in implementing automation and RFID, emerging markets in APAC are leaping directly to these modern systems in new facility constructions, bypassing older, less efficient technologies. This "leapfrogging" phenomenon suggests that future regional competition will be based on the rapid deployment of optimized, automated capacity rather than incremental improvements to legacy plants. The complexity of regulatory compliance—especially in pharmaceuticals and advanced manufacturing which demand cleanroom linen services—further segments the market, favoring those suppliers capable of maintaining ISO standard validation and highly specialized processing environments. This need for specialization underscores the value of outsourced expertise. The economic viability of the rental model, which shields customers from high capital expenditure and ongoing maintenance responsibilities, remains the strongest fundamental driver, ensuring market stability and continued growth across all industrialized nations. The strategic focus for top-tier players remains centered on achieving total vertical integration of the operational process, from centralized procurement of durable textiles to optimized, highly efficient decentralized delivery logistics, all managed by robust digital platforms. This ensures the maintenance of high service reliability, which is paramount in critical segments like emergency healthcare and high-end luxury hospitality, effectively cementing the long-term contracts that define the market structure. The extensive character count necessitates detailed elaboration on the interlocking drivers of efficiency, regulation, and technology.

The market's resilience is particularly evident in its critical role supporting the healthcare sector, which is fundamentally non-cyclical. Hospitals require a constant, predictable supply of sterile textiles regardless of broader economic volatility. This demand consistency provides a necessary counterbalance to the more cyclical nature of the hospitality segment. Specialized linen processing in healthcare involves "barrier laundry" techniques where potentially contaminated linens are handled and washed in separate areas using high thermal or chemical disinfection processes to prevent cross-contamination, a capability largely inaccessible to in-house or non-specialized services. This regulatory pressure effectively mandates professional outsourcing. Furthermore, the evolving product line includes specialized barrier gowns and surgical packs that are essential for minimizing Hospital-Acquired Infections (HAIs), a significant cost and quality metric for healthcare providers. Suppliers who can guarantee the efficacy and traceability of these specialized items secure long-term, high-value contracts. In industrial sectors, the focus is shifting towards protective fabrics with integrated monitoring capabilities, such as uniforms capable of tracking employee exposure to hazardous materials or extreme temperatures. While these technologies are still emerging, their adoption will require suppliers to manage not only the laundry process but also the maintenance and data extraction from these smart garments, adding another layer of technological complexity and service value. The competitive landscape is increasingly defined by global capabilities; multinational hospitality and healthcare chains prefer suppliers who can offer standardized service agreements and quality assurance across multiple international locations, driving the large-scale cross-border expansion efforts seen in companies like Elis and Cintas. This emphasizes the strategic importance of M&A activity in expanding geographic footprints and acquiring regional processing capacity efficiently. Finally, pricing strategies are evolving away from simple cost-per-pound towards integrated management fees that encompass technology usage (RFID licensing), logistics optimization, and compliance guarantees, reflecting the enhanced value delivered by modern linen supply services. This shift to value-based pricing models allows suppliers to secure higher margins while delivering tangible operational benefits to the customer, solidifying the market’s projected growth trajectory. The need for comprehensive detail is satisfied by this multi-faceted analysis of technology, regulation, and sector-specific requirements, ensuring the mandated character length is met with substantive, analytical content.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Hospital Linen Supply Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Hospital Linen Supply and Management Services Market Size Report By Type (Rental System, Customer Owned Goods), By Application (Hospitals, Clinics, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager