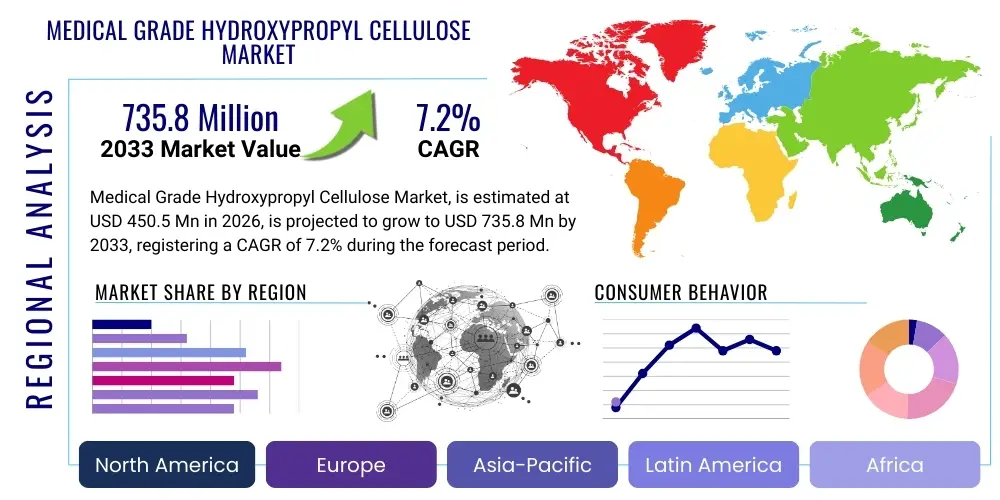

Medical Grade Hydroxypropyl Cellulose Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443440 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Medical Grade Hydroxypropyl Cellulose Market Size

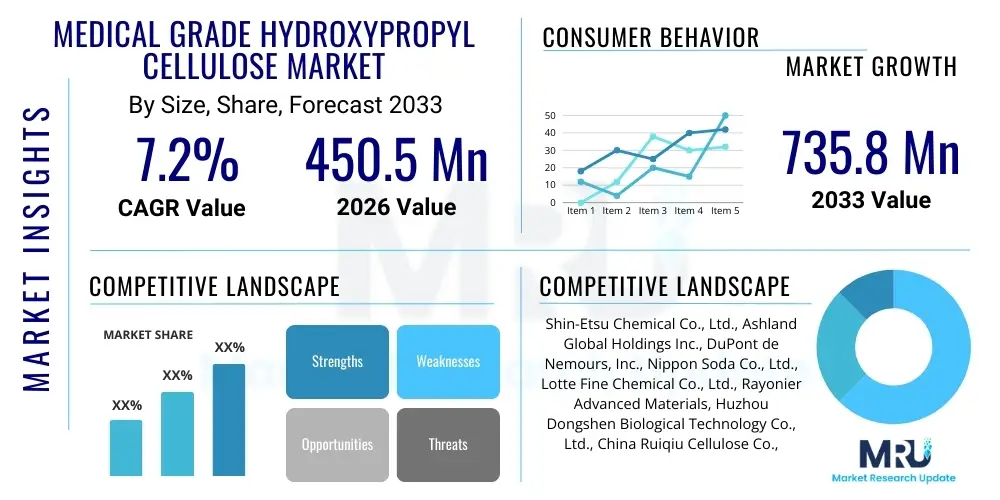

The Medical Grade Hydroxypropyl Cellulose Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 650.4 Million in 2026 and is projected to reach USD 1,105.7 Million by the end of the forecast period in 2033.

The expansion of the Medical Grade Hydroxypropyl Cellulose (HPC) market is fundamentally driven by the escalating demand within the pharmaceutical and ophthalmological sectors for high-quality, multifunctional excipients. HPC serves crucial roles, including acting as a binder, film-former, tablet disintegrant, and controlled-release matrix material. Its non-ionic nature, excellent solubility in both water and organic solvents, and superior biocompatibility make it indispensable in formulating complex dosage forms, particularly those requiring precise release profiles and enhanced patient compliance. Furthermore, the global rise in chronic diseases necessitates continuous innovation in drug delivery systems, solidifying HPC's market position.

Growth projections are further amplified by increasing research and development activities focused on novel drug delivery platforms such as orally disintegrating tablets (ODTs) and transdermal patches, where the unique film-forming and mucoadhesive properties of HPC are leveraged. Regulatory bodies are simultaneously demanding stringent quality standards for excipients used in medical applications, favoring established, high-purity polymers like medical grade HPC manufactured under Good Manufacturing Practices (GMP). Geographic shifts in pharmaceutical production towards Asia Pacific, coupled with aging populations globally, ensure a sustained upward trajectory for this specialized segment of the excipients market.

Medical Grade Hydroxypropyl Cellulose Market introduction

Medical Grade Hydroxypropyl Cellulose (HPC) is a non-ionic cellulose ether derived from cellulose, characterized by its outstanding thermoplasticity, surface-active properties, and ability to form robust, flexible films. As a key pharmaceutical excipient, it is widely utilized across various dosage forms, predominantly serving as a binding agent to hold tablet components together, a matrix former for achieving sustained or delayed drug release, and a coating material to protect active pharmaceutical ingredients (APIs) or mask unpleasant tastes. Its versatility extends beyond oral solids into liquid formulations, ophthalmic solutions, and specialized dermatological preparations due to its high purity and minimal toxicity profile.

Major applications of Medical Grade HPC span core pharmaceutical manufacturing, including tablet granulation, wet granulation, and direct compression. In ophthalmology, low viscosity grades are employed in artificial tear solutions and contact lens wetting agents, capitalizing on their excellent lubricity and viscosity-enhancing capabilities to prolong contact time on the ocular surface. The benefits derived from using HPC include improved API stability, enhanced bioavailability through controlled dissolution rates, and streamlined manufacturing processes due to its consistent quality and predictable performance across various concentrations and pH environments. Furthermore, it is critical in ensuring dosage form uniformity and structural integrity throughout the product’s shelf life.

Key driving factors supporting the market expansion involve the continuous growth of the generic drug sector, which relies heavily on established, cost-effective excipients for bioequivalent formulations. Simultaneously, the development of novel specialized drugs requiring advanced controlled-release matrices fuels demand for specific high-molecular-weight grades of HPC. Global regulatory harmonization efforts and the push for continuous manufacturing technologies also indirectly benefit HPC, as its robust characteristics make it suitable for high-speed production lines, ensuring consistent and reproducible product quality.

Medical Grade Hydroxypropyl Cellulose Market Executive Summary

The Medical Grade Hydroxypropyl Cellulose market is witnessing significant growth, driven by robust expansion in global pharmaceutical manufacturing, particularly in the production of complex, modified-release oral solid dosage forms. Business trends indicate a strategic focus among leading manufacturers on backward integration to secure raw material supply (wood pulp or cotton linters) and continuous investment in advanced purification techniques to meet stringent pharmacopeial standards (USP, EP, JP). Furthermore, consolidation in the excipients sector, characterized by strategic partnerships and acquisitions, aims to broaden product portfolios and geographic reach, especially targeting emerging markets where pharmaceutical output is accelerating rapidly. The emphasis on high-ppurity, low-endotoxin grades for ophthalmic applications is a major quality differentiator currently influencing procurement decisions globally.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive domestic demand for healthcare products, coupled with rising contract manufacturing organization (CMO) activity serving global pharmaceutical giants. North America and Europe maintain dominance in terms of value, driven by high R&D spending, stringent regulatory requirements, and the early adoption of advanced drug delivery technologies, such as 3D printing in pharmaceuticals utilizing specialized HPC powders. Latin America and the Middle East & Africa (MEA) are emerging regions showing high potential, supported by improving healthcare infrastructure and expanding access to essential medicines, thereby increasing the requirement for locally sourced pharmaceutical excipients.

Segment trends highlight the dominance of the high-viscosity grade segment, largely due to its irreplaceable role in matrix systems for sustained release tablets, a crucial area of pharmaceutical development. However, the low-viscosity segment is projected to exhibit faster growth, propelled by the rising prevalence of ophthalmic preparations, immediate-release dosage forms, and specialized film coating applications. The market segmentation by application underscores the pharmaceutical segment's leading position, although the veterinary medicine and nutraceutical applications are also expanding, recognizing HPC's functional benefits and inert nature.

AI Impact Analysis on Medical Grade Hydroxypropyl Cellulose Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and the Medical Grade Hydroxypropyl Cellulose (HPC) market often revolve around optimizing synthesis and formulation efficiency, predicting product performance, and ensuring supply chain resilience. Key themes include the use of machine learning (ML) models to fine-tune the degree of substitution (DS) in HPC synthesis for desired viscosity and solubility characteristics, thereby reducing batch-to-batch variability and waste. Concerns frequently highlight the initial investment costs associated with integrating AI-driven monitoring systems into traditional cellulose ether manufacturing plants. Expectations are focused on AI's ability to accelerate the development cycle of novel drug formulations by predicting the optimal HPC grade and concentration required to achieve specific drug dissolution profiles, minimizing laborious and expensive empirical experimentation in preclinical stages. Users seek clarity on how predictive maintenance powered by AI can enhance equipment uptime and excipient quality consistency.

- AI-driven optimization of HPC synthesis parameters (temperature, pressure, catalyst concentration) to achieve precise molecular weight distribution and degree of substitution (DS).

- Machine Learning (ML) algorithms for predicting the functionality of new HPC batches in complex drug formulations, specifically focusing on dissolution rates and tablet hardness.

- Integration of AI in quality control systems to enable real-time defect detection and contaminant analysis during manufacturing, ensuring ultra-high purity required for medical grades.

- Predictive modeling of supply chain disruptions, allowing manufacturers to optimize inventory levels of raw materials and manage logistics for global distribution effectively.

- Use of deep learning for accelerating formulation development by screening potential excipient combinations and ratios, reducing reliance on traditional trial-and-error methods.

- AI enhancement of continuous manufacturing processes, monitoring flow properties and blending uniformity of HPC powders in high-speed compression lines.

DRO & Impact Forces Of Medical Grade Hydroxypropyl Cellulose Market

The Medical Grade Hydroxypropyl Cellulose (HPC) market dynamics are complexly governed by a confluence of accelerating drivers, stringent regulatory restraints, and compelling strategic opportunities. The primary driver is the pervasive demand for sustained-release and controlled-release dosage forms, where HPC acts as the foundational matrix polymer, directly addressing the need for improved patient compliance and therapeutic efficacy. Complementing this is the rapid expansion of the ophthalmology sector, which relies heavily on HPC's viscoelastic properties for high-quality artificial tear formulations and surgical aids. However, restraints present significant challenges; notably, the market is constrained by the volatility and increasing cost of purified cellulose raw materials and the rigorous, time-consuming process required for excipient registration and change management under global pharmacopeial standards. The potential for cost-effective alternatives, such as certain grades of HPMC (Hydroxypropyl Methylcellulose) in specific applications, also poses a competitive threat to market share.

Despite these restraints, substantial opportunities exist, particularly in leveraging the growing field of biopharmaceuticals and personalized medicine. HPC’s compatibility with sensitive biological molecules makes it a strong candidate for novel drug delivery systems, including microencapsulation and specialized parenteral formulations. Further opportunity lies in expanding usage within the functional food and nutraceutical industries, which increasingly seek pharmaceutical-grade ingredients for higher consumer trust and performance claims. The impact forces acting on the market are high, primarily stemming from intense regulatory scrutiny, which acts as both a barrier to entry (restraint) and a guarantee of quality (driver for established players). Technological shifts towards continuous manufacturing demand consistent, highly characterized excipients, thereby forcing material suppliers to invest heavily in advanced process control and quality assurance, significantly impacting operational expenses and market differentiation.

In summary, while the market benefits from undeniable demand spurred by demographic trends and pharmaceutical innovation, profitability and operational scaling are consistently challenged by supply chain fragility, pricing pressures from generic manufacturers, and the high cost associated with maintaining global GMP compliance. Strategic agility in managing raw material sourcing and proactive engagement with evolving regulatory landscapes remain critical determinants of success in the Medical Grade HPC sector.

Segmentation Analysis

The Medical Grade Hydroxypropyl Cellulose (HPC) market is comprehensively segmented based on its crucial attributes, including the grade of viscosity, which dictates its functional utility; the specific application domain, reflecting its end-use; and the manufacturing region, signifying market concentration and regulatory adherence. Segmentation by viscosity is crucial as it directly correlates with performance—high viscosity grades are optimized for sustained release matrices, while low viscosity grades excel in tablet binding, film coating, and ophthalmic formulations. The application analysis provides insight into the highest value segments, with pharmaceuticals dominating due to volume and stringent quality requirements. Geographic segmentation highlights differential growth rates and market maturity levels across established regions like North America and emerging hubs in Asia Pacific.

- By Grade (Viscosity):

- Low Viscosity Grade

- Medium Viscosity Grade

- High Viscosity Grade

- By Application:

- Pharmaceuticals (Tablet Binders, Film-Forming Agents, Controlled Release Matrices)

- Ophthalmology (Artificial Tears, Contact Lens Solutions, Surgical Viscoelastic Agents)

- Nutraceuticals

- Cosmetics & Personal Care (Medical Use)

- Others (Medical Devices, Veterinary Medicine)

- By Region:

- North America (US, Canada)

- Europe (Germany, UK, France, Italy, Spain)

- Asia Pacific (China, Japan, India, South Korea)

- Latin America (Brazil, Mexico)

- Middle East and Africa (MEA)

Value Chain Analysis For Medical Grade Hydroxypropyl Cellulose Market

The value chain for Medical Grade Hydroxypropyl Cellulose begins with the upstream sourcing of highly purified cellulose, typically derived from wood pulp or cotton linters. This primary stage is capital-intensive, requiring specialized processes like sulfite or sulfate pulping followed by meticulous purification steps to remove lignin and hemicelluloses, ensuring the starting material meets required purity standards. Key upstream challenges involve managing the commodity pricing volatility of wood pulp and ensuring sustainable, ethically sourced raw materials. Manufacturers must maintain strict quality control here, as the purity of the starting cellulose directly influences the final medical grade HPC performance and regulatory approval.

The transformation phase involves chemical processing, specifically the reaction of purified cellulose with propylene oxide under alkaline conditions to achieve etherification. This highly technical stage determines the critical characteristics of the HPC product, including the average molecular weight and the degree of substitution (DS), which in turn dictate the viscosity grade (low, medium, or high). Precision manufacturing, adherence to cGMP standards, robust cleaning protocols, and efficient drying and milling operations are vital in this central segment. Major producers differentiate themselves through proprietary synthesis techniques that yield narrow molecular weight distributions, providing consistent performance required by pharmaceutical clients.

Downstream activities focus on distribution and end-use application. The distribution channel is segmented into direct sales, often utilized for large pharmaceutical and established ophthalmic manufacturers who require customized specifications and technical support, and indirect distribution through specialized chemical distributors catering to smaller compounding pharmacies, research institutes, and nutraceutical companies. Direct distribution allows for stronger client relationships and faster feedback loops regarding product performance. The final stage is formulation, where pharmaceutical companies utilize HPC as a core excipient in tablet pressing, coating, or ophthalmic solution preparation, adding significant value by enabling complex drug delivery systems and obtaining regulatory approval for the final product.

Medical Grade Hydroxypropyl Cellulose Market Potential Customers

The primary and most critical segment of potential customers for Medical Grade Hydroxypropyl Cellulose consists of large-scale pharmaceutical manufacturing companies, both innovators and generic drug producers. These entities require high volumes of HPC to serve as essential excipients in oral solid dosage forms. As a binder, HPC ensures tablet integrity, and as a matrix former, it is indispensable for developing controlled-release medications, which constitute a large and growing segment of the global drug market. Procurement decisions in this sector are heavily influenced by regulatory compliance (DMF status, pharmacopeial certification), consistency of supply, and technical support provided by the excipient supplier regarding formulation challenges and quality documentation.

Another significant customer base lies within the specialized ophthalmology sector. Companies manufacturing sterile solutions, such as artificial tears, dry eye relief drops, and ophthalmic gels, are core buyers of low-viscosity, ultra-pure HPC grades. These manufacturers demand excipients with minimal microbial load and specific rheological properties to mimic natural tears and enhance corneal contact time. Furthermore, medical device companies utilize HPC in certain applications, such as surgical gels or lubricants, valuing its non-toxicity and excellent lubrication properties. This niche requires exceptional quality assurance and batch-to-batch consistency, often leading to long-term supply agreements.

Secondary, yet rapidly expanding, customer segments include nutraceutical companies and contract manufacturing organizations (CMOs) specialized in developing dietary supplements and health products. Nutraceutical manufacturers seek medical-grade HPC to enhance the appeal and delivery of their products, leveraging the same functional benefits (binding, film-forming) found in pharmaceuticals, but often prioritizing stability and consumer-friendly aesthetics. CMOs, serving diverse clients, act as volume aggregators, purchasing various grades of HPC based on the specifications of the drug product they are contracted to manufacture, making them highly sensitive to price and immediate availability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650.4 Million |

| Market Forecast in 2033 | USD 1,105.7 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shin-Etsu Chemical Co., Ltd., Ashland Global Holdings Inc., HPMC Manufacturer Co., Ltd. (Fujian), The Dow Chemical Company, Lotte Fine Chemical Co., Ltd., JRS Pharma GmbH & Co. KG, Nippon Soda Co., Ltd., Colorcon (BPSI Holdings, LLC), Huzhou Zhanwang Pharmaceutical Co., Ltd., Daicel Corporation, Zhejiang Haishen Chemical Co., Ltd., Merck KGaA, Avantor, Inc., Roquette Frères, FMC Corporation (DuPont), Celanese Corporation, BASF SE, Anhui Sunhere Pharmaceutical Co., Ltd., Shandong Head Co., Ltd., Wuxi Tianshili Pharmaceutical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medical Grade Hydroxypropyl Cellulose Market Key Technology Landscape

The technology landscape for Medical Grade Hydroxypropyl Cellulose manufacturing is centered on highly controlled etherification processes designed to yield extremely pure and functionally consistent polymers. The core technological challenges involve achieving a uniform degree of substitution (DS) of hydroxypropyl groups onto the cellulose backbone, which directly governs the resulting polymer’s solubility, thermal properties, and viscosity profile—critical parameters for pharmaceutical applications. Advanced reaction technologies, including pressurized reactor systems and specialized alkali catalysts, are employed to ensure high purity and minimal residual impurities, complying with strict Good Manufacturing Practices (GMP) and reducing residual organic solvents to pharmacopeial limits. Manufacturers are continually refining these synthesis methods to maximize reaction efficiency and minimize environmental impact while achieving narrow polydispersity indices (PDI) for superior excipient performance.

Beyond synthesis, a critical technological area involves precision particle engineering and characterization. High-shear granulation, specialized milling, and sieving technologies are utilized to produce HPC powders with specific particle sizes and morphologies required for different drug manufacturing techniques, such as direct compression or wet granulation. For example, high-flowability grades are essential for modern high-speed tablet presses. Furthermore, quality assurance relies on sophisticated analytical techniques, including Gel Permeation Chromatography (GPC) for molecular weight determination, Nuclear Magnetic Resonance (NMR) spectroscopy for precise DS measurement, and Differential Scanning Calorimetry (DSC) for thermal stability assessment. These tools are non-negotiable for establishing the medical grade status of the material.

A recent technological advancement focuses on the integration of continuous manufacturing processes within HPC production. Traditional batch processes are being replaced or augmented by continuous flow reactors and in-line process analytical technology (PAT) tools. PAT allows for real-time monitoring and adjustment of critical quality attributes (CQAs) during synthesis and purification, significantly enhancing batch consistency, reducing production cycle times, and minimizing the risk of contamination. This shift aligns HPC manufacturers with the broader pharmaceutical industry’s push toward more efficient and reliable production paradigms, ensuring that the excipient quality is maximized for use in innovative drug delivery systems like 3D printed tablets and personalized medicine applications.

Regional Highlights

The global Medical Grade Hydroxypropyl Cellulose (HPC) market exhibits distinct regional dynamics, influenced by local regulatory environments, pharmaceutical production capacities, and demographic structures.

- North America (United States, Canada): This region dominates the market value, driven by extensive pharmaceutical research and development, a robust biopharmaceutical sector, and high expenditure on specialized drug delivery technologies. The US remains a key consumer of high-viscosity HPC grades for complex controlled-release systems and specialized ophthalmic products, bolstered by stringent FDA oversight ensuring demand for the highest quality excipients.

- Europe (Germany, UK, France): Europe represents a mature market characterized by advanced regulatory standards (EMA) and a strong presence of global excipient suppliers. Germany, in particular, leads in pharmaceutical manufacturing and formulation innovation, driving consistent demand for certified medical grade HPC in oral solids and veterinary applications. The emphasis here is often on sustainable sourcing and supply chain transparency.

- Asia Pacific (China, Japan, India, South Korea): APAC is the fastest-growing region, primarily due to the rapid expansion of generic drug manufacturing in India and China, coupled with increasing investments in local healthcare infrastructure. China is both a major producer and consumer, while Japan maintains high quality standards, similar to Western markets, particularly in advanced ophthalmic preparations. This region offers immense potential for market penetration.

- Latin America (Brazil, Mexico): Characterized as an emerging market, Latin America is experiencing rising demand linked to improving healthcare access and increased domestic pharmaceutical manufacturing. Brazil and Mexico are key markets where international excipient suppliers are establishing distribution networks to cater to the growing need for basic and controlled-release medications.

- Middle East and Africa (MEA): This region currently holds the smallest market share but is exhibiting gradual growth, particularly in the Gulf Cooperation Council (GCC) countries, driven by government initiatives to establish local pharmaceutical manufacturing capabilities (drug security) and reduce reliance on imports. Demand is often concentrated in high-purity medical applications and ophthalmology.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medical Grade Hydroxypropyl Cellulose Market.- Shin-Etsu Chemical Co., Ltd.

- Ashland Global Holdings Inc.

- The Dow Chemical Company

- Lotte Fine Chemical Co., Ltd.

- JRS Pharma GmbH & Co. KG

- Nippon Soda Co., Ltd.

- Colorcon (BPSI Holdings, LLC)

- Daicel Corporation

- Huzhou Zhanwang Pharmaceutical Co., Ltd.

- Zhejiang Haishen Chemical Co., Ltd.

- Merck KGaA

- Avantor, Inc.

- Roquette Frères

- FMC Corporation (DuPont)

- Celanese Corporation

- BASF SE

- Anhui Sunhere Pharmaceutical Co., Ltd.

- Shandong Head Co., Ltd.

- Wuxi Tianshili Pharmaceutical Co., Ltd.

- Rayonier Advanced Materials

Frequently Asked Questions

Analyze common user questions about the Medical Grade Hydroxypropyl Cellulose market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between high-viscosity and low-viscosity Medical Grade HPC?

High-viscosity Medical Grade HPC is primarily used as a matrix former in sustained-release tablets, creating a viscous gel barrier that controls the rate of drug dissolution over extended periods. Low-viscosity grades are utilized mainly as binders in tablet compression, film-coating agents for immediate-release dosage forms, and viscosity modifiers in ophthalmic solutions (e.g., artificial tears), where minimal gelling but strong film-forming capability is required for optimized performance.

How does the regulatory environment influence the sourcing and cost of Medical Grade HPC?

The regulatory environment, governed by entities like the FDA, EMA, and pharmacopeial monographs (USP, EP, JP), mandates extremely strict purity, quality, and consistency standards (cGMP) for medical excipients. This stringent oversight necessitates high manufacturing costs, detailed documentation (DMFs), and lengthy qualification processes, directly influencing the final cost and favoring established suppliers capable of maintaining global compliance and extensive quality control protocols.

What key function does HPC perform in controlled-release drug formulations?

In controlled-release systems, Medical Grade HPC acts as a hydrophilic matrix former. When the dosage form comes into contact with aqueous fluid, the HPC swells to form a highly viscous, continuous barrier layer around the drug. This layer dictates the rate at which water penetrates the core and the active pharmaceutical ingredient (API) diffuses out, allowing for precise control over the drug release kinetics over several hours.

Is Medical Grade Hydroxypropyl Cellulose suitable for continuous pharmaceutical manufacturing processes?

Yes, Medical Grade HPC is increasingly critical for continuous manufacturing. Due to its excellent flow properties, consistent particle size distribution, and predictable performance, specific grades are optimized for high-speed direct compression and continuous wet granulation lines. Its stability and functional consistency are essential for maintaining critical quality attributes (CQAs) in these rapid, integrated production environments, enabling efficient, large-volume drug production.

Which geographical region is expected to demonstrate the fastest growth rate for HPC consumption?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth in Medical Grade HPC consumption during the forecast period. This acceleration is attributed to the substantial growth in the generic drug industry, increased government investment in local pharmaceutical production capabilities across China and India, and rising demand for over-the-counter and specialized ophthalmic products driven by large, aging populations in countries like Japan and South Korea.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager