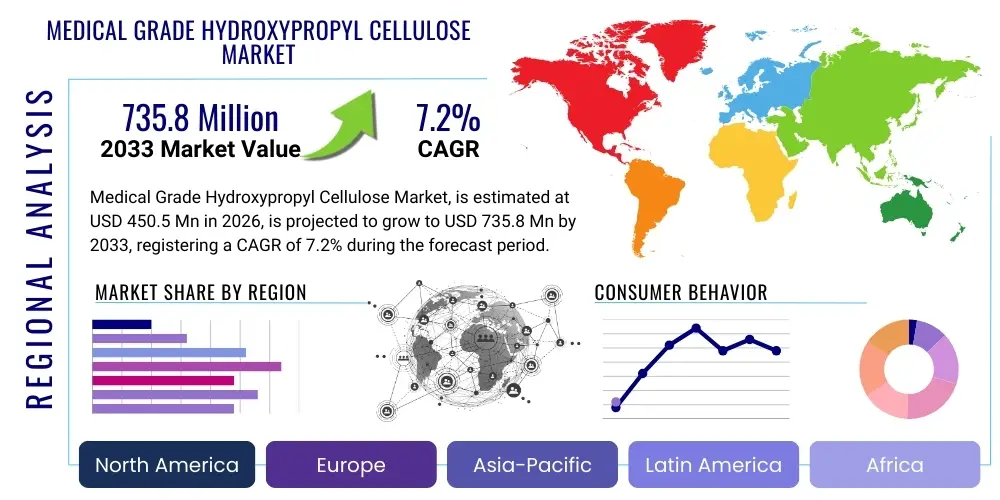

Medical Grade Hydroxypropyl Cellulose Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439151 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Medical Grade Hydroxypropyl Cellulose Market Size

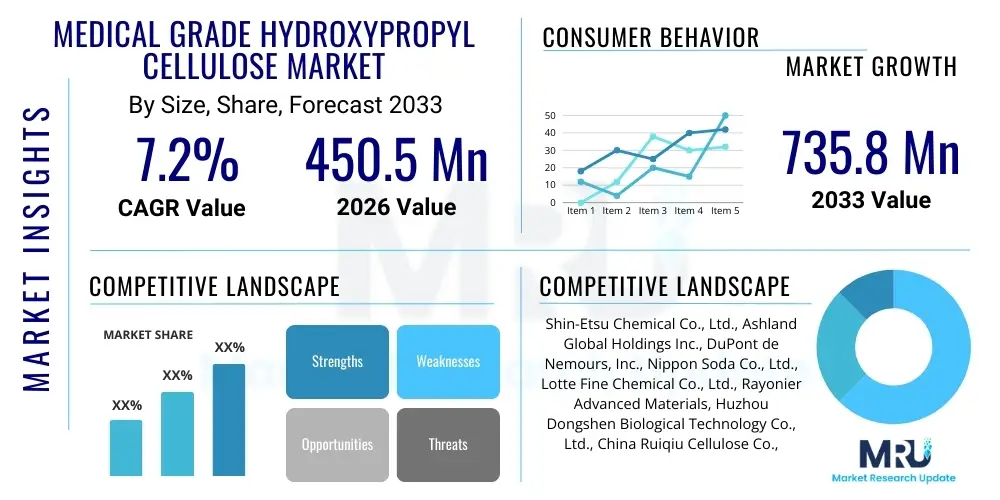

The Medical Grade Hydroxypropyl Cellulose Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 735.8 Million by the end of the forecast period in 2033.

Medical Grade Hydroxypropyl Cellulose Market introduction

Medical Grade Hydroxypropyl Cellulose (HPC) is a highly versatile, non-ionic cellulose ether utilized extensively across the pharmaceutical, ophthalmology, and advanced wound care sectors. Its defining characteristics, including excellent film-forming capabilities, superior water solubility, and exceptional binding properties, make it an indispensable excipient in drug formulation. HPC serves critical functions such as acting as a tablet binder, a disintegrant, a matrix former for controlled release systems, and a viscosity modifier in topical and ophthalmic preparations. The market growth is fundamentally linked to the global expansion of the generic and specialty drug manufacturing industries, coupled with rising demand for sophisticated drug delivery mechanisms that enhance patient compliance and therapeutic efficacy.

The product is typically synthesized through the etherification of alkali cellulose with propylene oxide. Achieving "medical grade" status requires stringent compliance with pharmacopeial standards (such as USP, EP, and JP) regarding purity, molecular weight distribution, and dissolution profiles. These quality requirements ensure safety and consistency when HPC is used in direct contact with biological systems. Key application areas include oral solids (tablets and capsules), ocular solutions (artificial tears), transdermal patches, and novel biodegradable matrices for tissue engineering. The demand landscape is also shifting towards low-viscosity grades for immediate release formulations and high-viscosity grades for sustained or extended-release matrices, enabling pharmaceutical companies to develop complex dosage forms efficiently.

Major driving factors influencing this specialized market include the increasing prevalence of chronic diseases requiring long-term medication, necessitating advanced controlled-release technologies. Furthermore, technological advancements in continuous manufacturing processes in the pharmaceutical industry are improving the incorporation efficiency of functional excipients like HPC. The inherent biocompatibility and low toxicity of HPC further solidify its position as a preferred polymer over synthetic alternatives, particularly in sensitive applications like ophthalmics and implantable devices, thereby securing a robust growth trajectory throughout the forecast period.

Medical Grade Hydroxypropyl Cellulose Market Executive Summary

The Medical Grade Hydroxypropyl Cellulose (HPC) market is experiencing strong momentum driven by robust expansion in pharmaceutical R&D spending and the accelerating shift towards advanced drug delivery systems, particularly in North America and Asia Pacific. Business trends indicate a focus among manufacturers on securing certifications for specialized, high-purity grades that meet specific regulatory requirements for biological and high-potency drug formulations. Strategic partnerships between HPC producers and major Contract Development and Manufacturing Organizations (CDMOs) are defining the supply chain, ensuring a stable influx of high-quality excipients required for global pharmaceutical production volumes.

Regionally, the Asia Pacific market is poised for the highest growth rate, fueled by expanding domestic generic drug markets in India and China, alongside increasing investment in local manufacturing infrastructure that requires high volumes of pharmaceutical excipients. North America and Europe, characterized by mature and highly regulated pharmaceutical sectors, remain dominant in terms of value generation, emphasizing the use of high-grade HPC in complex, patented drug formulations and innovative medical devices. Regulatory harmonization efforts across these regions are simultaneously driving demand for excipients with uniform quality profiles, benefiting established global suppliers.

Segmentation trends highlight the increasing dominance of the low-viscosity segment, primarily due to its broad utility as a tablet binder and film coating agent in high-volume generic drug production. However, the high-viscosity segment is critical for specialty applications, specifically sustained-release oral dosage forms and advanced ophthalmic gels, commanding premium pricing. Application-wise, oral formulation remains the largest revenue generator, but the ophthalmology segment is registering rapid growth, supported by the rising incidence of dry eye syndrome and the need for preservative-free, viscous tear substitutes where HPC is a key component.

AI Impact Analysis on Medical Grade Hydroxypropyl Cellulose Market

User inquiries concerning AI's impact on the HPC market primarily center on optimizing formulation development, predicting API-excipient compatibility, and streamlining quality control. Users express keen interest in how machine learning algorithms can rapidly screen potential excipient combinations, reducing the time and cost associated with preclinical formulation studies. Key thematic concerns revolve around utilizing AI for predictive modeling of drug release profiles based on HPC molecular weight and substitution levels, ensuring optimal performance of sustained-release tablets without extensive physical prototyping. Furthermore, significant expectations are placed on AI for enhancing manufacturing efficiency by monitoring complex continuous manufacturing lines where HPC is utilized, flagging deviations in real-time, and guaranteeing batch-to-batch consistency that meets stringent medical standards.

The integration of Artificial Intelligence and Machine Learning (ML) is fundamentally altering how pharmaceutical companies select and utilize specialized excipients such as Medical Grade Hydroxypropyl Cellulose. AI algorithms are being deployed to analyze vast datasets relating to excipient physical properties, stability data, and processing parameters, allowing formulators to quickly identify the optimal grade and concentration of HPC for a specific Active Pharmaceutical Ingredient (API). This predictive capability minimizes empirical testing, accelerates the development timeline for novel dosage forms, and ensures higher first-pass success rates in stability testing.

Beyond formulation, AI is crucial in quality assurance and supply chain management. Advanced image recognition and sensor fusion technologies, powered by AI, are monitoring the physicochemical properties of incoming HPC raw materials and the final drug products. This detailed monitoring capability ensures compliance with AEO requirements related to purity and particle size distribution. Moreover, predictive maintenance models utilize AI to optimize the operation of key processing equipment (e.g., granulation and tablet presses), maximizing the efficient use of high-value excipients like HPC and reducing waste, thereby contributing significantly to operational cost savings across the pharmaceutical manufacturing sector.

- AI-driven predictive modeling optimizes HPC grade selection for target drug release profiles.

- Machine learning accelerates preclinical formulation screening and reduces experimental failures.

- AI enhances quality control through real-time monitoring of excipient purity and consistency during manufacturing.

- Predictive analytics supports supply chain resilience for high-demand medical grade HPC raw materials.

- AI optimizes continuous manufacturing parameters, ensuring efficient utilization of HPC in high-throughput processes.

DRO & Impact Forces Of Medical Grade Hydroxypropyl Cellulose Market

The Medical Grade Hydroxypropyl Cellulose market is primarily driven by the expanding global pharmaceutical industry and the shift toward specialized dosage forms, countered by restraints related to stringent regulatory approval processes and volatility in raw material costs. Opportunities are abundant in the development of novel applications, particularly in biopharmaceuticals and specialized medical devices where HPC's biocompatibility is paramount. The interplay of these factors creates significant impact forces, pressuring manufacturers to invest continuously in purification technologies and maintain competitive pricing strategies while adhering to exacting quality standards mandated by global pharmacopeias.

Drivers: The fundamental driver is the escalating demand for high-quality pharmaceutical excipients suitable for sophisticated drug delivery systems, especially sustained-release oral tablets and complex ophthalmic solutions. The aging global population necessitates increased use of chronic disease medications, which often rely on HPC for controlled release kinetics. Furthermore, the push for patient convenience and compliance has amplified the need for once-daily dosing regimens, making HPC a core component in matrix formulation technology. The growth of the biosimilar and generic markets globally also drives volume demand for cost-effective, high-performance excipients.

Restraints: Significant restraints include the highly capital-intensive nature of achieving and maintaining medical-grade certification, which acts as a barrier to entry for smaller manufacturers. Fluctuations in the cost of propylene oxide and cellulose pulp—the primary raw materials—can affect profit margins. Moreover, the long and complex regulatory approval cycle for new drug formulations, which necessitates extensive stability testing for every excipient change, often slows down the adoption of innovative HPC grades. Potential competition from alternative polymers such as hypromellose (HPMC) and various acrylic polymers, though less versatile in some film-forming aspects, also presents a market constraint.

Opportunities: Key opportunities lie in developing next-generation functionalized HPC derivatives optimized for specialized drug classes, such as sensitive proteins or low-solubility APIs. The expanding application base in specialized wound care products, biodegradable implants, and 3D-printed pharmaceutical dosage forms represents untapped high-value segments. Geographically, emerging economies offer significant growth avenues as their pharmaceutical regulatory standards evolve and local manufacturing capabilities mature. Strategic partnerships focused on developing co-processed excipients incorporating HPC to simplify drug manufacturing steps present high commercial viability.

Segmentation Analysis

The Medical Grade Hydroxypropyl Cellulose market is systematically segmented based on viscosity grade, application area, and end-user type, allowing for precise market analysis tailored to distinct functional requirements within the healthcare industry. Viscosity categorization (low, medium, high) directly impacts the excipient's utility; low viscosity grades are favored for immediate release and tablet coating, medium grades for general binding and thickeners, and high viscosity grades are essential for achieving extended release kinetics and forming robust ophthalmic gels. This segmentation reflects the core functional roles HPC plays in stabilizing and modulating drug delivery.

Analysis by application reveals that oral formulations—encompassing tablets and capsules—account for the dominant market share, owing to the massive volume of orally administered drugs produced globally. However, specialized segments like ophthalmics and topical preparations exhibit faster growth rates due to the increasing incidence of related conditions and the need for highly refined, non-irritating excipients. The precise purity and quality control required for ophthalmics elevate the value proposition of the HPC utilized in this segment, driving specialized manufacturing processes.

End-user segmentation differentiates between pharmaceutical companies (the largest consumer), contract manufacturing organizations (CMOs/CDMOs), and research and academic institutions. The rising trend of outsourcing formulation and manufacturing to CDMOs significantly influences market dynamics, as these organizations require high-volume, globally certified batches of medical-grade HPC. Understanding these segment dynamics is critical for suppliers to align production capabilities and strategic pricing with the highly specific demands of each medical subsector.

- By Viscosity Grade

- Low Viscosity HPC

- Medium Viscosity HPC

- High Viscosity HPC

- By Application

- Oral Formulations (Tablets, Capsules, Suspensions)

- Ophthalmics (Artificial Tears, Gels)

- Topical Formulations (Creams, Ointments)

- Transdermal Patches

- Specialty Drug Delivery Systems

- By End-User

- Pharmaceutical Companies

- Contract Development and Manufacturing Organizations (CDMOs)

- Medical Device Manufacturers

- Research and Academic Institutions

Value Chain Analysis For Medical Grade Hydroxypropyl Cellulose Market

The value chain for Medical Grade Hydroxypropyl Cellulose initiates with the procurement and refinement of upstream raw materials, primarily high-purity wood pulp or cotton linters (cellulose) and propylene oxide. The quality and stable sourcing of these raw materials are foundational, as any impurity can severely compromise the 'medical grade' certification of the final product. Manufacturers focus intensely on the etherification process, which transforms alkali cellulose into HPC, followed by purification, grinding, and sieving to meet specific particle size distribution and viscosity standards required by pharmacopeias. This manufacturing step, characterized by high capital investment and technical expertise, adds the most significant value.

Downstream analysis involves the direct sales and distribution channels leading to the end-users. Direct sales are often preferred for major pharmaceutical clients requiring large, bespoke batches with strict quality documentation, facilitating deeper technical support and long-term contracts. Indirect distribution relies on specialized excipient distributors and chemical suppliers who manage inventory, handle smaller orders, and provide regional access to diverse end-users, including compounding pharmacies and smaller medical device firms. The distribution channel must comply with stringent handling and storage regulations to maintain product integrity, which adds complexity and cost to logistics.

The final stage involves the utilization of HPC by pharmaceutical and medical device manufacturers in their final product formulations. The value generated here is linked to the successful performance of HPC in achieving desired drug release profiles, enhancing stability, or providing necessary viscosity for a medical application. Feedback from these end-users regarding functionality and processability is critical, driving continuous product improvement in molecular structure and purity profiles upstream. This iterative cycle, governed by rigorous regulatory oversight, defines the competitive landscape of the market.

Medical Grade Hydroxypropyl Cellulose Market Potential Customers

The primary consumers of Medical Grade Hydroxypropyl Cellulose are globally recognized pharmaceutical companies that develop and manufacture branded and generic prescription drugs. These entities utilize HPC as a core functional excipient in various dosage forms, predominantly oral tablets for binding and controlled release, and as a stabilizer in liquid and suspension formulations. Their demand is characterized by high volume requirements and an absolute need for excipients that meet or exceed official pharmacopeial standards (USP, EP, JP) to ensure regulatory compliance across global markets.

A rapidly growing customer segment comprises Contract Development and Manufacturing Organizations (CDMOs). As pharmaceutical companies increasingly outsource formulation development and large-scale production, CDMOs become critical intermediaries. They require diverse grades of HPC to serve multiple clients and specialized projects, ranging from immediate-release generic tablets to complex extended-release matrices or advanced parenteral formulations, driving diversified demand for various viscosity profiles.

Furthermore, specialty segments such as ophthalmic solution producers and medical device manufacturers constitute high-value customers. Ophthalmic companies rely on high-purity HPC to manufacture artificial tears and eye drop formulations that require excellent film persistence and compatibility with sensitive eye tissues. Medical device companies use HPC in hydrogel matrices for wound dressings and as binders or coatings for implantable devices, prioritizing biocompatibility and degradation kinetics. These customers necessitate highly purified, often sterilized, grades of HPC, reflecting a niche but rapidly expanding area of consumption.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 735.8 Million |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shin-Etsu Chemical Co., Ltd., Ashland Global Holdings Inc., DuPont de Nemours, Inc., Nippon Soda Co., Ltd., Lotte Fine Chemical Co., Ltd., Rayonier Advanced Materials, Huzhou Dongshen Biological Technology Co., Ltd., China Ruiqiu Cellulose Co., Ltd., Shandong Head Co., Ltd., CP Kelco U.S., Inc., JRS PHARMA GmbH & Co. KG, Dow Chemical Company, AkzoNobel N.V., WACKER CHEMIE AG, Merck KGaA, Avantor, Inc., SE Tylose GmbH & Co. KG, Maple Pharma, Hefei TNJ Chemical Industry Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medical Grade Hydroxypropyl Cellulose Market Key Technology Landscape

The core technology surrounding Medical Grade Hydroxypropyl Cellulose production involves highly controlled etherification processes designed to achieve precise substitution patterns and molecular weight ranges. Manufacturing techniques have evolved from traditional batch reactors to modern, highly automated systems utilizing advanced temperature and pressure controls, which are essential for producing consistently high-purity HPC variants required for medical applications. Critical advancements include continuous processing technologies that not only improve production efficiency but also enhance the homogeneity and batch-to-batch consistency of the polymer, a non-negotiable requirement in pharmaceutical excipient manufacturing.

Current technological innovations are focused on creating specialized, functionalized HPC derivatives optimized for next-generation drug delivery challenges. This includes developing ultra-low viscosity grades tailored for immediate dissolution and high-concentration injectable suspensions, as well as highly pure grades intended for ophthalmic use where minimizing microbial load and particle contamination is critical. Furthermore, surface modification technologies, such as co-processing HPC with other excipients like silicon dioxide or magnesium stearate, are gaining traction to improve flowability, compressibility, and tableting efficiency, simplifying manufacturing for end-users.

A significant technological frontier is the integration of HPC into advanced pharmaceutical manufacturing methods, notably 3D printing (additive manufacturing). HPC's thermoplasticity and excellent binding properties make it an ideal filament or powder component for printing customized dosage forms (polypills) with complex release profiles. Research also heavily involves optimizing HPC grades for hot-melt extrusion (HME) and continuous direct compression techniques, ensuring that the excipient remains stable and functional under high shear and temperature stresses, thus supporting the industry-wide transition towards streamlined, efficient, and personalized medicine manufacturing.

Regional Highlights

The global Medical Grade Hydroxypropyl Cellulose market exhibits distinct regional dynamics driven by varying levels of pharmaceutical maturity, regulatory stringency, and manufacturing capacity. These regional highlights dictate investment strategies and supply chain allocations for major excipient producers.

- North America: This region holds a dominant share in terms of market value, primarily driven by the presence of major global pharmaceutical innovators and a substantial budget allocated to R&D for specialty drugs. High regulatory standards (FDA compliance) ensure demand for the highest purity and most technologically advanced grades of HPC. The focus here is on novel drug delivery systems, including controlled-release matrices and specialized ophthalmics.

- Europe: Characterized by a robust generics market and strong emphasis on quality standards (EMA), Europe is a mature market sustaining steady growth. Germany, France, and the UK are key contributors. The region shows strong adoption of functional excipients like HPC in continuous manufacturing processes, driven by regulatory incentives for modernization and efficient production, particularly in sustained-release oral solids.

- Asia Pacific (APAC): APAC is forecast to register the highest Compound Annual Growth Rate (CAGR). This expansion is fueled by the rapid growth of domestic pharmaceutical industries in China and India, the rising prevalence of lifestyle diseases, and increasing foreign direct investment in local manufacturing hubs. The primary demand driver is the high-volume production of affordable generic medicines, necessitating large quantities of standard and low-viscosity HPC grades. Japan maintains a leadership role in high-quality specialized excipients for its domestic market.

- Latin America (LATAM): Growth in LATAM is moderate but stable, concentrated mainly in Brazil and Mexico. Market expansion is dependent on improving regulatory harmonization and increasing penetration of patented drug formulations and local generic production. HPC demand is driven by local initiatives to enhance drug stability and shelf life in challenging climatic conditions.

- Middle East and Africa (MEA): This region is an emerging market, focusing on establishing localized pharmaceutical manufacturing capabilities to reduce reliance on imports. Growth is volatile but significant in nations like Saudi Arabia and the UAE. The demand for medical-grade HPC is intrinsically linked to government initiatives promoting healthcare infrastructure development and pharmaceutical self-sufficiency.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medical Grade Hydroxypropyl Cellulose Market.- Shin-Etsu Chemical Co., Ltd.

- Ashland Global Holdings Inc.

- DuPont de Nemours, Inc.

- Nippon Soda Co., Ltd.

- Lotte Fine Chemical Co., Ltd.

- Rayonier Advanced Materials

- Huzhou Dongshen Biological Technology Co., Ltd.

- China Ruiqiu Cellulose Co., Ltd.

- Shandong Head Co., Ltd.

- CP Kelco U.S., Inc.

- JRS PHARMA GmbH & Co. KG

- Dow Chemical Company

- AkzoNobel N.V.

- WACKER CHEMIE AG

- Merck KGaA

- Avantor, Inc.

- SE Tylose GmbH & Co. KG

- Maple Pharma

- Hefei TNJ Chemical Industry Co., Ltd.

- Sigachi Industries Limited

Frequently Asked Questions

Analyze common user questions about the Medical Grade Hydroxypropyl Cellulose market and generate a concise list of summarized FAQs reflecting key topics and concerns.What differentiates Medical Grade Hydroxypropyl Cellulose (HPC) from standard industrial grades?

Medical Grade HPC adheres to strict pharmacopeial standards (USP, EP, JP) concerning purity, heavy metal content, residual solvents, and specific molecular weight distributions. It must be non-toxic, biocompatible, and demonstrate high consistency required for drug formulation, unlike industrial grades used in construction or non-critical applications.

What are the primary functions of HPC in oral pharmaceutical dosage forms?

HPC serves multiple critical roles in oral formulations, including acting as an effective tablet binder to provide mechanical strength, a matrix former for achieving sustained or extended drug release profiles, and a film-former for protective and aesthetic coatings.

Which viscosity grade of HPC is typically used for sustained-release applications?

High Viscosity Grades of HPC are typically used for sustained-release applications. These grades form robust hydrogel matrices when hydrated, significantly slowing the diffusion and dissolution rate of the active pharmaceutical ingredient (API), enabling once-daily dosing regimens.

How does the increasing adoption of continuous manufacturing affect HPC demand?

Continuous manufacturing demands excipients with highly consistent physical properties, such as particle size and flowability. HPC suppliers must provide specialized, high-performance grades that ensure process efficiency and uniform quality output in continuous direct compression and hot-melt extrusion lines.

Which regional market is projected to exhibit the fastest growth for medical grade HPC?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth, primarily driven by the massive expansion of generic pharmaceutical manufacturing bases in countries like China and India, alongside increasing regional investment in sophisticated drug development and healthcare infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager