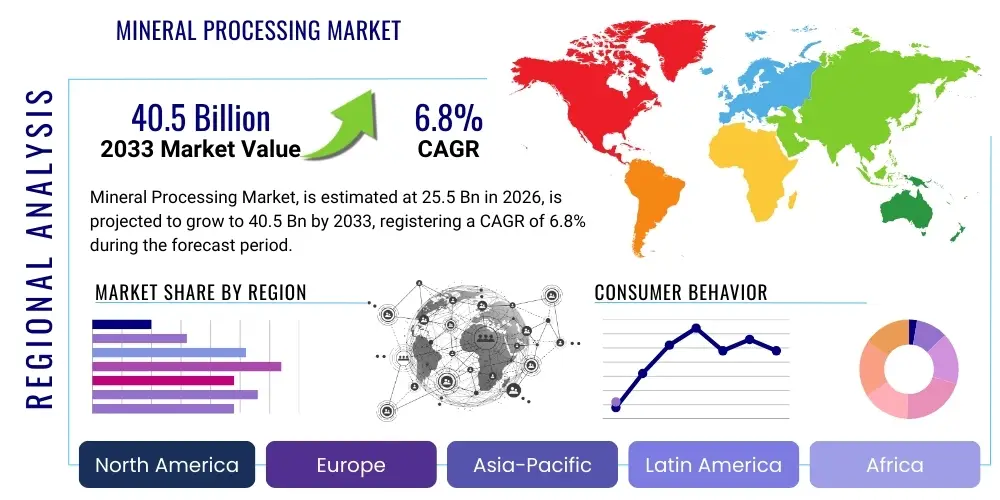

Mineral Processing Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442931 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Mineral Processing Market Size

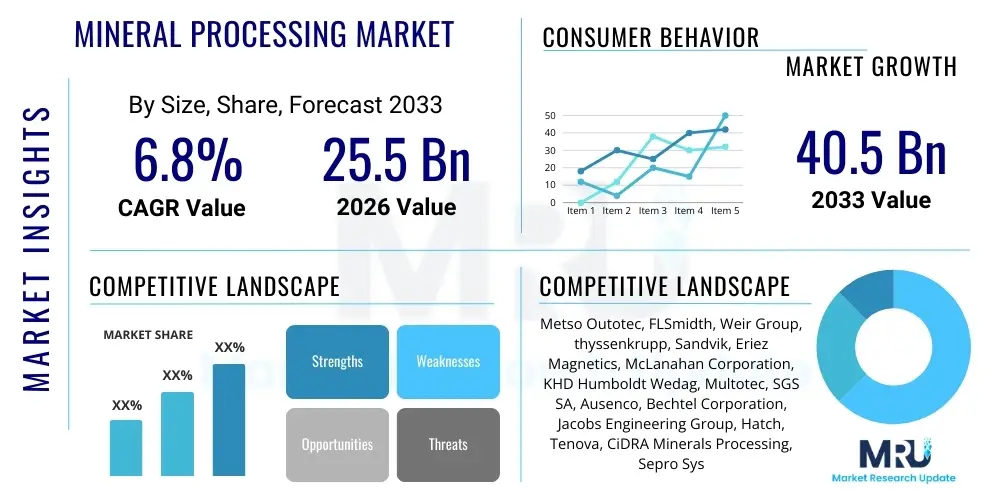

The Mineral Processing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $25.5 Billion in 2026 and is projected to reach $40.5 Billion by the end of the forecast period in 2033.

This robust growth trajectory is primarily underpinned by the accelerating global demand for critical minerals required in renewable energy technologies, electric vehicle manufacturing, and advanced electronics. Increased exploration activity in emerging economies, coupled with the necessity to process lower-grade ores efficiently and sustainably, drives significant investment in advanced comminution, separation, and extraction technologies. Furthermore, stringent environmental regulations necessitating water and energy efficiency are compelling mining operators to adopt modern processing methodologies, thereby expanding the market scope for sophisticated equipment and chemical reagents.

The transition toward digitalization, including the integration of Industrial IoT (IIoT) and advanced process control systems (APCS), is transforming operational efficiency within mineral processing plants. These technological advancements not only reduce operational costs but also maximize recovery rates, which is crucial as the average ore grade declines globally. Geopolitical factors influencing commodity supply chains also necessitate localized and efficient processing capabilities, stimulating capital expenditure in new and upgraded facilities across key resource-rich regions, solidifying the market's favorable outlook through 2033.

Mineral Processing Market introduction

The Mineral Processing Market encompasses the industrial sector dedicated to extracting valuable minerals from their raw ores, refining them into concentrates or finished products suitable for manufacturing and industrial use. This complex industry covers a wide range of physical and chemical operations, fundamentally including comminution (crushing and grinding), sizing, concentration (flotation, gravity separation, magnetic separation), and extraction processes (hydrometallurgy and pyrometallurgy). The primary objective of mineral processing is to maximize the economic recovery of desired minerals while minimizing environmental impact and operating costs, often dealing with increasingly complex ore bodies and lower metal concentrations.

Major applications of mineral processing extend across the extraction of metallic minerals (iron, copper, gold, nickel, lithium, cobalt), non-metallic minerals (phosphate, potash, industrial sands), and energy minerals (coal, uranium). The market is inextricably linked to global industrial output, infrastructure development, and technological shifts, particularly the energy transition. For instance, the escalating demand for battery minerals like lithium, cobalt, and nickel is creating a specialized and high-growth segment within the broader processing market, demanding tailored, high-efficiency chemical and physical separation techniques.

Key driving factors fueling market expansion include the exponential increase in global population, necessitating greater infrastructure and housing development; the aggressive push for decarbonization and electrification, which requires vast amounts of processed raw materials; and the widespread integration of advanced automation and data analytics tools designed to optimize recovery rates and improve safety standards. The sustained global commodity supercycle, characterized by supply chain constraints and higher material prices, also encourages investment in upstream processing capabilities, ensuring long-term supply security and operational resilience for global industries.

Mineral Processing Market Executive Summary

The Mineral Processing Market is characterized by significant capital expenditure focused on modernization and efficiency improvements, driven by macro-environmental pressures related to ore quality degradation and sustainability mandates. Current business trends emphasize the adoption of modular processing plants, allowing for rapid deployment and scalability, particularly in remote mining locations. The industry is witnessing consolidation among equipment manufacturers who are integrating advanced digital solutions—including sensors, machine learning algorithms, and real-time process simulators—into their core product offerings to provide end-to-end efficiency packages. Strategic partnerships between mining companies and technology providers are crucial for piloting and scaling novel water-saving and energy-reducing technologies, such as High-Pressure Grinding Rolls (HPGRs) and advanced froth flotation circuits, positioning operational optimization as a central competitive differentiator.

Regionally, the Asia Pacific (APAC) market maintains dominance, primarily due to the massive scale of mining operations in China, India, and Australia, coupled with rapid industrialization and corresponding mineral consumption growth. North America and Europe, while having mature mining sectors, are focusing heavily on developing sustainable and ethical mineral supply chains, which translates into higher adoption rates for advanced, environmentally compliant processing techniques, especially in critical mineral recovery. Latin America, rich in copper and iron ore reserves, shows robust growth driven by major greenfield and brownfield expansion projects aiming to meet global demand, often facilitated by foreign direct investment in large-scale processing infrastructure.

Segment trends reveal that the comminution segment, though mature, is undergoing significant technological disruption through energy-efficient alternatives like HPGRs and semi-autogenous grinding (SAG) mills optimized using predictive maintenance. The hydrometallurgy segment is expected to exhibit the fastest growth, propelled by complex ore bodies requiring chemical leaching processes and the increasing focus on urban mining and recycling of secondary raw materials, particularly battery metals. Furthermore, the consumables segment, including grinding media and chemical reagents (e.g., flocculants, collectors), is highly sensitive to production volumes and faces continuous innovation pressure to improve selectivity and reduce chemical usage per ton of ore processed, aligning profitability with sustainability metrics.

AI Impact Analysis on Mineral Processing Market

Analysis of common user questions regarding the impact of Artificial Intelligence (AI) on the Mineral Processing Market reveals key themes centered around operational efficiency, predictive maintenance, and sustainability improvements. Users frequently inquire about how AI can enhance recovery rates in complex flotation circuits, the reliability of machine learning models for predicting equipment failure in harsh operating conditions, and the practical implementation barriers to adopting AI-driven process control systems. A major concern revolves around data quality, infrastructure requirements, and the necessity for specialized personnel to manage these advanced systems. Overall expectations are high, focusing on AI's potential to autonomously optimize energy consumption, reduce reagent usage, and manage the variability inherent in ore feed quality, transitioning the industry towards fully autonomous and intelligent processing facilities.

AI's integration provides unprecedented opportunities for real-time decision-making, moving beyond traditional statistical process control (SPC). By analyzing vast datasets generated by sensors, cameras, and process instruments, AI algorithms can identify subtle correlations between input variables (e.g., particle size distribution, slurry density, reagent dosage) and output performance (e.g., concentrate grade, recovery rate). This capability is particularly transformative in complex separation processes like froth flotation, where small changes in operational parameters can yield significant economic impacts. The use of digital twins, powered by AI, enables operators to simulate various scenarios and optimize control strategies before deployment, minimizing risk and downtime.

Furthermore, AI is instrumental in extending the lifespan of expensive capital equipment. Predictive maintenance systems use deep learning to analyze acoustic, vibration, and thermal data from crushers, mills, and pumps, predicting imminent failures with high accuracy far earlier than conventional threshold-based systems. This proactive approach dramatically reduces unplanned downtime, a critical factor in capital-intensive continuous operations like mineral processing. The long-term vision involves fully closed-loop AI control, where the system adapts autonomously to changes in ore characteristics or external conditions, guaranteeing consistent throughput and efficiency, thereby making processing operations safer, more reliable, and economically viable even for marginal deposits.

- AI optimizes comminution circuits by adjusting mill feed rates and power draws based on real-time sensor data, maximizing throughput and energy efficiency (Specific Energy Consumption reduction).

- Machine learning algorithms enhance flotation selectivity by predicting optimal reagent dosages and air flow rates based on mineralogical analysis and chemical composition.

- Predictive maintenance schedules are generated using AI analysis of vibration and acoustic data, preventing catastrophic failures in SAG mills, conveyors, and pumps.

- Digital twins powered by AI facilitate scenario planning and training, allowing operators to optimize complex processing flowsheets virtually before real-world implementation.

- Computer vision and image analysis, utilizing AI, rapidly assess particle size distribution and froth stability, providing immediate feedback for process control adjustments.

DRO & Impact Forces Of Mineral Processing Market

The Mineral Processing Market's dynamics are shaped by a powerful interplay of accelerating resource depletion, demanding environmental sustainability goals, and revolutionary technological innovations. Drivers predominantly revolve around the inelastic demand for processed minerals, especially those crucial for the green energy transition (lithium, copper, nickel), necessitating higher operational throughput and efficiency from existing and new facilities. Restraints include the significant capital required for modern plant construction and upgrades, volatile commodity prices that affect investment decisions, and increasing regulatory burdens concerning water usage, tailings management, and energy consumption. Opportunities emerge from developing superior methods for processing low-grade and refractory ores, utilizing waste streams (mine tailings) as secondary resource inputs, and deploying modular, autonomous processing units that reduce site footprint and environmental disturbance. The overall impact forces illustrate a market under intense pressure to reconcile economic viability with stringent environmental and social governance (ESG) standards, compelling rapid technological evolution towards sustainable and automated solutions.

Specific drivers include the necessity for miners to process complex ores (which are becoming more common as high-grade deposits are exhausted) using advanced techniques like pressure oxidation or bioleaching, thereby increasing demand for specialized hydrometallurgical equipment. Furthermore, globalization requires standardization and certification of processing outputs, pushing companies toward quality control technologies and automated assay laboratories. Conversely, a major restraint is the increasing opposition from local communities regarding large-scale mining and processing activities, leading to prolonged permitting processes and higher operating risks. The shortage of skilled labor proficient in operating and maintaining advanced digital processing equipment poses a structural constraint on widespread technological adoption across less developed mining regions.

However, the market opportunities present compelling growth avenues. The circular economy model, which emphasizes resource recovery from spent consumer products and industrial waste (urban mining), is creating niche, high-value processing segments requiring specialized small-scale extraction plants. Furthermore, significant advances in sustainable processing—such as dry stacking of tailings, use of seawater desalination for process water, and integration of renewable energy sources—are not only minimizing environmental impact but also creating new market segments for specialized service providers and equipment manufacturers focused on sustainability solutions. The resultant impact force drives consolidation among technology providers, as integrated systems that promise both efficiency and compliance become the industry standard for new project development.

Segmentation Analysis

The Mineral Processing Market is segmented based on the type of operation, the type of mineral being processed, and the specific application sector. Operational segmentation (Type) covers the full flowsheet, from initial size reduction (comminution) through final chemical treatment (hydrometallurgy/pyrometallurgy). Mineral segmentation categorizes the market based on the intrinsic nature of the raw material (metallic, non-metallic), each requiring distinct processing paths. Application segmentation links processed materials directly to end-user industries such as mining projects (new installations), construction material production, and increasingly, specialized environmental recovery and remediation efforts. This structured segmentation allows stakeholders to target specific technological needs and market opportunities, recognizing that the demands for processing critical battery minerals differ significantly from those for bulk commodities like iron ore or coal.

Detailed analysis of the Type segment shows comminution holding the largest market share due to its essential nature and high energy consumption, driving continuous innovation toward energy-efficient equipment like HPGRs and advanced grinding media. However, the hydrometallurgy segment is projected to experience the fastest growth, fueled by the increasing difficulty in extracting metals from refractory ores and the rising importance of specialized leaching processes for lithium and rare earth elements (REEs). The Mineral Type segment reveals strong investment in metallic mineral processing, directly correlated with global industrialization and the energy transition, particularly copper, gold, and iron ore. Meanwhile, the non-metallic segment remains robust, driven by global demand for fertilizers and construction aggregates.

- By Type:

- Comminution (Crushing, Grinding, Milling)

- Separation (Flotation, Gravity Separation, Magnetic Separation, Screening)

- Extraction (Hydrometallurgy, Pyrometallurgy, Electrometallurgy)

- Dewatering & Solid/Liquid Separation (Filtration, Thickening, Drying)

- By Mineral Type:

- Metallic Minerals (Iron Ore, Copper, Gold, Nickel, Bauxite, Lithium, Cobalt)

- Non-Metallic Minerals (Potash, Phosphate, Industrial Sands, Limestone)

- Coal and Energy Minerals

- By Application:

- Mining and Metallurgy

- Construction Materials Production

- Environmental and Waste Treatment (Tailings reprocessing, Urban Mining)

Value Chain Analysis For Mineral Processing Market

The value chain of the Mineral Processing Market begins far upstream with geological exploration and resource definition, followed by the manufacturing and supply of complex processing equipment and chemical reagents. The core of the value chain is the actual processing plant operation, where raw ore is transformed into a marketable concentrate or refined metal. Downstream, the outputs of the processing plant feed directly into industrial manufacturing sectors, including steel production, chemicals, electronics, and construction. Efficiency improvements across this chain are highly leveraged; optimization in the comminution phase, for example, directly reduces energy costs and improves the efficiency of subsequent downstream separation steps. Key players are often vertically integrated or form strong strategic alliances to secure technology access and raw material supply, mitigating risks associated with supply chain volatility.

Upstream analysis focuses heavily on original equipment manufacturers (OEMs) who design and supply critical capital equipment (crushers, mills, flotation cells) and specialized service providers who supply consulting, engineering, and digital solutions. R&D investment at this stage is crucial, focusing on materials science for wear-resistant components and developing intelligent control systems. Raw material procurement, particularly for energy and water, heavily influences upstream costs. The distribution channel for this equipment is typically direct, involving long-term contracts and comprehensive after-sales service agreements due to the bespoke nature and high value of the machinery. Indirect channels are utilized more frequently for commodity processing reagents and spare parts, often through specialized chemical distributors and local suppliers.

Downstream analysis is defined by the end-user requirements for mineral purity and concentration. Highly concentrated and refined products command premium prices and require stricter quality control during the final processing stages (e.g., smelting, refining). The demand pull from high-growth industries like electric vehicle battery manufacturing dictates shifts in processing focus, emphasizing purity and sustainability provenance. Direct distribution dominates the flow of refined metals to large industrial buyers (e.g., automotive OEMs, semiconductor manufacturers), while concentrate sales often utilize global commodity trading houses. The ability of processors to meet increasingly stringent traceability requirements, often facilitated by blockchain technology, is becoming a crucial component of downstream value capture.

Mineral Processing Market Potential Customers

Potential customers and primary buyers in the Mineral Processing Market are typically large-scale mining corporations, junior exploration companies transitioning into production, and state-owned enterprises (SOEs) focused on strategic mineral reserves. These customers are categorized by their need for capital equipment for new projects (greenfield) or replacement/upgrade equipment for existing facilities (brownfield). Major buyers include integrated resource companies that manage the entire process from extraction to refinement, such as BHP, Rio Tinto, Vale, and Glencore. Beyond traditional miners, the customer base also includes contract processing service providers and specialized urban mining/recycling facilities, particularly those focusing on electronic waste (e-waste) and battery recycling.

The procurement decision-making process for these customers is characterized by long lead times, extensive technical evaluations, and a strong focus on total cost of ownership (TCO), reliability, and adherence to environmental compliance standards. They seek solutions that offer documented energy efficiency gains, maximum availability, and high recovery rates, especially when dealing with complex or low-grade ores. Suppliers who offer integrated digital packages (equipment plus automation software) often gain a competitive edge. Furthermore, government agencies and environmental regulatory bodies, while not direct buyers of equipment, act as powerful indirect customers by mandating specific processing standards and waste management technologies, compelling miners to invest in compliant solutions.

Emerging buyers also include specialized chemical and material producers who rely on highly purified mineral feedstocks. For example, battery cathode material manufacturers require specific purity levels of lithium, cobalt, and nickel sulfates, driving demand for advanced hydrometallurgical purification stages. Additionally, companies involved in rehabilitating legacy mine sites often purchase processing equipment designed for reprocessing old tailings dumps, transforming environmental liabilities into economic assets. This diversity in the end-user base underscores the resilience of the market, driven by both primary resource extraction and secondary resource recovery efforts globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $25.5 Billion |

| Market Forecast in 2033 | $40.5 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Metso Outotec, FLSmidth, Weir Group, thyssenkrupp, Sandvik, Eriez Magnetics, McLanahan Corporation, KHD Humboldt Wedag, Multotec, SGS SA, Ausenco, Bechtel Corporation, Jacobs Engineering Group, Hatch, Tenova, CiDRA Minerals Processing, Sepro Systems, Endress+Hauser, TAKRAF GmbH, Tega Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mineral Processing Market Key Technology Landscape

The Mineral Processing Market is undergoing a rapid technological renaissance focused on efficiency, sustainability, and data utilization. The cornerstone of this evolution is the shift from conventional technologies toward high-efficiency equipment, notably High-Pressure Grinding Rolls (HPGRs) replacing traditional ball mills in many applications due to their superior energy consumption profile. In separation, advanced sensors (e.g., optical sorters, LIBS analysis) are being deployed upstream to enable coarse particle rejection and maximize throughput before energy-intensive grinding. Furthermore, the development of specialized flotation cells and deep-cone thickeners addresses water efficiency challenges by improving solid-liquid separation and increasing water recovery rates, aligning technological advancement with crucial environmental mandates.

Digitalization forms the second critical pillar of the current technology landscape. This includes the widespread implementation of the Industrial Internet of Things (IIoT), utilizing thousands of interconnected sensors to monitor parameters like flow, pressure, particle size, and chemical composition in real-time. This massive data influx feeds into advanced process control systems (APCS) and artificial intelligence (AI) platforms, allowing for predictive modeling, autonomous decision-making, and dynamic optimization of complex circuits. The result is a substantial reduction in process variability, leading to higher average recovery rates and lower consumption of energy and chemical reagents, thereby fundamentally improving the economics of ore extraction.

Furthermore, specialized chemical and biochemical technologies are gaining prominence, particularly within hydrometallurgy. Bioleaching, which utilizes microorganisms to dissolve metals from sulfide ores, provides an environmentally gentler alternative to conventional smelting for certain metals, especially copper and gold. Simultaneously, continuous research into highly selective flocculants and collectors is crucial for optimizing the flotation process, enabling the efficient separation of complex, fine-grained mineral assemblages that were previously uneconomical to process. This convergence of mechanical, digital, and chemical innovations defines the competitive edge in modern mineral processing operations, emphasizing integrated solutions over standalone machinery.

Regional Highlights

Regional dynamics within the Mineral Processing Market are highly divergent, driven by local geological characteristics, industrialization rates, and regulatory frameworks.

- Asia Pacific (APAC): Dominates the global market volume due to the massive output from key economies like China, Australia, and India. Australia, a major producer of iron ore, gold, and increasingly lithium, drives demand for highly automated, large-scale processing equipment. China and India's rapid industrial growth necessitates massive throughput capacity for base metals and construction materials. Investment is focused on both scale-up and modernizing aging facilities to meet evolving domestic environmental standards, particularly related to water and dust control.

- North America: Characterized by high technological adoption and a focus on critical mineral supply security. The region, encompassing the U.S. and Canada, emphasizes sustainable practices, driving demand for technologies such as sensor-based sorting, dry stacking tailings systems, and fully autonomous processing controls. Significant investment is directed toward lithium and rare earth element processing infrastructure to reduce reliance on foreign supply chains.

- Europe: This region is heavily influenced by stringent ESG standards and the push for resource circularity. While primary mining activity is substantial in Nordic countries, a major growth driver is the urban mining and recycling sector, requiring specialized hydrometallurgical plants for battery recycling and e-waste processing. European miners prioritize energy-efficient equipment (HPGRs) and minimal environmental footprints.

- Latin America: A critical hub for copper, iron ore, and gold production, particularly in Chile, Peru, and Brazil. Market growth here is stimulated by large-scale greenfield expansions and brownfield debottlenecking projects. The need to process lower-grade porphyry deposits and manage vast amounts of tailings drives demand for robust, high-capacity comminution and flotation equipment, often operating under challenging high-altitude conditions.

- Middle East and Africa (MEA): This region offers immense potential, particularly in key mineral-rich nations like South Africa (platinum group metals, coal) and Saudi Arabia (industrial minerals, phosphates). Market development is often dependent on large government-backed mining initiatives and foreign investment. The focus is on establishing efficient, reliable infrastructure and overcoming operational challenges such as water scarcity, driving interest in dry processing techniques and robust thickening technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mineral Processing Market.- Metso Outotec

- FLSmidth

- Weir Group

- thyssenkrupp

- Sandvik

- Eriez Magnetics

- McLanahan Corporation

- KHD Humboldt Wedag

- Multotec

- SGS SA

- Ausenco

- Bechtel Corporation

- Jacobs Engineering Group

- Hatch

- Tenova

- CiDRA Minerals Processing

- Sepro Systems

- Endress+Hauser

- TAKRAF GmbH

- Tega Industries

Frequently Asked Questions

Analyze common user questions about the Mineral Processing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving growth in the Mineral Processing Market?

The central growth driver is the exponential global demand for critical minerals—such as lithium, copper, and cobalt—essential for the transition to renewable energy systems and electric vehicle infrastructure, coupled with the need to process increasingly complex, lower-grade ores efficiently.

How is environmental regulation impacting mineral processing technology adoption?

Environmental regulations are compelling operators to invest heavily in sustainable technologies, including water recovery systems (advanced thickening and filtration), energy-efficient comminution equipment (HPGRs), and dry stacking solutions for tailings management, prioritizing solutions that minimize ecological footprint.

Which segment of the mineral processing market is expected to grow the fastest?

The hydrometallurgy and extraction segment is projected for the fastest growth, driven by the necessity to chemically treat refractory ores and the expanding market for urban mining and recycling, particularly involving complex battery metals like lithium and nickel.

How does AI contribute to operational efficiency in a processing plant?

AI significantly enhances efficiency by providing real-time data analysis for advanced process control, optimizing parameters in complex circuits (like flotation) to maximize recovery rates, and enabling highly accurate predictive maintenance to drastically reduce unplanned equipment downtime.

What are the key technological advancements redefining comminution?

Key advancements in comminution focus on reducing energy consumption through the widespread adoption of High-Pressure Grinding Rolls (HPGRs) and the integration of smart, sensor-based sorting technologies upstream to reject barren material before energy-intensive crushing and grinding processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Mineral Processing Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Steam Dryer Market Size Report By Type (Automatic, Semi-Automatic), By Application (Mineral Processing and Manufacturing, Chemical Industry, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Crushing, Screening, and Mineral Processing Equipment Market Statistics 2025 Analysis By Application (Construction & Plant Modification, Mining, Foundries & Smelters, Others), By Type (Crushing & Screening Equipment, Mineral Processing Equipment), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Crushing, Screening, and Mineral Processing Equipment Market Statistics 2025 Analysis By Application (Plant Modification, Mining, Foundries & Smelters), By Type (Crushing and Screening Equipment, Mineral Processing Equipment), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Mineral Processing Market Statistics 2025 Analysis By Application (Metal Ore Mining, Non-metallic Ore Mining), By Type (Crushing, Screening, Grinding, Classification), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager