Multi-mode Optical Fibers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443263 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Multi-mode Optical Fibers Market Size

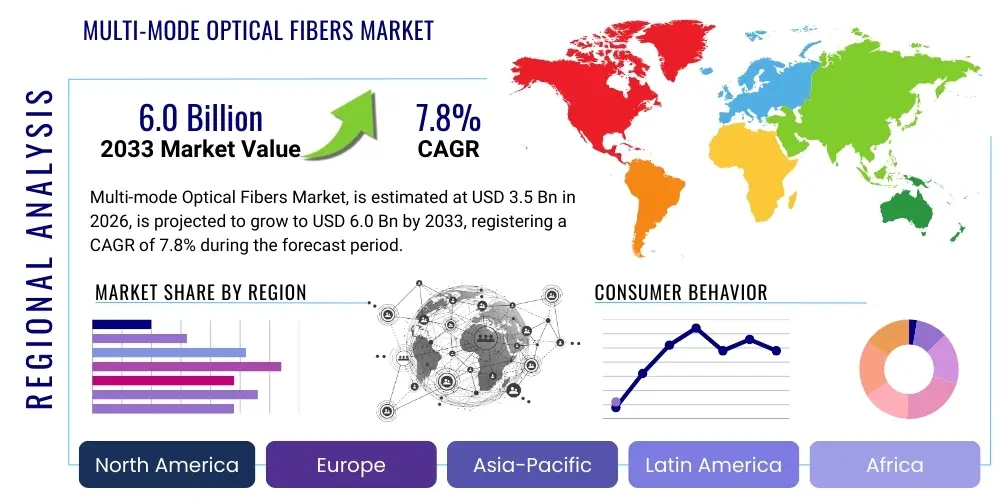

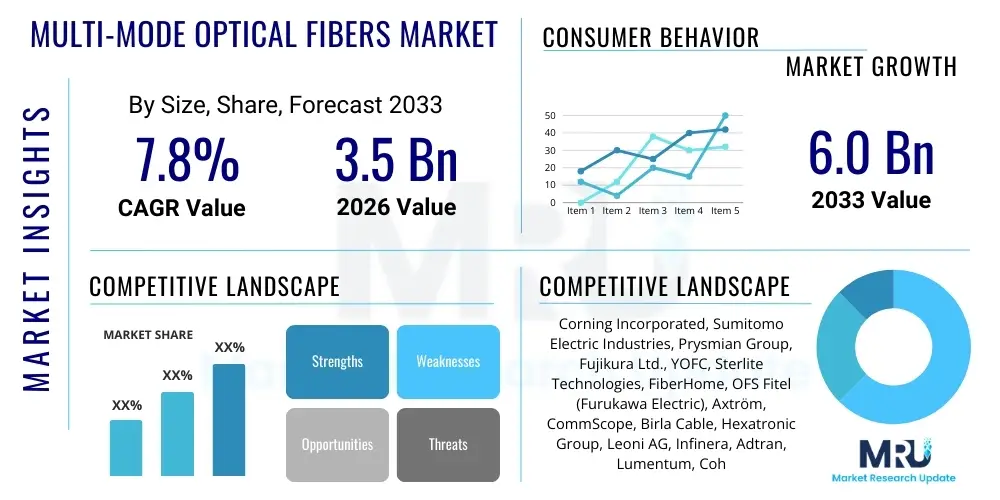

The Multi-mode Optical Fibers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 4.2 Billion in 2026 and is projected to reach USD 7.8 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by the accelerating deployment of hyperscale and edge data centers, which heavily rely on multi-mode fiber for high-speed, short-distance interconnections. Furthermore, the continuous upgrade cycle for enterprise Local Area Networks (LANs) and the increasing adoption of Fiber-to-the-Home (FTTH) infrastructure requiring hybrid short-haul links contribute significantly to market expansion, cementing the role of multi-mode fibers in modern communication ecosystems.

Multi-mode Optical Fibers Market introduction

The Multi-mode Optical Fibers Market encompasses specialized glass or plastic fibers designed to carry multiple light paths, or modes, simultaneously. These fibers are critically important in data transmission over relatively short distances, typically up to a few kilometers, making them the backbone of modern enterprise networks, campus backbones, and, most notably, high-speed data centers. Unlike single-mode fibers, multi-mode fibers offer larger core diameters (commonly 50 or 62.5 micrometers), simplifying connector alignment and lowering overall installation costs, which is a major benefit in high-density cabling environments. The primary applications range from high-definition video transmission and industrial control systems to complex storage area networks (SANs) and local area network (LAN) infrastructure supporting speeds up to 400G and beyond. Key benefits include cost-effectiveness for short runs, ease of splicing, and compatibility with cost-effective Vertical-Cavity Surface-Emitting Lasers (VCSELs). Driving factors for market growth include the proliferation of cloud computing services, the rising demand for higher bandwidth in enterprise environments, and standardization efforts promoting advanced multi-mode fiber types like OM5, optimized for wavelength division multiplexing (SWDM).

Multi-mode Optical Fibers Market Executive Summary

The Multi-mode Optical Fibers Market is experiencing significant momentum driven by fundamental shifts in global data infrastructure development and technological advancements. Business trends show a strong prioritization of high-density and low-latency network solutions, directly translating into increased demand for advanced fiber grades such as OM4 and OM5, particularly in the financial, healthcare, and technology sectors where data throughput is paramount. Regional trends indicate the Asia Pacific (APAC) region, spearheaded by infrastructural spending in China and India, will witness the fastest growth due due to extensive urbanization and massive investments in 5G backhaul and fixed broadband expansion. Conversely, North America remains the largest revenue generator, dominated by hyperscale data center construction. Segment trends highlight that the data center application segment maintains its dominance, spurred by migration to 200G and 400G Ethernet protocols. Fiber types optimized for Short Wavelength Division Multiplexing (SWDM), such as OM5, are rapidly gaining traction as they offer significant cost and efficiency advantages by enabling four wavelengths over a single fiber pair, maximizing infrastructure utilization while adhering to established multi-mode standards.

AI Impact Analysis on Multi-mode Optical Fibers Market

The burgeoning field of Artificial Intelligence (AI) and Machine Learning (ML) directly influences the Multi-mode Optical Fibers Market by imposing extreme requirements on network infrastructure, particularly within localized computing environments and data centers. Common user questions often revolve around whether existing multi-mode fiber infrastructure can support the immense bandwidth and low latency demanded by GPU clusters and AI accelerators, and what role OM5 fiber plays in future AI data fabrics. The core themes emerging from this analysis include concerns over network congestion optimization, the necessity for ultra-low latency internal connectivity crucial for parallel processing tasks, and the potential lifespan of current OM3/OM4 deployments under escalating AI workloads. Users are seeking clarity on how multi-mode technology will bridge the gap between AI processing units and high-speed storage, especially considering the rapid evolution of proprietary interconnects and open standards like Ethernet.

The deployment of AI training models necessitates huge server clusters linked by high-throughput interconnects to prevent bottlenecks in data transfer between computing nodes and memory resources. Multi-mode optical fibers, particularly the OM4 and OM5 variants, are perfectly positioned to meet these demands for intra-rack and inter-rack connectivity within AI-centric data centers. This increased density of high-speed connections drives the need for optimized cabling solutions that can handle 100G, 200G, and 400G Ethernet links over short distances efficiently and cost-effectively. Furthermore, the integration of AI for managing and optimizing network traffic—such as predictive maintenance, dynamic bandwidth allocation, and fault detection—will indirectly increase the stability and perceived value of the physical multi-mode fiber infrastructure, ensuring maximum uptime for resource-intensive AI operations. The future of AI inference and decentralized edge computing also relies on robust, affordable short-reach communication, reinforcing the crucial role of multi-mode solutions.

- AI workload density increases demand for ultra-high-speed (400G+) short-haul data center links.

- GPU clusters and AI accelerators require multi-mode fibers (OM4/OM5) for low-latency, high-throughput intra-rack connectivity.

- AI-driven network optimization tools increase the efficiency and utilization rates of existing fiber infrastructure.

- The edge computing proliferation, driven by real-time AI inference, expands the need for multi-mode fiber in smaller, distributed data facilities.

- Development of proprietary AI interconnect standards may necessitate flexible, high-density fiber patch panel solutions compatible with multi-mode platforms.

DRO & Impact Forces Of Multi-mode Optical Fibers Market

The Multi-mode Optical Fibers Market trajectory is shaped by a confluence of powerful market forces, centered on the urgent global need for faster data transmission, balanced against technological limitations and economic pressures. Drivers include the exponential growth in internet traffic, massive investment in data center infrastructure (driven by cloud services), and the ongoing transition from 10G and 40G to 100G, 200G, and 400G Ethernet standards, where multi-mode fibers provide the most economical solution for necessary short-reach links. The primary Restraints involve the inherent distance limitations of multi-mode technology compared to single-mode fiber, which caps their utility for long-haul transmission, and potential confusion in the market regarding optimal fiber grades (OM3 vs. OM4 vs. OM5) for specific high-speed applications. Opportunities abound in emerging technologies, such as Short Wavelength Division Multiplexing (SWDM) implementation using OM5 fibers, and the increasing adoption in industrial automation, smart buildings, and surveillance systems requiring robust, medium-range connectivity. The overarching Impact Forces suggest that technological standardization (IEEE and TIA) and the rapid pace of data center expansion will continue to outweigh distance restraints in the short-to-medium term, solidifying multi-mode fiber's market position.

One of the strongest drivers is the economic advantage multi-mode fiber offers in the context of high-speed transceiver technology. Multi-mode fibers pair effectively with cost-efficient Vertical-Cavity Surface-Emitting Lasers (VCSELs), which are significantly cheaper to manufacture and operate than the distributed feedback (DFB) lasers required for single-mode operation over short distances. This cost differential makes multi-mode fibers the preferred default solution for inter-rack connections up to 500 meters, which constitute the majority of links within modern hyperscale facilities. Furthermore, the push for smaller, distributed edge data centers, which require reliable connectivity within constrained geographical areas, naturally favors the ease of installation and resilience offered by multi-mode cabling solutions. The continuous evolution of multi-mode specifications, such as the bandwidth-boosting capabilities of OM5 over the 850 nm to 950 nm window, ensures that the technology remains competitive even as data rates escalate.

However, the market must navigate key restraints, primarily stemming from the technological hurdle known as modal dispersion, which limits the effective reach of multi-mode fibers as data rates increase. This inherent physical limitation means that for links exceeding 500 meters or even shorter distances at extreme speeds (e.g., 800G), single-mode fiber becomes the mandatory choice, inevitably cannibalizing a portion of the total addressable market. Furthermore, market uncertainty surrounding hybrid solutions, where certain campus environments integrate both single-mode and multi-mode systems, requires suppliers to manage complex inventory and offer seamless integration capabilities. Despite these challenges, the massive untapped potential in industrial IoT (IIoT) applications and the need for high-bandwidth passive optical networks within dense urban environments present significant long-term growth opportunities for multi-mode fiber deployment.

Segmentation Analysis

The Multi-mode Optical Fibers Market is meticulously segmented based on Type, Application, and Regional Geography, allowing for a precise understanding of market dynamics and targeted investment opportunities. Segmentation by Type reveals that OM4 and the newer, higher-capacity OM5 fibers are rapidly displacing older generations (OM1, OM2) due to the need to support 100G and 400G links. OM5, specifically designed for Short Wavelength Division Multiplexing (SWDM), is poised for substantial growth as data center operators seek to maximize utilization of existing fiber strands. The Application segment is overwhelmingly dominated by Data Centers, followed by Enterprise Networks (LANs) and emerging Industrial Applications. Analyzing these segments is crucial for predicting material requirements and supply chain logistics, reflecting the increasing global dependency on high-speed, localized networking infrastructure.

Focusing on the segmentation by application, the data center category remains the primary engine of demand, necessitating extremely high volumes of pre-terminated, optimized multi-mode assemblies. These applications demand minimal signal loss and maximum bandwidth distance product, fueling the preference for laser-optimized OM4 and OM5 fiber variants. In contrast, the enterprise network segment, while undergoing substantial modernization, often utilizes a broader mix of OM3 and OM4 fibers depending on the size of the campus and the specific transmission standards adopted. The rising importance of the Military and Aerospace application segment highlights the need for specialized, ruggedized multi-mode fiber that can withstand harsh environments while maintaining integrity under conditions of high vibration and temperature variance, representing a high-value niche market requiring bespoke manufacturing processes and rigorous testing standards.

Segmentation is critical for stakeholders involved in transceiver and active component manufacturing. The shift towards OM5 fiber directly correlates with the investment in SWDM transceiver technology, allowing for 40G/100G links over just two fibers rather than eight, dramatically reducing total cost of ownership. This trend underscores a pivotal change in the supply chain, moving away from purely physical layer products towards integrated solutions that optimize fiber infrastructure performance. Manufacturers must align their production lines to meet the stringent quality requirements of OM4 and OM5 to capture significant market share in the most lucrative data center segment, ensuring compliance with international performance standards, particularly concerning modal bandwidth specifications.

- By Type:

- OM1 (62.5/125 µm)

- OM2 (50/125 µm)

- OM3 (Laser Optimized 50/125 µm)

- OM4 (Laser Optimized 50/125 µm)

- OM5 (Wide Band Laser Optimized 50/125 µm)

- By Application:

- Data Centers (Inter-rack, Intra-rack, Zone Distribution)

- Enterprise Networks (LANs, Campus Backbones)

- Telecommunications (Short-haul access and FTTx)

- Industrial Control and Automation (Factory networks, SCADA)

- Military & Aerospace

- CCTV and Surveillance

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Multi-mode Optical Fibers Market

The value chain for the Multi-mode Optical Fibers Market is intricate, starting from raw material sourcing and culminating in the highly specialized installation and maintenance services provided to end-users. Upstream Analysis focuses on the procurement of high-purity silica glass and plastic polymers, alongside sophisticated manufacturing equipment utilized in the modified chemical vapor deposition (MCVD) process to create the preforms. This initial stage requires significant capital investment and highly specialized technical expertise to ensure the required geometrical precision and optical characteristics (such as differential mode delay and effective modal bandwidth) are achieved, which directly impacts the fiber's high-speed performance capabilities. Consolidation among major fiber preform and drawing companies ensures stringent quality control over the final fiber product, making the upstream segment highly influential yet concentrated.

The midstream involves the core manufacturing processes: fiber drawing, buffering, and cabling. Cable manufacturers take the raw fiber and incorporate protective layers, strength members (like aramid yarn), and jackets to create robust, installation-ready cables, which can range from loose tube outdoor cables to high-density ribbon cables used predominantly within data centers. This stage also includes the crucial step of connectorization and pre-termination, particularly for high-value OM4/OM5 patch cords and trunk assemblies required by hyperscale clients. The shift towards pre-terminated solutions, driven by the need for faster deployment and reduced human error in field termination, adds considerable value and complexity to this segment of the chain, requiring specialized, clean-room environments for assembly and testing.

The Downstream Analysis focuses on distribution and consumption. Distribution channels are typically complex, involving direct sales to large telecommunication companies and data center operators, indirect sales through global distributors (focused on electrical components and networking gear), and specialized system integrators (SIs). System integrators play a vital role, often consulting clients on network design, recommending the optimal fiber grade (OM3, OM4, or OM5), and performing the final installation, testing, and certification. The increasing technical requirements for testing multi-mode fiber, especially for 40G/100G/400G links using advanced test equipment, places the responsibility of quality assurance heavily on the distributors and integrators, ensuring that the installed base meets high-speed performance metrics. The choice between Direct and Indirect channels often depends on client size; major players use direct sales for volume contracts, while smaller enterprises rely heavily on indirect distribution for supply and installation support.

Multi-mode Optical Fibers Market Potential Customers

The primary end-users and potential customers for multi-mode optical fibers are organizations requiring high-bandwidth, short-distance connectivity within controlled environments. Hyperscale data center operators, including major cloud providers (Amazon AWS, Microsoft Azure, Google Cloud), represent the largest and most demanding customer segment. Their continuous need for expansion and upgrades to support 400G and 800G connectivity fuels the demand for OM4 and OM5 fiber in massive volumes, often necessitating customized, high-density trunk cabling solutions. These customers prioritize low latency, scalability, and adherence to strict reliability standards, often driving proprietary procurement specifications that exceed standard industry requirements.

A second major customer category is the large Enterprise Sector, encompassing financial institutions, universities, hospitals, and major corporate campuses. These entities rely on multi-mode fiber to support their high-speed Local Area Networks (LANs) and Storage Area Networks (SANs). As office environments evolve and incorporate high-bandwidth applications like 4K video conferencing, virtual desktop infrastructure (VDI), and massive data backups, enterprises continually upgrade their existing OM1/OM2 infrastructure to modern OM3/OM4 systems. For these customers, the primary purchasing drivers are total cost of ownership (TCO) over a 10-15 year period, ease of future scalability, and compliance with building safety codes, making structured cabling providers key intermediaries in this market segment.

Emerging potential customers are concentrated in the Industrial IoT (IIoT) and Smart City infrastructure domains. Industrial environments, such as large manufacturing plants, automated logistics centers, and energy utility substations, require robust, interference-immune communication links over medium distances. Multi-mode fibers, with their inherent immunity to electromagnetic interference (EMI) and high-data-rate capacity, are ideal for connecting sensors, controllers, and industrial Ethernet devices within these challenging settings. These customers seek durability, extended temperature operation, and certifications specific to industrial environments, often prioritizing specialized fiber-optic cable constructions over raw bandwidth metrics, thereby expanding the addressable market beyond traditional IT infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 7.8 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Corning Incorporated, Prysmian Group, Fujikura Ltd., Sumitomo Electric Industries, YOFC, LEONI AG, Sterlite Technologies Limited, CommScope Holding Company, Optical Cable Corporation (OCC), Furukawa Electric Co., Ltd., Belden Inc., Nexans SA, AFL (Fujikura subsidiary), FiberHome Telecommunication Technologies Co., Ltd., Finisar Corporation (now II-VI), Amphenol Corporation, TE Connectivity, OFS Fitel, LLC, Jiangsu Fasten Photonics Co., Ltd., Shenzhen SDGI Optical Fibre Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Multi-mode Optical Fibers Market Key Technology Landscape

The technology landscape of the Multi-mode Optical Fibers Market is defined by continuous innovation focused on maximizing modal bandwidth and minimizing modal dispersion to support ever-increasing data rates over required short distances. The foundational technology involves highly precise glass manufacturing processes, such as the Modified Chemical Vapor Deposition (MCVD) or Vapor Axial Deposition (VAD), used to create the fiber preform with a graded refractive index profile. This graded index profile is crucial for minimizing signal distortion by allowing different light modes to travel at nearly the same speed. The most significant advancement in recent years is the development of laser-optimized multi-mode fibers (LOMMF), specifically OM3, OM4, and OM5. These fibers are designed to function optimally with 850 nm Vertical-Cavity Surface-Emitting Lasers (VCSELs), which are essential for affordable, high-volume data center connectivity.

A critical technological driver is the maturation and standardization of OM5, or Wide Band Multi-mode Fiber (WBMMF). OM5 extends the operating wavelength range beyond the traditional 850 nm window to 953 nm, specifically enabling Short Wavelength Division Multiplexing (SWDM). SWDM technology allows the transmission of four distinct wavelengths over a single fiber pair, effectively quadrupling the capacity compared to traditional duplex multi-mode links without needing parallel fiber architecture (MPO/MTP). This breakthrough allows data center operators to deploy 100G/200G/400G links using fewer fibers, dramatically improving port density and reducing cable bulk in densely packed racks. The successful integration of OM5 with SWDM transceivers represents the leading edge of multi-mode technology, securing its relevance against competing single-mode short-reach solutions.

Furthermore, technology used in the market extends beyond the fiber itself to the connectivity solutions. High-density, MPO/MTP connectors are standard for multi-mode fiber in data centers, facilitating rapid deployment of 8-fiber (40G) and 12-fiber (100G/400G) parallel optics links. Advanced testing equipment utilizing Optical Time Domain Reflectometers (OTDRs) and specialized power meters is required to certify multi-mode link performance, ensuring low insertion loss and reflection, particularly for pre-terminated assemblies. Future technological advancements are focused on developing fibers with even flatter differential mode delay (DMD) characteristics and potentially moving towards hybrid fiber structures that integrate both single-mode and multi-mode sections within a single jacket to provide flexible solutions for complex campus and metro networks.

Regional Highlights

Geographically, the Multi-mode Optical Fibers Market demonstrates highly varied growth dynamics influenced by regional infrastructure maturity, data center investment levels, and telecommunications regulatory frameworks. North America maintains the largest market share, driven primarily by the presence of global tech giants, the concentration of hyperscale data centers, and the sustained modernization of vast corporate and governmental network infrastructures. The rapid adoption of 400G and future 800G Ethernet standards within the United States ensures continued high demand for premium OM4 and OM5 fiber variants for short-reach applications. Europe follows, with significant investments in centralized data facilities and the implementation of stringent data localization regulations fostering local data center construction, particularly in major hubs like Frankfurt, London, Amsterdam, and Paris (FLAP markets).

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This accelerated growth is attributed to aggressive digital transformation initiatives across China, India, Japan, and Southeast Asia, coupled with massive government-backed spending on 5G network expansion and fixed broadband (FTTx) deployment. Urbanization and the emergence of numerous domestic cloud service providers are fueling explosive demand for localized data center capacity, heavily utilizing multi-mode solutions for cost-effective internal links. Conversely, the Middle East and Africa (MEA) region, while smaller in absolute terms, is a high-potential market, seeing substantial growth driven by diversification efforts away from oil economies, leading to investments in large-scale smart city projects and regional data exchange hubs requiring robust fiber infrastructure.

- North America: Market leader; driven by hyperscale data center capacity expansion, early adoption of 400G/800G Ethernet, and continuous enterprise network upgrades.

- Asia Pacific (APAC): Fastest growing region; characterized by expansive 5G rollout, massive urbanization, and surging demand for domestic cloud services, particularly in China and India.

- Europe: Strong growth market; supported by strict data privacy regulations (GDPR) necessitating local data centers and robust investment in FLAP markets and pan-European network modernization.

- Latin America: Emerging market; growth tied to regional digital economy initiatives, expansion of local data processing facilities, and infrastructure improvements in Brazil and Mexico.

- Middle East & Africa (MEA): High potential niche; fueled by smart city development (e.g., NEOM in Saudi Arabia) and efforts to establish regional connectivity and communication hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Multi-mode Optical Fibers Market.- Corning Incorporated

- Prysmian Group

- Fujikura Ltd.

- Sumitomo Electric Industries

- YOFC (Yangtze Optical Fibre and Cable Joint Stock Limited Company)

- LEONI AG

- Sterlite Technologies Limited

- CommScope Holding Company

- Optical Cable Corporation (OCC)

- Furukawa Electric Co., Ltd.

- Belden Inc.

- Nexans SA

- AFL (Fujikura subsidiary)

- FiberHome Telecommunication Technologies Co., Ltd.

- II-VI Incorporated (now Coherent Corp.)

- Amphenol Corporation

- TE Connectivity

- OFS Fitel, LLC

- Shenzhen SDGI Optical Fibre Co., Ltd.

- ZTT Group

Frequently Asked Questions

Analyze common user questions about the Multi-mode Optical Fibers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between multi-mode (MMF) and single-mode (SMF) optical fiber in terms of application?

MMF is optimized for high-speed data transmission over short distances (typically under 550 meters) using less expensive VCSEL transceivers, making it ideal for data center inter-rack links and enterprise LANs. SMF is designed for long-distance transmission (many kilometers) using higher-cost lasers, primarily used in backbone, long-haul telecommunications, and Fiber-to-the-Home (FTTH) networks.

Why is OM5 fiber becoming increasingly important in modern data centers?

OM5 (Wide Band MMF) is crucial because it supports Short Wavelength Division Multiplexing (SWDM), allowing four wavelengths to transmit simultaneously over a single fiber pair. This significantly increases data rates (e.g., 400G) while minimizing the fiber count, reducing infrastructure bulk and cost compared to parallel optics solutions, and maximizing port density.

What are the key technological advancements driving demand for multi-mode fibers?

The primary driver is the standardization of high-speed Ethernet protocols (100G, 200G, 400G) within data centers, coupled with the development of laser-optimized fibers (OM3, OM4, OM5) that effectively minimize modal dispersion when paired with cost-effective VCSEL transceivers, offering a superior price-performance ratio for short links.

How does the growth of AI and edge computing influence the multi-mode fiber market?

AI and edge computing necessitate ultra-low latency and high-throughput connections within localized clusters (both centralized data centers and distributed edge facilities). Multi-mode fibers, particularly OM4 and OM5, provide the requisite high-density, low-latency links essential for connecting GPU clusters, AI accelerators, and high-speed storage, driving significant volume demand.

Which geographical region shows the highest growth potential for Multi-mode Optical Fibers?

The Asia Pacific (APAC) region is projected to show the highest CAGR. This is primarily fueled by extensive capital investment in 5G infrastructure, rapid urbanization, massive government support for digital transformation, and the subsequent expansion of domestic hyperscale and edge data center facilities across key nations like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager