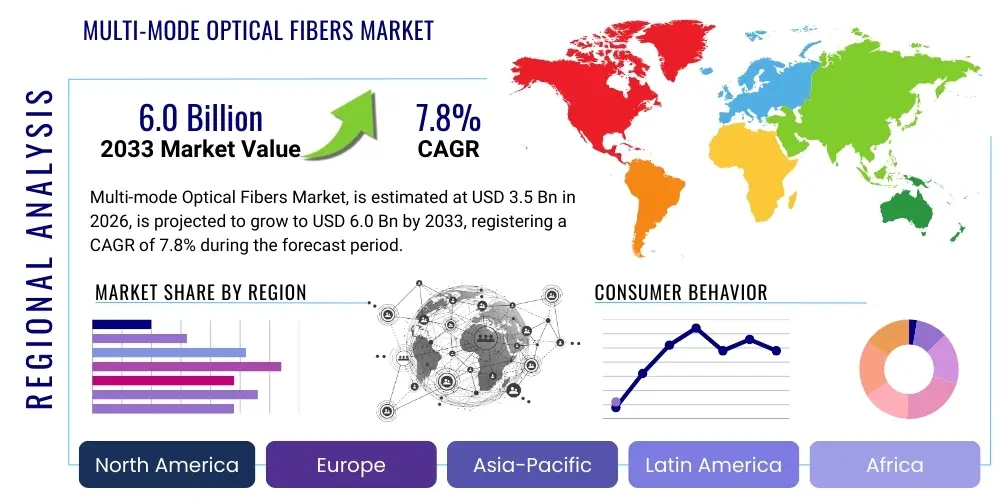

Multi-mode Optical Fibers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435592 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Multi-mode Optical Fibers Market Size

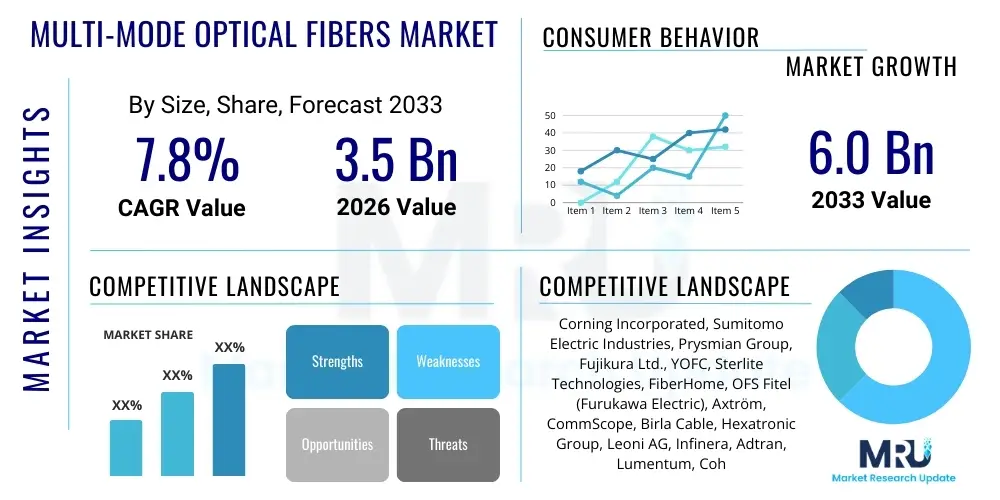

The Multi-mode Optical Fibers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 6.0 Billion by the end of the forecast period in 2033.

Multi-mode Optical Fibers Market introduction

Multi-mode Optical Fibers (MMFs) represent a critical segment of the optical communications industry, specifically designed for short-distance data transmission using inexpensive Light Emitting Diode (LED) or Vertical-Cavity Surface-Emitting Laser (VCSEL) sources. Unlike single-mode fibers (SMFs), MMFs have a larger core diameter, typically 50 or 62.5 micrometers, which allows multiple light paths (modes) to propagate simultaneously. This characteristic simplifies connectivity, reduces installation costs, and makes MMF the preferred solution for intra-building networks, campus backbones, and, most critically, high-speed connectivity within data centers, which are characterized by short, high-bandwidth links.

The primary applications driving the demand for MMF include enterprise local area networks (LANs), storage area networks (SANs), and hyper-scale data center interconnects. MMF supports various Ethernet standards (e.g., 10G, 40G, 100G, and increasingly 400G) over distances ranging from a few meters up to several hundred meters, depending on the fiber grade (OM1 through OM5). The ongoing proliferation of cloud computing, edge infrastructure, and the massive data volume generated by modern digital services necessitate reliable and high-density connectivity solutions that MMF technology efficiently provides, maintaining its relevance despite the rise of single-mode solutions for longer distances.

Key benefits driving the adoption of Multi-mode Optical Fibers include lower component costs for transceivers (especially VCSELs), ease of splicing, and robust handling properties due to the larger core size. The market is currently undergoing a significant technological transition, moving away from older OM1 and OM2 specifications towards optimized laser-optimized fibers like OM3, OM4, and the latest generation, OM5, which is optimized for wavelength division multiplexing (SWDM). This continuous innovation ensures that MMF remains a cost-effective and performance-competitive solution for the core networking needs of large enterprises and data center operators worldwide.

Multi-mode Optical Fibers Market Executive Summary

The Multi-mode Optical Fibers market is experiencing robust growth fueled primarily by the unprecedented global expansion of data center infrastructure and the ongoing migration to higher-speed Ethernet protocols (100G and 400G) within these facilities. Business trends highlight a pronounced shift toward Laser-Optimized Multi-mode Fiber (LO-MMF), specifically OM4 and OM5 grades, as enterprises and cloud providers seek to maximize bandwidth density and reach for short-to-medium distance interconnects, capitalizing on the cost advantages of VCSEL-based transceivers. Furthermore, the increasing deployment of 5G networks, requiring greater processing capacity at aggregation points and edge computing centers, indirectly boosts the demand for high-performance MMF cabling for internal connectivity.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, driven by massive investments in digital infrastructure, particularly in China and India, where government initiatives and burgeoning e-commerce sectors necessitate rapid data center build-outs. North America, however, maintains the largest market share, predominantly due to the high concentration of hyper-scale cloud providers and established enterprise networks that are continually upgrading legacy OM1/OM2 infrastructure. European markets are characterized by stringent regulatory environments promoting fiber deployment and a focus on industrial automation and smart cities, integrating MMF into specialized applications beyond traditional IT.

Segment-wise, the Data Center application category remains the dominant revenue generator, accounting for the largest share of MMF consumption. Within the type segmentation, Graded-Index MMF is vastly preferred over Step-Index MMF due to its superior bandwidth capabilities and reduced modal dispersion, critical for high-speed transmission. The market for OM5 fiber, optimized for Shortwave Wavelength Division Multiplexing (SWDM), is poised for accelerated growth, reflecting the industry's need to transmit 400G and 800G over fewer fiber strands, thus improving port density and efficiency within constrained data center spaces.

AI Impact Analysis on Multi-mode Optical Fibers Market

User queries regarding the impact of Artificial Intelligence (AI) on the Multi-mode Optical Fibers market center around whether the explosive data traffic generated by AI and Machine Learning (ML) training and inference will necessitate a transition entirely to Single-Mode Fiber (SMF), or if MMF can sustain the required inter-rack and intra-data center speeds. Key themes indicate concerns about MMF's distance limitations versus the need for ultra-low latency connectivity critical for distributed AI processing clusters. Users also frequently inquire about the role of advanced MMF grades, like OM5, in supporting next-generation AI accelerators and high-performance computing (HPC) environments where cost efficiency for short links remains paramount. The analysis suggests that while AI drives a significant overall increase in bandwidth demand, strengthening the case for SMF in long-haul interconnects, the specialized, short-reach, high-density requirements within AI training clusters and storage backbones continue to favor the cost-effective and lower power consumption benefits of VCSEL-driven MMF solutions.

- Increased Data Throughput Demand: AI workloads (training neural networks) generate massive inter-process communication traffic, boosting demand for 100G, 400G, and 800G connectivity over short distances where MMF excels.

- Preference for Short-Reach, High-Density Solutions: AI and HPC clusters are typically co-located, demanding high-density cabling between adjacent racks, a core competency of MMF infrastructure.

- VCSEL Technology Advantage: MMF combined with low-cost, low-power VCSEL transceivers offers a compelling total cost of ownership (TCO) advantage compared to more expensive laser technology used for SMF in links under 300 meters, aligning well with the mass deployment needs of AI data centers.

- Potential Shift in Standards: AI-driven data demands accelerate the adoption of OM5 fiber, which is specifically designed to leverage SWDM techniques, enabling higher data rates (like 400G) over fewer strands compared to previous MMF grades, thereby maximizing efficiency.

- Edge AI Computing Support: The growth of distributed and edge AI applications necessitates smaller, localized data processing units, utilizing MMF for robust and rapid connectivity within these localized ecosystems.

DRO & Impact Forces Of Multi-mode Optical Fibers Market

The Multi-mode Optical Fibers market is shaped by a complex interplay of growth drivers, inherent technical restraints, and promising technological opportunities, collectively defining the impact forces influencing strategic direction and investment. The primary driver is the incessant global increase in data consumption and the subsequent need for expanded and modernized data center capacity, particularly those supporting cloud services and content delivery networks. Restraints primarily involve the fundamental physical limitations of MMF, notably modal dispersion and higher attenuation compared to Single-Mode Fiber (SMF), which severely restricts transmission distance, forcing a market split where SMF dominates long-haul applications, sometimes encroaching on medium-haul MMF territory.

Opportunities for MMF largely reside in technological advancements such as the widespread adoption of OM5 fiber and the optimization of VCSEL technology, which allows MMF to cost-effectively support speeds up to 400G and beyond over short spans, securing its position in intra-data center architecture. The market is also heavily impacted by the rapid evolution of networking standards, necessitating continuous upgrades from older OM1/OM2 to OM4/OM5, providing a sustainable replacement and upgrade cycle for manufacturers. This dynamic environment requires continuous product innovation to maintain MMF’s competitive edge against the ever-increasing performance of SMF solutions.

The impact forces are predominantly derived from external factors, including the global 5G rollout, which boosts edge computing demand, and the escalating requirements of High-Performance Computing (HPC) environments used for AI and research. While the economic sensitivity of infrastructure investment acts as a potential dampening force (restraint), the long-term strategic necessity of high-speed digital connectivity ensures that the fundamental demand for optical fiber remains inelastic. The market balance hinges on the ability of MMF solutions to offer a superior total cost of ownership for short-distance applications compared to the higher capital expenditure associated with SMF transceivers.

Segmentation Analysis

The Multi-mode Optical Fibers Market is meticulously segmented based on key functional and application characteristics, providing granular insights into demand patterns and technological preferences across various industry verticals. Segmentation by fiber type distinguishes between Step-Index MMF, which is now largely obsolete due to high dispersion, and Graded-Index MMF, which represents the current industry standard (OM1 through OM5) and accounts for the vast majority of market share due to its superior bandwidth capacity enabled by its refractive index profile. Segmentation by core diameter focuses predominantly on 50/125 μm fibers (used in modern high-speed networks like OM3/OM4/OM5) and the older 62.5/125 μm fibers (historically used in OM1/OM2), with the former driving future market growth.

Application segmentation is crucial as it dictates the required fiber grade and volume consumption. Data centers constitute the largest and most dynamic segment, requiring constant upgrades to support higher port speeds and virtualization demands. Enterprise Networks, comprising office buildings, hospitals, and educational institutions, represent a stable segment requiring reliable horizontal and backbone connectivity. Furthermore, specialized segments like Military/Aerospace demand ruggedized MMF for harsh environment applications, while Industrial segments utilize MMF for factory automation and control systems, benefiting from its immunity to electromagnetic interference (EMI). These segments collectively define the structural demand for multi-mode fiber infrastructure globally.

- By Type:

- Step-Index Multi-mode Fiber (Legacy)

- Graded-Index Multi-mode Fiber (OM1, OM2, OM3, OM4, OM5)

- By Application:

- Data Centers

- Enterprise Networks (Commercial and Institutional)

- Telecommunications (Short-haul access and centralized office interconnects)

- Military and Aerospace

- Industrial and Factory Automation

- By Core Diameter:

- 50/125 μm

- 62.5/125 μm (Legacy)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Multi-mode Optical Fibers Market

The value chain for the Multi-mode Optical Fibers market begins with upstream activities focused on the production of ultra-pure silica glass and specialized chemicals required for preform fabrication. Key manufacturers engage in sophisticated processes like Vapor Axial Deposition (VAD) or Modified Chemical Vapor Deposition (MCVD) to create the optical fiber preform, which is then drawn into thin, uniform fibers. This stage is highly capital-intensive and requires specialized intellectual property, dominated by a few major integrated players like Corning, Sumitomo, and Prysmian. Pricing and supply stability are heavily influenced by the cost and availability of raw materials and energy inputs required for the drawing process.

The midstream involves the secondary processing and preparation of the bare fiber, including cabling, jacketing, and the integration of fibers into complex structured cabling systems, patch cords, and assemblies. This fabrication phase is critical for ensuring the longevity and performance integrity of the final product and is often handled by specialized cable manufacturers or system integrators. Distribution channels are varied, encompassing direct sales to hyper-scale data center operators for large project deployments, indirect sales through major electrical and networking distributors, and specialized value-added resellers (VARs) who provide installation and consultation services, catering primarily to the enterprise and small-to-medium business (SMB) segments.

Downstream activities center around the end-users—specifically data center managers, telecommunication service providers, and corporate IT departments—who procure and deploy the MMF cables and related networking hardware (transceivers, switches, patch panels). Direct sales are prevalent for major Data Center projects where customization and scale are critical, ensuring tight integration between fiber and active electronics. Indirect channels are more frequently utilized for smaller-scale enterprise rollouts and routine maintenance, leveraging the broad reach and inventory capabilities of distributors. The efficiency of the downstream segment is highly reliant on the availability of skilled labor for installation and splicing, as multi-mode fiber integrity is paramount for maintaining high data rates.

Multi-mode Optical Fibers Market Potential Customers

The primary customers for Multi-mode Optical Fibers are organizations characterized by high internal data traffic density and the need for cost-effective, high-speed connectivity over short distances, typically within a 550-meter range. Foremost among these are hyper-scale and co-location data center operators (such as Amazon Web Services, Microsoft Azure, and Equinix) who purchase MMF in vast quantities for inter-rack, intra-row, and aggregation layer connectivity. These buyers prioritize OM4 and OM5 fibers to support 100G, 200G, and 400G links using inexpensive VCSEL technology, making them the largest and most influential segment in terms of driving standards and volume demand.

The second major group comprises large enterprise IT departments across sectors like finance, healthcare, education, and manufacturing. These customers utilize MMF for building backbones, campus networks, and storage area networks (SANs) where they require robust, future-proof cabling systems to handle increasing user bandwidth demands and server virtualization. This segment often relies on indirect distribution channels and system integrators for procurement and installation, valuing ease of deployment and long-term reliability over absolute maximum bandwidth reach, ensuring continued demand for existing and new office build-outs.

Additionally, telecommunication companies, particularly those deploying Fiber-to-the-Premises (FTTP) or operating centralized distribution points, utilize MMF for internal connectivity and certain short-reach last-mile applications. The military and defense sectors also represent a niche, high-value customer base, demanding specialized, robust, and often armored MMF cables for tactical field communication systems and avionics, where immunity to electromagnetic interference and high durability are essential performance characteristics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 6.0 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Corning Incorporated, Sumitomo Electric Industries, Prysmian Group, Fujikura Ltd., YOFC, Sterlite Technologies, FiberHome, OFS Fitel (Furukawa Electric), Axtröm, CommScope, Birla Cable, Hexatronic Group, Leoni AG, Infinera, Adtran, Lumentum, Coherent Corp., Finisar (II-VI), Amphenol, HUBER+SUHNER |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Multi-mode Optical Fibers Market Key Technology Landscape

The technological evolution of the Multi-mode Optical Fibers market is intrinsically linked to advancements in laser technology, particularly the Vertical-Cavity Surface-Emitting Laser (VCSEL). VCSELs serve as the dominant light source for MMF transmission due to their low power consumption, small footprint, and cost-effectiveness, making them ideal for mass deployment in data center environments. Modern MMF grades, specifically OM3, OM4, and OM5, are laser-optimized, meaning their refractive index profile and core geometry are precisely engineered to minimize modal dispersion when coupled with VCSELs operating at the 850 nm wavelength window. This optimization is crucial for achieving high data rates (e.g., 100 Gbps, 400 Gbps) over distances up to 300 meters, which defines the sweet spot for MMF application.

A significant recent technological leap involves the standardization and adoption of Wide Band Multi-mode Fiber (WBMMF), known as OM5. This technology is optimized to support Shortwave Wavelength Division Multiplexing (SWDM), allowing four different wavelengths (850 nm to 950 nm) to be simultaneously transmitted over a single fiber pair. This innovation effectively quadruples the data carrying capacity without increasing the fiber count, proving vital for supporting 400G and future 800G applications while maintaining the existing MMF footprint and utilizing low-cost VCSEL arrays. The shift to OM5 mitigates the issue of fiber saturation in dense data center environments, ensuring MMF remains a competitive solution for high-density architectures.

Furthermore, technology development extends to the physical connectivity infrastructure, focusing on high-density MPO/MTP connectors and pre-terminated cable assemblies. These components drastically reduce installation time and increase reliability compared to traditional field termination, addressing the operational complexity associated with managing thousands of links in hyper-scale environments. Continuous innovation is also seen in fiber performance characteristics, such as bend-insensitive multi-mode fiber (BIMMF), which maintains signal integrity even under tight bending radii, facilitating easier routing and maximizing space utilization within crowded racks and cable trays.

Regional Highlights

- North America: Dominates the global market share due to the early and massive concentration of hyper-scale cloud providers (e.g., hyperscalers demanding high volumes of OM4 and OM5 fiber) and established high-speed enterprise networks. The continuous technological upgrade cycle from legacy infrastructure to 100G and 400G standards drives substantial replacement demand.

- Asia Pacific (APAC): Exhibits the fastest growth rate, fueled by aggressive digitalization initiatives, rapid expansion of internet penetration, and massive investments in data center construction, particularly in emerging economies like India, China, and Southeast Asia. Government support for digital infrastructure and the surge in 5G deployment are key accelerators in this region.

- Europe: Characterized by stable demand, driven by stringent data privacy regulations necessitating local data storage and processing, and the expansion of smart city infrastructure. Western European countries demonstrate high adoption of advanced fiber grades, while Central and Eastern Europe represent emerging growth pockets for new installations.

- Latin America (LATAM): Growth is moderate but accelerating, supported by increasing cloud service penetration and the establishment of local data center hubs by international providers. Brazil and Mexico are the leading markets, driven by modernization projects in finance and telecom sectors.

- Middle East and Africa (MEA): Emerging market region seeing significant infrastructure development, particularly in the UAE and Saudi Arabia, linked to ambitious national visions (e.g., Saudi Vision 2030). Demand is currently focused on new installations in oil and gas, telecommunications, and government sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Multi-mode Optical Fibers Market.- Corning Incorporated

- Sumitomo Electric Industries

- Prysmian Group

- Fujikura Ltd.

- YOFC (Yangtze Optical Fibre and Cable Joint Stock Limited Company)

- Sterlite Technologies Limited

- FiberHome

- OFS Fitel (A Furukawa Electric Company)

- Axtröm

- CommScope Holding Company Inc.

- Birla Cable Limited

- Hexatronic Group AB

- Leoni AG

- Infinera Corporation

- Adtran Holdings, Inc.

- Lumentum Holdings Inc.

- Coherent Corp.

- Finisar (now part of II-VI Incorporated/Coherent)

- Amphenol Corporation

- HUBER+SUHNER AG

Frequently Asked Questions

Analyze common user questions about the Multi-mode Optical Fibers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Multi-mode Fiber (MMF) and Single-mode Fiber (SMF)?

The primary difference lies in the core diameter. MMF has a larger core (typically 50 or 62.5 µm), allowing multiple light paths (modes) to travel, making it suitable for short distances (up to 550m) using cost-effective VCSEL transceivers. SMF has a narrow core (8-10 µm) for a single light path, providing vastly greater reach and bandwidth for long-haul and telecom applications.

Which Multi-mode Fiber grade is currently preferred for high-speed data center connectivity?

OM4 and the newest OM5 grades are currently preferred. OM4 is widely adopted for 100G and 200G links. OM5 (Wide Band MMF) is specifically optimized to support Shortwave Wavelength Division Multiplexing (SWDM), allowing 400G and future 800G transmission over fewer fibers, significantly improving density and cost efficiency in hyper-scale environments.

Is Multi-mode Fiber still relevant given the increasing adoption of Single-mode Fiber?

Yes, MMF remains highly relevant and is experiencing growth, particularly within data centers. For links under 300 meters, MMF combined with VCSEL technology offers a significant cost advantage (lower transceiver price) and reduced power consumption compared to SMF solutions, securing its role for intra-rack and inter-row connectivity.

What major factors are driving the projected growth of the MMF market through 2033?

Key growth drivers include the continuous global expansion of hyper-scale and edge data centers, the necessity for enterprise networks to upgrade to 10G, 40G, and 100G Ethernet standards, and the adoption of advanced fiber technologies like OM5 to maximize density and support AI-driven, high-bandwidth workloads.

How does the core diameter of Multi-mode Fiber affect its performance?

The core diameter (e.g., 50/125 µm versus 62.5/125 µm) directly impacts bandwidth capacity and distance reach due to modal dispersion. Modern 50/125 µm Graded-Index fibers (OM3, OM4, OM5) offer superior bandwidth and reach when paired with VCSELs compared to the legacy 62.5/125 µm fibers, which are often limited to 1 Gigabit speeds.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager