Natural Carotenoids Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440905 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Natural Carotenoids Market Size

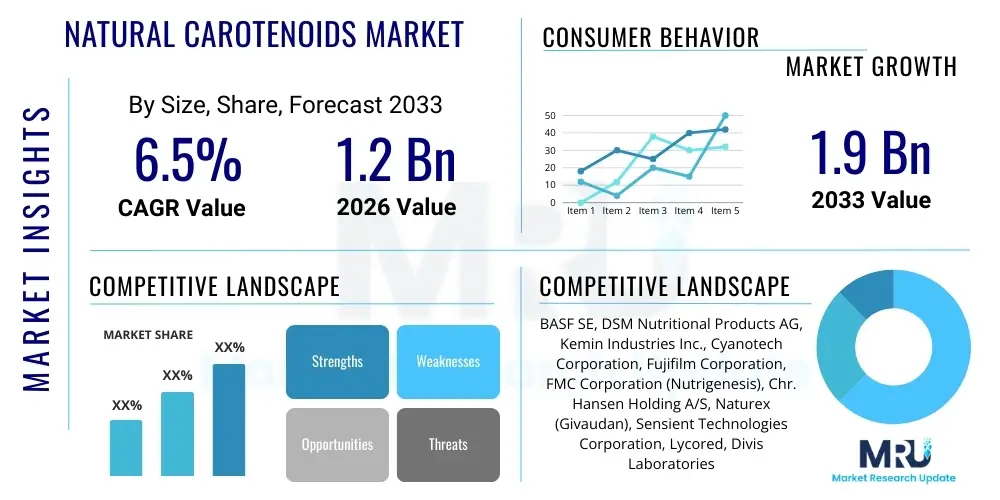

The Natural Carotenoids Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.38 Billion by the end of the forecast period in 2033. The expansive growth trajectory is primarily underpinned by shifting consumer preferences towards clean-label ingredients, functional foods, and preventive healthcare solutions globally. This sustained demand is further amplified by significant advancements in microalgae cultivation and extraction technologies, which collectively enhance the scalability and cost-efficiency of natural carotenoid production, thereby making them increasingly competitive alternatives to synthetic variants across various high-volume industrial applications such as nutraceuticals, advanced dietary supplements, and complex fortified food matrices. Regulatory environments across highly influential geographic regions, specifically including North America and Europe, are demonstrably favoring natural colorants and high-efficacy functional additives over artificial counterparts, a trend that substantially solidifies the market's positive outlook through 2033 while simultaneously demanding rigorous supply chain transparency, impeccable traceability, and stringent quality standardization protocols from all major manufacturers operating within this highly specialized and rapidly evolving bioproduction domain. Furthermore, the rising awareness concerning the profound antioxidant and photoprotective properties inherent in specific carotenoids, such as astaxanthin and lutein, is significantly driving their integration into high-value cosmetic formulations and targeted vision health supplements, cementing the projected revenue expansion over the delineated forecast horizon.

Natural Carotenoids Market introduction

The Natural Carotenoids Market encompasses the global production, distribution, and consumption of pigment molecules synthesized by plants, algae, and certain microorganisms, valued primarily for their vibrant coloring properties and profound biological functions, including acting as highly potent antioxidants and crucial precursors to Vitamin A. These compounds, which are fundamentally lipid-soluble, are indispensable in a diverse range of industries, most notably encompassing food and beverage processing, dietary supplementation, high-end cosmetic formulations, and specialized animal nutrition. Major applications focus on enhancing the visual appeal and nutritional profile of consumer goods, offering clean-label alternatives to artificial colorants, and providing targeted health benefits such as improved ocular health, enhanced immune function, and robust photoprotection against environmental stressors. Key benefits derived from utilizing natural carotenoids include their demonstrated capacity to combat oxidative stress, their inherently superior consumer acceptance due to natural sourcing, and their functional versatility across diverse product matrices. The primary driving factors propelling this substantial market expansion include the overarching global trend of consumer migration toward natural and organic food products, stringent regulatory opposition to synthetic food additives, continuous and successful technological innovations aimed at optimizing sustainable extraction and fermentation techniques, and the rapidly aging global population's increasing proactive engagement with preventive health and wellness strategies, which heavily rely on efficacious dietary supplements.

Natural Carotenoids Market Executive Summary

The global Natural Carotenoids Market is characterized by vigorous growth, largely steered by fundamental shifts in consumer dietary habits and decisive regulatory pressures favoring bio-based ingredients. Current business trends indicate a substantial strategic focus among key industry players on backward integration, particularly securing stable, cost-effective, and sustainable sourcing of microalgae and specialized botanical raw materials, often facilitated by advanced biotechnological processes like controlled fermentation and precision photobioreactor cultivation. Significant investment is being channeled into research and development efforts aimed at enhancing the bioavailability, physical stability, and overall shelf life of sensitive natural carotenoid compounds when incorporated into complex industrial formulations. Regionally, North America and Europe maintain their dominance, driven by exceptionally high consumer awareness regarding natural ingredients and deeply entrenched, rigorous clean-label mandates; however, the Asia Pacific (APAC) region is demonstrating the most aggressive compound annual growth, primarily fueled by rising disposable incomes, rapid urbanization, and the aggressive expansion of functional food and nutraceutical production capacity within economies such as China and India. Segment-wise, the Astaxanthin and Lutein categories are experiencing exponential demand growth due to their clinically validated benefits concerning eye health and cognitive function, while the application segment for dietary supplements continues to hold the largest market share, closely followed by the high-growth food and beverage sector actively replacing synthetic dyes with vibrant natural alternatives like beta-carotene and lycopene.

AI Impact Analysis on Natural Carotenoids Market

Analysis of common user questions regarding the influence of Artificial Intelligence (AI) on the Natural Carotenoids Market reveals significant interest in three primary areas: optimizing bioproduction efficiency, predicting market demand shifts, and accelerating novel compound discovery. Users frequently inquire about how AI-driven predictive modeling can stabilize the volatile supply chains inherent in biological sourcing, specifically asking about the application of machine learning (ML) to fine-tune environmental parameters within photobioreactors to maximize yield of specific high-value carotenoids like astaxanthin from microalgae, thereby reducing operational costs and ensuring product consistency. Additionally, there is considerable user concern regarding AI's potential role in analyzing complex metabolomics data, querying whether deep learning algorithms can identify new, highly potent, or more stable natural carotenoid variants faster than traditional biochemical screening methods. The overarching user expectation is that AI will introduce unprecedented levels of precision farming and process control, moving the industry away from traditional batch processing toward highly efficient, continuously optimized biomanufacturing systems, addressing longstanding industry challenges related to yield variability and high purification costs inherent in natural extraction processes, ultimately creating a much more scalable and economically viable sector capable of meeting surging global health and wellness demands.

- AI-driven optimization of microalgae cultivation parameters (temperature, light, nutrient dosing) to maximize carotenoid biosynthesis yield and purity.

- Machine learning algorithms utilized for predictive quality control and contaminant identification in raw biological feedstock, ensuring compliance and safety standards.

- Application of deep learning in metabolic pathway engineering for enhanced strain development of carotenoid-producing microorganisms (GEO Optimization).

- Automated market forecasting and demand sensing based on consumer sentiment analysis and regulatory shifts, guiding production allocation strategies.

- Use of bioinformatics and AI to rapidly screen and validate novel carotenoid structures or stabilization methods for nutraceutical applications.

DRO & Impact Forces Of Natural Carotenoids Market

The dynamics of the Natural Carotenoids Market are critically shaped by a complex interplay of powerful propelling forces, significant restrictive challenges, and expansive, latent opportunities. Primary market drivers include the accelerating global shift towards preventive healthcare models, which emphasizes the incorporation of dietary supplements rich in antioxidants, coupled with increasingly stringent governmental regulations in developed economies that systematically restrict the use of synthetic food colorants, compelling manufacturers to adopt natural alternatives. Conversely, the market faces notable restraints, chiefly stemming from the intrinsically high production and purification costs associated with natural sourcing, particularly from microalgae and controlled fermentation processes, alongside the inherent instability of certain natural carotenoids when exposed to light, heat, or oxygen during processing and storage, which necessitates complex encapsulation technologies. However, substantial opportunities exist, particularly in the untapped clinical nutrition sector, the aggressive expansion of the cosmetic and personal care industry seeking natural UV protection ingredients, and pioneering advances in high-efficiency, sustainable biotechnology platforms, such as continuous bioprocessing, which promise to significantly lower the production cost barrier. The overarching impact forces exert intense pressure on price points and competitive strategy, necessitating continuous innovation in extraction efficiency and compound stability while simultaneously mandating flawless compliance with evolving clean-label consumer mandates and international food safety standards, particularly concerning sustainable sourcing and transparent supply chain management.

Segmentation Analysis

The Natural Carotenoids Market exhibits multifaceted segmentation based on product type, source, and application, reflecting the diverse biological origins and widespread industrial utility of these potent compounds. The market analysis requires a meticulous examination of these segments to accurately gauge demand heterogeneity and identify core growth vectors. Product types such as Lutein and Astaxanthin currently command substantial market share, driven by compelling clinical evidence supporting their roles in vision and cardiovascular health, respectively. Segmentation by source highlights the continued transition towards biotechnological sourcing, where microalgae fermentation is rapidly displacing traditional extraction from fruits and vegetables due to superior yield control and production scalability. Furthermore, the application landscape is dominated by the dietary supplements and functional food sectors, which are capitalizing on the high nutritional value and consumer appeal of natural ingredients. A deeper understanding of these segment dynamics allows stakeholders to tailor their product development strategies and market entry approaches to maximize penetration into high-growth, high-value consumer niches, thereby optimizing resource allocation across the entire value chain.

- Product Type:

- Beta-Carotene

- Lutein

- Lycopene

- Astaxanthin

- Canthaxanthin

- Zeaxanthin

- Others (e.g., Cryptoxanthin)

- Source:

- Algae (e.g., Haematococcus pluvialis, Dunaliella salina)

- Fungi/Yeast (e.g., Phaffia rhodozyma)

- Fruits and Vegetables (e.g., Tomatoes, Carrots)

- Synthetic (Note: Focusing on Natural, but synthetic remains a comparative segment influence)

- Application:

- Food and Beverages

- Dietary Supplements/Nutraceuticals

- Animal Feed

- Cosmetics and Personal Care

- Pharmaceuticals

- Formulation:

- Oil Suspensions

- Powder

- Beads

- Emulsions

Value Chain Analysis For Natural Carotenoids Market

The Value Chain for the Natural Carotenoids Market initiates with highly specialized upstream activities, primarily involving the cultivation and harvesting of biological feedstock, such as microalgae (e.g., H. pluvialis for astaxanthin) or specific microbial strains used in fermentation. This upstream phase is technologically intensive, requiring significant capital investment in photobioreactors, closed cultivation systems, and proprietary strain optimization to ensure high yield and consistent quality of the precursor biomass. Challenges here revolve around maintaining sterile environments and efficiently scaling operations to manage fluctuations in raw material costs, demanding advanced process engineering and quality control protocols. The subsequent crucial midstream phase involves complex extraction, rigorous purification, and precise stabilization processes; these steps transform the raw biomass into highly concentrated, stable carotenoid ingredients suitable for commercial application, often relying on supercritical fluid extraction (SFE) or specific solvent-based methods, which are critical for achieving pharmaceutical or food-grade purity levels and meeting strict regulatory criteria.

Distribution channels represent the link between the specialized producers and the highly diverse downstream industrial consumers. Direct distribution is common for large-volume, specialized contracts, particularly between primary producers and major nutraceutical or cosmetic manufacturers who require stringent quality assurances and custom formulations, thereby allowing for meticulous control over product handling and technical specifications, which is paramount given the inherent instability of many natural carotenoids. Conversely, indirect distribution utilizes specialized ingredient distributors, brokers, and regional agents, particularly for smaller manufacturers or those targeting diverse geographical regions or niche application markets like animal feed. These intermediaries provide essential local market knowledge, manage inventory logistics, and facilitate necessary regulatory compliance specific to diverse international jurisdictions. The efficiency and reliability of these distribution networks are critical determinants of final product cost, market accessibility, and sustained competitiveness, necessitating robust cold-chain management and technical support across all global movement and storage operations.

The downstream sector is characterized by the incorporation of these refined carotenoid ingredients into final consumer products across diverse industries, including the formulation of eye health supplements, the color standardization of processed foods, and the development of high-performance anti-aging creams. End-user requirements drive the need for specific formulation characteristics, such as water dispersibility, enhanced bioavailability, and heat stability, influencing producer investment in advanced technologies like microencapsulation. Success in the downstream market hinges upon effective B2B marketing, strong clinical substantiation of health claims, and comprehensive consumer education regarding the superior functional benefits of natural carotenoids over their synthetic counterparts, thereby closing the loop by translating consumer willingness-to-pay for natural, beneficial ingredients back into sustained revenue generation for upstream bioproduction facilities.

Natural Carotenoids Market Potential Customers

Potential customers and primary end-users of natural carotenoids span a broad spectrum of consumer goods industries, driven fundamentally by the dual appeal of color enhancement and significant functional health benefits. The largest segment of buyers comprises companies within the dietary supplement and nutraceutical manufacturing sector, who purchase high-purity lutein, astaxanthin, and zeaxanthin primarily for formulation into vision health, cardiovascular support, and general immune boosting products, reflecting the core consumer demand for preventive wellness solutions. Food and beverage processors constitute the second major customer base, acquiring natural beta-carotene and lycopene specifically to replace synthetic azo dyes and artificial food colorings in products ranging from soft drinks and baked goods to dairy alternatives, aligning strictly with contemporary clean-label sourcing mandates and consumer preference for natural ingredient lists.

Beyond the immediate health and food sectors, there is a rapidly expanding customer group within the cosmetic and personal care industry. These manufacturers utilize high-grade astaxanthin and specialized beta-carotene derivatives as active ingredients in premium anti-aging formulations, sun protection products, and topical antioxidants, capitalizing on their documented ability to neutralize free radicals and offer photoprotective benefits to the skin. Furthermore, agricultural and animal feed manufacturers represent a critically stable customer segment, particularly for canthaxanthin and certain forms of lutein, which are essential for enhancing the pigmentation of poultry egg yolks, farmed salmon flesh, and ornamental fish, ensuring that the final animal products meet established aesthetic quality standards that are highly valued in commercial agricultural practices.

The purchasing decisions of these potential customers are heavily influenced by the critical factors of ingredient origin traceability, the technical stability of the supplied formulation (e.g., powder versus oil suspension), and compliance with country-specific regulatory approvals (e.g., GRAS status in the US or EFSA approval in Europe). Therefore, suppliers must not only offer competitive pricing but also provide comprehensive technical documentation, strong clinical validation data, and assurances of sustainable and ethical sourcing practices. This necessitates deep customer engagement, particularly with R&D departments, to ensure that the carotenoid ingredient effectively integrates into complex formulation matrices without compromising efficacy or stability, thereby securing long-term supply contracts and cementing customer loyalty across these highly demanding industrial sectors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.38 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, DSM Nutritional Products AG, Kemin Industries Inc., Chr. Hansen Holding A/S, Cyanotech Corporation, D.D. Williamson & Co. Inc., Divi's Laboratories Limited, ExcelVite Sdn. Bhd., Fuji Chemical Industry Co. Ltd., AstaReal AB, Algatech Ltd., Novus International Inc., Lycored Corp., EID Parry Ltd. (Algae Division), Valensa International, Allied Biotech Corporation, Zhejiang Medicine Co. Ltd., Sensient Technologies Corporation, Givaudan SA, Carotech Bhd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Natural Carotenoids Market Key Technology Landscape

The Natural Carotenoids Market is defined by a rapidly advancing technological landscape focused intensely on maximizing yield, ensuring purity, and significantly enhancing the stability and bioavailability of the final ingredients. Key technologies currently driving innovation include advanced photobioreactor systems, which offer highly controlled, closed environments for the efficient cultivation of microalgae such as H. pluvialis and D. salina. These systems leverage sophisticated LED light spectral management and precise CO2 injection techniques to optimize photosynthetic efficiency and subsequently boost the cellular accumulation of targeted carotenoids like astaxanthin and beta-carotene, significantly reducing the environmental footprint and minimizing contamination risks associated with traditional open pond cultivation methods. Continuous flow and bioreactor optimization employing machine learning are paramount to reducing operational variability and achieving industrial-scale cost efficiency, allowing producers to meet the high-volume demands of the global nutraceutical industry.

Extraction and purification methodologies represent another critical technological frontier. Supercritical Fluid Extraction (SFE), particularly using non-toxic CO2, has become the preferred industry standard for high-value carotenoids due to its ability to selectively extract lipid-soluble compounds without leaving harmful solvent residues, thereby meeting the stringent quality requirements of the food and pharmaceutical sectors. Complementary technologies include membrane filtration and advanced crystallization techniques used downstream to achieve ultra-high purity levels (e.g., 90%+ concentration), essential for specialized cosmetic and dietary supplement applications where dosage precision is vital. The industry is also seeing increased application of enzymatic hydrolysis methods to break down cell walls more effectively, thereby maximizing the recovery rate from resilient biological sources, ensuring resource maximization and minimizing processing waste.

Finally, stabilization and delivery technology is fundamentally necessary to counteract the intrinsic susceptibility of natural carotenoids to degradation by light, oxygen, and heat, a challenge that historically limited their shelf life and application range. Microencapsulation and nano-emulsification are pivotal, involving coating the sensitive carotenoid molecules within protective matrices (often starch derivatives, gelatin, or liposomal structures) to improve stability and facilitate their incorporation into water-based matrices like beverages or powders. These delivery technologies also play a dual role in significantly enhancing the oral bioavailability of the carotenoids, ensuring superior absorption and clinical efficacy once consumed. Continuous investment in these sophisticated delivery systems is critical for unlocking new high-growth applications, particularly in functional beverages and fortified foods, where carotenoid stability under demanding processing conditions is non-negotiable for product viability.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand and supply landscape of the Natural Carotenoids Market, reflecting differences in regulatory frameworks, consumer health expenditure, and local bioproduction capacity. Each region contributes uniquely to the global market trajectory, requiring localized strategic engagement from key players.

- North America: Dominant market share attributed to high consumer health consciousness, widespread acceptance and integration of dietary supplements, and robust, well-established regulatory support for natural food colorants (e.g., FDA approval systems). The region is a pioneer in clinical research related to carotenoids, driving high demand for lutein and astaxanthin for vision health. The US leads in consumption, fueled by the large geriatric population focused on anti-aging and preventive therapies.

- Europe: Characterized by highly restrictive regulations concerning synthetic food additives (e.g., the EU colorants directive), which strongly incentivizes the mandatory substitution with natural carotenoids in the food and beverage industry. The region emphasizes sustainability and traceability, driving demand for premium, ethically sourced carotenoid ingredients, particularly from specialized microalgae cultivation facilities located in Scandinavian countries and the Netherlands.

- Asia Pacific (APAC): The fastest-growing region globally, propelled by burgeoning middle-class populations, increasing disposable income, rapid urbanization leading to lifestyle shifts, and the consequent growth of the domestic functional food and beverage markets, particularly in China, Japan, and India. While traditionally a manufacturing hub for synthetic colorants, APAC is now heavily investing in sophisticated bioproduction capabilities, particularly microalgae and fermentation technology, to meet both local and export demands for high-purity natural ingredients.

- Latin America (LATAM): Emerging market demonstrating significant potential, largely driven by the growth of the animal feed sector (poultry and aquaculture) requiring natural pigments, coupled with a growing interest in nutraceuticals, particularly in Brazil and Mexico. Challenges include regulatory fragmentation and dependence on imported high-tech ingredients, but local sourcing from specialized fruit/vegetable extracts (e.g., annatto, capsicum) is strong.

- Middle East and Africa (MEA): Represents the smallest, yet developing, regional market. Growth is localized in the Gulf Cooperation Council (GCC) countries, driven by increasing awareness of health supplements and the importation of premium food products. Limited local manufacturing of advanced natural carotenoids means the region relies heavily on imports from Europe and North America, necessitating complex logistics and supply chain management.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Natural Carotenoids Market.- BASF SE

- DSM Nutritional Products AG

- Kemin Industries Inc.

- Chr. Hansen Holding A/S

- Cyanotech Corporation

- Divi's Laboratories Limited

- ExcelVite Sdn. Bhd.

- Fuji Chemical Industry Co. Ltd.

- AstaReal AB

- Algatech Ltd.

- Lycored Corp.

- EID Parry Ltd. (Algae Division)

- Valensa International

- Allied Biotech Corporation

- Zhejiang Medicine Co. Ltd.

- Sensient Technologies Corporation

- Givaudan SA

- Novus International Inc.

- D.D. Williamson & Co. Inc.

- Bio-Techne Corporation

Frequently Asked Questions

Analyze common user questions about the Natural Carotenoids market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between natural and synthetic carotenoids in the market?

Natural carotenoids are derived from biological sources like algae, fungi, or plants, offering superior biological activity and consumer appeal due to clean-label positioning. Synthetic carotenoids are chemically manufactured, often offering lower cost but facing increasing regulatory scrutiny and consumer distrust regarding artificial additives.

Which natural carotenoid segment is driving the fastest market growth?

Astaxanthin and Lutein are experiencing the most rapid growth due to extensive clinical evidence validating their efficacy in eye health (Age-related Macular Degeneration prevention) and their high antioxidant potency, making them essential ingredients in premium nutraceuticals and high-end cosmetic products globally.

How is biotechnology influencing the cost efficiency of natural carotenoids?

Biotechnology, particularly utilizing closed photobioreactors and microbial fermentation, significantly enhances cost efficiency by providing highly predictable and scalable production yields, reducing dependence on volatile agricultural harvests, and allowing for precise control over purity, crucial for lowering overall production barriers.

What are the main regulatory hurdles affecting the widespread adoption of natural carotenoids?

Key hurdles include the high cost and time required for achieving regulatory approvals (e.g., Novel Food status in the EU or GRAS in the US) for new sourcing methods or formulations, alongside managing stringent international purity and heavy metal contamination limits required by global food safety authorities.

Which application sector holds the largest current market share for natural carotenoids?

The Dietary Supplements and Nutraceuticals sector currently holds the largest market share, driven by high per capita spending on health maintenance products, strong consumer belief in antioxidant benefits, and the increasing trend of self-medication and proactive wellness management, particularly in North America and Europe.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Natural Carotenoids Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Natural Carotenoids Market Size Report By Type (Astaxanthin, Beta-Carotene, Fucoxanthin, Lutein, Canthaxanthin, Lycopene, Other), By Application (Food, Feed, Pharmaceuticals, Cosmetics, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager