Natural Carotenoids Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434871 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Natural Carotenoids Market Size

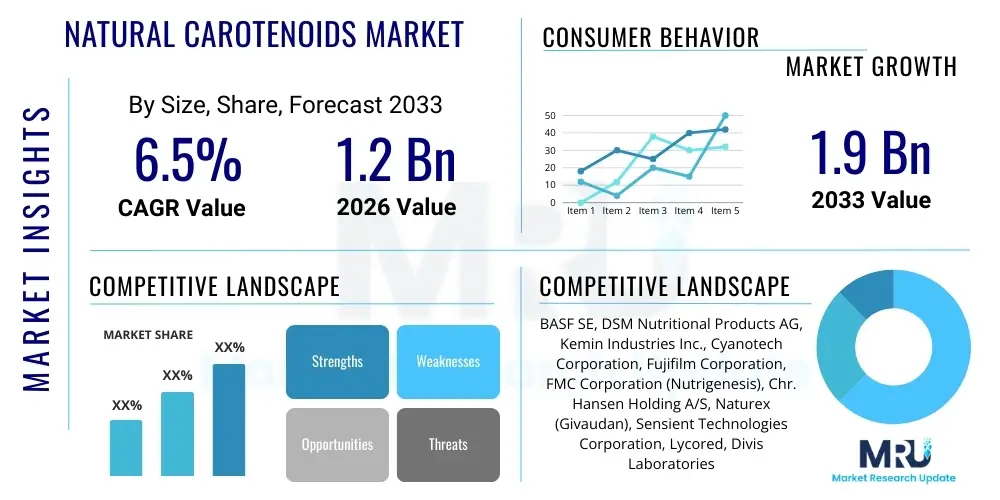

The Natural Carotenoids Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $1.9 Billion by the end of the forecast period in 2033.

Natural Carotenoids Market introduction

Natural carotenoids represent a class of vibrant pigments synthesized by plants, algae, and photosynthetic bacteria. These fat-soluble compounds, encompassing over 750 known structures such as beta-carotene, lutein, astaxanthin, and lycopene, are essential micronutrients widely recognized for their powerful antioxidant properties and roles in photoprotection. The market encompasses the sourcing, extraction, purification, and commercial application of these compounds across various high-value industries. Primary sources are diverse, ranging from microbial fermentation (e.g., Haematococcus pluvialis for astaxanthin) to plant extraction (e.g., marigold flowers for lutein), emphasizing sustainable and biotechnological production methods.

The major applications of natural carotenoids span four critical sectors: nutraceuticals and dietary supplements, food and beverages, animal feed, and cosmetics. In the supplement industry, specific carotenoids like lutein and zeaxanthin are paramount for vision health, mitigating age-related macular degeneration (AMD), while lycopene is valued for cardiovascular and prostate health benefits. The food and beverage sector utilizes carotenoids extensively as natural coloring agents, replacing synthetic dyes to meet stringent clean label requirements and enhancing product visual appeal while delivering inherent nutritional value. This functional integration drives significant market dynamics.

Market growth is predominantly driven by the accelerating global trend towards preventive healthcare and the subsequent rise in demand for functional foods and natural supplements. Consumers are increasingly seeking ingredients derived from natural sources, associating them with enhanced safety and efficacy compared to artificial additives. Furthermore, stringent regulatory scrutiny on synthetic food colorants across developed economies, particularly in the European Union and North America, substantially bolsters the adoption rate of natural carotenoid alternatives, cementing their critical role in modern product formulation strategies.

Natural Carotenoids Market Executive Summary

The natural carotenoids market is characterized by robust commercial activity driven by intense research and development focused on optimizing biosynthesis and extraction efficiency. Key business trends include the vertical integration among major market players, securing raw material supply chains, particularly microalgae and fermentation strains, to ensure consistency and cost competitiveness. There is a noticeable strategic shift toward high-value segments, specifically Astaxanthin and Lutein, which command premium pricing due to their proven efficacy in high-growth therapeutic areas like eye health and cognitive function. Furthermore, sustainability initiatives, focusing on reducing the environmental footprint of cultivation methods, are becoming central to corporate strategy, appealing to ethically conscious consumers and investors.

Geographically, North America and Europe remain the dominant revenue generators, primarily owing to high consumer awareness, mature regulatory frameworks supporting nutraceutical sales, and high per capita expenditure on preventive health supplements. However, the Asia Pacific (APAC) region is poised to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid expansion in APAC is fueled by expanding middle-class populations, increased urbanization leading to dietary changes, and rapid modernization of regulatory standards favoring natural food additives in populous markets like China and India. Government initiatives promoting health and wellness also play a crucial supportive role in regional market development.

Segment trends confirm the Nutraceutical application segment's supremacy in terms of market share, driven by the aging global population and the concomitant increase in chronic health concerns requiring supplemental support. By product type, Astaxanthin is emerging as a critical growth engine, attributed to its status as one of the most potent natural antioxidants known, finding broad utility across supplements, cosmetics, and specialized aquaculture feeds. In terms of source, microbial and algal production methods are gaining significant traction over traditional botanical extraction, offering scalable, controlled, and environmentally superior means of producing high-purity carotenoids, thus stabilizing supply volatility inherent in agricultural sourcing.

AI Impact Analysis on Natural Carotenoids Market

Common user questions regarding AI's impact on the Natural Carotenoids Market frequently center on its potential to revolutionize production efficiency and product personalization. Users inquire how AI algorithms can predict optimal growth conditions for microalgae, thereby maximizing carotenoid yield and minimizing resource use, or how machine learning can accelerate the screening of new, highly efficient microbial strains. A secondary theme concerns quality assurance, asking whether AI-powered vision systems and real-time analytical tools can ensure purity levels exceed traditional methods, addressing concerns about contamination and batch inconsistency. Finally, significant interest exists in AI's role in market forecasting, specifically anticipating shifts in consumer demand for specific carotenoid types based on trending health data and nutritional science breakthroughs, ensuring that supply chains are agile and responsive to nuanced market signals.

The practical implementation of Artificial Intelligence and Machine Learning (ML) is fundamentally transforming the upstream segment of the value chain. AI is being deployed to optimize fermentation kinetics and photobioreactor environments. By continuously monitoring parameters such as light intensity, temperature, pH, and nutrient concentration, ML models can dynamically adjust cultivation settings to stress the organisms optimally, forcing maximum carotenoid biosynthesis—a technique particularly vital for high-value compounds like Astaxanthin derived from algae. This precise control not only boosts yield exponentially but also drastically reduces operational energy consumption and production waste, enhancing the sustainability profile of the sourcing process.

Furthermore, AI is instrumental in accelerating downstream processing and product development. Predictive modeling assists in selecting the most effective and stable formulation matrix for finished products, minimizing degradation during storage and maximizing bioavailability upon consumption. In the context of product innovation, deep learning algorithms analyze vast datasets encompassing genetic information, clinical trial results, and ingredient interactions, facilitating the rapid identification of novel synergistic combinations or personalized dosing recommendations based on individual health biomarkers, thereby pushing the market toward highly customized nutraceutical solutions and maintaining a competitive edge through technological superiority.

- AI optimizes microalgae cultivation parameters (light, nutrients, temperature) for maximal carotenoid biosynthesis yields.

- Machine Learning accelerates the discovery and selection of high-producing microbial strains through genomic analysis.

- Predictive maintenance using AI minimizes downtime in complex bioreactor and extraction facilities.

- Deep learning models forecast consumer trends and localized demand for specific carotenoid-based supplements.

- AI-powered quality control systems enhance purity assurance and detect trace contaminants in real-time during processing.

- Personalized nutrition platforms utilize ML to recommend tailored carotenoid intake based on user biometric and health data.

DRO & Impact Forces Of Natural Carotenoids Market

The natural carotenoids market is currently propelled by several powerful drivers, most notably the pervasive consumer shift toward health-conscious consumption patterns globally. This movement is intrinsically linked to the proven efficacy of certain carotenoids, such as lutein and zeaxanthin, in supporting ocular health, a necessity amplified by increased screen time across all demographics. Concurrently, regulatory shifts in major economic blocs, favoring natural ingredients over synthetic alternatives in both food coloring and pharmaceutical applications, provide substantial tailwinds. Furthermore, ongoing clinical research continually validates the role of compounds like astaxanthin as potent internal sunscreens and powerful anti-inflammatories, expanding their market appeal beyond basic nutrition into therapeutic and cosmeceutical applications, thereby ensuring sustained market momentum.

Despite strong driving forces, the market faces significant restraints that temper growth potential and necessitate strategic navigation by key players. Primary among these is the inherently high cost of production associated with natural extraction and fermentation processes compared to the low-cost chemical synthesis of synthetic alternatives, creating pricing pressure in competitive end-user markets. Additionally, the stability and bioavailability challenges of natural carotenoids pose a technical hurdle; these compounds are highly sensitive to oxidation, heat, and light, requiring advanced and often expensive encapsulation or stabilization technologies to maintain potency throughout the product lifecycle. Regulatory complexity also acts as a restraint, particularly concerning novel sources or applications, requiring extensive and costly approval processes.

Significant opportunities exist in emerging markets and technological advancements, promising future expansion. The increasing focus on personalized nutrition offers a lucrative pathway, where specialized carotenoid mixtures can be formulated based on individual genetic or biomarker profiles, commanding premium pricing and higher market penetration. Technological breakthroughs in biotechnology, particularly synthetic biology and precision fermentation, hold the potential to dramatically lower production costs, enhance yield, and improve the environmental sustainability of carotenoid sourcing, thereby overcoming the key restraint related to pricing. Moreover, the largely untapped potential of natural carotenoids in veterinary health and feed, beyond standard pigmentation, represents a rapidly expanding vertical market that promises high returns on specialized investment.

Segmentation Analysis

The Natural Carotenoids Market is systematically segmented based on Product Type, Source, Application, and Geography, reflecting the diverse origins and widespread industrial utilization of these potent compounds. The segmentation analysis reveals the specific market dynamics within each category, highlighting the dominance of high-value segments such as Astaxanthin and Lutein within the product type classification, driven by their superior functional benefits and strong clinical backing. Source segmentation underscores the growing technological advantage and scalability of microbial and algal sourcing methods over traditional botanical extraction, positioning biotech firms as future market leaders. Finally, the application analysis clearly defines nutraceuticals and dietary supplements as the largest consuming sector, consistently demanding high-purity ingredients for health optimization products, while the food industry remains crucial for volume consumption as a natural colorant.

- By Product Type:

- Beta-Carotene

- Lutein

- Astaxanthin

- Lycopene

- Canthaxanthin

- Zeaxanthin

- Others (e.g., Capsanthin, Cryptoxanthin)

- By Source:

- Algae

- Fungi/Yeast

- Botanical (Fruits, Vegetables, Flowers)

- Synthetic (Note: Focus is on Natural, but synthetic comparison often crucial for context)

- By Application:

- Nutraceuticals and Supplements

- Food and Beverages (Coloring and Fortification)

- Animal Feed (Aquaculture and Poultry)

- Cosmetics and Personal Care

Value Chain Analysis For Natural Carotenoids Market

The value chain for the natural carotenoids market begins with extensive upstream analysis focused on securing and optimizing raw material procurement. This stage involves the selection and cultivation of high-yield sources, predominantly microalgae strains (like Haematococcus pluvialis or Dunaliella salina), specialized yeast, or specific botanical materials (e.g., marigold petals). The key challenge upstream is achieving scale and consistency while minimizing cultivation costs. For microalgae, this involves highly controlled photobioreactor systems or large open-pond systems, managed through sophisticated monitoring to ensure optimal growth and maximum carotenoid accumulation before harvesting. Investment in R&D at this initial stage is critical for developing more robust and efficient strains, improving the yield per unit of cultivation space, and minimizing dependency on variable environmental factors, which directly impacts the final ingredient cost.

The midstream segment involves the intricate processes of harvesting, extraction, and purification. Harvesting microalgae requires specialized techniques (e.g., flocculation, centrifugation) to concentrate the biomass. This is followed by extraction, where methods like supercritical CO2 extraction are increasingly favored over traditional solvent-based processes due to their higher efficiency, purity, and environmental safety, yielding premium-grade extracts. Purification is then essential to achieve high standardized concentrations (e.g., 5% or 10% Lutein), meeting stringent regulatory standards for use in nutraceuticals. Distribution channels vary; large, integrated players often use direct sales to major multinational food and supplement manufacturers, ensuring tight control over quality and logistics. Conversely, smaller producers often rely on specialized ingredient distributors and brokers who manage warehousing, smaller batch sizes, and regulatory documentation across diverse geographic markets, serving as crucial intermediaries.

The downstream component involves formulation, quality assurance, marketing, and final sales to end-users. After purification, the raw carotenoid ingredient must often be processed further, such as microencapsulation or creation of beadlets, to enhance stability, improve shelf-life, and maximize bioavailability—essential characteristics for integration into complex food matrices or supplement capsules. Marketing efforts focus heavily on scientific substantiation and clean-label narratives, appealing directly to consumer trends. End-use industries (Nutraceuticals, F&B, Cosmetics) represent the final link, where the ingredient is incorporated into finished products and sold through retail, e-commerce, or specialized distribution networks. Maintaining strong backward traceability and demonstrating sustainable sourcing practices throughout the entire value chain is paramount for gaining competitive advantage and consumer trust in this highly sensitive ingredients market.

Natural Carotenoids Market Potential Customers

The primary and most lucrative customer segment for natural carotenoids comprises manufacturers in the Nutraceutical and Dietary Supplements industry. These buyers demand extremely high-purity, standardized extracts, particularly Lutein, Zeaxanthin, Astaxanthin, and Lycopene, for targeted health formulations. Their purchasing decisions are driven by clinical evidence supporting specific health claims (such as vision support, immunity boosting, and anti-aging properties), regulatory compliance, and consistent supply reliability. This segment leverages carotenoids as premium functional ingredients, catering to an aging global population seeking proactive health maintenance and relying heavily on supplement consumption, making them the largest value consumer in the market.

A secondary, high-volume customer segment is the Food and Beverage (F&B) industry, particularly manufacturers focused on 'clean label' and natural positioning. These customers purchase carotenoids, predominantly Beta-Carotene and Annatto (Bixin/Norbixin), primarily for their function as natural coloring agents in products like juices, baked goods, confectionery, and dairy alternatives. The driving force for F&B procurement is the urgent need to replace artificial FD&C dyes under mounting consumer pressure and regulatory mandate. While the volume demand is high, the required purity and concentration might be lower than nutraceutical grade, making cost-effectiveness a crucial factor in their supplier selection, often favoring larger suppliers capable of providing stable, large-scale volumes.

Furthermore, the Animal Feed and Aquaculture sectors represent a specialized but rapidly growing customer base. In aquaculture, particularly salmon and trout farming, Astaxanthin and Canthaxanthin are essential for achieving the characteristic pink-red pigmentation required for market acceptance. In poultry, these compounds are utilized to enhance the color saturation of egg yolks and broiler skin, adding perceived quality and value. These buyers prioritize cost efficiency, ease of integration into feed mixtures, and efficacy in pigmentation. Cosmetic and personal care companies also constitute a niche, high-value customer group, utilizing carotenoids for their topical antioxidant and skin-protection benefits in creams, sunscreens, and anti-aging formulations, focusing heavily on source purity and aesthetic integration.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $1.9 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, DSM Nutritional Products AG, Kemin Industries Inc., Cyanotech Corporation, Fujifilm Corporation, FMC Corporation (Nutrigenesis), Chr. Hansen Holding A/S, Naturex (Givaudan), Sensient Technologies Corporation, Lycored, Divis Laboratories Ltd., Parry Nutraceuticals (EID Parry), Valensa International, Doehler Group, Hefei TNJ Chemical Industry Co. Ltd., Algatech Ltd., AstaReal AB, Piveg Inc., Indena S.p.A., Allied Biotech Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Natural Carotenoids Market Key Technology Landscape

The technological landscape of the Natural Carotenoids Market is continuously evolving, driven by the need to enhance yield, purity, and sustainability while reducing costs. A critical focus area is the advancement in cultivation methods, specifically the transition from traditional open pond systems to highly controlled closed photobioreactors (PBRs) for microalgae cultivation. PBR technology allows for precise regulation of crucial environmental parameters, including CO2 supply, light spectrum, and nutrient delivery, which minimizes the risk of contamination and significantly increases the concentration of valuable carotenoids per biomass unit. Furthermore, genetic engineering and synthetic biology techniques are being utilized to optimize the metabolic pathways of algae and yeast strains, leading to 'super-producer' organisms that synthesize carotenoids more efficiently, thus lowering the final ingredient cost and ensuring supply reliability.

In the downstream segment, sophisticated extraction and purification technologies are defining market competitiveness. Supercritical Carbon Dioxide (sc-CO2) extraction has emerged as the industry gold standard due to its ability to selectively extract heat-sensitive carotenoids without using harsh organic solvents, resulting in cleaner, purer, and regulatory-compliant final products, a necessary attribute for the nutraceutical sector. Complementary technologies such as High-Performance Liquid Chromatography (HPLC) and advanced filtration systems are integral for achieving the ultra-high purity required for pharmaceutical and specialized supplement applications. Technological investment in these purification steps is essential to differentiate premium ingredients in a crowded market and meet increasing demands for contaminant-free ingredients.

Stabilization and delivery technologies form the third pillar of the technological landscape, addressing the inherent instability of natural carotenoids which are prone to rapid degradation when exposed to oxygen, light, or heat. Microencapsulation, liposomal delivery systems, and nanoemulsion technologies are widely adopted to protect the active compounds, enhance their shelf life, and significantly improve their oral bioavailability upon consumption. These delivery systems are crucial for ensuring the efficacy of the final product, especially in functional food and beverage applications where ingredients are subjected to harsh processing conditions. Continuous innovation in these areas is vital for unlocking new formulation possibilities and expanding the application scope of natural carotenoids beyond conventional supplement formats.

Regional Highlights

The regional market for natural carotenoids exhibits marked variations in maturity, consumption patterns, and growth trajectories. North America, driven by the United States, commands the largest market share due to high consumer spending on health and wellness, established regulatory pathways for dietary supplements, and robust penetration of functional foods. Europe follows closely, characterized by stringent regulations banning many synthetic colors, thereby creating a captive market for natural alternatives, particularly in the F&B industry. The rapid expansion of the Asia Pacific (APAC) market, however, is positioning it as the primary future growth engine. This growth is underpinned by increasing disposable incomes, rising awareness regarding preventive health, and substantial governmental investment in food security and nutrition programs across key economies like China, India, and Japan.

- North America: Market leader, strong demand from the nutraceutical sector, focus on Lutein and Astaxanthin for eye and brain health supplements. Regulatory environment favors natural sourcing.

- Europe: High adoption rate due to strict EU regulations (EFSA) severely limiting synthetic food colors, driving demand for Beta-Carotene and Lycopene in F&B manufacturing. Strong focus on sustainable sourcing.

- Asia Pacific (APAC): Fastest-growing region, fueled by rising middle-class consumer segments, rapid urbanization, and increasing acceptance of functional foods; China and India are major production hubs and consumption centers.

- Latin America (LATAM): Emerging market with growing potential in animal feed and domestic F&B coloring applications, although supply chains can be fragmented.

- Middle East and Africa (MEA): Primarily import-dependent, with opportunities in the premium cosmetics and specialized health supplement markets, driven by high-income countries in the GCC region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Natural Carotenoids Market.- BASF SE

- DSM Nutritional Products AG

- Kemin Industries Inc.

- Cyanotech Corporation

- Fujifilm Corporation (AstaReal AB)

- FMC Corporation (Nutrigenesis)

- Chr. Hansen Holding A/S

- Lycored

- Divis Laboratories Ltd.

- Parry Nutraceuticals (EID Parry)

- Valensa International

- Doehler Group

- Algatech Ltd.

- Sensient Technologies Corporation

- Piveg Inc.

- Indena S.p.A.

- Allied Biotech Corporation

- Microphyt S.A.

- Katana Bio.

- Syntace S.A.

Frequently Asked Questions

Analyze common user questions about the Natural Carotenoids market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for natural carotenoids?

The primary driver is the accelerating global consumer preference for clean-label products and preventive healthcare solutions. Natural carotenoids, valued for their strong antioxidant properties and scientifically proven benefits in areas like ocular and cardiovascular health, are replacing synthetic ingredients across supplements and food industries due to consumer desire for natural sourcing.

How does the production cost of natural carotenoids compare to synthetic alternatives?

Natural carotenoids generally have significantly higher production costs due to the complex, resource-intensive nature of cultivation (especially microalgae farming) and specialized extraction/purification methods (like sc-CO2 extraction). This contrasts with synthetic counterparts, which benefit from cheaper, large-scale chemical synthesis processes, leading to cost competitiveness challenges for natural producers.

Which natural carotenoid segment exhibits the highest growth rate?

Astaxanthin is the segment exhibiting the highest growth rate. Derived primarily from microalgae, Astaxanthin is recognized as one of the most potent natural antioxidants, driving demand in high-value applications across nutraceuticals, cosmeceuticals, and specialized aquaculture feeds, significantly outpacing the growth of Beta-Carotene and Lycopene.

What technological advancements are key to improving carotenoid stability and shelf life?

Key technological advancements focus on encapsulation and delivery systems. Techniques such as microencapsulation, liposomal delivery, and nanoemulsions are employed to shield the sensitive carotenoid molecules from degradation caused by heat, light, and oxidation, ensuring maximum biological efficacy and extending the shelf life of the final product formulations.

Which application segment holds the largest share in the Natural Carotenoids Market?

The Nutraceuticals and Dietary Supplements application segment holds the largest market share. This dominance is driven by high regulatory acceptance of carotenoids for specific health claims (e.g., AMD prevention, immune support) and substantial consumer uptake of high-concentration supplements aimed at addressing chronic health concerns linked to aging populations globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Natural Carotenoids Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Natural Carotenoids Market Size Report By Type (Astaxanthin, Beta-Carotene, Fucoxanthin, Lutein, Canthaxanthin, Lycopene, Other), By Application (Food, Feed, Pharmaceuticals, Cosmetics, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager