Oxetane Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442213 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Oxetane Market Size

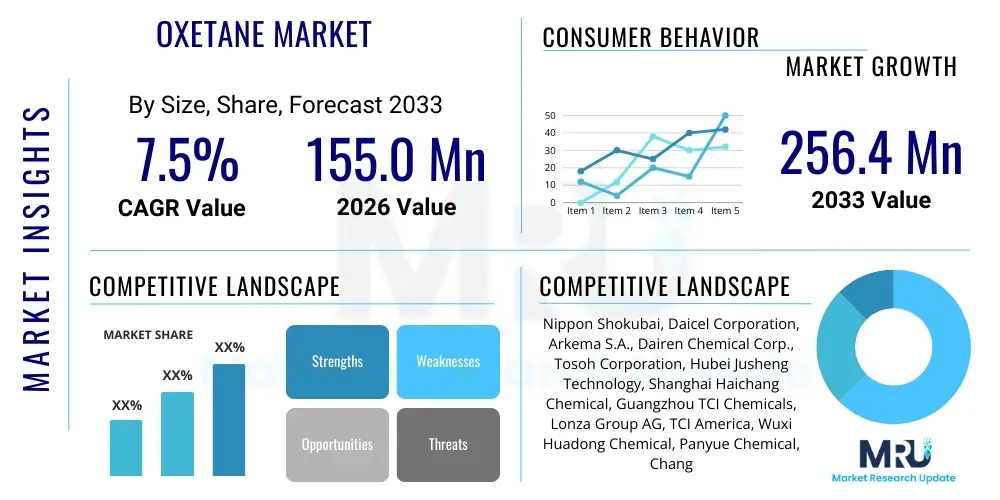

The Oxetane Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% (CAGR) between 2026 and 2033. The market is estimated at $150.5 Million USD in 2026 and is projected to reach $275.2 Million USD by the end of the forecast period in 2033. This robust expansion is primarily fueled by the increasing demand for high-performance specialty chemicals, particularly in the pharmaceutical and advanced materials sectors where oxetane derivatives offer superior structural stability and controlled reactivity for complex synthetic processes. The increasing investment in research and development activities focused on novel drug discovery and polymer innovation acts as a significant catalyst for market valuation growth over the coming seven years.

Oxetane Market introduction

Oxetane is a four-membered heterocyclic ether compound characterized by a strained ring structure, which imparts high reactivity and unique chemical properties essential for specialized industrial applications. It serves as a crucial building block in organic synthesis, particularly valued for its role in modifying molecular structures in medicinal chemistry and developing advanced materials. The market encompasses various substituted oxetane derivatives, such as Oxetane-3-Methanol and 3-Ethyl-3-Hydroxymethyl Oxetane, which are utilized based on their specific functional requirements in end-use industries. Oxetane’s ability to participate in ring-opening polymerization makes it indispensable in the synthesis of high-performance polyether polyols and oligomers used in advanced coatings and adhesives.

Major applications of oxetane derivatives span across the pharmaceutical industry, where they are integral for synthesizing novel drug candidates, especially in oncology and antiviral research, due to the bioisosteric replacement capabilities they offer. Furthermore, the agrochemical sector leverages oxetane's structural stability to create enhanced, more efficacious pesticide and herbicide molecules. In material science, oxetane compounds are widely utilized in UV-curable coatings, high-solids paints, and specialty resin formulations, providing characteristics like low viscosity, high mechanical strength, and excellent adhesion. The versatility and unique characteristics of the oxetane ring position it as a premium chemical intermediate.

The primary driving factors propelling the Oxetane market include the escalating global investment in pharmaceutical research and development, particularly the focus on small-molecule drug discovery requiring complex structural intermediates. Secondly, the increasing regulatory pressure for volatile organic compound (VOC) reduction in coatings and adhesives boosts the demand for high-solid and UV-curable systems, often incorporating oxetane-based monomers. The inherent benefits, such as enhanced thermal stability, improved weather resistance, and controlled polymerization kinetics afforded by oxetane derivatives, further cement its necessity across multiple high-value industrial chains, ensuring sustained market growth throughout the forecast period.

Oxetane Market Executive Summary

The global Oxetane market is experiencing robust growth driven predominantly by technological advancements in drug synthesis and the burgeoning demand for high-performance specialty polymers in the Asia Pacific region. Business trends indicate a shift towards outsourcing complex chemical synthesis to specialized contract manufacturing organizations (CMOs) that require large quantities of high-purity oxetane intermediates. Furthermore, sustainability initiatives are influencing product development, favoring oxetane-based formulations in coatings that minimize environmental impact, thereby expanding their commercial applicability across stringent regulatory environments in North America and Europe. Key market participants are concentrating on capacity expansion and strategic partnerships to secure raw material supply and broaden their geographical reach, capitalizing on the increasing complexity of chemical synthesis requirements globally.

Regionally, Asia Pacific (APAC) stands out as the most dynamic and fastest-growing market segment, primarily fueled by the rapid expansion of the pharmaceutical manufacturing bases in countries like China and India, coupled with significant investments in infrastructure and construction demanding advanced coatings and adhesives. North America and Europe maintain substantial market shares due to high levels of pharmaceutical R&D expenditure and the stringent adoption of high-performance polymer solutions in aerospace and automotive industries. Regional trends also show increasing integration of oxetane suppliers into regional value chains to mitigate logistics challenges and ensure timely supply to critical end-users. Regulatory support for new drug filings utilizing novel chemical entities containing oxetane rings further solidifies regional market strength.

In terms of segment trends, the Application segment dominated by Pharmaceuticals holds the largest market share, illustrating oxetane's critical function as a bioisostere and ring-expansion scaffold in drug discovery. Within the Derivative Type segment, specialized derivatives such as 3-Ethyl-3-Hydroxymethyl Oxetane (EHMO) are exhibiting accelerated growth due to their superior performance characteristics in UV-curable systems and specialty resin production, providing improved flexibility and faster curing times. The shift in manufacturing preference towards high-solid content formulations across the materials sector is consistently driving the demand for specialized oxetane monomers, leading to segment diversification and innovation focused on purity and scalability across the entire product portfolio.

AI Impact Analysis on Oxetane Market

User inquiries concerning the influence of Artificial Intelligence (AI) on the Oxetane market frequently revolve around how computational chemistry can accelerate the discovery and synthesis of novel oxetane-containing drug candidates, whether AI-driven process optimization can enhance manufacturing yield and purity, and the potential for predictive modeling to identify new high-performance polymer formulations utilizing oxetane monomers. Key themes indicate strong user expectation that AI will revolutionize the early-stage drug discovery pipeline, significantly reducing the time and cost associated with synthesizing and screening complex molecules. Furthermore, users are concerned about the integration challenges of high-throughput screening data with existing AI platforms and the necessity for specialized, Oxetane-specific training datasets to ensure reliable predictive outcomes in synthetic chemistry. The primary concern is moving beyond theoretical predictions to practical, scalable industrial synthesis.

The application of AI and Machine Learning (ML) algorithms is poised to transform the discovery and optimization phases for oxetane-based products. In pharmaceuticals, generative AI models can propose novel molecular structures incorporating the oxetane ring to optimize drug efficacy, bioavailability, and metabolic stability, dramatically shortening the lead identification phase. AI-powered retrosynthesis tools are simultaneously being employed to identify the most efficient and cost-effective synthetic routes for complex oxetane derivatives, optimizing reaction conditions, catalysts, and solvent selection. This predictive capability reduces reliance on costly and time-consuming laboratory experimentation, streamlining R&D budgets across the industry. This computational acceleration translates directly into faster time-to-market for new materials and pharmaceutical compounds.

Beyond discovery, AI is influencing the manufacturing processes of oxetane intermediates. Process analytical technology (PAT) coupled with ML algorithms is enabling real-time monitoring and control of chemical reactors, leading to optimized reaction yields, minimization of impurity formation, and significant reductions in energy consumption. For high-performance polymers, AI can predict the resulting physical properties—such as glass transition temperature, tensile strength, and UV resistance—based on varying oxetane monomer concentrations, allowing materials scientists to rapidly iterate and customize formulations for specific applications, thus minimizing wastage and accelerating material commercialization. This data-driven approach ensures the consistency and quality required by stringent end-user specifications.

- AI accelerates novel oxetane derivative discovery through generative chemistry modeling.

- Machine Learning optimizes synthetic pathways for high-purity oxetane intermediates, reducing production costs.

- Predictive analytics enables real-time quality control and enhanced process efficiency in manufacturing.

- AI aids in rapid formulation screening for oxetane-based specialty polymers and UV coatings.

- Computational tools minimize experimental failures, speeding up R&D cycles in medicinal chemistry.

DRO & Impact Forces Of Oxetane Market

The Oxetane market dynamics are primarily shaped by a confluence of strong market drivers, inherent chemical and manufacturing restraints, significant emerging opportunities, and macro-economic impact forces. Key drivers include the exponential growth in demand for novel small-molecule pharmaceuticals requiring complex building blocks like oxetane, coupled with the increasing adoption of high-performance, low-VOC specialty coatings in the automotive and aerospace sectors. Restraints center on the high cost and complexity associated with synthesizing high-purity oxetane derivatives, regulatory hurdles concerning chemical manufacturing safety, and fluctuating prices of key raw materials like epichlorohydrin. Opportunities arise from expanding applications in 3D printing resins, advanced functional materials, and the exploration of bio-based oxetane synthesis routes. These elements collectively dictate the market’s expansion trajectory and competitive intensity over the forecast period, emphasizing innovation and efficiency.

The primary impact forces influencing the market are the rapid pace of globalization in pharmaceutical R&D, which creates integrated demand across continents, and technological shifts towards precision manufacturing. Economic impact forces include global GDP growth influencing infrastructure development (boosting coatings demand) and healthcare expenditure (driving drug research). Political and regulatory impact forces, such as the REACH regulation in Europe or FDA guidelines in North America, mandate high standards for chemical purity and safety, disproportionately affecting specialized chemical producers like those in the oxetane space. Socially, the increasing focus on advanced healthcare and consumer demand for durable, high-quality products continue to drive end-user industries that rely on oxetane chemistry, ensuring sustained, non-cyclical demand for these specialized chemical intermediates.

The interaction between the driving factors and restraining elements creates market tension that requires strategic maneuvering from manufacturers. For instance, the high cost of production, a restraint, is partially offset by the high value-add and premium pricing commanded by oxetane derivatives in niche, high-performance applications like advanced drug intermediates. The opportunity to develop greener, more sustainable synthesis methods through biocatalysis presents a long-term strategy to overcome raw material volatility and regulatory restraints. Successful navigation of these impact forces requires substantial investment in R&D, establishing robust supply chain resilience, and achieving high purity standards necessary for pharmaceutical and electronics applications where minute impurities are unacceptable and pose a significant barrier to entry.

Segmentation Analysis

The Oxetane market is systematically segmented based on derivative type, application, and geographical region, providing a granular view of market dynamics and growth pockets. Segmentation by Derivative Type differentiates between specialized oxetane molecules crucial for distinct chemical processes, reflecting the varying complexity and purity requirements of different end-user sectors. Segmentation by Application highlights the crucial role oxetane plays in high-value industries, dominated by pharmaceutical synthesis and the manufacturing of performance-critical polymeric materials. This detailed categorization is essential for manufacturers to tailor product specifications, optimize production scales, and deploy targeted marketing strategies toward the most lucrative end-use sectors globally, ensuring product alignment with evolving industrial demands.

The derivative-based segmentation is critical as the reactivity and utility of oxetane compounds are highly dependent on the substituents attached to the four-membered ring. For instance, derivatives with hydroxyl groups (like Oxetane-3-Methanol) are often preferred for polymerization reactions or cross-linking agents, while others might be selected specifically for their bioisosteric properties in drug design. The application segmentation clearly demonstrates the market’s dependence on technological maturity and regulatory environment, with pharmaceutical applications commanding premium pricing due to rigorous quality control requirements. Conversely, the polymers and resins segment is characterized by high volume demand, driven by large-scale industrial use in coatings, adhesives, and sealants requiring consistency and cost-effectiveness. The careful analysis of these segments reveals heterogeneous growth patterns.

- Derivative Type:

- Oxetane-3-Methanol (O-3-M)

- 3-Ethyl-3-Hydroxymethyl Oxetane (EHMO)

- 3-Methyl-3-Methoxymethyloxetane (MMO)

- 3,3-Bis(hydroxymethyl)oxetane (BHMO)

- Other Oxetane Derivatives (Including specialized fluorinated and chiral oxetanes)

- Application:

- Pharmaceutical Intermediates and Drug Synthesis

- Agrochemical Synthesis

- Polymer and Resin Synthesis (Epoxy Curing Agents, Polyether Polyols)

- UV-Curable Coatings and Inks

- Adhesives and Sealants

- Specialty Chemical Synthesis

- Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain)

- Asia Pacific (China, Japan, India, South Korea)

- Latin America (Brazil, Argentina)

- Middle East and Africa (MEA)

Value Chain Analysis For Oxetane Market

The value chain of the Oxetane market begins with the procurement of upstream raw materials, primarily epichlorohydrin, which is often derived from propylene, or other specialty chemical precursors like pentaerythritol in the case of certain substituted oxetanes. Manufacturing involves complex, multi-step chemical synthesis processes, often requiring stringent temperature and pressure controls to ensure high yield and purity of the desired oxetane product. This upstream phase is capital-intensive and requires high technical expertise, creating significant barriers to entry. Key challenges at this stage include managing raw material price volatility and ensuring regulatory compliance related to hazardous chemical handling, which directly impacts the final product cost and market competitiveness across all derivative types.

Moving downstream, the distribution channel for oxetane derivatives is highly specialized, typically involving direct sales to large pharmaceutical and specialty chemical manufacturers, or through dedicated chemical distributors focused on niche markets like advanced materials. Direct channels are preferred for high-volume, continuous supply agreements, particularly for pharmaceutical intermediates where purity and traceability are paramount. Indirect distribution through specialized chemical houses services smaller R&D laboratories, academic institutions, and specialty formulators who require smaller, customized batches of oxetane compounds. The efficiency of the distribution network, particularly the ability to handle and transport these sensitive chemicals safely, significantly influences the final customer price and market penetration.

The final stage involves the utilization of oxetane derivatives by end-user industries. Pharmaceutical companies use them for small-molecule synthesis, incorporating the ring structure into drug candidates, while polymer manufacturers utilize them as monomers or cross-linking agents in their formulations. The proximity of oxetane production facilities to major consumption centers, particularly in APAC and North America, is crucial for minimizing logistics costs and ensuring supply chain resilience. Given the high-value nature and specificity of oxetane applications, long-term strategic partnerships between manufacturers and key downstream users are common, facilitating co-development of new derivatives tailored to specific product performance requirements and securing predictable long-term demand.

Oxetane Market Potential Customers

The primary potential customers and end-users of oxetane derivatives are highly specialized entities operating within high-value technology sectors. These include major global pharmaceutical companies and biopharmaceutical firms actively engaged in small-molecule drug discovery, particularly focusing on targets where the introduction of a cyclized ether structure can enhance pharmacological properties, such as improved membrane permeability or metabolic stability. These buyers require oxetane intermediates in extremely high purity (often >99%) and demand comprehensive analytical support and robust documentation to satisfy stringent regulatory submissions for new drug applications (NDAs). This segment represents the highest value per volume in the overall market structure.

Another significant group of potential customers encompasses specialty chemical producers and material science companies focused on performance polymers, UV-curable systems, and advanced coatings. These manufacturers utilize oxetane monomers, like EHMO, to synthesize polyether polyols or to act as reactive diluents and cross-linking agents in high-performance adhesive and coating formulations. Customers in this category prioritize consistency, competitive pricing for bulk procurement, and technical support regarding formulation compatibility and polymerization kinetics. Their demand is intrinsically linked to global industrial output, particularly in the automotive, aerospace, and electronics manufacturing sectors, which require durable, high-specification protective materials.

Furthermore, agrochemical producers constitute a growing segment, utilizing oxetane derivatives to synthesize novel, patent-protected active ingredients for herbicides and pesticides. The oxetane ring often contributes to improved stability or targeted biological activity of the active compound. Lastly, research institutions, academic chemistry departments, and contract research organizations (CROs) are continuous buyers, albeit in smaller quantities, requiring a broad range of oxetane derivatives for basic research, method development, and feasibility studies. These diverse customer bases underscore the pervasive utility of oxetane chemistry across multiple high-tech industries, driving the need for scalable and flexible manufacturing capacities globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $150.5 Million USD |

| Market Forecast in 2033 | $275.2 Million USD |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TCI Chemicals, Sigma-Aldrich (Merck KGaA), Santa Cruz Biotechnology, Alfa Aesar (Thermo Fisher), Wako Pure Chemical Industries, Dairen Chemical Corp., Nanjing Chemical Industry Park, Evonik Industries, BASF SE, ChemScene, Cayman Chemical, Achemica, Tokyo Chemical Industry Co., Ltd., Matrix Scientific, VWR International, Nippon Shokubai, Jiangsu Linyuan Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oxetane Market Key Technology Landscape

The technological landscape of the Oxetane market is centered around refining and innovating the synthesis methods for these strained heterocyclic compounds, focusing primarily on achieving higher yields, exceptional purity necessary for medicinal chemistry, and improved cost-effectiveness for bulk industrial applications. Traditional synthesis routes, often involving the cyclization of diols or reactions utilizing epichlorohydrin derivatives, are being continuously optimized through the application of advanced catalysis, including phase-transfer catalysis and organocatalysis, which allow for milder reaction conditions and reduced environmental footprints. Furthermore, Continuous Flow Chemistry techniques are emerging as a transformative technology, enabling safer handling of volatile intermediates and offering scalability advantages over traditional batch processes, especially critical for high-volume oxetane derivatives used in polymer synthesis.

Purity analysis and quality assurance represent another critical technological domain. Since oxetane derivatives are used extensively in drug manufacturing, technologies such as high-resolution Mass Spectrometry (HRMS), advanced Gas Chromatography (GC), and Nuclear Magnetic Resonance (NMR) spectroscopy are standard requirements to ensure the absence of trace impurities and the confirmation of precise molecular structure. Innovations in chiral synthesis technology are also crucial for manufacturing enantiomerically pure chiral oxetanes, which are highly sought after in pharmaceutical applications where stereoisomerism dictates biological activity. The integration of Process Analytical Technology (PAT) allows for real-time monitoring and feedback control during synthesis, moving manufacturing towards a ‘right-first-time’ paradigm, minimizing batch failures and ensuring regulatory compliance globally.

Looking ahead, emerging technologies such as enzymatic synthesis (biocatalysis) are being explored as a sustainable and potentially cheaper alternative to conventional chemical routes, promising reduced energy consumption and milder operating conditions. Furthermore, the development of specialized polymer processing equipment, particularly for UV curing applications, is intrinsically linked to the market, as the performance of oxetane-based monomers in coatings and inks requires optimized UV lamp technologies and coating application methods. This co-dependence means technological advancements in downstream processing directly drive the specifications and demand for upstream oxetane derivatives, pushing manufacturers toward consistent innovation in both synthesis and product formulation to meet increasingly strict performance metrics in end-use markets.

Regional Highlights

- Asia Pacific (APAC): APAC is the fastest-growing region, driven primarily by the colossal manufacturing bases in China and India, particularly for generic pharmaceuticals and specialty chemicals. Significant government investment in infrastructure and burgeoning automotive production fuel high demand for oxetane-based UV coatings and adhesives. The shift of global manufacturing capacities to this region necessitates localized supply chains for oxetane intermediates, contributing heavily to regional market expansion and technological adoption. The cost advantage in production also makes APAC a major supplier of bulk oxetane derivatives globally.

- North America: North America holds a significant market share, characterized by high levels of R&D spending in the biotechnology and pharmaceutical sectors, particularly in the U.S. The demand here is focused on high-purity, low-volume, and specialized oxetane derivatives required for patented drug synthesis. Strict environmental regulations also drive the adoption of advanced, low-VOC oxetane formulations in performance coatings for aerospace and defense applications, maintaining the region's position as a high-value market segment.

- Europe: Europe is a mature market, heavily regulated by REACH, fostering a strong demand for sustainable and high-quality oxetane derivatives. Germany, Switzerland, and the U.K. are key consumption hubs, anchored by established chemical giants and a strong pharmaceutical presence. European demand is often characterized by innovation in materials science, focusing on developing highly durable and specialized oxetane polymers used in specialized electronics and automotive components, emphasizing performance and safety compliance.

- Latin America (LATAM): The LATAM market, while smaller, is exhibiting steady growth, particularly in Brazil and Mexico, linked to expanding local pharmaceutical production and increasing foreign investment in manufacturing. Growth is tied to improving economic stability and rising industrialization, increasing the need for locally sourced specialty chemicals and construction-related coatings. Market penetration is often achieved through international distributors targeting local formulators.

- Middle East and Africa (MEA): The MEA region is slowly developing, with demand primarily concentrated in the Gulf Cooperation Council (GCC) countries due to large-scale construction projects and diversification efforts away from oil economies. The limited local manufacturing capabilities mean the market is heavily reliant on imports of finished oxetane products and formulations, presenting opportunities for established global players to secure long-term supply agreements related to major industrial and infrastructure developments in the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oxetane Market.- TCI Chemicals (Tokyo Chemical Industry Co., Ltd.)

- Sigma-Aldrich (Part of Merck KGaA)

- Santa Cruz Biotechnology

- Alfa Aesar (Part of Thermo Fisher Scientific)

- Wako Pure Chemical Industries (Part of Fujifilm Corporation)

- Dairen Chemical Corp.

- Nanjing Chemical Industry Park

- Evonik Industries AG

- BASF SE

- ChemScene LLC

- Cayman Chemical Company

- Achemica (Hangzhou Achemica Co., Ltd.)

- Matrix Scientific

- VWR International (Part of Avantor)

- Nippon Shokubai Co., Ltd.

- Jiangsu Linyuan Chemical Co., Ltd.

- Central Glass Co., Ltd.

- J & K Scientific Ltd.

- Spectrum Chemical Mfg. Corp.

- Synthonix, Inc.

Frequently Asked Questions

Analyze common user questions about the Oxetane market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the current demand for oxetane derivatives?

The demand for oxetane is predominantly driven by its critical role as a building block in the synthesis of novel pharmaceutical intermediates and its use as a highly reactive monomer in the production of high-performance UV-curable coatings, adhesives, and specialty polyether polymers requiring enhanced stability and low viscosity.

Which geographical region is expected to show the highest growth rate for the Oxetane market?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to the rapid expansion of generic drug manufacturing capabilities, increasing investment in industrial coatings, and the general acceleration of chemical manufacturing and R&D activities across countries like China and India.

How do the high costs of oxetane synthesis impact its market adoption?

The high synthesis costs, stemming from complex, multi-step reactions and stringent purity requirements, limit oxetane’s use primarily to high-value applications like patented drug synthesis and performance-critical materials where the superior chemical characteristics justify the premium pricing, rather than high-volume commodity chemical markets.

What is the role of oxetane in the pharmaceutical industry?

In pharmaceuticals, oxetane acts as a bioisostere for other functional groups (like gem-dimethyl groups), offering improved physicochemical properties such as enhanced metabolic stability, increased water solubility, and better pharmacokinetic profiles for small-molecule drug candidates, making it indispensable in modern medicinal chemistry.

What emerging technology is most likely to affect oxetane manufacturing efficiency?

Continuous Flow Chemistry is the most influential emerging technology, as it facilitates safer, more efficient, and highly scalable production of oxetane derivatives by allowing precise control over reaction parameters, reducing waste, and enabling high-volume output necessary for industrial-scale polymer applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager