Oxetane Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433131 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Oxetane Market Size

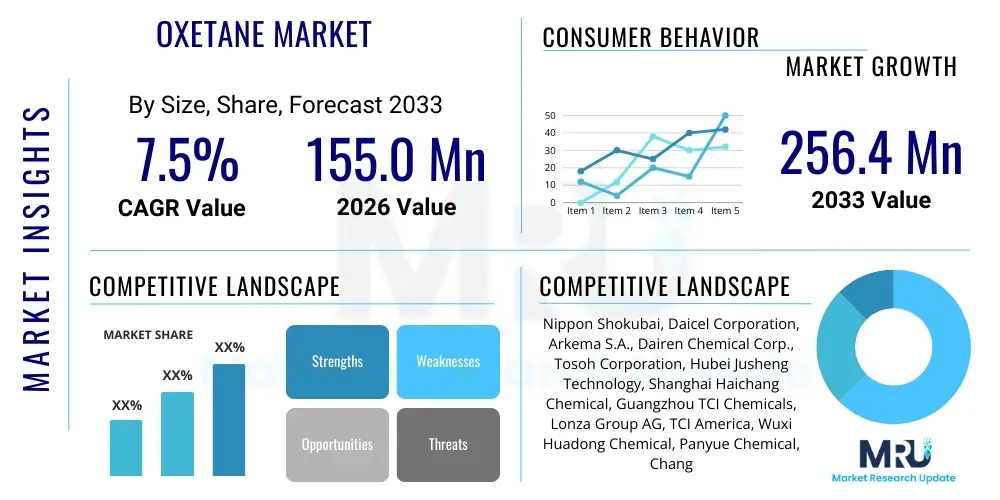

The Oxetane Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 155.0 Million in 2026 and is projected to reach USD 256.4 Million by the end of the forecast period in 2033.

Oxetane Market introduction

The Oxetane Market encompasses the production, distribution, and application of oxetane compounds, which are saturated heterocyclic organic molecules containing a four-membered ring structure composed of three carbon atoms and one oxygen atom. This unique ring structure imparts high reactivity, making oxetanes invaluable intermediates in complex chemical synthesis. Oxetane derivatives, such as 3-ethyl-3-hydroxymethyloxetane (EHMO) or 3-ethyl-3-oxetanemethanol (EOM), are crucial building blocks for various advanced materials and specialty chemicals due to their propensity for ring-opening polymerization, resulting in polyether polyols with exceptional properties.

Major applications for oxetane and its derivatives span across high-performance polymers, pharmaceuticals, electronic materials, and specialized coatings. In the pharmaceutical sector, oxetane rings are used to modulate the physicochemical properties, such as lipophilicity and metabolic stability, of drug candidates, thereby enhancing bioavailability and efficacy. For instance, the incorporation of oxetane moieties into new chemical entities is a key strategy employed in medicinal chemistry to overcome patentability hurdles and improve pharmacokinetic profiles. The versatility of oxetane as a starting material allows its utilization in synthesizing photo-curable resins, liquid crystalline polymers, and radiation-curable compositions, particularly within the electronics industry for manufacturing printed circuit boards (PCBs) and optical components.

The primary driving factors for the Oxetane Market include the escalating demand for high-purity specialty polymers in the automotive and aerospace industries, where materials requiring superior thermal stability and mechanical strength are paramount. Furthermore, the rapid growth of the advanced electronics sector, especially in Asia Pacific, necessitates high-performance dielectric materials, often derived from oxetane polymerization. The constant pursuit of novel drug structures in the global pharmaceutical R&D landscape further stimulates demand for specialized oxetane building blocks. The inherent benefits of oxetane-derived products—including low viscosity, rapid curing speed, high glass transition temperature (Tg), and excellent chemical resistance—position them favorably against conventional alternatives, reinforcing their market penetration across sophisticated industrial applications.

Oxetane Market Executive Summary

The global Oxetane Market is characterized by robust growth, driven primarily by the escalating demand for high-performance functional materials, particularly in Asia Pacific, which dominates both production and consumption due to its stronghold on the electronics and chemical manufacturing sectors. Business trends indicate a strong emphasis on capacity expansion and vertical integration among key players to secure raw material supply chains and improve synthesis purity, which is critical for end-uses such as drug synthesis and electronic encapsulation. Furthermore, strategic collaborations between chemical producers and pharmaceutical companies are accelerating the development of proprietary oxetane-based drug delivery systems and intermediates, enhancing market value.

Regional trends highlight that North America and Europe are pivotal markets for pharmaceutical-grade oxetanes, driven by stringent regulatory frameworks and significant investment in biotechnology and specialized drug development. Conversely, the Asia Pacific region, led by China, Japan, and South Korea, is the central hub for industrial and electronic applications, benefiting from lower manufacturing costs and concentrated electronic supply chain clusters. The increasing adoption of 3D printing technologies and the subsequent requirement for highly reactive and durable photopolymer resins are creating new avenues for oxetane derivatives in these geographical regions, diversifying the application portfolio beyond traditional uses.

Segment trends reveal that the high-purity grade segment (99% and above) is exhibiting the fastest growth due to its indispensable role in advanced therapeutic agents and sensitive electronic coatings where impurities can significantly compromise performance. Application-wise, the Electronic Materials segment holds the largest share, driven by the proliferation of advanced display technologies and semiconductor packaging materials that rely on the thermal stability and dielectric properties of polyoxetanes. The shift towards solvent-free, UV-curable systems in the adhesives and coatings sectors further strengthens the demand for liquid oxetane monomers, offering environmental benefits and improved processing efficiency.

AI Impact Analysis on Oxetane Market

User queries regarding AI's influence on the Oxetane Market often center on how artificial intelligence can optimize the complex, multi-step synthesis pathways of high-purity oxetane compounds, predicting reaction yields, and ensuring quality control for sensitive end-uses like drug development. Key themes include the use of machine learning (ML) in molecular design to identify novel oxetane derivatives with improved properties (e.g., enhanced thermal resistance or specific drug targeting capabilities), and the application of computational chemistry to model the kinetics of ring-opening polymerization to achieve materials with highly specific molecular weights and dispersities. Concerns frequently relate to the initial cost of implementing sophisticated AI platforms in chemical R&D and manufacturing facilities, alongside the necessity for high-quality, standardized data sets to train predictive models effectively within a niche market like oxetane chemistry.

The expectations are high regarding AI’s capacity to significantly reduce the time and expense associated with traditional trial-and-error chemical synthesis. AI-driven retrosynthesis planning tools can rapidly analyze various potential routes for creating complex oxetane-containing molecules, suggesting the most efficient, cost-effective, and environmentally friendly processes. This precision manufacturing capability, facilitated by predictive maintenance and quality assurance algorithms, is crucial for market segments that demand ultra-high purity, such as ophthalmic materials and microelectronics. By leveraging generative AI models to explore vast chemical spaces, researchers can swiftly identify oxetane analogues suitable for treating challenging diseases or developing next-generation battery components.

Ultimately, the impact of AI is transforming the Oxetane Market from a traditional synthesis domain into a data-driven chemical engineering sector. AI tools facilitate tighter process control, ensuring batch-to-batch consistency—a critical factor for pharmaceutical intermediates where regulatory scrutiny is intense. Furthermore, AI helps mitigate supply chain risks by predicting fluctuations in precursor chemical availability and optimizing inventory levels, thereby enhancing the overall resilience and responsiveness of the oxetane production ecosystem. The integration of AI and IoT sensors on reactors allows for real-time monitoring and autonomous adjustments, leading to superior yields and reduced operational waste, solidifying the market’s move toward smarter manufacturing practices.

- AI-driven optimization of oxetane synthesis pathways, reducing reaction steps and purification costs.

- Machine learning for predicting the physicochemical properties (e.g., Tg, refractive index) of polyoxetane polymers.

- Computational tools for accelerated drug discovery by screening and designing oxetane-containing pharmaceutical intermediates.

- Enhanced quality control and purity assurance through real-time process monitoring and anomaly detection.

- Predictive maintenance schedules for polymerization reactors, minimizing downtime and increasing manufacturing efficiency.

DRO & Impact Forces Of Oxetane Market

The dynamics of the Oxetane Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively influencing the competitive landscape and strategic direction of key industry players. The principal drivers stem from the technological advancements in specialized application fields, particularly the explosive growth of the semiconductor and advanced electronics industries that require materials with specific dielectric constants and thermal stability unmatched by traditional epoxies or acrylates. The constant pressure on pharmaceutical companies to introduce novel, orally bioavailable drug candidates has cemented the role of oxetanes as essential structural motifs, driving sustained demand from the healthcare sector. Furthermore, global initiatives promoting sustainability favor oxetane-based UV-curable systems and solvent-free coatings, reducing VOC emissions and aligning with stricter environmental regulations worldwide.

However, the market faces significant restraints, primarily associated with the high cost and complexity involved in synthesizing high-purity oxetane monomers. The production process requires specialized equipment and highly controlled conditions to prevent undesirable side reactions, leading to higher manufacturing capital expenditure compared to commodity chemicals. Furthermore, the volatility in the prices of key raw materials, such as epichlorohydrin or other precursor chemicals used in cyclization reactions, poses a consistent challenge to profit margins. Regulatory hurdles, particularly in obtaining approvals for new oxetane derivatives for pharmaceutical use, can be protracted and expensive, slowing down market entry for innovative compounds.

The opportunities within the Oxetane Market are substantial, centered on diversification into high-value niche segments. The growing adoption of stereospecific oxetane derivatives for chiral drug synthesis represents a high-growth avenue, offering superior selectivity and yield in API manufacturing. The expansion into energy storage, specifically utilizing polyoxetanes as components in solid-state electrolytes or specialized binders for advanced battery technologies (e.g., lithium-ion batteries), presents a transformative opportunity. Moreover, continuous innovation in polymerization techniques, such as cationic ring-opening polymerization (CROP) modifications, offers the chance to tailor polymer properties precisely for biomedical applications like hydrogels and medical devices, ensuring robust long-term market expansion and technological leadership for forward-thinking manufacturers.

Segmentation Analysis

The Oxetane Market segmentation provides a granular view of demand patterns across various grades, applications, and end-use industries, highlighting areas of high growth and technological penetration. This market is primarily segmented based on purity level (e.g., 98% and >99%), recognizing that ultra-high purity is non-negotiable for sensitive sectors like pharmaceuticals and advanced electronics, while standard grades suffice for certain coating and general chemical applications. Further segmentation based on derivative type, such as 3-Ethyl-3-(hydroxymethyl)oxetane (EHMO), 3,3-Bis(hydroxymethyl)oxetane (BHMO), and 3-Ethyl-3-(methoxymethyloxetane), helps differentiate market drivers as each derivative offers unique functional properties suitable for distinct industrial requirements.

Application analysis segments the market into Electronic Materials, Pharmaceuticals, Specialty Polymers & Adhesives, and Research & Development. Electronic materials consistently command the largest market share due to the ongoing miniaturization trend in consumer electronics and the critical need for materials that offer high transparency, low shrinkage during curing, and robust thermal performance in encapsulation resins and optical fibers. The pharmaceutical segment, though smaller in volume, holds significant value due to the high price point of specialized oxetane building blocks essential for drug synthesis. The growth of the specialty polymers segment is highly correlated with the automotive industry’s shift towards lightweight, durable materials.

The End-User segmentation provides insight into the primary consuming entities, including Chemical Manufacturing, Electronics Industry, Healthcare & Biotechnology, and Automotive & Aerospace. The Electronics Industry is the largest consumer, utilizing oxetanes in LED encapsulation, semiconductor packaging, and display coatings. The Healthcare sector, encompassing both pharmaceutical manufacturing and medical device production, relies on oxetanes for modifying drug compounds and creating biocompatible polymers. This structured segmentation is vital for market players in tailoring their product offerings, R&D strategies, and regional distribution efforts to effectively address the specific technical demands and procurement patterns of these diverse end-user groups, optimizing their market positioning and competitive advantage.

- Purity

- 98% Grade

- >99% Ultra-High Purity Grade

- Derivative Type

- 3-Ethyl-3-(hydroxymethyl)oxetane (EHMO)

- 3-Ethyl-3-oxetanemethanol (EOM)

- 3,3-Bis(hydroxymethyl)oxetane (BHMO)

- Other Oxetane Derivatives

- Application

- Electronic Materials (Encapsulants, Coatings, Dielectrics)

- Pharmaceutical Intermediates and Drug Synthesis

- Specialty Polymers and Polyether Polyols

- Adhesives and Sealants (UV-Curable Systems)

- Coatings and Paints

- End-User Industry

- Electronics and Semiconductor Industry

- Healthcare and Biotechnology

- Chemical Manufacturing

- Automotive and Aerospace

Value Chain Analysis For Oxetane Market

The Oxetane Market value chain begins with the upstream procurement and synthesis of precursor chemicals. Key raw materials typically include epichlorohydrin, glycidol, or specific substituted diols, which undergo cyclization reactions under controlled conditions to form the desired oxetane monomers. This upstream segment is highly concentrated, involving specialized chemical producers that must ensure the highest quality input materials, as impurities at this stage directly impact the purity of the final oxetane product, which is crucial for high-value applications. Technological expertise in reaction engineering and purification techniques, particularly distillation and crystallization processes, represents a significant barrier to entry in this initial stage.

The midstream process involves the actual manufacturing of oxetane derivatives and their immediate polymerization into polyoxetanes or functionalized polyols, which are then sold as intermediates. Manufacturers often specialize in either high-volume, standard-grade oxetanes for polymer use or low-volume, high-value, chiral oxetane intermediates tailored for pharmaceutical research. Distribution channels are bifurcated: direct sales are prevalent for large-volume customers (e.g., major pharmaceutical companies or large polymer manufacturers) requiring technical support and customized specifications. Indirect channels utilize specialized chemical distributors and agents, particularly in regions where manufacturers lack a direct physical presence, serving smaller R&D labs and regional specialty chemical formulators.

The downstream segment constitutes the end-user application and consumption of oxetane derivatives. Direct customers are typically large-scale electronic component producers (e.g., semiconductor packaging firms), specialized adhesive formulators, and pharmaceutical API manufacturers. Indirect consumers are the ultimate buyers of products containing oxetane derivatives, such as automotive manufacturers using oxetane-based coatings or patients consuming oxetane-containing drugs. The efficiency of the downstream segment is highly dependent on the timely delivery of high-purity material and consistent supply, making supply chain resilience a critical competitive factor across the entire value chain.

Oxetane Market Potential Customers

The potential customers for oxetane derivatives are diverse yet concentrated in high-technology, specialized sectors where material performance and chemical precision are paramount. In the Electronics Industry, major buyers include manufacturers of advanced packaging materials (epoxy and polyimide encapsulants), producers of liquid crystalline materials, and companies involved in the fabrication of optical waveguides and high-frequency components. These end-users specifically seek oxetanes that offer excellent dielectric properties, low moisture absorption, and thermal stability to ensure the longevity and reliability of miniaturized electronic devices. The transition toward high-density interconnects and flexible electronics continues to drive robust demand from this segment.

Another significant customer base resides in the Healthcare and Biotechnology sectors. Pharmaceutical companies and Contract Research Organizations (CROs) are primary buyers, utilizing oxetanes as proprietary building blocks to introduce novel structural elements into Active Pharmaceutical Ingredients (APIs), particularly in oncology and antivirals. These customers prioritize ultra-high purity, stereochemical control, and comprehensive regulatory documentation (e.g., Certificates of Analysis). Furthermore, manufacturers of medical devices, such as specialized catheters, dental resins, and surgical adhesives, represent a growing segment demanding biocompatible polyoxetane materials.

Additionally, the Specialty Polymers and Coatings industry represents a foundational customer segment. This includes major adhesive and sealant producers, especially those focused on UV-curable systems for industrial bonding, protective coatings for high-wear areas in the automotive and aerospace sectors, and specialty polymer manufacturers creating robust polyether polyols for polyurethane synthesis. These customers value the high reactivity, low viscosity, and fast curing capabilities that oxetane monomers provide, allowing for efficient manufacturing processes and superior product performance in demanding environments. This diversity ensures a balanced demand profile across economic cycles for Oxetane suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 155.0 Million |

| Market Forecast in 2033 | USD 256.4 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nippon Shokubai, Daicel Corporation, Arkema S.A., Dairen Chemical Corp., Tosoh Corporation, Hubei Jusheng Technology, Shanghai Haichang Chemical, Guangzhou TCI Chemicals, Lonza Group AG, TCI America, Wuxi Huadong Chemical, Panyue Chemical, Changzhou Sunlight Chemical, Alfa Aesar, BASF SE |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oxetane Market Key Technology Landscape

The technological landscape of the Oxetane Market is primarily defined by advanced chemical synthesis methods and specialized polymerization techniques required to achieve high purity and specific molecular architecture. The synthesis of the oxetane ring typically involves cyclization reactions, often utilizing proprietary catalyst systems to enhance yield and minimize the formation of undesirable side products, such as cyclic ethers or acyclic isomers. Key technological advancements focus on improving the efficiency of the Paternò–Büchi reaction or modifications of the standard dialkylation/cyclization approach, aiming for scalable, cost-effective, and environmentally benign processes. Furthermore, manufacturers are investing in highly optimized purification techniques, including fractional distillation under vacuum and simulated moving bed chromatography (SMBC), to produce the ultra-high purity grades (>99.9%) essential for sensitive electronic and pharmaceutical applications, where impurity levels must be controlled in the parts per million (ppm) range.

In terms of application, the critical technology is Cationic Ring-Opening Polymerization (CROP). Oxetanes are uniquely suited for CROP due to the strain inherent in the four-membered ring, allowing for rapid and controlled polymerization using initiators like Lewis acids or strong protic acids. Recent technological focus has been on developing novel, latent cationic initiators that only become active upon exposure to UV light or heat, enabling highly precise photolithography and faster curing cycles in coatings and adhesives. This control over polymerization kinetics is central to tailoring the final polymer properties, such as molecular weight distribution, glass transition temperature (Tg), and cross-linking density, which dictate performance in end-use applications like high-refractive-index lenses or optical fiber claddings. The ability to control the stereochemistry during polymerization is also a cutting-edge area, vital for developing chiral polyoxetanes for advanced material science.

The ongoing technological shift toward sustainable chemistry is pushing the market toward process intensification and continuous flow manufacturing. Utilizing microreactor technology allows for better control over exothermic cyclization reactions, improving safety, reducing batch variability, and significantly increasing production throughput while minimizing waste generation. The development of specialized oxetane derivatives that are bio-derived or bio-compatible also represents a crucial technological area, particularly for medical implants and sustainable packaging materials. This continuous drive toward precision synthesis and controlled polymerization dictates the competitive edge in the Oxetane Market, moving it toward high-performance specialty chemicals.

Regional Highlights

- Asia Pacific (APAC): APAC stands as the dominant market for oxetane derivatives, driven by its massive electronic manufacturing base and extensive chemical production infrastructure, particularly in China, South Korea, and Japan. The region accounts for the largest consumption volume, predominantly within the Electronic Materials segment, including semiconductor packaging, optical coatings, and advanced display fabrication. Favorable governmental support for manufacturing, coupled with the presence of major polymer and chemical companies, facilitates robust supply chain operations. The pharmaceutical intermediate consumption is also growing substantially, spurred by expanding domestic R&D and manufacturing capacity, cementing APAC’s role as the primary engine for global market growth.

- North America: North America represents a high-value market, focusing heavily on specialized, pharmaceutical-grade oxetane intermediates and advanced research materials. The region's demand is characterized by stringent quality requirements and a strong emphasis on innovation in drug discovery and development. Leading pharmaceutical companies and specialized biotech firms constitute the major end-users. While manufacturing volume is smaller compared to APAC, the average selling price and profitability in this region are significantly higher, reflecting the demand for ultra-high purity and customized chemical synthesis services, particularly for novel drug candidates requiring oxetane scaffolds for improved oral bioavailability.

- Europe: The European market maintains a steady position, marked by strong demand from the high-end automotive sector (for specialty coatings and composites) and a mature pharmaceutical industry. Regulatory pressures related to environmental standards are accelerating the adoption of oxetane-based UV-curable systems, aligning with directives aimed at reducing Volatile Organic Compound (VOC) emissions from coatings and adhesives. Germany, Switzerland, and the UK are key contributors, focusing on materials science innovation, precision engineering, and specialized chemical synthesis, often through partnerships between academic research institutions and chemical corporations.

- Latin America (LATAM): LATAM is an emerging market for oxetanes, exhibiting moderate growth primarily tied to expanding domestic industrialization, especially in automotive assembly and construction activities that require performance coatings and adhesives. Brazil and Mexico are the primary consuming nations. The market is highly reliant on imports from Asia and North America for specialized grades, though local opportunities for bulk polymer production and basic coating formulations are gradually developing as regional economies stabilize and invest in infrastructure projects requiring durable materials.

- Middle East and Africa (MEA): The MEA market is currently the smallest but shows promise, largely fueled by investment in infrastructure, renewable energy projects, and diversification away from oil economies. Demand is concentrated in specialized coatings for oil and gas pipelines (requiring high chemical resistance) and growing localized manufacturing efforts, particularly in the UAE and Saudi Arabia. The healthcare and pharmaceutical sectors are nascent but expanding, providing a potential long-term growth trajectory for specialized chemical inputs like oxetane derivatives, although logistical challenges and high import duties remain structural impediments to rapid market penetration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oxetane Market.- Nippon Shokubai Co., Ltd.

- Daicel Corporation

- Arkema S.A.

- Dairen Chemical Corp.

- Tosoh Corporation

- Hubei Jusheng Technology Co., Ltd.

- Shanghai Haichang Chemical Co., Ltd.

- Guangzhou TCI Chemicals Co., Ltd.

- Lonza Group AG

- TCI America (Tokyo Chemical Industry Co., Ltd.)

- Wuxi Huadong Chemical Co., Ltd.

- Panyue Chemical (Shanghai) Co., Ltd.

- Changzhou Sunlight Chemical Co., Ltd.

- Alfa Aesar (Thermo Fisher Scientific)

- BASF SE

- Merck KGaA

- Evonik Industries AG

- Mitsubishi Chemical Corporation

- DIC Corporation

- Kaneka Corporation

Frequently Asked Questions

Analyze common user questions about the Oxetane market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary commercial applications of Oxetane derivatives?

Oxetane derivatives are primarily used as highly reactive intermediates in specialty chemical synthesis. Their largest commercial applications include electronic materials (encapsulants, optical coatings, dielectrics) due to their low viscosity and excellent curing properties, and pharmaceutical synthesis, where they serve as key building blocks to improve drug stability and bioavailability.

Why is the purity grade of Oxetane critical in the market?

Purity is paramount, especially the >99% ultra-high purity grade, because oxetanes are used in sensitive processes like API manufacturing and semiconductor packaging. Impurities, even in trace amounts, can negatively affect the performance, stability, and regulatory compliance of the final product, potentially compromising drug efficacy or device reliability.

Which geographical region dominates the consumption of Oxetane?

Asia Pacific (APAC), particularly fueled by China, South Korea, and Japan, dominates the consumption of oxetane. This leadership is attributed to the region's massive concentration of electronics manufacturing facilities and rapid expansion in chemical production and sophisticated materials science industries.

What synthesis technique is commonly used to form polyoxetanes?

The most common technique is Cationic Ring-Opening Polymerization (CROP). This method leverages the inherent strain of the four-membered oxetane ring, enabling rapid and controlled polymerization using cationic initiators. CROP allows manufacturers to precisely tailor the molecular weight and thermal properties of the resulting polyether polyols.

How does the Oxetane market contribute to sustainable manufacturing?

The Oxetane market supports sustainability by enabling the shift toward UV-curable, solvent-free coatings and adhesives. These oxetane-based systems rapidly cross-link upon UV exposure, significantly reducing the use of hazardous organic solvents and lowering Volatile Organic Compound (VOC) emissions in industrial processes.

What are the key drivers propelling market growth in the near term?

Key drivers include the global demand for advanced functional materials in high-tech consumer electronics (5G integration, advanced displays), and the continuous innovation in medicinal chemistry requiring specialized oxetane scaffolds for novel drug development. The adoption of oxetanes in high-performance aerospace and automotive composites also provides substantial momentum.

What role do oxetane compounds play in pharmaceutical R&D?

In pharmaceutical R&D, oxetane rings are used as bioisosteres for other functional groups or as structural modifiers. Incorporating an oxetane moiety can enhance the metabolic stability of a drug candidate, improve its solubility, and modulate its lipophilicity, which collectively leads to better pharmacokinetic profiles and increased therapeutic efficacy.

Are there significant cost restraints impacting the Oxetane Market?

Yes, significant restraints include the high synthesis cost and technical difficulty associated with manufacturing high-purity oxetane monomers. The need for specialized equipment and stringent process controls to manage the cyclization reaction and purification process contributes substantially to the overall production cost compared to commodity chemicals, limiting widespread, low-cost application.

How is the market exploring new applications for oxetane?

The market is actively exploring new applications by focusing on advanced battery technology, using polyoxetanes as components in solid-state electrolytes or separators due to their ionic conductivity and dimensional stability. Furthermore, high-refractive index oxetane polymers are being developed for use in sophisticated micro-optics and virtual reality (VR) lenses.

What is the significance of 3-Ethyl-3-(hydroxymethyl)oxetane (EHMO) in the market?

EHMO is one of the most commercially significant oxetane derivatives. It is widely utilized due to its dual functionality—the oxetane ring allows for polymerization, while the hydroxyl group facilitates secondary reactions or cross-linking. EHMO is crucial in synthesizing polyether polyols, high-performance resins, and UV-curable adhesives offering superior thermal and chemical resistance.

How does AI contribute to improving oxetane quality control?

AI, specifically through machine learning algorithms integrated with process analytical technology (PAT) sensors, provides real-time monitoring of synthesis parameters. This capability allows for immediate detection of anomalies, predictive adjustment of reaction conditions, and ensures batch-to-batch consistency, significantly improving the purity and quality assurance of the final oxetane product.

What are the typical end-user industries for specialty polymers derived from oxetane?

End-user industries for specialty polymers include the automotive and aerospace sectors, where polyoxetanes are used in structural adhesives, lightweight composites, and protective coatings due to their exceptional mechanical strength, heat resistance, and dimensional stability, contributing to vehicle performance and fuel efficiency targets.

How do regulatory factors influence the regional market dynamics?

In regions like Europe and North America, strict regulatory requirements regarding environmental compliance (e.g., VOC limitations) and pharmaceutical quality standards (cGMP) favor manufacturers capable of producing high-purity, low-emission oxetane products. This drives up the value of specialized, compliant suppliers in these markets.

What is the competitive structure of the global Oxetane supply chain?

The global oxetane supply chain is characterized by a moderate degree of concentration, with key players primarily located in Asia Pacific and specialized chemical houses in Europe and North America. Competition is based not only on price but heavily on product purity, technical support, and the capacity for producing customized or proprietary derivatives.

What technological advancement is currently focused on optimizing polymerization?

A key technological focus is the development and implementation of latent cationic initiators. These initiators remain inert until activated by external stimuli like UV light, allowing for precise control over the onset and rate of polymerization, which is essential for advanced manufacturing techniques such as 3D printing and high-resolution lithography using oxetane resins.

How does the demand for optical materials affect the Oxetane Market?

Oxetanes are highly valued in optical materials due to their ability to form polymers with high transparency, low light absorption, and controllable refractive indices. The increasing global demand for high-performance camera lenses, optical fibers, and advanced display components, especially in high-end consumer electronics, directly drives the market for specialty oxetane monomers.

What challenges are faced by new entrants attempting to join the Oxetane market?

New entrants face substantial hurdles, including high capital expenditure for complex synthesis facilities, the necessity for deep intellectual property (IP) protection surrounding proprietary catalysts and purification methods, and the challenge of meeting stringent purity specifications required by established pharmaceutical and electronics customers.

What is the role of oxetanes in the adhesives and sealants segment?

In adhesives and sealants, oxetane monomers are incorporated into formulations to enhance curing speed and final material hardness, particularly in UV-curable systems. They improve adhesion, chemical resistance, and reduce the shrinkage experienced during the curing process, making them ideal for assembly and protective applications.

How has the COVID-19 pandemic impacted the dynamics of the Oxetane Market?

The pandemic initially disrupted supply chains, but the increased global focus on pharmaceutical R&D, coupled with accelerated digitization and demand for consumer electronics, ultimately boosted the consumption of high-purity oxetanes for both drug synthesis and electronic component manufacturing, driving medium-term positive growth.

What is the difference between direct and indirect distribution channels for Oxetane?

Direct distribution involves sales straight from the manufacturer to large, dedicated end-users (like major polymer houses or pharma firms) often involving customized specifications and technical support. Indirect distribution utilizes specialized chemical distributors to reach smaller R&D laboratories, regional formulators, or end-users needing smaller, off-the-shelf volumes.

In which medical devices are polyoxetanes frequently utilized?

Polyoxetanes, valued for their biocompatibility and mechanical strength, are increasingly utilized in medical devices such as specialized wound dressings, dental resins, bone cements, and potentially in coatings for implantable devices, where material purity and long-term stability are critical performance criteria.

What key raw materials are essential for Oxetane synthesis?

Key raw materials for oxetane synthesis commonly include epichlorohydrin, specific substituted diols (like pentaerythritol derivatives), or glycidol derivatives. The precise choice depends on the final oxetane derivative desired, but efficient access to high-quality precursor chemicals is vital for cost-effective production.

How does the automotive industry utilize oxetane-derived materials?

The automotive industry employs oxetane derivatives in high-performance coatings that require superior scratch resistance, UV stability, and chemical resistance for exterior components. They are also used in light-weighting strategies, incorporated into structural adhesives and advanced composite materials to improve vehicle efficiency and safety standards.

What is the market potential for chiral oxetane derivatives?

The market potential for chiral oxetane derivatives is very high, particularly in the pharmaceutical industry. Chiral synthesis is crucial for developing enantiomerically pure drugs, and these specialized oxetanes offer chemists precise control over stereochemistry, leading to superior yields and reduced regulatory complexities in the development of new Active Pharmaceutical Ingredients.

How is the Oxetane Market being influenced by the rise of 3D printing technology?

The rise of 3D printing, especially stereolithography (SLA) and Digital Light Processing (DLP), is driving demand for oxetane monomers. Oxetanes are favored components in photopolymer resins as they provide rapid curing times, low shrinkage, and high mechanical integrity, essential for additive manufacturing of precise, functional prototypes and end-use parts.

What technological investments are manufacturers making in the upstream segment?

In the upstream segment, manufacturers are heavily investing in flow chemistry and microreactor technology to achieve process intensification. This investment aims to enhance safety, improve reaction selectivity, and ensure continuous, highly controlled production of oxetane intermediates, thereby optimizing resource utilization and minimizing batch variations.

What distinguishes Oxetane from common epoxy resins in performance?

Oxetanes generally exhibit lower viscosity than epoxy resins, facilitating easier handling and higher filler loading in formulations. Crucially, polyoxetanes often offer superior thermal stability and higher glass transition temperatures (Tg) compared to standard epoxies, making them preferable for applications exposed to extreme temperatures, such as semiconductor encapsulation.

Why is R&D investment critical for sustaining market growth?

R&D investment is critical as it drives the development of novel oxetane derivatives with proprietary functionalities, enabling entry into high-value niche applications such as advanced battery materials or targeted drug delivery systems. Innovation in synthesis and polymerization techniques also ensures cost leadership and regulatory compliance.

How does the demand for advanced display technologies impact the market?

Advanced display technologies, including OLED and micro-LED displays, require highly stable, transparent, and low-dielectric constant materials for encapsulation and bonding layers. Oxetane-based polymers meet these stringent optical and thermal requirements, leading to consistent growth in demand from display panel manufacturers globally.

What impact does the price volatility of precursor chemicals have on market stability?

Price volatility of precursor chemicals, such as epichlorohydrin, introduces significant instability in the market, directly impacting the manufacturing costs and profit margins of oxetane producers. Manufacturers often mitigate this risk through strategic long-term supply agreements or by pursuing backward integration into precursor chemical production.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager