Perfluoroelastomer (FFKM) Parts and Seals Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441022 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Perfluoroelastomer (FFKM) Parts and Seals Market Size

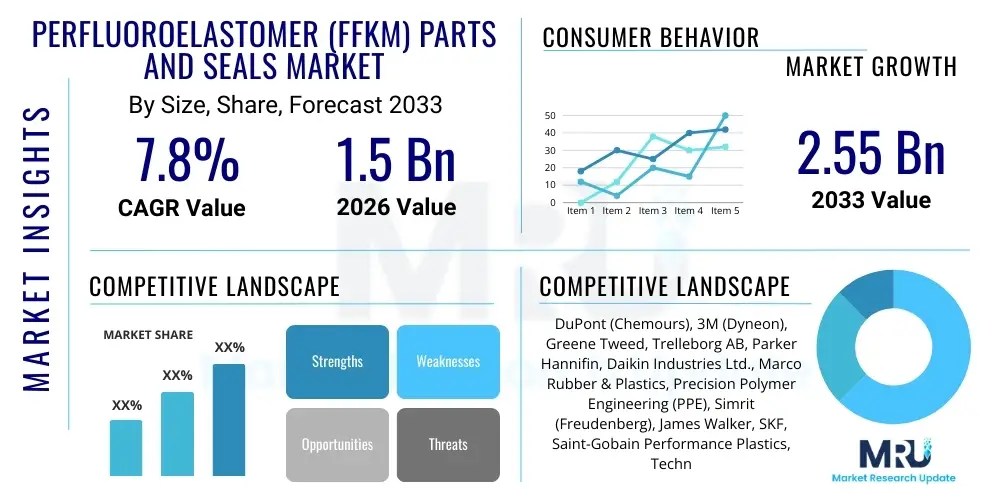

The Perfluoroelastomer (FFKM) Parts and Seals Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $1.15 Billion in 2026 and is projected to reach $1.82 Billion by the end of the forecast period in 2033.

Perfluoroelastomer (FFKM) Parts and Seals Market introduction

The Perfluoroelastomer (FFKM) Parts and Seals Market encompasses high-performance sealing solutions utilized in the most demanding industrial environments. FFKM is a synthetic rubber material possessing exceptional resistance to nearly all chemical media, including aggressive solvents, concentrated acids, and strong bases, while simultaneously offering outstanding thermal stability up to 327°C (620°F). These unique properties position FFKM as the material of choice for critical static and dynamic sealing applications where standard elastomers (like FKM or EPDM) fail, ensuring uptime, safety, and long-term operational integrity in high-stakes processes such as semiconductor manufacturing, aerospace propulsion systems, and deep-sea oil and gas extraction. The primary market drivers include stringent safety regulations requiring high-reliability components, rapid expansion in corrosive chemical processing facilities, and the continuous technological advancements in sectors demanding higher operating temperatures and pressures, such as plasma etching and specialized refining.

FFKM components, which include O-rings, gaskets, diaphragms, and customized shapes, are essentially fully fluorinated polymers derived from TFE (Tetrafluoroethylene), similar to PTFE, but possessing the elastomeric characteristics necessary for compression set and sealing functionality. This distinction allows FFKM to combine the chemical inertness of PTFE with the resilience and elasticity of standard rubber, a combination critical for maintaining seal integrity under dynamic load and extreme heat cycling. Major applications span industries requiring zero contamination and absolute resistance to degradation, making them indispensable in sensitive environments like pharmaceutical aseptic processing, analytical instrumentation, and advanced battery manufacturing equipment. The inherent benefits, such as reduced maintenance cycles, prevention of costly system failure, and compliance with ultra-high purity standards (especially in semiconductor cleanrooms), are fueling sustained demand globally, despite the high initial cost associated with these materials.

The market expansion is fundamentally driven by the relentless pursuit of efficiency and extreme performance across heavy and specialized industries. For instance, in the aerospace sector, FFKM seals are mandatory in fuel control systems and hydraulic actuators subjected to jet fuels and extreme thermal gradients, ensuring aircraft safety and reliability. Simultaneously, the burgeoning market for specialized chemicals and the transition toward smaller node manufacturing in semiconductors necessitates seals that can withstand increasingly aggressive plasma chemistries and extreme temperatures without leaching or material breakdown. This continuous escalation in operational severity dictates a premium demand for specialized FFKM compounds tailored for specific environments, pushing manufacturers toward innovative compounding techniques and strict quality control protocols to meet the evolving technical requirements of their end-users.

Perfluoroelastomer (FFKM) Parts and Seals Market Executive Summary

The FFKM market is characterized by robust growth anchored by non-cyclical, high-technology sectors. Key business trends indicate a strong focus on supply chain resilience and vertical integration among major manufacturers to control raw material quality and reduce lead times, especially given the complex and capital-intensive polymerization process required for FFKM base polymers. Furthermore, a discernible trend toward application-specific formulation development, particularly low compression set FFKM for high-temperature sealing and ultra-high purity grades for semiconductor fabrication, is driving premium pricing and market differentiation. The competitive landscape is intensely focused on intellectual property related to novel curing systems and filler technologies that further enhance chemical resistance and thermal performance beyond existing industry benchmarks, ensuring compliance with evolving standards like USP Class VI for medical applications.

Regionally, the Asia Pacific (APAC) region, spearheaded by China, Taiwan, South Korea, and Japan, dominates the market growth trajectory due to massive investments in semiconductor fabrication plants (fabs) and expanding chemical infrastructure. North America and Europe maintain a strong market share driven by mature, high-value aerospace, oil and gas exploration (particularly deep-water drilling), and pharmaceutical industries, which prioritize performance and regulatory compliance over initial cost. Segment trends reveal that the Semiconductor & Electronics segment is the fastest-growing application area, necessitated by the shift towards advanced manufacturing nodes (e.g., 5nm and below) which require unprecedented seal integrity against corrosive etching gases and plasma environments. This segment's high-volume, high-value demand significantly influences market dynamics and future product development priorities, overshadowing the historically dominant Chemical Processing and Aerospace segments.

The overall market trajectory reflects a move away from general-purpose FFKM toward customized, high-purity, and specialty-cured compounds designed for specific, highly critical processes. The challenge of high material cost and fabrication complexity remains a limiting factor, compelling end-users to seek highly optimized designs and predictive maintenance strategies to maximize the lifespan of these costly components. Strategic alliances between FFKM material suppliers and major equipment OEMs are becoming crucial for co-developing next-generation sealing solutions that can immediately integrate into new equipment designs, thus solidifying market position and ensuring long-term contractual stability. The market remains inherently oligopolistic, with stringent technical barriers to entry reinforcing the positions of established global leaders who possess the necessary material science expertise and cleanroom manufacturing capabilities.

AI Impact Analysis on Perfluoroelastomer (FFKM) Parts and Seals Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the FFKM market generally cluster around three core themes: enhancing material science R&D, optimizing highly complex manufacturing processes, and utilizing predictive maintenance in high-value applications. Users frequently question whether AI can accelerate the development of new, more resilient FFKM grades, reduce the inherent high cost of production, and provide real-time assurance of seal reliability in critical infrastructure. There is keen interest in how machine learning algorithms can analyze vast datasets of chemical compatibility, temperature cycling performance, and compression set behavior to design optimal seal geometry and material composition far faster than traditional empirical testing methods. Additionally, the adoption of AI-powered quality control systems (e.g., automated visual inspection) is a major concern, as it directly impacts the purity and dimensional accuracy required for zero-defect applications like lithography and high-pressure chemical reactions. Overall expectations are high regarding AI's potential to drive down component failure rates and improve yield in FFKM production.

The immediate and tangible impacts of AI are currently focused on operational efficiency and advanced simulation. AI-driven predictive maintenance (PdM) platforms, which analyze vibration, pressure, and temperature data from equipment utilizing FFKM seals (such as pumps, valves, and mechanical seals), are proving essential in maximizing seal lifespan and preventing catastrophic failures in remote or hazardous environments, like deep-sea drilling rigs or highly automated chemical plants. These systems move beyond scheduled replacements, allowing for ‘just-in-time’ seal servicing, thereby significantly reducing unnecessary downtime and operational expenditure, despite the high cost of the replacement parts themselves. Furthermore, computational chemistry, augmented by machine learning, is beginning to streamline the selection of specialized curing agents and filler systems, reducing the trial-and-error cycle historically required for developing new FFKM compound grades tailored for emerging aggressive chemistries, such as those found in advanced battery electrolytes or specialized refrigerants.

However, the full integration of AI faces challenges related to data infrastructure and standardization. The complexity of FFKM manufacturing involves numerous sensitive parameters (mixing, curing time, pressure profiles) that require high-fidelity, standardized data collection across different batches and production facilities. Ensuring the quality and volume of this data is sufficient to train robust AI models for process optimization and fault prediction remains a significant hurdle. Furthermore, security concerns surrounding proprietary formulation data, often considered highly sensitive intellectual property by FFKM manufacturers, necessitate robust, decentralized data management solutions. Despite these obstacles, AI’s role in ensuring ultra-high component reliability and facilitating advanced material discovery is undeniable, setting a trajectory for a more data-driven and automated future for the FFKM sealing industry, potentially lowering the total cost of ownership for end-users by extending maintenance intervals substantially.

- AI-driven Predictive Maintenance (PdM) enhances seal life cycle management in high-value assets.

- Machine Learning accelerates R&D for novel FFKM compound formulations by simulating chemical compatibility.

- AI algorithms optimize complex polymerization and curing processes, improving manufacturing yield and consistency.

- Automated Vision Systems (AVS) use AI for high-precision, zero-defect quality inspection, crucial for semiconductor seals.

- Supply Chain Analytics models predict raw material shortages and optimize inventory levels for expensive base polymers.

DRO & Impact Forces Of Perfluoroelastomer (FFKM) Parts and Seals Market

The FFKM market's dynamics are dictated by a powerful convergence of stringent performance demands (Drivers) and inherent material limitations (Restraints), leading to niche but significant market growth opportunities. The primary driver is the necessity for operational integrity in extreme environments, particularly the growth in semiconductor fabrication requiring ultra-high purity seals resistant to highly aggressive fluorine-based plasma and etching gases at elevated temperatures. This is compounded by the expansion of demanding applications in high-pressure, high-temperature (HPHT) oil and gas extraction and the burgeoning market for specialized chemical synthesis, where material failure poses significant safety, environmental, and financial risks. However, the market is restrained by the exceptionally high cost of FFKM raw materials and subsequent manufacturing, which restricts its use solely to the most critical applications. This high barrier to entry necessitates rigorous cost-benefit analysis by end-users. The significant opportunity lies in addressing emerging technologies such as the hydrogen economy (fuel cells, storage infrastructure) and advanced biotechnology, which require materials exhibiting broad chemical resistance combined with excellent long-term durability and low leachables, areas where FFKM uniquely excels, driving targeted product innovation and market penetration.

Elaborating on the drivers, the continuous technological push in key sectors ensures sustained demand. In aerospace, the push for lighter, hotter, and more fuel-efficient engines requires sealing solutions capable of handling higher operating temperatures and specialized jet fuels without degradation over long flight cycles. Similarly, the pharmaceutical and biotechnology sectors are increasingly adopting complex, highly automated systems for drug manufacturing and sterile processing, demanding USP Class VI certified FFKM seals to ensure product safety, zero contamination, and cleanability (CIP/SIP). These regulatory and performance mandates create an inelastic demand curve for FFKM materials, as substitution with lower-cost elastomers is often impossible without compromising safety or process quality. Furthermore, the global infrastructure push for chemical and petrochemical production, especially in developing economies, continuously exposes equipment to harsher chemicals and extreme conditions, making FFKM a critical component for risk mitigation and regulatory compliance in these hazardous environments.

The restraints, primarily cost and manufacturing complexity, exert continuous pressure on the supply side to find efficiencies. The multi-step polymerization process of perfluorinated monomers and the subsequent demanding curing cycles require highly specialized equipment and cleanroom facilities, contributing significantly to the final component price, often 10 to 50 times higher than standard FKM seals. This necessitates careful inventory management and design optimization by users. Impact forces, such as the accelerating pace of miniaturization in electronics and the increased geopolitical focus on energy security (driving deep-sea and unconventional drilling), continuously amplify the need for reliable sealing technology. The opportunity derived from these forces lies in material innovation: manufacturers are investing heavily in new proprietary curative systems that enhance resistance to specific media (e.g., steam, amines, hot water) and developing FFKM grades with improved elasticity or lower friction coefficients for dynamic sealing applications, thereby expanding FFKM's applicability beyond traditional static sealing roles and overcoming existing performance limitations to capture new, high-growth niche markets like high-purity chemical distribution systems.

Segmentation Analysis

The Perfluoroelastomer (FFKM) Parts and Seals market is primarily segmented based on the critical factors of Product Type (governed by component geometry and function) and End-Use Industry (determined by the specific chemical and thermal demands of the application). Type segmentation includes standard O-rings and custom-molded parts, reflecting the scale of customization required, while the application segmentation highlights the most critical vertical markets where FFKM is indispensable, such as Semiconductor & Electronics, Chemical Processing, and Aerospace & Defense. Analyzing these segments is essential for understanding the highly diverse material specifications and purity requirements demanded across the market, ranging from ultra-cleanroom specifications for chip manufacturing to high-pressure, high-temperature requirements for downhole oil exploration. The segmentation provides a clear framework for assessing market maturity, growth potential, and the direction of material science innovation required to meet industry-specific challenges.

- Product Type

- O-rings

- Gaskets and Seals (Custom/Standard)

- Diaphragms

- Other Molded Parts (e.g., Valves, Connectors)

- End-Use Industry

- Semiconductor & Electronics

- Chemical Processing

- Oil & Gas (Upstream, Midstream, Downstream)

- Aerospace & Defense

- Pharmaceutical & Medical

- Food & Beverage

- Others (Energy, Industrial Machinery)

Value Chain Analysis For Perfluoroelastomer (FFKM) Parts and Seals Market

The FFKM value chain is highly specialized, beginning with the complex and capital-intensive upstream production of perfluorinated monomers, primarily Tetrafluoroethylene (TFE) and sometimes Perfluoromethyl Vinyl Ether (PMVE), which are then polymerized to form the raw FFKM gum. This upstream phase is concentrated among a few global chemical giants due to the required expertise and intellectual property, creating a natural oligopoly. The midstream involves the compounding process, where the raw gum is mixed with specialized fillers (e.g., carbon black, inorganic oxides) and proprietary curing agents, a crucial step determining the final properties (purity, temperature rating, chemical resistance) of the finished compound. This is followed by molding and curing, which demand high-precision equipment and often require cleanroom environments, especially for semiconductor-grade seals, adding significantly to the complexity and cost of goods sold. Downstream activities involve distribution channels, which are typically segmented into direct sales to large OEMs (Original Equipment Manufacturers) who require custom designs and long-term supply agreements, and specialized distributors who cater to smaller Maintenance, Repair, and Operations (MRO) buyers and local custom molders.

Upstream analysis emphasizes the scarcity and price volatility of fluorinated monomers, which fundamentally impacts the stability of FFKM component costs. Manufacturers often strive for long-term sourcing contracts to mitigate price risks associated with raw material supply interruptions. The transition through compounding and fabrication is critical; it is here that material science expertise is paramount, as component failure is often attributed to improper compounding or suboptimal curing cycles rather than the base polymer itself. High-performance seal manufacturers typically maintain strict control over their compounding recipes and proprietary curative systems to differentiate their products in the market, often offering grades certified to withstand specific proprietary media used by major chemical or semiconductor firms. This control over proprietary formulations reinforces the competitive advantage of established players who can offer certified, traceable performance guarantees.

The downstream distribution channel reflects the high-value, low-volume nature of the FFKM market. Direct sales are preferred for major strategic partnerships—such as supplying seals for a new jet engine platform or a high-volume semiconductor lithography tool—as they allow for close technical collaboration on design integration and rapid iteration. Indirect channels, utilizing specialized technical distributors, play a vital role in servicing the broad MRO market across diverse geographies, providing immediate inventory access and local technical support for replacement parts in chemical plants, refineries, and general industrial equipment. The choice between direct and indirect distribution often hinges on the component's criticality and customization level, with ultra-high purity parts almost exclusively managed via direct OEM relationships to ensure strict traceability and quality assurance throughout the supply chain and minimizing the risk of counterfeit or substandard parts entering critical systems.

Perfluoroelastomer (FFKM) Parts and Seals Market Potential Customers

Potential customers for FFKM parts and seals are predominantly found in industries where component failure is unacceptable due to safety, environmental, or extreme financial costs associated with downtime or process contamination. The primary buyers are major Original Equipment Manufacturers (OEMs) who integrate these seals into high-performance equipment, such as pump and valve manufacturers supplying to chemical processing plants, semiconductor tool manufacturers (e.g., for etching and deposition equipment), and engine and hydraulic system integrators in the aerospace sector. A significant portion of the market also targets end-users who engage in Maintenance, Repair, and Operations (MRO), often purchasing replacement seals through specialized distributors for existing critical systems in oil refineries, pharmaceutical bioreactors, and power generation facilities, where extending maintenance cycles and ensuring chemical compatibility are paramount operational concerns. These end-users prioritize long-term performance, certification standards (like API 6A, NORSOK, USP Class VI), and traceability of the components over initial cost.

In the Semiconductor and Electronics vertical, the key customers include Tier 1 equipment manufacturers like Applied Materials, Lam Research, and TEL, as well as the world's largest chip fabricators such as TSMC, Samsung, and Intel. These customers demand highly specialized FFKM grades with extremely low metal ion content and minimal particle generation to prevent contamination during delicate processes like chemical vapor deposition (CVD) and atomic layer deposition (ALD). In the Oil & Gas sector, potential customers are major exploration and production companies (e.g., ExxonMobil, Shell) and service providers (e.g., Schlumberger, Baker Hughes) who require robust FFKM seals for downhole tools, subsea components, and critical surface equipment operating at extreme pressures and temperatures. The demand from these sectors is driven by the need for materials that can resist highly corrosive gases like H2S and aggressive drilling fluids, ensuring safe operation hundreds of feet below the surface. This customer base seeks components with verifiable performance data and high mechanical integrity under sustained stress.

The Aerospace and Pharmaceutical industries represent another core customer segment. Aerospace customers include manufacturers like Boeing, Airbus, and their respective supply chains, focusing on seals for fuel systems, hydraulic reservoirs, and auxiliary power units where resistance to specialized aviation fluids and extreme temperature swings is mandatory. Pharmaceutical end-users, including major drug manufacturers and biotech firms (e.g., Pfizer, Roche), prioritize FFKM components for systems that involve Sterilization-In-Place (SIP) and Clean-In-Place (CIP) processes using high-pressure steam or concentrated cleaning chemicals. These segments demand seals that adhere strictly to regulatory standards (e.g., FDA compliance, USP Class VI) and exhibit zero potential for leaching, which could compromise drug purity. The purchasing decision across all these customer groups is highly technical, involving extensive qualification and testing protocols before adoption into mission-critical equipment, reinforcing the expertise required by FFKM suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.15 Billion |

| Market Forecast in 2033 | $1.82 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Greene Tweed, DuPont, Trelleborg AB, Daikin Industries, 3M, Parker Hannifin, Precision Polymer Engineering (PPE), Chesterton, Saint-Gobain, AGC Inc., Parco Inc., Kalrez, Simrit, Valqua Ltd., Freudenberg Group, Seal & Design Inc., Technetics Group, Gapi S.p.A., EnPro Industries, KWO Dichtungen GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Perfluoroelastomer (FFKM) Parts and Seals Market Key Technology Landscape

The technological landscape of the FFKM market is dominated by advancements in material science focused on pushing the thermal and chemical boundaries of the elastomer while simultaneously improving processability and purity. A critical area of innovation involves novel monomer and polymerization techniques aimed at increasing the cross-linking density and thermal stability of the base polymer, often involving the introduction of new functional groups within the polymer backbone. Furthermore, advancements in specialized curing chemistries, such as those utilizing triazine or peroxide systems, are central to enhancing specific performance characteristics, such as improving compression set resistance at elevated temperatures or increasing resistance to highly oxidizing media like oxygen plasma. The development of next-generation curative agents allows manufacturers to fine-tune the material's properties for extreme niches, ensuring compatibility with increasingly aggressive process environments in semiconductor fabrication, thereby minimizing particle generation and gas permeability which are critical failure modes in high-purity applications.

Another major technological focus is advanced compounding and filler technology. FFKM materials rely heavily on high-performance fillers (e.g., specialized carbon black, PTFE powders, or nano-fillers) to achieve desired mechanical properties, such as hardness, tensile strength, and reduced coefficient of friction. Recent breakthroughs involve the use of proprietary nanofillers and surface modification techniques that improve the homogeneity of the compound mixture and enhance the interaction between the polymer matrix and the filler particles, resulting in seals with superior dimensional stability and reduced potential for material degradation in harsh chemicals. For the semiconductor market, the development of white or translucent FFKM grades, which use highly inert, non-carbon-based fillers, is crucial for minimizing contamination risks and meeting ultra-high purity standards. These technical advancements require substantial investment in mixing equipment and proprietary compounding protocols to maintain the integrity of the specialized FFKM compounds throughout the manufacturing process.

Precision molding and fabrication techniques also form a significant part of the technology landscape. Since FFKM parts are costly, scrap rates must be minimized, driving the adoption of high-precision injection molding and transfer molding in cleanroom environments (ISO Class 5 or better). Key technologies here include automated deflashing, post-curing optimization (a mandatory step to fully develop mechanical properties and remove volatiles), and advanced traceability systems (e.g., laser etching or RFID tagging) to ensure that every finished component can be tracked back to its specific batch, curative system, and manufacturing environment. The integration of advanced computer-aided design (CAD) and Finite Element Analysis (FEA) is also critical, allowing engineers to simulate complex stress and temperature profiles that the seal will encounter, optimizing the geometry of the part (e.g., O-ring squeeze, groove design) to prevent premature failure and ensure maximum lifespan under critical operational conditions, effectively extending the total cost of ownership value proposition for end-users.

Regional Highlights

The dynamics of the FFKM market exhibit strong regional variance tied directly to industrial specialization, regulatory environments, and capital expenditure in high-technology sectors. North America, encompassing the United States and Canada, remains a vital market, particularly due to its robust aerospace, defense, and oil and gas industries. The U.S. is a global leader in high-pressure, high-temperature (HPHT) drilling and complex chemical manufacturing, necessitating extensive use of highly certified, performance-driven FFKM seals. Furthermore, the presence of major aerospace manufacturers and stringent military specifications drives consistent demand for seals with exceptional thermal and chemical resistance, ensuring the region maintains high average selling prices (ASPs) for specialized grades. The focus here is less on volume and more on high-performance, long-duration reliability required by established industrial standards and regulatory oversight bodies.

Asia Pacific (APAC) stands out as the highest-growth region, primarily fueled by massive, ongoing capital investment in semiconductor fabrication facilities, particularly in Taiwan, South Korea, China, and Japan. The rapid expansion of advanced electronics manufacturing, requiring ultra-pure FFKM seals for deposition, etching, and cleaning processes, positions APAC as the dominant consumer of high-purity grades. Additionally, the rapid industrialization across China and Southeast Asia, particularly in chemical processing, petrochemicals, and pharmaceutical production, generates significant volume demand for standard and high-temperature FFKM gaskets and O-rings. The region’s competitive manufacturing environment also drives intense price sensitivity for general industrial grades, although demand for premium, customized solutions remains strong within the electronics supply chain.

Europe represents a mature but highly sophisticated market, driven by strict environmental regulations, pharmaceutical excellence, and a strong presence in specialized chemical production and precision engineering (e.g., automotive R&D and high-end industrial machinery). Countries like Germany, France, and the UK prioritize quality control, traceability, and adherence to specific European Union directives (REACH). The demand for FFKM here is concentrated in specialized sectors requiring certified compliance, such as sterile medical devices and critical equipment in chemical plants handling hazardous materials. The Middle East and Africa (MEA) market growth is largely tied to upstream oil and gas activities. Investments in deep-sea and challenging onshore drilling projects in the Arabian Peninsula and North Africa necessitate robust FFKM components resistant to sour gas (H2S and CO2) and extreme temperatures, making Oil & Gas the overwhelmingly dominant application segment in this geographical region, albeit with volatility linked to global crude oil price fluctuations and associated CAPEX cycles.

- North America: Strong demand driven by Aerospace, Defense, and HPHT Oil & Gas exploration; focus on high-reliability, certified components.

- Asia Pacific (APAC): Leading growth region due to unprecedented investment in Semiconductor fabrication and general chemical infrastructure expansion; highest consumption of ultra-high purity grades.

- Europe: Mature market emphasizing Pharmaceutical, specialized Chemical Processing, and high-end industrial machinery; driven by stringent environmental and safety regulations.

- Middle East & Africa (MEA): Growth strongly tied to Oil & Gas extraction, demanding extreme pressure and sour gas resistance.

- Latin America: Emerging market with focus on localized oil production and expanding industrial base in countries like Brazil and Mexico.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Perfluoroelastomer (FFKM) Parts and Seals Market.- Greene Tweed

- DuPont

- Trelleborg AB

- Daikin Industries

- 3M

- Parker Hannifin

- Precision Polymer Engineering (PPE)

- Chesterton

- Saint-Gobain

- AGC Inc.

- Parco Inc.

- Kalrez (A DuPont Brand)

- Simrit (A Freudenberg Brand)

- Valqua Ltd.

- Freudenberg Group

- Seal & Design Inc.

- Technetics Group

- Gapi S.p.A.

- EnPro Industries

- KWO Dichtungen GmbH

Frequently Asked Questions

Analyze common user questions about the Perfluoroelastomer (FFKM) Parts and Seals market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of FFKM over FKM or PTFE?

FFKM offers superior chemical resistance, approaching the inertness of PTFE, combined with the elasticity and sealing capability of an elastomer. Unlike FKM, FFKM resists nearly all aggressive chemical media, including plasma and strong oxidizing agents, while maintaining thermal stability up to 327°C, critical for extreme applications.

Which end-use industry drives the highest demand for specialized FFKM?

The Semiconductor and Electronics industry drives the highest demand for specialized, ultra-high purity FFKM grades. This is due to the non-negotiable requirement for zero contamination (low metal ion leaching, minimal outgassing) when seals are exposed to extremely corrosive etching gases and plasma environments during chip fabrication.

What factors contribute to the high cost of FFKM seals?

The high cost stems from the complexity and capital intensity of synthesizing the fluorinated base monomers, the proprietary nature of the curative systems used, and the necessity for precision molding and curing within stringent cleanroom environments to ensure material purity and dimensional accuracy.

How is the FFKM market addressing sustainability and environmental concerns?

The market addresses sustainability by focusing on developing longer-lasting, more reliable seals, which reduces maintenance frequency and waste. Additionally, R&D is focused on minimizing the environmental footprint of fluorinated monomer production and reducing PFOA/PFOS related compounds in the manufacturing cycle, ensuring compliance with global environmental regulations like REACH.

What are the key technical challenges facing FFKM seal manufacturers?

Key challenges include developing new compounds that resist emerging aggressive media (like specialized battery electrolytes or advanced refrigerants), further improving compression set resistance at continuous high temperatures, and maintaining cost efficiency without compromising the essential ultra-high purity requirements needed by sensitive end-use sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager