Perfluoroelastomer (FFKM) Parts and Seals Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431786 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Perfluoroelastomer (FFKM) Parts and Seals Market Size

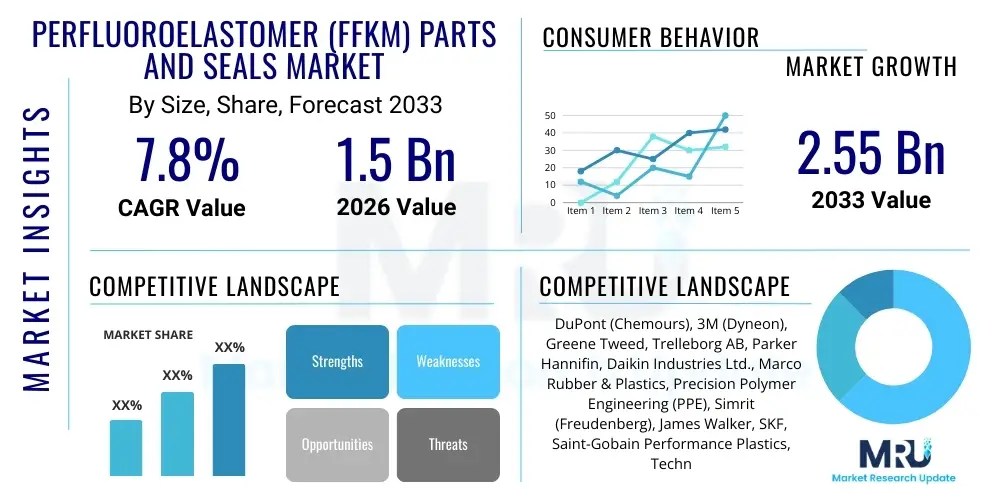

The Perfluoroelastomer (FFKM) Parts and Seals Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.55 Billion by the end of the forecast period in 2033.

Perfluoroelastomer (FFKM) Parts and Seals Market introduction

The Perfluoroelastomer (FFKM) Parts and Seals Market centers around high-performance sealing solutions essential for extreme operational environments characterized by high temperatures, aggressive chemical media, and demanding plasma compatibility. FFKM is a fully fluorinated polymer offering the broadest chemical resistance of any elastomeric material, combining the chemical inertness of PTFE with the resilience and elasticity of standard elastomers. This unique combination makes FFKM indispensable across highly critical industrial applications where seal failure could result in catastrophic system downtime, significant safety hazards, or enormous financial losses. Key products include O-rings, gaskets, custom molded shapes, and diaphragms, tailored specifically for applications requiring longevity and integrity under duress.

Major applications driving the demand for FFKM include the semiconductor manufacturing industry, where ultra-pure environments and exposure to corrosive plasma require seals with minimal outgassing and high heat resistance. In the chemical processing industry (CPI), FFKM components are vital for pumps, valves, and mechanical seals handling harsh acids, bases, and volatile organic compounds at elevated pressures. Furthermore, the aerospace and oil & gas sectors utilize FFKM for critical sealing points in engines, hydraulic systems, and downhole equipment where extreme thermal cycling and contact with aggressive lubricants or supercritical fluids are commonplace. The fundamental benefit of FFKM lies in its ability to significantly extend Mean Time Between Failure (MTBF) for high-value equipment, thereby reducing maintenance costs and enhancing operational efficiency.

The market growth is primarily driven by the increasing complexity of industrial processes and the continuous push towards higher purity standards and more extreme operating parameters in end-user sectors. Specifically, the miniaturization trends in semiconductor fabrication necessitate superior plasma resistance and cleanliness from sealing materials. Additionally, stringent safety and environmental regulations in the chemical and energy sectors further mandate the adoption of highly reliable, chemically resistant sealing elements like FFKM. Innovation in curing technologies and compounding techniques, leading to application-specific FFKM grades optimized for specific chemicals or temperature ranges, also acts as a significant market accelerant.

Perfluoroelastomer (FFKM) Parts and Seals Market Executive Summary

The FFKM Parts and Seals market is experiencing robust expansion, fueled by non-negotiable reliability requirements in high-stakes industries such as semiconductor manufacturing, chemical processing, and aerospace. Current business trends indicate a strong move toward application-specific material development, where manufacturers are launching specialized FFKM grades offering enhanced features such as improved low-temperature flexibility, superior resistance to specific amine compounds, or enhanced resistance to high-energy plasma etching processes. This customization trend allows suppliers to capture niche, high-margin segments. Furthermore, supply chain resilience is becoming a key strategic priority, with major FFKM producers investing in localized production capabilities to mitigate geopolitical risks and improve lead times, particularly in North America and Asia Pacific.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, predominantly driven by massive investments in semiconductor fabrication facilities (fabs) in countries like China, South Korea, and Taiwan. The rapid expansion of chemical manufacturing and pharmaceutical production in emerging Asian economies also contributes substantially to demand. North America and Europe, while mature, maintain strong demand due to the presence of large aerospace primes and specialized chemical operations requiring the highest quality sealing solutions, often governed by rigorous industry certifications such as those required by NORSOK or FDA regulations. The Middle East and Africa (MEA) market is poised for gradual growth, correlated with investments in deep-water and unconventional oil and gas exploration, necessitating materials capable of withstanding extreme pressure and high concentrations of hydrogen sulfide.

Segment trends reveal that O-rings remain the dominant product type due to their ubiquitous use across various fluid handling and mechanical systems. However, custom-molded parts, including diaphragms and complex internal valve seals, are the fastest-growing segment, reflecting the increasing need for highly engineered, non-standard sealing geometries in advanced equipment. Segmentation by end-use highlights the Semiconductor industry as the largest revenue contributor, consistently driving material innovation due to its demand for ultra-high purity and plasma resistance. The Chemical Processing Industry (CPI) follows closely, driven by capacity expansions and the replacement of standard elastomers with more durable FFKM to enhance plant safety and efficiency.

AI Impact Analysis on Perfluoroelastomer (FFKM) Parts and Seals Market

Users frequently inquire about how Artificial Intelligence (AI) and machine learning (ML) can be integrated into the highly specialized FFKM production and deployment lifecycle. Common questions revolve around AI’s role in optimizing complex chemical formulations, predicting material performance under extreme, multi-variable conditions, and enhancing quality control during molding and curing processes. There is significant interest in utilizing predictive maintenance algorithms, powered by ML, to monitor operational conditions of seals (e.g., thermal exposure, pressure spikes) in real-time within critical equipment, thereby calculating the remaining useful life (RUL) of the FFKM component. Key themes center on leveraging AI to reduce expensive material waste, accelerate the R&D cycle for new FFKM grades, and transition from reactive replacement to proactive, condition-based monitoring, ensuring maximum uptime in high-purity and hazardous environments.

- AI-driven optimization of polymer synthesis and cross-linking reactions to achieve desired mechanical properties (e.g., hardness, tensile strength) with minimal material variation.

- Machine learning algorithms applied to Finite Element Analysis (FEA) simulations to accurately predict seal compression set and chemical degradation rates under fluctuating operational parameters, reducing reliance on lengthy physical testing.

- Integration of Computer Vision (CV) systems with AI for automated, high-speed inspection of finished FFKM parts, ensuring dimensional accuracy and surface defect detection far exceeding human capabilities, crucial for semiconductor applications.

- Predictive maintenance analytics using sensor data (temperature, pressure, vibration) from pumps and valves to forecast FFKM seal failure, enabling just-in-time replacement and minimizing unplanned downtime in chemical plants.

- Optimization of supply chain and inventory management for specific FFKM grades using AI to match fluctuating demand from specialized industries like semiconductor fabrication, balancing cost efficiency with crucial lead time responsiveness.

- Accelerated discovery of novel perfluoroelastomer chemistries by using generative AI models to explore vast compositional spaces and identify structures with enhanced thermal stability or specialized chemical inertness properties.

- AI assistance in troubleshooting field failures by analyzing historical performance data and correlating specific operational stress profiles with material degradation mechanisms, improving future material selection guidelines.

DRO & Impact Forces Of Perfluoroelastomer (FFKM) Parts and Seals Market

The market for FFKM parts and seals is strongly influenced by a robust set of drivers centered on mandatory reliability in high-purity and harsh environments, coupled with significant restraints related to cost and processing difficulty. Key drivers include the stringent material requirements imposed by the semiconductor industry, particularly the need for superior plasma resistance and ultra-low particle generation as feature sizes shrink. Opportunities primarily arise from the ongoing transition in the oil and gas sector towards high-pressure/high-temperature (HPHT) drilling and the growing demand for high-purity equipment in the rapidly expanding biopharmaceutical manufacturing sector. The inherent market dynamic is characterized by high switching costs and extreme barriers to entry due to the specialized nature of FFKM technology and compounding expertise.

Driving forces for FFKM adoption are consistently linked to regulatory mandates and the economic cost of failure. In the chemical industry, stricter environmental regulations necessitate zero-leak sealing, pushing operators away from standard elastomers towards reliable FFKM components that offer multi-year service life in aggressive fluids. The global increase in capital expenditure (CapEx) in specialized manufacturing, particularly in complex cleanroom environments, translates directly into higher demand for premium sealing solutions. Furthermore, continuous technological advancements in end-user machinery, demanding faster speeds, higher pressures, and more chemically aggressive operational cycles, intrinsically requires the thermal and chemical stability profile unique to perfluoroelastomers.

Restraints, however, pose significant challenges to broader market penetration. The primary constraint is the exceptionally high cost of FFKM raw materials and the complex, energy-intensive processing required for molding and curing these materials, resulting in a substantially higher unit cost compared to FKM or EPDM. This high cost restricts FFKM usage exclusively to critical sealing points. Another significant restraint involves the difficulty in processing FFKM, which often requires highly specialized equipment and expertise to achieve the tight dimensional tolerances and flawless surface finish essential for high-purity applications, such as those found in vacuum systems. Opportunities are centered on developing lower-cost, high-performance FFKM variants and expanding applications in non-traditional sectors like fuel cells and renewable energy storage, where chemical resistance and long service life are emerging requirements.

Segmentation Analysis

The FFKM Parts and Seals market is primarily segmented based on product type, end-use industry, and application. This granular segmentation allows manufacturers and strategists to precisely target high-growth niches where the material's unique performance attributes command premium pricing. The product segmentation details the manufacturing configuration, ranging from standardized O-rings to complex, custom-engineered components crucial for specialized equipment. End-use segmentation clearly identifies the main industries driving demand, with the semiconductor sector being the foremost innovator and consumer due to its zero-tolerance policy for contamination and equipment downtime. Application segmentation further refines the analysis by focusing on specific operational points, such as static seals in valves or dynamic seals in reciprocating pumps, which dictates the specific FFKM grade required for optimum performance and longevity.

- By Product Type:

- O-Rings

- Gaskets

- Custom Molded Shapes (Diaphragms, Valve Seats)

- Sealing Components for Mechanical Seals

- By End-Use Industry:

- Semiconductor Manufacturing

- Chemical Processing Industry (CPI)

- Aerospace & Defense

- Oil & Gas (Downhole, Exploration)

- Pharmaceutical & Bioprocessing

- Food & Beverage

- Others (Automotive, Power Generation)

- By Application:

- Static Sealing

- Dynamic Sealing (Rotary and Reciprocating)

- Plasma Sealing

- Vacuum Sealing

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Perfluoroelastomer (FFKM) Parts and Seals Market

The FFKM value chain is highly concentrated and specialized, starting with the complex and capital-intensive upstream production of base perfluoroelastomer polymers. Only a few global chemical giants possess the proprietary polymerization technology required to produce the high-purity, high-molecular-weight polymers necessary for FFKM compounding. This highly technical upstream stage creates significant barriers to entry and dictates the raw material pricing for the entire industry. The midstream involves compounding and molding, where specialized processors combine the base polymer with proprietary curing agents, fillers, and additives. This compounding step is crucial as it determines the final properties, such as high-temperature capability or plasma resistance, making it a key differentiator among finished product manufacturers. Precision molding and post-curing are critical steps requiring stringent quality control to meet the tight tolerances of modern industrial equipment.

Downstream distribution channels for FFKM seals are typically segmented into direct sales and specialized indirect distribution. For large, critical customers like major semiconductor OEMs or aerospace manufacturers, direct sales via dedicated application engineering teams are common. This approach ensures technical consultation and traceability of high-value components. Indirect channels involve authorized, technically proficient distributors who manage inventory and provide local support to smaller chemical plants, maintenance operations (MRO), and general industrial users. These distributors often maintain certified cleanroom facilities for packaging, especially when servicing the ultra-pure semiconductor sector. E-commerce platforms are minimally utilized for primary FFKM sales due to the technical nature of product selection, but they serve as essential platforms for replacement parts and basic MRO purchasing.

The complexity of the application and the high risk associated with seal failure necessitate a strong technical interface throughout the value chain. Upstream suppliers must work closely with compounders to develop specialty grades, and compounders must collaborate directly with end-users to tailor seals for specific chemical or thermal profiles. Traceability from raw material batch to final installed part is paramount, particularly in regulated industries like aerospace and pharmaceuticals. Direct and indirect channels are strategically employed to balance technical intimacy with market reach; direct channels focus on design-in opportunities and complex, custom solutions, while specialized indirect partners provide essential localized support and rapid delivery for critical replacement needs, ensuring the market remains serviced efficiently and reliably.

Perfluoroelastomer (FFKM) Parts and Seals Market Potential Customers

Potential customers for FFKM parts and seals are predominantly found in industries where operational failure is unacceptable due to high economic cost, extreme safety hazards, or regulatory non-compliance. The primary buyers are original equipment manufacturers (OEMs) and end-users operating complex process equipment. Semiconductor fabrication equipment manufacturers (e.g., plasma etching tools, CVD systems) are significant volume buyers, purchasing FFKM seals as critical components designed directly into their high-vacuum process chambers. In the chemical sector, refinery and petrochemical plant operators, particularly those managing polymerization, chlorination, or strong acid production, are continuous users for MRO purposes, replacing seals in pumps, compressors, and pipeline valves. These end-users prioritize chemical resistance and long service intervals above all else, making FFKM a non-negotiable requirement for minimizing hazardous leaks and extending maintenance cycles.

Aerospace and defense customers represent another crucial segment, utilizing FFKM for critical sealing applications in engines, fuel systems, and hydraulic actuation systems where exposure to aggressive jet fuels (e.g., Skydrol), high temperatures, and high altitudes demands extreme reliability and fire resistance. The oil and gas sector, particularly companies involved in high-pressure/high-temperature (HPHT) and deep-water drilling, constitutes a growing customer base, relying on FFKM for reliable sealing in downhole tools and subsea equipment that encounter corrosive sour gas (H2S) and extreme thermal gradients. Furthermore, the specialized biopharmaceutical industry is a rapidly emerging customer group, requiring FDA-compliant FFKM seals for sterile processing equipment, fermenters, and filtration systems, driven by the need for ultra-cleanliness, steam-in-place (SIP) compatibility, and resistance to aggressive cleaning agents.

In essence, the target clientele consists of organizations that view sealing components not as commodities, but as high-value, enabling technology that directly influences operational safety, throughput, and profitability. Their purchasing decisions are heavily influenced by technical performance data, material certifications, supplier application expertise, and proven field performance in challenging environments. The shift towards cleaner energy technologies also introduces new potential customers in the hydrogen economy, where FFKM's resistance to permeability and aggressive media is being tested for use in high-pressure hydrogen compressors and fuel cell stacks, expanding the traditional customer base into emerging industrial domains requiring stringent material integrity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.55 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DuPont (Chemours), 3M (Dyneon), Greene Tweed, Trelleborg AB, Parker Hannifin, Daikin Industries Ltd., Marco Rubber & Plastics, Precision Polymer Engineering (PPE), Simrit (Freudenberg), James Walker, SKF, Saint-Gobain Performance Plastics, Technetics Group, Gapi Group, Custom Advanced Connections. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Perfluoroelastomer (FFKM) Parts and Seals Market Key Technology Landscape

The technology landscape surrounding FFKM parts and seals is defined by advancements in three primary areas: polymerization chemistry, sophisticated compounding and curing techniques, and ultra-precision molding processes. In terms of chemistry, innovation focuses on developing novel terpolymers and specialized curing systems, such as peroxide-cured or triazine-cured systems, to fine-tune the final properties. For instance, manufacturers are actively developing FFKM grades with enhanced resistance to aggressive chemicals like high-concentration amines or superheated steam, which requires precise control over the backbone structure and cross-link density. This pursuit of specialized chemistry allows for performance optimization beyond the standard operating envelope, directly addressing the increasingly harsh demands of modern industrial processes, especially in HPHT and highly corrosive environments.

Compounding technology represents a critical competitive edge, as manufacturers must ensure homogeneous dispersion of high-purity, inert fillers (e.g., carbon black, PTFE powder) within the highly viscous FFKM polymer matrix. Proper compounding is essential to achieve the desired mechanical properties while maintaining the low extractables and minimal outgassing required for semiconductor and vacuum applications. Furthermore, the curing process technology, involving complex temperature and pressure profiles (post-curing), is crucial for maximizing cross-link density and achieving the maximum thermal stability of the final product. Failure to execute precise compounding and curing results in seals with inferior compression set resistance and shorter service life, highlighting the technical barrier to entry in this specialized segment.

Molding and finishing technologies are equally paramount, particularly in the production of geometrically complex seals and ultra-pure O-rings. Precision injection molding and compression molding techniques, often performed in controlled cleanroom environments, are utilized to ensure zero-flash, tight dimensional tolerances, and flawless surface finishes. Advanced surface treatments, such as specialized plasma cleaning processes or proprietary coating applications, are sometimes employed to further reduce particle generation and enhance chemical inertness, satisfying the stringent purity standards of leading-edge semiconductor lithography and etching tools. The integration of advanced process monitoring and control systems (SPC/SQC) throughout the manufacturing process ensures consistency and traceability, which are non-negotiable requirements for high-reliability FFKM components.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global FFKM market, driven by monumental investments in the semiconductor and electronics manufacturing sectors, particularly in Taiwan, South Korea, and Mainland China. The establishment of new mega-fabs necessitates massive uptake of ultra-high purity FFKM seals for vacuum and plasma processing equipment. Additionally, the region’s robust growth in specialty chemicals and pharmaceuticals, coupled with less stringent legacy infrastructure, allows for rapid adoption of state-of-the-art FFKM sealing technology, positioning it as the fastest-growing and largest revenue region globally.

- North America: North America holds a significant market share, characterized by high demand from the aerospace & defense industry (where FFKM is specified for extreme environmental conditions) and the sophisticated Oil & Gas sector, specifically for HPHT exploration in the Gulf of Mexico and shale operations. The region benefits from stringent safety and environmental regulations, driving end-users to invest in premium, high-reliability FFKM solutions over less expensive alternatives. Furthermore, significant government incentives promoting domestic semiconductor manufacturing (e.g., CHIPS Act) are expected to further bolster demand in the near term.

- Europe: The European market is stable and mature, primarily driven by the established chemical processing and specialized manufacturing industries, especially in Germany and the Benelux region. Demand is closely tied to rigorous EU environmental and safety directives (e.g., REACH), which necessitate advanced sealing materials to prevent hazardous emissions. Key consumers include pharmaceutical producers requiring compliant seals for sterilization processes and automotive manufacturers using FFKM in specialized applications like fuel injection systems and turbochargers designed for extreme thermal loads.

- Latin America (LATAM): The LATAM market is relatively small but exhibits potential growth, primarily linked to the recovery and expansion of oil and gas exploration in Brazil (pre-salt reserves) and Mexico. Adoption is slower compared to North America and Europe, often constrained by budget considerations, but the demand for high-performance FFKM is growing in critical offshore and deep-water applications where standard elastomers fail prematurely, ensuring gradual yet critical niche expansion.

- Middle East & Africa (MEA): Growth in the MEA region is intrinsically linked to substantial CapEx in the petroleum and refining sector. The prevalence of harsh operating conditions, including high temperatures and the presence of corrosive agents like hydrogen sulfide (sour gas) and elevated concentrations of brine, dictates the mandatory use of specialized FFKM grades for wellhead equipment, pipelines, and processing facilities. Strategic investments in petrochemical diversification are expected to sustain the demand for reliable sealing solutions throughout the forecast period.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Perfluoroelastomer (FFKM) Parts and Seals Market.- DuPont (Chemours)

- 3M (Dyneon)

- Greene Tweed

- Trelleborg AB

- Parker Hannifin Corporation

- Daikin Industries Ltd.

- Marco Rubber & Plastics

- Precision Polymer Engineering (PPE)

- Freudenberg Sealing Technologies

- James Walker

- SKF Group

- Saint-Gobain Performance Plastics

- Technetics Group

- Gapi Group

- Custom Advanced Connections

- ERIKS NV

- Parco Inc.

- Seal & Design Inc.

- Gallagher Fluid Seals

- American High Performance Seals

Frequently Asked Questions

Analyze common user questions about the Perfluoroelastomer (FFKM) Parts and Seals market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of FFKM seals over FKM seals?

FFKM (Perfluoroelastomer) offers superior chemical resistance and thermal stability compared to FKM (Fluoroelastomer) because FFKM is fully fluorinated, meaning its polymer backbone is completely saturated with fluorine. This saturation provides chemical inertness close to PTFE, allowing it to withstand temperatures up to 325°C and resist nearly all industrial solvents, acids, and bases, which FKM cannot consistently handle.

Which end-use industry is the largest consumer of FFKM parts and why?

The Semiconductor Manufacturing industry is the largest consumer. FFKM is mandatory for sealing plasma etching and deposition chambers because it exhibits ultra-low particle generation, minimal outgassing in vacuum, and exceptional resistance to high-energy plasma, essential criteria for maintaining the high-purity environment required for advanced microchip fabrication.

What are the main market restraints impacting the broader adoption of FFKM?

The primary restraint is the extremely high cost of raw FFKM polymers and the specialized, complex processing required for manufacturing. This economic barrier limits the use of FFKM exclusively to critical, high-reliability applications where seal failure poses significant financial or safety risks, preventing widespread adoption in general industrial equipment.

How is the market addressing the need for application-specific FFKM grades?

Manufacturers are investing heavily in R&D to develop proprietary FFKM grades customized for niche applications, such as materials optimized for superior resistance to high-concentration amines in oil and gas, or formulations featuring enhanced low-temperature flexibility for aerospace use, allowing for precise material selection based on specific operational stresses and chemical exposure profiles.

Is FFKM suitable for high-pressure high-temperature (HPHT) oil and gas applications?

Yes, FFKM is highly suitable for HPHT applications. Its excellent thermal stability, resistance to explosive decompression (RGD), and inertness towards aggressive media like sour gas (H2S), supercritical CO2, and drilling fluids make it an essential sealing material for downhole tools and subsea equipment operating under extreme pressure and temperature conditions exceeding the limits of conventional elastomers.

What role does traceability play in the FFKM supply chain?

Traceability is critical, particularly in the aerospace and pharmaceutical industries. It ensures that every FFKM part can be tracked back to its specific batch of raw material, compounding formula, and cure cycle. This level of control is vital for quality assurance, regulatory compliance, and rapid root cause analysis in the event of an unexpected seal failure in critical equipment.

How does the increasing focus on clean energy influence FFKM demand?

The shift to clean energy, particularly hydrogen fuel cells and high-pressure hydrogen storage, drives FFKM demand due to its excellent barrier properties and resistance to the embrittlement caused by compressed hydrogen gas. FFKM seals are being specified for critical connections in hydrogen compressors and piping systems where high reliability is paramount for safety and efficiency.

What is the current trend in FFKM manufacturing regarding quality control?

The current trend involves the widespread adoption of advanced automated inspection techniques, often utilizing high-resolution cameras and AI-driven computer vision systems. This shift ensures zero-defect output, particularly for semiconductor seals, by rapidly identifying minute surface imperfections and dimensional deviations that are invisible or inconsistent with manual inspection methods.

How do global trade dynamics affect the pricing and availability of FFKM?

Global trade dynamics significantly affect FFKM pricing and availability because the upstream production of perfluorinated monomers is highly centralized, involving complex and proprietary chemical processes limited to a few major global suppliers. Geopolitical events or trade restrictions on these key fluorine-based chemicals can instantly impact the cost and lead times for finished FFKM parts worldwide.

What are the typical lifespan expectations for FFKM seals in industrial environments?

In high-stress industrial environments like chemical processing or aerospace, FFKM seals are engineered for long-term service, often expected to perform reliably for two to five years, sometimes longer, before requiring replacement. This extensive lifespan, far exceeding standard elastomers, is a key justification for their high initial investment cost, significantly reducing maintenance frequency and associated costs.

What unique challenge does plasma etching pose to sealing materials in semiconductor manufacturing?

Plasma etching subjects seals to highly reactive radicals (ionized gas particles) at elevated temperatures, leading to chemical erosion, material loss, and particle generation. FFKM is specifically formulated to withstand this harsh environment, exhibiting low erosion rates and minimal particle contamination compared to standard fluoroelastomers, which degrade quickly under plasma exposure.

Why is compression set resistance an important property for FFKM O-rings?

Compression set resistance is vital because it measures the seal's ability to return to its original thickness after prolonged compression at high temperature. A poor compression set means the seal permanently deforms and loses its elasticity, leading to leaks. High-quality FFKM maintains excellent memory, ensuring a lasting and secure sealing force over extended operational periods in dynamic or thermal cycling applications.

How do manufacturers ensure the purity of FFKM components for pharmaceutical use?

For pharmaceutical and bioprocessing applications, manufacturers must ensure compliance with FDA and USP Class VI standards. This involves using specialized, high-purity compounding materials, employing rigorous cleanroom manufacturing environments to prevent contamination, and conducting extensive extractables and leachables testing to guarantee the material will not compromise the final drug product integrity or stability.

What is the difference between static sealing and dynamic sealing with FFKM?

Static sealing involves surfaces that remain stationary (e.g., flange gaskets or housing seals in valves) and primarily relies on compression set resistance and chemical inertness. Dynamic sealing involves movement (e.g., reciprocating pistons or rotating shafts) and requires FFKM materials optimized not only for chemical resistance but also for abrasion resistance, tear strength, and low friction to manage continuous movement without excessive wear or failure.

Which geographical region is showing the fastest adoption rate for FFKM technology?

The Asia Pacific (APAC) region, driven primarily by massive governmental and private investments in cutting-edge semiconductor fabrication facilities, is exhibiting the fastest adoption rate. The immediate need for advanced, plasma-resistant sealing technology in newly built mega-fabs creates an unprecedented demand surge for FFKM materials in this region.

How does the volatility in crude oil prices affect the FFKM market?

Volatility in crude oil prices indirectly influences the FFKM market by impacting capital expenditure (CapEx) in the oil and gas sector. When prices are high, exploration and drilling activities increase, boosting demand for high-reliability FFKM seals in HPHT drilling equipment. Conversely, prolonged low prices can lead to delayed projects and reduced MRO spending, temporarily restraining market growth in that segment.

What is the significance of thermal cycling resistance for FFKM in aerospace applications?

Thermal cycling resistance is crucial in aerospace because components often experience rapid and extreme temperature fluctuations (e.g., from ambient ground temperature to high temperatures at engine operation or low temperatures at high altitude). FFKM must maintain its mechanical integrity and sealing force throughout these cycles to prevent leaks and structural failures, a testament to its broad operating temperature range.

Are there any emerging competitive materials to FFKM currently being explored?

While FFKM holds a dominant position in ultra-high performance sealing, research is ongoing into advanced high-performance polymers, potentially including new generations of PEEK and reinforced PTFE derivatives. However, none currently match the unique combination of high chemical resistance, elasticity, and maximum continuous operating temperature (MCOT) offered by commercially available FFKM grades.

How is digital transformation influencing the procurement process for FFKM components?

Digital transformation is leading to sophisticated inventory management systems and integration of supplier platforms, allowing major industrial buyers to predict replacement schedules (often assisted by AI) and automate reordering of specific FFKM part numbers. This transition enhances supply chain efficiency, particularly for MRO activities in large chemical plants, ensuring crucial seals are available when needed.

What are the typical filler materials used in FFKM compounding?

Typical filler materials used in FFKM compounding include specialized forms of carbon black, which provide conductivity and enhance mechanical strength, and various forms of high-purity PTFE powder, which aid in abrasion resistance and reduce friction. The choice and purity of the filler are crucial, especially for seals destined for plasma environments where fillers must not contaminate the process chamber.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager