Potato Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443490 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Potato Market Size

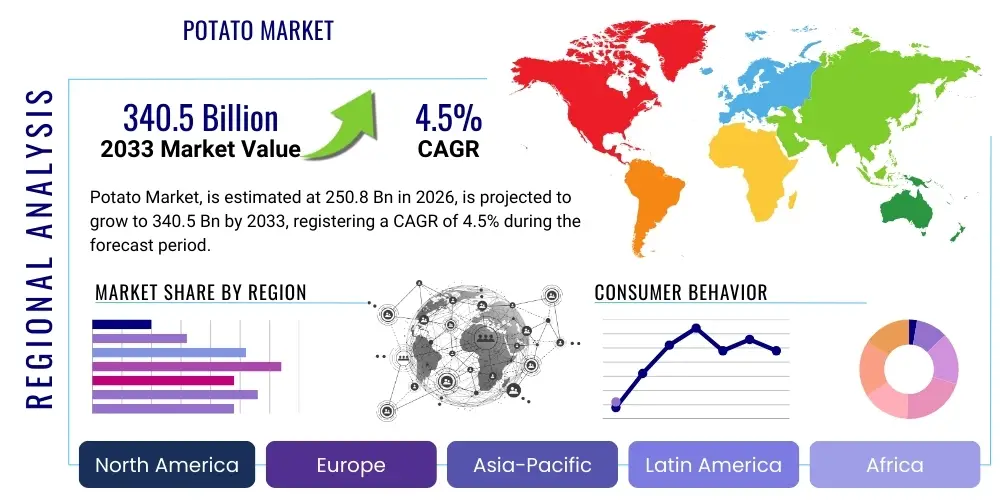

The Potato Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 250.8 Billion in 2026 and is projected to reach USD 340.5 Billion by the end of the forecast period in 2033. This robust growth trajectory is underpinned by increasing global consumption, diversification of processed potato products, and technological advancements enhancing yield and storage capabilities. The demand surge in developing economies, coupled with sophisticated supply chain management in established markets, contributes significantly to this positive financial outlook.

Potato Market introduction

The global potato market encompasses the cultivation, trade, processing, and consumption of potatoes (Solanum tuberosum), one of the world's most critical food staples after rice and wheat. Potatoes are highly valued for their nutritional density, caloric efficiency, and versatility in culinary applications. The market is fundamentally divided into fresh consumption (table potatoes) and processed products, which include frozen fries, chips, flakes, starch, and dehydrated varieties. The adaptability of the potato crop to various climatic conditions and its role in global food security position it as a foundational component of the agricultural economy.

Major applications for potatoes span the retail sector, food service industry, and industrial processing. In the food service sector, frozen French fries and specialized potato ingredients for prepared meals drive significant demand. Retail consumers rely on fresh potatoes for home cooking and shelf-stable processed options. Beyond direct human consumption, potatoes are utilized in the production of animal feed, industrial starch, and alcoholic beverages, further diversifying their economic footprint. The primary driving factors for market expansion include sustained population growth, evolving consumer dietary habits favoring convenience foods, and strategic investments in high-yield seed varieties and precision agriculture techniques.

The inherent benefits of potatoes, such as their high Vitamin C and potassium content, coupled with continuous innovation in processing technology to extend shelf life and enhance flavor profiles, ensure their continued market dominance. Furthermore, sustainability initiatives focusing on water-efficient irrigation and pest management are increasingly shaping cultivation practices, aligning the industry with broader environmental responsibility goals while maintaining high yields necessary to meet global demand.

Potato Market Executive Summary

The potato market is characterized by resilient growth, primarily fueled by the burgeoning processed food segment and substantial regional shifts in production and consumption patterns. Current business trends indicate a strong move toward value-added products, such as gourmet chips, low-fat frozen options, and specialized potato starch for industrial applications. Key market players are heavily investing in vertical integration, securing raw material supply chains, and leveraging automation in processing facilities to achieve economies of scale and maintain product quality consistency. Consolidation among major processing companies is accelerating, leading to increased efficiency and concentrated market power in specific segments like frozen potato products.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, driven by massive consumption volumes in countries like China and India, coupled with rapid urbanization that increases demand for convenient, processed potato foods. North America and Europe maintain technological leadership, particularly in seed science, storage infrastructure, and high-quality frozen product manufacturing, making them crucial centers for innovation and export. Latin America and the Middle East & Africa are emerging markets, showing significant potential due to expanding retail chains and increasing adoption of Westernized dietary patterns, though infrastructure limitations pose occasional challenges to growth consistency.

Segment-wise, the Processed Potato Products segment, particularly frozen fries and potato chips, dominates the market revenue and exhibits the highest growth rate, reflecting consumer preference for ease of preparation. Within raw potato varieties, the demand for varieties suitable for specific industrial processing (e.g., high-solid potatoes for chipping) is intensifying. Sustainability and health considerations are driving the adoption of organic and non-GMO potato farming practices, forming niche but rapidly expanding market segments, signaling a maturing market landscape focused on both volume and ethical sourcing.

AI Impact Analysis on Potato Market

User queries regarding AI's influence on the potato market overwhelmingly focus on three core areas: optimizing farm efficiency, enhancing supply chain transparency, and predicting disease outbreaks and market fluctuations. Users frequently ask about the implementation cost of AI-driven precision agriculture systems, the reliability of AI algorithms in diverse weather conditions, and how automation might affect labor requirements in harvesting and sorting. Key concerns revolve around data privacy, the digital divide between large industrial farms and smaller producers, and the standardization of data collection necessary for effective machine learning models. Expectations are high, centered on achieving maximized yields with minimal resource input and ensuring food safety through intelligent monitoring.

The deployment of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is revolutionizing potato cultivation, shifting traditional farming towards highly precise, data-driven operations. AI-powered systems analyze vast datasets related to soil health, weather patterns, historical yield data, and satellite imagery to generate predictive models for planting, irrigation, and fertilization schedules. This precision minimizes waste, conserves critical resources such as water and nutrients, and significantly boosts overall crop yield per hectare, directly addressing user demands for efficiency and sustainability. Furthermore, AI facilitates better risk management by providing early warnings regarding potential pest infestations or fungal diseases, allowing for targeted intervention rather than broad chemical application.

In the post-harvest sector, AI plays a crucial role in optimizing storage and supply chain logistics. Vision systems equipped with deep learning models are employed in processing plants for rapid quality grading and defect detection, ensuring only the highest quality potatoes proceed to processing or retail channels. Supply chain optimization uses predictive analytics to forecast demand fluctuations, manage inventory levels efficiently, and optimize transportation routes, reducing spoilage and operational costs. This integration of AI across the entire value chain is pivotal in transforming the potato industry into a more resilient, responsive, and technologically advanced agricultural sector.

- AI-driven Precision Agriculture: Optimizing irrigation, nutrient application, and pesticide use based on real-time field conditions.

- Predictive Yield Modeling: Utilizing historical and current data (climate, soil) to accurately forecast harvest volumes and quality.

- Automated Disease and Pest Detection: Using drone and sensor imagery combined with machine vision to identify early signs of crop stress or infection.

- Enhanced Quality Sorting: AI-powered optical sorters rapidly identify defects, size variations, and external damage in processing facilities.

- Supply Chain Optimization: ML algorithms forecasting consumer demand and optimizing cold storage capacity and logistical pathways.

DRO & Impact Forces Of Potato Market

The dynamics of the global potato market are shaped by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and crucial Impact Forces. The primary drivers sustaining market expansion include relentless global population growth, particularly in Asia and Africa, which guarantees continuous demand for staple foods. Equally significant is the rapid globalization of fast-food chains and the increasing consumer preference for processed, convenient potato products like chips, hash browns, and frozen fries, especially in urban environments where time constraints dictate dietary choices. Technological advancements in cold storage and transportation infrastructure also facilitate cross-border trade, stabilizing supply and mitigating regional shortages, thereby fostering market resilience.

Conversely, the market faces significant restraints, notably the vulnerability of potato crops to extreme weather events caused by climate change, including severe droughts or excessive rainfall, which directly impacts yield volatility and commodity prices. Phytosanitary restrictions and regulatory hurdles across international borders, designed to prevent the spread of diseases like potato cyst nematodes, also complicate global trade flows. Additionally, growing health consciousness among consumers in developed economies sometimes leads to reduced consumption of fried or highly processed potato products, pushing demand toward healthier, alternative carbohydrate sources or fresh, minimally processed varieties.

Opportunities for future growth are predominantly found in the development of highly specialized, value-added potato derivatives, such as modified starches used extensively in the food and textile industries, and the expansion of the market for organic and non-GMO certified potatoes. Investment in sustainable farming practices, including vertical farming trials and drought-resistant seed development through genetic engineering, offers pathways to mitigate climate-related restraints and secure long-term supply stability. The emerging markets present substantial untapped potential for both cultivation expansion and the establishment of local processing facilities, enabling companies to localize their supply chains and tap into growing middle-class consumer bases effectively.

Segmentation Analysis

The potato market segmentation provides a comprehensive breakdown of the industry based on how the crop is utilized, categorized predominantly by product type, application, and variety. Analyzing these segments is crucial for understanding specific consumer preferences and identifying high-growth sectors within the overall market. The market's structural integrity is maintained by the balance between the fresh potato segment, which serves fundamental food security needs, and the processed segment, which captures significant consumer expenditure through convenience and novelty. Regional variations in dietary habits heavily influence the dominant segment in any given geography, necessitating localized strategies for market penetration and growth.

The segmentation by product type, dividing the market into Fresh and Processed categories, highlights the intense value addition inherent in the processed sector. Within processed potatoes, sub-segments like frozen (fries, wedges), chips (crisps), dehydrated (flakes, granules), and others (starches, flour) exhibit different growth drivers and competitive landscapes. Frozen potato products benefit heavily from the growth of Quick Service Restaurants (QSRs) and institutional catering, while potato chips maintain a strong presence in the snack industry, driven by flavor innovation and expansive retail distribution networks across the globe.

Furthermore, segmentation by application—encompassing food service, retail, and industrial use—delineates the end-user consumption patterns. The food service industry is highly sensitive to economic cycles and dining out trends, whereas retail sales offer more stable consumption patterns. Industrial applications, primarily starch and potato flour production, are dictated by demand from non-food sectors, such as pharmaceuticals, textiles, and paper manufacturing. Understanding the growth dynamics within these specific applications is essential for suppliers and processors seeking to optimize production capacity and distribution efficiency.

- By Product Type:

- Fresh Potato

- Processed Potato Products

- Frozen

- Chips/Crisps

- Dehydrated

- Starch

- Others (Flour, Specialty Products)

- By Application:

- Food Service

- Retail

- Industrial Use (Non-Food)

- By Variety:

- Russet

- White

- Red

- Yellow/Yukon Gold

- Specialty Varieties

Value Chain Analysis For Potato Market

The potato market value chain is extensive and complex, beginning with upstream activities focused on agricultural inputs and cultivation, moving through midstream processing and manufacturing, and culminating in downstream distribution and final consumer sale. Upstream analysis involves seed breeding, production of certified seed potatoes, fertilization, and cultivation technologies (including heavy machinery and irrigation systems). Key participants at this stage include agricultural input suppliers, biotechnology firms specializing in crop genetics, and primary potato growers who manage farm operations. The efficiency and quality established at this stage critically determine the yield and suitability of the potatoes for specific processing purposes.

The midstream sector is dominated by processors—large integrated food companies specializing in transforming raw potatoes into value-added products like fries, chips, or starch. This stage involves complex operations such as washing, peeling, cutting, frying/baking, freezing, and packaging. These processing units often require significant capital investment in highly automated machinery and stringent quality control systems to meet food safety standards and maintain product consistency. Direct and indirect distribution channels dictate how these finished goods reach the consumer. Direct distribution often involves large contracts with institutional buyers, such as QSR chains or large institutional caterers, ensuring a highly streamlined supply flow with minimal intermediaries.

Downstream analysis focuses on the final points of sale, which are broadly segmented into retail and food service channels. The retail channel encompasses supermarkets, hypermarkets, and local grocery stores, where both fresh and packaged potato products are sold directly to household consumers. The food service channel includes restaurants, hotels, schools, and hospitals, which purchase processed or prepared products in bulk. Distribution channels for fresh potatoes typically involve wholesalers and local market networks, whereas processed products rely heavily on sophisticated cold chain logistics networks. Indirect channels, involving multiple layers of distributors, brokers, and logistics providers, are common for accessing fragmented or remote markets, while e-commerce platforms are increasingly serving as a significant, albeit growing, channel, particularly for specialty and shelf-stable products.

Potato Market Potential Customers

The potential customer base for the potato market is highly diversified, spanning global populations through various consumption routes, primarily categorized by end-user type. The largest segment of end-users are household consumers who purchase fresh potatoes or retail-packaged processed products for consumption at home. This demographic is influenced by factors such as disposable income, cultural dietary preferences, and the increasing demand for convenience in meal preparation. High-quality, packaged fresh potatoes and innovative ready-to-cook processed options are primary drivers targeting this consumer segment, especially in developed urban areas.

The second major group consists of commercial food establishments, including Quick Service Restaurants (QSRs), fine-dining restaurants, and institutional caterers (hospitals, schools, corporate cafeterias). These buyers demand consistent quality, specific dimensions (e.g., standard fry cuts), and reliable bulk supply, making them key customers for large-scale processors specializing in frozen potato products. Contracts with major global QSR chains represent extremely high-volume, long-term business opportunities for potato processors, requiring strong cold-chain infrastructure and supply stability.

Finally, industrial buyers form a critical, often unseen, customer base. These include manufacturers in the food industry requiring potato starches and flakes as functional ingredients (thickeners, stabilizers, binders) for products like soups, sauces, and ready meals. Furthermore, non-food manufacturers, such as those in the paper, textile, and pharmaceutical industries, purchase industrial-grade potato starch for various applications, ranging from paper sizing agents to capsule binders. These buyers prioritize technical specifications, high purity, and competitive pricing, often requiring specialized contractual agreements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 250.8 Billion |

| Market Forecast in 2033 | USD 340.5 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | McCain Foods Limited, Lamb Weston Holdings Inc., J.R. Simplot Company, PepsiCo Inc. (Frito-Lay), The Kraft Heinz Company, Idahoan Foods, Aviko B.V., Farm Frites B.V., Uren Food Group, Pinguin NV, AGRANA Beteiligungs-AG, W&H Marriage & Sons Ltd, Basic American Foods, Cavendish Farms, Ore-Ida (H.J. Heinz Company), General Mills (Green Giant), R. D. Offutt Company, Albert Bartlett and Sons, Calbee, Inc., Intersnack Group GmbH & Co. KG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Potato Market Key Technology Landscape

The potato market relies heavily on a dynamic technological landscape encompassing both pre-harvest agricultural methods and post-harvest processing and storage solutions. In cultivation, the key technological drivers are related to precision agriculture, which utilizes Internet of Things (IoT) sensors, drones, and satellite imaging to monitor field conditions in real-time. This includes advanced GPS-guided planting and harvesting machinery, variable rate technology (VRT) for precise application of inputs like fertilizer and water, and sophisticated forecasting models that optimize resource deployment and maximize yield uniformity. Furthermore, modern potato breeding programs heavily leverage molecular markers and genetic engineering techniques to develop disease-resistant, drought-tolerant, and high-solid varieties specifically tailored for the demanding requirements of industrial processing, thereby securing raw material quality.

Post-harvest technology centers on extending the shelf life, ensuring safety, and enhancing the quality of both fresh and processed potatoes. Advanced controlled atmosphere storage (CAS) technologies are essential for managing temperature, humidity, and atmospheric gas levels in storage facilities, significantly minimizing post-harvest losses and enabling year-round supply stabilization. For processing, high-speed automated sorting and grading systems, often integrating AI-powered optical scanners, ensure strict adherence to quality specifications and efficiently remove defective products. Innovative processing techniques, such as vacuum frying and pulsed electric field (PEF) processing, are being adopted to create healthier processed products (e.g., lower oil absorption) while maintaining texture and color attributes preferred by consumers.

Furthermore, technology plays a critical role in global distribution. Sophisticated cold chain logistics, integrating real-time tracking and monitoring systems, ensure that frozen and chilled potato products maintain the required temperature consistency from the processing plant to the end consumer, which is vital for product safety and quality integrity. Digital platforms and blockchain technology are also emerging for enhanced traceability across the supply chain, providing transparency regarding the origin, processing history, and movement of potato products. This technological integration across the entire value chain is pivotal for mitigating risks, improving operational efficiency, and meeting increasingly rigorous regulatory and consumer demands for safety and sustainability.

Regional Highlights

The global potato market exhibits significant regional variations in terms of production methods, consumption volume, and market maturity, with distinct leaders in production and technological adoption. Asia Pacific (APAC) stands as the dominant region in terms of both production and consumption volume. Countries like China and India are the world's largest potato producers, driven by massive domestic food demands and increasing urbanization. The growth in APAC is further catalyzed by rising disposable incomes, leading to increased adoption of Western fast-food culture and a subsequent surge in demand for processed potato products like chips and frozen fries, making it the most lucrative region for market expansion during the forecast period.

Europe represents a highly mature and technologically advanced market, particularly in potato processing and seed potato exports. Nations such as the Netherlands, Germany, and France are renowned for their highly specialized farming practices, large-scale processing companies (e.g., Aviko, Farm Frites), and robust export capabilities, particularly for frozen fries destined for international food service markets. Regulatory frameworks regarding pesticide use and food safety are particularly stringent in Europe, driving innovation towards sustainable and organic cultivation methods. The region also maintains a strong traditional consumption base for fresh table potatoes.

North America, led by the United States and Canada, is characterized by high consumption per capita of processed potato products and significant investment in agricultural biotechnology and large-scale mechanized farming. Key drivers here include the extensive presence of global quick-service restaurant chains and the sophisticated retail snack food industry. The region is a leader in genetic research for disease resistance and storage technology, ensuring consistent supply and high-quality processing inputs. Latin America and the Middle East & Africa (MEA) are characterized as emerging markets, offering significant future potential as local economies develop, supply chains modernize, and local processing capabilities expand to meet growing middle-class demand for convenience foods.

- Asia Pacific (APAC): Dominates in production and consumption volume; rapid growth driven by urbanization and rising processed food demand in China and India.

- Europe: Leader in potato processing technology, seed potato export, and sophisticated cold storage infrastructure; mature, high-value market focused on quality and sustainability.

- North America: High per capita consumption of processed products; strong technological adoption in large-scale farming and food manufacturing; hub for agricultural research and innovation.

- Latin America: Emerging processing sector; potential for increased domestic consumption and export growth, particularly in Brazil and Argentina.

- Middle East & Africa (MEA): High growth potential due to infrastructure improvements and increasing adoption of retail and food service formats, driven by demographic shifts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Potato Market.- McCain Foods Limited

- Lamb Weston Holdings Inc.

- J.R. Simplot Company

- PepsiCo Inc. (Frito-Lay Division)

- The Kraft Heinz Company

- Idahoan Foods, LLC

- Aviko B.V. (Part of Royal Cosun)

- Farm Frites B.V.

- Uren Food Group

- Pinguin NV

- AGRANA Beteiligungs-AG

- W&H Marriage & Sons Ltd

- Basic American Foods

- Cavendish Farms

- Ore-Ida (Owned by H.J. Heinz Company)

- General Mills (Green Giant Brand)

- R. D. Offutt Company

- Albert Bartlett and Sons

- Calbee, Inc.

- Intersnack Group GmbH & Co. KG

Frequently Asked Questions

Analyze common user questions about the Potato market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth in the processed potato segment?

The processed potato segment growth is primarily driven by increasing consumer demand for convenience foods, rapid expansion of Quick Service Restaurants (QSRs) globally, and innovative product development offering extended shelf life and diverse flavors. Urbanization and busy lifestyles make frozen fries, chips, and dehydrated products highly attractive options.

How does climate change impact global potato production?

Climate change introduces significant volatility by increasing the frequency of extreme weather events, such as prolonged droughts and flooding, which directly reduce potato yields and quality. This necessitates substantial investment in resilient farming practices, irrigation infrastructure, and the development of drought-resistant potato varieties.

Which region holds the largest share of the potato market, and why?

The Asia Pacific (APAC) region currently holds the largest share in terms of volume, primarily due to immense production and domestic consumption volumes in highly populated countries like China and India. Growing middle classes and the adoption of modern dietary habits further solidify APAC’s market dominance and potential for growth.

What are the key technological advancements shaping the future of potato cultivation?

Key technological advancements include the widespread implementation of AI and IoT-driven precision agriculture for optimized resource use, advanced genetic breeding techniques for disease resistance, and sophisticated controlled atmosphere storage (CAS) systems to minimize post-harvest spoilage and ensure year-round availability.

What is the current market trend regarding healthy potato consumption?

There is a rising trend towards healthier potato options, including demand for organic, non-GMO certified fresh potatoes, and processed products prepared using healthier methods such as vacuum frying or air frying, resulting in lower fat content. This shift is influencing product innovation across major processors to meet evolving dietary expectations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Sweet Potato Sticks Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Industrial Potato Graders Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Potato Chips Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Potato Fryers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Sweet Potato Fries Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager