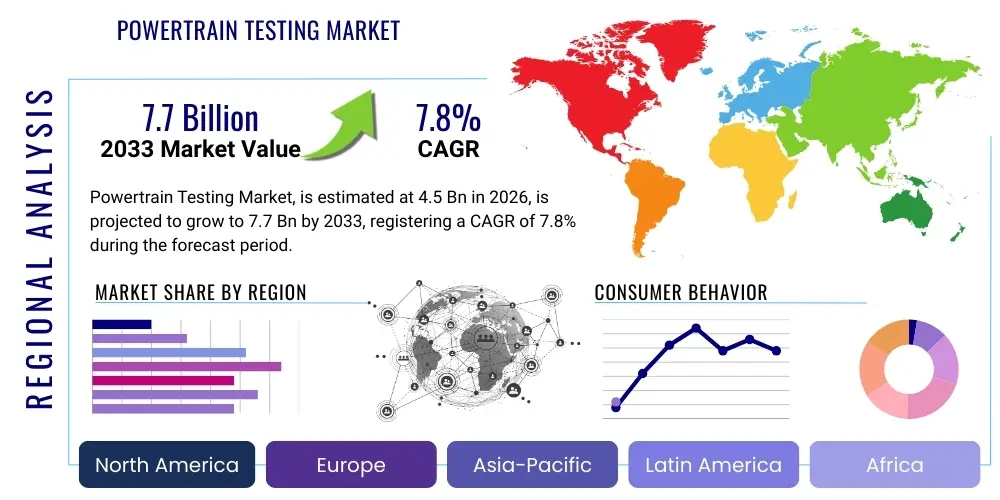

Powertrain Testing Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441043 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Powertrain Testing Market Size

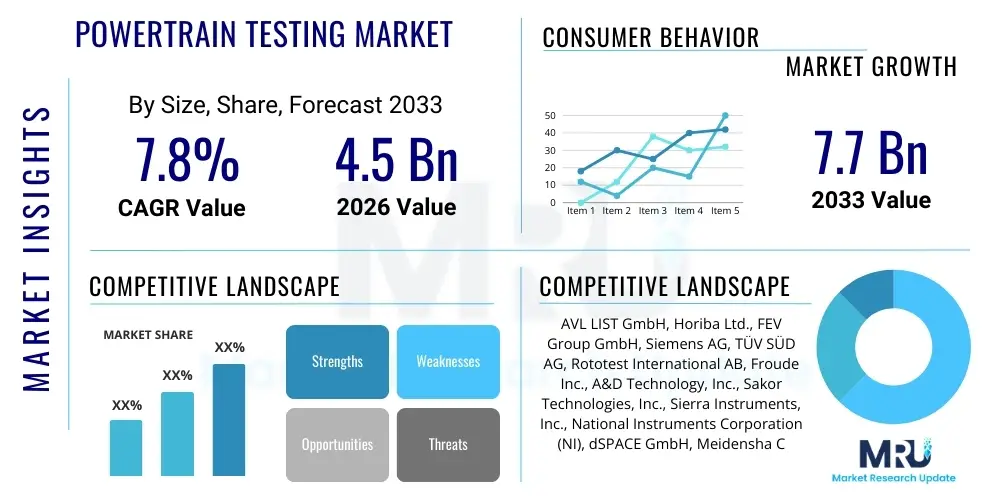

The Powertrain Testing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.7 Billion by the end of the forecast period in 2033.

Powertrain Testing Market introduction

The Powertrain Testing Market encompasses the equipment, software, and services utilized for evaluating the performance, durability, efficiency, and emissions of various powertrain components and integrated systems. This market is fundamentally driven by the global transition towards stringent environmental regulations and the accelerating electrification of the automotive sector, requiring precise and rigorous validation cycles for Internal Combustion Engine (ICE), hybrid, and purely electric powertrains. The primary function of powertrain testing is to ensure that vehicles meet mandated safety standards, fuel economy targets, and emission thresholds (such as Euro 7 and CAFE standards), while optimizing overall system integration and performance under diverse operating conditions.

Key products within this domain include engine dynamometers, chassis dynamometers, transmission testing systems, battery emulators, and high-fidelity simulation software. Major applications span research and development (R&D) for new engine designs, quality assurance, end-of-line testing in manufacturing, and regulatory compliance validation. The shift from traditional mechanical testing toward hardware-in-the-loop (HiL) and software-in-the-loop (SiL) simulations is a defining characteristic of the modern market landscape, enabling faster iteration cycles and reduced physical prototyping costs. This integration of virtual and physical testing methodologies is crucial for handling the complexity introduced by hybrid architectures and battery management systems (BMS).

The benefits derived from advanced powertrain testing solutions are multifold, including enhanced vehicle reliability, improved fuel efficiency, reduced development timelines, and compliance with increasingly complex global certification requirements. Driving factors include mandatory government regulations targeting CO2 emissions, the massive investments being channeled into electric vehicle (EV) and fuel cell vehicle (FCV) development by major OEMs and Tier 1 suppliers, and the necessity to validate complex electronic control units (ECUs) and thermal management systems integral to modern powertrains. The growing demand for advanced testing solutions capable of replicating real-world driving cycles with high accuracy is continuously spurring innovation in sensor technology and data analytics within this market.

Powertrain Testing Market Executive Summary

The global Powertrain Testing Market is currently experiencing transformative business trends characterized by a massive pivot toward validating electric and hybrid powertrains, shifting the investment focus from traditional dynamometers to high-voltage battery simulators, high-speed motor testing benches, and specialized e-axle test rigs. Key business strategies involve mergers and acquisitions aimed at integrating simulation software expertise with hardware manufacturing capabilities, thereby offering holistic, turnkey testing solutions to automotive clients. Furthermore, service models, particularly in outsourced testing and calibration, are gaining prominence as OEMs seek to manage capital expenditure while accelerating their electrification roadmaps. Sustainability and energy recuperation capabilities within test cells are becoming critical competitive differentiators.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, predominantly driven by China’s aggressive pursuit of EV market dominance and India’s stringent new emission norms (e.g., Bharat Stage VI equivalent). North America and Europe, while mature, are seeing significant spending concentrated on developing and certifying next-generation EV platforms and advanced driver-assistance systems (ADAS) integration with powertrain control. European leadership is particularly strong in the development of highly accurate real driving emissions (RDE) testing methodologies and specialized hydrogen fuel cell testing infrastructure, reflecting their ambitious climate targets. Investment in standardized, globally scalable testing procedures is crucial across all major regions to facilitate global vehicle launches.

Segment-wise, the market is defined by the shift from ICE testing to electric powertrain testing, which is projected to show the highest growth rate. Within the component segment, battery testing systems and electric motor testing systems are experiencing rapid expansion, demanding capabilities for testing high-power, high-voltage systems efficiently and safely. By application, the R&D segment maintains the largest share due to continuous product innovation, but the manufacturing and end-of-line testing segments are rapidly deploying advanced, automated systems to ensure mass-produced components meet stringent quality checks. The software segment, encompassing sophisticated modeling, simulation, and data analysis tools, is increasingly critical for enhancing the efficiency and validity of physical tests, underpinning all major market segments.

AI Impact Analysis on Powertrain Testing Market

Users frequently inquire whether Artificial Intelligence (AI) will fully automate powertrain testing, how AI can expedite the validation of complex hybrid and electric architectures, and what role machine learning plays in predictive maintenance and optimizing test schedules. Based on this analysis, the key themes revolve around AI's ability to handle the enormous data streams generated by modern test cycles, drastically reduce calibration time for intricate control strategies, and enable predictive anomaly detection in both the powertrain under test and the testing equipment itself. Concerns often focus on the validation and trustworthiness of AI-generated test scenarios and the skills gap required for engineers to effectively deploy and manage these sophisticated systems. Expectations are high regarding AI's potential to shorten product launch cycles by automating repetitive tasks and generating optimized calibration maps faster than traditional methods.

The application of AI in powertrain testing extends beyond simple data processing. Machine learning algorithms are being trained on historical test data to identify optimal test parameters and sequence, reducing unnecessary or redundant physical testing runs. This cognitive augmentation allows engineers to focus on high-value tasks, such as critical fault diagnostics and complex system integration challenges. Furthermore, AI contributes significantly to the fidelity of virtual testing environments by dynamically adjusting simulation models based on real-world inputs, ensuring that HiL simulations more closely mimic actual vehicle behavior under stress. This blend of predictive analytics and automated scenario generation is fundamental to testing the next generation of highly coupled electric powertrains.

The incorporation of AI facilitates more robust and faster fault diagnosis. By analyzing patterns in sensor data (e.g., vibration, temperature, current spikes), AI models can often predict component failure or degradation before it becomes critical, optimizing maintenance schedules for the testing infrastructure itself and providing deeper insights into the longevity of the tested powertrain components. The continuous integration of deep learning techniques into test automation platforms is standardizing and accelerating the process of developing complex control software for EV battery management systems (BMS) and torque vectoring systems, representing a major advancement over manual calibration methods.

- AI optimizes test cell scheduling and resource allocation through predictive analytics, maximizing utilization.

- Machine learning accelerates calibration processes for complex ECUs and BMS, reducing development time by generating optimized control parameters.

- Deep learning algorithms enhance anomaly detection and fault diagnosis in powertrain components, improving reliability insights.

- AI enables the creation of highly realistic and dynamic virtual test scenarios for HiL/SiL, adapting simulations based on real-time data inputs.

- Generative AI tools assist in automating the creation of test reports and complex documentation, ensuring regulatory compliance traceability.

DRO & Impact Forces Of Powertrain Testing Market

The Powertrain Testing Market is strongly influenced by critical regulatory mandates, rapid technological shifts, and substantial investment dynamics. Drivers (D) include the universal push toward electrification, necessitating entirely new testing methodologies for batteries and e-motors, and stringent global emission standards (e.g., Euro 7, CAFE 2025+). Restraints (R) are primarily centered on the high initial capital investment required for establishing or upgrading specialized test cells capable of handling high-voltage EV powertrains, the lack of standardized global testing protocols for new energy vehicles (NEVs), and the scarcity of skilled technicians capable of operating and maintaining advanced simulation and testing equipment. Opportunities (O) arise from the emerging hydrogen fuel cell vehicle (FCV) segment, the increasing demand for outsourced testing services, and the integration of highly advanced data analytics and AI for enhanced test cycle efficiency. These forces collectively shape a market undergoing rapid, capital-intensive transformation.

The primary impact force driving current market behavior is the pace of EV adoption. Original Equipment Manufacturers (OEMs) globally are under intense pressure to transition their fleets, which directly translates into urgent demand for specialized test equipment capable of handling high rotational speeds and high energy throughput required for electric motors and battery packs, respectively. This driver significantly outweighs the restraint of high investment costs for leading manufacturers, forcing rapid infrastructural upgrades. Furthermore, the regulatory environment acts as a consistent and non-negotiable driver; meeting complex targets related to both tailpipe and lifecycle emissions requires continuous refinement and testing iteration, ensuring market stability for testing service providers and equipment vendors.

Conversely, the complexity introduced by hybrid powertrains—which integrate traditional combustion components with electric drives—represents a key restraint in terms of testing complexity. Validating the seamless operation, efficiency, and safety of the control strategies managing the power split between these two systems demands incredibly sophisticated and high-fidelity test environments, often pushing the limits of current hardware-in-the-loop systems. However, this complexity also generates a significant opportunity for specialized software and simulation providers who can offer scalable, virtualized testing solutions that mitigate the physical testing bottlenecks, ensuring rapid validation and deployment of new powertrain control modules (PCMs).

Segmentation Analysis

The Powertrain Testing Market is broadly segmented based on the type of fuel or power source being tested (ICE, Hybrid, EV), the type of equipment utilized (dynamometers, battery test systems, sensors), the testing application (R&D, quality control, manufacturing), and the end-user (OEMs, Component Suppliers, Independent Test Labs). This multi-faceted segmentation highlights the market's dynamic response to the automotive industry's electrification trend. The shift away from pure internal combustion engine testing is significantly reshaping segment dominance, prioritizing high-precision electrical measurement and control systems over traditional mechanical load testing components. Each segment reflects differing technological maturity and growth trajectories based on regulatory pressures and regional manufacturing concentration.

By technology, the market is rapidly diversifying. Traditional engine and chassis dynamometers remain essential, especially for hybrid vehicle development and emerging markets, but the highest growth is concentrated in specialized electric powertrain testing equipment. This includes high-power cycling equipment for large-format EV batteries, motor dynamometers capable of simulating extreme transient loads and high-speed operations (up to 20,000 RPM or more), and dedicated e-axle test stands that evaluate integrated electric drive units (EDU). The service segment, particularly focused on outsourced testing and validation for small- to medium-sized electric vehicle startups, is also expanding rapidly as new entrants prioritize agility over large capital expenditure.

The segmentation by end-user demonstrates that Original Equipment Manufacturers (OEMs) represent the largest volume purchasers of highly integrated, full-scale test facilities, particularly in R&D environments. However, Tier 1 and Tier 2 suppliers, focused on specific components like transmissions, turbos, or battery modules, drive high demand for smaller, more specialized component testing benches and durability rigs. Independent certification bodies and third-party test laboratories, often driven by mandated regulatory checks (e.g., WLTP compliance), represent a stable but critically important segment requiring accredited, high-accuracy equipment and traceable data logging systems. Understanding these distinct user requirements is crucial for market vendors specializing in hardware versus software solutions.

- By Fuel Type:

- Internal Combustion Engine (ICE)

- Hybrid Electric Vehicle (HEV/PHEV)

- Battery Electric Vehicle (BEV)

- Fuel Cell Vehicle (FCV)

- By Equipment Type:

- Engine Dynamometers

- Chassis Dynamometers

- Transmission Test Systems

- Component Testing Equipment (e.g., turbocharger, e-axle)

- Battery Test Equipment (Cells, Modules, Packs)

- Motor/Inverter Test Systems

- By Application:

- Research and Development (R&D)

- Durability Testing

- Certification and Regulatory Compliance

- Quality Control and End-of-Line (EoL) Testing

- By End User:

- Original Equipment Manufacturers (OEMs)

- Tier 1 and Component Suppliers

- Independent Testing Laboratories

- Academic and Research Institutions

Value Chain Analysis For Powertrain Testing Market

The value chain of the Powertrain Testing Market begins with the upstream suppliers responsible for specialized raw materials, advanced sensor components, high-precision measuring instruments (e.g., torque transducers, flow meters, emission analyzers), and robust computational hardware required for test cell infrastructure. Key upstream activities involve the design and manufacture of high-power electronics necessary for modern EV testing equipment, such as regenerative power supplies and high-speed data acquisition systems. Partnerships between software firms specializing in control systems (like NI, dSPACE) and hardware manufacturers (like AVL, Horiba) are crucial at this stage to ensure integrated product offerings.

Midstream activities involve the core market players: system integrators and equipment manufacturers. These entities design, assemble, calibrate, and install the complete test cells, including dynamometers, climate chambers, safety systems, and automation software. This stage demands high engineering expertise in electrical, mechanical, and software domains to deliver turnkey solutions tailored to specific customer needs (e.g., specific torque or speed requirements for heavy-duty truck powertrains versus passenger vehicle e-motors). Downstream activities focus heavily on service and support, including maintenance contracts, calibration services, software updates, and ongoing technical consultancy, which often generate stable, recurring revenue streams for the market leaders. Furthermore, specialized training services are increasingly important for clients managing complex, high-voltage test environments.

The distribution channel often involves a combination of direct sales and localized indirect channels. Major OEMs typically engage in direct procurement contracts with global suppliers (e.g., AVL, Horiba) for large-scale R&D facility projects, ensuring direct technical collaboration and customization. Indirect channels involve authorized distributors and regional agents who handle sales, installation, and first-line support in emerging markets where direct supplier presence is limited. For niche component testing equipment and specialized software licenses, online platforms and specialized system integrators may also play a role, particularly targeting Tier 2 suppliers and academic institutions. The high value and complexity of the equipment generally necessitate significant technical engagement across all distribution pathways, ensuring proper installation and operational safety.

Powertrain Testing Market Potential Customers

The primary end-users and buyers in the Powertrain Testing Market are the global automotive industry stakeholders who are actively involved in the design, manufacturing, and regulation of propulsion systems. This includes large multinational Original Equipment Manufacturers (OEMs) such as Volkswagen Group, Toyota, General Motors, and BYD, who require extensive, state-of-the-art facilities for their continuous R&D efforts across ICE, hybrid, and electric platforms. These customers typically invest heavily in full-scale chassis and engine dynamometer systems, alongside dedicated battery and motor testing labs, often integrating them with their global simulation networks.

A second major customer segment comprises Tier 1 and Tier 2 automotive suppliers (e.g., Bosch, Continental, BorgWarner, ZF). These companies focus on designing and validating specific powertrain components like transmissions, power electronics (inverters), turbochargers, and battery management systems. Their purchasing patterns favor smaller, highly specialized component test benches, durability rigs, and highly accurate measuring and sensing equipment tailored to meet the strict quality standards imposed by OEMs. Their needs are often highly specific regarding load conditions and environmental simulations.

The third critical segment includes Independent Testing Laboratories (ITLs) and Certification Bodies (e.g., TÜV SÜD, Intertek), along with national governmental research institutes. These organizations require testing infrastructure to provide accreditation, perform regulatory compliance testing (e.g., emissions testing against WLTP, safety checks), and offer outsourced validation services. Their core demand is for certified, high-throughput testing systems that offer verifiable data traceability and meet stringent national and international standards. This segment is characterized by recurring demand for calibration services and software updates to remain compliant with evolving regulatory frameworks.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.7 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AVL LIST GmbH, Horiba Ltd., FEV Group GmbH, Siemens AG, TÜV SÜD AG, Rototest International AB, Froude Inc., A&D Technology, Inc., Sakor Technologies, Inc., Sierra Instruments, Inc., National Instruments Corporation (NI), dSPACE GmbH, Meidensha Corporation, NTS Test Services, Intertek Group plc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Powertrain Testing Market Key Technology Landscape

The technological landscape of the Powertrain Testing Market is dominated by advanced simulation techniques and high-power electronics designed to handle the unique challenges of electric vehicle development. Hardware-in-the-Loop (HiL) and Software-in-the-Loop (SiL) simulations are paramount, allowing engineers to test electronic control units (ECUs) and complex software algorithms in a virtual environment before physical hardware is available. This reduces the risk and cost associated with late-stage design changes. Key technologies include high-fidelity real-time simulators capable of replicating dynamic vehicle behavior, coupled with advanced mathematical modeling tools for component behavior (e.g., battery thermal runaway models, motor efficiency maps).

For physical testing, the market relies heavily on regenerative dynamometers and high-voltage battery test systems. Regenerative dynamometers are crucial for EV testing as they can absorb and return the electrical energy generated by the motor during braking or deceleration back to the grid or internal storage, drastically improving energy efficiency within the test cell and reducing operational costs. Battery cyclers and emulators are required to simulate various charging and discharging scenarios, thermal conditions, and extreme duty cycles to ensure the longevity and safety of high-capacity battery packs. These systems must handle voltages exceeding 800V and utilize sophisticated safety protocols for thermal management and fire suppression.

Furthermore, data acquisition and analytics technologies are central to modern powertrain testing. High-speed data loggers and specialized sensors are necessary to capture transient phenomena within milliseconds, essential for characterizing power electronics performance and dynamic engine behavior. Integration with Big Data platforms and specialized data post-processing software allows for the rapid analysis of terabytes of data generated during complex test cycles (such as WLTP or RDE tests), facilitating faster calibration decisions and comprehensive compliance reporting. The ongoing trend involves the standardization of communication protocols to enable seamless integration between disparate equipment from multiple vendors within a single test facility.

Regional Highlights

The global distribution of the Powertrain Testing Market reflects the geographic concentration of automotive manufacturing, regulatory adoption, and technological investment in electrification.

- Asia Pacific (APAC): APAC is the largest and fastest-growing region, primarily driven by China, which is the global leader in EV production and adoption. Governments across the region, especially in China, South Korea, and Japan, have heavily invested in NEV testing infrastructure. The sheer volume of vehicle production and the implementation of stringent local emission standards (e.g., China V/VI) ensure continuous high demand for testing equipment and services, particularly in battery testing and high-speed motor validation.

- Europe: Europe is characterized by a high technological maturity and an aggressive regulatory environment, notably through the implementation of the Real Driving Emissions (RDE) protocol and impending Euro 7 standards, which drive demand for highly accurate and certified emissions testing equipment. The region is a leader in developing hydrogen fuel cell technology and complex hybrid architectures, translating into high investment in specialized FCV testing and advanced HiL/SiL simulation tools.

- North America: Driven by major OEMs and aggressive electrification targets in California and other states, North America exhibits robust demand for advanced chassis dynamometers and simulation capabilities. The focus is increasingly on validating large, high-performance electric vehicles (trucks and SUVs) and ensuring compliance with stringent safety and longevity standards mandated by NHTSA and EPA/CARB, focusing on long-term battery degradation testing.

- Latin America, Middle East, and Africa (MEA): These regions represent emerging markets where the transition toward electrification is slower, meaning that investment remains balanced between servicing legacy ICE systems and establishing foundational infrastructure for NEVs. The demand often focuses on cost-effective, durable equipment for quality control and localized emissions compliance testing, with slow but steady growth projected in major economic hubs like Brazil, Mexico, and the UAE.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Powertrain Testing Market.- AVL LIST GmbH

- Horiba Ltd.

- FEV Group GmbH

- Siemens AG

- TÜV SÜD AG

- Rototest International AB

- Froude Inc.

- A&D Technology, Inc.

- Sakor Technologies, Inc.

- Sierra Instruments, Inc.

- National Instruments Corporation (NI)

- dSPACE GmbH

- Meidensha Corporation

- Intertek Group plc

- Keysight Technologies, Inc.

- Vektronix, Inc.

- Schenck RoTec GmbH

- KUKA AG (Specialized Robotics for EoL)

- Comau S.p.A.

- Dana Incorporated (Testing Services Division)

Frequently Asked Questions

Analyze common user questions about the Powertrain Testing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving growth in the Powertrain Testing Market?

The overwhelming factor driving market growth is the global regulatory push toward vehicle electrification (BEVs, PHEVs) and the simultaneous imposition of stringent emission standards (Euro 7, CAFE), necessitating massive investment in specialized testing and validation infrastructure for complex battery and e-motor systems.

How is the shift to electric vehicles (EVs) impacting traditional dynamometer usage?

The shift to EVs is changing dynamometer requirements from high-torque, low-speed ICE engine testing to high-speed (up to 20,000 RPM or more), low-inertia motor testing. Furthermore, dynamometers are increasingly required to be regenerative, capturing energy from the electric powertrain during simulated braking cycles to improve test cell efficiency.

What is the role of Hardware-in-the-Loop (HiL) simulation in modern powertrain testing?

HiL simulation is critical for accelerating the development cycle, particularly for complex control software (like Battery Management Systems and power electronics inverters). It allows engineers to test the Electronic Control Unit (ECU) in a realistic, virtual vehicle environment early in the design phase, drastically reducing the need for costly physical prototypes and enabling rapid iteration.

Which regional market holds the greatest potential for growth in powertrain testing?

Asia Pacific (APAC), particularly driven by China’s dominant position in the manufacturing and rapid adoption of Electric Vehicles (EVs), exhibits the highest growth potential. Regional government policies and the scale of automotive production are accelerating investment in specialized NEV testing facilities.

What are the key challenges faced by independent testing laboratories (ITLs)?

Key challenges for ITLs include the substantial capital investment required to upgrade infrastructure for high-voltage EV testing, ensuring compliance with rapidly changing and diverging international regulatory standards, and maintaining highly skilled staff competent in complex electrical system diagnostics and simulation tools.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Automotive Powertrain Testing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Powertrain Testing Market Size Report By Type (Engine Test, Gearbox Test, Turbocharger Test, Powertrain Final Test), By Application (Components Manufacturers, Automotive Manufacturers, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Powertrain Testing Revenue Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Turbocharger Test, Gearbox Test, Engine Test), By Application (Automotive Manufacturers, Components Manufacturers, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager