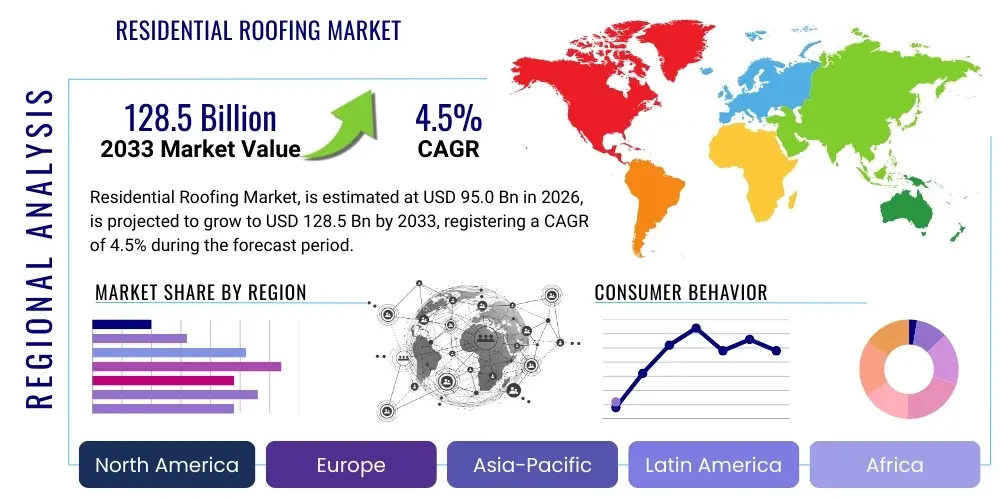

Residential Roofing Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442284 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Residential Roofing Market Size

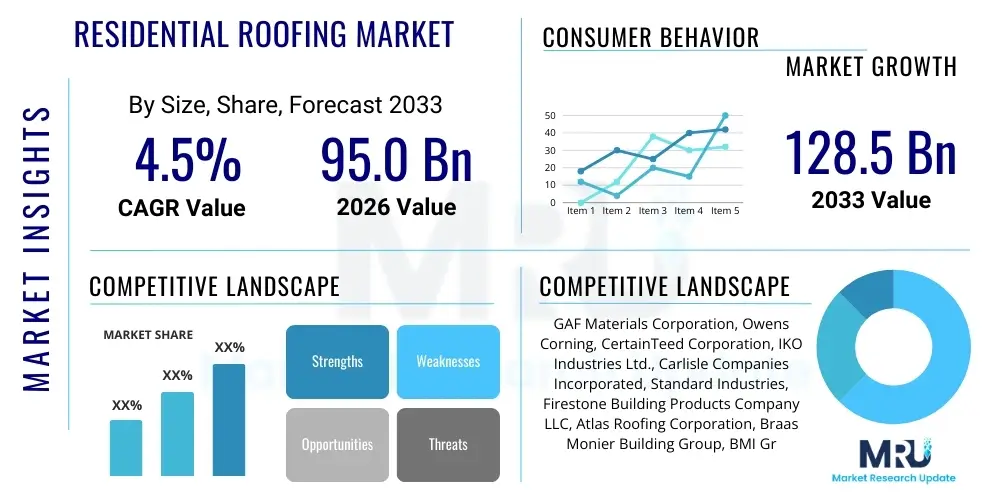

The Residential Roofing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 35.5 Billion in 2026 and is projected to reach USD 50.1 Billion by the end of the forecast period in 2033.

Residential Roofing Market introduction

The Residential Roofing Market encompasses the supply, installation, and maintenance of exterior coverings for residential structures, providing essential protection against weather elements while contributing significantly to energy efficiency and aesthetic appeal. This market is highly sensitive to macroeconomic indicators such as housing starts, interest rates, and consumer disposable income, driving both new construction roofing demand and critical repair and replacement cycles. Product offerings are diverse, ranging from traditional asphalt shingles and concrete tiles to high-performance materials like metal roofing, advanced synthetic membranes, and sustainable solar-integrated systems. The primary function of a residential roof is durability and weather resistance, but increasingly, performance metrics related to fire resistance, wind uplift ratings, and thermal reflectivity are becoming standard requirements, particularly in regions prone to extreme weather events. The market dynamics are characterized by intense competition among manufacturers, specialized distributors, and professional roofing contractors, all striving to meet evolving consumer expectations for longevity, sustainability, and curb appeal. The technological evolution in this sector focuses on developing lighter, more durable, and ecologically responsible materials that minimize environmental impact and maximize structural integrity over extended lifecycles. Furthermore, regulatory mandates pertaining to energy performance and disaster resilience are compelling stakeholders across the value chain to prioritize innovation in material science and installation techniques to ensure compliance and market relevance.

The major applications of residential roofing materials span across single-family homes, multi-family dwellings, townhouses, and manufactured housing units. Historically, the replacement market segment, driven by the typical 15-to-30-year lifespan of most roofing materials and the necessity for immediate repairs following storm damage, dominates the volume and value contribution to the overall market size. This replacement segment provides a stable revenue stream, largely insulated from the immediate volatility affecting new construction, although it remains significantly influenced by insurance payout cycles and regional climatic patterns. The benefits of modern residential roofing extend far beyond mere shelter; they include enhanced thermal performance leading to reduced heating and cooling costs, improved home valuation and resale potential, and superior protection of underlying structural components from moisture intrusion and decay. The integration of advanced features such as ventilation systems, waterproofing underlayments, and photovoltaic (PV) ready materials has transformed the roof from a static structural element into a dynamic component of the home’s overall energy management system. Effective project management, coupled with highly skilled installation labor, remains paramount to realizing these benefits, driving continuous demand for certified and reputable contracting services within the ecosystem.

Key driving factors propelling the growth of the residential roofing market are multifaceted, anchored significantly by demographic shifts and the sustained need for housing stock maintenance. Rapid urbanization in emerging economies, alongside a consistent demand for renovation and remodeling in mature markets like North America and Europe, fuels material consumption. Furthermore, increasing public awareness regarding energy efficiency and sustainable building practices is stimulating the adoption of premium, long-lasting roofing solutions, such as metal and polymer-modified asphalt products, which offer superior performance and lower lifecycle costs. The rising frequency and intensity of severe weather events globally—including hurricanes, hail storms, and extreme heat waves—are driving insurance-backed replacement cycles and necessitating the implementation of stricter, resilient building codes. These codes frequently mandate the use of higher-grade materials designed to withstand specific environmental stresses, thereby elevating the average cost per square foot of roofing installed. The convergence of consumer preference for aesthetically pleasing, architecturally diverse roofing options and regulatory pressure for enhanced energy performance creates a robust market environment focused on material innovation and application versatility, ensuring sustained expansion throughout the forecast period as consumers increasingly view the roof as a critical investment in home infrastructure and long-term asset protection.

Residential Roofing Market Executive Summary

The global residential roofing market is experiencing robust growth driven predominantly by the cyclical replacement segment and substantial increases in new residential construction, particularly in rapidly urbanizing regions of Asia Pacific and selective metropolitan areas in North America. Current business trends indicate a critical focus on material innovation, shifting consumer preference away from basic asphalt shingles towards higher-performance and aesthetically versatile options, including advanced synthetic materials, coated metal panels, and cool roofing products designed to meet stringent energy efficiency standards like those set by programs such as Energy Star. Market participants are heavily investing in vertical integration and distribution channel optimization to enhance supply chain resilience, counteracting volatility in raw material costs, specifically petrochemical derivatives and metals. A notable trend is the digitalization of the contracting process, utilizing sophisticated software for estimating, project management, and drone technology for precise roof assessment, which streamlines operations, improves accuracy, and addresses ongoing challenges related to skilled labor shortages. This operational shift, coupled with an increased emphasis on providing comprehensive warranties and integrated systems (roofing, insulation, and ventilation), defines the competitive landscape, rewarding firms that can offer superior lifecycle value and installation quality, thereby commanding premium pricing and strengthening customer loyalty through assurance of long-term structural integrity and performance.

Regional trends reveal distinct growth patterns shaped by local climate, economic maturity, and regulatory environments. North America and Europe, characterized by highly mature housing stocks, rely heavily on the replacement and reroofing segment, where market growth is stimulated primarily by storm damage and mandatory adherence to updated building codes requiring enhanced resilience and insulation values. Conversely, the Asia Pacific region is poised for the fastest expansion, fueled by massive infrastructure development, explosive growth in the middle-class demographic, and extensive new residential housing projects across populous nations like China and India, leading to high demand for cost-effective, durable materials such as clay tiles and standard asphalt shingles, though demand for higher-end materials is rapidly accelerating in urban centers. Latin America and the Middle East & Africa (MEA) present burgeoning opportunities, driven by increasing foreign investment in construction and a move towards more climate-appropriate, sustainable materials that can handle extreme heat and humidity. The fragmented nature of the contractor base in many developing markets necessitates stronger strategic partnerships between global manufacturers and local distribution networks to ensure consistent product availability and standardized installation practices, while simultaneously navigating complex import tariffs and diverse cultural preferences regarding aesthetic roofing profiles and colors, which remain highly localized and impactful on purchasing decisions and market penetration strategies.

Segmentation trends highlight the continued dominance of the asphalt shingles segment in terms of volume due to their cost-effectiveness and ease of installation, making them the default choice in mass-market housing, despite increasing competition from alternatives. However, the metal roofing segment is projected to exhibit the highest CAGR, benefiting from its superior lifespan, extreme weather resistance, inherent recyclability, and capability for sophisticated architectural design, appealing to the premium and environmentally conscious consumer base, especially in coastal and high-wind areas. The repair and replacement segment will maintain its structural superiority over new construction, acting as the consistent stabilizing factor for the market through economic downturns, driven by the non-discretionary nature of roof repair. Furthermore, the material sub-segment focusing on advanced synthetics, including composite shingles and polymer roofing, is gaining significant traction due to their lightweight properties, excellent resistance to impact, and ability to convincingly mimic the appearance of traditional high-cost materials like slate and shake without the corresponding maintenance requirements or weight restrictions. Manufacturers are responding to these shifts by diversifying product portfolios, investing heavily in material engineering to enhance fire ratings and thermal efficiency across all material types, and tailoring product sizes and aesthetic finishes to better suit specific regional housing styles and regulatory mandates concerning roofing material appearance in historical or planned communities.

AI Impact Analysis on Residential Roofing Market

User queries regarding the impact of Artificial Intelligence (AI) on the residential roofing market predominantly revolve around three critical themes: efficiency improvements in pre-sales assessment and estimation, automation possibilities in manufacturing and supply chain logistics, and the role of AI in predictive maintenance and damage assessment. Users are keenly interested in how AI-powered drone inspections and satellite imagery analysis can automate the detection of subtle roof damage, dramatically speeding up the insurance claim process and reducing the risk associated with manual inspections. There is also significant anticipation regarding AI's potential to optimize complex logistical challenges, such as demand forecasting for specialized materials and streamlining delivery schedules to job sites, mitigating supply chain bottlenecks that frequently plague construction projects. Concerns often center on the initial investment costs for implementing AI tools, data security, and the necessary upskilling of existing contractor teams to effectively utilize these sophisticated technologies, ensuring that AI integration leads to genuine competitive advantages rather than just adding layers of complexity. The overarching expectation is that AI will transform the roofing process from a traditionally manual trade into a highly data-driven, precise, and standardized service, enhancing both safety and profitability for industry participants willing to embrace digital transformation.

The application of AI extends significantly into customer relationship management (CRM) and personalized product recommendations. AI algorithms can analyze regional weather patterns, historical material performance data, homeowner insurance requirements, and aesthetic preferences gathered through initial digital consultations to suggest the optimal roofing material and system configuration, thereby increasing customer satisfaction and conversion rates. For manufacturers, AI is proving invaluable in quality control, using machine vision systems to monitor production lines for material defects with precision far exceeding human capabilities, leading to reduced waste and higher product consistency. Furthermore, predictive modeling, driven by AI, allows firms to anticipate maintenance requirements based on real-time environmental data and material aging models, enabling proactive intervention rather than reactive repair. This transition towards predictive servicing enhances the roof's lifespan and provides new recurring revenue streams for contractors offering comprehensive, technologically advanced maintenance contracts. The adoption curve for these technologies is steepening rapidly, particularly among larger, multi-regional contracting firms seeking scalability and consistent service delivery across diverse geographical locations and regulatory environments.

- Enhanced Damage Assessment: AI-powered drones and image recognition software automate the detection and quantification of storm damage, accelerating insurance claim processing and improving inspection accuracy.

- Optimized Logistics and Supply Chain: Machine learning algorithms refine inventory management, predict material demand fluctuations, and optimize delivery routing, reducing lead times and operational costs.

- Predictive Maintenance Scheduling: AI models analyze material degradation and environmental exposure to forecast potential failures, enabling proactive repairs and maximizing roof longevity.

- Automated Estimation and Quoting: AI rapidly processes measurements and material requirements from digital plans or scans, generating highly accurate and competitive project quotes instantaneously.

- Improved Worker Safety: AI analysis of jobsite imagery identifies and flags potential safety hazards (e.g., unsecured harnesses, improper staging), enhancing compliance and mitigating accident risks.

- Personalized Product Recommendations: Utilizing large datasets, AI assists homeowners in selecting materials based on budget, climate resilience, aesthetic preference, and local building code adherence.

DRO & Impact Forces Of Residential Roofing Market

The core dynamics of the Residential Roofing Market are shaped by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and the resulting Impact Forces. Key drivers include the necessity for replacement cycles in aging housing infrastructure across mature markets, the accelerated pace of residential construction in emerging economies due to demographic growth and urbanization, and the non-negotiable regulatory requirements mandating higher energy efficiency and resilience standards following increasingly frequent and severe climate events. These external pressures force material innovation and adoption of premium products like metal and cool roofs. The fundamental force underpinning market stability is the cyclical nature of replacement demand, which ensures a steady baseline revenue irrespective of fluctuations in new housing starts. Furthermore, the rising awareness and consumer demand for aesthetically superior, long-lasting roofing solutions that offer superior protection against fire and high winds amplify the market value, compelling manufacturers to broaden their high-performance product lines and improve material longevity beyond traditional warranty periods, thereby sustaining long-term market valuation increases and justifying the premium pricing structures for advanced material systems.

Restraints primarily revolve around the volatile cost and availability of key raw materials, particularly petroleum-based products essential for asphalt shingles and metal commodities like steel and aluminum, which creates pricing instability and challenges for fixed-price contracts. A significant persistent restraint is the acute shortage of skilled labor across most major markets, severely impacting the capacity of contractors to undertake projects promptly and maintain high installation quality, often leading to project delays and elevated labor costs. Furthermore, the fragmentation of the industry, particularly among smaller, local contractors, sometimes hinders the rapid adoption of advanced installation techniques and digital technologies, creating inconsistencies in service delivery and product performance warranties across regions. The high initial capital outlay required for premium, durable materials, such as slate, concrete tile, or high-gauge metal, can also deter cost-sensitive consumers in certain socioeconomic segments, forcing continued reliance on cheaper, less durable options. Navigating these economic and labor constraints requires strategic sourcing, investment in automated manufacturing processes, and robust training programs aimed at bridging the skills gap within the installation workforce.

Opportunities in the residential roofing market are abundant, chiefly centered on the burgeoning niche of sustainable and renewable energy-integrated roofing solutions, such as Building-Integrated Photovoltaics (BIPV) and highly reflective ‘cool roof’ coatings that significantly reduce thermal load and energy consumption. Regulatory shifts towards Net-Zero energy building requirements globally present a lucrative pathway for specialized system providers. Technological advancements in synthetic and composite materials offer opportunities to create products that combine the desired aesthetic appeal of traditional materials with superior durability and lightweight properties, unlocking installation possibilities on structures where weight constraints previously limited material selection. Furthermore, the massive market created by post-disaster reconstruction and mandated resilient building upgrades provides substantial, though intermittent, revenue spikes, necessitating quick-response supply chain capabilities. Strategic geographic expansion into rapidly developing economies with large-scale planned housing projects and the consolidation of fragmented regional markets through mergers and acquisitions represent pivotal avenues for established players to achieve scale and maximize their market penetration, capitalizing on both regulatory push and consumer demand for advanced, energy-efficient roofing systems that integrate seamlessly with modern smart home infrastructure.

DRO & Impact Forces Of Residential Roofing Market

The Residential Roofing Market is fundamentally driven by housing stock aging and regulatory mandates for resilience and energy efficiency, counterbalanced by supply chain volatility and a critical shortage of skilled labor. Significant opportunities lie in the commercialization of sustainable technologies, particularly BIPV and cool roofing systems, which are increasingly favored by modern building codes and environmentally conscious consumers. The market's high sensitivity to raw material prices (asphalt, steel) and dependency on construction sector health act as primary restraints. The core impact forces include constant pressure for material innovation to improve fire ratings and wind resistance, driven by insurance industry standards, and the compelling need for digital transformation (AI-powered assessments, optimized logistics) to overcome persistent operational inefficiencies and labor constraints, ultimately leading to a market favoring integrated system providers offering superior lifecycle value.

Segmentation Analysis

The Residential Roofing Market is segmented based on Material Type, Construction Type, and Application (End-Use Sector), providing a granular view of market dynamics and consumer preferences. Material Type segmentation, which includes Asphalt Shingles, Metal Roofing, Concrete & Clay Tile, and others like Wood Shakes and Synthetic Materials, reveals diverse growth rates, with metal and synthetics outpacing traditional asphalt due to perceived longevity and sustainability benefits. Construction Type divides the market into New Construction and Repair & Replacement, with the latter consistently holding the dominant market share globally, reflecting the non-discretionary spending required for maintaining existing residential assets. Application segmentation primarily focuses on single-family residences, which constitute the largest consumer base, followed by multi-family structures and specialized housing, each demanding tailored product specifications regarding fire resistance, noise reduction, and installation complexity. Understanding these segments is crucial for manufacturers to align production capacities, tailor marketing strategies, and optimize distribution channels to effectively cater to the distinct needs of each market niche, recognizing that material selection is often heavily influenced by regional climatic norms, local aesthetic traditions, and specific governmental building codes pertaining to residential structures.

- By Material Type:

- Asphalt Shingles

- Metal Roofing

- Concrete & Clay Tile

- Wood Shakes and Shingles

- Synthetic (Polymer & Composite) Materials

- Others (Slate, Built-Up Roofing)

- By Construction Type:

- New Construction

- Repair and Replacement

- By Application (End-Use Sector):

- Single-Family Residences

- Multi-Family Housing

- By Geography:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa (UAE, Saudi Arabia, South Africa, Rest of MEA)

Value Chain Analysis For Residential Roofing Market

The value chain for the residential roofing market begins with the Upstream Analysis, which focuses on the sourcing and processing of core raw materials. This includes petroleum derivatives (asphalt and synthetic polymers), metals (steel, aluminum, copper), aggregates (stone granules for shingles), and natural minerals (clay and cement for tiles). The profitability and stability of the entire subsequent chain are highly contingent upon the volatile global commodity markets, impacting manufacturers' gross margins and pricing strategies. Key upstream activities involve specialized refining processes for asphalt modification to enhance UV resistance and flexibility, and energy-intensive smelting and rolling operations for metals. Strategic supplier relationships, often involving long-term contracts and hedging strategies, are critical for mitigating risk associated with fluctuating raw material costs and ensuring a consistent supply of quality inputs, particularly for high-volume producers of standard asphalt shingles and specialized metal coil producers catering to standing seam systems. Environmental regulations related to material extraction and processing also increasingly influence upstream operational costs and drive the adoption of sustainable sourcing practices.

The midstream phase involves the manufacturing and distribution channels. Manufacturing transforms raw materials into finished roofing products, where economies of scale and technological efficiency—such as continuous processing for shingles and precision forming for metal panels—are crucial competitive differentiators. Distribution is complex, involving direct sales to large contractors for major projects, but predominantly relying on specialized wholesale distributors, building material suppliers, and large retail home centers. These channels handle inventory management, localized logistics, and credit facilitation, bridging the gap between national manufacturers and thousands of regional contractors. The distribution network must be resilient and localized, especially for heavy or bulky materials like tiles and certain shingle palettes, requiring optimized warehousing and transportation networks to minimize freight costs and ensure timely delivery to job sites, which is a major factor in project completion schedules. The effectiveness of this distribution channel significantly influences a manufacturer's market penetration and ability to quickly respond to localized demand spikes, such as those following weather-related damage events.

Downstream analysis focuses on the installation, end-user consumption, and post-sale services. Installation is performed primarily by a fragmented network of local and regional roofing contractors, who represent the direct and indirect sales link to the residential end-user (homeowners and residential developers). The skill level and certification of these contractors are paramount, as installation quality directly dictates product performance and warranty validity. Indirect distribution dominates, where the manufacturer sells to a distributor, who then sells to the contractor, who finally serves the consumer. Direct distribution is rare but used by some premium brands offering highly technical systems or proprietary installation training. The value chain concludes with post-sale support, including warranty fulfillment, maintenance contracts, and eventual replacement cycles. Digital platforms for contractor management, customer engagement, and remote damage assessment (using AI/drones) are becoming vital tools to enhance the efficiency and transparency of the downstream services, fostering stronger brand loyalty and capitalizing on the recurring nature of the repair and replacement market segment.

Residential Roofing Market Potential Customers

The primary and largest segment of potential customers in the residential roofing market consists of existing homeowners requiring repair, maintenance, or full roof replacement. This segment is driven by the age of the structure, specific material lifecycles (typically 15 to 30 years for most common materials), and unexpected damage caused by severe weather events (e.g., hail, hurricanes, extreme heat). These customers often prioritize durability, long-term warranty coverage, and curb appeal, and their purchasing decisions are heavily influenced by insurance claim availability, the advice of their chosen contractor, and available financing options. Targeting this replacement market requires focused marketing on material longevity, weather resilience, and the economic benefits of energy-efficient systems, appealing to the consumer's need to protect their largest asset while minimizing overall lifecycle costs. The spending in this sector is generally non-discretionary when damage is severe, providing market stability, but is increasingly discretionary when consumers upgrade materials during replacement to enhance home value and adopt sustainable technologies.

A second significant customer base comprises residential developers, home builders, and general contractors engaged in new construction projects, ranging from large-scale suburban developments of single-family homes to high-density multi-family apartment complexes. For this segment, the purchasing criteria are primarily driven by cost-effectiveness, large volume supply reliability, compliance with strict local building codes for new structures (especially fire ratings and wind load requirements), and speed of installation. Builders often prefer standard, proven, and easily accessible materials like asphalt shingles or cost-optimized tile systems to manage project timelines and budgets effectively. Manufacturers targeting this segment must focus on establishing strong relationships with national and regional purchasing organizations, offering streamlined logistics, competitive bulk pricing, and materials that minimize complexity and installation time on the job site, enabling rapid deployment across numerous units simultaneously. The demand from this sector is highly sensitive to interest rate fluctuations and macroeconomic policies affecting the housing market.

A specialized, yet rapidly growing, customer segment includes property management companies, housing associations, and investors managing portfolios of multi-family residences and rental properties. These customers prioritize low maintenance requirements, high structural resilience, and standardization across their properties to simplify inventory and repair processes. They are increasingly adopting premium, long-life materials like metal roofing or advanced synthetics, despite the higher initial cost, due to the substantial reduction in lifecycle repair and maintenance expenditures and the avoidance of disruptive and costly cyclical replacements. This segment demands materials that are extremely durable and systems that offer high levels of waterproofing and long commercial warranties. Finally, institutional purchasers, such as government housing authorities or specialized retrofitting programs focusing on energy conservation, represent specific contract opportunities for manufacturers and contractors capable of meeting strict public procurement standards regarding material sustainability, energy performance certifications, and adherence to socially responsible labor practices.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.5 Billion |

| Market Forecast in 2033 | USD 50.1 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GAF Materials Corporation, Owens Corning, CertainTeed Corporation, IKO Industries, Inc., Carlisle Companies Incorporated, Holcim Group (Elevate/Firestone), Braas Monier Building Group (BMI Group), TAMKO Building Products LLC, Malarkey Roofing Products, Atlas Roofing Corporation, DaVinci Roofscapes, Eagle Roofing Products, Boral Roofing, Decra Roofing Systems, Saint-Gobain S.A., 3M Company, R.I.T.A.S. S.p.A., Henry Company, PABCO Roofing Products, Drexel Metals |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Residential Roofing Market Key Technology Landscape

The technological landscape of the residential roofing market is rapidly evolving, moving far beyond simple material manufacturing towards integrated system solutions that prioritize energy efficiency, structural integrity, and smart home integration. A critical area of advancement is the development of Building-Integrated Photovoltaics (BIPV), where solar energy generation capabilities are seamlessly incorporated directly into the roofing material itself, such as solar shingles or tiles, replacing bulky, rack-mounted panels. This integration provides a cleaner aesthetic, easier installation, and serves the dual function of weather protection and power generation, appealing strongly to modern, environmentally conscious homeowners. Furthermore, the chemistry of asphalt and synthetic membranes has seen significant innovation, introducing polymer-modified asphalt (SBS and APP modifiers) to enhance elasticity, low-temperature flexibility, and overall resistance to cracking and thermal shock, dramatically extending the effective lifespan of shingle products in extreme climates. These material science breakthroughs are essential for meeting increasingly demanding warranty expectations and reducing the environmental footprint associated with frequent material replacement, thereby aligning manufacturer offerings with global sustainability goals and regulatory pressure.

Digital technologies are fundamentally transforming the pre-installation and assessment phases. The proliferation of high-resolution aerial imaging captured by drones and advanced satellite mapping services, combined with sophisticated photogrammetry software, allows contractors to conduct highly accurate, non-invasive roof measurements and detailed damage assessments within minutes. This shift minimizes the necessity for dangerous manual inspections, reduces liability, and provides precise material estimates, significantly cutting down the time required for quoting and streamlining the insurance claims process by generating verifiable, standardized documentation. Alongside digital measurement, specialized software platforms are now integrating three-dimensional modeling capabilities, allowing homeowners and contractors to visualize different material and color options on their specific home structure before commitment. This enhancement in visualization improves customer experience, reduces miscommunication, and accelerates the decision-making cycle. The adoption of these digital tools is becoming a prerequisite for large contractors seeking to maintain competitive efficiency and manage high volumes of simultaneous projects across wider geographic service areas effectively, establishing a new standard for professionalism in the service delivery component of the roofing value chain.

Beyond material composition and assessment tools, technological progress in installation techniques and ventilation systems is also highly impactful. Innovations in synthetic underlayments—lightweight, highly durable substitutes for traditional felt—offer superior waterproofing, moisture management, and tear resistance, drastically improving the overall performance of the roofing system and protecting the underlying structure during the construction phase. Furthermore, the sophistication of attic and roof ventilation technology has advanced considerably, moving from passive vents to actively monitored, smart ventilation systems that adjust airflow based on temperature and humidity readings, preventing premature material degradation, mitigating ice dam formation, and optimizing the home's energy envelope. Manufacturers are also developing easier, faster-to-install material systems, such as interlocking metal panels or large format synthetic tiles, designed to reduce on-site labor time and costs, directly addressing the industry's pervasive challenge of skilled labor scarcity. These advancements collectively ensure that the modern residential roof functions as an integrated, high-performance system crucial for the home's overall efficiency and structural longevity, representing a substantial technological leap forward for a traditionally conservative construction segment.

Regional Highlights

The North American residential roofing market remains the largest and most valuable segment globally, characterized by high disposable income, a large aging housing stock, and rigorous building codes often mandating resilient materials due to frequent severe weather events, particularly across the Midwest and Southeastern regions. The replacement and reroofing segment dominates market activity, primarily driven by insurance claims following hail and wind damage, ensuring consistent, high-volume demand for premium asphalt shingles and specialized metal roofing systems known for their high impact and uplift ratings. Innovation is rapid in this region, with a strong push towards Energy Star compliant cool roofs and sophisticated synthetic materials. Regulatory environments, particularly in states like California, often pioneer mandates for energy efficiency, fire resistance, and solar readiness, compelling manufacturers and contractors in the US and Canada to continuously update their product offerings and installation techniques to remain compliant and competitive. The competitive landscape is defined by the strategic presence of large national manufacturers and a highly fragmented, yet professional, network of independent certified contractors.

Asia Pacific (APAC) is projected to be the fastest-growing region, driven by unparalleled rates of urbanization, significant population growth, and enormous investments in new residential infrastructure across developing economies like China, India, and Southeast Asian nations. The demand is currently dominated by high-volume, cost-effective roofing solutions, including traditional clay and concrete tiles favored for their thermal properties in hot climates, and basic asphalt shingles for mass housing. However, as disposable incomes rise and awareness of energy efficiency and modern aesthetics increases among the emerging middle class, demand for high-end materials such as quality metal roofing and advanced synthetic materials is accelerating rapidly in major metropolitan areas. Regulatory harmonization and the adoption of modern building standards across APAC are gradually pushing the market towards higher quality, more durable materials, especially in coastal regions facing increasing typhoon risks. Europe presents a mature market characterized by a strong emphasis on tradition, aesthetics, and extremely high standards for energy performance (thermal insulation) and sustainability. Strict national and EU-level regulations concerning environmental impact, material recyclability, and energy consumption drive the preference for highly durable, long-life solutions like clay/concrete tiles and specialized metal and slate roofing, often favoring materials that blend seamlessly with historical architectural styles while maximizing thermal performance capabilities.

- North America: Market leader, replacement-driven by weather events (hail/wind); strong adoption of highly resilient metal roofing and advanced synthetic composites; strict adherence to energy codes (e.g., cool roof mandates).

- Asia Pacific (APAC): Fastest growth region fueled by massive new construction and urbanization, shifting from traditional materials to modern, durable, and energy-efficient options in key urban centers.

- Europe: Mature market focusing heavily on sustainability, thermal performance, and integration with traditional architectural aesthetics; dominated by tile, slate, and high-performance metal systems.

- Latin America: Characterized by economic volatility and high demand for cost-effective, climate-appropriate solutions; increasing adoption of durable materials to mitigate hurricane and seismic risks.

- Middle East & Africa (MEA): Growth driven by luxury residential projects and climate demands; high reliance on materials offering superior solar reflectivity and thermal mass to combat extreme heat.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Residential Roofing Market.- GAF Materials Corporation

- Owens Corning

- CertainTeed Corporation

- IKO Industries, Inc.

- Carlisle Companies Incorporated

- Holcim Group (Elevate/Firestone)

- Braas Monier Building Group (BMI Group)

- TAMKO Building Products LLC

- Malarkey Roofing Products

- Atlas Roofing Corporation

- DaVinci Roofscapes

- Eagle Roofing Products

- Boral Roofing

- Decra Roofing Systems

- Saint-Gobain S.A.

- 3M Company

- R.I.T.A.S. S.p.A.

- Henry Company

- PABCO Roofing Products

- Drexel Metals

Frequently Asked Questions

Analyze common user questions about the Residential Roofing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key factors driving the growth of the residential roofing market?

The market growth is primarily propelled by the necessity of replacing aging roofing systems in mature markets (the dominant replacement segment), escalating demand for new housing units in rapidly urbanizing regions, and the regulatory requirement for enhanced material resilience and energy efficiency driven by increasingly severe climate patterns globally.

Which residential roofing material is expected to show the highest growth rate?

Metal roofing is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to its superior durability, exceptional lifespan, lightweight characteristics, high resistance to extreme weather (including fire and high winds), and increasing adoption for its aesthetic versatility and inherent sustainability through recyclability.

How is AI technology impacting the residential roofing contractor business?

AI integration is revolutionizing contractor operations by enabling rapid, highly accurate damage assessments via drone and satellite imagery, optimizing supply chain logistics and material demand forecasting, and streamlining the quoting process, leading to improved efficiency, reduced manual labor risks, and faster claim settlements.

What is the most significant restraint challenging the residential roofing market?

The most pressing restraint is the acute shortage of skilled installation labor across critical regional markets. This constraint severely limits contractors' capacity, increases overall project costs, and often leads to prolonged construction timelines, overshadowing material price volatility as a long-term operational hurdle.

Is the residential roofing market dominated by new construction or repair and replacement?

The residential roofing market is fundamentally dominated by the Repair and Replacement segment. This non-discretionary spending on maintaining existing infrastructure accounts for the majority of the market volume and value, providing substantial stability compared to the more cyclical and economically sensitive new construction segment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager