Rotomoulding Powder Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441932 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Rotomoulding Powder Market Size

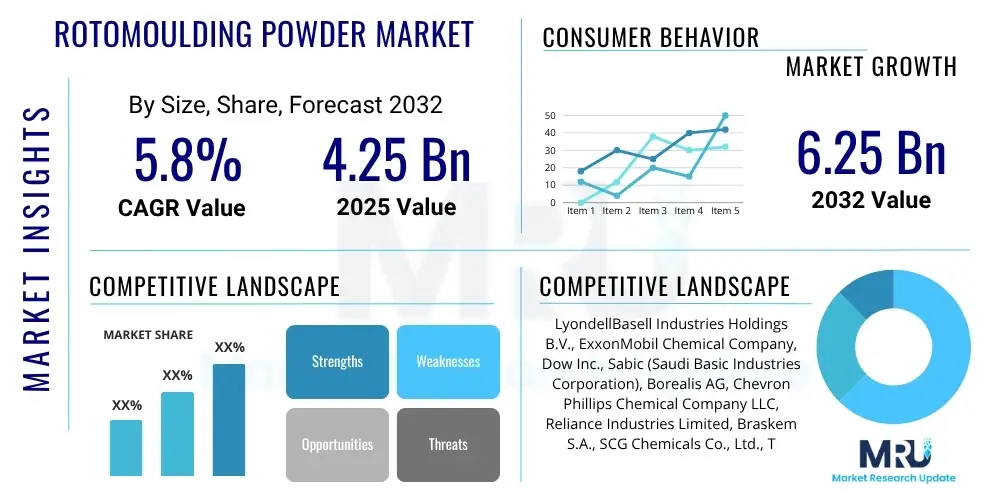

The Rotomoulding Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033.

Rotomoulding Powder Market introduction

The Rotomoulding Powder Market encompasses the production and distribution of thermoplastic polymers, primarily polyethylene grades such as LLDPE (Linear Low-Density Polyethylene), specifically engineered for the rotational molding process. Rotomoulding, or roto-molding, is a manufacturing technique used to create hollow plastic products by heating and rotating a mold containing powdered polymer material. This method is highly valued for its ability to produce stress-free, seamless parts with uniform wall thickness and complex geometries, making the resulting powder a foundational component across various heavy-duty and consumer applications. The versatility of the process allows for the integration of inserts and multiple layers, enhancing product functionality and durability, which drives consistent demand for high-quality powder feedstocks.

The primary product forms utilized in this market are finely ground polymer resins, optimized for flow characteristics and thermal stability during the molding cycle. While polyethylene dominates due to its cost-effectiveness, excellent chemical resistance, and wide availability, other specialized powders like nylon, polycarbonate, and polypropylene are utilized for applications requiring enhanced mechanical strength, high-temperature resistance, or specific regulatory compliance. Major applications span critical infrastructure, including large storage tanks for water, fuel, and chemicals, industrial material handling solutions such as pallets and containers, and diverse consumer products like toys, furniture, and complex medical components. The high customization potential and lower tooling costs compared to blow molding or injection molding solidify rotomoulding powder’s position as a preferred raw material across these sectors.

Driving factors for market expansion include the rapid growth of the water management sector, particularly in developing economies demanding robust water storage solutions, and the increasing adoption of lightweight, durable plastic components in the automotive and construction industries. Furthermore, the inherent benefits of rotomoulded products, such as superior impact resistance, lack of welded seams (preventing leakage), and the capability for post-consumer recycled content integration, contribute significantly to market buoyancy. Ongoing material science advancements focused on enhancing UV resistance, thermal performance, and reducing cycle times through optimized powder formulations further propel the demand for innovative rotomoulding powders globally.

Rotomoulding Powder Market Executive Summary

The Rotomoulding Powder Market is characterized by robust growth underpinned by strong demand across infrastructure and industrial sectors globally. Key business trends include a strategic shift towards specialty grades, particularly cross-linkable polyethylene (XLPE) and fire-retardant formulations, driven by stringent safety regulations and the need for high-performance end-products in industrial settings. Consolidation among major polymer suppliers to integrate grinding and compounding capabilities is evident, aimed at ensuring stringent quality control over particle size distribution and melt index, which are critical determinants of final product quality. Furthermore, the market is experiencing increasing pressure to develop sustainable solutions, fostering investment in bio-based and recycled rotomoulding powders to meet corporate social responsibility goals and evolving environmental regulations, impacting the competitive landscape through innovation focused on circular economy principles.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive infrastructure investment, particularly in water treatment and chemical storage facilities in rapidly urbanizing nations like China and India. North America and Europe, while mature, demonstrate stable demand driven by stringent environmental regulations necessitating leak-proof storage containers and the continuous expansion of the automotive and leisure industries requiring highly durable plastic parts. Latin America and the Middle East & Africa (MEA) are emerging regions, where increased industrialization and agricultural modernization necessitate large-scale tanks and material handling equipment, creating significant localized opportunities for powder manufacturers and specialized compounders who can tailor products to extreme climatic conditions often found in these geographies.

Segmentation trends highlight the enduring dominance of Polyethylene (PE), specifically LLDPE, due to its exceptional processability and mechanical properties suitable for large tanks. However, market growth within segments is accelerating fastest in niche areas such as high-density polyethylene (HDPE) for specialized chemical containers and engineered plastics like nylon for precision automotive components. Application-wise, the Tank segment (covering water storage, septic, and chemical tanks) maintains the largest market share, but the Material Handling segment (pallets, bins, road barriers) is demonstrating the highest growth trajectory, reflecting global emphasis on supply chain efficiency and logistics improvement. This segment-specific dynamism requires suppliers to maintain diversified product portfolios capable of addressing varying mechanical, chemical, and thermal requirements across end-use industries.

AI Impact Analysis on Rotomoulding Powder Market

Common user questions regarding AI's influence in the Rotomoulding Powder market typically revolve around optimizing material science, enhancing process efficiency, and predicting supply chain disruptions. Users frequently inquire how Artificial Intelligence can automate quality control, specifically the correlation between powder morphology (particle size and shape) and final product performance (impact resistance, porosity). Furthermore, interest lies in using machine learning algorithms to predict material degradation over time, optimize energy consumption during the lengthy heating and cooling cycles of rotational molding, and forecast raw material pricing volatility, particularly for ethylene feedstock. The underlying themes are efficiency enhancement, defect reduction, and strategic predictive capability across the manufacturing value chain, moving rotomoulding from an art into a highly controlled, data-driven science.

AI's primary impact involves the application of machine learning (ML) models to analyze vast datasets generated during the grinding, compounding, and molding processes. This analysis enables real-time adjustments to grinding parameters to ensure optimal particle size distribution (PSD), thereby minimizing porosity and maximizing material flow—critical factors determining product integrity. Furthermore, AI-powered predictive maintenance (PdM) for molding machines and auxiliary equipment, such as pulverizers, ensures minimal downtime and sustained operational efficiency. By modeling complex variables like oven temperature gradients, cooling rates, and material additives, AI is facilitating the development of advanced polymer formulations, reducing dependence on lengthy, traditional trial-and-error R&D cycles and accelerating time-to-market for specialized powders, particularly those requiring superior UV or chemical resistance properties.

The integration of AI also significantly influences strategic market operations, offering sophisticated tools for demand forecasting tailored to specific regional or application segments, aiding inventory management for both polymer producers and powder compounders. Leveraging natural language processing (NLP) and computer vision, quality inspection of final rotomoulded products can be highly automated, detecting subtle defects like pinholes or warping that might escape human inspection. This shift towards data-centric decision-making enhances material yield, lowers energy intensity per molded unit, and ultimately improves the competitive positioning of powder suppliers who invest in integrating these intelligent systems into their manufacturing workflows, driving a transition towards 'Smart Rotomoulding' facilities globally.

- AI-driven optimization of polymer grinding parameters for precise particle size distribution (PSD).

- Machine learning models for predictive maintenance of rotomoulding equipment, reducing unplanned downtime.

- Enhanced quality control using computer vision for automated defect detection in final molded parts.

- Accelerated R&D through AI simulations to predict performance characteristics (e.g., UV stability, impact strength) of new powder formulations.

- Improved demand forecasting and inventory management through predictive analytics on raw material and end-user demand fluctuations.

- Optimization of heating and cooling cycles in rotomolding ovens to minimize energy consumption and cycle time.

DRO & Impact Forces Of Rotomoulding Powder Market

The Rotomoulding Powder Market dynamics are shaped by a complex interplay of internal market demands and external economic and environmental pressures. Key drivers include the inherent design flexibility offered by the process, making it suitable for short production runs and highly specialized products, which caters well to bespoke industrial needs. Furthermore, the global emphasis on robust water and sanitation infrastructure, particularly in emerging economies, mandates the use of large, durable, seamlessly constructed plastic tanks, sustaining high demand for LLDPE powder. Restraints primarily revolve around the comparatively long cycle times of the rotomolding process compared to injection or blow molding, which limits production capacity for high-volume, standardized parts, and the persistent volatility in crude oil and natural gas prices, directly impacting the cost structure of polymer feedstocks like ethylene and propylene, thereby compressing manufacturer margins.

Opportunities for market expansion are significant, particularly through the development and commercialization of technical and high-performance powders, such as flame-retardant grades for construction, anti-microbial powders for medical and food handling applications, and conductive polymers for specialized industrial uses. The ongoing push towards sustainability offers a major pathway for growth, driving innovation in chemical recycling and the effective incorporation of post-consumer recycled (PCR) content into rotomoulding powder formulations without compromising critical mechanical properties. This alignment with circular economy principles not only mitigates feedstock price risks but also opens doors to environmentally conscious consumers and regulated markets, encouraging strategic collaborations between powder manufacturers and specialized recycling entities to ensure consistent supply of quality recycled materials compatible with the rotomoulding process requirements.

The impact forces within the market are predominantly driven by technological advances in compounding and pulverization, specifically the adoption of cryogenic grinding which offers superior particle size control, enhancing powder flow characteristics and reducing porosity in the final product. Regulatory forces, particularly those related to plastic waste management and safety standards (e.g., fire ratings for building materials), necessitate continuous product adaptation. Competitive intensity remains high, primarily focused on price and supply chain reliability, particularly in the commoditized LLDPE segment. However, differentiation is achieved through specialized service offerings, technical support for molders, and the introduction of custom color compounds, allowing manufacturers to capture premium margins in niche, high-specification markets that value material consistency and technical support over absolute lowest cost.

Segmentation Analysis

The Rotomoulding Powder Market is extensively segmented based on the type of polymer utilized, which dictates the performance characteristics of the final product, and by the application segment, reflecting diverse end-user needs. Polymer type segmentation is critical as LLDPE dominates the volume market due to its cost and utility for large storage solutions, whereas specialized polymers like Nylon and Polycarbonate command higher prices in applications demanding superior mechanical, thermal, or chemical resistance. The application segmentation, ranging from large industrial tanks to smaller consumer items, illustrates the pervasive nature of rotational molding across industrial, municipal, and residential sectors. Understanding these segments is paramount for manufacturers to tailor production capabilities, focus R&D efforts on specific material requirements (e.g., UV stabilization for outdoor use, chemical resistance for industrial storage), and strategically position products to capture value across varied end-markets.

- By Type:

- Polyethylene (LLDPE, HDPE, LDPE, XLPE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polycarbonate (PC)

- Nylon

- Others (e.g., EVOH, Specialty Compounds)

- By Application:

- Tanks and Containers (Water Storage, Chemical Storage, Fuel Tanks, Septic Tanks)

- Material Handling (Pallets, Bins, Road Barriers, Cones)

- Automotive (Ducts, Fuel Tanks, Air Intake Systems, Trims)

- Consumer Goods and Leisure (Furniture, Kayaks, Toys, Coolers)

- Construction and Industrial (Insulation, Housings, Light Fixtures)

- Medical and Healthcare (Trays, Equipment Housings)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Rotomoulding Powder Market

The Rotomoulding Powder value chain initiates at the upstream level with the production of polymer resin pellets, primarily derived from petrochemical feedstocks such as ethylene, a process dominated by large integrated petrochemical companies. These resin pellets are then transported to specialized compounders or powder manufacturers, where the crucial intermediate step of pulverization occurs. Pulverization involves grinding the pellets into fine powder, optimizing particle size distribution and morphology essential for consistent flow and successful molding. This stage also includes compounding, where additives such as UV stabilizers, colorants, anti-static agents, and fire retardants are introduced to create application-specific powders, adding significant value and technical differentiation to the raw material.

The middle segment involves the distribution and direct sales channels, where the finished rotomoulding powder is supplied to the downstream rotational molders—the manufacturers who utilize the powder to produce final products. Distribution is typically managed through a combination of direct sales for large volume users and specialized chemical distributors who provide inventory management, localized technical support, and smaller batch deliveries to a broader customer base, ensuring widespread market penetration. Effective logistics management is critical here, given the relatively low bulk density of the powder, which impacts shipping costs and storage requirements, necessitating optimized packaging and transport solutions tailored to the product’s physical state.

The downstream analysis focuses on the end-use applications, which drive demand based on the specific requirements of various sectors like water management, material handling, and automotive manufacturing. The relationship between the powder supplier and the rotational molder is often collaborative, with suppliers providing technical assistance to optimize molding cycles and resolve quality issues related to material performance. Direct channels are prevalent for high-volume commodity grades (e.g., standard water tank LLDPE), while indirect channels utilizing technical distributors are crucial for marketing specialized, smaller-volume, high-value powders (e.g., cross-linkable or nylon powders), ensuring technical expertise reaches the end-user effectively and enabling quicker response to market feedback regarding material performance.

Rotomoulding Powder Market Potential Customers

Potential customers for Rotomoulding Powder are predominantly rotational molders and specialized plastics fabricators operating across diverse industrial and consumer sectors globally. The primary customer base includes large-scale manufacturers specializing in water and chemical storage solutions, requiring vast quantities of LLDPE powder with consistent UV and chemical resistance properties. Another significant customer segment comprises manufacturers of specialized industrial equipment, such as material handling entities producing bulk bins, industrial hoppers, and robust transportation pallets, where high impact strength and durability are key purchasing criteria. These customers often seek technical collaboration to develop tailored material specifications that minimize cycle times and reduce warping in their specific mold designs.

Secondary, yet rapidly growing, customer segments include automotive component manufacturers who utilize rotomolding for complex parts like fuel tanks, air ducts, and bespoke interior trim components, often requiring specialized materials like nylon or high-density polyethylene for heat and chemical resistance. Furthermore, the leisure and consumer goods industries—including manufacturers of kayaks, playground equipment, and outdoor furniture—represent a steady demand stream, prioritizing aesthetic properties like color consistency and surface finish. Potential customers value suppliers who offer not only cost-competitive pricing but also robust technical data sheets, consistent batch-to-batch quality, reliable supply chain logistics, and the ability to customize formulations quickly to meet stringent regulatory or design specifications, making material performance and supplier relationship management critical factors in the purchasing decision process.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LyondellBasell, SABIC, ExxonMobil Chemical, The Dow Chemical Company, Borealis AG, Chevron Phillips Chemical, Eastman Chemical Company, A. Schulman (LyondellBasell), Matrix Polymers, Basell Polyolefins, Reliance Industries Limited, PTT Global Chemical Public Company Limited, Dajac Laboratories, Inc., Muehlstein, ICO Polymers, Custom Chemicals Corp., Broadway Colours, W. Müller GmbH, Polyvisions, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rotomoulding Powder Market Key Technology Landscape

The Rotomoulding Powder market relies heavily on precise manufacturing technologies, primarily focusing on advanced pulverization and compounding techniques designed to optimize the material's properties for the molding process. The core technology involves cryogenic grinding, which utilizes extremely low temperatures (often achieved using liquid nitrogen) to embrittle the polymer pellets before mechanical milling. This process is crucial because it allows for the creation of powders with a highly desirable, consistent particle size distribution (PSD) and a uniform spherical shape. Optimal PSD ensures efficient packing density in the mold and minimizes the likelihood of pinholes and bubbles, thereby enhancing the structural integrity and surface finish of the final product. Continuous innovation in grinding equipment, including specialized mills and classifiers, aims to reduce energy consumption during this intensive process while improving powder throughput and maintaining stringent quality standards required for specialized applications.

Compounding technology represents another vital area of innovation, focusing on integrating performance-enhancing additives directly into the polymer matrix before or during pulverization. Key advancements include extrusion and blending techniques that ensure homogeneous dispersion of stabilizing agents, color pigments, and functional additives such as flame retardants or anti-microbial components. Modern compounders are utilizing twin-screw extruders and sophisticated dosing systems to precisely manage the melt index and incorporate challenging materials like recycled polyethylene (rPE) or specialty engineering resins. The technological challenge here is maintaining the polymer's integrity and flowability while achieving superior performance characteristics, particularly concerning UV stabilization for outdoor applications where powder lifespan is critical. Advanced analytical tools, such as rheometers and thermal analysis equipment, are essential for validating the process and certifying material consistency.

Furthermore, technology related to material handling and processing feedback mechanisms is becoming increasingly important. Automated screening and sieving systems ensure the removal of oversized particles, minimizing processing defects at the molder’s site. The future landscape is driven by the integration of IoT sensors and data analytics platforms within the compounding and molding facilities. These technologies enable real-time monitoring of key process variables—temperature, pressure, energy usage, and powder flow characteristics—allowing for immediate adjustments and significantly reducing batch-to-batch variability. This shift towards smart manufacturing techniques not only improves material efficiency and reduces waste but also facilitates the rapid development and scale-up of novel, high-performance powder grades necessary to address evolving industry requirements, such as enhanced chemical barrier properties or reduced weight targets in the automotive sector.

Detailed analysis of the current market structure reveals that standardization across particle morphology remains a high priority for large-volume purchasers. The technical specifications of the powder, including bulk density, melt flow index, and sieve analysis results, are continuously scrutinized by molders to ensure predictable output and minimize material waste, which can be significant in large tank manufacturing. Specialized testing protocols, often exceeding general industrial standards, are becoming mandatory, particularly for powders destined for potable water storage or pharmaceutical containment applications. This trend towards hyper-specification is driving research into polymer additives that can enhance surface tension and reduce static cling, improving powder handling and flow inside complex mold geometries without compromising structural strength or long-term UV stability. The development of high-flow polyethylene grades that require less dwelling time in the oven is also a critical technological frontier, aimed at mitigating the long cycle time restraint inherent to the rotomoulding process.

The macroeconomic environment, characterized by fluctuating energy prices and increasing global trade restrictions, necessitates robust supply chain resilience for powder producers. Diversification of sourcing strategies for basic resins (ethylene and propylene) across different geographical regions and suppliers is a risk mitigation priority. Furthermore, market participants are increasingly leveraging sophisticated enterprise resource planning (ERP) systems and logistics platforms to optimize warehousing and transportation, particularly considering that rotomoulding powder occupies significantly more volume per weight than its raw pellet form, increasing logistical complexities and costs. Efficient inventory management, coupled with regional production hubs, allows key players to quickly respond to regional demand spikes in sectors like construction or agriculture without incurring excessive shipping overheads or lengthy lead times, a critical competitive advantage in high-growth markets like Southeast Asia.

Regional Highlights

Regional dynamics are pivotal to the Rotomoulding Powder Market, with distinct growth patterns and material demands across global geographies, influenced heavily by infrastructure development, regulatory frameworks, and industrial capacity.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market, primarily driven by rapid urbanization and massive governmental investment in infrastructure projects, particularly in China, India, and Southeast Asian nations. High demand is seen for large water storage tanks, sanitation products, and agricultural implements, sustaining robust consumption of LLDPE powder. The region benefits from lower manufacturing costs and increasing industrial production, although regulatory pressures regarding plastic waste are rapidly increasing, fueling interest in recycled content powders.

- North America: A mature market characterized by high consumption of specialized and engineered rotomoulding powders. Demand is stable across the automotive, material handling (e.g., highly durable bins and pallets), and recreational sectors (kayaks, marine products). Emphasis is placed on technical performance, quality consistency, and adherence to stringent safety standards (e.g., FDA compliance for food-grade containers), driving innovation in niche high-value materials like cross-linkable PE and nylon compounds.

- Europe: The European market is defined by rigorous environmental regulations and a strong focus on sustainability and circular economy practices. While demand is steady across industrial applications, there are significant opportunities for bio-based and advanced recycled rotomoulding powders. Key applications include sophisticated material handling solutions, industrial machinery housings, and automotive components, often requiring high fire-retardancy and specific technical certifications.

- Latin America (LATAM): This region offers considerable growth potential, linked to increasing investment in industrialization, agriculture, and mining operations, all of which require substantial material handling equipment and durable storage tanks. Market growth is typically volatile, tied closely to commodity prices and regional economic stability, but the underlying need for improved infrastructure supports long-term expansion for standard polyethylene grades.

- Middle East & Africa (MEA): Growth in MEA is highly concentrated in GCC countries and parts of South Africa, fueled by large construction projects and water scarcity challenges, necessitating extensive water storage and transportation solutions. The challenging environmental conditions (high UV exposure and temperature fluctuations) demand specialized powder formulations with superior UV stabilization and thermal resistance, creating a focused market for high-performance LLDPE and specialized additives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rotomoulding Powder Market.- LyondellBasell

- SABIC

- ExxonMobil Chemical

- The Dow Chemical Company

- Borealis AG

- Chevron Phillips Chemical

- Eastman Chemical Company

- Matrix Polymers

- Basell Polyolefins

- Reliance Industries Limited

- PTT Global Chemical Public Company Limited

- Muehlstein

- ICO Polymers

- Custom Chemicals Corp.

- Broadway Colours

- W. Müller GmbH

- Polyvisions, Inc.

- Americhem Inc.

- Teknor Apex Company

- Resin Technology, Inc. (RTI)

Frequently Asked Questions

Analyze common user questions about the Rotomoulding Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary polymer used in rotomoulding and why is it preferred?

Linear Low-Density Polyethylene (LLDPE) is the dominant polymer, accounting for the largest volume share. It is preferred due to its excellent processability, low melting point, high impact strength, good chemical resistance, and cost-effectiveness, making it ideal for large, complex hollow parts like storage tanks.

How does the quality of rotomoulding powder (particle size) affect the final product?

Powder quality, especially particle size distribution (PSD) and morphology, directly determines the final product’s integrity. A consistent, fine powder ensures efficient fusion, minimal air entrapment (porosity), reduced cycle time, and a smooth surface finish, which is critical for preventing stress cracks and leaks.

Which application segment drives the highest demand for rotomoulding powder?

The Tanks and Containers segment (including water, chemical, and septic storage) drives the highest volume demand globally. This is primarily fueled by infrastructure development, agriculture requirements, and the need for durable, seamless storage solutions across industrial and residential sectors.

What are the key technological advancements influencing powder manufacturing?

Key technological advancements include the refinement of cryogenic grinding for optimal particle size distribution, specialized compounding techniques to integrate high-performance additives (e.g., UV stabilizers, fire retardants), and the use of AI/IoT for real-time process monitoring and quality control in pulverization.

What role does sustainability play in the future of the Rotomoulding Powder market?

Sustainability is a crucial growth driver. The future involves increasing the utilization of high-quality post-consumer recycled (PCR) polyethylene powder and developing bio-based polymers. This strategic shift addresses global environmental regulations, reduces reliance on virgin fossil fuels, and caters to environmentally conscious end-users.

The Rotomoulding Powder Market exhibits robust potential driven by increasing application diversity and technological refinements in material science. The market’s reliance on petrochemical feedstocks presents inherent supply chain risks, compelling stakeholders to prioritize efficiency and explore alternative materials, including sustainable and bio-based options. Manufacturers are focusing heavily on developing specialty grades that offer enhanced fire resistance, superior mechanical properties, and UV stability, moving beyond commodity LLDPE to capture higher-margin industrial and automotive applications. Geographically, Asia Pacific remains the central hub for volumetric growth due to rapid urbanization and large-scale infrastructure projects, while mature markets in North America and Europe focus on high-specification, customized compounds and circular economy initiatives to maintain competitive advantage.

Technological innovation centered on advanced compounding and AI-assisted pulverization techniques ensures consistent powder quality, a critical success factor for downstream rotational molders. The integration of artificial intelligence is enhancing predictive maintenance and optimizing complex molding parameters, thereby reducing overall energy consumption and minimizing material waste, creating a more sustainable and efficient manufacturing ecosystem. This focus on material consistency and operational optimization is essential for penetrating highly regulated industries such as automotive and healthcare. The competitive landscape is intensely focused on vertical integration, with major petrochemical producers increasingly acquiring or partnering with specialized compounders to secure quality control throughout the value chain, from polymerization to final powder formulation.

Future market expansion is contingent upon resolving challenges associated with high tooling costs for complex molds and achieving faster cycle times relative to competing molding technologies. Strategic investments in digitalization, coupled with a concerted effort to scale up the use of chemically recycled polyethylene, will define leadership in the next five to ten years. The versatility of rotational molding, capable of producing seamless, durable, and large-format products, ensures its indispensable role in essential sectors, cementing the long-term positive outlook for specialized rotomoulding powder manufacturers who can deliver consistent quality and application-specific performance enhancements across a demanding global customer base.

The competitive rivalry in the Rotomoulding Powder Market is multifaceted, ranging from price wars in the generic LLDPE segment to technological superiority battles in the niche markets for engineered plastics. Differentiation strategies increasingly rely on providing superior technical service, including onsite training for molder operators and customized material optimization workshops, rather than just material sales. The concept of 'total solution provision' is gaining traction, where powder suppliers offer a comprehensive package that includes material supply, color matching, specialized additives, and technical consulting on mold design and process optimization. This consultative approach creates strong customer lock-in and fosters long-term relationships, insulating suppliers from short-term price fluctuations inherent in the petrochemical commodity cycle and ensuring a stable revenue stream derived from value-added services linked directly to application success and operational efficiency improvement for the downstream customer base.

The future demand landscape is projected to be strongly influenced by shifts in global water infrastructure needs, particularly the implementation of smart water grids and decentralized water treatment solutions, which require thousands of robust, non-corrosive intermediate plastic tanks. This infrastructure boom directly translates into sustained, high-volume demand for standard and medium-density polyethylene powders. Concurrently, the increasing complexity of components in electric vehicles (EVs), such as specialized battery housings or complex thermal management ducts produced via rotomoulding, is opening new high-value opportunities for specialty materials that can handle higher operating temperatures and complex chemical environments. Thus, the Rotomoulding Powder Market is evolving from a traditionally infrastructure-focused industry to one deeply integrated into the advanced manufacturing and sustainable technology sectors, necessitating continuous evolution of material science capabilities to capture emerging growth vectors effectively.

The market also faces challenges from substitute materials and competing manufacturing technologies, specifically blow molding and injection molding, which offer faster production speeds for smaller parts. To counteract this, rotomoulding powder manufacturers are focusing on material formulations that reduce the required thickness of the final product while maintaining structural integrity, reducing overall material consumption and cycle time. Furthermore, promoting the unique advantages of rotational molding, such as producing seamless, large, multi-layer components with low residual stress, remains a core marketing strategy. The push for multi-layer molding capability, which allows for different materials to be layered (e.g., a UV-resistant outer layer and a food-safe inner layer), requires complex powder blending and specialized compounding to ensure compatibility and adhesion between the disparate material layers, pushing the technical boundaries of current rotomoulding powder production capabilities and providing specialized suppliers with a strong technological edge in offering these advanced, functional components.

Finally, the growing sophistication of the global logistics network plays a crucial role in market dynamics, enabling powder suppliers to maintain leaner inventories and deliver just-in-time (JIT) to molders worldwide, mitigating the risks associated with storing large volumes of low-density powder. Specialized packaging solutions, such as bulk bags optimized for transport and handling, are continuously being refined to reduce contamination risk and ensure powder consistency upon delivery. The market's overall health is inextricably linked to global industrial investment and consumer confidence, but the underlying technological advancements in material quality, combined with essential infrastructure needs in water and logistics, solidify a trajectory of specialized and steady expansion for the rotomoulding powder sector through the forecast period, positioning the industry as a quiet but essential enabler of modern industrial and consumer products globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager