Scandium Metal Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440951 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Scandium Metal Market Size

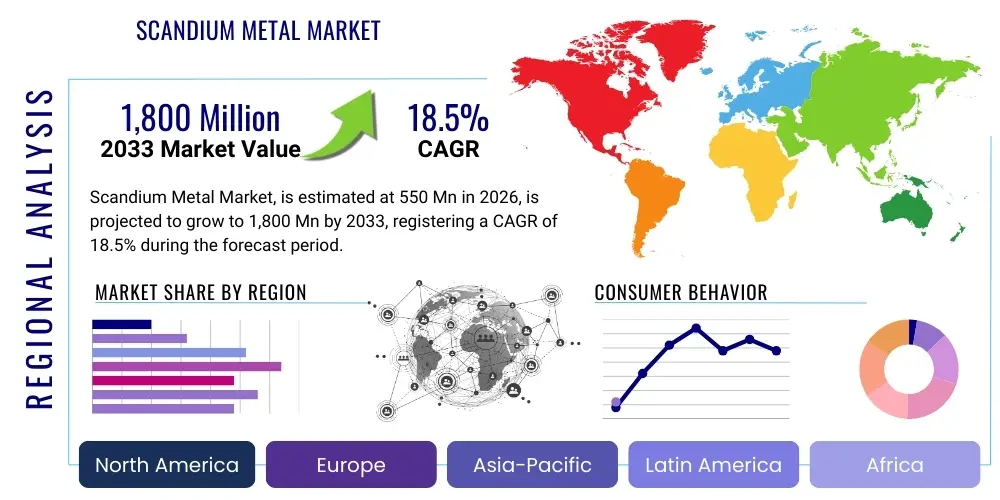

The Scandium Metal Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $550 Million USD in 2026 and is projected to reach $1,800 Million USD by the end of the forecast period in 2033.

Scandium Metal Market introduction

Scandium (Sc) is a rare earth metal, often classified more accurately as a 'rare element' due to its highly dispersed availability, primarily valued for its extraordinary effectiveness as an alloying agent, even when incorporated at minimal concentrations, typically ranging from 0.1% to 0.5% by weight. The core product segments in the market include high-purity Scandium Oxide (Sc2O3), which serves as the primary material for energy applications, and pure Scandium Metal, which is typically alloyed with aluminum to create high-performance master alloys. These Aluminum-Scandium (Al-Sc) alloys exhibit substantially enhanced mechanical properties compared to conventional aluminum alternatives, notably higher strength-to-weight ratios, exceptional resistance to stress corrosion cracking, superior weldability without loss of strength, and remarkable grain refinement. This unique combination of benefits makes Scandium an indispensable material for industries prioritizing structural integrity and weight reduction, such as high-end aerospace, defense, and specialized manufacturing sectors. The market dynamics are currently characterized by rapidly escalating demand confronting historical limitations in reliable and consistent supply, driving significant technological investment into diversified extraction methods.

The major applications for Scandium metal and its compounds span several strategically critical high-technology sectors. Historically, its most crucial and high-value application has been within the aerospace and defense industries, where the adoption of Al-Sc alloys is instrumental in achieving aggressive lightweighting goals for structural components, missile guidance systems, and advanced aerial vehicle parts. This lightweighting directly translates into significant operational cost reductions via improved fuel efficiency and prolonged material lifespan under extreme conditions. However, the most explosive demand growth in recent years has emerged from the green energy technology sector, particularly Solid Oxide Fuel Cells (SOFCs). Scandium-stabilized zirconia (ScSZ) functions as a superior electrolyte material for these cells, enabling lower operational temperatures, thereby improving durability and efficiency significantly, positioning Scandium as a crucial enabler for decentralized power generation and energy storage solutions essential for grid stability and sustainable energy transition. Furthermore, Scandium has niche, yet vital, roles in the consumer electronics market, specifically in high-intensity discharge (HID) lamps for enhanced light quality and efficiency, and is actively being explored for next-generation battery architectures seeking improved energy density and faster charging capabilities.

The key driving factors propelling the exponential growth of the Scandium market are fundamentally rooted in global mandates for resource efficiency and the pursuit of unparalleled structural performance. The commercial aviation and defense sectors’ relentless pursuit of lighter, yet stronger, airframes and vehicles, often mandated by stringent regulatory emissions standards and competitive operational requirements, necessitates an increasing uptake of Al-Sc alloys, where substitution is technically infeasible without performance degradation. Simultaneously, the profound global transition toward cleaner, localized energy sources has turbocharged the SOFC market, establishing a stable, long-term, and high-value demand stream for high-purity Scandium Oxide. This demand is further supported by consistent governmental and defense budgets worldwide, which prioritize advanced materials for tactical equipment, high-speed vehicles, and secured material supply chains. The inherent benefits, such as superior metallurgical performance and direct contribution to climate change mitigation technologies, solidify Scandium's status as a strategically vital material for modern industrial development. As targeted extraction technologies mature and global supply chains diversify, the previously prohibitive cost barriers are beginning to mitigate, signaling a broadened potential for application across high-performance automotive and industrial machinery sectors.

Scandium Metal Market Executive Summary

The executive outlook for the Scandium Metal Market suggests a profound transition from a highly constrained, specialized commodity to an indispensable, critical strategic material, predominantly catalyzed by material science innovations in high-performance alloys and revolutionary solid-state energy solutions. Current business trends are characterized by aggressive vertical integration and strategic supply-side partnerships, whereby primary rare earth and nickel producers are collaborating directly with downstream aerospace, defense, and SOFC manufacturers to secure guaranteed, stable supply contracts. A dominant operational strategy involves intensified investment in exploiting secondary resource streams, such as efficiently recovering Scandium from bauxite refining residues (red mud) and processing mining tailings. This critical diversification strategy is paramount for mitigating extreme price volatility and systematically dismantling the existing supply bottlenecks that have historically limited market scaling. Furthermore, substantial R&D expenditure is observed in developing advanced, high-purity processing technologies tailored to meet the exceptionally stringent quality mandates of the SOFC industry, which often requires purity levels exceeding 99.99% to ensure optimal electrolyte performance and longevity.

Regional dynamics reveal distinct patterns of resource availability and technology consumption. North America and Europe stand as the premier consumption hubs, their demand overwhelmingly dictated by the defense, commercial aerospace, and high-precision advanced manufacturing sectors. These markets benefit significantly from governmental policies and initiatives designed to secure reliable critical material supplies and foster robust domestic processing capabilities. Conversely, the Asia Pacific (APAC) region, spearheaded by China, maintains its dominant position in the global rare earth processing and supply chain, directly impacting the availability and market pricing of Scandium. Meanwhile, economic powerhouses like Japan and South Korea are global leaders in commercial SOFC technology deployment, creating an intense, internal demand pull for high-purity Scandium Oxide necessary for cell fabrication. The emerging markets in Latin America and the Middle East and Africa (MEA) are primarily strategic due to their underlying geological potential, housing vast, often untapped, reserves associated with existing nickel, bauxite, and titanium mining, positioning them as potential future key global suppliers rather than immediate, significant consumers. Global geopolitical considerations regarding resource control heavily influence regional investment and long-term procurement strategies.

Analysis of segmental trends highlights a pronounced and rapid pivot in growth potential toward the application sector, specifically driven by energy solutions. While the aerospace and defense segments continue to offer consistently high-value, inelastic demand due to the non-substitutable performance attributes of Al-Sc alloys, the Solid Oxide Fuel Cell (SOFC) segment is definitively forecasted to exhibit the steepest compound annual growth rate throughout the forecast period. The fundamental need for distributed, highly efficient, and modular energy solutions is expanding the deployment of SOFCs across numerous applications, including commercial data centers, isolated remote power units, and critical military applications, consequently multiplying the demand for high-purity Scandium-stabilized zirconia (ScSZ). Furthermore, the segmentation based on material purity is becoming increasingly critical, as the stringent requirements for SOFCs necessitate ultra-high purity material, which commands significantly higher prices and requires specialized processing streams, contrasting with metallurgical applications that might utilize slightly lower, yet still high-grade, Scandium metal for alloy preparation. This high level of specialization dictates specific market positioning and investment decisions among producers and processors.

AI Impact Analysis on Scandium Metal Market

Common user inquiries regarding the transformative influence of Artificial Intelligence (AI) and Machine Learning (ML) on the Scandium Metal Market frequently address its potential to overcome persistent supply constraints and high production costs. Users often pose questions designed to quantify AI’s value, such as, "By what percentage can AI reduce the energy footprint in Scandium solvent extraction?" or "How quickly can machine learning discover and validate new, high-performance aluminum-scandium alloy variants compared to traditional methods?" A core theme of user concern centers on the feasibility and economic returns of integrating complex AI systems within often outdated legacy mining and chemical processing infrastructure. Conversely, user expectations are highly optimistic regarding AI's capability to deliver predictive reliability across the volatile supply chain, aligning the sporadic supply from byproduct sources with highly demanding aerospace and energy manufacturing cycles. The collective summary suggests that users view AI as the critical technological lever capable of shifting Scandium from a niche, constrained material toward a widely accessible, mainstream engineering commodity by resolving structural supply chain inefficiencies and accelerating materials innovation.

The successful implementation of Artificial Intelligence and Machine Learning algorithms is poised to fundamentally redefine several complex and high-cost stages across the Scandium value chain. In the initial exploration and resource utilization phases, sophisticated AI models are deployed to analyze enormous volumes of geological survey data, hyperspectral imaging from satellites, and complex geochemical assays derived from low-grade feedstocks, such as bauxite residue. This predictive analytical capability allows for the precise identification of economically viable recovery zones and optimal extraction pathways within large, dispersed resource bodies, dramatically reducing the traditionally lengthy and capital-intensive exploration and feasibility study timeline. Moreover, within the highly specialized purification stage, AI is used to model and dynamically optimize the parameters of complex hydrometallurgical and solvent extraction processes. By autonomously adjusting variables like temperature, pH levels, and reagent flow rates, the system ensures maximum separation efficiency of high-purity Scandium from numerous co-extracted elements (like titanium, iron, and other rare earths), directly reducing both reagent consumption and energy use, thereby lowering the unit production cost substantially.

Beyond resource processing, AI plays a pivotal and accelerating role in downstream application development, especially within the challenging field of materials science research focused on new Al-Sc alloys. Advanced Generative AI and computational materials models can rapidly simulate the microstructural behavior and long-term performance (e.g., fatigue life, creep resistance) of millions of theoretical alloy compositions under specified industrial parameters, eliminating the need for vast numbers of costly and time-consuming physical laboratory tests. This simulation capability drastically shortens the commercialization pipeline for next-generation, high-performance materials vital for demanding applications in aerospace, automotive safety structures, and advanced additive manufacturing feedstock. Furthermore, in the critical domain of supply chain management, complex ML algorithms utilize real-time data from global mining outputs, processing yields, and industry demand indicators (like airline build rates) to enhance forecasting accuracy, effectively matching the inherently limited and intermittent Scandium supply with critical manufacturing requirements, thereby mitigating market volatility and enhancing overall supply resilience for end-users.

- AI-driven geological modeling accelerates the identification and assessment of primary and secondary Scandium ore bodies, especially low-grade bauxite residue.

- Machine Learning optimizes complex solvent extraction parameters in real time, significantly enhancing purification efficiency and lowering energy consumption during refinement.

- Predictive maintenance analytics applied to specialized processing and purification infrastructure minimizes costly operational downtime and increases facility throughput capacity.

- Generative AI models substantially accelerate the design, simulation, and initial validation of novel Aluminum-Scandium alloy compositions tailored for specific high-stress applications.

- ML algorithms improve demand forecasting reliability and inventory management, crucial for handling the highly volatile and strategically sensitive supply chain of this niche metal.

- Automated quality control systems utilizing spectroscopic analysis and computer vision ensure the ultra-high purity standards required for sensitive Solid Oxide Fuel Cell (SOFC) electrolytes (ScSZ).

DRO & Impact Forces Of Scandium Metal Market

The current market dynamics for Scandium metal are characterized by an intense juxtaposition of powerful, technologically driven demand-side drivers colliding with fundamental, supply-side restraints, resulting in a market environment defined by high growth potential and significant investment risk. The foundational drivers include the unique and non-substitutable performance advantages that minute additions of Scandium confer upon aluminum, notably the superior strength-to-weight ratio, exceptional grain structure control, and enhanced weldability essential for advanced structural components in commercial and military aerospace, electric vehicle (EV) chassis, and high-speed transportation infrastructure. Concurrently, the accelerating, policy-driven global pivot towards cleaner energy production places enormous pressure on Scandium supply, primarily through the Solid Oxide Fuel Cell (SOFC) segment, where Scandium-stabilized zirconia offers unparalleled system efficiency gains. These synergistic core applications establish Scandium as a critical, enabling material for global lightweighting and energy transition objectives, ensuring robust and sustained high demand largely immune to minor macroeconomic cycles.

Despite the powerful drivers, market restraints are significant and persistent, dominated by severe supply chain instability and the resultant extremely high unit material cost. Scandium is rarely, if ever, produced as a primary mineral commodity; rather, it is recovered as a trace byproduct from mining operations centered on other metals such as titanium, nickel, tungsten, or uranium. This inherent byproduct dependency means that the volume and consistency of Scandium supply are intrinsically linked to, and often distorted by, the external commodity cycles of the primary mined material, leading to chronic uncertainty and procurement risk. The subsequent process of recovering and purifying this dispersed element involves highly complex, multi-stage hydrometallurgical separation and specialized refinement techniques, adding massive capital and operational costs. This prohibitive material cost acts as the single largest barrier to mass-market commercialization, restricting Scandium use predominantly to low-volume, high-performance, premium applications, thus limiting its ability to penetrate cost-sensitive, high-volume industries like general automotive manufacturing. Overcoming this dependency through focused investment in diversified, dedicated supply sources is essential for future market unlocking.

The primary strategic opportunities within the Scandium market center fundamentally on radical supply diversification and continuous technological breakthroughs in processing. Immense potential exists in commercializing highly efficient, low-cost technologies specifically designed for extracting Scandium from previously uneconomic, secondary resource streams, most notably the vast, globally distributed waste stockpiles of bauxite residue (red mud), phosphogypsum, and coal fly ash. Successful, cost-effective extraction from these waste products would revolutionize supply stability and significantly lower the input production cost, directly mitigating the main market restraint. Further opportunities are emerging through the continuous innovation of Al-Sc alloy formulations specifically tailored for nascent applications, including advanced additive manufacturing (3D printing) feedstock, where the metal’s ability to control fine grain structure and mitigate hot tearing is highly advantageous. The market is also heavily influenced by macro impact forces, including escalating geopolitical tensions regarding critical mineral supply independence and supportive governmental regulatory frameworks that vigorously promote clean energy technology deployment (e.g., SOFC subsidies), necessitating rapid national investment in securing domestic Scandium reserves and local processing capabilities to ensure strategic autonomy.

Segmentation Analysis

Segmentation of the Scandium Metal Market is paramount for dissecting its highly diverse and technically demanding consumption profile, which is strictly governed by the intended end-user application and the specific material purity required. The market structure is initially categorized based on the physical form of Scandium utilized—primarily Scandium Oxide (Sc2O3), which is favored by the energy sector, or Scandium Metal, essential for metallurgical purposes. Further, the segmentation is refined by end-use industry, distinguishing between the high-specification demands of aerospace versus the high-volume potential of consumer electronics or the rapid growth of the energy segment. Due to the high value and specialized nature of this element, volume sales are often secondary to the stringent requirements concerning material purity and chemical suitability for a given application. For example, energy producers require ultra-high purity oxides (5N) for optimal electrolyte performance, whereas metallurgical applications prioritize the specific properties of the master alloy. This detailed segmentation analysis is crucial for stakeholders to accurately identify and strategically target investment toward the highest-margin, fastest-growing opportunities within energy storage and advanced structural materials.

- By Type:

- Scandium Oxide (Sc2O3)

- Scandium Metal

- Scandium Chloride (ScCl3)

- Scandium Master Alloys (e.g., Al-Sc Master Alloys)

- Scandium Nitrate

- By Purity:

- 99.9% (3N) Purity

- 99.99% (4N) Purity

- 99.999% and above (5N+) Purity

- By Application/End-Use:

- Aerospace and Defense (Structural components, airframes, missile systems utilizing Al-Sc Alloys)

- Solid Oxide Fuel Cells (SOFCs) (Electrolyte material: Scandium-Stabilized Zirconia (ScSZ))

- Consumer Electronics and Lighting (High-Intensity Discharge (HID) lamps, specialty lighting systems)

- Automotive Industry (High-performance lightweight components, EV structure R&D)

- 3D Printing/Additive Manufacturing (Advanced alloy powders for complex geometry parts)

- Sporting Goods (High-end bicycle frames, aluminum baseball bats, lacrosse sticks)

- Specialized Industrial Applications (Target materials, scientific instrumentation)

Value Chain Analysis For Scandium Metal Market

The Scandium Metal value chain is notoriously complex, highly specialized, and extremely concentrated, directly reflecting the profound logistical and technical challenges inherent in its extraction as a byproduct. The upstream segment commences with primary resource extraction operations for other metals, such as Nickel, Bauxite, or Uranium, where Scandium is present in only trace amounts. This byproduct origin dictates that the stability and volume of the upstream Scandium supply are highly vulnerable to the volatile commodity cycles and economic performance of the primary mined material, creating significant uncertainty. Following initial resource recovery, the material enters the highly specialized purification stage, which requires intense and complex hydrometallurgical processing, typically involving multiple stages of solvent extraction, to transform the dilute feedstock into marketable Scandium Oxide (Sc2O3). Only a limited number of specialized global facilities possess the requisite technical expertise, operational infrastructure, and security clearances for this high-purity processing, effectively creating acute bottlenecks and concentrating market power within these few key processors. Modern upstream investment trends are strongly focused on developing dedicated Scandium recovery plants linked specifically to secondary sources like major bauxite residue tailings ponds, aiming to bypass the inherent instability of the primary commodity market.

The midstream segment involves the meticulous conversion of high-purity Scandium Oxide into its various commercial forms, including highly purified Scandium Metal, crucial master alloys (most commonly Al-Sc master alloys containing a precise 2% Scandium content), or specialized chemical compounds like Scandium Chloride or finished ScSZ powder. This conversion demands highly specialized metallurgical expertise and specific, high-temperature processing equipment, further restricting the number of viable midstream market participants. The subsequent distribution channel is characteristically narrow, relying heavily on specialized technical distributors and direct sales contracts rather than operating within broad, transparent commodity trading markets, which is typical for low-volume, high-value, technical products. Direct contractual agreements between primary processors and major downstream consumers (such as global aerospace and SOFC manufacturers) are commonplace, serving to ensure rigorous quality control, guaranteed material specification adherence, and long-term supply security, effectively bypassing traditional bulk commodity brokerage models. Key downstream end-users include high-technology manufacturers across the aerospace, advanced energy, and specialized electronics sectors, who incorporate the material into final, high-value products.

The distinction between direct and indirect distribution channels is exceptionally clear and critically important in the Scandium market, primarily due to the non-negotiable requirement for high technical assurance and consistent quality. Direct channels involve processors selling highly specialized products, such such as master alloys or custom ScSZ powders, directly to Tier 1 manufacturers and prime contractors (e.g., major commercial airframe builders or global SOFC integrators). This channel facilitates strict, confidential control over material specification, supports joint application development, and ensures supply chain integrity for mission-critical uses. Conversely, indirect channels rely on a small network of highly specialized, technically capable distributors who manage logistics, handle smaller-volume R&D orders, and provide essential technical support for niche applications (e.g., specialized sporting goods or small R&D laboratories). Given the strategic classification of Scandium by many governments, procurement related to national defense and strategic stockpiling almost exclusively operates through secure, direct procurement channels to maintain absolute control over the material’s provenance and quality. The technical complexity and strategic importance of Scandium necessitates that the distribution model places a premium on technical expertise and material security over simple logistical efficiency.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $550 Million USD |

| Market Forecast in 2033 | $1,800 Million USD |

| Growth Rate | CAGR 18.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rusal, Clean TeQ Holdings Limited (Sylebra Scandium Project), Sumitomo Metal Mining Co. Ltd., Materion Corporation, A&M Rare-Metals, Platina Resources Ltd., Scandium International Mining Corp., China Rare Earth Holdings, Inner Mongolia Qingyun Rare Earth Co. Ltd., DNI Metals Inc., Rio Tinto, NioCorp Developments Ltd., Treibacher Industrie AG, Ganzhou Rare Earth Association, Stanford Advanced Materials, Australian Mines Limited, Metalloinvest, AMG Advanced Metallurgical Group N.V., Midwest Industrials Metals Corp., Nanjing Baotou Rare Earth Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Scandium Metal Market Potential Customers

The primary consumers of Scandium metal are technologically advanced institutions and major global corporations operating almost exclusively in sectors where significant performance gains—specifically weight reduction and enhanced material integrity—provide a substantial competitive advantage that overwhelmingly justifies the high material cost. This profile establishes a highly specialized, concentrated customer base focused rigorously on achieving technological superiority and efficiency gains. Potential customers fall predominantly into three strategic purchasing categories: global aerospace and defense prime contractors, specialized energy technology manufacturers, and advanced materials research and development laboratories. Aerospace purchasers, encompassing major airframe manufacturers (both military and commercial) and developers of advanced missile systems, fundamentally require Al-Sc master alloys to reduce structural dead weight, significantly improve fatigue life, and enhance the corrosion resistance of critical components. This directly translates into substantial operational cost reductions over the asset lifespan and improved platform performance metrics essential for air superiority.

The energy segment currently represents the fastest-expanding customer group by volume and long-term investment, primarily driven by manufacturers of high-efficiency Solid Oxide Fuel Cells (SOFCs). These companies possess an inelastic demand for extremely high-purity Scandium Oxide (Sc2O3), which is essential for synthesizing the Scandium-stabilized zirconia (ScSZ) electrolyte. This electrolyte is crucial because it facilitates high ionic conductivity, enabling the fuel cells to operate reliably at lower temperatures, thereby extending the stack's lifespan and drastically increasing system efficiency. As global legislative and corporate decarbonization efforts intensify, the volume demand from SOFC producers—who cater to distributed generation, data centers, auxiliary power units, and grid-scale storage—is structurally positioned to become the dominant demand segment. Furthermore, specialized technology developers focusing on advanced lighting systems (e.g., specialized high-intensity discharge lamps for critical infrastructure) and pioneering advanced battery materials (exploring Scandium as a crucial electrode additive) constitute vital, albeit smaller, customer segments pursuing enhanced energy efficiency, durability, and superior power density.

A rapidly burgeoning and strategically important customer segment includes enterprises dedicated to advanced manufacturing techniques, particularly powder metallurgy and sophisticated additive manufacturing (3D printing). Companies utilizing metal 3D printing for highly specialized, complex parts—such as customized medical implants, high-performance prototypes, or bespoke aerospace engine components—are increasingly procuring high-quality Al-Sc alloy powder feedstock. The fine, homogeneous grain structure and superior material integrity conferred by Scandium in these metal powders are exceptionally valued in 3D printing applications, enabling the rapid production of high-integrity parts with complex geometries that are impossible to achieve through traditional casting or forging methods. Additionally, powerful government agencies, national defense laboratories, and specialized university research facilities purchase Scandium not just for immediate use but also for strategic stockpiling, critical material resilience research, and the development of new high-temperature or radiation-resistant materials essential for future technology. This customer group often prioritizes long-term supply security and technical specification adherence over short-term cost minimization.

Scandium Metal Market Key Technology Landscape

The defining technological landscape of the Scandium Metal market is characterized by intense innovation across three critical, interconnected phases: achieving highly efficient and sustainable extraction from extremely low-concentration source materials, ensuring ultra-high purity refinement necessary for sensitive applications, and developing novel metallurgical techniques for maximizing alloy performance. Given that Scandium invariably exists in trace quantities within complex feedstocks, the upstream technological R&D is rigorously focused on innovative, highly selective hydrometallurgical separation processes. While conventional solvent extraction (SX) remains the operational standard for purifying Scandium Oxide, continuous research efforts are strategically shifting toward highly specialized technologies like advanced ionic liquid extraction and optimized ion exchange resins. The goal of these next-generation processes is to significantly improve selectivity, speed up recovery rates, and enhance separation efficiency, particularly from challenging secondary feedstocks such as bauxite residue (red mud), simultaneously minimizing the environmental footprint and radically reducing operational processing costs. Success in these upstream technologies is the necessary prerequisite for unlocking vast, previously non-commercialized secondary global resources, thus revolutionizing the structural resilience and stability of the global Scandium supply.

In the midstream segment, the technological requirement for producing ultra-high purity Scandium compounds, most critically 5N (99.999%) purity Sc2O3, necessitates the application of extremely sophisticated refinement processes, including controlled thermal decomposition, vacuum calcination, and multi-stage distillation techniques. This level of extreme purity is absolutely non-negotiable for critical high-performance applications such as Solid Oxide Fuel Cell (SOFC) electrolytes, where even minimal trace impurities—measured in parts per million (ppm)—can severely degrade ionic conductivity, dramatically reducing cell performance and lifespan. Key technological advancements in this refinement phase are concentrated on engineering robust, scalable industrial processes capable of achieving consistent, high-volume, ultra-high purity production through continuous operational cycles, replacing less efficient batch processes. This focus on continuous processing improves overall yield consistency and significantly reduces the intense energy requirements associated with multiple, high-temperature purification steps. Furthermore, the technology utilized for converting high-purity Scandium Oxide into Scandium Metal typically employs refined metallothermic reduction methods, such as the calcio-thermic process, which must be meticulously controlled in inert atmospheres to ensure the resultant metal is free of gaseous inclusions and perfectly suited for creating flawless, high-performance master alloys.

Downstream, the most economically significant technological innovation surrounds the continuous development and optimization of Aluminum-Scandium master alloys and the creation of highly specialized alloy powders specifically engineered for additive manufacturing (3D printing). Metallurgical advancements are focused intensely on perfecting the master alloy production process to ensure the complete and uniform dispersion of the trace Scandium atoms within the bulk aluminum matrix. This perfect dispersion is essential for maximizing the element’s exceptional effects on grain refinement and structural strengthening. For advanced 3D printing applications, technologies such as inert gas atomization and plasma atomization are absolutely critical for manufacturing extremely high-quality, perfectly spherical, low-oxygen metal powders with precisely controlled particle size distributions and guaranteed chemical composition stability. These technological breakthroughs in both bulk alloy formation and specialized powder metallurgy are paramount for realizing Scandium's full potential across modern industries, particularly aerospace and defense, ensuring material homogeneity, structural integrity, and reliability in all complex, mission-critical components fabricated using advanced manufacturing techniques.

Regional Highlights

Geographically, the Scandium Metal Market presents a distinctive landscape characterized by a highly centralized and technically specialized supply base coupled with major demand centers that are strategically focused and geographically diverse. The Asia Pacific (APAC) region currently holds a dominant, but often complex, position in the global supply chain, primarily due to the extensive rare earth and advanced byproduct processing infrastructure centered in China. China’s processing capacity significantly influences both global availability and benchmark market pricing. However, aggressive resource exploration and robust processing capabilities are rapidly developing in other APAC nations, notably Australia, which is advancing several projects aimed at commercially exploiting Scandium-rich bauxite and nickel laterite deposits. This effort is positioning Australia as a major, reliable future supplier to Western and specialized Asian markets. Concurrently, the APAC demand profile is rapidly escalating, fueled by massive regional investment in green energy technology, particularly in Japan and South Korea, which are global pioneers and major manufacturers of high-efficiency Solid Oxide Fuel Cells (SOFCs), driving intense internal competition for secure sources of ultra-high-purity Scandium Oxide.

North America and Europe constitute the most mature and highest-value demand markets, with consumption concentrated heavily within the defense, commercial aerospace, and specialized industrial sectors. North America, propelled by substantial R&D budgets from defense contractors and major commercial aircraft manufacturers, leads globally in the mature adoption of high-performance Al-Sc alloys for essential lightweighting and structural integrity enhancements. Crucially, governmental strategic initiatives in the US and Canada, which classify Scandium as a critical material, are aggressively funding domestic exploration and supply chain resilience projects. These initiatives are designed to reduce strategic reliance on geopolitically sensitive foreign sources. Europe mirrors this trend, utilizing strong regulatory frameworks and industrial mandates focused on reducing carbon emissions and enhancing fuel efficiency. This sustained policy pressure drives consistent high demand from Europe's technologically advanced automotive and aerospace engineering bases, augmented by substantial European Union (EU) support for strategic R&D into cutting-edge SOFC technology.

The emerging markets of Latin America and the Middle East and Africa (MEA) are primarily significant due to their unexploited geological resource potential rather than current consumption volume. Several nations in the MEA region, particularly those with vast bauxite and laterite deposits, represent massive, untapped potential sources of byproduct Scandium. However, large-scale, high-purity commercial extraction in these areas is currently constrained by insufficient infrastructure, technical know-how, and the required capital investment. Similarly, Latin America, especially Brazil, with its extensive mineral wealth, is a critical area for future Scandium supply exploration and resource mapping. Currently, Scandium consumption in these emerging regions is negligible, typically limited to imports for small-scale local defense applications or preliminary industrial R&D. The future diversification and resilience of the global market supply will significantly depend on the successful and cost-effective commercialization of high-purity Scandium extraction technologies within these currently resource-rich, but supply-constrained, developing nations.

- North America: High-value consumption anchored in the defense and aerospace sectors; strong governmental mandates for securing and developing resilient domestic critical material supply chains.

- Europe: Consistent, high demand from pioneering SOFC manufacturing and sophisticated automotive/aerospace R&D; market growth driven by strict environmental regulations and efficiency mandates.

- Asia Pacific (APAC): Acts as the dominant global supplier base (China, Australia) and the fastest-growing consumer market (Japan, South Korea) for SOFC and specialized electronics applications.

- Latin America: Holds significant untapped geological supply potential related to large mineral reserves (bauxite); current consumption is low, focused on resource exploration.

- Middle East and Africa (MEA): Emerging as a resource exploration hub with massive potential in bauxite residue and laterite deposits; current industrial demand is minimal, focused on future supply development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Scandium Metal Market.- Rusal (United Company RUSAL)

- Clean TeQ Holdings Limited (Sylebra Scandium Project)

- Sumitomo Metal Mining Co. Ltd.

- Materion Corporation

- A&M Rare-Metals

- Platina Resources Ltd.

- Scandium International Mining Corp.

- China Rare Earth Holdings

- Inner Mongolia Qingyun Rare Earth Co. Ltd.

- DNI Metals Inc.

- Rio Tinto

- NioCorp Developments Ltd.

- Treibacher Industrie AG

- Ganzhou Rare Earth Association

- Stanford Advanced Materials

- Australian Mines Limited

- Metalloinvest

- AMG Advanced Metallurgical Group N.V.

- Midwest Industrials Metals Corp.

- Nanjing Baotou Rare Earth Co., Ltd.

- Kemet Corporation

Frequently Asked Questions

What is the primary factor limiting the widespread adoption of Scandium alloys?

The primary constraint is the extremely high production cost and resulting price volatility, stemming directly from the structurally fragmented and unstable supply chain. Scandium is recovered as a trace byproduct, making reliable, high-volume sourcing and high-purity processing technically and economically challenging.

How is Scandium Metal primarily used in the energy sector, and why is its purity important?

In the energy sector, ultra-high purity Scandium Oxide (Sc2O3) is vital for manufacturing Solid Oxide Fuel Cells (SOFCs). It stabilizes Zirconia, creating an extremely efficient electrolyte (ScSZ). High purity is critical because trace impurities severely degrade the ionic conductivity, reducing the cell's lifespan and overall efficiency.

Which industry segment accounts for the highest value consumption of Scandium?

The aerospace and defense industries are the highest-value consumers. They utilize Scandium to produce Aluminum-Scandium (Al-Sc) alloys, which deliver a crucial combination of superior strength-to-weight ratio, enhanced weldability, and resistance to stress corrosion, essential for mission-critical components.

Are there any viable, direct substitutes for Scandium in lightweight aluminum alloys?

While other elements like Lithium or Zirconium can improve certain aluminum properties, there is currently no direct, single-element substitute capable of offering Scandium's unique synergistic benefits: exceptional grain refinement, simultaneous strength enhancement, and outstanding weldability without compromising material integrity.

What major technological advances are expected to stabilize and secure future Scandium supply?

The stabilization of supply fundamentally relies on the successful commercialization of advanced hydrometallurgical technologies focused on economically extracting Scandium from previously non-commercialized secondary waste sources, such as the vast, globally accessible reserves of bauxite residue (red mud).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- High Purity Scandium Metal Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Scandium Metal Market Statistics 2025 Analysis By Application (Aluminum-Scandium Alloys, High-Intensity Metal Halide Lamps, Lasers, SOFCs), By Type (Scandium Oxide 99.99%, Scandium Oxide 99.999%, Scandium Oxide 99.9995%, Scandium Metal Ingot), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager