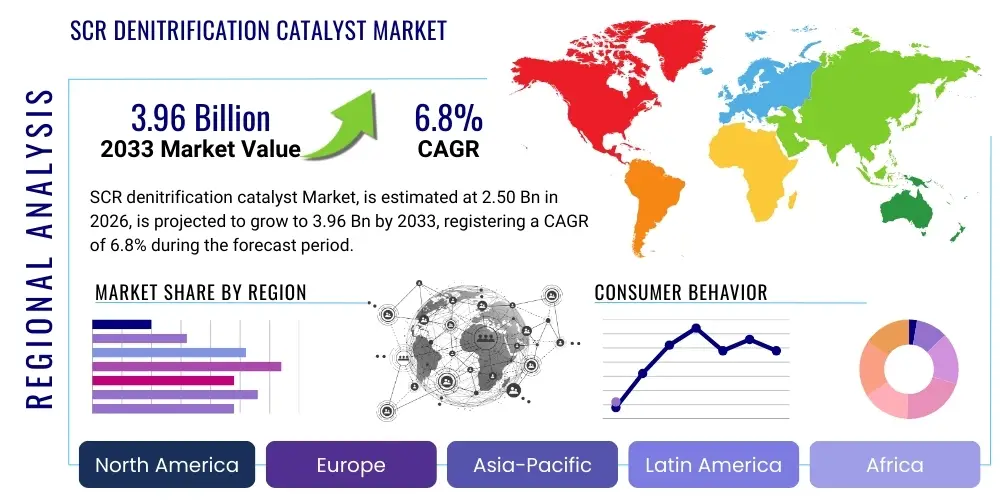

SCR denitrification catalyst Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441725 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

SCR denitrification catalyst Market Size

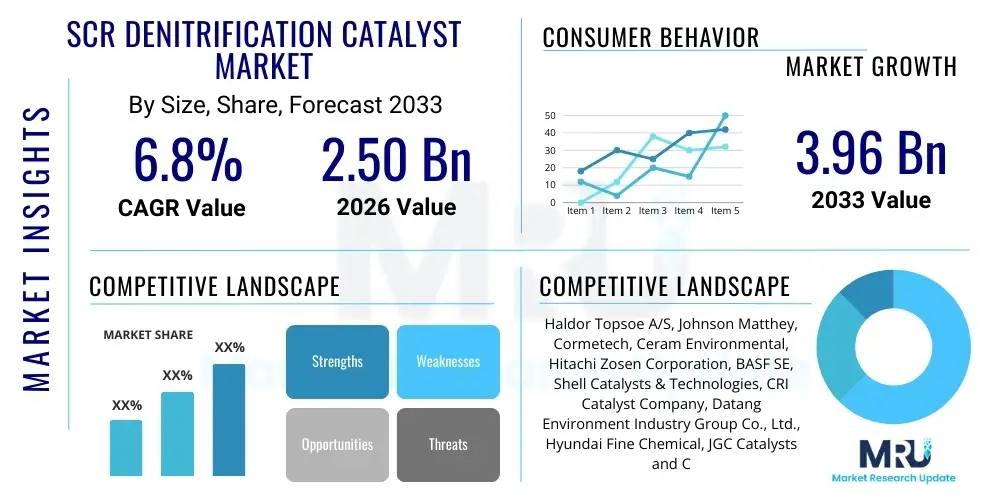

The SCR denitrification catalyst Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 2.50 billion in 2026 and is projected to reach USD 3.96 billion by the end of the forecast period in 2033.

SCR denitrification catalyst Market introduction

The Selective Catalytic Reduction (SCR) denitrification catalyst market is fundamentally driven by the global necessity to mitigate nitrogen oxide (NOx) emissions, which are significant contributors to acid rain, smog, and respiratory diseases. SCR technology represents the most effective and widely adopted post-combustion method for controlling these pollutants, primarily through the injection of a reducing agent, typically ammonia or urea, into the exhaust gas stream in the presence of a specialized catalyst. This chemical reaction converts harmful nitrogen oxides into harmless diatomic nitrogen (N2) and water (H2O). The market encompasses various catalyst types, including honeycomb, plate, and corrugated structures, utilizing materials such as vanadium pentoxide, titanium dioxide, and specialized zeolites designed for optimum efficiency across different temperature ranges and fuel types.

Major applications of SCR denitrification catalysts span critical industrial sectors, including thermal power generation plants (coal, gas, and oil-fired), cement production facilities, waste incineration plants, chemical processing units, and increasingly, marine vessels adhering to stringent IMO Tier III regulations. The catalysts are engineered to withstand harsh operating environments, including exposure to sulfur, dust, and varying temperatures, ensuring long-term operational performance. The product’s primary benefit lies in its high NOx removal efficiency, often exceeding 90%, thereby enabling compliance with increasingly stringent regional and international environmental regulations, such as the EPA standards in North America and the Euro VI/VII directives in Europe.

Key driving factors propelling market expansion include the rapid industrialization and urbanization across the Asia Pacific region, leading to higher energy demand and subsequent growth in coal-fired power generation, necessitating robust emission controls. Furthermore, continuous regulatory tightening concerning air quality standards globally acts as a non-negotiable compliance requirement for operators, driving sustained demand for high-performance catalyst systems. Technological advancements focused on developing low-temperature SCR catalysts and catalysts with improved sulfur resistance are also widening the applicability of this technology, particularly in areas like heavy-duty diesel engines and specialized industrial processes where exhaust temperatures are lower.

SCR denitrification catalyst Market Executive Summary

The SCR denitrification catalyst market is experiencing robust growth, primarily anchored by stringent global environmental mandates targeting NOx emissions from stationary and mobile sources. Business trends indicate a significant shift towards catalyst materials optimized for lower operating temperatures and enhanced durability, addressing the operational complexities faced by industries like marine transport and mid-sized industrial boilers. Geographically, Asia Pacific, driven by China and India’s massive power generation and industrial base, maintains the dominant market share and highest growth trajectory, while North America and Europe prioritize the replacement market and the integration of SCR systems into retrofitted older facilities to meet updated compliance levels. This regional divergence in maturity dictates varying demands for catalyst types and volumes, with emerging markets focusing on new installations and developed economies focusing on optimization and maintenance.

Segment trends reveal that the power generation application segment remains the largest consumer, although the industrial application segment, encompassing cement, glass, and chemical industries, is witnessing accelerated adoption due to sector-specific regulatory pressure. Furthermore, within catalyst types, the honeycomb structure is highly favored for large-scale fixed installations due to its high geometric surface area and structural robustness. However, plate and corrugated catalysts are gaining traction in space-constrained applications, such as marine engines and smaller utility boilers, due to their lower pressure drop characteristics. Material science trends point towards a growing interest in iron and copper zeolite catalysts, which offer superior low-temperature performance compared to traditional vanadium-titanium formulations, enhancing system flexibility and reducing operational costs related to exhaust gas heating.

Overall, the market structure is characterized by intense competition among specialized chemical manufacturers and environmental technology providers. Strategic priorities for market participants include securing long-term supply agreements with major industrial operators, investing heavily in research and development to improve catalyst lifespan and efficiency, and establishing comprehensive catalyst regeneration and recycling services. The increasing focus on the circular economy and sustainable industrial practices is presenting significant opportunities for companies that can offer closed-loop solutions, minimizing the environmental impact associated with spent catalyst disposal and promoting resource efficiency across the entire value chain.

AI Impact Analysis on SCR denitrification catalyst Market

User queries regarding AI's influence on the SCR denitrification catalyst market predominantly revolve around optimizing operational efficiency, enhancing predictive maintenance capabilities, and improving regulatory compliance monitoring. Users frequently ask how machine learning algorithms can predict catalyst deactivation rates, when the optimal time for regeneration is, and whether AI can fine-tune the ammonia injection ratio in real-time to maximize NOx removal while minimizing ammonia slip (unreacted ammonia). The key themes emerging from this analysis center on leveraging AI for prescriptive analytics to reduce variable operating costs, extend catalyst service life, and ensure stable, high-efficiency pollutant reduction under dynamically changing load conditions, thereby transforming SCR operation from reactive management to proactive optimization.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies is fundamentally enhancing the performance and longevity of SCR systems. AI algorithms process vast amounts of data—including exhaust gas temperature, flow rate, NOx concentration, ammonia injection rate, and historical performance metrics—to build highly accurate predictive models of catalyst behavior. These models can anticipate potential system failures or drops in efficiency far in advance, allowing operators to schedule maintenance precisely when needed, rather than relying on fixed intervals or reacting to major efficiency losses. This shift dramatically reduces unexpected downtime and optimizes the utilization of expensive catalyst inventories, offering substantial operational savings for large-scale facilities like power plants.

Furthermore, AI-driven control systems are proving instrumental in optimizing the Selective Catalytic Reduction process itself. By continuously analyzing real-time input parameters, AI can precisely adjust the ammonia injection rate (AIG) to maintain high denitrification efficiency across rapid load changes, a critical challenge in dynamic industrial settings. This intelligent control minimizes both NOx emissions and ammonia slip—the latter being a regulated pollutant itself and an indicator of wasteful reagent use. The deployment of advanced sensor technology combined with AI-enabled data visualization platforms provides plant operators with deeper insights into system health, fostering a data-driven approach to environmental compliance and overall plant management.

- AI-enabled Predictive Maintenance: Forecasts catalyst aging, fouling, and deactivation rates to optimize replacement and regeneration cycles.

- Real-time Optimization: Utilizes ML to dynamically adjust ammonia/urea injection rates for maximizing NOx reduction and minimizing ammonia slip under varying load conditions.

- Process Diagnostics: Identifies sensor drift, distribution issues, and potential hardware failures within the SCR system, reducing unscheduled downtime.

- Regulatory Compliance Monitoring: Provides advanced analytics and reporting features to ensure continuous, documented adherence to strict emission limits.

- Supply Chain Efficiency: Optimizes procurement and inventory management for catalysts and reducing agents based on predicted consumption patterns and market logistics.

DRO & Impact Forces Of SCR denitrification catalyst Market

The SCR denitrification catalyst market is influenced by a complex interplay of regulatory drivers mandating pollution control and inherent operational challenges associated with catalyst technology. The primary drivers stem from tightening global environmental legislation (e.g., Euro VI, IMO Tier III, Chinese Five-Year Plans) which sets extremely low NOx emission thresholds for both stationary sources and maritime transport, making high-efficiency SCR indispensable. Opportunities are emerging through technological innovation, specifically the development of novel catalyst materials (such as iron-zeolites) capable of performing efficiently at lower temperatures, broadening the application scope to processes previously excluded due to thermal limitations. Conversely, the market faces significant restraints, including the high capital expenditure required for installing SCR systems, the recurring cost of catalyst replacement or regeneration, and the inherent toxicity and supply chain volatility associated with raw materials like vanadium and titanium dioxide. The collective forces of stringent compliance demands, technological advancement, and cost pressures shape the strategic decisions of market participants and end-users alike.

The impact forces within the market are predominantly driven by regulatory evolution and technological maturity. The increasing global focus on climate change mitigation and air quality improvements continuously elevates the compliance bar, acting as the strongest sustaining impact force. The maturity of SCR technology means that while it is effective, innovation must focus on incremental improvements in lifetime, resistance to poisoning (especially sulfur and alkali metals), and energy consumption. Furthermore, the push towards a circular economy introduces a strong force for companies specializing in catalyst regeneration and recycling, transitioning away from linear consumption models. This necessitates investment in sophisticated infrastructure for handling and reprocessing spent catalysts safely and efficiently, often involving complex chemical processing to restore activity.

The market also experiences pressure from the competitive emergence of alternative NOx reduction technologies, such as advanced combustion techniques (though typically less efficient than SCR) and non-thermal plasma methods. While SCR remains the gold standard for high-volume, high-efficiency requirements, the threat of substitution in niche applications drives continuous R&D investment within the catalyst sector. The economic viability of end-user industries, particularly power generation, directly impacts demand for new SCR installations and scheduled catalyst replacement cycles. Therefore, global energy policy and industrial output volumes are critical macroeconomic impact forces that indirectly determine market demand for denitrification catalysts.

Segmentation Analysis

The SCR denitrification catalyst market is comprehensively segmented based on its structural type, the core material composition, the specific application sector, and the geographic region. This segmentation provides a detailed framework for understanding market dynamics and identifying areas of high growth. Segmentation by type differentiates between honeycomb, plate, and corrugated structures, each optimized for varying pressure drop requirements, installation space, and flow characteristics. Segmentation by material is crucial as it determines the optimal operating temperature range; vanadium-titanium catalysts dominate high-temperature applications, while zeolite-based catalysts are increasingly preferred for low-to-medium temperature segments, particularly in mobile and natural gas applications.

The application segmentation is fundamental, highlighting the differential demand intensity across industrial sectors. Power generation, primarily coal-fired and natural gas plants, remains the dominant application due to the massive scale of exhaust gas needing treatment. However, significant growth is noted in specialized industrial segments such as cement, glass manufacturing, and petrochemicals, where process emissions are becoming more tightly regulated. The burgeoning marine sector, driven by the IMO Tier III regulations requiring NOx abatement in Emission Control Areas (ECAs), represents a dynamic and high-value niche market requiring specialized, durable, sulfur-resistant catalyst systems designed for ship operations.

Understanding these segments allows manufacturers to tailor product specifications and pricing strategies effectively. For instance, high-volume power plant applications prioritize cost-effectiveness and long service life (vanadium-titanium honeycomb), whereas marine applications prioritize compact size, high efficiency, and resistance to thermal shock (often zeolite or specialized plate types). The continued technological innovation within specific material segments, such as developing low-temperature catalysts suitable for gas turbines or small diesel applications, directly influences the growth rate and competitiveness within the broader segmentation structure.

- By Type:

- Honeycomb Catalyst

- Plate Catalyst

- Corrugated Catalyst

- By Material:

- Vanadium-Titanium Oxide

- Zeolite-based Catalyst (Copper, Iron)

- Other Materials (e.g., Ceramic, Precious Metals)

- By Application:

- Power Generation (Coal-fired, Gas Turbines)

- Industrial (Cement, Glass, Waste Incineration, Chemical)

- Mobile Sources (Marine Vessels, Heavy-Duty Diesel Vehicles)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For SCR denitrification catalyst Market

The value chain for the SCR denitrification catalyst market begins with the upstream sourcing and processing of critical raw materials, primarily titanium dioxide (TiO2), vanadium pentoxide (V2O5), tungsten oxide (WO3), and various zeolites. This stage is highly capital-intensive and relies on a stable supply of these specialty chemicals, often sourced from a limited number of global suppliers. The stability and purity of these raw materials directly impact the final catalyst activity and lifespan. Upstream risks include geopolitical factors affecting mining operations and volatility in commodity pricing, which translate directly into the manufacturing costs of the final product. Catalyst manufacturers then undertake complex chemical processes, including extrusion, coating, and calcination, to produce the structured catalysts (honeycomb, plate) that meet precise performance specifications tailored to end-user requirements.

Mid-stream activities are dominated by specialized catalyst manufacturing companies that possess proprietary formulations and extensive application knowledge. These companies invest heavily in R&D to improve resistance to poisoning, enhance low-temperature activity, and increase mechanical durability. Distribution channels are typically a mix of direct sales to large end-users (e.g., major utility companies or EPC contractors handling new power plant construction) and indirect sales through specialized distributors and agents, particularly for the aftermarket and smaller industrial installations. Direct sales emphasize technical consultation and customized solutions, leveraging the manufacturer's deep technical expertise to integrate the SCR system seamlessly into existing infrastructure.

The downstream segment involves installation, monitoring, maintenance, and, critically, catalyst regeneration and replacement. Installation is often handled by specialized engineering firms or EPC contractors. The aftermarket for regeneration services is a rapidly growing part of the value chain, driven by the high cost of new catalysts and the environmental mandate to recycle materials. Regeneration companies restore the activity of spent catalysts through chemical washing and heat treatment, extending their useful life. End-users, primarily power plants and large industrial facilities, are focused on maximizing the catalyst's operational efficiency and ensuring long-term compliance, making the quality of technical support and long-term service agreements critical purchasing factors.

SCR denitrification catalyst Market Potential Customers

The primary consumers and end-users of SCR denitrification catalysts are industries characterized by large-scale combustion processes that generate substantial NOx emissions, placing them under stringent regulatory control. The power generation sector, encompassing both conventional thermal power stations (coal and gas-fired) and combined cycle facilities, represents the largest single customer segment due to the immense volumes of flue gas requiring treatment and mandatory compliance with air quality standards. These entities require high-volume, highly durable catalyst systems capable of sustained performance over many years of continuous operation, often favoring honeycomb vanadium-titanium compositions for high-temperature stability.

Secondary high-potential customer groups include heavy industry sectors such as cement manufacturing, glass production, and metallurgical processing plants. These industries often face unique challenges, including high dust loads and the presence of catalyst poisons (like alkali metals) in the flue gas, demanding specialized catalyst formulations (e.g., high-ash resistance types). Additionally, the marine sector is an increasingly important customer, driven by the International Maritime Organization (IMO) regulations. Ship owners and naval architects require compact, sulfur-resistant, and low-temperature catalysts for new ship builds and retrofits, specifically targeting operations within Emission Control Areas (ECAs) globally.

Furthermore, manufacturers of heavy-duty diesel engines and gas turbines, particularly those used in industrial applications, mobile power generation, and specialized vehicles, constitute another significant customer base. For these applications, the focus shifts towards smaller, highly active, and rapid-response zeolite-based catalysts that can function effectively at lower temperatures and handle transient engine operating conditions. The recurring demand for catalyst regeneration and replacement ensures that all existing industrial facilities equipped with SCR systems remain perpetual customers of the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.50 Billion |

| Market Forecast in 2033 | USD 3.96 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Haldor Topsoe A/S, Johnson Matthey, Cormetech, Ceram Environmental, Hitachi Zosen Corporation, BASF SE, Shell Catalysts & Technologies, CRI Catalyst Company, Datang Environment Industry Group Co., Ltd., Hyundai Fine Chemical, JGC Catalysts and Chemicals Ltd., Mitsubishi Hitachi Power Systems, Sinocat Environmental Technology Co., Ltd., Seshin C&T, Tianhe Environmental Protection Technology. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

SCR denitrification catalyst Market Key Technology Landscape

The technology landscape of the SCR denitrification catalyst market is characterized by continuous efforts to enhance efficiency, broaden the operational temperature window, and improve resistance to deactivation agents such as sulfur, arsenic, and alkali metals. The dominant technology remains the Vanadium-Titanium (V2O5/WO3/TiO2) formulation, which offers exceptional performance and longevity in high-temperature environments (300°C to 400°C), typically found in coal-fired power plants. Technological innovation in this traditional segment focuses on optimizing the catalyst geometry (e.g., cell pitch and hydraulic diameter) to minimize pressure drop while maintaining high mass transfer rates, thereby improving overall system energy efficiency and reducing parasitic power consumption associated with flue gas fans.

A crucial area of recent development centers on low-temperature SCR (LTSCR) technology, primarily utilizing zeolite-based materials doped with transition metals such as copper (Cu-Zeolite) and iron (Fe-Zeolite). These catalysts are effective at temperatures as low as 175°C to 300°C, making them suitable for mobile applications (heavy-duty diesel engines) and processes like gas turbine exhaust treatment where the flue gas temperature is significantly lower or where heat recovery necessitates lower operating temperatures. The key technological advantage of zeolites is their hydrothermal stability and ability to operate efficiently in low-sulfur environments. Research is currently focused on developing zeolite formulations that exhibit better durability against hydrothermal aging and enhanced resistance to poisoning in medium-sulfur applications, bridging the gap between high-temperature V2O5 and low-temperature mobile catalysts.

Furthermore, advanced catalyst manufacturing techniques, including monolithic and structured packaging, are defining the competitive edge. Specialized coating techniques, such as washcoating active material onto durable ceramic or metal substrates, ensure optimal dispersion and adhesion, maximizing active surface area while maintaining mechanical strength. Another technological frontier involves advanced monitoring and control systems, often leveraging AI and IoT sensors (as detailed previously), which are integral to ensuring the catalysts operate at their peak performance point under dynamic load conditions. Finally, chemical engineering innovations in catalyst regeneration—moving towards more effective, less chemically aggressive washing and thermal treatments—are key to promoting the longevity and circularity of these expensive components.

Regional Highlights

The global SCR denitrification catalyst market exhibits pronounced regional variations in demand, driven by differing regulatory timelines, industrial bases, and energy mixes. Asia Pacific (APAC) dominates the market in terms of both market size and growth rate, primarily due to the region's massive industrial expansion, particularly in China and India, where dependency on coal-fired power generation necessitates widespread deployment of SCR systems to combat severe air pollution. Regulatory bodies in these nations are increasingly adopting stringent emission standards, mirroring those in the West, leading to a strong demand for new catalyst installations and subsequent replacement cycles. Japan and South Korea also contribute significantly, focusing on highly efficient, customized systems for their refined industrial sectors and marine fleets.

Europe and North America represent mature markets characterized by replacement demand and retrofit installations, rather than large-scale new builds in the power sector. In Europe, the implementation of directives like the Industrial Emissions Directive (IED) maintains steady demand for performance optimization and catalyst upgrades across existing industrial and power infrastructure. North America, influenced by EPA regulations, sees substantial sustained demand from the refining, gas pipeline, and power sectors. The regional focus here is heavily skewed towards optimizing operational efficiency, minimizing ammonia slip, and integrating advanced monitoring technologies (including AI-driven controls) into existing SCR systems to ensure continuous compliance and reduce environmental liability.

The Middle East and Africa (MEA) and Latin America (LATAM) are emerging markets, displaying moderate growth, often linked to new infrastructure projects in the petrochemical, cement, and nascent natural gas power generation sectors. Demand in these regions is driven by both localized national environmental policies and international project financing requirements that mandate adherence to global emission standards. The market penetration rate is lower than in APAC, but sustained economic development and increasing regulatory maturity are expected to drive higher adoption rates in the latter half of the forecast period, particularly for modular SCR solutions catering to localized energy facilities.

- Asia Pacific (APAC): Market leader by volume and growth, driven by expansive coal power sector in China and India, coupled with rapidly tightening domestic emission standards (e.g., China's Ultra-Low Emission requirements).

- Europe: Focus on replacement and maintenance market; strong adherence to IED mandates; high adoption of advanced, low-temperature catalysts for specialized industrial applications and mobile sources.

- North America: Stable demand driven by EPA regulations and replacement cycles in the power generation and petroleum refining sectors; early adopter of AI integration for system optimization and compliance monitoring.

- Latin America (LATAM): Emerging market characterized by gradual regulatory tightening; demand linked to new infrastructure projects and the expansion of the natural gas sector.

- Middle East and Africa (MEA): Growth tied to diversification of energy sources and industrialization projects (cement, petrochemicals); reliance on international standards for large-scale projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the SCR denitrification catalyst Market.- Haldor Topsoe A/S

- Johnson Matthey

- Cormetech

- Ceram Environmental

- Hitachi Zosen Corporation

- BASF SE

- Shell Catalysts & Technologies

- CRI Catalyst Company

- Datang Environment Industry Group Co., Ltd.

- Hyundai Fine Chemical

- JGC Catalysts and Chemicals Ltd.

- Mitsubishi Hitachi Power Systems

- Sinocat Environmental Technology Co., Ltd.

- Seshin C&T

- Tianhe Environmental Protection Technology

- Nippon Shokubai Co., Ltd.

- W. R. Grace & Co.

- EPR Catalysts, Inc.

- Kawasaki Heavy Industries, Ltd.

- UOP, A Honeywell Company

Frequently Asked Questions

Analyze common user questions about the SCR denitrification catalyst market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the SCR denitrification catalyst market?

The primary driver is the global implementation of stringent environmental regulations, such as the IMO Tier III and various national ultra-low emission standards, mandating significant reductions in nitrogen oxide (NOx) emissions from industrial and mobile combustion sources.

How do low-temperature SCR (LTSCR) catalysts differ from traditional formulations?

LTSCR catalysts, primarily zeolite-based (Cu or Fe), operate efficiently at lower exhaust gas temperatures (175°C to 300°C), making them essential for applications like heavy-duty diesel engines and gas turbines, compared to traditional vanadium-titanium catalysts requiring higher temperatures (300°C to 400°C).

What is the significance of catalyst regeneration in the market value chain?

Catalyst regeneration is crucial for extending the service life of expensive catalysts, reducing operational costs for end-users, and supporting the circular economy mandate by chemically and thermally restoring the activity of spent materials, minimizing waste disposal.

Which application segment holds the largest market share for SCR catalysts?

The power generation segment, particularly coal-fired and natural gas power plants, currently holds the largest market share due to the immense volume of flue gas requiring treatment and the non-negotiable compliance requirements for major utility operators globally.

How does the integration of AI impact SCR system operations?

AI significantly impacts SCR operations by enabling predictive maintenance, forecasting catalyst aging, and optimizing the real-time ammonia injection ratio to achieve maximum NOx reduction efficiency while minimizing ammonia slip and reducing overall operational expenditure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager