Seamless Stainless Steel Pipes Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443324 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Seamless Stainless Steel Pipes Market Size

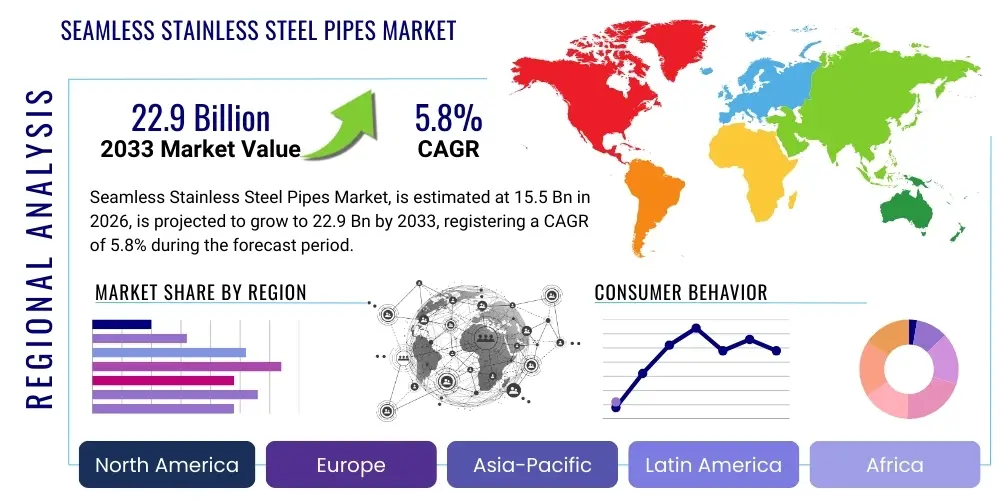

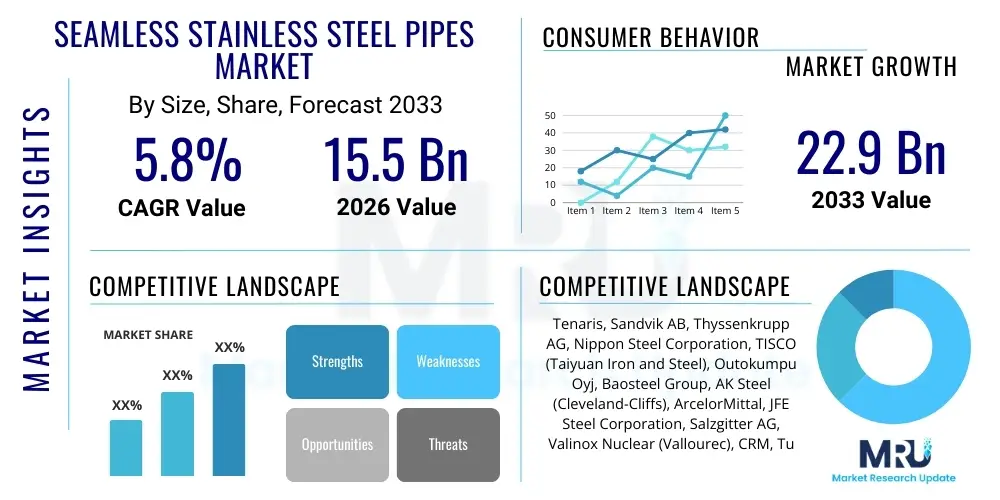

The Seamless Stainless Steel Pipes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $15.5 Billion in 2026 and is projected to reach $22.9 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily driven by escalating demand from critical infrastructure sectors, particularly oil and gas, chemical processing, and power generation, which require materials exhibiting exceptional corrosion resistance and mechanical strength under high pressure and temperature operating conditions. Market valuation reflects significant capital expenditure in upstream and downstream processing facilities globally, coupled with stringent regulatory standards mandating high-integrity piping systems.

Seamless Stainless Steel Pipes Market introduction

The Seamless Stainless Steel Pipes Market encompasses the manufacturing, distribution, and utilization of piping solutions characterized by the absence of a longitudinal weld seam. These pipes are typically produced through extrusion, cold drawing, or piercing processes, resulting in a homogenous structure that offers superior mechanical properties, particularly enhanced pressure containment capabilities, improved dimensional accuracy, and optimal resistance to fatigue and stress corrosion cracking compared to welded alternatives. Stainless steel grades, including Austenitic (304, 316), Ferritic, Martensitic, and Duplex variants, are utilized depending on the specific application environment, ranging from cryogenic conditions to extremely high temperatures and corrosive media. Major applications span critical infrastructure areas such as heat exchangers, boilers, hydraulic systems, nuclear power plants, and sophisticated fluid transport in chemical refineries, where material integrity is paramount for operational safety and longevity. The inherent benefits, including high durability, excellent anti-corrosion properties, and long service life, are the primary driving factors for sustained market growth. Furthermore, the global push towards modernization of aging infrastructure and the increasing complexity of chemical processes necessitate the adoption of premium, high-performance materials like seamless stainless steel tubing.

Product description highlights pipes manufactured to conform to international standards such as ASTM A312, ASME SA312, and various EN specifications, ensuring interchangeability and reliability across global projects. These products are crucial in sectors where material failure could result in catastrophic environmental and economic consequences. The primary driving factors fueling market expansion include sustained investment in the global energy sector, particularly unconventional oil and gas exploration requiring high-strength piping, and the stringent quality demands imposed by the pharmaceutical and food processing industries for hygienic, non-reactive surfaces. Geopolitical stability affecting resource extraction projects and fluctuating raw material prices (nickel, chrome) remain pivotal variables influencing short-term market dynamics and long-term procurement strategies for major end-users. Regulatory frameworks, especially those pertaining to environmental protection and industrial safety, further reinforce the necessity for high-integrity seamless products, thereby supporting premium pricing and continued technological innovation in manufacturing techniques.

Seamless Stainless Steel Pipes Market Executive Summary

The Seamless Stainless Steel Pipes Market is positioned for stable expansion, underpinned by secular growth trends across critical industrial applications, despite cyclical volatility in the oil and gas sector. Business trends indicate a pronounced shift towards high-performance and specialty alloy grades, such as Duplex and Super Duplex stainless steel, driven by the exploration of deeper, more corrosive offshore reserves and the necessity for superior strength-to-weight ratios in complex industrial machinery. Manufacturers are increasingly focused on process optimization, including sophisticated cold working and annealing techniques, to enhance the internal surface finish and minimize residual stress, directly addressing the demanding specifications of the aerospace and nuclear industries. Furthermore, sustainability requirements are influencing manufacturing processes, pushing for reduced energy consumption and improved scrap utilization, which major market players are integrating into their corporate strategy to achieve better Environmental, Social, and Governance (ESG) scores and secure long-term client contracts requiring certified sustainable sourcing.

Regional trends highlight Asia Pacific (APAC) as the epicenter of market growth, primarily due to massive investments in infrastructure development, rapid industrialization in countries like China and India, and the corresponding expansion of chemical processing and power generation capacities. North America and Europe, while mature, exhibit strong demand for replacement and modernization projects, especially within the nuclear power and refining sectors, focusing on high-value, long-life products. Segment trends emphasize the dominance of the Austenitic grades (304/304L and 316/316L) due to their versatility and cost-effectiveness, though the fastest growth is anticipated in specialized grades tailored for extreme environments. The large diameter segment is seeing increased uptake in heavy industry applications, while small diameter tubing remains critical for hydraulic and instrumentation systems. Strategic mergers and acquisitions are shaping the competitive landscape, allowing key players to consolidate market share, secure raw material supply chains, and gain technological advantage in specialized manufacturing techniques.

AI Impact Analysis on Seamless Stainless Steel Pipes Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Seamless Stainless Steel Pipes Market predominantly center around process efficiency, defect detection accuracy, predictive maintenance capabilities, and supply chain resilience. Key themes reveal user expectations for AI to minimize production waste, particularly during the demanding cold drawing and annealing stages, and to enhance quality control by automating the ultrasonic and eddy current testing processes, thereby achieving zero-defect manufacturing essential for high-integrity applications. Concerns often revolve around the initial capital investment required for implementing AI-driven monitoring systems and the necessity for specialized workforce training to manage complex predictive maintenance algorithms. Ultimately, the consensus is that AI will transform manufacturing from reactive quality assurance to proactive process optimization, leading to higher material yields, reduced operational costs, and superior product consistency, essential traits for competitive advantage in a high-precision market.

- AI-driven Predictive Maintenance: Utilizing machine learning algorithms to analyze vibration, temperature, and pressure data from rolling and drawing machinery, predicting equipment failure before occurrence, thereby minimizing unplanned downtime and optimizing production schedules.

- Enhanced Quality Control (QC): Implementation of computer vision and deep learning models for automated, real-time inspection of pipe surface integrity, detecting microscopic defects that human inspectors or traditional NDT methods might miss, drastically reducing rejection rates.

- Process Parameter Optimization: AI models adjusting heating, cooling, and drawing speeds in real-time based on material composition and desired mechanical properties, leading to consistent wall thickness, improved metallurgical structure, and reduced material stress.

- Supply Chain and Inventory Management: Predictive analytics anticipating raw material (e.g., nickel, molybdenum) price fluctuations and demand variability, optimizing procurement cycles and maintaining strategic inventory levels to ensure continuity of production for long-lead-time projects.

- Energy Consumption Efficiency: Applying neural networks to manage furnace operations and cooling systems, ensuring optimal energy utilization during the high-temperature annealing phase, contributing to lower operational expenditures and better adherence to sustainability goals.

DRO & Impact Forces Of Seamless Stainless Steel Pipes Market

The Seamless Stainless Steel Pipes Market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), collectively shaping its growth trajectory and competitive landscape. Primary drivers include the global energy transition, which necessitates reliable piping for hydrogen transport and carbon capture and storage (CCS) projects, alongside relentless demand from the core Oil & Gas sector for deep-water exploration materials. Restraints largely center around the volatile pricing of key alloying elements such as nickel and chromium, which directly impacts manufacturing costs and profit margins, coupled with the capital-intensive nature of seamless pipe production, creating high barriers to entry for new competitors. Opportunities are significant in emerging markets where infrastructure development is accelerating, and in the specialization towards niche applications, such as high-purity piping for semiconductor manufacturing and pharmaceutical utilities, where premium pricing justifies significant R&D investment. These forces create an environment where technological innovation in metallurgy and manufacturing efficiency determines success, ensuring high-integrity products meet increasingly stringent operational specifications across all major industrial end-user segments.

Impact forces govern the speed and direction of market growth. Technological superiority, particularly in the production of specialized grades like Super Duplex stainless steel, acts as a pivotal positive force, enabling market players to capture high-margin contracts in severe service environments. Conversely, stringent environmental regulations regarding industrial effluents and energy consumption during the manufacturing process pose a structural restraint, forcing companies to invest heavily in compliance and sustainable technologies. Geopolitical instability, particularly impacting global trade flows and commodity markets, presents a continuous uncertainty, influencing investment decisions in major pipeline and refinery projects. The collective impact suggests a market that is resilient due to its essential nature in industrial operations, but highly sensitive to macroeconomic shifts and raw material price volatility, necessitating careful risk management and supply chain diversification by industry participants.

Segmentation Analysis

The Seamless Stainless Steel Pipes market is comprehensively segmented based on material type, diameter, and end-user industry, reflecting the diverse application requirements across global industries. This segmentation is crucial for understanding specific growth pockets and tailoring product offerings to meet precise performance specifications. Material segmentation, which includes various grades of stainless steel such as Austenitic, Martensitic, Ferritic, and highly specialized Duplex and Super Duplex alloys, dictates the pipe's resistance profile against corrosion, pressure, and temperature extremes. Diameter segmentation—small, medium, and large—reflects the operational scale, from precision instrumentation lines to high-volume fluid transport networks. Finally, end-user segmentation highlights the dominance of sectors like Oil & Gas and Chemical & Petrochemical, which demand high-integrity, safety-critical components, distinguishing them from sectors like Construction or Automotive, which may prioritize cost efficiency alongside standard mechanical performance.

- By Material Type:

- Austenitic (304/304L, 316/316L, 321, 347)

- Duplex (2205)

- Super Duplex (2507)

- Ferritic

- Martensitic

- Others (High-Nickel Alloys)

- By Diameter:

- Small Diameter Pipes (Up to 6 inches)

- Medium Diameter Pipes (6 to 18 inches)

- Large Diameter Pipes (Above 18 inches)

- By End-User Industry:

- Oil & Gas (Upstream, Midstream, Downstream)

- Chemical & Petrochemical

- Power Generation (Thermal, Nuclear, Renewables)

- Food & Beverage and Brewing

- Pharmaceuticals and Biotechnology

- Automotive and Transportation

- Construction and Infrastructure

- Others (Aerospace, Marine)

Value Chain Analysis For Seamless Stainless Steel Pipes Market

The value chain for the Seamless Stainless Steel Pipes Market begins with the highly capital-intensive upstream segment, involving the sourcing and processing of primary raw materials, specifically iron ore, chromium, nickel, and molybdenum. Specialized steel manufacturers refine these raw materials into stainless steel billets or specialized hollows, requiring highly controlled melting and alloying processes to achieve the precise metallurgical composition required for seamless applications. Critical upstream activities include securing stable supplies of nickel and chrome, which often involves long-term contracts and strategic vertical integration to mitigate price volatility. Success at this stage relies heavily on metallurgical expertise and efficient energy management due to the high energy intensity of steel production. Failure in maintaining precise material specification at the billet stage directly impacts the structural integrity and corrosion resistance of the final seamless pipe, emphasizing the stringent quality checks required from the beginning of the chain.

The midstream phase involves the core manufacturing process, transforming the billets into seamless pipes through methods such as rotary piercing, hot extrusion, and subsequent cold working (drawing or rolling) and finishing (annealing, pickling, polishing). This stage is characterized by high precision engineering, utilizing specialized machinery to achieve exact dimensional tolerances and surface finishes. Technological innovation in cold drawing processes allows manufacturers to produce longer, thinner-walled pipes with superior mechanical properties, crucial for high-pressure applications. The downstream segment involves complex distribution channels, encompassing direct sales to large Engineering, Procurement, and Construction (EPC) firms involved in major industrial projects, as well as indirect distribution through specialized industrial distributors and stockists who cater to smaller projects and maintenance, repair, and overhaul (MRO) demand. Direct channels are preferred for highly customized, large-volume contracts, whereas indirect channels provide critical inventory access and just-in-time delivery for ongoing operational needs across regional markets.

The effectiveness of the distribution network is paramount, as seamless stainless steel pipes often require specialized handling and certification. Direct distribution focuses on establishing deep technical relationships with EPCs and major end-users in sectors like nuclear power, providing comprehensive technical support and supply chain management integration. Indirect distribution, leveraging a network of knowledgeable stockists, provides geographical reach and swift availability of standard grades, minimizing lead times for local projects. The value derived at the downstream end is heavily tied to value-added services such as cutting, threading, bending, and specialized testing (hydrostatic, radiographic), ensuring the pipes are delivered ready for installation. Maintaining a robust quality management system across the entire value chain—from alloying element traceability in the upstream to final non-destructive testing (NDT) in the downstream—is essential for retaining client trust and complying with global industry standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $15.5 Billion |

| Market Forecast in 2033 | $22.9 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tenaris, Sandvik AB, Thyssenkrupp AG, Nippon Steel Corporation, TISCO (Taiyuan Iron and Steel), Outokumpu Oyj, Baosteel Group, AK Steel (Cleveland-Cliffs), ArcelorMittal, JFE Steel Corporation, Salzgitter AG, Valinox Nuclear (Vallourec), CRM, Tubacex, Zhejiang Jiuli Hi-Tech Metals, Marcegaglia Specialties, Webco Industries, Chelpipe (TMK), Sumitomo Metal Industries (Nippon Steel), Tata Steel. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Seamless Stainless Steel Pipes Market Potential Customers

Potential customers for seamless stainless steel pipes are primarily large-scale industrial operators and specialized engineering firms whose core operations depend on the reliable transport of corrosive or high-temperature fluids and gases. The largest consumer base resides within the Energy sector, encompassing national and international oil companies (NOCs/IOCs), pipeline operators (midstream), and refinery owners (downstream), who require robust materials certified for extreme pressures and exposure to sour gas environments. Chemical processing plants and petrochemical facilities constitute another critical customer segment, utilizing these pipes for heat exchanger tubing and process lines where chemical inertness and resistance to specific reagents are non-negotiable safety requirements. These customers prioritize long-term reliability and high-specification materials, often leading to preference for certified suppliers with proven track records in high-integrity installations.

Furthermore, the Power Generation industry, especially nuclear and high-efficiency fossil fuel power plants, represents a significant customer base, demanding seamless pipes for boiler tubes, superheaters, and feedwater systems where dimensional accuracy and thermal performance are critical to operational efficiency and safety compliance. The Food & Beverage and Pharmaceutical sectors also represent a growing high-value customer segment, driven by strict sanitary requirements and regulatory mandates (e.g., FDA, GMP). These industries require pipes with exceptionally smooth internal surfaces (high Ra values) to prevent microbial contamination and product hang-up, often utilizing electro-polished stainless steel grades. Procurement in these sectors is driven less by initial cost and more by certification, traceability, and the ability of the pipe material to maintain product purity over extended operational cycles, making high-quality seamless pipes the standard for critical fluid pathways.

Seamless Stainless Steel Pipes Market Key Technology Landscape

The technological landscape of the Seamless Stainless Steel Pipes Market is defined by continuous innovation aimed at improving metallurgical properties, dimensional accuracy, and production efficiency while reducing costs and environmental impact. A cornerstone technology remains the Mandrel Mill Process, combined with Hot Extrusion for the initial shaping of the hollows, followed by sophisticated cold finishing techniques. The pursuit of superior mechanical performance has driven advancements in Cold Pilgering and Cold Drawing technologies. Cold Pilgering involves precise deformation of the pipe walls and diameter, yielding exceptional surface finish and homogeneity, particularly vital for small-diameter high-pressure tubing used in aerospace and instrumentation. Advanced cold drawing equipment utilizes specialized tooling and lubricants to achieve tight tolerances and enhanced material hardness, crucial for demanding applications like downhole oil country tubular goods (OCTG) and heat exchanger tubes.

A second crucial area of technological development lies in Non-Destructive Testing (NDT) and quality assurance. High-frequency ultrasonic testing (HFUT) and Eddy Current Testing (ECT) systems are integrated into production lines to perform real-time internal and external defect scanning, ensuring zero-defect output for critical service applications. Modern NDT utilizes automated data analysis and sophisticated signal processing to enhance detection sensitivity, meeting rigorous standards like ASME B31.3. Furthermore, the integration of advanced metallurgical processes, such as Vacuum Oxygen Decarburization (VOD) and Argon Oxygen Decarburization (AOD), ensures extremely low impurity levels in the steel matrix, which is essential for producing high-performance specialty alloys like Super Duplex stainless steel. These advanced melting techniques minimize inclusions, enhancing the pipe’s resistance to pitting corrosion and stress corrosion cracking (SCC), thereby extending the service life in aggressive chemical and marine environments.

Finally, technology focused on process sustainability is rapidly gaining prominence. Modern seamless pipe mills are adopting advanced heat treatment and annealing furnaces that utilize energy-efficient technologies, minimizing gas consumption and reducing the overall carbon footprint. Furthermore, process control technology, leveraging sensors and data analytics, optimizes the temperature profiles during manufacturing, minimizing grain growth and ensuring consistent microstructure throughout the pipe length. Specialized surface treatment technologies, including mechanical polishing and electro-polishing, are employed for high-purity applications, achieving Ra values below 0.4 μm, meeting the stringent hygiene requirements of the semiconductor and pharmaceutical industries. This holistic approach, combining material science, precision engineering, and quality control automation, defines the cutting edge of seamless pipe manufacturing and maintains the material's relevance in technologically demanding markets.

Regional Highlights

- North America: The region maintains a strong market for high-specification seamless stainless steel pipes, driven primarily by the modernization of aging infrastructure in the refining and chemical sectors, and robust demand from the aerospace and defense industries for high-strength, lightweight tubing. The U.S. shale oil and gas sector, particularly horizontal drilling and hydraulic fracturing activities, mandates the use of highly corrosion-resistant Duplex and Super Duplex alloys in downhole and processing applications. Regulatory adherence to ASME and API standards ensures premium pricing and competitive advantage for domestic manufacturers specializing in certified products. Furthermore, the burgeoning demand for hydrogen transport and storage infrastructure in Canada and the U.S. is creating a new, highly demanding niche market for seamless stainless steel.

- Europe: Characterized by mature industrial economies and stringent environmental and quality regulations, the European market focuses on high-value, specialized applications, notably in nuclear power generation, pharmaceutical manufacturing (requiring ultra-high purity surfaces), and chemical plants requiring corrosion resistance for complex synthesis processes. Germany, France, and Italy are key consumption centers. The region is a technological leader in cold finishing and metallurgical development, with a strong emphasis on sustainability and circular economy practices influencing raw material sourcing and manufacturing efficiency. Demand is highly reliant on long-term infrastructure investment cycles and MRO activities in established industrial facilities.

- Asia Pacific (APAC): APAC is the fastest-growing market, fuelled by rapid urbanization, massive infrastructure projects in China and India, and the expansion of the regional manufacturing base. The tremendous growth in the chemical, petrochemical, and power generation sectors across Southeast Asia (e.g., Vietnam, Indonesia) drives high-volume demand for standard austenitic grades (304/316). While price sensitivity is higher compared to Western markets, there is increasing demand for high-performance specialty alloys due to the region's expanding deep-sea oil and gas activities and the development of sophisticated technology hubs requiring ultra-high purity piping for semiconductor fabrication. Domestic players in China and India are rapidly increasing capacity and technological capabilities, influencing global trade flows.

- Middle East and Africa (MEA): This region is dominated by large-scale capital expenditure in the Oil & Gas industry, particularly related to extraction, processing, and export infrastructure. The harsh, often sour gas environments require extensive use of high-strength, corrosion-resistant materials, specifically Duplex and Super Duplex stainless steel. Saudi Arabia, UAE, and Qatar are major consumers, driving demand through long-term upstream development projects. The market is project-driven and highly sensitive to global oil price movements, with procurement often managed through massive international EPC contracts favoring suppliers capable of providing large volumes of certified, high-specification seamless pipe within demanding timelines.

- Latin America: Characterized by significant commodity-driven economies, particularly oil and gas in Brazil, Mexico, and Argentina, and mining operations. Demand for seamless pipes is tied to investment cycles in the energy sector and infrastructural upgrades. Brazil, with its deep-water pre-salt reserves, requires highly specialized stainless steel alloys for challenging operational environments. Economic stability and political risk are key factors influencing major capital investment decisions, resulting in a market characterized by cyclical procurement patterns and a high reliance on imported specialized products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Seamless Stainless Steel Pipes Market.- Tenaris

- Sandvik AB

- Thyssenkrupp AG

- Nippon Steel Corporation

- TISCO (Taiyuan Iron and Steel)

- Outokumpu Oyj

- Baosteel Group

- AK Steel (Cleveland-Cliffs)

- ArcelorMittal

- JFE Steel Corporation

- Salzgitter AG

- Valinox Nuclear (Vallourec)

- CRM

- Tubacex

- Zhejiang Jiuli Hi-Tech Metals

- Marcegaglia Specialties

- Webco Industries

- Chelpipe (TMK)

- Sumitomo Metal Industries (Nippon Steel)

- Tata Steel

- Capitol Manufacturing Co.

- Reliance Steel & Aluminum Co.

- Bristol Metals, LLC

- APEX Steel

- Rath Manufacturing LLC

- Walsin Lihwa Corp.

- POSCO

- Sosta Stainless Steel

- Shandong Huanli Group

Frequently Asked Questions

Analyze common user questions about the Seamless Stainless Steel Pipes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of seamless stainless steel pipes over welded pipes?

Seamless stainless steel pipes offer superior strength, pressure containment capabilities, better corrosion resistance due to the absence of welds, and higher mechanical consistency, making them essential for critical, high-stress applications like heat exchangers and high-pressure fluid lines.

Which stainless steel grades are dominant in the seamless pipe market?

Austenitic grades, particularly 304/304L and 316/316L, are dominant due to their excellent balance of corrosion resistance, weldability, and cost. However, Duplex and Super Duplex stainless steels (e.g., 2205, 2507) are experiencing the fastest growth due to their superior performance in highly corrosive oil and gas environments.

How does the Oil & Gas industry influence demand for seamless stainless steel pipes?

The Oil & Gas industry is the largest consumer, driving demand for specialized seamless pipes in upstream exploration, midstream transport, and downstream refining. Specifically, deep-sea and unconventional extraction require high-strength seamless tubes resistant to H2S and CO2, ensuring safety and operational longevity.

What key technological advancements are shaping the future of seamless pipe production?

Key advancements include the integration of AI for predictive maintenance and real-time quality control, superior cold working techniques (Cold Pilgering) for enhanced dimensional accuracy, and specialized metallurgical processes for creating high-purity, specialty corrosion-resistant alloys required in nuclear and hydrogen applications.

Which geographical region represents the highest growth potential for seamless stainless steel pipes?

Asia Pacific (APAC) currently exhibits the highest growth potential, fueled by massive ongoing industrialization, infrastructural development, and substantial capital investments in power generation and petrochemical capacities across China, India, and Southeast Asia.

What differentiates small diameter pipes from large diameter pipes in terms of end-use?

Small diameter seamless pipes are typically used in high-precision applications like instrumentation lines, hydraulic systems, and heat exchanger tubing, prioritizing dimensional accuracy and thermal efficiency. Large diameter pipes are utilized for high-volume transport in major pipeline networks and large-scale pressure vessels in chemical plants and refineries, prioritizing structural integrity and flow capacity.

How does raw material price volatility affect the seamless pipe manufacturing profitability?

Raw material price volatility, particularly fluctuations in nickel, chromium, and molybdenum costs, significantly impacts the profitability of manufacturers. Since these alloying elements are critical for corrosion resistance, manufacturers often employ hedging strategies or utilize long-term supply contracts to stabilize costs and maintain competitive pricing for long-term projects.

What role do regulatory standards play in market entry and operation?

Regulatory standards (e.g., ASME, API, ASTM, PED) are essential market entry barriers, mandating rigorous testing and certification processes. Compliance ensures material safety and reliability, particularly in safety-critical sectors like nuclear and petrochemicals, favoring established manufacturers with proven quality management systems and high traceability protocols.

What are the challenges associated with manufacturing Super Duplex seamless pipes?

Manufacturing Super Duplex seamless pipes presents challenges related to maintaining the precise Ferrite-Austenite phase balance during heat treatment, which is critical for achieving optimal corrosion resistance and mechanical strength. This requires highly specialized annealing furnaces and strict control over processing parameters, driving up production complexity and cost.

How are environmental concerns impacting the production side of the market?

Environmental concerns are driving manufacturers to adopt cleaner production technologies, including energy-efficient melting and annealing processes, minimizing industrial wastewater (pickling) through advanced filtration, and enhancing scrap metal utilization (recycling), aligning production with sustainability goals and stringent European Union environmental mandates.

Define the key role of cold working processes in seamless pipe manufacturing.

Cold working, primarily involving cold drawing and cold pilgering, is essential for improving the dimensional accuracy, enhancing the surface finish, and increasing the mechanical strength (hardness and yield strength) of the seamless pipes, particularly for high-pressure and critical instrumentation tubing applications that require exact tolerances.

Which end-user segment requires the highest level of internal surface finish and why?

The Pharmaceutical and Semiconductor industries require the highest level of internal surface finish (often electro-polished to sub-micron Ra values). This is necessary to prevent microbial growth (in pharma) and particle contamination (in semiconductors), ensuring high purity of conveyed media and compliance with strict sanitary regulations.

Explain the significance of traceability in the seamless stainless steel pipe value chain.

Traceability is critical for safety and liability, enabling manufacturers to track the pipe back to its specific batch, raw material heat, and processing parameters. This is paramount in high-integrity applications like nuclear or offshore oil and gas, allowing for quick identification and recall in case of material defects or failure.

What is the projection for the growth rate of Duplex stainless steel pipes versus Austenitic grades?

While Austenitic grades (304/316) hold the largest market volume, Duplex and Super Duplex grades are projected to exhibit a significantly higher compound annual growth rate (CAGR). This acceleration is driven by their adoption in aggressive new energy and offshore environments where standard Austenitics are inadequate for corrosion prevention.

How does the MRO (Maintenance, Repair, and Overhaul) sector contribute to market stability?

The MRO sector provides market stability by generating steady, continuous demand for replacement pipes and small-batch orders for existing industrial facilities, counteracting the cyclical volatility associated with major, greenfield capital expenditure projects, ensuring consistent business for distributors and specialty manufacturers.

What impact does China’s domestic production capacity have on global market pricing?

China’s massive domestic production capacity, supported by large integrated steel mills, exerts downward pressure on the global pricing of standard-grade austenitic seamless pipes. This influence compels Western manufacturers to specialize further in high-performance, complex alloys to maintain profitability and competitive differentiation.

What is the difference between hot-finished and cold-finished seamless pipes?

Hot-finished pipes are processed at high temperatures and typically have thicker walls, larger diameters, and looser dimensional tolerances, often used in less critical structural or transport applications. Cold-finished pipes undergo further processing at room temperature (cold drawing/pilgering), resulting in superior surface finish, tighter tolerances, and enhanced mechanical properties for critical applications.

What is the market potential for seamless stainless steel pipes in hydrogen economy applications?

The market potential is substantial. Seamless stainless steel pipes are critical for the safe transportation and storage of compressed hydrogen, which requires materials resistant to hydrogen embrittlement and high pressures. Specialized high-nickel stainless steels and Duplex alloys are being evaluated and deployed for these next-generation energy infrastructure projects.

How do EPC firms influence supplier selection in the market?

Engineering, Procurement, and Construction (EPC) firms act as critical gatekeepers, selecting suppliers based on technical compliance, proven project history, financial stability, and the ability to deliver certified material in large volumes under strict timelines. Their procurement decisions heavily favor established, internationally certified seamless pipe manufacturers.

What are the common non-destructive testing (NDT) methods used for quality assurance?

Common NDT methods include Ultrasonic Testing (UT) to detect internal flaws and wall thickness variations, Eddy Current Testing (ECT) for surface and near-surface defect detection, and hydrostatic testing to verify pressure containment capabilities, all crucial for certifying the pipe for high-integrity service.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager